THORChain Prepares New Bullish Wave · Trades at Bottom PricesLook at the period between June 2022 and October 2023. This is literally what we call "bottom prices," and this is exactly what we have now.

In this case, RUNEUSDT, the period starts January 2025 until this present day. THORChain is trading at bottom prices. The best time to buy before a major bullish wave.

Look back to October 2023, after a very strong and prolonged sideways period, the market turned extremely bullish, this is the exact same pattern we will have again. After months and months of sideways, the market will recover and turn, producing a new trend, an uptrend.

In late 2020, also around October, there was another consolidation period at bottom prices before a major rise. So this happens all the time. THORChain goes up and then hits bottom. Once at the bottom it lingers there for a while finally to recover and become super bullish. Each bullish period lasts anywhere between 6-12 months. Can be more or less depending on when you start to come but the project has been proven to move wild and big when the bulls are in. Which is what comes next.

Do not be deceived by the low prices or the short-term, everything can change in an instant and you already saw the preview, you already saw what is possible and to this market phase we are getting close. We are getting close to the next bullish wave and this wave will produce marketwide growth. Many more pairs will move compared to previous cycles and the advance will last that much longer.

It is already happening. The low was hit in January, almost 8 months ago. We are about to move higher, the highest prices since 2021.

Namaste.

RUNEUSDT

RUNE at the Brink: Rebound Opportunity or Breakdown Incoming?🧩 Overview:

RUNE/USDT is currently hovering at a critical support zone — a historical demand area that has triggered strong bullish rallies in the past. Positioned between $1.00–$1.30, this level has been a battle ground between buyers and sellers. The big question now: Will RUNE bounce for a bullish reversal or break down into deeper lows?

---

🔍 Key Levels Identified:

Major Support Zone (Demand Area): $1.00 – $1.30 (yellow box)

Immediate Resistance: $1.95 → $3.11 → $4.92

Extended Bullish Targets: $6.87 → $9.09 → $11.48 → $15.02

Deeper Bearish Targets (if support fails): $0.80 → $0.55 → $0.32

---

🟢 Bullish Scenario (Recovery Rally):

📌 Key Signal: Strong hold and price reaction above the $1.00–$1.30 zone.

1. Reversal Patterns: Look for double bottom, bullish engulfing, or strong weekly pin bars to signal a potential reversal.

2. Momentum Confirmation: A breakout above $1.95 with high volume could trigger a strong continuation to $3.11 and $4.92.

3. Macro Tailwinds: A broader recovery in Bitcoin and the crypto market could enhance bullish pressure on altcoins like RUNE.

🎯 Mid to Long-Term Bullish Targets:

$3.11 → $4.92 → $6.87+

Potential upside of 200–400%+ from current levels if bullish structure confirms.

---

🔴 Bearish Scenario (Breakdown):

📌 Critical Risk: Weekly candle close below $1.00 with volume confirmation.

1. Support Breakdown: If $1.00 fails, price may revisit previous lows around $0.80 or even test historical demand levels at $0.32.

2. Bearish Continuation Pattern: Sustained lower highs and lower lows suggest downtrend continuation unless invalidated.

3. Volume Pressure: Heavy sell volume on breakdowns reinforces bearish bias.

⚠️ Bearish Targets: $0.80 → $0.55 → $0.322 (historical low)

---

🔄 Pattern & Structure:

Historical Accumulation Zone: The yellow box has been a long-term accumulation area since 2021.

Repeat Behavior: Previous touches to this zone sparked multi-week rallies.

Potential Wyckoff Accumulation: If price forms a sideways range with rising lows, this may be the early stage of a markup phase.

---

🧠 Strategic Outlook for Traders:

✅ Bullish Strategy:

Conservative entry: Wait for breakout + retest of $1.95

Aggressive entry: Accumulate within $1.00–$1.30 zone with tight stop below $0.98

❌ Bearish Strategy:

Short setup on confirmed breakdown below $0.98

Avoid trading without confirmation of direction (no FOMO)

---

🚀 Conclusion:

RUNE is standing at a make-or-break level — a tipping point between a bullish breakout or further bearish pressure. Smart traders don't just predict direction; they prepare for both outcomes. This is not just a technical zone — it's the market’s decision point.

