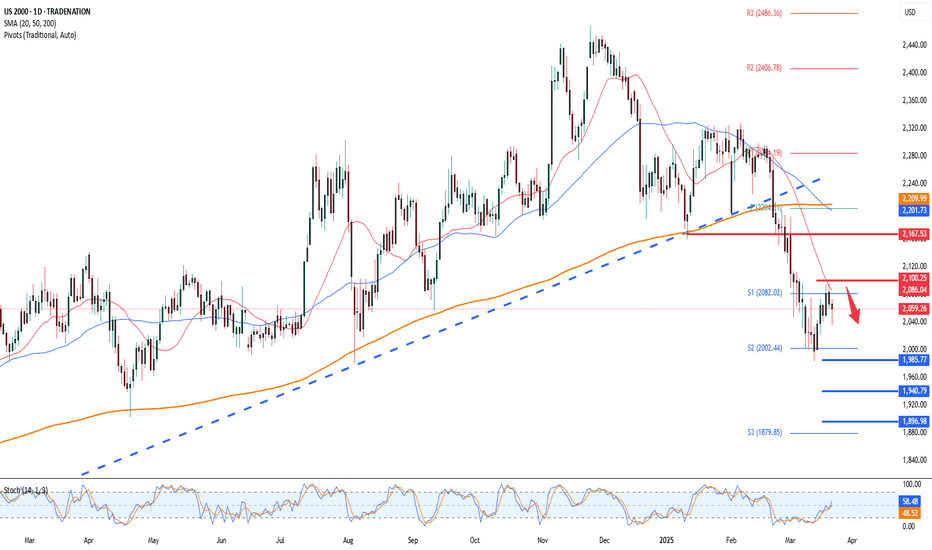

Russell 2000: How deep can the Bear Market go?As the markets navigate uncertainty, the Russell 2000 appears to have entered a #bearmarket, contrasting with other indices that are still correcting. A pressing question looms: Has the market correction concluded, or are we on the brink of a broader bear market?

Last Friday's market turmoil saw panic-like sell-offs, deeply affecting major U.S. and European #stocks with losses ranging from 6% to over 10%. Such widespread sell-offs suggest a panic reaction, possibly indicating a market bottom. However, panic alone cannot confirm this hypothesis.

To evaluate the likelihood of a deeper bear market and potential buying opportunities, several factors need consideration.

Currently, the Russell 2000 is approximately 30% down from its previous all-time high. Technically, it rests in a horizontal support zone. However, the strength of this zone is debatable. Let’s explore why.

The initial moves by President Trump to impose reciprocal tariffs have already been felt, but the reactions of other nations remain unpredictable. Should other countries react strongly or if further tariffs and legal changes are introduced by President Trump, we could be heading toward a global trade war. Such a development could compromise the support zone, potentially driving the Russell 2000 down by 50%, reminiscent of the COVID-19 pandemic drop in 2020. A target range of 1250–1200 points could thus be realistic.

If the situation deteriorates further and we revisit pandemic lows, the Russell 2000 could plummet by nearly 60%, reaching as low as 950 points, mirroring the 2020 scenario.

I've recently suggested that this scenario may be the right time to cautiously start building small positions, considering additional declines could occur. A cautious and incremental market entry is a wise strategy during such uncertain periods.

We hope this focused analysis on the #Russell2000 provides valuable insights as you navigate these turbulent times.

Russell2000

US Small Companies Index ‘Russell 2000’ in Critical Trend!US Small Companies Index ‘Russell 2000’ in Critical Trend!

Let's take a look from a Fundamental and Technical perspective;

In 2020, the middle band (main trend line) of the logarithmic rising channel was broken and the upward movement had continued since then. Today, however, the same critical support level is being tested again.

If it cannot hold at this level, a long-term trend break may occur. This would significantly increase the risk perception in Russell 2000 companies.

What is Russell 2000?

It does not include large technology giants such as Nasdaq or S&P 500, but small and medium-sized companies that hold the real pulse of the US economy.

These companies are more fragile and more vulnerable to economic fluctuations.

The spread of anti-Trump protests shows that small businesses are starting to be affected both physically and economically.

The prospect of no interest rate cut by the Federal Reserve (FED) is crushing these companies under high borrowing costs.

The contraction in consumer spending can directly hit the profits of these companies because they are dependent on the domestic market.

