Is ONDO Gearing Up for a Massive Breakout or Just a Bull Trap?Yello, Paradisers! Is #ONDO setting up for a bullish explosion, or is this just the calm before another dump? Here's what the current price action is signaling, and why this zone could be the final opportunity before a major move…

💎ONDOUSD has remained one of the strongest-performing altcoins, even amid broader market corrections. Since peaking in December, however, it has entered a healthy corrective phase. Currently, the price is forming a falling wedge pattern, and the ABC zigzag correction appears to have completed — an early sign of potential trend reversal.

💎#ONDOUSDT is currently consolidating above a moderate support zone between 0.766 and 0.70, a level that has held firmly since early March. This repeated defense of support, along with the completed correction, is reinforcing the potential shift in market sentiment.

💎If bullish momentum starts building, price is likely to aim towards the descending resistance around the 0.90 level. A confirmed breakout above this area would flip market structure bullish, potentially igniting a trend continuation toward the next resistance range between 1.10 and 1.20.

💎Should this breakout sustain and strength remain, ONDO could target the strong resistance zone between 1.40 and 1.50, which also aligns with the 50% Fibonacci retracement — a critical level where sellers are likely to return.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

RWA

CHEX moves to $3Chintai claims to be a key player in the real asset tokenization (RWA) sector due to its strategic advantages: being licensed in Singapore (one of the strictest jurisdictions in regulating blockchain projects), partnering with global corporations and engaging a market maker to provide liquidity. These factors form a stable foundation for the growth of the ecosystem, with the CHEX token acting as its key element.

I expect a significant uptick over the next two months and a distribution phase in the summer. I will further short this asset from September.

Alex Kostenich,

Horban Brothers.

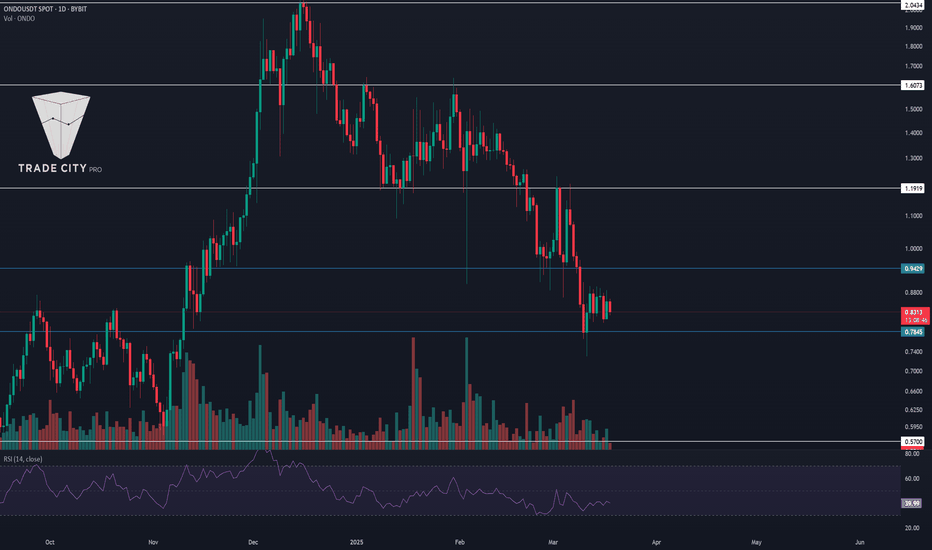

Tradecitypro | Ondo: Key Levels to Watch for Trend Reversal 👋 Welcome to TradeCity Pro!

In this analysis, I’ll be reviewing Ondo, one of the RWA projects, currently ranked 32nd on CoinMarketCap with a market cap of $3.04 billion.

📅 Daily Timeframe

As seen in the daily timeframe, a downtrend has formed, extending down to the $0.7845 low. Currently, with declining volume, the price has entered a consolidation and corrective phase.

💥 If the price manages to stabilize below $0.7845, the next bearish leg could begin. Therefore, upon breaking this level and confirming a trigger in lower timeframes, we can enter a position.

✨ In case of an upward correction, the first resistance zone will be at $0.9429, and if the price corrects further, breaking $1.1919 could confirm a trend reversal.

🛒 For spot buying, the risky trigger is $1.1919, while the main triggers are $1.6073 and $2.0434. If you have already purchased this coin, you can set your stop loss at $0.7845 in case of a breakdown. The RSI entering the oversold zone could serve as a momentum confirmation.

⌛️ 4-Hour Timeframe

In the 4-hour timeframe, a range box has formed between the $0.7845 and $0.8875 levels.

✔️ Buyers have shown stronger volume and momentum within this range. If $0.8875 is broken, you can enter a long position.

🔽 For a short position, if $0.7845—a significant level on the daily timeframe as well—breaks, you can enter. As mentioned earlier, breaking this level could trigger the next bearish leg.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Chainlink ($LINK) The Road to $100Chainlink holds a leading position in oracle technology and continues to expand its influence. The project actively cooperates with major companies and blockchain ecosystems, which strengthens its position in the market. For example, partnerships with Google Cloud, SWIFT and other tech industry giants confirm Chainlink's relevance to traditional businesses.

One of the key factors behind Chainlink's success is its decentralized architecture, which provides high security and fault tolerance. This is especially important in the face of growing demand for reliable smart contract solutions.

Recently, Chainlink CEO Sergey Nazarov participated in a crypto summit organized at the White House. This event was an important step in the legalization and regulation of the crypto industry in the United States. Sergey Nazarov's participation emphasizes the importance of Chainlink as one of the key players in the blockchain ecosystem. His presentation focused on the role of oracle networks in ensuring data transparency and security, which is particularly important for regulators and governments. This attention to the project from the authorities may contribute to further development of Chainlink and its integration into traditional financial systems.