#RUNE #RUNEUSDT #CryptoAnalysis #AltcoinWatch #BreakoutSetup #DemandZone #TechnicalAnalysis #CryptoOutlook #BullishScenario #BearishScenario #Wyckoff

RUNE : Ready to pump?Hello friends🙌

👀According to the price drop, you can see that the price has reached an important area, which, according to the pattern formed, if the specified resistance is broken, we can enter with risk and capital management and move to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

THORChain 1,784% Profits Potential & Technical AnalysisHere we can see THORChain sandwiched in-between EMA89 and EMA55. The action is not happening above EMA89 but this shouldn't be considered bearish, more like "we are not there yet." Or, "still consolidating but with a bullish bias."

The bias is bullish because the low came in early February 2025. So that is more than 5 months ago. A bearish trend or bearish continuation would require lower lows in those 5 months. The fact that after the low in February there was a small recovery and this recovery ended as a higher low on the retrace, means the downtrend reached its end. Since the downtrend is over, we are seeing consolidation, accumulation before the market turns. The turning is the bullish cycle, the uptrend. And we are in the process of seeing this change materialize into the market, price and chart.

The minimum target is the "baseline level" between $7.44 and $6.20. The target to aim for should be $18 and if you are feeling optimistic then $28. I've seen this project grow incredibly strong in the past so I wouldn't be surprised if it ends up moving even higher.

This is a simple chart. What goes down, must come back up; specially when we are talking about Crypto. The best financial market in the whole world. Young, but highly profitable. Risky? I don't know... It is risky to be young. But the potential rewards make up for any risk the market carries. We can take risk when we are young. We should. You play it safe because you are old. No risk, no fun. Plan ahead, success is yours.

Namaste.

RUNE Ready for a Big Move? Accumulation Breakout Incoming!Current Market Structure:

#RUNE has been in an accumulation phase after a prolonged bearish trend. The price is consolidating, forming a potential Wyckoff Accumulation pattern. No further bearish signs are present except for the previous break of a strong support level.

Key Levels to Watch:

🔹 Support: $0.788 (previous level)

🔹 Resistance: $2.5 (breakout zone)

🔹 Accumulation Range: $1.13 – $1.6

Trading Plan:

🔹 A confirmed breakout above the resistance level will signal the start of a bullish trend.

🔹 Ideal long entry on breakout with a retest confirmation.

🔹 Stop-loss below accumulation range to minimize risk.

🔹 Targeting $7 as the next resistance level.

What do you think?

Will #RUNE break out soon, or are we in for more sideways movement? Share your thoughts in the comments!

Like & Follow for more trade setups and insights!

RUNEUSDT | Red Box Sell Wall Still HoldingRUNEUSDT is currently facing a strong resistance zone, clearly marked by a heavy sell wall inside the red box .

Until that level is broken with volume and confirmed as support, my bias remains negative and I stay short-focused .

“I will not insist on my short idea. If the levels suddenly break upwards and do not give a downward break in the low time frame, I will not evaluate it. If they break upwards with volume and give a retest, I will look long.”

No need to predict. Let the structure guide you.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

RUNEUSDT Breakout and Bull Flag Forming!!After nearly three months of tight consolidation, BINANCE:RUNEUSDT has finally broken out of its range-bound “box” structure. a powerful sign that the market is ready to move. This type of breakout often signals the end of indecision and the start of a strong directional trend.

What makes this setup even more exciting is the formation of a bull flag pattern right after the breakout. Known as a classic continuation pattern, the bull flag usually signals that the asset is simply pausing before its next leg up. The tight pullback within the flag is showing low-volume correction. A bullish sign that buyers are still in control.

With this confluence of a range breakout followed by a bull flag, BINANCE:RUNEUSDT is flashing all the signs of a potentially explosive move to the upside. However, it’s important to stay disciplined – always manage your risk and keep stop losses in place below the flag structure or previous support levels.

Next move could be strong. Stay sharp and ride the wave!

