RSP

SUPER CYCLE TOP SOON IGV WAVE 5 The chart posted is by far the strongest chart within the market and has a clean wave structure from an Elliot Wave view . I have now taken a position for the last wave and will exit and go 100 % short all markets once the 5th wave has reached the targets min 106.7 to ideal target is 111 zone this should be seen based on my work in spiral cycle top is due 2.5 TD days from today with the alt on June 6/9 best of trades WAVETIMER

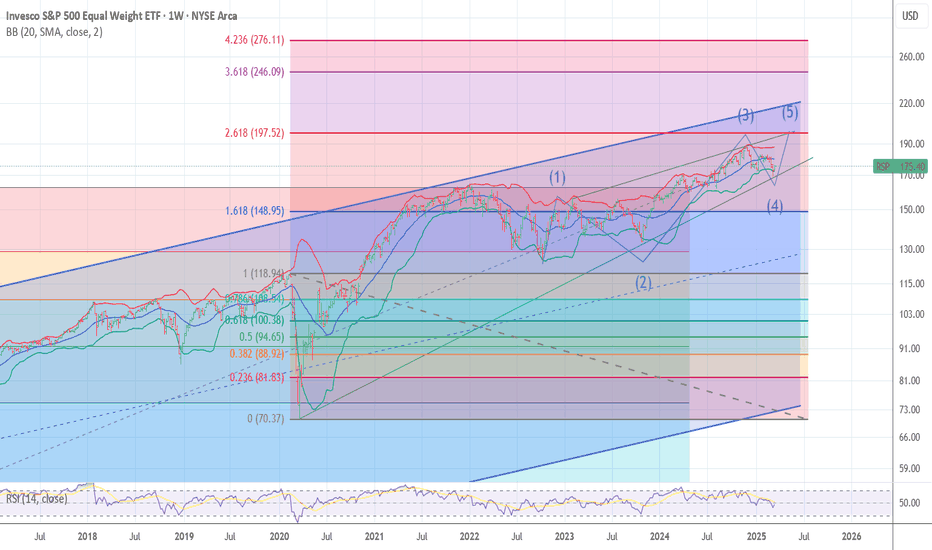

RSP and WHY I AM BULLISH STILL197/199 target The chart posted is the sp 500 equal weighted RSP has dropped to a trend line dated back to march 23 2020 . I have three clean points and all are major . Elliot Wave calls for a final 5th wave to end this advance in the area of 198 plus or minus 1.25 Fib relationship and PUT /CALL as well as most of my spiral and cycles point to the final advance to a Bull market top is now setup . BULL MARKETS TOP ON GOOD NEWS > Best of trades WAVETIMER

US Markets Cleared For A 13% to 24% Rally - Get SomeThis video highlights why I believe the US markets are ready to make a big move higher over the next 12 to 24+ months.

Many people suggest the markets will crack or crash, or we will experience some black/grey swan event. I'm afraid I have to disagree with this belief.

Yes, there is always a chance we will see some market event. However, to disrupt the US/global economy, there would have to be some event that disrupts the world, not just one or two smaller countries.

I do believe the US is making a broad transition into the 21st century, and new leadership (Govt) is required to make that happen.

But I also believe the seeds have been planted for exponential growth over the next 10-20+ years - and many traders are too focused on the crash dummies to see the real potential.

Watch this video. Share your comments if you like.

I believe we will see pullbacks and rotations on the way up - but I don't think we'll see any big crash event until after 2031 (or later).

Get some. This is going to be BIG.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

SPY/QQQ Plan Your Trade July 15-19 - US Broad-Sector RallyHappy Sunday.

Last week, I updated my SPY Cycle Pattern predictions, highlighting what I expected to happen over the next 15+ trading days. Even though it is almost impossible to accurately predict future price trends, ranges, and Daily close levels, I think I've done a pretty good job setting accurate expectations over the past 15+ trading days with my SPY Cycle Patterns.

This weekend, as I was analyzing this week and beyond, something became visible that alerted me to a broad market capital shift taking place. For more than 90+ days, I've warned traders that capital will move away from high-flying tech and other symbols to identify undervalued, ignored, and depressed stocks that still have fairly solid fundamentals/earnings.

Last week, we saw several stocks, most commonly shown on RSP (the equal-weighted S&P 500 ETF), break away from a flagging formation and shoot upward - gapping as it rallied. This is an obvious function of capital actively seeking new opportunities in ignored, undervalued, and depressed stock symbols. This is capital moving more evenly across the US stock market, attempting to ride the next wave higher.