According to my analysis, the price of LINK has the potential for significant growth in the coming months. Considering the current market trends as well as technical analysis based on Fibonacci levels, we can assume that the price of LINK will reach the range of $80-100 by September 2025.

Alex Kostenich,

Horban Brothers.

BlackRock and ONDO Pioneer Real World AssetsBlackRock has initiated strategic expansion into the Real World Assets (RWA) sector, with preliminary allocations to its BUIDL fund signaling active preparation for tokenization initiatives. Supporting evidence includes documented transactions, which underscore early-stage operational readiness for asset digitization. A detailed analysis of these deals can be found below.

Concurrently, the upcoming crypto summit, featuring participation from a White House representative of ONDO, highlights growing institutional and governmental engagement with digital asset frameworks. This development suggests alignment between public-sector policy and private-sector innovation, reinforcing the potential for regulatory advancements in tokenization.

Such coordinated activity underscores a broader trend toward integrating blockchain-enabled solutions into traditional financial infrastructure, with industry leaders and policymakers collaboratively exploring scalable applications of decentralized technologies.

Alex Kostenich,

Horban Brothers.

$OM Bullish pennantBINANCE:OMUSDT is currently doing a bullish pennant pattern after an explosive move from 1.67 area. A break of this pennant could send BINANCE:OMUSDT price parabolically to around 6.40 - 6.80 area, measured using the length of the pole in confluence with 2.618 fib level.

In a typical retrace on a continuation move towards the upside, volume tends to dry out, signalling that a move may be due sooner than later. In futures, BINANCE:OMUSDT.P O/I continue to hover around $14M which is a good sign given the sentiment of the market towards premium RWA projects, with a positive L/S ratio.

On the flipside, a break of the lower level will only continue the current ranging move of BINANCE:OMUSDT towards 3.30 - 3.50 area.

Given that the market is still focusing on BTC, BINANCE:OMUSDT will continue to move in a laggard fashion, therefore there is still time to find a long entry near 3.55 - 3.63 area. Once money shifts towards alts, this will propel BINANCE:OMUSDT to new ATHs.

As always, manage your risks.

GL!

- JD

$ONDO: Ondo Finance – Tokenizing the Future or Facing Roadblocks

(1/9)

Good morning, champs! ☀️ LSE:ONDO : Ondo Finance – Tokenizing the Future or Facing RWA Roadblocks?

Ondo Finance just joined Mastercard’s Multi-Token Network, aiming to tokenize U.S. Treasuries! But with market volatility, is this RWA gem a buy or a wait? Let’s dive in! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Recent Trend: Transaction volume spiked to 400M in Jan 2025, now ~300M 💰

• Market Insight: Up 1.6% recently (Daily Hodl, Feb 2025) 📏

• Sector: RWA tokenization surging with TradFi interest 🌟

It’s buzzing in the DeFi space! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Not specified; holds 40% of tokenized securities market 🏆

• Holdings: U.S. Treasuries, bonds via USDY, OUSG tokens ⏰

• Trend: Whales hold 88% of tokens, per IntoTheBlock 🎯

Firm, leading RWA tokenization! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Partnership: Joined Mastercard MTN as first RWA provider (Feb 26, 2025) 🔄

• Expansion: Teamed with World Liberty Financial for RWAs 🌍

• Market Reaction: Steady growth in transaction volume 📋

Adapting, bridging TradFi and DeFi! 💡

(5/9) – RISKS IN FOCUS ⚡

• Volatility: Crypto market swings could hit token value 🔍

• Regulation: Compliance hurdles in tokenized assets 📉

• Concentration: High whale ownership (88%) risks dumps ❄️

Tough, but risks loom! 🛑

(6/9) – SWOT: STRENGTHS 💪

• RWA Leader: 40% tokenized securities market share 🥇

• Big Backers: BlackRock, Coinbase Ventures support 📊

• Tech Edge: Tokenizing U.S. Treasuries for DeFi 🔧

Got fuel in the tank! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: High whale concentration, market volatility 📉

• Opportunities: TradFi integration, DeFi yield growth 📈

Can it tokenize to the moon? 🤔

(8/9) – 📢Transaction volume at 300M, Mastercard partnership live, your take? 🗳️

• Bullish: $2 soon, TradFi loves it 🐂

• Neutral: Steady, risks balance ⚖️

• Bearish: $0.90 looms, whales dump 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

SMCI’s transaction volume and TradFi ties scream potential 📈, but whale concentration adds caution 🌿. Volatility’s our buddy—dips are DCA gold 💰. Grab ‘em low, climb like pros! Gem or bust?

ONDO is the brainchild of BlackRockONDO is the top-1 tokenization platform for Real World Assets. I have already spoken at May 2024 where I talked about the relevance of the RWA sector and its aspirations for widespread adoption in blockchain. Specifically ONDO is a very progressive project that is launching its ONDO Chain! I think we will see strong upside in the asset over the near term and approach the 1.618 Fibonacci level. More globally, I would expect much higher values.

Horban Brothers.

An Analysis and Outlook for the Goldfinch (Deep Research)Goldfinch is a decentralized lending protocol that seeks to expand access to capital by creating a global credit marketplace. Goldfinch aims to bring those who have traditionally been left out of financial services, especially in developing countries, into the credit system. This is accomplished through the creation of a single global credit marketplace where borrowers from startups in Lagos to large institutions in New York can access credit from the same capital markets.

