The Ruble's Unlikely Triumph: What's Driving It?The early months of 2025 have seen the Russian Ruble emerge as the world's top-performing currency, achieving a significant appreciation against the US dollar. This unexpected rally is largely attributed to robust domestic economic measures. Faced with persistent inflation exceeding 10%, the Central Bank of Russia implemented a stringent monetary policy, raising the key interest rate to a high of 21%. This aggressive stance not only aims to curb price growth but also makes the Ruble highly attractive to foreign investors seeking elevated yields through carry trade strategies, thereby increasing demand for the currency. Furthermore, a healthy trade surplus, marked by increased exporter conversion of foreign earnings, has bolstered the Ruble's supply-demand dynamics.

Beyond internal economics, shifting geopolitical perceptions have played a vital role. Growing market anticipation of a potential ceasefire in the Ukraine conflict has notably reduced the perceived political risk associated with Russian assets. This improved sentiment encourages some international investors to return cautiously to Russian markets. Concurrently, a weakening trend in the US dollar, influenced by evolving US trade policies, has amplified the Ruble's relative strength on the global stage.

Strategically, Russia's ongoing efforts to decrease its reliance on the US dollar are also providing underlying support for the Ruble. Initiatives promoting trade settlements in national currencies, such as recent agreements enabling Ruble payments with Cuba, reflect a long-term pivot towards establishing alternative financial channels. However, this Ruble strength presents challenges, particularly for the state budget heavily dependent on converting dollar-denominated oil revenues. A stronger Ruble yields fewer domestic funds, potentially straining finances, especially amidst volatile global oil prices. The balancing act between maintaining high rates to control inflation and mitigating their impact on domestic credit and investment remains a critical consideration for policymakers.

Russia

Geopolitical Analysis and Impacts on Currency Markets

Hello, my name is Andrea Russo and today I want to talk to you about how recent geopolitical news is impacting the Forex market, analyzing the main currency pairs and providing a detailed technical picture.

Current Geopolitical Context

This week, the geopolitical landscape has been characterized by a series of significant events. Among them, tensions between the United States and Russia have dominated the scene, with a phone call between Donald Trump and Vladimir Putin that has opened up the possibility of a negotiation in Ukraine. However, the situation on the ground remains critical, with Russian forces advancing in several Ukrainian regions2. Furthermore, uncertainty over gas supplies in Europe has led to significant volatility in energy markets, with the price of gas falling by 3%.

Impacts on the Forex Market

Geopolitical tensions have had a direct impact on the Forex market, influencing volatility and capital flows. For example:

EUR/USD: The pair has been showing a bearish trend, influenced by economic uncertainty in Europe and the strength of the dollar as a safe haven.

USD/JPY: The dollar has gained ground against the yen, thanks to the perception of economic stability in the United States.

GBP/USD: The British pound has been under pressure due to concerns about economic growth in the United Kingdom.

Technical Analysis

A technical analysis of the major currency pairs reveals the following trends:

EUR/USD: Technical indicators suggest a "sell" position, with key support at 1.0832 and resistance at 1.0862.

USD/JPY: The pair is showing "buy" signals, with an uptrend supported by resistance at 148.09.

GBP/USD: Indicators are mixed, with resistance at 1.2944 and support at 1.2920.

Conclusion

Geopolitical dynamics continue to play a crucial role in determining the movements of the Forex market. Investors should carefully monitor global developments and use technical tools to make informed decisions. The current volatility offers opportunities, but also requires careful risk management.

I hope this analysis has been useful to you in better understanding the connections between geopolitics and Forex. Stay tuned for more updates!