In my opinion, this new Broad-Sector rally phase may continue to push the SPY/QQQ much higher than everyone expects. As a result, it could change how the SPY Cycle Patterns reflect the pending rally, contraction, and continued rally throughout the next two weeks.

Watch this video to learn more.

If I had to make a new, fresh analysis of what I expect after this big capital shift in the markets, I would move my upper price targets a bit higher and expect price to continue a stronger melt-up over the next 10 to 20+ days (throughout Q2:2024).

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

Thin AIR OEX I am now 33% long puts The sp 100 has reached into the fib relationship of a major top the sp 500 has Entered the min 5510 to 5531 RSI bearish setup I had hoped and the word is HOPED we print 5554 /5585 BUT cycles are running out and the Fang sector aka AAPL targets and msft in the lower end of super cycle targets .are being met . SOX has reach a perfect 1.618 and we saw the turn a second time . this shows the math is in control and that the fractals forming . Wavetimer I am now long march 485 qqq puts and spy 565 560 puts and RCL

RSP is now in wave 5 as stated it should The chart posted is the RSP index for the SP 500 equal weight index . last week I said it needed to rally still in a 5th up. I am waiting for confirmation of the End of the 5th .It is a 5 wave rally as I said at the oct low major short squeeze . I do see this as the end of wave B just above the 2022 top . This is the bearish wave count.. The Alt would then see this rally to end on april 2nd for the end of a bigger wave 3 top all wave counts show a very deep and sharp break is now just ahead NEXT DATE is MAY 2could we see a sharp drop into april 10/12 and then rally ??? will we see sell in may and go away ?? . Best of Trades WAVETIMER

$RSP & $RUT performing better at the moment, vs $SPXAMEX:RSP vs AMEX:SPY

Equal weight vs regular #SP500

We can see that equal weight has been performing better

Russell 2000

TVC:RUT is no longer stuck in a rut :)

It had a fake breakout in the daily charts in August but look at it now.

That weekly is looking Nicely!

We've stated a few times that we believed these 2 would be moving better than normal averages.

We also said TVC:DJI would keep leading, it has. Another new All time high.

Another call, NASDAQ:NDX should surpass, it's more aggressive.

RSP performing better than $SPX, good news for breadthThe AMEX:SPY is underperforming AMEX:RSP (equal weight SP:SPX ).

This means that underperformers could very well pick up the slack & outperform the Big 7 going forward. They have been performing well.

The Volatility Index TVC:VIX is down on the day BUT up from open.

Will the moving avg's push it lower or do we get some sort of support here? This is a MAJOR SUPPORT level!

TVC:VIX rarely gets close to oversold, let alone oversold.

AMEX:SPXS AMEX:SPXL #stocks

30%+ of $SPX = 10 companies, last time this high was 99Good Evening everyone.

While AMEX:RSP , equal weight AMEX:SPY , did well recently, the ten largest stocks are now making up more than 30% of the CBOE:SPX , wow!

However, it's been at a higher percentage than that before.

1999/2000 & in the early 90's, was around 40%

TVC:VIX hit a new low and it is likely hitting MAJOR SUPPORT, solid yellow line.

#stocks

S&P 500 Equal Weight ETF (RSP) ~ December 4H SwingAMEX:RSP chart analysis/mapping.

RSP ETF rally representing S&P market breadth - offering legitimacy to overall market strength & further indication of healthy stock rotation, instead of "Magnificent 7" concentration.

Trading scenarios:

Continuation rally #1 = ascending trend-line (white) / descending trend-line (light blue) confluence zone.

Continuation rally #2 = multiple gap fills / 78.6% confluence zone.

Shallow pullback #1 = 61.8% Fib / ascending trend-line (green dashed).

Shallow pullback #2 = gap fill / 50% Fib / 200MA confluence zone.

Deeper pullback #1 = gap fill / 38.2% Fib confluence zone.

Capitulation #1 = descending trend-line (white) / gap fill / ascending trend-line (light blue) / 23.6% Fib confluence zone.

$NDX & $SPX momentum slowing down hardNASDAQ:NDX looks a little short term toppish.

Look at weekly NASDAQ:QQQ ;

Considering that the Nasdaq 100 went higher the RSI is much lower than previous top. Shows a serious slowdown in momentum.

Ditto for CBOE:SPX

However, the equal weight AMEX:SPY seems to have some room to go.

