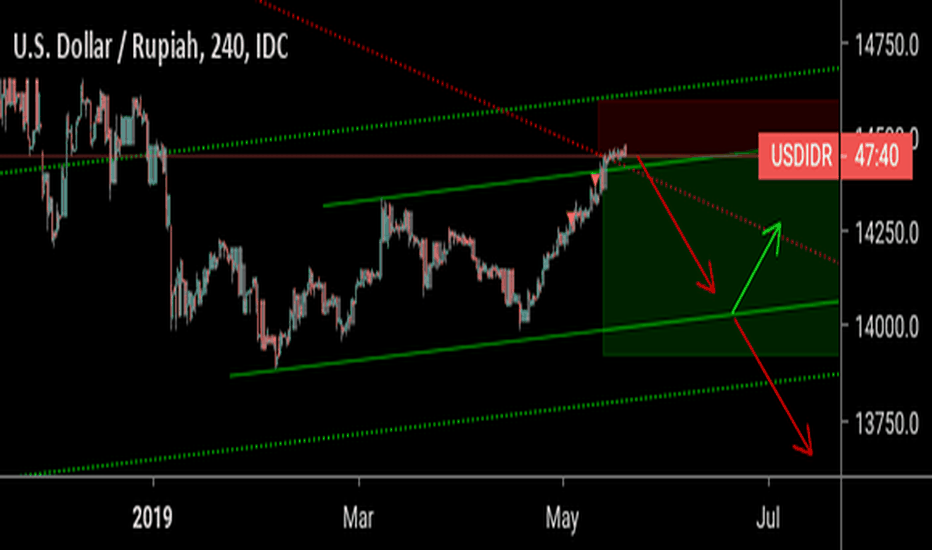

USDIDR Buy On WeaknessThis chart shows the USD/IDR pair (U.S. Dollar/Indonesian Rupiah) on a weekly timeframe. Below is the analysis based on the visible trend lines, price action, and channels:

1. Ascending Channel:

The chart illustrates a clear upward channel that has been maintained since 2017, suggesting a long-term bullish trend in the USDIDR pair.

The price has bounced from the lower bound of the channel, which indicates that the support line around the 15,200 region is holding well.

2. Support and Resistance:

Support: The price is currently hovering around 15,459. The nearest strong support zone is at 15,200 as it coincides with both historical price levels and the lower bound of the upward channel.

Resistance: There are several resistance levels ahead:

16,400 (the dotted line): This seems to be a mid-level resistance line within the channel.

16,600: This appears to be the next major resistance, as indicated by the chart and could represent a key decision zone.

3. Possible Future Movement:

The chart suggests a bullish bias in the future, as indicated by the projected zigzag path. The price is expected to bounce between resistance and support lines before possibly reaching towards the upper boundary of the channel near 16,600.

Short-term correction: Before further bullish movement, the price might dip slightly towards the 15,400 or 15,200 support levels.

4. Long-Term Outlook:

The price trend continues to suggest an upward movement in the long term, as the channel is clearly moving upwards. A breakout above the 16,400–16,600 resistance zone could accelerate the USDIDR towards new highs.

Conclusion :

Bullish Outlook: The USDIDR seems to be in a long-term bullish channel. After potentially testing support at 15,200, the price may resume its upward trajectory, targeting 16,400 and possibly 16,600 in the coming months.

Rupiah

Bullish Bias on USDIDRIndonesia rupiah would like to weakening since we've got a pennant pattern on this market as their bullish continuation signal. Buy on break should be your consideration with the supply area as price target and 14300 as a bullish invalidation if the price goes down and close below it

Rupiah: Below 10k for Singaporean Dollar? SGDIDR is below it's psychological level of 200 days moving average (MA200). This show that the sell pressure is still intact, and we expect a downtrend move for SGDIDR. As long price still lower than 10440 (MA200) and below 10285 as a neckline of Head & Shoulder pattern, there is a downside risk to hold SGDIDR with downside target at 9765 and 10075 as its minor target price.

If Indonesian would go for holiday to SG, they can wait for a lower SGD few months ahead. As long it stay below 10285 - 10440.

#GaleriSaham | Global Market

Final trend confirmation for Indonesian Rupiah?The movement of US Dollar to Rupiah seems in the end of consolidation? After 3x the price breaks the trend line, according to the fan principle theory, the third will be a strong confirmation. We see that US dollar will strengthen toward Rupiah to upper consolidation range 14525 - 14550. If US Dollar then breaks 14550, seems the USDIDR will rally.

