BTC - Crucial days aheadAt the moment of typing this:

BTC is in the Equilibrium Zone of the Ichimoku Cloud.

BTC is below its 50EMA on the daily chart.

BTC has found support from its 100EMA.

BTC is below its Ichimoku Cloud Conversion Line (Tenkan Sen). The Conversion Line (Tenkan Sen) is indicating short-term momentum is sideways.

BTC is below its Ichimoku Cloud Base Line (kijun Sen).

BTC is fighting to get back above the Ichimoku Cloud Leading Span A (Senkou Span A) cloud resistance level. BTC needs to close a daily candle back above this level and turn it into strong support.

The Lagging Span (Chikou Span) is under the price from 30 periods ago but at the moment is indicating momentum is sideways but be aware that it is a fast reaction indicator.

The Chaikin Money Flow (CMF) is indicating BTC is now back in the accumulation zone at 0.03.

The Moving Average Convergence Divergence (MACD) is indicating momentum is downwards but selling pressure has lost some strength because you can see the red Histogram is becoming lighter. We need the histogram to start to get smaller and eventually start back above the Base Line at 0.0 creating a green histogram. The Signal Line (Orange Line) is still above its MACD Line (Blue Line). The MACD Line had dropped under the MACD Base Line at 0.0 which means that a 12 Period EMA has dropped under a 26 Period EMA on the price chart. The MACD is crucial to keep an eye on for an eventual curve up off the MACD Line and a potential MACD Line crossing back over the Signal Line. The Weekly MACD is also a crucial indicator to keep an eye on because we do not want the MACD Line to cross over the Base Line at 0.0 on the weekly.

To freak you out, I have added a Fibonacci Spiral to this chart, if the daily candle on the 23rd April’s was the bottom then the next Fibonacci Spiral resistance is at around $71K but that is if the price can make it back over Leading Span A (Senkou Span A) resistance & the Schiff Pitchfork Median line. You can see that part of the Fibonacci Spiral support coincides with the 100EMA.

The Trend is your friend until the bend at the end. But……. there are other factors you need to take into consideration. Don’t forget that the Ichimoku Cloud is also your friend & can confirm to you if it’s a Bull, Bear or just an undecided market.

Is there a chance BTC could go down more, yeah sure because crypto is crazy volatile and Biden could announce he wants to now up capital gains to 95% which most Americans don’t seem to realise is a proposal & that Biden actually needs the senate to vote YES on it first……. I’m not American, but even i know this, so why the panic sell?

The fact that BTC has not yet dropped to its Leading Span B (Senkou Span B) cloud support is a very good sign. If however, BTC does drop further into the cloud, then it could drop to about $39,600 if the 150EMA fails at about $43K. This will be a crucial week to see if BTC can close a daily candle back in the Bullish Zone of the Ichimoku Cloud.

I hope this is helpful and useful to you. Good luck with your Trading or Hodl-ing 🔥🚀🌍🌔🪐🛸👽

Schiff Pitchfork

BTC update.... with indicatorsBTC update with a few different indicators to help you:

At the moment of typing this, BTC is back above its 50EMA. BTC needs to CLOSE a Daily Candle above this level and turn it into strong support.

BTC is still in the Bullish Zone of the Ichimoku Cloud.

BTC has managed to close above its Ichimoku Cloud Base Line (Kijun sen) 2 days in a row, it looks like this could be a 3rd day that we close above it.

The Ichimoku Cloud Conversion Line (Tenkan Sen) is indicating short-term momentum is sideways.

The Ichimoku Cloud Base Line (Kijun Sen) is indicating mid-term momentum is sideways.

The Ichimoku Cloud Lagging Span (Chikou Span) is inside the price from 30 Periods ago indicating uncertainty but notice however that we have UPWARDS MOMENTUM now indicated by the Lagging Span (Chikou Span) Tip pointing upwards.

If we look at the Chaikin Money Flow (CMF) we can see that BTC is still in the Accumulation Zone with the CMF (Green Line) pointing upwards and is at 0.07. Note that it was at 0.02 2 days ago.