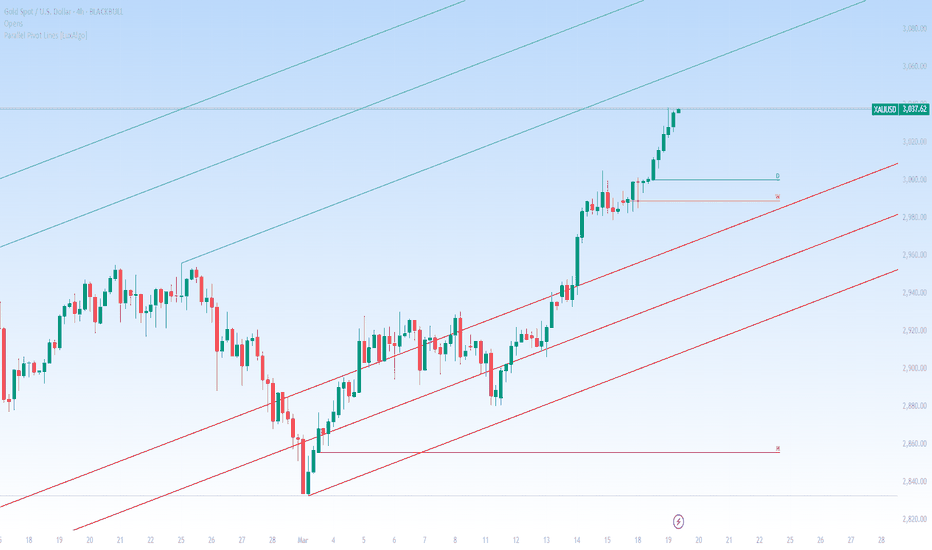

Why gold may—or may not—reach $3,060 next Gold is now up 15.57% in 2025 after gaining 27.2% in 2024.

If the current momentum continues, traders may target the upper parallel trendline near $3,060 and rising.

Safe-haven demand is a key driver of this rally, but what could disrupt it?

For one, U.S. President Donald Trump and Russian President Vladimir Putin spoke for 90 minutes today, agreeing on steps toward a peace deal in Ukraine, including a pause on attacks on energy infrastructure. However, Putin declined to accept a broader 30-day ceasefire proposed by U.S. and Ukrainian officials.

Why gold remains strong: Latest on Ukraine and Yemen Gold remains in high demand as a safe-haven asset, currently trading at $2,998.7 per ounce.

Why the need for a haven? Here’s an update:

A ceasefire in Ukraine hinges on some unpalatable conditions. Donald Trump has announced plans to speak with Vladimir Putin on Tuesday, saying that land and power plants are part of the negotiations. Reports suggest his administration is considering recognising Crimea as Russian territory and may push for UN recognition.

In the Middle East, the U.S. carried out military strikes over the weekend on Houthi-controlled areas in Yemen. The strikes came after the group threatened to resume attacks on Red Sea shipping.

Trump has declared that Iran will be held directly responsible for “for every shot fired” by the Tehran-backed Houthi rebels. In response, the Houthis vowed to “respond to escalation with escalation.”.

Russia-Ukraine-Europe: Forex Impact

Hello, I am Professional Trader Andrea Russo. Today I want to share with you a reflection on the current geopolitical situation, in particular on the war in Ukraine and its global implications. The latest developments show us an increasingly complex panorama: America seems to have taken an ambiguous position, with signals that could be interpreted as a rapprochement with Putin. This has led to an intensification of the conflict between Russia and Europe, with consequences that could redefine the global balance.

The current situation and its implications

The war in Ukraine, which has been going on for years now, has had a devastating impact not only on the military front, but also on the economic and political front. Recently, the United States' decision to limit the flow of intelligence to Ukraine has favored the Russian advance in some strategic areas. This change in approach has raised doubts about the real American position and has fueled tensions between Western allies.

Europe, for its part, is in a delicate position. On the one hand, it faces economic pressures from sanctions against Russia; on the other, it must maintain a united front to support Ukraine. However, the lack of a clear strategy could lead to internal divisions and a weakening of its global position.

In this context, the European Union recently announced an ambitious €800 billion plan for rearmament, called "ReArm Europe". This plan aims to strengthen European defense through significant investments, including €650 billion from national resources and €150 billion from loans guaranteed by the community budget.2 The President of the European Commission, Ursula von der Leyen, stressed that we live in an era of rearmament and that Europe must be ready to defend itself autonomously.