RWA

Goldfinch plays a significant role in the real world assets (RWA) space in the context of decentralized finance (DeFi) by providing a unique approach to lending. Unlike many DeFi protocols that require cryptocurrency collateral, Goldfinch specializes in providing unsecured loans. This is accomplished through partnerships with real borrowers and organizations that evaluate borrowers' creditworthiness and RWAs, allowing for greater access to credit beyond the cryptocurrency sphere.

Goldfinch promotes the integration of traditional finance (TradFi) with DeFi through tokenization of real assets. This not only makes investing in DeFi more accessible and understandable for traditional investors, but also expands opportunities to generate income through real economic activity.

The protocol is based on TranchedPool and SeniorPool contracts. TranchedPool divides capital into junior and senior, where junior capital carries the most risk and senior capital is provided through SeniorPool. The CreditLine contract manages loan terms and repayments. Lenders receive ERC721 tokens confirming their right to repay capital and interest. The FIDU token is used to

representing shares in SeniorPool, and GFI is used to manage the protocol. UniqueIdentity and Go contracts define user access to protocol features, and Zapper facilitates the movement of funds between pools. GFI tokens are distributed through eirdrops, staking, and rewards for participants.

Team

Mike Sall and Blake West are co-founders of Goldfinch. Their involvement in the project aims to address financial imbalance by providing access to capital to low-income communities around the world through DeFi's decentralized lending protocol. Their initiative, Goldfinch, aims to serve over 2 million people in 20 countries by focusing on secured loans that are backed and fully secured off-chain. They talk a lot about their mission, discussing growth, improving the user experience at DeFi, and how they believe cryptocurrencies are changing the global economy. Their approach involves extensive user research, looking at various groups including financial giants like Blackrock and Apollo to understand and improve the user experience in the Web3 space.

Mark Roszak is listed as an advisor to Goldfinch, a DeFi project focused on providing access to capital to underserved communities. Given his experience, this role likely includes providing strategic advice on compliance, legal frameworks, and possibly business development.

Fundraising

Undisclosed Round (Feb. 2, 2021)

Raised: $1.00M

Investors:

Coinbase Ventures: Venture arm of Coinbase, one of the largest cryptocurrency exchanges, focusing on early-stage startups in blockchain and cryptocurrencies.

IDEO CoLab Ventures: Known for investing in companies using technology to solve social and environmental problems.

Variant: A venture capital firm focusing on crypto and blockchain technologies.

Stratos Technologies: A blockchain infrastructure company.

Robert Leshner: Founder of Compound Finance, bringing significant experience to DeFi.

Kindred Ventures: Focuses on early stage startups in the technology sector.

This round was key to establishing an initial base, likely used to develop core technology and initial market testing.

Seed Round (June 16, 2021) Raised: $11.00M

Investors:

Andreessen Horowitz (a16z): Lead investor in this round, known for his significant investments in blockchain and technology startups.

Balaji Srinivasan: Former CTO of Coinbase, a well-known figure in the crypto space.

Divergence Ventures: Venture capital focused on crypto and blockchain.

SV Angel: An early stage investment fund.

a_capital: Venture capital specializing in crypto and blockchain.

Ryan Selkis: Founder of Messari, a cryptocurrency market intelligence platform.

This Seed round would be key to scaling operations, expanding the team, and possibly starting to deploy the protocol in the real world.

Series A (Jan. 6, 2022) Raised: $25.00M Investors:

Andreessen Horowitz (a16z): Leading round again, showing strong support.

OrangeDAO: Decentralized venture fund.

Kingsway Capital: Venture capital with interests in blockchain. Blocktower Capital: Hedge fund and investment company,

focused on cryptocurrency.

Stratos Technologies: A returning investor indicating confidence in the direction of the project.

A Series A round usually signifies a project's willingness to significantly expand its operations, improve its technology, and possibly enter new markets or improve its current market presence.

Key Points:

Repeated investments from companies like a16z and Stratos Technologies indicate a strong belief in Goldfinch's mission and technology.

The mix of traditional venture capital, crypto-focused funds, and individual investors with significant influence in the DeFi space shows the broad appeal and potential of Goldfinch.

Each round seems to have been used strategically to build, scale and expand the project, in line with typical startup growth phases but tailored to the unique needs of the DeFi protocol.

Tokenomics

Initial offering: 114,285,714 GFI tokens. There is currently no inflation, but it is believed that the introduction of moderate

inflation in three years could benefit the protocol by rewarding future participants. This will ultimately be decided by the community.

Token distribution

Liquidity Providers (16.2%):

Early Liquidity Provider Program (4.2%): Early Liquidity Provider tokens for early capital contributors, with unlocking for 6 months starting January 11, 2022, and a 12-month transfer restriction for U.S. participants.

Retroactive Liquidity Provider Distribution (4.0%): For 5,157 liquidity providers as of the December 14 snapshot, excluding the early program, with various unlocking terms ranging from immediate to 12 months depending on the contribution.

Senior Pool Liquidity Mining (8.0%): For ongoing liquidity mining, details in the Liquidity Mining section.

Backers (8.0%):

Flight Academy (3.0%): For 10,182 participants outside the US, with unlock schedules ranging from immediate to 24 months.

Backer Pool Liquidity Mining (2.0%): Tokens are distributed as interest is paid, with retroactive distribution for existing backers.

Backer Staking (3.0%): For future staking by backers, not yet implemented but expected to be offered soon.

Auditors (3.0%): Reserved for future Auditors systems, not yet implemented.

Borrowers (3.0%): Reserved for possible future distribution to borrowers.

