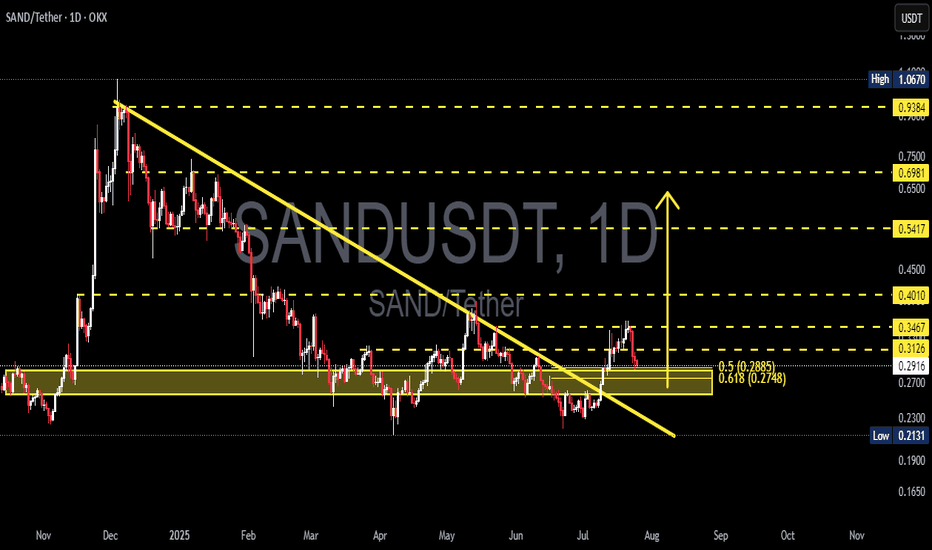

SANDUSDT Breaks Major Downtrend – Golden Pocket Retest!

Technical Analysis:

SAND/USDT has successfully broken out of a descending trendline that had been capping the price since late 2024. The breakout occurred with increased volume, signaling strong buyer interest.

Following the breakout, price rallied and is now retesting a key support zone, which includes:

A demand zone (yellow box) between 0.2748 - 0.2885, aligning with the Fibonacci Golden Pocket (0.618 - 0.5)

A solid horizontal support around 0.2913

Fibonacci retracement levels are clearly defined:

0.3126

0.3467

0.4010

0.5417

Up to major resistance near 0.9384

---

Bullish Scenario 🟢:

If the price holds above the Golden Pocket zone and prints bullish confirmation (such as a bullish engulfing or hammer candlestick), then further upside potential is likely:

1. Initial targets: 0.3126 and 0.3467

2. Mid-range targets: 0.4010 and 0.5417

3. Long-term potential: 0.6981 and possibly the major resistance at 0.9384

Stronger confirmation would come from a daily candle closing above 0.3126.

---

Bearish Scenario 🔴:

If price breaks below the 0.2748 zone, it could indicate a failed breakout, potentially leading to:

1. Initial support: 0.2700

2. Deeper pullback zone: 0.2131 (previous low)

3. Potential fakeout of the trendline breakout

A daily close below 0.2748 would strongly validate the bearish setup.

---

Chart Pattern Overview:

Descending Triangle Breakout already confirmed

Price is now in the retest phase of the breakout

The Golden Pocket Fibonacci zone is the crucial point of trend continuation or reversal

---

Conclusion:

The breakout from the long-standing downtrend marks a strong shift in structure. However, a successful retest at the Golden Pocket will be key to confirming further bullish continuation. If buyers defend this zone, SAND is likely to print a higher low and resume its upward move.

#SANDUSDT #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #FibonacciLevels #TrendlineBreakout #GoldenPocket #BullishSetup #BearishSetup

SAND

SAND – Rotation in PlaySAND is showing early signs of strength off the long-term demand zone near $0.23–0.24, where it's been accumulating for several months. Price just printed a strong weekly bounce, up +16%, reclaiming the bottom of the range.