The impact on the Forex world

This geopolitical situation has inevitably had repercussions on the Forex market. The war in Ukraine has already caused significant volatility in global currencies, with the euro coming under pressure due to economic uncertainties in Europe. At the same time, the US dollar has shown relative strength, but recent ambiguity in US foreign policy could weaken this position.

Emerging market currencies, especially those close to the conflict, remain highly vulnerable. The Russian ruble, for example, has seen significant swings, reflecting economic sanctions and the country's internal dynamics.

What to expect going forward

Looking ahead, the forex market is likely to remain highly volatile. Investors will need to closely monitor geopolitical developments and adjust their strategies accordingly. The key will be to maintain a flexible approach and diversify portfolios to mitigate the risks associated with this global uncertainty.

In conclusion, the current situation presents an unprecedented challenge for traders and investors. However, with a well-planned strategy and careful analysis of the context, it is possible to navigate through these turbulent waters and identify investment opportunities.

Will Russia’s New Dawn Reshape Global Finance?As the Russo-Ukrainian War edges toward a hypothetical resolution, Russia stands poised for an economic renaissance that could redefine its place in the global arena. Retaining control over resource-laden regions like Crimea and Donbas, Russia secures access to coal, natural gas, and vital maritime routes—assets that promise a surge in national wealth. The potential lifting of U.S. sanctions further amplifies this prospect, reconnecting Russian enterprises to international markets and unleashing energy exports. Yet, this resurgence is shadowed by complexity: Russian oligarchs, architects of influence, are primed to extend their reach into these territories, striking resource deals with the U.S. at mutually beneficial rates. This presents a tantalizing yet treacherous frontier for investors—where opportunity dances with ethical and geopolitical uncertainties.

The implications ripple outward, poised to recalibrate global economic currents. Lower commodity prices could ease inflationary pressures in the West, offering relief to consumers while challenging energy titans like Saudi Arabia and Canada to adapt. Foreign investors might find allure in Russia’s undervalued assets and a strengthening ruble, but caution is paramount. The oligarchs’ deft maneuvering—exploiting political leverage to secure advantageous contracts—casts an enigmatic shadow over this revival. Their pragmatic pivot toward U.S. partnerships hints at a new economic pragmatism, yet it prompts a deeper question: Can such arrangements endure, and at what cost to global stability? The stakes are high, and the outcomes remain tantalizingly uncertain.

This unfolding scenario challenges us to ponder the broader horizon. How will investors weigh the promise of profit against the moral quandaries of engaging with a resurgent Russia? What might the global financial order become if Russia’s economic ascent gains momentum? The answers elude easy resolution, but the potential is undeniable—Russia’s trajectory could anchor or upend markets, depending on the world’s response. Herein lies the inspiration and the test: to navigate this landscape demands not just foresight, but a bold reckoning with the interplay of economics, ethics, and power.

Will We See the Euro Trading Below Par?CME: Micro EUR/USD Futures ( CME_MINI:M6E1! ) #Microfutures

Since the US election last November, the Euro currency has lost ground against the US dollar, with the EUR/USD exchange rate sliding from 1.08 to as low as 1.02.

A combination of new policies from the Trump administration aims to strengthen the dollar. Recent efforts to end the geopolitical crisis will not support the euro. On the contrary, they could push the European common currency below the critical 1-dollar level.

Quick Review of the EUR/USD Price Trend

The euro has swung widely against central bank policies and geopolitical events:

• 2020: The Fed implemented massive stimulus measures in response to the pandemic. Lowering interest rates and increasing money supply reduced the value of the USD

• 2021: The faster vaccine rollout and quicker reopening of the US economy boosted economic growth and investor sentiment towards the USD

• 2022: (1) The Fed raised interest rates to combat inflation, making the USD more attractive to investors compared to the Euro. (2) Europe faced an energy crisis due to its dependence on Russian gas. This crisis led to economic uncertainty and weakened the euro. (3) Ongoing geopolitical tensions created economic instability in Europe, further weakening the euro against the USD

• Q4 2022 and 2023: European Central Bank abandoned its long-held zero-rate policy in September 2022. It raised rates eight times to 4.00%. These actions narrowed the interest rate differentials between the US and Europe, and helped the euro rebound

• 2024: The EUR/USD moved mainly sideways in the range of 1.06 and 1.12. Fed easing and rebounds of US inflation contributed to the mild volatility.

