Sbinbreakout

SBI Breaks Head and Shoulders Pattern on 4H Chart – Time to Buy?SBI Breaks Out of Head and Shoulders Pattern – Pullback Entry Opportunity at ₹876

State Bank of India (SBI) has been forming a classic Head and Shoulders pattern on the 4-hour timeframe, and it has now successfully broken below the neckline, signaling a potential bearish move ahead.

From a trading perspective, this breakout could present an opportunity for short sellers. A pullback or retest of the neckline around ₹876 could be an ideal entry point for those looking to ride the trend. If the pattern plays out as expected, downside targets are seen in the ₹845–₹850 range.

As always, traders should monitor price action closely during the retest and manage risk accordingly, as false breakouts are always possible, especially around key levels.

SBIN upside target 840, 850State Bank of India may see good bullish momentum this week, the stock is on a bullish breakout on the daily chart, breaking which could show the stock a good rally. This stock can also see targets up to 840. The stock has also closed with a gain of five percent in today's session. The stock has also seen a bullish engulfing candlestick pattern on the daily chart indicating a good uptrend in the stock.

SBIN--Head & Shoulders pattern??This stock is bullish in action.

A strong fall is noticed from the header section 795 levels

and we have a left shoulder at 780 levels.

price after clearing the liquidity below neckline price will take u turn until the right shoulder which is strong. So keep an eye on this stock for short once reaches to the right shoulder area.

we have a demand zones lies at 650-640 areas.

wait for the price to form a right shoulder, to confirmation and breaks the neckline for more confirmation and retest for more confluence to enter short side up to the demand zones.

SBIN--Rally Base Rally or ReversalThis stock is continuously rising...

we have a demand zone lies at 700 levels...

observed rally base rally is going to observe in this stock.

if failed to go long from this place price will test the demand zone at 700 levels...

keep looking for long side from this demand zone for the target 840.

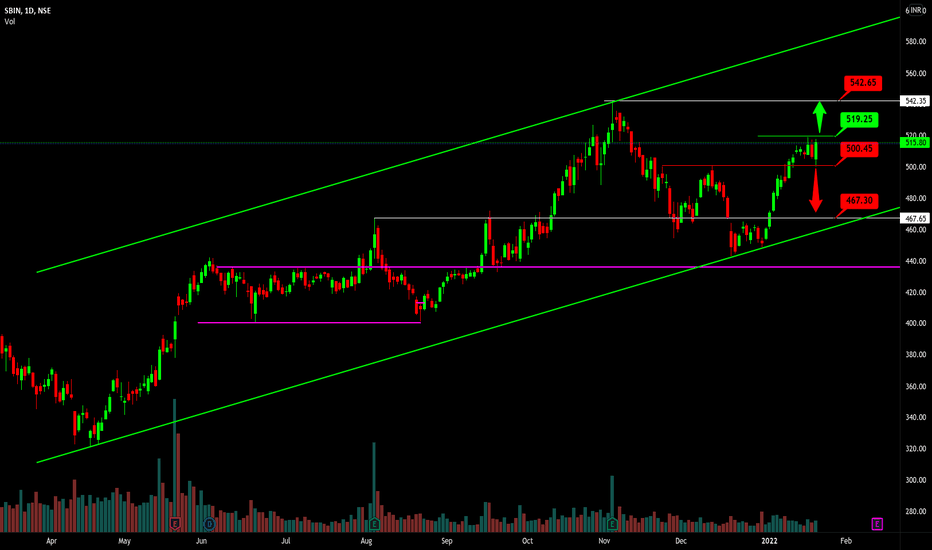

BUY SBIN AROUND 440 TGT 495/535/580/640 SL BELOW 380 AVG @ 425Currently it is trading below 100 DMA and it is supposed to make a minor pull back before taking support around 200 DMA and will resume its further uptrend. As budget session is also approaching and the previous quarterly results were also stable and is supposed to perform better in the current quarter. Any breakout above the price action line will make it to go for above mentioned target with given SL.

SBIN--Test of Supply is Needed??Observations::

price clears all the demand zones on bottom side...

now price is coming back to test the previous demand zone may acts supply zone

or to test strong fall area to again fall...

POI are marked on the chart please look at these areas...for sell

Keep track these levels. 580 and 590 Zone

SBIN--Drop base drop formation??Observations::

This is a continuation post to my previous post about SBIN::

Consolidation Happens between the demand zone and supply zones. Price restriction is happens between the zones.

While breaking the previous demand zone, price leaves a supply zone @586-590 range,

if price wants to test this supply zone and falls below or continue to fall down.

A Drop -Base-Drop is going to be observed, we have left with drop formation, if price breaks the smaller trendline will observe a fall towards target 1 and target2.

keep track this instrument.

SBIN--Fake Breakout @590 range.----->> after strong fall from 588-590 range, price again coming back to supply zone with consolidation to upside,

if failed to create a new high and falls below 575 range then sell for the target of 565 range.

the demand zone @ 575 range acts as support and the demand zone created at 582 becomes resistance, hence price is in consolidation.

if price consolidation to downwards price again rise from 565 range.

Monthly expiry is between 590 to 565 range.

keep track of these levels.

SBIN Conditional Buy levels 28.03.2023This is conditional buy view on NSE:SBIN . If 45min candle closed above 515, we can make a entry with stop loss of 507. My expected upside target will be 528.00. It would be positional trade for 1-2 days.

Note: This is my personal analysis, only to learn stock market behavior. Thanks.

sbin upside move we can see 300++sbin share news,

sbin share price,

sbin share latest news today,

sbin share latest news,

sbin share analysis,

sbin share news today,

sbin share price target tomorrow,

sbin share target,

sbin share buy or not,

sbi bank share,

sbin share chartink,

sbin shares,

sbin share future,

sbin share forecast,

sbin share intraday tips today,

sbin share latest news telugu,

sbin share latest news tamil,

sbin share latest news malayalam,

sbin share latest,

sbin share latest news english,

sbin share market,

sbi share news,

sbin share options,

sbin share price target,

sbin share prediction,

sbin share price target 2020,

sbin share price target 2021,

sbin share price today,

sbin share review,

sbin share result,

sbin share tomorrow,

sbin share today,

sbin share target today,

sbin share tips,

sbin share target next,

sbin share target price,

Science Backed by Data[SBIN Series]: SBIN looks BullishNSE:SBIN looks bullish on 15 min chart with ichimoku cloud showing bullish breakout. RSI looks to be trending bullish. Initial immediate targets looks 192.10/194.55 with immediate Stoploss of 187.25 for risky traders or for brave traders 186.30/185.25.

For swing traders first target is 202.50 and then with trailing stoploss till 210-215.

If you are interested in what sectors are doing good, look for this analysis in related ideas.

CNXPHARMA

AuroPharma

Britannia

Reliance are leaders from last week. CNXIT is emerging as a fast challenger beating CNXFMCG . BankNifty is still a poor laggard.

July Performance

2020 Performance