Understanding ROI in Crypto: More Than Just a NumberHello, Traders! 👏

Return on Investment (ROI) is often the first metric new investors focus on when evaluating an asset, a strategy, or even their trading performance. It’s easy to see why. It's simple, intuitive, and widely used across both traditional finance and the cryptocurrency sector. One formula, and suddenly you have a "score" for your investment. Green is good. Red is bad. Right?

Well…Not quite.

In the crypto market, where price swings can be extreme, timelines are compressed, and risk profiles differ significantly from those in traditional markets, a simplistic ROI figure can be dangerously misleading.

A 50% ROI on a meme coin might look great, until you realize the token is illiquid, unbacked, and you're the last one holding the bag. Conversely, a 10% ROI on a blue-chip crypto asset with strong fundamentals might be significantly more meaningful in risk-adjusted terms.

In this article, we'll delve beyond the basic formula and break down what ROI really tells you, how to use it correctly, and where it falls short. Let's go!

What Is ROI and How Do You Calculate It?

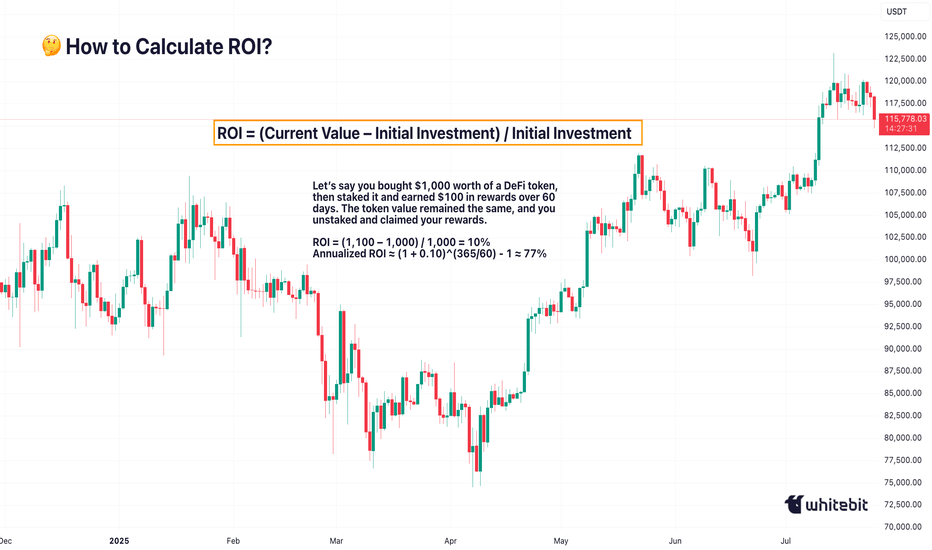

The Basic Formula for Return on Investment Is: ROI = (Current Value – Initial Investment) / Initial Investment.

Let’s say you bought ETH at $2,000 and sold it at $2,600: ROI = (2,600 – 2,000) / 2,000 = 0.3 → 30%. Seems straightforward. You made 30% profit. However, crypto is rarely straightforward.

What if you held it for 2 years? Or 2 days? What if gas fees, staking rewards, or exchange commissions altered your real costs or returns? Did you include opportunity cost and the profits missed by not holding another asset? ROI as a raw percentage is just the beginning. It’s a snapshot. However, in trading, we need motion pictures, full narratives that unfold over time and within context.

Why Time Matters (And ROI Ignores It)

One of the most dangerous omissions in ROI is time.

Imagine two trades: Trade A returns 20% in 6 months. Trade B returns 20% in 6 days.

Same ROI, very different implications. Time is capital. In crypto, it’s compressed capital — markets move fast, and holding a position longer often increases exposure to systemic or market risks.

That’s why serious traders consider Annualized ROI or utilize metrics like CAGR (Compound Annual Growth Rate) when comparing multi-asset strategies or evaluating long-term performance.

Example: Buying a Token, Earning a Yield

Let’s say you bought $1,000 worth of a DeFi token, then staked it and earned $100 in rewards over 60 days. The token value remained the same, and you unstaked and claimed your rewards.

ROI = (1,100 – 1,000) / 1,000 = 10%

Annualized ROI ≈ (1 + 0.10)^(365/60) - 1 ≈ 77%

Now that 10% looks very different when annualized. But is it sustainable? That brings us to the next point…

ROI Without Risk Analysis Is Useless

ROI is often treated like a performance badge. But without risk-adjusted context, it tells you nothing about how safe or smart the investment was. Would you rather: Gain 15% ROI on a stablecoin vault with low volatility, or Gain 30% ROI on a microcap meme token that could drop 90% tomorrow?