• Q4 2024 to Current. Dollar ascended quickly after the election win of Donald Trump. Investors expect strong dollar with the support of the new America First policies

Ukraine Peace Talks and Possible Outcomes

On February 12th, Presidents Trump and Putin agreed to immediately start negotiations to end the ongoing conflict in Ukraine. On February 18th, US and Russian officials held peace talks in Saudi Arabia. The two sides agreed to create a high-level team to lead the Ukraine peace talks. Neither Ukraine nor the EU participated in the meeting.

How the peace talks would progress remain highly uncertain. Using Game Theory, we could break them down into two mutually exclusive and collectively inclusive outcomes:

• Peace: US, Russia, Ukraine and the EU sign a peace agreement to end the conflict and ensure long-lasting peace. Whether it will be a fair treaty is a hotly debated topic.

• No-Peace: Peace talks break down. The 3-year-long conflict continues. This could last for years but eventually will lead to a win/loss outcome or a draw.

From an investing perspective, “No-Peace” is equivalent to “Risk On”. It may imply higher gold prices, higher energy costs and lower equity value. Meanwhile, “Peace” means “Risk Off”. We may see declining gold, lower oil and gas, and rising stock prices.

However, it would be difficult to pick the price direction if we can’t predict the outcome.

Peace or No Peace – A Steep Cost for Europe

For better or worse, the recent events are a wakeup call to European countries.

The US had defense spending totaling $967 billion in 2024, which is 3.49% of its GDP. For a comparison, the total defense spending for EU member states reached $358 billion in 2024. This represents around 1.9% of the EU's GDP

• The US accounted for 73% of the defense spending in the 32 countries in NATO

• Since 2022, the US contributed to 2/3 of all the financial aids sending to Ukraine

The US administration intends to cut its financial support. Europe will have to increase defense spending dramatically. In a worst case, a complete breakdown in Cross-Atlantic relations could see the US exiting NATO and all US troops withdrawing from Europe.

How much is the spending gap? In 2024, Russia had defense budget of $462 billion, or 6.7% of its GDP. Ukraine had defense budget of $40 billion, or 22% of its GDP.

• EU plus Ukraine spent $64 billion less than Russia in defense budget.

In my opinion, in a Peace scenario and with reduced US involvement, the EU defense budget must surpass that of Russia to ensure Ukraine to stay on top. I find this to be 2.5% of GDP. This means a 32% increase or $471 billion in total defense spending.

For No-Peace, the EU will be fighting an active war. NATO will need to maintain a standing army of 1 million troops and rebuild an entire defense industry. In this scenario, I feel that the defense budget needs to double 5% of GDP. budget to raise a large army and rebuild an entire defense industry. This means a 163% increase or $942 billion in total defense spending.

If the above numbers sound outrageous, Israel, a country constantly fighting for its survival, will serve as a good refence point. In 2024, Israel's defense spending amounted to 117.5 billion Israeli shekels (around $32.5 billion USD), which is 6.7% of its GDP.

The EU has an estimated GDP growth at 0.9% in 2024 and a forecast growth of 1.5% in 2025. The defense budget increase will cause mandatory cuts in non-defense spending. The combined effect will be negative, pushing GDP growth into a negative territory.

In my opinion, re-arming Europe is critical to its survival. However, defense buildup comes at a steep cost. The expectations of lower GDP growth will push the value of Euro currency lower, likely below the 1-dollar critical level.

Commitment of Traders shows diminishing bullish sentiment

The CFTC Commitments of Traders report shows that on February 11th, total Open Interest (OI) for CME Euro FX Futures is 622,873 contracts. “Asset Manager” (i.e., hedge funds) own 338,182 in Long, 177,937 in Short and 35,597 in Spreading.