This area has acted as a key base since mid-2023 — with each touch producing a notable reaction. Now trading at $0.286, SAND is attempting to rotate toward the top of the established range.

Key Levels

Support (Range Low): $0.23–0.24 (strong demand zone)

Resistance (Mid-Range): $0.43

Range High: $0.85

A clean flip of the mid-range ($0.43) could open the door to test $0.70+.

📌 Risk management: A break and weekly close below $0.23 invalidates this setup. As long as it holds, the upside potential is attractive from a risk/reward standpoint.

This is a classic accumulation > reclaim > expansion structure. Let the chart speak if the range holds, the rotation is in play.

SAND/USDT at Critical Support Zone – Rebound Potential?Detailed Technical Analysis:

The SAND/USDT weekly chart shows the price currently hovering around a historically strong support zone between $0.20 – $0.25. This yellow-marked demand area has been tested multiple times since 2021 and has consistently prevented further downside, making it a crucial decision point for both bulls and bears.

🟢 Bullish Scenario:

If the price manages to hold this key support and prints bullish price action (e.g., a bullish engulfing or hammer candlestick), a reversal is likely. The projected upward path on the chart outlines the next key resistance levels:

1. $0.3710 – Initial resistance.

2. $0.4500 – First major breakout confirmation.

3. $0.5825 - $0.7000 – Mid-term resistance cluster.

4. $0.8218 - $1.3530 – Longer-term targets if bullish momentum sustains.

Bullish Confirmation:

Weekly candle close above $0.37

Breakout with strong volume beyond $0.45

🔴 Bearish Scenario:

If the price breaks below and closes under the $0.20 support zone, it would signal a bearish continuation, with possible downside targets at:

1. $0.14 – Minor historical support.

2. $0.09 - $0.075 – Extreme low support region and historical bottom.

Bearish Confirmation:

Weekly close below $0.20

Strong breakdown volume without immediate bullish rejection

📊 Chart Pattern Overview:

✅ Triple Bottom / Accumulation Zone:

The current support area resembles a potential triple bottom structure or long-term accumulation phase. If confirmed, this pattern could mark the beginning of a new bullish cycle.

🧠 Conclusion:

SAND is at a make-or-break level. As long as the price holds above the $0.20 - $0.25 support zone, bullish recovery remains a valid possibility. However, a breakdown below this level could trigger a significant bearish move.

#SANDUSDT #CryptoAnalysis #AltcoinSeason #TechnicalAnalysis #BullishScenario #BearishScenario #CryptoTrading #PriceAction #SupportResistance #TripleBottom

sand buy spot "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

SANDUSD targeting the 1day MA200 at 0.42000Sandbox / SANDUSD has entered a Channel Up structure ever since it double bottomed on Support A and crossed above the Falling Resistance.

Now it's supported by the 1day MA50 and is aiming at a new Higher High on the 1day MA200.

Target 0.42000

Follow us, like the idea and leave a comment below!!

#SAND/USDT#SAND

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.2790, which acts as strong support from which the price can rebound.

Entry price: 0.2828

First target: 0.2890

Second target: 0.2971

Third target: 0.3048

SANDUSD: The recovery back to 1.07350 has started.Sandbox (SANDUSD) is marginally bearish on its 1D technical outlook (RSI = 43.227, MACD = -0.001, ADX = 35.488) as it dropped below its 1D MA50 again. However, the breakout over its 5 month LH trendline has already happened and calls for a long term recovery. As you can see the Fibonacci retracement levels form fairly symmetric Resistances with the previous LH levels, so we expect them one by one to get filled (final TP = 1.07350).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

TradeCityPro | SAND: Critical Support Test After Pullback👋 Welcome to TradeCity Pro!

In this analysis, I want to review the SAND coin for you. It’s one of the most popular Metaverse projects, widely recognized and among the top in its category.