Contributors (0.65%): For those who have made significant contributions to the community, following a similar unlock schedule as Flight Academy.

Community Treasury (14.8%): For community decision-making such as grants, adjusting minutes, and covering loan defaults. Early and Future Team (28.4%): For initial team, advisors, and contractors, with various unlocking schedules.

Warbler Labs (4.4 %): For a separate Goldfinch-based organization, with a 3-year unlock schedule.

Early Supporters (21.6%): For 60+ early investors who contributed $37 million, with a 3-year unlock schedule, initial lockup, and transfer restrictions.

Airdrop

In January 2022, Goldfinch held its first major airdrop of GFI tokens. This airdrop was aimed at rewarding early adopters who actively supported and utilized the platform prior to the launch of the GFI token. Participants who contributed to the ecosystem received GFI tokens based on their activity and contribution. Criteria for participation in this airdrop included:

Conducting transactions on the platform. Participating in lending or investing.

Active participation in the community, for example through discussions and suggestions for improving the platform.

In total, about 15% of the total GFI offering was distributed to the participants of this airdrop. This helped to create an initial base of token holders interested in further development of the project.

During 2022, Goldfinch also conducted several airdrops aimed at attracting new users to the platform. These airdrops were aimed at incentivizing registration, platform usage, and lending participation. Participants had to complete certain actions such as:

Registering and creating an account on the platform.

Conducting their first transaction or investing in lending pools.

Participating in GFI token staking.

These airdrops helped to expand the user base and increase the number of active participants on the platform.

Market Data

Active Loans in the context of Goldfinch refer to loans that were issued by the protocol and are currently outstanding, meaning they have not been fully repaid or charged off.

Active loans are part of what Goldfinch calls borrower pools. Each pool represents the loan terms, interest rate and repayment schedule for a single borrower. Investors can contribute capital to these pools, effectively becoming lenders. These loans are designed to make a tangible impact by financing businesses that may not have access to traditional banking services or capital markets, especially in regions of low financial accessibility. Regarding TVL, the value continues to hold in the neighborhood of $70-80 million. This is the amount that investors and platform members have put into loan pools, including both senior and junior tranches, to lend to real businesses, especially in emerging markets. This figure suggests that Goldfinch has significant support from the DeFi community, enough to sustain lending operations. However, to fully understand it, one should compare this TVL with other DeFi protocols, consider its dynamics over time, and analyze how this figure relates to loan volume, interest rates, and defaults.

Such TVL may attract additional attention to the platform, both from potential investors and analysts, as it is an indicator not only of financial stability, but also of the potential for further growth and development.

Blockchain

According to our blockchain research we were able to determine that the project's investors still have not sold their assets and received their tokens from cryptocurrency exchange Coinbase.

Angel investors also received their tokens and continue to hold them.

Over the past week, a major player has become active and continues to buy coins at the market price. He has a total of about 10 wallets with a growing number of GFI coins. All wallets look like this.

To summarize from a blockchain perspective, Goldfinch has a good and sensible distribution of tokens among the big players. They will be the key price drivers, so you should pay attention to their transactions.

Conclusion

Goldfinch is focused on the RWA sector, which is expected to show strong growth during the current bull market. With DeFi rapidly evolving and gaining more attention, Goldfinch is at the forefront, offering a unique platform to bridge traditional finance and blockchain technology. Innovative model

Goldfinch, based on tokenizing real assets and integrating them into the DeFi ecosystem, opens new horizons for investors and borrowers. The platform not only provides access to credit, but also creates a bridge between traditional and decentralized finance, allowing investors to participate in the growth of the RWA sector through a transparent and automated smart contract system. In the current bullrun, where the RWA sector is starting to play an increasingly important role, Goldfinch is well positioned to become a key player, providing market participants with unique opportunities to grow and diversify their portfolios. The Protocol is ready to take a leading role in shaping the new financial landscape, offering solutions that not only meet current trends, but also pave the way for the future development of the global financial system.

Best wishes, Horban Brothers!

Polymesh: Revolutionizing Regulated Asset TokenizationThe digital transformation in finance has led to a significant paradigm shift, especially with the emergence of real world assets (RWAs) on blockchain. This evolution not only increases liquidity but also democratizes access to investment opportunities. To understand the scale, an infographic is provided below.

Polymesh is a blockchain platform specifically designed to manage and trade regulated assets digitally. The project aims to create an infrastructure for tokenization of Real World Assets (RWA), such as securities, real estate, artwork and more. Polymesh is designed to tokenize assets that are subject to regulation, making it attractive to financial institutions and companies dealing with securities or other regulated assets. The Polymesh team developed the ERC-1400 standard for Ethereum, which went further in terms of providing compliance standards for tokenized assets, but Polymesh is extending that concept for its native blockchain.

Team

Bill Papp - Chief Executive Officer: Joined Polymesh Association from Arival Bank, where he was CEO and board member. Extensive experience in financial services, including stints at BankProv, Pacific Premier Trust, MEFA, Mizuho Americas, Pacific Crest Securities, Prudential Securities, and Lehman Brothers. He holds a bachelor's degree in business from Michigan State University and a master's degree from Tufts University.

Adam Dossa - Chief Technology Officer: He moved from Polymath to Polymesh Association in 2022. He has experience at Morgan Stanley where he worked on trading and regulatory infrastructure development. At Polymesh, he is responsible for technical strategy and blockchain technology development.

Nick Cafaro - Head of Product: Responsible for the development of new products and solutions based on Polymesh.