Traders use metrics such as the Sharpe Ratio (which measures returns versus volatility), Maximum Drawdown (the Peak-to-Trough Loss During a Trade), and Sortino Ratio (which measures returns versus downside risk). These offer a more complete picture of whether the return was worth the risk. ⚠️ High ROI isn’t impressive if your capital was at risk of total wipeout.

The Cost Side of the Equation

Beginners often ignore costs in their ROI math. But crypto isn’t free: Gas fees on Ethereum, trading commissions, slippage on low-liquidity assets, impermanent loss in LP tokens, maybe even tax obligations. Let’s say you made a 20% ROI on a trade, but you paid 3% in fees, 5% in taxes, and lost 2% in slippage. Your actual return is likely to be closer to 10% or less. Always subtract total costs from your gains before celebrating that ROI screenshot on X.

Final Thoughts: ROI Is a Tool, Not a Compass

ROI is beneficial, but not omniscient. It’s a speedometer, not a GPS. You can use it to reflect on past trades, model future ones, and communicate performance to others, but don’t treat it like gospel.

The real ROI of any strategy must also factor in time, risk, capital efficiency, emotional stability, and your long-term goals. Without those, you’re not investing. You’re gambling with better math. What do you think? 🤓

ROI

Noah Cloud Pattern - Ruff Times AheadI expect this will get very bad before getting even badder and then better before getting really really better again.

There will be red and green bars and lines and numbers at some point throughout the day, so buy if you want or sell.

I am not a financial advisor.

Ferrari - Don't Miss Out on 50% ROI!Very strong setup here. Ferrari respects the SMA200 for years and did touch the SMA200 and bounce from it. It also respected the current trendline and the SMA200 and trendline bounce did happen at the 23rd Fib retrace level. Very bullish setup.

--

🐂 Trade Idea: Long - RACE

🔥 Account Risk: 20.00%

📈 Recommended Product: Stock

🔍 Entry: +/- 426,00

🐿 DCA: No

😫 Stop-Loss: 390,00

🎯 Take-Profit #1: 600.00 (50%)

🎯 Trail Rest: Yes

🚨🚨🚨 Important: Don’t forget to always wait for strong confirmation once possible entry zone is reached. Trade ideas don’t work all the time no matter how good they look. Do not get a victim of FOMO, there is always another trade idea waiting. 🚨🚨🚨

If you like what you see don’t forget to leave a comment 💬 or smash that like ❤️ button!

—

Ferrari is a super strong brand. Backlog is huge and current waiting time is measured in years not months. Luxury stocks were punished during the last months because of fear of growth and a weak consumer but Ferrari is somewhat else. Misconceptions regarding shipments and China are putting pressure on Ferrari's shares since the third-quarter announcement. Nevertheless, the shipments' decline is a result of an ERP transition, and the reduction in China is intentional.

Don't forget, people who buy Ferraris do not care about inflation or the economic situation of a country. Also, you can't lease a Ferrari, you can only buy it. This gives the manufacturer a strong cashflow. In addition, Ferrari's unique market position, strong brand, and prudent management justify its high valuation and promise market-beating returns.

—

Disclaimer & Disclosures pursuant to §34b WpHG

The trades shown here related to stocks, cryptos, commodities, ETFs and funds are always subject to risks. All texts as well as the notes and information do not constitute investment advice or recommendations. They have been taken from publicly available sources to the best of our knowledge and belief. All information provided (all thoughts, forecasts, comments, hints, advice, stop loss, take profit, etc.) are for educational and private entertainment purposes only.

Nevertheless, no liability can be assumed for the correctness in each individual case. Should visitors to this site adopt the content provided as their own or follow any advice given, they act on their own responsibility.

The Power of HODLINGMANTRA ( NASDAQ:OM ) has been making waves in the crypto market, not just for its price surge but for the incredible profit booked by a savvy trader. This feat has drawn the attention of investors worldwide. A reported $6 million profit from trading NASDAQ:OM has sparked interest and speculation about the coin's future, as well as its potential to deliver significant returns. Let's explore both the technical and fundamental aspects driving this market activity.

The Million-Dollar Trade

A crypto trader, identified by the wallet address "0xdc2," achieved a staggering return on investment (ROI) of 161X within approximately 10 months. The trader bought OM tokens at an average price of $0.026 and recently sold 600,000 tokens on Binance for a profit of $2.49 million, highlighting their total profit of $6.28 million.