✔️ This project’s coin currently holds a market cap of $693 million and ranks 91st on CoinMarketCap.

⏳ 4-Hour Timeframe

As you can see on the 4H chart, after a bullish leg that pushed the price up to 0.3140, a correction phase began. Following the break of 0.2903, the price has now corrected down to 0.2714.

🔍 If this 0.2714 level breaks, the price could continue down to the support at 0.2437 — so a break below 0.2714 would be a valid short entry.

👀 Personally, I prefer waiting for the price to first bounce off 0.2714, move upward, and print a lower high relative to 0.2903, then break 0.2714 on a second attempt. In that case, the short setup becomes much more reliable.

🔽 That said, even if the level breaks now without a bounce — since RSI is already near the oversold zone — I’ll still open a short. If RSI enters oversold, it could lead to a sharp drop.

⚡️ One negative factor for short positions is that volume has been decreasing since the price started correcting from 0.3140, which isn't a good signal for further downside — there’s a divergence between price and volume.

📈 However, that’s a positive signal for potential long positions. When volume drops during a correction in an uptrend, it shows buyers still have control. As long as this divergence persists, the uptrend is more likely to continue than to reverse.

📊 For long positions, if buying volume enters the market and the price holds above 0.2714, you can enter based on lower-timeframe structure breaks. The main long entry will be confirmed once the price breaks above the 0.3140 high.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

sand long longterm spot "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

The Sandbox: Your Altcoin ChoiceLet's continue with Your Altcoin Choice. Some analysis can take a while, but all will be done.

The Sandbox is in a very good situation as shown on the chart. The price range marked with light blue is a long-term support and also a confirmed buy zone. The last wave, amounting to more than 375%, came out of this zone. After a correction and long-term higher low, SANDUSDT is ready to go at it again.

This chart shows potential for a "small wave" relatively speaking. Small in relation to the potential The Sandbox has for the full bull market. See this chart below:

Notice the big difference. This one has a total potential of more than 5,000%. This would include the bull market bull run phase which is not included in the first chart.

The previous bullish cycle, from November 2020 through November 2021 produced total growth of 29,371%. There was a stop, a correction between March and June 2021 lasting 87 days. After this the last bullish jump.

This is what needs to be kept in mind for this cycle. 87 days but much more growth happened afterward. With all the sideways action in these transition years, we get used to seeing a stop after just one wave. When the market is full blown bullish, this stop is only temporary and after it ends we get the resumption of the bullish wave.

We have been seeing sideways, the bull market is an uptrend. This is a big difference and something to keep in mind. Crypto will grow.

Bitcoin, The Sandbox, Gala Games, Cardano and much more.

Thanks a lot for your continued support.

Namaste.

#SAND #SANDUSDT #SANDBOX #LONG #SWING #AMD #Eddy#SAND #SANDUSDT #SANDBOX #LONG #SWING #AMD #Eddy

SANDUSDT.P SWING Long AMD Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style. (( AMD SETUP ))

Based on your strategy and style, get the necessary confirmations for this Swing Setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

By scratching the price and time bar, you can see the big picture and targets.

Note: The price can go much higher than the second target, and there is a possibility of a 50%-100% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

Be successful and profitable.

SAND in coming days ...Currently, SAND is forming an ascending triangle, indicating a potential price increase. It is anticipated that the price could rise, aligning with the projected price movement (AB=CD).

However, it is crucial to wait for the triangle to break before taking any action.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

$SAND Sandbox Over 70% Retracement... Ready for Higher?NYSE:SAND Sandbox has committed a over 70% retracement after superbuy signal from a height of approximately $1

Current Price: $0.36

Price action is forming a Falling Wedge and Bullish Divergences Spotted also

Expecting a retest of previous supports - now resistances at 0.41, 0.54, 0.7, 0.82, 0.96

#sand Invalidation is at under 0.3

Is There Hope for Sandbox ($SAND) or Is The Gameverse Dead?The Decline of NYSE:SAND : A Look at Its Current State

Once a shining star in the play-to-earn (P2E) gaming and NFT ecosystem, Sandbox ( NYSE:SAND ) has seen a staggering decline from its all-time high of $8.44 to a mere $0.34 at the time of writing. This sharp drop has left investors and gamers questioning the future of metaverse gaming and the sustainability of blockchain-based virtual worlds.

