EYPT | Range bound Long-Term pattern suggests that after previous dilution, Eyepoint's stock price went range bound for quite awhile before breaking out.

This marks potential accumulation range for anyone looking to build a position in EYPT.

Ranges make for good swing trade positions (especially 20%+ both ways) and a way to average down.

Range low/ highs, range from $1.42 - $1.87 is approximately $0.45 of profit both ways up (~20%+) until EYPT confirms they are adhering to terms of loan with CRG.

Weekly MACD and Stochastics have divergence with stock price. This could infer spring board type action on good news (break below range could cause problems).

Previous quarter showed that $EYPT was on track w/ meeting terms of CRG loan agreement.

positive earning/ ER beat should help satisfy some hedge funds/ big $ investors. I remain cautiously optimistic.

$EYPT could potentially come and test lows of the range within next week. I am looking to use this as a way to add to current position/ swing trade it to highs and lower cost basis on my long-position.

**On the other hand, falling below this range could cause knee jerk reaction/ selloff. I am going to be watching this carefully.

Tip # 7: When trading, It is very important to have a game plan. It is good practice to establish rules to your system (i.e. do you buy in increments?, at what point do you not like the investment anymore? how long are you willing to hold?).

- Please Like and Follow for trade ideas & so I can continue to chart and build my reputation. Thank you in advance =)

Have a Twitter? check out my page for more: @volatilitywatch

Disclosure: I am long EYPT. This is not a note to buy or sell. Please do your homework before investing.

//-----------------------------------------------------------------------------------

Check out current trade in TGTX =) #BULLISH

Russell2000

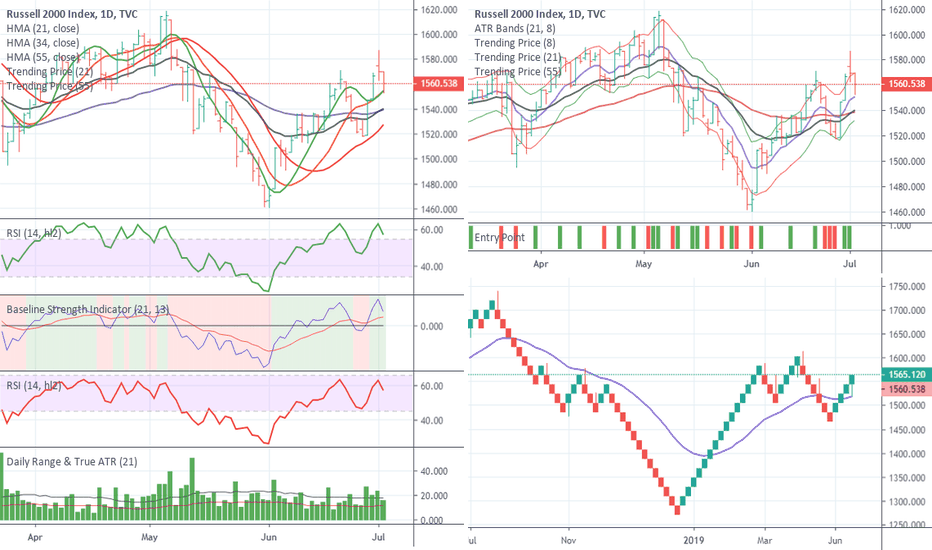

RTY One Hour time frame. $850.00The E-Mini Russell 2000 one hour time frame

is in sideways movement. The market is at

the bottom of support price point 1560 and

is showing signs of a potential up push.

A potential entry would be to wait for the

market to close above the counter trend line

bullish. The future resistance price point

1580 about +170 ticks away may be a great

exit for potential profits. About +$850.00

trading one contract.

Monitor with cautionConsolidation has been established with a range of 1548.12 - 1586.77

For the technicians out there who like patterns. A Pivot High was just completed. So, look at the bottom of the consolidation range for your breakout signals.

Anchor bar on the consolidation is a positive bar which suggests a 70% chance of breakout to the top.

Coupled with the pivot high - I would decrease that down to 30%.

This is a mixed bag of directional signals, suggesting the market hasn't decided yet.

Strong Week AheadPersonally endured an internet brown out this weekend. This is getting released late.

Noticed immediate change in strength of the Russell after reorganization.

No new projections this last week.

Bullish going into the weekend.

G20 announcements are exciting for the market.

Expecting a range this week of between 1542.80 - 1629.23

ES1! AB=CD WEEKLYCURRENT LEG SUPPORT A STRONG MOVE DOWN 2700-2500 RANGE

CURRENT DOUBLE TOP

CURRENT OSCILLATION TURNING POINT

WITH A LOT OF HANDS HEAVY LONG SUPPORTED BY CHINA TRADE MEDIA PUMP ES COULD VERY WELL SMACK DOWN INVESTORS 3RD QTR

3000 IS STILL A C>D TARGET

CURRENT MOVEMENT IS B>C

A>B HAS BEEN SATISFIED TWICE WHICH MEANS A DOUBLE TOP

E-Mini Russell 2000 One hour time frame +319 ticks BullishThe E-Mini Russell 2000 One hour time frame

entered into an up channel. The market is

now at the bottom of the channel to where the

market could extend to the top. The future

high price could be 1566.80 about +319 Ticks

away which is $1,595.00 for every one contract

traded. I am going to use the tunnel trader for

entry as the market extends to the top.