This trade underscores the potential of holding onto a coin for strategic periods and taking advantage of market conditions. However, it also raises concerns about sell pressure in the wake of significant dumps.

Market Confidence Despite Sell-Off

Despite the dump, NASDAQ:OM maintained upward momentum, reflecting strong market confidence. A 26.58% price increase over 24 hours saw the token trading at $4.15, with trading volume surging 33% to $771.50 million.

Altcoin Market Sentiment

The overall positive sentiment in the altcoin market, with the crypto market cap breaching the $3 trillion mark, has helped bolster NASDAQ:OM 's price.

Futures Open Interest Growth

MANTRA Futures Open Interest surged by 53%, indicating increased investor activity and hinting at further potential price gains. This is a critical indicator of the token's growing appeal among traders.

Technical Analysis

NASDAQ:OM reached a 24-hour high of $4.47 before slightly retracing to $4.15, marking a consolidation phase after its sharp rise. The Relative Strength Index (RSI) stands at 90, indicating overbought conditions. While this suggests the potential for a short-term correction, it also reflects heightened buying pressure.

The large-scale token dump may trigger sell-offs by smaller investors, potentially leading to a short-term dip. However, the broader market sentiment and rising Futures Open Interest could mitigate this impact.

A Lesson for Traders

The $6M profit story serves as both inspiration and caution for traders. Strategic holding and avoiding FOMO (Fear of Missing Out) can lead to substantial returns. It reflects on a missed opportunity, when i sold sold a memecoin at a $3M market cap, only to watch it climb to $300M later.

This highlights the importance of conducting thorough research and believing in your investments while being mindful of market conditions.

Conclusion

MANTRA ( NASDAQ:OM ) continues to capture the attention of traders and investors alike with its significant price movements and market activity. The coin's ability to hold steady after a massive sell-off and its impressive Futures Open Interest growth hint at its strong potential in the crypto space.

While short-term fluctuations are expected, NASDAQ:OM 's broader market confidence and fundamentals position it as an asset worth watching. For savvy traders, the mantra is clear: patience, research, and timing are key to unlocking the full potential of crypto investments.

Lookback into a Yield Seeking Analytics: EUR Hit TargetDear Investors,

Goal

I often hear: "... but I learned from my mistakes." This phrase might be a kind emote of forgiving yourself, but you can learn much more from your successes. Today, I want to write more about an example of a success because I learned from it. I want to explain what I learned from this take profit and conclude the analytics because I know most of you never return to how an analytics you read concluded. In this follow-up analytics, I'll extend the chart of the previous setup and communicate the original data I didn't specify in that analytics. I also want to have this written because some of you prefer reading over watching my videos. In the meantime, I've released an open-source indicator on TradingView, and you'll see how this indicator could have extended or contradicted the analytics.

News & Sentiment Analytics

The initial analytics started with news analytics. I believe news can overwrite technical indicators. So, I usually begin my analytics with the news. For this purpose, I wrote some natural language processing algorithms. Some of you wrote to me, that you don't believe AI can outperform humans in supply/demand location and liquidity detection. Perhaps, that's true, but the fact is, while you commit your attention to one market and limited news, AI simultaneously processes hundreds of thousands of news from thousands of news agencies. From all these data, I emphasized the following in the analytics:

"Beyond technicals, the European Central Bank (ECB) has been cautious in raising interest rates to combat inflation, in contrast to the US Federal Reserve's more aggressive tightening cycle. This divergence in monetary policies has made the USD more attractive to yield-seeking investors."

I often extend news analytics with sentiment analytics. I could have written any combination of news, but I gave one as an example where sentiment analytics estimated a heavyweight.

Technical Analytics & Chart Patterns

In the video analytics, I used daily candles because I wanted to protect your attention from intraday noise. Nevertheless, the price action happens to be smooth. So, in this idea, I used 4-hour candles to better show the projection of how the price went into the take profit area.

Once I got an idea about a possible bearish trend from news and sentiment, I added my humble technical analytics knowledge to the setup. I noted the rising channel chart pattern that statistically, often breaks downward. You find the dotted purple trendlines on the chart. Furthermore, I calculated a demand zone between the two blue trendlines. I guessed the price could seek demand somewhere in this area. That's why you saw a falling arrow in the analytics. The trendlines themselves are the results of candle analytics, which is part of my technical analytics.