#galerisaham | Global Market

GOLD IDR 31 year bullish cycleThanks for viewing,

This just comes after looking at gold vs a number of different currencies like XAU/AUD which and XAU/NZD both of which have set new all time highs. The value of gold is one thing, the value of your home currency is a another thing. This is why people hold gold - to protect themselves from the slow and steady (or not so slow and steady at times) devaluation of the currency.

Since the overseas markets are mostly down over the past 18 months, bond yields are near all time lows, and central banks are seemingly starting a new monetary easing (currency devaluation) cycle there seems not to be many reliable stores of value in the market. Except much maligned but very reliable gold that has played that role countless times over thousands of years. Here it is going parabolic once again - a mix of rising USD gold prices and rupiah depreciation vs USD.

Normally I view parabolic moves with a high degree of suspicion, and if gold sets new all-time highs in USD terms - which a lot of people expect to happen - who knows how high that will be in IDR terms. Gold is well utilised in Indonesia as a store of value after recent (2013 to now) steady and the sharper steeper devaluations on 1998. I wonder if, looking back at the gold/idr price since 1997 you can point to a time where it would not have been a good time to buy gold? Because in a lot of economies, there is no such time. The right time to buy gold in a weak currency is now.

Rupiah is in Hazardous RoadFX_IDC:USDIDR

I predict Rupiah (USDIDR) might keep depreciating to more than Rp14,300/USD.

If Rupiah Breakout Resistance (Rp14,300/USD), then the possibility of Rupiah strengthening to Rp13,600/USD or any level below Rp14,000/USD is vanished. Rupiah will be on the verge to keep weakening to its lowest level at Rp15,300/USD.

Rupiah must move below Rp14,000/USD in the next 1-2 weeks to shrink any threats that make Rupiah might keep decreasing to Psychology level at Rp15,000/USD.

USD / IDR time for a correction - because everything correctsThis is 100% technical analysis and 0% fundamental analyis. I would like to see for myself if TA can stand on its own.

By my count there is some strong bearish divergence shown on the RSI. Three higher highs have translated to lower highs on the RSI, indicating slowing momentum. When that slowing momentum is also coincident with what seems to be (I only spent 5 mins on it) wave 5 of 5. Since this is the first time I have looked up the currency pair on a technical chart it would be unlikely that I did so "at the top" but right now it is a plausible scenaro.

Saying that I would normally expect wave 5 to at least reach the top of the channel, and of course, normally top the wave 3 high as well. However, it seems a real posibility that it will fall short. The IDR has been weakening for years and a correction may be warranted - especially if the USD loses strength.

What will happen now is the start of a small correction (to start with to the lower trend line) but keep an eye on signs that the correction may be steeper or deeper. If the lower trend-line is broken with momentum and volume I would stay in the short trade. Because wave 5 (if it turns out to be the wave 5 top) is truncated (lower) it would indicate there is significant downward pressure and the correction could be swift.

My other scenario is a lot more bullish; that this is just sub-wave 1 of the larger degree 5th wave up. This would mean all time highs for IDR in a year or two.

I am not "trading" IDR but keeping an eye on it. I don't trade FOREX - mainly commodities like bitcoin, silver, gold, and crude. This is published for my own education. Comments welcome. Let's see how it turns out.

Further IDR Depreciation?This has been a tough one to make a prediction because it is at the same level during the crisis in 1998, but notice it is the new normal for Rupiah, even though nominal term seems horrifying, but in terms of percentage it is tamer than of that in 1998, 2008/2009 and 2015. Looking at the 3 flags pattern there are probability that IDR may hit 15k in the near term.

The low inflation in Indonesia (2.88% in September 2018) will hopefully control the IDR movement against the USD because considering a higher real yield from IDR bonds will invite foreign investors to buy in and creating a higher demand for IDR bonds and of course it will appreciate the IDR as well.

USDIDR will definitely determined by 2019 next electionI'm betting on Rupiah strengthened against dollar if Mr. Prabowo being elected in next 2019 president election and predicting Rupiah will go straight above 15K-ish if Mr. Jokowi continue to the second period.

My ressistant and support is above.

Mr. Prabowo x Mr. Sandi = Military x Businessman = IDR will be strengthened to 12K-ish

Mr. Jokowi x Mr. Ma'aruf Amin = Businessman x Religious Leader = IDR will be weakened to 15K-ish

Tradingview,

Blockchaindedi

2:20 P.M - 1 September 2018, Indonesia.

USD/IDR Almost bearish?Now price of USD/IDR has reach its peak from 2014-2015 run, is USD/IDR still too high? maybe yes, its reach last highest price.

so? its preferred that holders will selling their dollars to rupiahs soon by now, or if they dont, not many people want to buy dollar at this time...