Will Vaz-Jones - Head of Partnerships: He is responsible for the education, implementation and management of key partnerships. Moved to Polymath in early 2019 after working in the traditional financial sector where he was an analyst and then held roles in corporate and business development.

Graeme Moore - Head of Tokenization: Author of “B is for Bitcoin”. Prior to Polymesh, he was the first employee at Polymath, worked as Creative Director at Spartan Race, and was an associate at Canada's largest independent investment firm.

Francis O'Brien (FOB) - Head of Developer Relations: He joined Polymesh after actively participating in the Polymath community since 2017. He has become a key advocate for Polymesh due to his ability to explain the complex technical aspects of blockchain. Prior to that, he worked as an engineer in the oil and gas industry.

Robert Gabriel Jakabosky - Head of Applied Blockchain Research: He started programming in high school and then worked at AlphaTrade, a financial services company. At Polymesh, his work is related to blockchain research.

Amirreza Sarencheh - Cryptography and Blockchain Architect: His role involves working in cryptography and blockchain architecture.

The Polymesh team is a unique combination of experience, expertise and innovative approach, making it exceptionally strong in blockchain technology and financial innovation. It's a really cool team where each member brings their unique contribution, creating synergies towards a common goal of revolutionizing financial services through blockchain. With such a diverse and talented team, Polymesh is at the forefront of innovation, making it one of the most exciting asset tokenization projects to date.

Architecture

Most general purpose blockchains have a limited set of primitives, forcing functions such as security tokens and their management to be implemented via smart contracts, leading to scalability and performance issues. In Polymesh, financial primitives are integrated at the core of the blockchain, allowing users to operate the network with low predefined costs and enabling developers to build innovative decentralized applications (dApps).

Regulated Assets: These are the cornerstone of Polymesh. Leveraging Polymath's experience in creating the ERC-1400 standard, Polymesh aims to balance openness and transparency with compliance with jurisdictional requirements.

Identity: Crucial for all actions involving regulated securities. Polymesh makes identity a core element where all actions are performed through an identity rather than a public key. Identities are universal and permissioned, collecting a set of claims or attestations from network-approved or issuer-specific authorities. These claims are used for managing asset ownership, transfer, and other restrictions.

Record Keeping: Polymesh records all primary and secondary transfers of security tokens, ensuring that ownership data is transparently captured on the blockchain, which reduces information asymmetry between the issuer and token holders.

Capital Distribution: Polymesh allows issuers to distribute cash flows associated with assets by capturing ownership distribution data at fixed times. Distribution can occur on-chain using stablecoins, via external payment receipts, or through a combination of both.

Corporate Governance: Polymesh provides tools for corporate actions leveraging blockchain technology, combining transparency with the ability to vote privately, thus reducing the risk of vote manipulation.

Stablecoins: Polymesh supports stablecoins to facilitate on-chain activities like cash distributions at a fraction of traditional costs. Stablecoins can be pegged to any currency and issued by adequately licensed and capitalized third parties.

Economy

Enabling Economy:

Nominated Proof-of-Stake (NPoS): This consensus mechanism involves Validators, who are regulated entities responsible for running nodes and processing transactions, and Nominators, who stake POLYX on validators. Validators produce blocks, while Nominators stake on them to enhance network security.

Block Rewards: Distributed equally among Validators adhering to protocol rules, with a portion kept by Validators and the remainder distributed to Nominators based on their stake.

Bonding Period: Time during which staked POLYX is locked after a withdrawal request, adjustable via governance.

Finality: Achieved when more than two-thirds of Validators vote in favor of a block, ensuring quick and trusted finalization.

Internal Economy:

Network Reserve Funding: Sources include a transfer from Polymath's Ethereum-held reserve, protocol usage fees, and transaction fees.

Governance: Managed by the Polymesh Governing Council, with potential future governance by POLYX tokenholders.

POLYX Supply: No fixed supply; increases through block rewards, which are also funded by network fees, to support the NPoS mechanism.

Enabled Economy:

Fee Structure:

Transaction Fees: Charged based on transaction size and complexity.

Protocol Fees: For specific blockchain functions, set by the Governing Council.

Developer Fees: Set by developers for smart contracts/extensions, aiding in ecosystem development.

POLYX Utility:

Acts as gas for transactions, similar to ETH on Ethereum.

Encourages participation in blockchain security through staking.

Prevents spam by costing each transaction.

Funds ecosystem growth through grants.

Facilitates governance decisions by allowing staking for votes.

POLY to POLYX Upgrade:

A one-way bridge allows POLY token holders to upgrade to POLYX at a 1:1 ratio, with a requirement for identity validation to transact with POLYX.

This token economy structure aims to ensure the sustainability, security, and utility of the Polymesh blockchain, tailored specifically for regulated assets with an emphasis on compliance and governance.

Polymesh Private

Polymesh Private is a private blockchain infrastructure solution from Polymesh designed for institutions that require increased levels of privacy, control and compliance in their blockchain operations. With Polymesh Private, you can restrict access to the network, making it completely private, where only authorized participants have access to data and transactions. Suitable for companies and institutions that want to take advantage of blockchain technology for internal processes while maximizing privacy and control. This can be useful for testing new financial instruments or for transactions that require strict confidentiality.

Polymesh's Strategic Partnerships and Innovations

1. Institutional and Regulatory Compliance:

Fortuna Digital Custody Ltd.:

Fortuna, an esteemed institutional-grade digital asset custodian based in Ireland, has been approved as a node operator for the Polymesh blockchain. This partnership not only extends Polymesh's network into new European markets but also strengthens the blockchain's security and compliance framework by ensuring all node operators are known and regulated entities. This move aligns with Polymesh's commitment to regulated assets and institutional-grade operations.