Indicators

In the signal idea, you couldn't see my Adaptive MFT Extremum Pivots indicator because I released this TradingView script after my video analytics. However, this script wasn't necessary to get a profitable vision. I added it to the update to note how the level where the price managed to fall aligns with the S3 support level, and the demand zone news-sentiment-pattern estimated aligns with the zone where the supports (S1-S3) are located. You can read the precise values in the indicator's table in the bottom right corner of the chart.

Results: +2.64% ROI, -0.18% drawdown, Trail Profit

Eventually, I added date and range computing arrows to the chart to show the results. It says a +2.64% profit over 45 bars (9 days, 12 hours). You can see the timestamp of the sentiment analytics above the candles: 01 December. You can also read the sentiment analytics idea in TradingView. See the relevant ideas. I used a stop loss at $1.102. In the worst-case scenario, I'd book a -0.18% drawdown, but the price never hit the negative limit. I don't specify the future price in this idea because I moved my stop loss down to act as a trail profit until the price decides to reverse, and I booked my profit.

It's not an investment advice. I don't claim mine was the only possible setup to take a profit from the price action. Historic results don't guarantee future returns. No indicator or analytics is inherently more superb than the others. Do your research. I only hope you learned a few practices from this idea you can use in your analytics, too.

Kind regards,

Ely

Essential Trading Terms for Crypto TradersGreetings everyone!

Here are ten crucial terms every crypto trader should know:

ATH - The highest price ever recorded. It represents an asset's peak value and often signals potential profit for early investors.

ATL - The lowest price ever recorded. Breaking ATL can trigger further price declines, leading to potential buying opportunities or increased risks.

ROI - Measuring investment performance. ROI helps assess the returns of an investment relative to its initial cost, aiding in comparing different investment options.

FUD (Fear, Uncertainty, and Doubt) - Spreading fear and misinformation to gain an advantage. Recognizing FUD is essential for avoiding emotional trading decisions and whales trap.

KYC - Verification of customer identity for regulatory compliance. KYC ensures that trading platforms adhere to regulations and prevent money laundering.

AML - Regulations to prevent money laundering. AML measures make it harder for criminals to disguise illegally obtained funds as legitimate income.

DD - Conducting due diligence before making investment decisions. DD involves thorough research and analysis to assess potential risks and rewards.

DYOR - Doing your own research and verifying information. DYOR is a fundamental principle for successful trading, emphasizing the importance of independent research.

FOMO - The panic-driven urge to buy or sell an asset. FOMO can lead to impulsive trades and is often seen during bull markets later stages.

HODL - Holding onto an investment for the long term. HODLers believe in the potential for long-term gains and resist short-term price fluctuations.

Understanding these terms can help you navigate the cryptocurrency communities more confidentl. So, remember to DYOR, stay vigilant about FUD, and consider your HODL strategy while keeping an eye on ROI, ATH, and ATL 💜💜

GEO Group: BullishThe War on Fraud

People Will go to Jail

Government Expenditures are being reduced, however, by giving contracts to the GEO group, the government is bullish on this company.

Fundamentally, net income and net revenue increase, bullish, especially in a time when the US dollar is increasing in value.

Michael Burry's only stock position is GEO group

I see no resistance or walls until at least $20 price levels, easy 100% return on investment. By buying shares, I do not need extra exposure which I typically use option plays for. I will sit on this play. I typically am never this long on something, but I truly believe that in this age of BTC and fraud from people who think the IRS are fools, will be surprised when the feds come knocking for the money. If the fed needs to reduce the money supply, it will do so by any means necessary. Also, like fundamentals, and financials, fully agree with this being way too undervalued.

Just for the record I think EV cars will fail because they have zero towing capacity, likely will look into Hydrogen power instead.

SPML INFRA - LONG - SWING TRADENSE:SPMLINFRA looks good for long.

Logic behind long:-

- on higher time frame(monthly) price is make ing reversal and changing trend

- weekly trend change to sideways

- on daily (lower time frame) price has broken the price structure.

Entry @41.90 cmp

Stop loss @ 38

Target @ 62.70

BTC ROI IS DEAD 0_0 XBITCOIN has done nearly a 3,470,256% increase over the past 10 years, how much could you really make after its gone up so high!

- I personally own 0 BTC not even a SATOSHI!

- If BTC reaches $1,000,000 (£789k) then that would be a return of around 34 X LOL (So if I put £1,000 I only get back £34k) MEH BORING!

- I am here for 100-1,000 X GAINS!

