Sbin

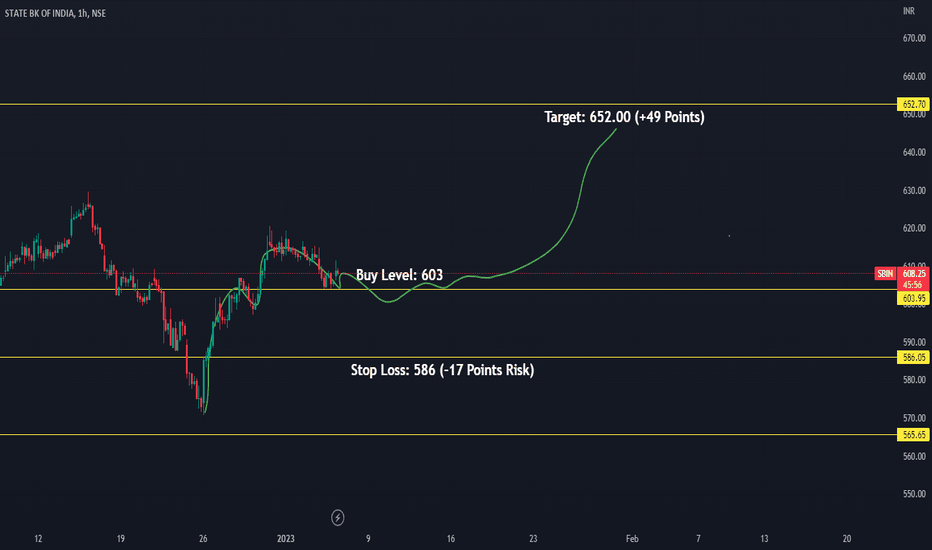

SBIN Conditional Buy levels 28.03.2023This is conditional buy view on NSE:SBIN . If 45min candle closed above 515, we can make a entry with stop loss of 507. My expected upside target will be 528.00. It would be positional trade for 1-2 days.

Note: This is my personal analysis, only to learn stock market behavior. Thanks.

Sector Analysis Four sectors that are outperforming NSE:NIFTY

{A} NSE:BANKNIFTY Though not by big margin definitely out performing NSE:NIFTY . Break above 42000 will be a great sign.

Stocks to watch out; 1) NSE:CANBK 2) NSE:ICICIBANK 3) NSE:INDUSINDBK 4) NSE:SBIN

{B} PSU Bank . 1) NSE:CANBK 2) NSE:SBIN 3) NSE:BANKBARODA

{C} NSE:CNXINFRA got a big push at Budget and is evident from stock performance . 1) NSE:LT 2) NSE:SIEMENS 3) NSE:ABB 4) NSE:NTPC

{D} BSE:MIDCAP is best out performer, if overall market improves will run away. 1) NSE:CUMMINSIND 2) NSE:PGHL 3) NSE:HAL 4) NSE:TORNTPOWER

SBIN -- Good prospect for long & towards 700SBIN took good support on trendline (from 2019) despite of fall in recent days.

So, target would be around 700 in 3-4 months considering the trendlines pattern.

You can see upper trendline cut through candles but it's to showcase the width of trendline till 2019 in various cases, it acted as resistance.

Note: this is just an educational purposes and not a recommendation at all.

IMPORTANT LEVEL FOR SBI BANK525-535 IS is an important level for sbi bank.this level is 50%fibonacci retracement level of last move and also it has the huge volume happening in this level which is showing in the fixed range volume profile.so let"s see what happened if it corrects or not and if so how this level reacts in this movment?

Play with State Bank of IndiaHi folks!

Here is an idea that focuses on State Bank of India only. Adopting this method you will trade only State Bank of India stock / futures / options.

Here is how it works:

Capital:

Whatever capital you wish to deploy, you will open a Fixed Deposit (FD) in State Bank of India. Presently on 1 (one) year deposit the interest rate is 6.75%. Immediately after opening the FD, you will also open an Overdraft (OD) Account on the FD. The interest rate on OD is 1% over the FD rate and the limit is capped at 90% of FD amount. You can complete both processes online. So, if you open a Rs.100000 FD then the OD account will be opened with Rs.90000. This is the amount you will have to trade in the market.

It is important to note that OD interest is applied only when you withdraw money from the OD account. Otherwise you are not charged anything.

So, when you are waiting for a trade opportunity, the money is parked in FD earning you higher rate of interest than a Savings account. And when the time comes to open a trade, you will withdraw the required money from OD account and transfer it to your broker and then take the trade.

After closing the trade (either in profit or loss) you will immediately transfer the money back from the broker to the OD account and pay whatever interest is accrued for that period. Effectively you will make the OD account balance Zero. Thereby the OD interest is applied only for the number of days wherein you used the amount. And once again the FD will start accruing interest.

Advantage:

This approach ensures that you receive higher interest rate on your capital and amount is not unnecessarily parked with the broker while you are waiting for a trade. You also don't have to maintain the capital in Savings Account. Even if you already have FDs, with this approach you don't have to break them to deploy capital in market.

Hope some of you find this idea useful.

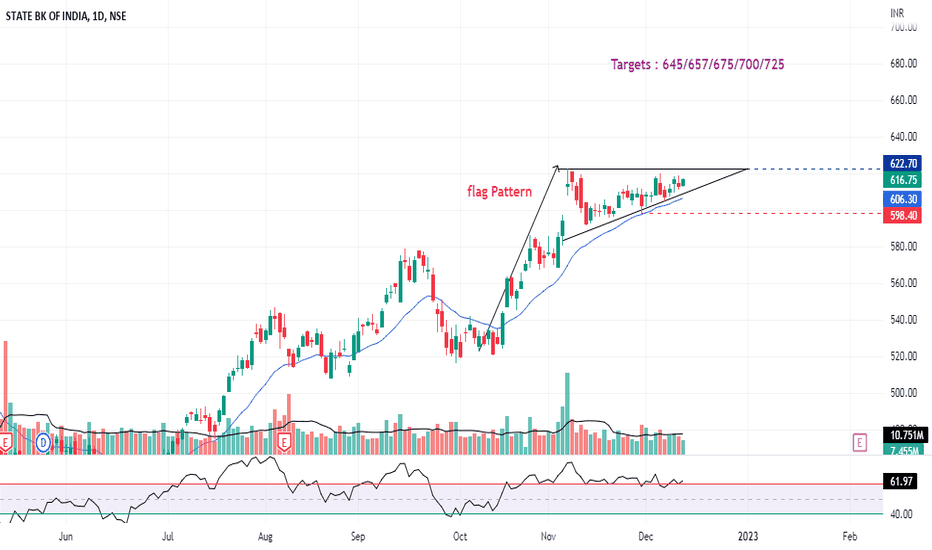

SBIN : Breakout Candidate (Flag Pattern)#SBIN : King of PSU Banks in a kind of Flag structure, Breakout Candidate Soon.

Good Strength in all 3 Time Frame (D/W/M)

Banking Sector will Grow as long as Indian Economy grows.

Take 10% & keep Trailling.

Happy Trading !!!

Keep Sharing, Loving & following to Learn more.