I have added a Schiff Pitchfork (Points A,B,C) and as you can see, BTC is below is Schiff Pitchfork Median Line. BTC found support from its Lower Green Schiff Pitchfork Support Line and is now above the Lower Yellow Schiff Pitchfork Support Line. BTC needs to eventually close a daily candle back above its Schiff Pitchfork Median Line.

I have added a MACD on this chart instead of my usual ADX DI SMA just to break things up and hopefully help you learn something different, especially if your new and don’t know what these indicators are actually indicating.

The Moving Average Convergence Divergence (MACD) is showing that the MACD (Blue Line) is still under its Signal Line (Orange Line). Notice however that the Signal Line is starting to curve downwards and the MACD Line is looking like it may start curving upwards. So if you are waiting for a buy signal, then you would wait for the MACD Line to cross back ABOVE the Signal Line. Notice however that the MACD Line is still ABOVE its Base Line which is at 0.0 on the MACD indicator. So what does this mean? It means that while the DISTANCE between a 12 Period EMA & a 26 Period EMA on the Price Chart has shortened, the 12 Period EMA has NOT yet crossed UNDER its 26 Period EMA on the Price Chart…. This is a good thing 👍. So we do need the MACD Line to eventually start curving upwards.

As i said in my previous post, that liquidation wasn’t the end, and BTC is still in a longterm uptrend. If you follow the Ichimoku Cloud System like i do, then you realise it ain’t over until BTC flops around in the various Bearish Zones on the higher timeframes and then fails to cross back up into the Equilibrium & Bullish Zone, which BTC is showing no sign of doing anytime soon.

I hope you have found this post helpful & informative & i wish you good luck with your Trading or Hodl-ing 👍🔥🚀🌍🌔🪐🛸👽

ADA on a possible masive bull run target for 2021Cardano is poised to hit targets we did not think possible on this 2021 Bull run. With all the smart contracts and all the dapps that will be built on the Cardano protocol along with the bridges being built to support other blockchains and governance and on and on....... I am starting to think that we may be giving the eoy Ada price no justice at all. I posted a previous Cardano price of $50 but now with this Schiff Pitchfork and this yellow trendline that begins from March 2020, we could be seeing highs at $60. Of course, this is all speculative and not meant for trading but only my opinion on how I see this protocol hitting certain values.

how to apply pitchfork and auto pitchfork studyPitchfork , is a technical indicator for a quick and easy way for traders to identify possible levels of support and resistance of an asset's price. It is presents and based on the idea that the market is geometric and cyclical in nature

* Developed by Alan Andrews, so sometimes called Andrews’ Pitchfork

* It is created by placing three points at the end of previous trends

* Schiff and Modified Pitchfork is a technical analysis tool derived from Andrews' Pitchfork

In general, traders will purchase the asset when the price falls near the support of either the center trendline or the lowest trendline. Conversely, they'll sell the asset when it approaches the resistance of either the center line or the highest trendline.

█ Usage Tips :

* Andrews' Pitchfork (Original) best fit in a Strong Trending Market

* Schiff and Modified Pitchfork better with Correcting or Sideways Market. Modified Pitchfork is almost identical to a Parallel Chanel

Step By Step Applying Pitchfork

Auto Pitchfork Study ʙʏ DGT ☼☾

Besides Auto Pitchfork Pivot, Support and Resistance plotting, study also includes Auto Fibonacci Retracement Levels and Zig Zag indicator

Link to the Auto Pitchfork ʙʏ DGT ☼☾ :

ETH is a buy....watch price actionSo we all know what happens here. The schiff pitchfork is the corrective fork and we drew it several days ago. All you have to do is right click on the original and it shows you where the corrective price action will take you. Right now we are flirting with the lower median line and bottom fib channels. This is typically a buy signal. This is not financial advice and you should do your own research before making any investments. The indicators tell you what to expect and show you the likeliness of future price action moves based on current trends. Trends can change at any time, so please watch all price action for future analysis. Happy Trading!!!!