- The only projects I see doing that are: XRP, XLM, ALGO, QNT, HBAR, VET, CSPR, CSC & AGIX!

NUU great opportunity for 100% ROIthe retracement could come to an end soon,

we have already retraced 75% of the main bullish impulse and we are facing a big demand zone imo.

Here the risk is minimized compared with the reward of right guess, BUY the DIP !

Performance distribution of retail investors and hedge fundsMy thoughts about performance. This kind of info is not very available so I have to do some guesswork. We that spend all day in front of the computer expect to get better returns than 10% a year. But we have no idea what is possible and where we "rank" compared to others. All academics look at ever is day traders, yes 99% of day traders lose money and 1% earn peanuts while taking huge risk, we get it. And sometimes they look at passive investors. Cool. But no one ever says anything about active investors or Forex speculators, just that "on average active retail investors outperform", how wonderful, the average, yes I'd call myself the average normie definitely LOL! And regulators are even worse, all they care about is protecting dumb money and scaring people away from day trading. The french "market authority" on television was literally screaming "flee Forex it is dangerous, you should fleeeeeee!", I kid you not.

First we look at retail investors.

So the french "market authority" (AMF) looked at FX & CFD brokers representing about half of the individual FX & CFD investor population. 14799 persons in the 2009-2013 period.

They found that over 4 years close to 90% of traders lost money. This is another of their deceptive tricks.

It's just as with science these days, the data says something, the abstract says the opposite.

So according to the extremely biased french AMF OWN DATA:

- 30% of traders are in the "0" column, and according to their own data there aren't that many traders with tiny accounts, so ~30% breakeven.

- They refuse to give any % result, some may be recalculated by overall we do not know, therefore I will assume it does not look as bad (or they'd show)

- 5% of all investors make 2/3 of the losses, or at least half

- 1% of all investors only are actually making significant returns (and 2/3 of the total)

- As always day traders that destroy the stats are mixed with the rest

- Most "winning" traders are barely above 0, making just a few hundreds to thousands a year

www.amf-france.org

From other sources and the AMF sort of confirms this, we know that:

- Losers (especially big losers) that stick to investing, the ones that never give up never surrender in the face of adversity, the courageous ones with "heart", ye these guys, their losses get bigger and bigger actually.

- Most winners continue to win and their profits get bigger.

Here page 19, this is for stocks, we can see the net monthly market-adjusted returns of 62,439 households a large discount brokerage firm from

January 1991 to December 1996:

- On average, as they keep hammering us with, they underperform the market by 0.14% (each month!)

- The average individual investor gross returns are slightly above the S&P 500 index returns (page 3)

- The average individual investor net returns are slightly below the S&P index returns (about 91% of the S&P)

- The S&P returns a bit less than 1.5% monthly

- The worst of the worst managed to return -20.85% below index monthly, probably a permabear day trader or something

- The 1st percentile is at -4.86% below market, 5th at -2.45%, and 25th -0.73%

- The 99th percentile is at +4.44%, 95th +2.15%, 75th +0.50%

- The best individual investor got 48.35% above market MONTHLY

- The best individual investor difference between net and gross is minuscule, obviously it is not a day trader, probably some lucky investments

- The gross median return is at -0.01%!

faculty.haas.berkeley.edu

So it seems this is how it goes, a normal distribution:

We do not have that much info, and what little there is is rather hard to find, and hidden behind mountains of trashy scams "how much money can I make day trading join my course". I really only care about my own performance but it's always interesting to see how it's all distributed, what is possible, etc. For some reason I am interested in patterns and statistics. Funny. The info does not get shared a lot. Based on research and what gets exchange it seems most "traders" are VERY interested in money and "lambos" and very few are interested in stats, patterns, numbers. Ye I mean what do stats and figures have to do with investing right? It's not about some numbers it's about how much money you can make trading on a phone and what you will do with all of that money right? Honestly if we eliminate day traders that already make up at least 2/3 of FX investors, and all the lambo trolls that hate numbers but "it's ok I manage my emotions", it's not 10% making money but 30% at least I am sure, and 10% making decent money (enough to start a real career). Would be nice if they could just once separate day traders and look at FX investors with a time horizon greater than 1 day. All we can do is guess more or less, obviously more than 10% of these make money, but has to be less than 50% very probably. 10 to 50%, that's pretty wide. Probably in the 20-40 range, that's all I can say with high certainty.

Hedge funds next.