Possible Scenarios for This Week:

🔴 If the protests deepen and the market panics:

If a break below $180 comes, the $170 support level is tested.

With panic sales, the $150 - $160 region, which is the lower band of the channel, may come to the agenda.

🟢If the environment calms down and economic data signals a recovery:

Strong purchases come from the middle trend line.

$200 - $210 band can be targeted.

In short, support is now being tested, if it breaks, the risk of serious decline is on the table.

Russell 2000 INTRADAY ahead of tariff announcement Donald Trump’s team is finalizing options for a reciprocal tariff plan, with proposals including a tiered system and a customized approach. Markets await clarity from the president’s 4 p.m. Rose Garden announcement, which could impact trade and financial markets.

Resistance Level 1: 2028

Resistance Level 2: 2045

Resistance Level 3: 2080

Support Level 1: 1980

Support Level 2: 1944

Support Level 3: 1900

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

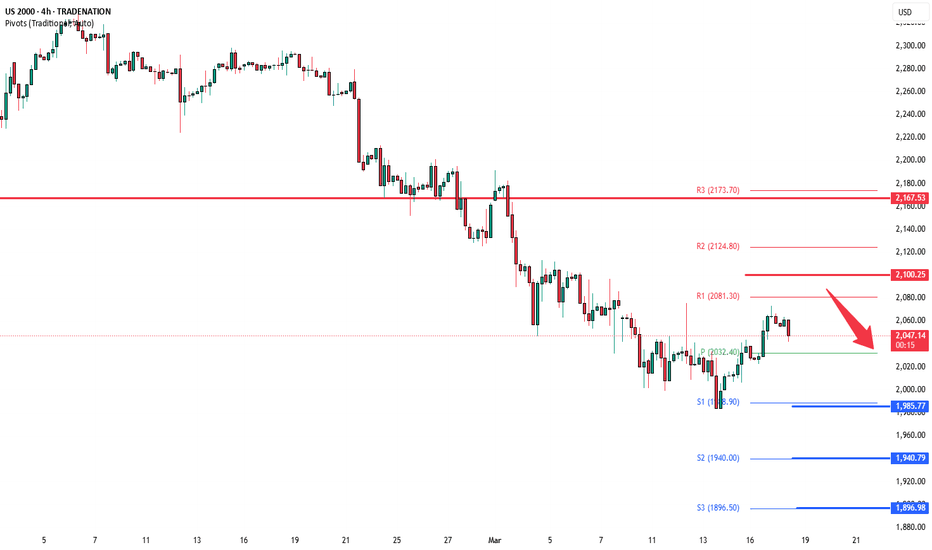

Russell 2000 H4 | Pullback resistance at 50% Fibo retracementRussell 2000 (US2000) is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 2,046.13 which is a pullback resistance that aligns with the 50.0% Fibonacci retracement.

Stop loss is at 2,095.00 which is a level that sits above the 78.6% Fibonacci retracement and a swing-high resistance.

Take profit is at 1,984.80 which is a multi-swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

"US2000 / RUSSELL 2000" Indices Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US2000 / RUSSELL 2000" Index CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (2120) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 2H timeframe (2060) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

✂Primary Target - 2180 (or) Escape Before the Target

✂Secondary Target - 2230 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US2000 / RUSSELL2000" Index CFD Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

RUSSELL 2000 INTRADAY reaction to US PCESlightly hawkish as Core PCE remains elevated—could delay Fed rate cuts.

US Equityes may face short-term selling pressure as yields react.

If risk appetite holds, dips could present buying opportunities in growth stocks.

Watch Treasury yields & Fed commentary for further market direction.

Key Support and Resistance Levels

Resistance Level 1: 2113

Resistance Level 2: 2131

Resistance Level 3: 2167

Support Level 1: 2060

Support Level 2: 2022

Support Level 3: 1987

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell 2000 Elliott Wave Analysis (WXYXZ in progress)Possible wave (ii) complex correction in the form of a WXYXZ still in progress.

Expecting corrective rally to fail around the 2200 resistance zone.

A final wave down from there should find a bottom around the 1900 support zone where wave (ii) should end.

Expecting wave (iii) to commence from there...