Pitchforks Ready BAT/BTC #basicattentiontoken $BAT #BAT Here we see our BAT BTC weekly chart from Binance . You can see BAT had a massive downside here from last summer. But it's recovering nicely and looks great for upside . You see we have drawn a large pitchfork indicator on this chart and it seems to fit. The top of that first pitchfork line up seems to be near 2600 and that also is where you see that long red line . That's an indicator called a VPVR and there's an obvious area of confluence near 2598 , so this appears to be a target in the near future. You can see our first target area - it's where the black arrow is pointing . The target above that appears to be the .382 fib near 3687 . Above that is our middle pitchfork line near 4600 . Above that is very bullish and targets would be

5859 - that's our .618 fib

6669 - that's our .706 fib

7405 - that's our .786 fib

8700 - that's the top of the pitchfork end of year 2021

thank you for having a look ! And fyi this is technically a Schiff pitchfork , it's one of the free indicators in your left side panel on Trading View.

Btc and crypto state chart analysisI don't know why i cant replicate my schiff pitchfork, even when I use the values I see on the main chart. Ill keep trying to figure that out.

-----------------------------------------------

Mid term, I am bearish on Btc. The bounce spots can be seen and there will be a link to the pitchfork chart for future reference to it. It def appears to be rising wedge motions, but we keep hitting the support trend-line underneath.

Some may find it more advantageous to just trade alts instead of Btc due to the nature or the market and alt movement.

I don't really think there is too much more to say. its a 20 minute video, i get into doge at the end and mainly show how high up targets were already hit and how i can see a potential downside. But if you just buy the bottoms, then it really doesn't matter what happens in between.

I see a possible upside of around 55k and possible downside bounce around 30-35k. Though with 4hr hull averages, a bounce at the blue line and the averages would be about 43k. Though, after a 43k bounce, I could see the pink line or about 46k, providing decent resistance and pushing Btc further down.

TL:DR I think Btc has more downside than upside because alts have already hit big targets and rising wedge possibility. The 4hr hull averages give me hope, but i do not like falling under the pink line (1.75).

Bitcoin's 'Hard Forks'This is a thread looking to tell the story of Bitcoin's swings with Modified Schiff Pitchforks (aka 'Hard Forks' because they are tricky to understand and explain for TA beginners). This is a bit of fun, but there is some serious TA in there as well. These tools are legit and I recommend spending some time learning geometry techniques like these, or not... whatever you like.

I'm looking for price to break above the median line (ML), but a conservative target is a re-rest of the ML.

Should we break below the lower median line parallel, I might have to reconsider the options in the very short term.

Alone At The Party BTC/USD pitchfork #Bitcoin #btc #crypto Bitcoin hasn't actually closed above that purple middle pitchfork line since 2018 . We've bumped into twice now , in 2019 and just recently . That's called a Schiff Pitchfork and I find it does seem to fit certain charts , it fits bitcoin pretty well going straight back to 2018 , so perhaps this pitchfork has some staying power . Whilst closing above that purple line where the red flags and red arrows are would be a bullish sign for continuation , it has not happened yet . Our last volume spike was about a week ago . I've said before that I expect Bitcoin might wick up to 12400 area or even 13k area but since we've already had quite a rise since March dump- I would really be expecting a hard retrace at some point after that or soon . I seem to be "Alone At The Party " on this one though . As many others on here are bullish for 17k to come in weeks or by end of year . I am not expecting that high a price this year . And although I'm long-term bullish I may be mid-term bearish since I'm really expecting 5k area next year in 2021 ( with possible spikes lower .) But again , I seem to be Dancing With Myself here on this one as everyone else is crazy champagne guy .

USD's pain is the WORLD's, and CRYPTO's gain !If we break below the black multi-year support line, and if we test it's underbelly successfully by bouncing off the white 0.25 level of the Schiff pitchfork, which we seem to have done already, we need to fall below the white 0.25 level and turn it into resistance.

If this happens and if we stay decisively below it, for several weeks, after multiple unsuccessful tries to break through and up.

In that case...

...the coming bitcoin bull-run will leave in the dust pretty much every bull-market we've ever seen in the financial world people will be stunned.

In the very long run, on a ten to thirty year horizon, the world is going to de-dollarize further. This is bad for the value of the dollar, and very good for the Emerging Market's massive volume of dollar-denominated loans, as the dollar will weaken, those loans will be way easier to finance.