Hedge funds were doing great in the 90s and Morgan Stanley has a doc about them here:

www.morganstanley.com

Page 6 we can see discretionary funds making 18% a year with a max drawdown of only 5%. For all strategies except perma-bear the max drawdown is smaller than the annual returns. With all the regulations and harder market (and little fixed income) the results today are probably not as good but I do not think they are extremely different either.

My guess on how hedge funds fulfill their max drawdown obligations is they place most the money somewhere safe (92% of the whole in case of an 8% drawdown) and then they risk the entire 8%, they might give a bit of it to each of their traders that go aggressive, and if they return 100% on the 8% that's an 8% return overall. I'm pretty sure that's the idea. But they might not freeze the entire capital and go 10X leverage, maybe they do something more complicated, with 50% in cash/bonds, 30% in "safe enough" investments, and 20% in high risk active trading with a max drawdown of 25% on these 20% (so 5% overall). The definitely do something like this, have to. The serious ones at least.

The S&P returned 17.2% with a max drawdown of 15.4%, and page 4 we can see again a normal distribution:

- The median directional return yearly was 16.3% (0.9% below market!) and median max drawdown 28.5%

- The 75% percentile made 20.5% (3.3% above market), remember retail 75ers were 0.50% above mkt monthly

- The 25% bottom only make 11.1% which is 6.1% below market for the year

- Stock selection has similar drawdown and the returns of the 25, 50, 75 are 12, 17.2, 20.9

- There are no giant losers or giant winners but there aren't 66000 funds, and they have restrictions

- In particular

So actually pretty similar thing. The major difference is around 15% of the retail stock investors lost money in a raging bull market and no hedge funds did (except the few bears I guess). Otherwise, same normal distribution but with less extremes for hedge funds, they're more compact around the center (market).

BTC Return on Investment Right on TrackLooks like Bitcoin is doin its thang. We had that major correction that previous cycles had around this time. Now we are looking to be at the top of the next peak according to Orion as well as the BTC ATH ROI. I'm thinking we will see another 10% drop in the next 8 days before we finally turn around and push back up towards 60k and beyond. Previous cycles had this secondary dip as well before breaking their all time highs. HODL on folks!

BTC Logarithmic CurveTHEORY

- I never understood why most students needed to learn what a Log was until I've studied a BTC chart.

- A Log curve in simple term goes 0 to .99999999

- It never touches 1. It is infinite. Meaning it goes forever always getting closer to 1.

- My assumption is that BTC will become stable one day. It may take many more halving's for that to happen.

- With that being said, that's why BTC is an excellent investment opportunity in the year 2020. (Of course with a proper bottom entry)

- Each halving comes a significant reduction of (RIO) Return On Investment.

CHART

- After many hours of studying this chart. I observed a pattern. BTC usually switches trends yearly on the macro level.

- I base that theory on this chart. If historical evidence does in fact repeat then my theory analysis will be true.

- I like to think of this chart of like playing darts w/ a blindfold on. It is a million dollar question.

OPPOSING VIEW

- Many say BTC is in a Wyckoff pattern. " Fill the gap"

I tend to believe that Bitcoin will revolutionize the world the same way the internet has been able to. I will remain optimistic because I believe in the technology.

Like & drop a comment on what you think will happen.

Bitcoin, Gold and S&P 500 Return of investment comparison.While it's true that Bitcoin is the most volatile and risky asset, the ROI of 65% is pretty adequate compared to Gold 25% and S&P 500"only" 6% return of investment.

From this chart you can simply see that Bitcoin has the biggest spikes and is still the fastest growing and it's very important to have a proper strategy, when investing into Bitcoin.

From the chart you can see, that Bitcoin can be seen as the hardest asset to trade due to these strong fluctuations.

Keep in mind, that the ROI date is set to today, 20 October 2020.

The ROI tells you one thing , if you invested on the January 1. a $1000, you would currently have:

1. $1,650 dollars if invested into Bitcoin

2. $1,250 dollars if invested into Gold

3. $1,067 dollars if invested into SPX500

Of course, when you are investing into Gold or SPX there is going to be some fee from the Broker when you are buying the asset or holding, while you can buy Bitcoin at many Exchanges for a free of charge (SEPA mostly) and you can even pay with it!

All of these three options are still better than holding your money in your bank account with a 0,5% interest, which can't even pay for the inflation , which is around 2% per year.

So even if Bitcoin is going to fall, let's say to $10,000 it would still outperform both Gold and SPX in term of ROI, which is the most important indicator at which Investors look at.