------

*would appreciate feedbacks and thoughts on this*

**this is not a trade recommendation, just an idea that I am working with**

Russell INTRADAY muted reaction to positive durable goods dataRussell INTRADAY muted reaction to positive durable goods data

Key Support and Resistance Levels

Resistance Level 1: 2113

Resistance Level 2: 2131

Resistance Level 3: 2167

Support Level 1: 2060

Support Level 2: 2022

Support Level 3: 1987

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell 2000 H1 | Approaching pullback supportRussell 2000 (US2000) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 2,087.22 which is a pullback support.

Stop loss is at 2,065.00 which is a level that lies underneath a pullback support and the 50.0% Fibonacci retracement.

Take profit is at 2,131.72 which is a pullback resistance that aligns with the 161.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

RUSSELL 2000 The Week Ahead 24th March '25RUSSELL 2000 bearish & oversold, the key trading level is at 2100

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

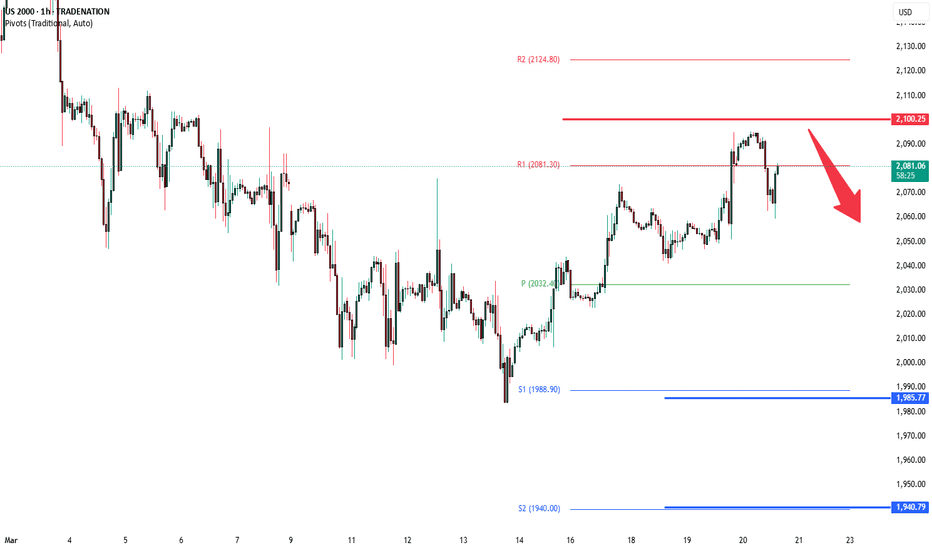

Russell 2000 INTRADAY Bearish oversold bounce back Key Support and Resistance Levels

Resistance Level 1: 2081

Resistance Level 2: 2100

Resistance Level 3: 2124

Support Level 1: 1982

Support Level 2: 1940

Support Level 3: 1896

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell2000 INTRADAY Oversold bounce back capped at 2081Key Support and Resistance Levels

Resistance Level 1: 2081

Resistance Level 2: 2100

Resistance Level 3: 2124

Support Level 1: 1982

Support Level 2: 1940

Support Level 3: 1896

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell 2000 Year-End Price Target and Technical Rebound OutlookIf you ahven`t bought the Double Bottom on RUT 2K:

Now the Russell 2000 Index (RUT), which tracks small-cap stocks, has recently entered oversold territory, signaling that a potential technical rebound could be on the horizon. Oversold conditions typically occur when selling pressure becomes excessive, driving the index below its fundamental value and creating an opportunity for a corrective bounce.

Several technical indicators, including the Relative Strength Index (RSI), have fallen below the 30 level — a classic oversold signal. Historically, similar setups have led to strong short-term recoveries as buying interest returns once the selling momentum exhausts itself.

Additionally, market breadth indicators suggest that the recent pullback has been broad-based, with a high percentage of RUT 2K components trading below their 50-day and 200-day moving averages. This type of widespread weakness often precedes a period of mean reversion, where prices bounce back toward key resistance levels.

Given these technical signals, my price target for RUT 2K is $2,450 by the end of the year. A rebound toward this level would represent a recovery of approximately 10-12% from current levels, aligning with previous post-oversold rallies in the index. If broader market sentiment stabilizes and small caps benefit from improving economic conditions or easing rate hike pressures, the path toward this target becomes increasingly plausible.

While downside risks remain — including ongoing macroeconomic uncertainty and geopolitical tensions — the technical setup suggests that RUT 2K is primed for a recovery in the coming months.