• While they maintain a long-short ratio of 1.9:1, hedge funds have reduced long positions by 1,014 while increasing short positions by 2,249.

• This indicates that “Smart Money” is becoming less bullish on the Euro.

Trade Setup with Micro Euro/USD Futures

If a trader shares a similar view, he could express his opinion by shorting the CME Micro Euro/USD Futures ($M6E).

M6E contracts have a notional value of 12,500 euro. With February 19th settlement price of 1.0435, each March contract (M6EH5) has a notional value of $13,044. Buying or selling one contract requires an initial margin of $260.

Hypothetically, a trader shorts March M6E contract and the euro drops to $0.99. A short futures position would gain $668.75 (= (1.0435 – 0.99) x $12500). Using the initial margin as a cost base, a theoretical return would be +257% (= 668.75 / 260).

The risk of shorting euro futures is rising euro. Investors could lose part of or all their initial margin. A trader could set a stop loss while establishing his short position. In the above example, the trader could set a stop-loss at 1.06 when entering the short order at 1.0435. If euro rebounds, the maximum loss would be $206.25 ( = (1.06 – 1.0435) *12500).

To learn more about all the Micro futures and options contracts traded on CME Group platform, you can check out the following site:

www.cmegroup.com

The Leap trading competition, #TheFuturesLeap, sponsored by CME Group, is currently running at TradingView. I encourage you to join The Leap to sharpen your trading skills and put your trading strategies at test, competing with your peers in this paper trading challenge sponsored by CME Group.

www.tradingview.com

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Gold reacts to unserious peace talksThe United States and Russia recently held peace talks in Saudi Arabia without Ukraine’s participation. Russian officials did not mention offering any concessions and U.S. officials did not claim to have scored any in Tuesday's meeting.

Adding to the unseriousness of the talks, Donald Trump called Zelensky a “dictator,” and suggested that Ukraine is responsible for the war, echoing obvious Russian talking points.

Gold rose above $2,930 per ounce on Wednesday, just shy of last week’s record high of $2,940.

Technical indicators remain in extreme overbought territory, although extreme geopolitical uncertainty may call for extreme readings for longer. In the near term, the pullback appears corrective, with XAU/USD still holding above all key moving averages on the 4-hour chart.

Trump-Putin Ukraine Deal: Impacts on Forex

Hello, I am Professional Trader Andrea Russo and today I want to talk to you about an important news that is shaking up the global markets: Donald Trump has apparently reached an agreement with Vladimir Putin to end the war in Ukraine, with an agreement that includes Ukraine's exit from NATO. The historic meeting between the two leaders will take place in Saudi Arabia and this move is expected to have a profound impact on the global geopolitical and financial landscape, especially on the Forex market.

Geopolitical and Economic Impact:

The announcement of a possible agreement between Trump and Putin could mark a significant turning point in the war in Ukraine. If Ukraine were to actually leave NATO, it would open a new phase of stability for the region, but at the same time it could create uncertainty on the geopolitical borders. This decision will directly affect the currency markets, in particular the currencies of the countries involved, the main European currencies and the US dollar.

In the current context, the war in Ukraine is one of the main causes of economic instability worldwide. Any end to hostilities could lead to a reduction in economic sanctions and a revival of trade flows between Russia, Europe and the United States. These changes will be closely monitored by traders, as any geopolitical fluctuations could affect the dynamics of currencies globally.

Implications for Forex:

A possible agreement between Trump and Putin could have a direct impact on Forex, especially on the following currencies:

Russian Ruble (RUB): A peace agreement would lead to a possible revaluation of the ruble. International sanctions against Russia could be gradually removed, boosting the Russian economy and supporting demand for the ruble in global markets.

Euro (EUR): Ukraine's exit from NATO could lead to greater stability for European countries involved in the conflict, but it could also reduce the risk associated with energy and military security. In the short term, the Euro could appreciate against riskier currencies, but the situation could vary depending on the political reactions in Europe.

US Dollar (USD): The dollar could react positively if the Trump-Putin deal is seen as a stabilization of international relations, but it will also depend on how the Federal Reserve responds to evolving economic conditions. A slowdown in the conflict could reduce the uncertainty that has pushed markets towards the dollar as a safe haven.