I am going to be also releasing a study on what's the best simple way of Buying Bitcoin in long term and profiting from it, so stay tuned.

If you liked this analysis, let me know by dropping that like button!

If you have any questions, feel free to ask me here or via dm!

Until next time!

Cheers,

Tibor

FINDING THE BEST ROI BETWEEN SIMILAR ASSETS 📚 With Alpha's PoP💬Introduction :

Today we are comparing the Dow Jones, NASDAQ, and the S&P by their annual performance to show how our open source indicator "Alpha Performance of Period" (PoP) can be used and why the results are useful. We will also look at other markets later in the writeup to see how they compare and to get a sense of which markets provide the best risk-to-reward and ROI.

The idea here is to compare highly correlated markets over time to see which of these markets preforms the best overall represented by a period chosen by the user. This will help tell us which of these indexes is the best/worst to trade/invest with on average.

For this article we will assume "best" equates to "best for long positions", but the indicator could be used for other purposes such as best shorting opportunities (largest drawdown amounts).

Comparing these indexes shows that the NASDAQ has historically outperformed, while the DOW underperformed, and the S&P has been somewhere in the middle since the tech bubble on a year-over-year basis.

You can also see this on the chart as represented by the indicator's metrics contained within its label, but we will summarize it below:

NOTE: The figures below are rounded up to the nearest .01%, see charts for exact %'s.

Equity Indices Total Annual performance results: (main chart)

(Jan. 2000 - present)

SPX = +111.79%

NDX = +156.10%

DJI = +117.65%

Now let's look at the quarterly and monthly performance:

Equity Indices Total Quarterly performance results:

(Jan. 2000 - present)

SPX = +104.57%

NDX = +160.75%

DJI = +111.65%

Equity Indices Total Monthly performance results:

(Jan. 2000 - present)

SPX = +91.22%

NDX = +125.274%

DJI = +101.68%

Equities Summary:

While the NASDAQ has had periods of underperformance (for example the dot com bubble burst), on each of the charts you can see that not only has the NASDAQ outperformed (and the Dow underperformed) over time, the NASDAQ has also generally outperformed during each different period measurement. We won't do the math for each period here as that's the main purpose of this indicator, but you can apply the indicator on your own chart and take a look at it yourself.

The main takeaways for us are this:

1. You are better off trading and/or holding the NASDAQ when compared to the 3 main indexes.

2. You are better off trading the S&P than the DJI.

3. The performance of the NASDAQ during COVID isn't an anomaly, and it doesn't necessarily indicate a tech bubble, outperformance in a specific period and overtime is the norm with this index.

Now that you see how this works on the indexes, let's showcase how it can work for other markets.

-----

RARE EARTH METALS~

Rare Earth Metals Total Annual performance results:

(Jan. 2000 - present)

GOLD = 193.87%

SILVER = 186.72%

PALLADIUM = 361.27%

Rare Earth Metals Total Quarterly performance results:

(Jan. 2000 - present)

GOLD = 201.80%

SILVER = 197.60%

PALLADIUM = 304.04%

Rare Earth Metals Total Monthly performance results:

(Jan. 2000 - present)

GOLD = 206.59%

SILVER = 209.60%

PALLADIUM = 283.25%

Rare Earth Metals Summary:

As you can see, despite the general public's love of Gold, Palladium vastly outperforms it. Meanwhile, we can confirm Silver underperforms. Many people wouldn't suspect Palladium was superior, but we now know from the resulting data (Hooray!).

-----

FOREX~

Main Forex USD pairs Total Annual performance results:

(Jan. 2000 - present)

EURUSD = 19.48%

GBPUSD = -9.03%

AUDUSD = 23.90%

Main Forex USD pairs Total Quarterly performance results:

(Jan. 2000 - present)

EURUSD = 20.75%

GBPUSD = -16.53%

AUDUSD = 20.98%

Main Forex USD pairs Total Monthly performance results:

(Jan. 2000 - present)

EURUSD = 19.57%

GBPUSD = -16.70%

AUDUSD = 21.93%

Forex Summary:

As you can see against a USD base-pair, GBP is the worst performing from the 2000's by all periods. One might assume the more popular EUR pair preformed better than for example AUD, but the reality is AUD takes the cake and preformed better than both EUR and USD by each period over time.