BINANCE:RUNEUSDT Currently trading at $1.87

Buy level : Above $1.86

Stop loss : Below $1.6

Target 1: $2.2

Target 2: $3

Target 3: $4

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

Thorchain "Back To Baseline" Easy 280% Profits TargetThorchain (RUNEUSDT) is no longer bearish, the bullish bias is now fully confirmed and this statement is supported by many chart signals. Let's look at those.

First, there is a strong and classic reversal bottom formation, the Adam & Eve pattern.

This pattern was completed when RUNEUSDT moved above its base (black line on the chart).

This pattern on its own is a strong reversal signal but that is not all, today RUNEUSDT is moving above EMA89 and recently conquered EMA55 daily for the first time as resistance. This is happening with three green daily candles and the strongest bullish momentum since March 2024.

Current action is indicative of so much more to come, but here we will focus on something basic and simple, the "baseline."

This is a very easy target, RUNEUSDT is set to test the December 2024 resistance zone, the price zone from where it took the plunge. Obviously, this resistance will break after some challenge easy, but this is the first and main level that will be tested on this bullish wave. That's a very easy 280% profits target in the coming months, very easy with a strategy based on buy and hold. You can't go wrong. You will be happy with the results.

Thorchain will grow, Bitcoin will grow, the Altcoins will continue growing and what you are witnessing now, is only the start.

Thanks a lot for your continued support.

Namaste.

Thorchain (RUNE) about to go 1100%?Dearest reader,

Welcome back for yet another great analysis, there is alot to unpack on the chart above so lets dive right in. Thorchain has seen a brutal crash/retrace of a whopping 87% since december regarding their financial situation around the thorfi hack. There is always something right? Ignore the FUD and look at the chart, it's screaming ''buy buy buy!''

Lets go through the chart from left to right.

1. Lower support line, has seen 5 confirmations so far, dating back all the way to 2020 (Small 1's)

2. Bullflag. Has seen 6 confirmations of this channel (green circles) and had a breakout in november 2023

3. Retest of BOTH 1 and 2, the upper line of the bullflag and also the support line since 2020

4. Stochastic RSI is oversold, sellers are exhausted, makes sense! it has seen a 87% drop allready. MFI has seen the lowest point in the history of this token (17) and has been moving back up. Note: Stochastic RSI is a lagging indicator and MFI is forward looking. Both look bullish

If the pattern from 2020 would repeat that could mean that by august this year we will see a price of 11 dollars yet again, that's a whopping 1100% from this point.

Target: 11/12$

Entry: 1$

Stoploss: 0.75$ (There is some support here, so even when this area is hit it might still bounce up.

~Rustle

RUNE - Make or break ...RUNE is currently in a prolonged downtrend, respecting the descending resistance lines since its peak. Price is now approaching a critical horizontal support zone:

🔴 Key Support: $0.75

🟠 Minor Support Zone: $1.00 – $1.10

🟢 Major Resistance Levels:

$2.50 (First trendline test)

$4.00 (Second trendline)

$6.00+

The price action is compressing near the lower boundary of the descending channel, while RSI is drifting toward oversold levels (RSI ~37.85). Historically, RUNE has seen relief rallies from this region.

⚠️ Scenarios to Watch:

Bullish:

Price holds above $0.75 and RSI enters oversold territory.

Break and close above $1.10 could trigger a relief rally toward $2.50.

Confirmation would come with increasing volume and break of descending trendline.

Bearish:

Breakdown below $0.75 support could open doors for further downside.

Possible targets below $0.75: psychological levels at $0.50 or lower, especially if volume increases on the breakdown.

📈 RSI Indicator:

RSI nearing oversold, currently ~37.85.

No confirmed bullish divergence yet, but worth watching closely for potential reversal signals.

🧩 Strategy Notes:

Conservative traders: Wait for reclaim of trendline and a close above $1.10–1.20 for safer entry.

Aggressive traders: Look for bullish RSI divergence or price action confirmation around $0.75 for a potential bounce play.

Risk management is crucial — set tight stop losses below critical levels.

🎯 Summary:

RUNE is at a make-or-break zone. $0.75 is a crucial historical support. A bounce from here could send the price towards the first resistance at $2.50, while a breakdown may lead to further bearish momentum. Watch RSI and volume for clues!