British Pound (GBP): The pound could benefit from a possible de-escalation of the crisis, but again, domestic political factors in the UK, such as its post-Brexit negotiations, will continue to influence the currency.

What to expect in the coming days:

News of the Trump-Putin meeting in Saudi Arabia will be watched closely by the markets. If the details of the deal are confirmed, we can expect an immediate reaction in the currency markets. Forex is likely to see increased volatility in the currency pairs tied to the nations involved, with shifts in capital flows that could reflect a new perception of risk or stability.

Conclusions:

In summary, the Trump-Putin deal could be a turning point in the war in Ukraine and have a significant impact on financial markets, especially Forex. Investors will need to carefully monitor geopolitical developments and prepare for possible currency fluctuations. With the end of hostilities, stability could return to favor some currencies, but the situation remains delicate and constantly evolving.

Trump-Putin call sparks euro rallyThe euro surged to session highs after former U.S. President Donald Trump announced a 90-minute call with Russian President Vladimir Putin, during which they agreed to visit each other and initiate negotiations to end the war in Ukraine. Trump stated that peace talks would begin “immediately.”

Technically, the euro rebounded from downtrend support, keeping attention on a potential breakout at the January range of 1.02–1.05. Bears potentially remain vulnerable as long as the pair holds above the 1.02 level.

Shortly after his conversation with Putin, Trump spoke with Ukrainian President Volodymyr Zelensky. Zelensky later confirmed the discussion, describing it as “meaningful” and mentioning plans for a new agreement on security, economic cooperation, and resource partnerships.

Yen strengthens as Russia rejects Ukraine peace planThe USD/JPY pair is experiencing notable movements, with the yen strengthening against the dollar at 156.72. This yen appreciation is driven by its status as a safe-haven currency amid growing geopolitical tensions and potential instability in Eastern Europe, following Russia's rejection of Trump's Ukraine peace plan. While the robust US dollar, supported by rising Treasury yields, applies external pressure, the yen's appeal is bolstered by the Bank of Japan's (BOJ) recent considerations for a possible rate hike. As the BOJ continues to assess economic data, including wage growth and clarity on future US policies, the potential for such hikes further supports the yen's strength. Traders should monitor BOJ policy announcements and global geopolitical developments, as the yen's safe-haven status might attract more interest, balancing external pressures from US economic factors.

21k before Trump will lose USA elections in November.So it's obvious, that BTC will rally to reach new ATH before November and will collapse miserably after Trump will lose USA election and stock market crash. Also, COVID-19 will create real apocalypse in the USA (I'm talking about riots and shooting in the streets because bastards there have too many guns and not so much brain). But if Russia will help Trump with reelection, bitcoin will pump further to the moon.

#shorttesla

Russian Ruble CRUSHED! Lost The War!Russian Ruble FX_IDC:USDRUB is getting destroyed! Russia with an economy half the size of California can never go up against 60% of the global GDP while killing off nearly 1 million able-bodied men out of their economy. Corruption is out of control, 35% of the economy is allocated to the war, not future investment.

Russia is suffering from Dutch Disease

As usual #MMT gets it wrong again! As highlighted.

So did the "sanctions don't work" crowd

Bitcoin Breaks Record, Shrugs Off Risk-On Label Gold extended gains for a third consecutive session, crossing $2,650 per ounce, as investors sought safety following an escalation in the Russia-Ukraine conflict.

Meanwhile, Bitcoin is also performing well and doesn't appear to be acting totally as a risk-on asset in this environment, surging to a fresh record high. President-elect Donald Trump’s administration is reportedly considering a dedicated cryptocurrency policy role within the White House, Bloomberg reported.

Adding to Bitcoin's momentum, the Financial Times revealed that Trump Media and Technology Company is in advanced talks to acquire crypto trading platform Bakkt.

Bitcoin remains above key technical levels, including the 50- and 100-day EMAs, while the RSI hit overbought territory at 80.