Despite recent hype around Web3 gaming and metaverse adoption, the broader NFT and P2E sectors have remained relatively muted, contributing to NYSE:SAND ’s price drop. However, does this spell the end for The Sandbox, or is a reversal on the horizon?

Technical Analysis

The Relative Strength Index (RSI) currently sits at 23, indicating that NYSE:SAND is in heavily oversold territory. Typically, an RSI below 30 suggests that an asset is due for a rebound, as selling pressure diminishes.

The daily chart is forming a rising wedge pattern, which is a traditionally bearish formation. If the pattern holds, further declines could be expected. However, the $0.39 pivot zone is a critical resistance level. Should NYSE:SAND manage to break above this level, it could spark a campaign towards the $1 mark, a move that would be monumental for the token.

Currently, NYSE:SAND is down 7.27% on the day, with a 14% decline over the last 24 hours. The lack of bullish momentum suggests that investors remain hesitant about a potential comeback. However, if volume spikes and momentum shifts, a short-term recovery could be on the table.

Market Data & Sentiment

- Current Price: $0.3487

- 24-Hour Trading Volume: $113.85 million

- Market Cap: $859.36 million

- Circulating Supply: 2.46 billion NYSE:SAND

Despite the downturn, The Sandbox maintains a top-100 ranking in the crypto market, proving that it still holds relevance. The challenge now is for the platform to reignite user interest and expand beyond its current stagnation.

The Road Ahead: Dead or Dormant?

While the NFT and metaverse hype has faded, it doesn’t necessarily mean the sector is dead. Innovation, adoption, and strategic partnerships could breathe life back into NYSE:SAND and other metaverse tokens.

Be careful with SAND !!!The price has formed a bullish wedge on the 1h time frame, and if it breaks out, it can drive the price up to around $0.43.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

SAND Analysis: Path to 0.6 Before Final Correction to 0.49SAND is nearing the completion of wave (a) in its corrective pattern. The next expected move is a rise toward the 0.52 level for wave (b), followed by a climb to around 0.6 for wave (c). After this, SAND is likely to head downward to complete the fifth wave of the larger correction, targeting approximately 0.49.

Will SAND Make a Comeback or Sink Lower? Yello, Paradisers! Are you ready for what could be a make-or-break moment for SAND? Let’s dive into the details to ensure you don’t get caught on the wrong side of the market.

💎#SANDUSDT is approaching a key support level at $0.4787, a zone that has historically acted as a springboard for bullish momentum. This level has been tested multiple times, showcasing its strength. However, if this support fails to hold, it could trigger a wave of selling pressure, potentially dragging the price down to the next significant demand zone at $0.3754.

💎If SAND manages to hold above the 100-day EMA and regains bullish momentum, a retest of the $0.7463 resistance zone becomes highly likely. A successful breakout above this level could pave the way for a rally toward $1.00 or higher.

💎Volume is another critical factor to monitor. A rebound from the $0.4787 support level accompanied by strong buying interest could signal a quick bullish reversal. On the other hand, a breakdown below $0.3754 with increasing volume would likely intensify selling pressure.

💎This is a pivotal moment for #SANDUSD, Paradisers. The market is setting up for a decisive move, one that could shake out weak hands before the real trend emerges.

Stay patient, wait for confirmation, and always manage your risk. Trading isn’t about being emotional; it’s about being strategic. Only those who remain disciplined and focused will succeed in the long term.

MyCryptoParadise

iFeel the success🌴