2. Expanding Utility Across Sectors:

TokenTraxx's Music NFTs:

TokenTraxx has pioneered the issuance of music NFTs on Polymesh, marking a revolutionary step in the music industry. By leveraging Polymesh's infrastructure, TokenTraxx enables artists like Evan Malamud to directly monetize and distribute their music through NFTs. This initiative not only reduces dependency on intermediaries but also introduces new revenue streams for artists, showcasing Polymesh's versatility beyond traditional financial assets.

AlphaPoint's Integration for Asset Tokenization:

AlphaPoint, a global leader in digital asset infrastructure, has integrated Polymesh into its platforms for tokenization. This partnership simplifies the process of asset tokenization, offering enhanced security, compliance, and efficiency, particularly suited for regulated financial products.

On Chain Listings (OCL) for Real Estate:

OCL is transforming real estate transactions in Florida by integrating with Polymesh. This partnership leverages blockchain for AI-driven title verification and monitoring, aiming to reduce fraud and enhance transaction transparency and efficiency.

REtokens' Real Estate Tokenization:

REtokens has utilized Polymesh to tokenize $30 million in real estate assets, making property investment more accessible and liquid. This initiative demonstrates how Polymesh's features like governance, compliance, and secure settlement can revolutionize real estate investment by allowing fractional ownership and increasing market liquidity.

3. Interoperability and Ecosystem Expansion:

ZenCrypto UAB's Equinox Bridge:

The launch of the Equinox bridge by ZenCrypto facilitates interoperability between Polymesh and Ethereum, allowing for the seamless transfer and wrapping of assets. This bridge not only enhances the utility of POLYX, Polymesh's native token, but also broadens the network's reach by integrating with one of the largest blockchain ecosystems.

4. Strategic Alliances for Global Influence:

Global Blockchain Business Council (GBBC) Membership:

Joining the GBBC positions Polymesh at the forefront of policy-making and standard-setting in the blockchain industry, particularly in the realm of tokenized securities and real-world assets (RWAs), fostering greater institutional adoption and regulatory clarity.

5. Enhancing User Experience:

Talisman Wallet with Ledger Support:

The integration of Polymesh into the popular multi-chain Talisman Wallet, now compatible with Ledger hardware wallets, enhances the security and user experience for managing digital assets on Polymesh, reflecting the growing demand for secure, multi-chain wallet solutions.

These developments collectively highlight Polymesh's strategic focus on:

Compliance and Security: By partnering with regulated entities and focusing on regulated assets.

Innovation: Applying blockchain technology to new sectors like music and real estate.

Interoperability: Ensuring Polymesh assets can interact with other major blockchains.

Accessibility: Making investment opportunities in regulated assets more accessible to a broader audience.

Polymesh is not only expanding its technological capabilities but also its market presence, reinforcing its position as a leader in the tokenization of real-world assets.

Conclusion

Polymesh has significant prospects for growth, particularly in the context of growing interest in asset tokenization and the need for regulatory compliance. Its specialization in regulated assets, technological innovation and strategic partnerships create a sustainable foundation for future growth and adoption in the global financial market. At the moment, the project looks like Ethereum in its nascent stage. Get ready, tokenization is here, billion dollar companies are getting ready to tokenize via Polymesh!

Horban Brothers.

$ONDO mechanism for BlackRock tokenizationYou know how optimistic we are about tokenizing real world assets and ONDO is one of the projects for tokenization. The most influential investment fund BlackRock is an investor in ONDO and is ready to tokenize its assets. My minimum forecast for the foreseeable future is $3.45. Buckle up!

Horban Brothers.

Pendle: A DeFi tool for risk and revenue sharingPendle is not just another DeFi project, it's a tool that cuts to the heart of the cryptocurrency profitability problem. Most people in the industry are chasing quick profits, not realizing that the market is a zero-sum game in which most people lose. Pendle, on the other hand, offers something different: the ability to split an asset into principal and future gains by tokenizing them. It's not just clever, it's brilliant. Why? Because it allows traders and investors to manage risk and return in a way that no one else can. Most DeFi protocols are just pretty wrappers for high-risk schemes. They promise you returns, but they don't tell you that you're risking everything, especially in a bear market. Pendle solves this problem by allowing you to lock in a return in advance or speculate on it. It's like insurance against volatility, but with the opportunity to earn more if you know what you're doing. And here's the paradox: the DeFi market is growing, but most participants don't even understand how the underlying economics work. Pendle gives you the tools to stay one step ahead. One more point: tokenizing yield through PT (base token) and YT (yield token) is not just a technical trick. It's a way to separate risks and opportunities. You can sell YT if you want to get rid of uncertainty, or buy it if you believe in yield growth. It's like options, but in the DeFi world where the rules aren't settled yet. And guess what? Most investors don't realize this. They only see the price of the PENDLE token, but they don't see what's behind it.

Alex Kostenich,

Horban Brothers.

PLUME (EXPERIMENTAL)$PLUME is a public blockchain optimized for the rapid adoption and demand-driven integration of real world assets (RWAs). We recognize that the core driver of the RWA revolution is tangible demand, particularly for yield-bearing assets that offer stability, transparency, and income generation.

ONDO - The Sweet Spot!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈After rejecting the $2 round number, ONDO has been in a correction phase and it is currently approaching the lower bound of its rising broadening wedge marked in blue.

