Sarepta's Plunge: A Confluence of Challenges?Sarepta Therapeutics (SRPT) faces significant market headwinds. The company's stock has seen a notable decline. This stems from multiple, interconnected factors. Its flagship gene therapy, ELEVIDYS, is central to these challenges. Recent patient deaths linked to similar gene technology raised safety concerns. The FDA requested a voluntary pause in Elevidys shipments. This followed a "black box warning" for liver injury. The confirmatory EMBARK trial for Elevidys also missed its primary endpoint. These clinical and regulatory setbacks significantly impacted investor confidence.

Beyond specific drug issues, broader industry dynamics affect Sarepta. Macroeconomic pressures, like rising interest rates, reduce biotech valuations. Geopolitical tensions disrupt global supply chains. They also hinder international scientific collaboration. The intellectual property landscape is increasingly complex. Patent challenges and expirations threaten revenue streams. Cybersecurity risks also loom large for pharmaceutical companies. Data breaches could compromise sensitive R&D and patient information.

The regulatory environment is evolving. The FDA demands more robust confirmatory data for gene therapies. This creates prolonged uncertainty for accelerated approvals. Government initiatives, like the Inflation Reduction Act, aim to control drug costs. These policies could reduce future revenue projections. Sarepta's reliance on AAV technology also presents inherent risks. Next-generation gene editing technologies could disrupt its current pipeline. All these factors combine to amplify each negative impact.

Sarepta's recovery depends on strategic navigation. Securing full FDA approval for Elevidys is crucial. Expanding its label and maximizing commercial potential are key. Diversifying its pipeline beyond a single asset could de-risk the company. Disciplined cost management is essential in this challenging economic climate. Collaborations could provide financial support and expertise. Sarepta's journey offers insights into the broader gene therapy sector's maturity.

Sareptatherapeutics

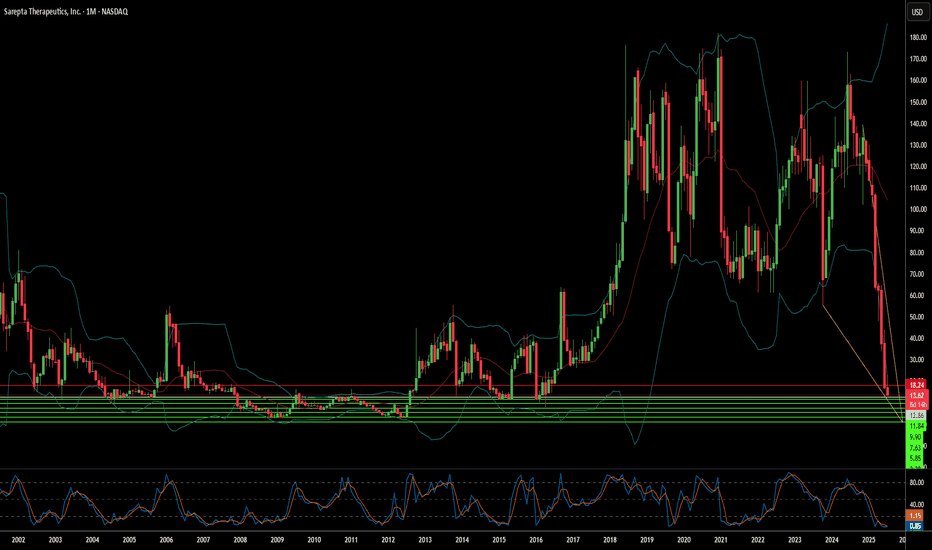

SRPT Sarepta Therapeutics Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SRPT Sarepta Therapeuticsprior to the earnings report this week,

I would consider purchasing the 120usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $9.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SRPT Sarepta Therapeutics Potential Buyout SoonIf you haven`t bought SRPT here:

Then you need to know that there is a Massive catalyst coming!

Sarepta Therapeutics is going to announce Duchenne muscular dystrophy Phase 3 data for its SRP-9001-301 - (EMBARK) by mid November.

This week institutions bought calls worth more than $10Mil that SRPT Sarepta Therapeutics will trade above $135 by November 17.

Some even bought the $210 strike price!

They also have a big partnership with the giant Roche Holding AG (RHHBY).

I think SRPT Sarepta Therapeutics is well positioned for a potential takeover soon!

Looking forward to read your opinion about it.