-----

CRYPTOCURRENCY~

Main Crypto USD(T) pairs Total Annual performance results:

(Jan. 2017 - present)

BLX = 1351.18%

ETHUSDT = 8967.62%

LTCUSD = 5012.80%

Main Crypto USD(T) pairs Total Quarterly performance results:

(Jan. 2017 - present)

BLX = 504.60%

ETHUSDT = 1124.81%

LTCUSD = 824.44%

Main Crypto USD(T) pairs Total Monthly performance results:

(Jan. 2017 - present)

BLX = 357.63%

ETHUSDT = 739.39%

LTCUSD = 530.67%

Crypto Summary:

Crypto has the largest period losses, but it also has the largest period gains (by far). Of all the crypto pairs, ETH offers the best ROI. Interestingly, ETH offers the best ROI of all markets mentioned in this article as well (although it also has the biggest losses and highest risk associated with its uptrends). Some might find it odd that Litecoin outperforms Bitcoin (although like with ETH, the drawdown is notably more intense).

-----

Conclusion:

Use "Alpha Performance of Period" (PoP) to compare markets for what is best suited to your portfolio depending on your individual risk appetite. It is meant to be used on highly correlated markets, but as you can see you can also compare different sets of markets together to get a sense of which offers the best risk-to-reward, ROI, etc. This tool thus has many uses related to figuring out which markets you want to trade based on historical data and offers a simple way to quickly compare past performance. Hope you guys enjoy it! :D

Resources:

apple.news

Hit that 👍 button to show support for the content!

Help the community grow by giving us a follow 🐣

1st Quarter Real-time Results of Trend King + 50%It is exactly 3 months since Trend King was publicly released.

I am happy to announce the 1st quarter real-life results:

⬆️ +50%

That's over +400% annualized ROI.

🤛25X #Bitcoin buy & hold returns with no leverage.

A $10K investment --> $15K = subscription fees paid off multiple times over.

This includes trading fees 60% higher than BitMEX and Binance and allows for each Trend King version release capability only as they became publicly available.

Contact me for access to:

- The TradingView Indicator

- Automated solutions

HOW-TO GRID TRADE: Show Me The Money (Tutorial #3)HOW-TO GRID TRADE:

Show Me The Money (Tutorial #3).

When I started this Grid Strategy Tutorial Series , I assumed readers would understand the profit potential straight away. I was wrong! Perhaps, because as I told my personal story and evolution into grid trading, I mentioned that I used grid trading for my "side money" (money I was not actively trading with other strategies). Yes, that's true. Initially, I just wanted an ROI on this otherwise dormant extra capital that was sitting at an exchange earning nothing.

NOTE: If chart illustration above overlaps or is unreadable, there is a screenshot below.

MY EPIPHANY

It was when my passive "Grid Trading Side Project" started earning a better ROI than my hands-on active trading that I had my epiphany! No way was I going to give up on the other styles of trading I enjoyed, but when it comes to making money consistently and with far less risk... hands-down, it was grid trading I decided to master.

A TUTORIAL SEGWAY

I decided I'd throw some backtest results out so you could get a taste of what I'm talking about. Of course, the backtests posted here are in NO WAY predictive of what the market might deliver at your doorstep tomorrow, but I think you get the point. Many hundreds of real people have also shared there active results with me, so there is ample validation about the viability of this strategy.

My personal results and those of others I coach are impressive, to say the least. However, we've lost money too, IT'S CRYPTO TRADING for crying out-loud. But like anything, you keep at it, you learn from others, you use indicators, you get better, you win some, you lose some, you master it and then... the winning results will exceed your losses. It doesn't take long at all. And YES, there's money in them there grids!

MORE RESULTS...

HOW TO I SEE MY POTENTIAL PROFIT?

Want more current results? Want to test your favorite coins? DO IT NOW... You may test any cryptocurrency at any of your favorite exchanges and get instant backtest results by visiting a grid bot or automation platform. Backtests are simple, fast and impressive.

THIS IS THE THIRD IN A SERIES OF GRID STRATEGY EDUCATIONAL TUTORIALS

I hope this tutorial series helps increase your bottomline!

HOW DO I LEARN MORE?

1) Review my related IDEAS and TUTORIALS (linked below)

2) Explore my GRID INDICATORS (linked Below)

HOW DO I AUTOMATE MY GRID STRATEGY?

Additional help and recommendations are at the bottom of this tutorial.

PLEASE HIT THE LIKE BUTTON (and follow me... lots of great stuff in the works!)

As always, I appreciate your support. Please share with others.

ENJOY!

Dan Hollings

Master Crypto Grid Trader

Please Explore My Other Indicators, Scripts, Grids and Educational Ideas.

@ DanHollings on Tradingview.