Brent - Oil waiting for a new war?!Brent oil is located between EMA200 and EMA50 in the 4H time frame and is moving in its upward channel. At the bottom of the rising channel, which is also at the intersection with the demand zone, we will look for oil buying positions. In case of a valid failure of the downward trend line, we can witness the continuation of this upward trend.

Senior Russian lawmakers have warned that Washington’s decision to allow Kyiv to launch deep strikes into Russia using American long-range missiles will escalate the conflict in Ukraine and could lead to World War III. Vladimir Dzhabarov, the first deputy chairman of the Russian upper house’s foreign affairs committee, stated that Moscow’s response would be immediate. Speaking to the state-run TASS news agency, he remarked, “This is a significant step toward the start of World War III.”

Russia’s Ministry of Defense confirmed that its missile defense systems had intercepted five out of six missiles fired. According to the RIA news agency, debris from one of the missiles, part of the U.S. Army’s ATACMS tactical missile system, landed near a military facility in the Bryansk region. Interfax news agency also reported that the attack on Bryansk was confirmed and attributed to Ukraine’s use of ATACMS missiles.

Russian Foreign Minister Sergey Lavrov described Ukraine’s strikes on Russia’s border regions using ATACMS missiles as a clear message of escalating tensions. He also noted that President Vladimir Putin had previously issued warnings about such actions.

Mike Waltz, a congressman from Florida, stated on November 18 that the Biden administration’s decision represents another step up the escalation ladder, with no clear end goal in sight. Meanwhile, Donald Trump Jr. warned on X that this move risks sparking “World War III,” echoing Kremlin warnings. Former President Trump has yet to outline a specific plan for ending the war, raising concerns that he might pressure Ukraine into accepting an unfavorable agreement with Russia.

In other developments, Francisco Blanch, a commodities strategist at Bank of America, noted that Trump’s pledge to impose hefty tariffs to boost U.S. manufacturing and create jobs could lower commodity prices. Speaking on Bloomberg TV, he remarked, “Trump’s priority is the U.S. economy.” Trump has proposed a 20% tariff on all foreign goods and a 60% tariff on Chinese imports. Experts warn that such a strategy could lead to inflationary pressures.

Meanwhile, the Biden administration has halted issuing LNG export licenses to countries without free trade agreements with the U.S., citing the need to study the environmental, economic, and national security impacts of such exports.

Additionally, a report reveals that BP’s ambitious efforts five years ago to transform from an oil company to a low-carbon energy business have been reversed. BP is now focusing on reclaiming its position as an oil and gas giant, addressing investor concerns over future profitability. Competitors like Shell and Equinor have similarly scaled back their green energy plans due to the energy shock from the Ukraine war and the declining profitability of renewable projects.

BP CEO Murray Auchincloss plans to invest billions in new oil and gas projects in the Gulf of Mexico and the Middle East while slowing down its low-carbon operations. The company has halted 18 initial hydrogen projects and announced plans to sell off wind and solar operations. Both BP and its competitors continue to invest in low-carbon energy but are focusing more on quickly profitable sectors like biofuels. Offshore wind and hydrogen projects that have already commenced will proceed, with additional investments considered only if competitive returns are assured.

Russian nuclear warning lifts gold Gold extended gains for a second session, climbing to $2,630 as tensions between Russia and Ukraine reignited demand for safe-haven assets.

Russia unveiled an updated nuclear doctrine Tuesday, paving the way for potential use of atomic weapons, just as Ukraine deployed U.S.-manufactured missiles on Russian soil for the first time since the war began.

Russian Foreign Minister Sergey Lavrov called on the U.S. and its allies to take note of Moscow’s revised nuclear policies.

On the technical front, gold’s recovery may have further room to run, with the 4-hour chart signaling potential upside. However, the Average Directional Index (ADX) suggests trend momentum remains muted. Key resistance levels include $2,639 and the 200-day simple moving average at $2,654.

Is Russia's Financial Fortress Built on Shifting Sands?The transformation of Russia's financial system has been nothing short of seismic. Once deeply integrated with global markets, Moscow's monetary landscape now finds itself in a state of radical reconfiguration, navigating the turbulent waters of international isolation. This shift carries profound implications, not just for Russia, but for the very foundations of the global financial order.