THORChain: Your Altcoin ChoiceTHORChain (RUNE) looks great, for buyers. Right now the action is happening right above a major low, the November 2022 low.

RUNEUSDT hit a major low in November 2022 together with Bitcoin. It then went on to produce a lower low that was followed by a ~1,400% bullish wave. This is only the preview pre-bull market year. In this bull-market year, growth should be much stronger.

Much of this bullish wave has been erased, corrected and now RUNEUSDT stands above long-term support. This is the buy-zone, a long-term buy-zone. The accumulation zone.

This is a great place/price to buy-up, buy-in, rebuy and reload. Buy, buy, buy, buy focusing on the long-term. This is truly a great opportunity and entry price. We do not focus on the fact that prices are dropping nor the short-term. We focus on the future and the potential we have for growth.

Just as the 2022/2023 bearish cycle produced a major bullish phase; this strong correction we are seeing now in early 2025 will launch the next bull market, growth will be many times bigger compared to the last wave.

This is a good one. You are wise if you are looking at this pair.

Thanks a lot for your continued support.

RUNEUSDT (THORChain), Your TOP Altcoin Choice.

A strong and solid target for this cycle can be $30. It can go higher just as it can reach lower, but this is a good level to look for. A good price to use as a reference point.

Namaste.

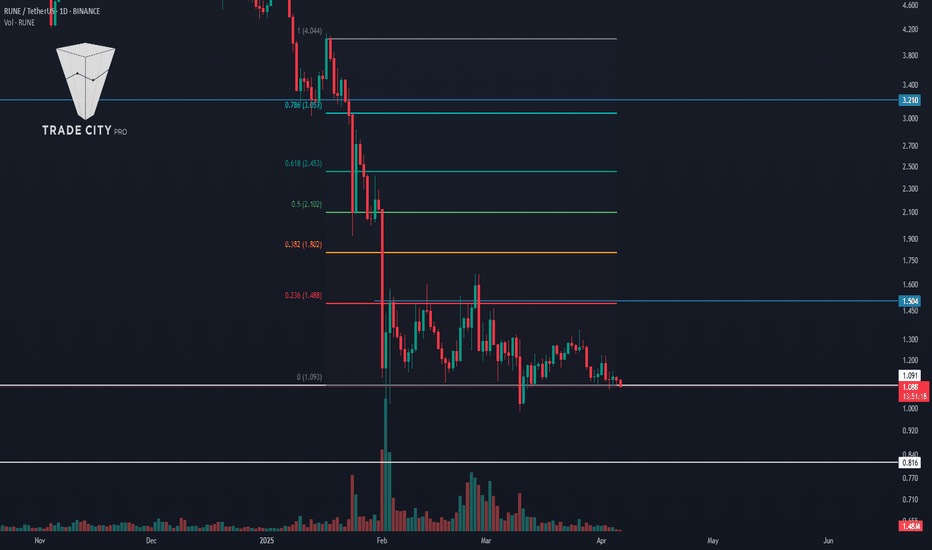

TradeCityPro | RUNE: Decoding Its Descent in DeFi Markets👋 Welcome to TradeCity Pro!

In this analysis, I want to discuss the RUNE coin, which was requested in the comments of yesterday's analysis. This project is one of the DeFi projects, with a market cap of $383 million, ranking 118th.

📅 Weekly Timeframe

In the weekly timeframe, as you can see, it has started a downward leg from the peak of 6.894 and is moving downwards, reaching the area of 1.110.

✔️ Currently, it seems that the downward momentum has slightly decreased, and the price is moving downward more slowly. The RSI oscillator is also near the 30 area, ready to enter into Oversell and introduce a new downward momentum into the market.

💫 If this occurs and the price consolidates below 1.110, the next support will be 0.816, which is a very important floor, and if this area breaks, the last support the price will have is 0.386.

🔑 On the other hand, if the price is supported at 1.110 and breaks the trend line that the price has, we can confirm a trend change and the start of a new upward trend. The main trigger will still be 6.894.

📅 Daily Timeframe

In the daily timeframe, the price has a range box between 1.091 and 1.504, and after the downward leg following the break of 3.210, it has now entered a ranging phase and is ranging in this area.