RUSSELL 2000 The Week Ahead 17th March '25RUSSELLL2000 INTRADAY bearish & oversold capped by resistance at 2170

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

RUSSELL2000 INTRADAY Bearish continuation capped at 2056 Key Support and Resistance Levels

Resistance Level 1: 2097

Resistance Level 2: 2132

Resistance Level 3: 2167

Support Level 1: 2000

Support Level 2: 1981

Support Level 3: 1957

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell2000 INTRADAY Key Trading LevelsKey Support and Resistance Levels

Resistance Level 1: 2097

Resistance Level 2: 2132

Resistance Level 3: 2167

Support Level 1: 2000

Support Level 2: 1981

Support Level 3: 1957

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell2000 The Week Ahead 10th March '25Sentiment: Bearish INTRADAY, Price action is consolidating in a tight trading range.

Resistance: Key Resistance is at 2135, followed by 2175 and 2208.

Support: Key support is at 2020 followed by 2000 and 1900.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell 2000 INTRADAY ahead of US Non Farm PayrollsSentiment: Neutral, Price action is consolidating in a tight trading range.

Resistance: Key Resistance is at 2100, followed by 2113 and 2123.

Support : Key support is at 2054 followed by 2035 and 2026.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell 2000 H4 | Pullback resistance at 61.8% Fibo retracementRussell 2000 (US2000) is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 2,133.07 which is a pullback resistance that aligns close to a 61.8% Fibonacci retracement.

Stop loss is at 2,202.00 which is a level that sits above the 50.0% Fibonacci retracement and a swing-high resistance.

Take profit is at 2,047.95 which is a swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Russell 2000 Key levels ahead of US OpenBearish Scenario:

The Russell 2000 index remains in a shorter-term downtrend, signaling continued bearish momentum. The key resistance level to watch is 2208. If an oversold rally occurs but faces rejection at this level, the index could resume its decline, targeting 2078, followed by 2015 and the psychological 2000 level over a longer timeframe.

Bullish Scenario:

A confirmed breakout above 2208 and a daily close above this level would invalidate the bearish outlook. This could trigger further upside movement, with resistance targets at 2230, followed by 2278.

Conclusion:

The near-term sentiment remains bearish, with 2208 as the key pivot level. A rejection from this resistance would reinforce downside risks, while a breakout above it could indicate a shift toward renewed bullish momentum. Traders should closely monitor price action around this level to assess the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

RUSSELL capped by 200DMA, The Week Ahead 03rd March '25The Russell 2000 (US2000) index exhibits bearish sentiment as the long-term uptrend is under threat, with price action closing below the psychologically significant 200-day moving average (2209). Since reaching an all-time high on November 25, 2024, the index has started to show weakness, suggesting a potential continuation of its corrective consolidation.

Bullish Scenario:

The 2209 level (200-day moving average) serves as a critical support zone.

A bullish rebound from this level could restore upward momentum.

Potential upside targets include:

2257 (initial resistance)

2324 (next major resistance)

2360 (longer-term target)

A strong bounce from 2209 could signal a recovery and reaffirm the broader uptrend, attracting renewed buying interest.

Bearish Scenario:

A confirmed break below 2141 support, followed by a daily close under this level, would indicate further weakness.

This could accelerate the downside momentum, leading to potential targets at:

2093 (next key support)

2023, if selling pressure intensifies

A sustained move below 2141 would invalidate the bullish outlook, suggesting the corrective phase could deepen, with the potential for an extended pullback.

Market Outlook:

The 2209 level remains the key pivot—holding above it could support a recovery, while a decisive break lower would confirm a deeper correction. Traders should monitor price action closely for confirmation signals to assess the next directional move in the market.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Timing the Markets with Consumer SentimentBusinesses and producers around the world always cheer when U.S. consumer sentiment is in the 80 to 100 zone, as U.S. consumers play a big part in the global economic ecosystem.

The United States remains the largest consumer market in the world, but since the pandemic, this index has not recovered above the 80 level.

Does it mean that, there is a risks economy to enter into a recession?

How can we use this index to time our investments and trades?

E-mini Russell Futures

Ticker: RTY

Minimum fluctuation:

0.10 index points = $5.00

Micro E-mini Russell Futures

Ticker: M2K

Minimum fluctuation:

0.10 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

Trading competition: www.tradingview.com

Trading the Micro: www.cmegroup.com

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com