AMEX:RSP

IWM has now ended the 1st ABC up decline now in waveB The chart posted is the IWM Russell 2000 tracking etf . As the forecast called for an ABC rally back to just above 181 we should now see a 3 wave decline to about 171/165 focus on 167 area over the next 2 weeks and then rally in a 5 wave structure from that low about dec 4 to the 10 th low into a peak at .618 at the 185.7 to 187.10 area about dec 24th to dec 29th Before the next very clear leg down in the BEAR market The market could holdup to jan 10 to the 17th some what but after that the data get very very neg in the Business cycle

This Statement is FalseCharting is amazing. The excitement it gives me is far greater than the satisfaction a good trade could ever give me. It is easy for me to state this fact since I don't trade. I consider the stock market as a super-long-term strategy. A strategy that lasts for generations, not a career. After all, the most wealthy have ancestors heavily invested in the stock market decades ago.

Charting can be prone to showing ghosts when there are none.

We tend to believe a crisis is coming, when in fact it is ending.

No wonder the yield curve is super important. With specific adjustments to rates, the FED manages to accelerate and decelerate the economy.

I recently found out about the following chart:

SPX-equal-weight vs SPX-market-cap

This chart represents "democracy" in wealth distribution between the 500 members of SPX.

The higher the chart, the more spread out the wealth distribution.

Now we are apparently reaching what appears to be a significant floor.

There is a lot of ground to cover regarding this chart above.

First things first, there appears to be a significant correlation between yield rates and wealth spread. There also appears to be a lag on this chart. First there is a wealth distribution change, and then the yield rates change appropriately.

The charts above state that high yield rates go hand-in-hand with higher wealth distribution.

At first this may seem counter-intuitive. How on earth do high yield rates help the markets? We all know that equities suffered last year because of the rapid rate hike.

It is simple, really. High yield rates encourage banks to lend money.

High yield rates help spread money from the few to the many.

As a historical analogue we could compare the SPX/DJI chart.

This chart is false.

The many vs the few is not what you think it is.

There is one caveat with this chart. SPX is a market-cap index while DJI is a stock-price index.

With that in mind we should consider the following:

-- The SPX/DJI chart is not 100% comparable. It may even represent the "average cost" of a stock. Since Market-Cap (money) is divided by Stock-Price (stock).

-- In hindsight, we realize that the Great Depression happened in a period of ample and cheaper stocks, with market cap diminishing. It might have been the absolute definition of a bubble. Buyers bought progressively more and more stocks that came into existence out of thin air.

Does this story ring any bells? Has anyone heard about derivatives?

The RSP/IVV chart we talked before had an excellent behavior and correlation to yield rates.

All was well, until now. Now we have an issue...

The RSP/IVV ratio, which appears to lead yield rates is rapidly dropping. With that in mind, the FED should have lower yield rates into what the market prices them.

Right now, the FED attempts killing the market.

A conclusion is hard to make. Both the SPX/DJI charts, and the RSP/IVV-yield-rate chart suggest that yield rates are significantly overextended upwards.

Have we leaped too fast too quick? Has the FED overreacted?

Does wealth distribution suggest lower rates in the months to come?

Has the market settled with a low-rate hyper-inflationary future?

Will the RSP/IVV floor give-in?

Is a roaring '20s-like bubble brewing? Just like our "friend" Musk called...

Tread lightly, for this is hallowed ground.

-Father Grigori

SPX | Balance of PowerNot all is equal. And nothing is static.

Entropy is the foundation of our world, and it is the bane of a rich man's existence.

You collect in one spot, then nature comes up and spreads your work around.

Entropy is the unbeatable power of justice. In the end entropy always wins.

One has limited amount of time to temporary evade it.

Panta Rhei - Heraclitus

Everything flows. Money just like water, tends to move around. It is what it is meant to do.

Rich men need poor ones to collect from. In the end, there is nothing else to collect from the poorer ones. But the cycle must continue. No rich man could ever possibly give out wealth for free. Instead, they let nature do its trick and rebalance things.

I will now try to make a rough model of the changes in markets. Divide markets in distinct periods so as to have a better understanding on the progress of a bull market.

Energy Conservation

Money and entropy tend to spread out. When the stock market was "invented", few had the stocks and many had the money. Trading is a way to manipulate entropy to our advantage. We let nature spread what we don't need, and as a repayment we accumulate what we need. The stock market is like a free energy machine .

The invention of the stock market resulted in a massive wealth transfer, and ended with a painful crash; The Great Depression. The peak of the Roaring '20s was the peak of wealth accumulation from the few.

In the post-Great-Depression economy, money spread out again. From the few to the many.

In these decades, DJI (the big 30) stagnated while SPX (the 500) progressively got stronger.