🔽 For a short position, given that the price has hit a lower high compared to 1.504, the likelihood of breaking the floor of the box is high, and with the break of 1.091, we can enter a short position.

📊 An important point is that the market volume in this range box has decreased significantly and keeps decreasing. With the entry of volume in any direction, the market can start moving in that direction.

📈 If buying volume enters the market, the first long trigger is the break of the 1.504 area. This area overlaps with the 0.236 Fibonacci, and breaking this area, the next important levels are 0.382, 0.5, and 0.618 Fibonacci.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#RUNEUSDT is showing signs of growth📈 Long BYBIT:RUNEUSDT.P from $1.161

🛡 Stop loss $1.140

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is at 1.08, indicating the area with the highest trading volume.

➡️ The 1.154 level acts as a local support, as the price previously bounced from this zone.

➡️ The volume and market profile highlight areas of high trader activity, especially in the 1.100 – 1.161 range.

🎯 TP Targets:

💎 TP 1: $1.174

💎 TP 2: $1.185

💎 TP 3: $1.195

📢 Monitor key levels before entering the trade!

📢 If 1.140 is broken downward, the trade may be invalidated.

📢 If the price holds above 1.161 and continues rising, the bullish momentum remains intact.

BYBIT:RUNEUSDT.P is showing signs of growth — expecting further upside movement!

RUNE Long OpportunityMarket Context:

RUNE has been trading within a range for the past few weeks, and price has now retraced to the lower support level of this range. This presents a solid opportunity for a long entry targeting the next resistance levels.

Trade Details:

Entry Zone: $1.18

Take Profit Targets:

$1.30 - $1.35

$1.45 - $1.60

Stop Loss: Just below $1.10

This setup offers a strong risk-to-reward ratio, with potential for range-bound trading before a breakout. 🚀

Rune - Thorchain: A Mid-Term Opportunity Too Good to IgnoreThorchain (RUNE) presents a compelling short-to-midterm opportunity that’s hard to pass up. Despite reports suggesting that North Korean hackers have used it to launder stolen Ethereum, the technical indicators are extremely bullish.

Volume: One of the highest levels we've seen in a long time.

RSI: Oversold on the weekly chart, signaling a strong potential for a rebound.

Midterm Target: A 5x to 6x increase.

This looks like the best buying opportunity at the moment—unless I’m overlooking something fundamental. If I am, feel free to share your thoughts in the comments. Thanks!

RUNE sell/short setup (4H)The RUNE token, after experiencing heavy drops due to negative news, is now trading within a range.

A price top has been fake out, leading to a drop. On a retracement to higher levels, we can look for a sell/short setup.

We have identified two entry points for a short position.

Targets are marked on the chart.

A daily candle closing above the invalidation level will invalidate this view.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

THORChain Bullish Confirmed: 361% Back To Baseline PotentialWhen a Cryptocurrency trading pair moves and closes daily above EMA13, this confirms a bullish bias. The longer the moving average the stronger the signal/confirmation.

Here we are looking at RUNEUSDT (THORChain) and we can see a move and close above EMA13 and EMA21. The move above EMA21 happened today and this one is confirmed only when the session (daily candle) closes above this level.

EMA13 is a short-term exponential moving average when it comes to Cryptocurrency trading charts. A move above this level signals the change of a bearish bias towards a bullish one.

The fact that RUNEUSDT is moving also above EMA21 fully confirms the short-term bullish signal given by the break above EMA13. In simple terms, we are going up —bullish confirmed.

When there is a strong drop, as shown in this chart, there is always a counter move "back to baseline." The baseline here is the last high because of a double-top between May and December 2024.

Back to baseline would give us a minimum of 361% potential for growth. This is short-term. There is sure to be more, much more because we are in a bull-market year. Prepare for massive growth. This is an easy chart, an easy trade.

Thank you for reading.

Your continued support is highly appreciated.

Namaste.

ACHUSDT UPDATEACHUSDT is a cryptocurrency trading at $0.03285. Its target price is $0.06500, indicating a potential 90%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about ACHUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. ACHUSDT is poised for a potential breakout and substantial gains.