A cautionary tale (commentary)There is an old traders tale that says something to the nature of, if a price tries three times to break a support or resistance level, yet fails, it will retreat the opposite direction.

January 2018, the DJI tried to break above 27,000. It got to 26,616 before it retreated. Not enough strength.

October 2018, it tried again and got to 26,951 before it retreated. It pulled back to 21712 to get a running start in an attempt to break it.

April 2019, it tried for the third time and reached 26,695 before pulling back to 24,248.

Did it finally punch 27,000 hard enough that it just needs a love tap? Or is this last attempt going to be a half-hearted thud before a drop 20,000 or 18,000?

It is difficult to tell.

All the strength indicators reflect that it can get through this level.

DJI is trying to reach 27,058

SP500 is trying to reach 2999

NASDAQ is trying to reach 8178

Russell 2000 is trying to reach 1552

But they are also weak signals. Signals generated while being caught in consolidation so near to the top.

Consolidation so near the summit, it is like being trapped in a room that has filled with water, you have nearly broken through the ceiling but you are running out of breath as you take your last breath from the last few inches left of an air pocket before....... we break through or we drown.

Once we reach this level again, will we become impacted by a tweet? A trade war? An oil embargo? Such as we were in May?

The wind was in the sails that day. The markets all closed the Friday before strong. Yet Sunday evening prior to the Far East opening the markets for us to start a new week. A little tweety bird went out and took all of the markets enthusiasm away.

Yet here we are again. The 26,000 range.

Extreme caution needs to be exercised here - Trade with caution. Double check everything. Monitor your stops, monitor the VIX.

This can be a record year - either as an amazing new start to the bull market. Or the year we stripped 23% - 32% of the market away.

Russell 2000: Buy opportunity on 1D.The index has bounced this week off the 1,458.00 Support which was the contact point on October - November 2018. This is a cyclical buy opportunity on 1D and an early long signal as 1D is still neutral (RSI = 44.642, ADX = 33.294, Highs/Lows = 0.0000). We are long on RTY targeting 1,590 (Resistance). If this bullish sequence later holds the 1,498.80 - 1,514.20 zone as a Support, we may be looking at the start of a strong bull run to the ATH and beyond.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Russle 2000 ShortAlthough I strongly discourage the action of shorting in my personal strategy this doesn't keep me from speculating on the possible price fluctuation of the index. Viewing recent recessionary signals such as the inverted yield curve, raising tensions in the US-China relation as well as US-Mexican relations I've come to the conclusion that there might be something sketchy going on in the markets. Also noting the decision of Neil Woodford to close withdrawals from his fund I've come to the conclusion that there is rising anxiety for investors on the future of stock prices. If this sentiment continues we could see perhaps lower lows than those seen during the December period. I personally believe the recent market rally was driven merely by the good news caused by the increased sales of the holidays and other factors as well, but now entering to one of the usually most negatives stages of the year the fragility of the market could again be exposed.

Additionally, from a technical point of view, we can observe a MACD cross over on the weekly chart. This indicates that the short-term average of price fluctuation is moving lower than the longer 26-period average, therefore, indicating a possible future change in the longer-term average and therefore moving the price lower. Also were positioned in a support level which may be tested and stand strong but with further downward pressure it could easily push through in the near future leading to a strong move to the downside.

Although I don't recommend a strategy based on buy and sell signals I feel the there is a high amount of bearish signals being triggered, not only in the chart but in the news as well as in economic data such as the Yield curve inversion. The low level of unemployment also signals me we're if not at then near full employment which could lead to higher wages and therefore layoffs (this is mear speculation and not based on any fundamental truth).

This analysis remains exactly the same on multiple other indexes such as the SPX, DJIA, and ME (although I belive the ME to be a way more riskier investment given the political situation of Mexico)

My recommendations would be:

1) Play it safe, don't short

2) Have your money on a safe haven such as gold or keep your money liquid

3) Buy once the market has had a significant drop such as the December lows and lower

4) Brace for impact

Elliott Wave View: Russell Should Extend LowerElliott Wave sequence in Russell (RTY_F) from May 6, 2019 high (1621.9) appears incomplete favoring further downside. The bounce to 1571.5 in the Index ended wave X. Index has extended lower in wave Y and broken below the previous low on May 14 low (1516.7). This suggests the next leg lower has started. The internal of wave Y is unfolding as a double three Elliott Wave structure. Down from 1571.5, wave ((w)) ended at 1492.9 as a zigzag Elliott Wave structure where wave (a) ended at 1522.1, wave (b) ended at 1548.9, and wave (c) ended at 1492.9.

Wave ((x)) bounce is now complete at 1523.90 peak while below there should extend lower. We don’t like buying the Index, and as far as pivot at May 16 high (1571.44) stays intact, expect Index to move lower. Potential target to the downside is 1441.85 – 1466.32 area where cycle from May 6, 2019 peak reaches 100% extension.

SPX 600 points lower by August Rising Wedge trend linesBounce above 2900.. Could be a hundred point higher than here today..So enjoy the rally to accumulate short around these levels. Any time higher is a gift.

All time high fractionally??? or just Oct 2018 high

Global slowdown contagion hitting our shores..

Rates cut sooner than the fall to fan the fire before its out

The market didn't read this one soon enough. Job Cuts.Guiding Lower.

Recession Stock Time

Trade Safe

AMEX:SPY