Moreover, the green zone is a strong support and round number $1.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the $1 round number and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #ONDO approaches the blue circle, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Chainlink goes for the title of top-1 blockchain in the worldChainlink is going mainstream! The project is being implemented in a number of major European banks and has also reached an agreement on partnership with SWIFT! This is an incredible result for cryptocurrencies. Chainlink also has multiple applications in other areas: DeFi, Gaming, NFT, DePin and RWA. Take note, don't miss out on an Apple-level project in its infancy!

TOTAL Cryptocurrencies: Global Market Indicator and AnalysisAccording to my theory, we are witnessing a crypto market growth cycle with a growth phase of 35 months and a correction phase of 13 weeks. I expect the crypto market to continue to grow until November 1, 2025, driven by the arrival of large investment funds and corporations behind blockchain technology as well as tokenization. The RWA sector is at a nascent stage and trillions of assets will be tokenized and used for fast transactions, ease of transfers, 24-hour accessibility and transparency. In addition, the arrival of institutional investors via ETFs should not be overlooked. Today, BlackRock owns over 470k BINANCE:BTCUSDT and is unlikely to stop. BYBIT:ETHUSDT is undervalued, BINANCE:SOLUSDT shows the very availability of cryptocurrency for everyone on the planet. Memesession is actually testing the Solana network for its suitability for massadoption. Staying bearish regarding the cryptocurrency market looks like ignoring the internet in the early 2000s. Focus on the RWA direction, a large number of projects are about to show parabolic growth!

Horban Brothers.

UBXS by BIXOS: Your next $RIO. Tokenizing Realty~!Project description:

UBXS is the native utility token of the Bixos ecosystem, which focuses on merging blockchain technology with real estate investments, enabling users to invest in tokenized real estate assets while benefiting from decentralized finance (DeFi) services.

Type of project:

Real estate tokenization and DeFi platform.

Is it under a block?:

Yes, UBXS operates on Binance Smart Chain (BSC), facilitating real estate investments, staking, and governance within the Bixos ecosystem.

Latest update or news:

As of July 2024, Bixos launched its Real Estate Tokenization Platform, allowing users to purchase fractional ownership of real estate properties using UBXS tokens, increasing accessibility to real estate markets for smaller investors.

Narrative:

Real estate tokenization, decentralized finance (DeFi), and blockchain-based asset ownership.

Why is it a good investment?

Institutional Backers and Angel Investors:

Binance Labs:

Binance Labs has supported the development of UBXS and the Bixos platform due to its innovative approach to real estate tokenization and the use of blockchain technology to disrupt traditional real estate markets.

Pantera Capital:

Pantera Capital has backed the project, seeing the potential of Bixos to tokenize real-world assets, particularly in the high-value real estate sector, which opens up new opportunities for investors.

Framework Ventures:

Framework Ventures has invested in UBXS, recognizing its integration of decentralized finance with real estate, creating a new form of asset-backed tokens for the DeFi space.

Angel Investors:

Sandeep Nailwal (Co-founder of Polygon):

Nailwal has shown interest in the use of blockchain to tokenize real-world assets like real estate, though no direct investment in UBXS has been confirmed.

Meltem Demirors (CoinShares):

Demirors, a strong advocate for tokenization of assets, has expressed support for projects that bridge traditional industries with blockchain, aligning with UBXS’s goals of real estate tokenization.

Futuristic Use Case:

Tokenization of real estate:

UBXS allows users to purchase fractional ownership of real estate properties through tokenization, making real estate investments accessible to a broader audience and providing liquidity to an otherwise illiquid asset class.

DeFi integration for real estate assets:

Through the Bixos platform, real estate-backed UBXS tokens can be used for decentralized finance services such as staking, lending, and yield farming, creating new ways to generate income from tokenized assets.

Cross-border real estate investments:

By tokenizing real estate, UBXS enables investors from around the world to participate in property investments that were traditionally limited by geographic and financial barriers, democratizing access to the real estate market.

Governance and decision-making:

UBXS token holders can participate in governance decisions regarding the Bixos platform, including voting on new real estate projects, platform upgrades, and changes to the tokenomics, giving users a say in the direction of the ecosystem.

Why will it make a significant amount of profits?

Unique competitive edge:

UBXS combines real estate tokenization with decentralized finance, offering users the ability to invest in real-world assets while benefiting from the liquidity and financial services provided by DeFi, making it a strong competitor in both the real estate and DeFi spaces.

Growing demand for tokenized real estate:

As more investors seek to diversify their portfolios with real estate, the demand for tokenized real estate solutions like UBXS will grow, driving the value of the platform and the $UBXS token.

Revenue from real estate-backed DeFi services:

UBXS generates revenue through its staking, lending, and yield farming services, which allow token holders to earn passive income from real estate-backed assets, driving long-term utility and demand for $UBXS tokens.

Expansion into new markets:

As Bixos expands its real estate tokenization platform into new markets and properties, the demand for UBXS tokens will rise, as more users seek to participate in fractional ownership and DeFi services related to real estate investments.

Wormhole. Could it be a unicorn of 2025?One of the nice projects that caught my attention. Can be the main transfer road in rwa sector.

* What i share here is not an investment advice. Please do your own research before investing in any digital asset.

* Never take my personal opinions as investment advice, you may lose all your money.

Tradecitypro | HBAR: Momentum, Key Levels, and Future Targets👋 Welcome to Trade City Pro!

In this analysis, I’ll be reviewing the HBAR coin, which belongs to the Hedera project. This coin operates in the DeFi and RWA categories and also features a Layer 1 network.

📅 Weekly Timeframe

On the weekly timeframe, we observe a powerful bullish leg that began at the 0.04226 level and extended to 0.33994, marking an impressive 700% growth.