At the heart of this evolution lies the Russian Central Bank, whose Governor, Elvira Nabiullina, has found herself at the center of an unprecedented storm. Tasked with controlling inflation amid soaring interest rates, Nabiullina faces a growing chorus of dissent from Russia's business elite - a rare and significant development in a country where corporate voices have long remained muted. This internal conflict underscores the delicate balance the Central Bank must strike, as it seeks to stabilize the ruble and safeguard economic growth in the face of crippling Western sanctions.

Russia's financial system has demonstrated remarkable adaptability, forging new international partnerships and developing alternative payment mechanisms. Yet, these adaptations come at a cost, as increased transaction costs, reduced transparency, and limited access to global markets reshape the country's economic landscape. Consumer behavior, too, has evolved, with Russians increasingly turning to cash transactions and yuan-denominated assets, further signaling the shift away from traditional Western financial systems.

As Russia navigates this uncharted territory, the implications extend far beyond its borders. The reconfiguration of its financial architecture is shaping new models for sanctions resistance, the emergence of parallel banking networks, and a potential realignment of global currency trading patterns. The lessons learned from Russia's experience may well influence the future of international economic relationships, challenging long-held assumptions about the resilience of the global financial order.

BRICS Summit 2024: Big Promises, Little Impact?Russia will host the BRICS summit in Kazan from October 22-24, where President Vladimir Putin will push for a new SWIFT-like payment system to challenge US dollar dominance.

The group, comprising Brazil, Russia, India, China, and South Africa, has expanded to include Egypt, Ethiopia, Iran, and the UAE, with further expansion on the table as nations like Thailand and Myanmar express interest in joining.

As we lead into the BRICS summit, the Dollar Index (DXY), may be “overstretched” according to DBS’ FX analyst Philip Wee, after appreciating more than 3% this month.

However, Jim O’Neill, the former UK treasury minister who coined the term "BRICS" back in 2001 remains skeptical about BRICS. He argues that while the summits generate media attention, they rarely produce meaningful outcomes. O’Neill also points to ongoing tensions between key members China and India that get in the way of the block’s aspirations.

XAUUSD | Market outlookGold Reserve Diversification: At the LBMA conference, central bank representatives shared that gold purchases are driven by financial and strategic goals.

US Election Impact:

Uncertainty over the upcoming presidential elections, with Trump and Harris closely tied in polls, is prompting banks to hedge risks.

Geopolitical Risks: Tensions in the Middle East are also boosting gold, with Israel expressing readiness to target Iran's military infrastructure.

Price Trends:

Long-term trend: Upward, aiming to break the historical high of 2685.00 . Potential targets: 2750.00 and 2810.00 if consolidation succeeds.

Support and Correction: If the price drops to 2602.00 , long positions toward 2685.00 are favourable. A breakout below 2602.00 could trigger a correction targeting 2546.00 and 2471.00 .

Medium-term trend:

Correction: Last week’s correction did not reach key support at 2575.61–2564.61 . If a reversal occurs, the price could rise to 2685.61 and potentially 2712.70–2701.70 .

Correction Scenario: If another correction develops, the price may revisit 2575.61–2564.61 , followed by growth toward 2625.00 and 2685.00 .

Will geopolitical tension support oil prices?

Kazakhstan planned to cut its oil output, while Russia reported lower production in Sep, restricting the supply.

Meanwhile, the heightened geopolitical tension in the Middle East increases concerns over oil production and transport.

At the same time, market participants remain optimistic about the US economy, which could support oil demand. Today's NFP release may provide insights regarding the US job markets.

USOIL has significantly recovered from its low last month. The price retested its support at 67.50 USD per barrel before closing above its psychological support at 70.00 USD per barrel.

If USOIL sustains its upward momentum, the price may retest the following resistance at 75.00 USD per barrel.

On the contrary, USOIL may return to 70.00 USD per barrel if the price retraces before its continuation.