But the big-30 had an ace up their sleve.

In trading the game must always go on. There is always a way to get richer.

And so, commodities became the new place for wealth to accumulate to.

From all of the above we have come to realize that bubble tops come when the few have accumulated the maximum possible from the many. DJI/SPX measures oligarchy, while the inverse SPX/DJI measures democracy in the spread of wealth in stocks.

Many bubbles and many crashes have followed after the Great Depression. The .com bubble crash and the GFC are memorable to young and old alike. And they all exhibit the same base structure. It is all the same, with one crucial difference.

The 2020 economy is vastly different from the 1920 economy.

The role of SPX and DJI has changed in the last few decades. DJI used to represent the companies that shaped bubbles and SPX the ones that followed. Now NDX and SPX are the indices that represent fast growth while DJI has taken the role of the "index of stability".

The modern balance-of-power measure is the following:

SPX-equal-weight divided by SPX-market-cap.

www.tradingview.com

Since I couldn't find an SPX-equal-weight index in TradingView, I have constructed a similar chart using two ETFs, RSP and IVV. The RSP/IVV chart is a good analogue to the standard chart.

And so, where do we conclude?

After much analysis we can say the following in retrospect.

The 2008 bubble was quick but with big repercussions.

Money democracy shows signs of impeding financial weakness.

And as for the post-2009 Bull Market...

We realize that it progressively turns into a bubble. While there is no definitive way to "normalize" SPX, SPX/M2SL proves a good candidate for absolute SPX cost.

Yield rates tell many tales.

Usually yield rates increase as the wide economy needs them. Strong economies need a lot of money and they can withstand high yield rates. And contrary to popular belief, yield rates are positively correlated with yield rates. Now however, the wide economy refuses to absorb such high yield rates. High production cost and high rates can destabilize the economy.

Money Democracy is Positively Correlated to Yield Rates.

Now we witness the wide economy refuse to absorb these yields.

This has resulted in unprecedented wealth accumulation from the few.

Speculation Chart:

While this type of analysis is subjective, it is interesting to see patterns repeat.

Composite Chart:

An experimental chart attempts to calculate the scale of the derivative bubble we are in.

We realize that equity prices are now lying. They are simply too inflated and riddled with derivatives to believe in.

All of that was quite complex to follow through, and even harder to make a conclusion.

In the end, the simplest analysis might be the best.

A massive bearish upward channel has formed. Now price has rejected once again off the ceiling. The real recession may have not even started yet...

Tread lightly, for this is hallowed ground.

-Father Grigori

Bonus Charts:

Have we reached a golden ceiling?

RSP 5 WAVES DOWN WAVE 1 HAS ENDED The chart posted tonight is the Equal weighted SP 500 So far this is the cleanest wave structure of all the indexes and as of tonight I can say this is my Preferred wave count and should be the guide going forward for the next 6 to 9 months . So The rally from the oct low of 2022 rallied in a abc x abc for the students for the rest of you it was a ABC rally it did fall short of a .786 to peak at 75 % W.D GANN and an old friend Don Wolanchuk . since the july 27 turn I can count 5 clean waves down and waves 1 and 5 are equal within .25 of one point at the lows .This is now labeled WAVE 1 or wave A but I lean towards wave 1 of wave C which means we have a much bigger decline coming after the A B C rally back to 50 = 144 to .618 % 147 of the drop from July and should peak into the previous 4th wave which was 143.5 . from this rally we should hear good news . This rally I will mark as WAVE 2 or B Wave 3 or C target is in to targets and both are into a perfect Fibonacci retracement

92 and the alt is 75.6. Has I stated the data for the last 121.9 years shows me the avg bear market is 2.4 to 3.2 years long and the price damage is from 38 to 55 % and the avg is 44 % plus or minus 1.75 % .So has I stated in the first week of July long term holdings should be hedged or sold and into 30 and 90 day tbills !!! I see the odds of 92 being the target as it is also .786 from the march 23 low 2020 and 50 % from the march 2009 low as well. BEST OF TRADES WAVETIMER !

$RSP This chart becomes significantly crucial if the trend line AMEX:RSP This chart becomes significantly crucial if the trend line is breached. "trend line break" refers to a situation where the price of an asset moves beyond or crosses over a trend line that has been drawn on a price chart. Trend lines are used to represent the direction and strength of a trend in a market. A trend line break can signal a potential change in the trend direction or a shift in market sentiment.

Uptrend Line Break: An uptrend line break occurs when the price moves below an ascending trend line. This can indicate a potential shift from an uptrend to a downtrend or a period of consolidation.