🔍 The 0.33994 level serves as a critical resistance, closely aligned with the 0.44075 resistance, creating a highly significant supply zone between these two levels.

✨ Currently, the price has been rejected twice from this area. In my view, this is a healthy development for the bullish trend, as corrections are essential for sustained growth. Considering the 700% surge over a few candlesticks, this pullback likely helps close long positions and strengthens the trend's foundation.

📊 Market volume has also been decreasing during this correction, signaling alignment with the bullish trend. Additionally, the RSI is exiting the overbought zone, paving the way for the price to establish a new structure and potentially resume its upward movement.

🔼 If the 0.44075 resistance is broken, the price could achieve a new all-time high (ATH). To determine specific targets, we need to wait for this resistance to break and use Fibonacci levels based on the recent corrections.

📉 In case of a deeper correction, the 0.13023 level will be the most critical support. This area has shown strong reactions in the past and can act as a solid support during significant pullbacks. The 0.19647 level could also provide support, but the primary level remains 0.13023.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ONDO 4H TRADE SETUP ONDO is a very exciting project with massive potential in the tokenization of real world assets, an aspect of crypto that has many very high profile interested parties, such as BlackRock and now the US Government via the Trump administration. World Liberty Financial (which is run by the Trump family) has an ONDO position currently and has been adding to it over time, so what is the future of ONDO?

For me the chart has some key points:

- Structurally ONDO been bearish since the later stages of December, retracing 50% from local high and losing the 4H 200 EMA in the process before bouncing off the bullish Orderblock that started the end of year rally in the first place, a very strong support area.

That bounce was capped off by the bearish orderblock zone with rejection in that zone on four separate occasions, so we now have a local range with a clear S/R level at the midpoint.

- Within that mini range we have higher lows constantly which forms a diagonal support as buyers put increasing pressure on price to break through the Bearish orderblock. The 4H 200 EMA has also been reclaimed and in a bullmarket this level is a key level to consider, more so during a trending phase and not chop but still important in this situation.

- That's the technical analysis but money is made in execution of the trade. For me a reclaim of the bearish orderblock would be a bullish trigger for ONDO to climb back up the hill towards local high with consideration to set SLs in stages. The trade would be invalidated on a loss of the bearish orderblock flip as this Swing fail pattern often leads to a further sell-off.

- In a bearish scenario, say BTC misbehaves or some bad news hits the timeline I would step away from the coin if diagonal support is lost. I would look to become a buyer at the bullish orderblock which would give a higher probability entry with the range midpoint and bearish orderblock as targets for price to reach.

BTC still runs the market currently with alts not getting much liquidity, I do believe that will change soon going into the second half of Q1. Once Bitcoin can get a trend going altcoins will follow in my view.

Solana's Ecosystem and the Winds of ChangeIn the tapestry of today's financial markets, I see patterns that most do not. The current state of the Solana ecosystem reminds me of the housing market before the 2008 crash; not in its vulnerability, but in the potential for exponential growth, masked by the noise of the day-to-day market fluctuations.

Solana's Rise and the RWA Sector

Solana, with its high transaction throughput and low costs, has positioned itself as a beacon for developers and users alike. It's not just about speed; it's about utility. The Real World Asset (RWA) sector on Solana, particularly with projects like Parcl, offers a unique opportunity. Parcl enables investors to engage with real estate markets through tokenization, providing liquidity to an otherwise illiquid sector. This is akin to giving a farmer access to the stock market, only without the intermediaries that often siphon off value.

The potential here is vast, as it democratizes access to real estate investment, which has traditionally been the preserve of the wealthy. Solana's infrastructure supports this with its scalability, making it an ideal platform for such financial innovations. The growth in this sector could mirror the growth in tech stocks during the early internet boom, but with a foundation that's more robust and less speculative.

The ETF Approval Horizon

Now, about the ETF. The winds of regulatory change are upon us. With a new SEC chair who understands the transformative power of blockchain technologies rather than fear-mongering about them, we're looking at a landscape where a Solana ETF could not only be approved but could potentially redefine institutional investment in cryptocurrencies.

This isn't merely speculation; it's about understanding the shifts in regulatory climates. Much like how I foresaw the mortgage-backed securities debacle, I see a clear path for Solana ETFs, driven by the necessity for financial institutions to adapt or perish in this new digital economy. The approval of such an ETF would inject significant liquidity into Solana, potentially increasing its market cap and solidifying its position against other blockchain networks.

The future of Solana, particularly with its RWA initiatives and the potential ETF approval, could be a defining moment in blockchain's integration into traditional finance. But remember, we navigate these waters not for the calm but for the storm of opportunity they promise.

Horban Brothers,

Alex Kostenich

Nexera #NXRA Ethereum+BNBchain+Polygon+Avalanche ECOSYSTEM /(RWANexera

#NXRA

Nexera (formerly AllianceBlock) founded 2018, launch of

#ALBT

token in 2020, later rebranded as

#NXRA

supply increased from approximately 864 million to 2 billion

75% of the new supply is within the company,

10% of the new supply is allocated for liquidity and exchange listings. 6% of the new supply will be allocated to strategic partners that add value beyond financial investment, such as institutional expertise, large user bases and innovative technology, and 5% of the new supply will be allocated over the next 10 years. It is reserved for the DAO Fund, which will support grants, governance offerings, and ecosystem initiatives. 4% of the new supply is allocated to contributors and strategic partners instrumental in the development of Nexera Chain.

Token launch date (May/June)2025

Price movements before and after these lock openings will be inevitable in the coming months. Let's watch and see what happens.