CHFJPY inside Schiff Pitchfork.At first, I see that CHFJPY respects its trendline, then I added Schiff Pitchfork that provides clearer levels of the price movement. I consider the 0.5 line of Pitchfork as an inner trend line and the 1.0 line of Pitchfork as the main trend line.

Now the movement of price seems slow, that I predict the price will move down first to take more orders to rise. In the next supply zone, the traders would take profit that makes the price will retrace a bit. Afterward, the price will continue the trend and break the supply zone.

*For education only*

*Risk management is number one*

GBPJPY on the Pitchfork ChannelThe price forms Double Top or M-Pattern that it is expected to go down until the next Demand area below. After that, the price will follow its main trend direction; Uptrend on Daily. The price is expected to touch 0.5 line of Pitchfork which confluence with demand area (the grey box) before going up, or, touch the outer line; 1.0 level; of Pitchfork which confluence with the lower Demand area (the lower grey box).

The short term target is the nearest supply area.

*For education purposes only*

*Take your own risk*

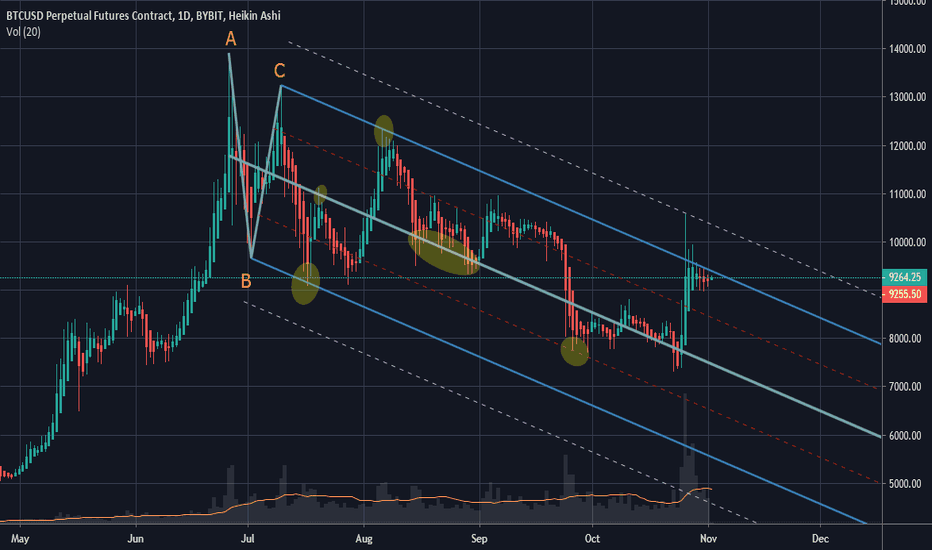

Schiff Fork Breakout?Using anchor points A,B, and C, this Schiff fork has guided price action well since the June high.

A solid daily close above the upper parallel would put us back into a bullish scenario... but not until that happens!! If we drop back lower, I'm looking for lower parallels to act as support.

XRP/BTC: The Ripple Question *Highly speculative*Schiff pitchfork using points 1, 2, 3. These channels have been valid for all historical XRP price action.

Profit potential on right side: ~300%+

Oversold RSI, similar patterns for previous huge returns on both stoch and regular.

Support at 2600 hasn't yet been touched, nor broken, was used for previous pumps

My previous XRP TA (below) resulted in being stopped out, but now is the time to ask if there will finally be a reversal. Essentially, a return to median seems possible, and would net huge returns. On the flip side, the question of whether XRP may die completely here should be considered. For that reason, a stop is definitely necessary for this trade, and it may even be a good idea to short XRP on its demise.

Bagholders have been capitulating for weeks, so this may be the biggest reversal yet. Could news help this to unfold?

*Not financial advice, just an idea*

MDA/BTC Ready to Rise from the Ashes?MDA/BTC looks dead right now, but it is retesting the top of the pitchfork channel after its huge run from fall 2018 to spring 2019. Could be a good R:R for entry, with a clear SL level.