ETH - BTC ETF News: What It Means for the Market+ China Rumors 🚨 ETH - BTC ETF News: What It Means for the Market + China Rumors 💥🌐

July just ended with a crypto bombshell 💣 — and the market is barely reacting.

Let’s break it down:

🧠 One part hard news.

🌀 One part geopolitical smoke.

🎯 All parts worth watching if you care about macro market shifts.

🏛️ SEC Approves Real BTC & ETH for ETF Flows (July 29)

Say goodbye to the cash-only ETF model.

The SEC now allows direct in-kind creation/redemption of Bitcoin and Ethereum in ETFs.

That means providers like BlackRock, Fidelity, VanEck can now use actual BTC/ETH, not just synthetic tracking.

✅ Bullish Impact:

💰 Real Spot Demand: ETF inflows = real crypto buying

🔄 Efficient Arbitrage: No middle step via cash = faster flows

🧱 TradFi + Crypto Merge: ETFs now settle with crypto — not just track it

🎯 Better Price Accuracy: Spot ETFs reflect true market value more cleanly

📉 The market reaction? Mild.

But don’t get it twisted — this is a structural reset, not a meme pump.

⚠️ But There’s a Bearish Angle:

🏦 Centralized Custody: Crypto now lives in Coinbase, Fireblocks vaults

⚠️ Network Risks: ETF performance now tied to ETH/BTC uptime

🧑⚖️ Regulatory Overreach: More hooks into validator networks, MEV relays

🌊 Volatility Risk: Panic redemptions = real BTC/ETH sold into open markets

Still, this is good news for Ethereum in particular.

Why? Because ETH isn’t just money — it’s infrastructure.

And now Wall Street is finally using it, not just watching it.

🇨🇳 And Then There’s China… Rumor or Tumor?

Crypto Twitter is swirling with unconfirmed whispers from July 29 that China may be prepping a major Bitcoin statement ahead of the BRICS summit.

But let’s be clear:

🚨 It’s a rumor. Or a tumor. 🧠

And like many tumors in crypto — there’s a 40% chance it brings bad news. 🤕

Still, here’s what’s being floated:

🧠 Speculations Include:

🔓 BTC re-legalization in “special finance zones” (HK-style)

🏦 BTC in national reserves (!)

🤖 CBDC integration or smart contract interoperability

⚒️ Return of official state-backed Bitcoin mining

🧯 But no official sources. Just geopolitics + timing.

China’s FUD/FOMO pattern is Bitcoin tradition — don’t get trapped by hopium.

But if even half of it is true... buckle up.

📈 Ethereum Leads the Charge — But Watch These Alts:

If ETFs go fully crypto-native, some sectors light up 🔥

🔹 1. Ethereum Layer 2s (ARB, OP, BASE)

→ ETF gas pressure = L2 scaling demand

🔹 2. DeFi Protocols (UNI, AAVE, LDO)

→ TradFi liquidity meets on-chain utility

🔹 3. ETH Staking Derivatives (LDO, RPL)

→ Institutions want yield = LSD narrative grows

🔹 4. Oracles (LINK)

→ ETFs need trusted on-chain data = Chainlink shines

🔹 5. BTC on ETH Bridges (ThorChain, tBTC)

→ If BTC flows into ETH-based ETFs, bridges light up

🚫 What I will Avoid:

❌ Memecoins – zero relevance to ETF flows

❌ GameFi – not part of TradFi’s roadmap

❌ Ghost Layer 1s – no users, no narrative, no pump

🧠 My Take:

ETH is building momentum toward $4,092 — the third breakout attempt on your 1-2-3 model.

🔥 The fuse is lit. Target? $6,036

Timing? Unknown. But structure is in place.

Meanwhile, Bitcoin Dominance is rising.

ETH is shining.

Solana — while powerful — continues paying the price for memecoin madness 💀

We’re entering a new phase — where ETFs settle with real crypto , China watches the stage, and macro money is warming up behind the curtain.

So stack smart.

Study the flows.

Don’t let silence fool you — the biggest moves come after the news fades.

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

SEC

XRP - One More Wave Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

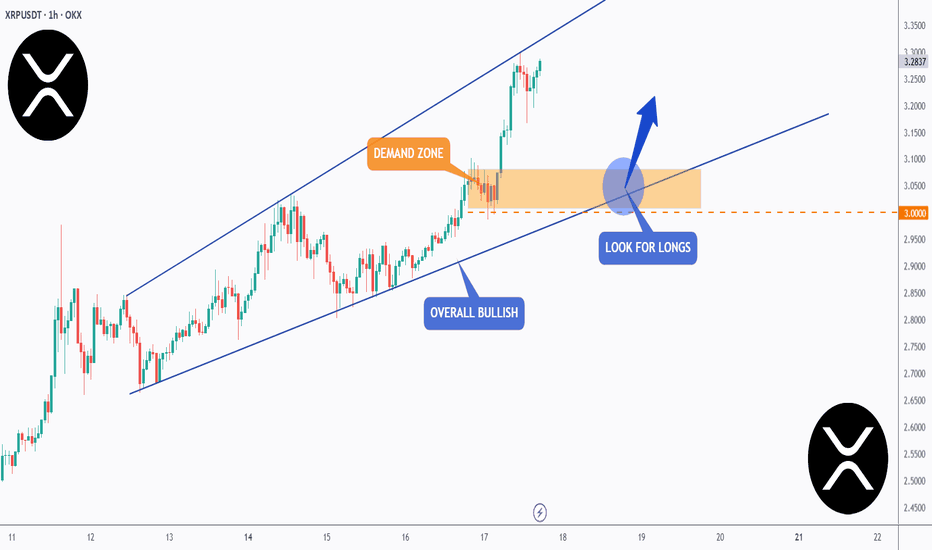

📈XRP has been overall bullish trading within the rising wedge pattern in blue.

However, it is approaching its all-time high at $3.4.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the orange demand zone and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #XRP retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

TradeCityPro | ADA Eyes Breakout from Bearish Channel Top👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ADA coin for you. The Cardano project is one of the oldest and most popular projects in crypto.

🔍 The coin of this project has a market cap of 22.21 billion dollars and is ranked 10 on CoinMarketCap.

📅 Daily Timeframe

On the daily timeframe, ADA is moving downward within a descending channel and is currently trying to break out of the channel from the top after reaching a support zone.

⭐ One positive sign for buyers is that they didn’t let the price reach the bottom of the channel. Instead, they used the overlap between the midline of the channel and the key 0.5579 zone (marked as a support area) to stop the price from falling.

✨ However, as long as the coin is fluctuating inside this channel, the trend remains bearish. Holding the midline is not a sign of trend reversal yet, but it does indicate weakening of the current trend and may act as one of the bases for a future reversal.

✅ Looking at the RSI oscillator, we can see that each time the price tried to break the channel’s top, RSI reached the 70 area and got rejected, causing the price to drop.

⚡️ Currently, the price is very close to the top of the channel, but RSI has just broken above the 50 line and is moving upward. This is a bullish sign for buyers, as it shows there is still room for upward momentum, which increases the chance of a breakout.

🎲 The nearest trigger for confirming the breakout from the channel is the 0.7212 zone, which is a bit far, and the price will likely form a higher low and high before reaching it, confirming the breakout earlier.

💥 But based on the current data, the breakout trigger remains at 0.7212, and for spot buying, this is the first valid entry level.

👀 Personally, I’m not adding any altcoins to my portfolio right now, as Bitcoin Dominance is still in an uptrend. As long as this trend continues, large capital flows into altcoins are unlikely.

🛒 More reasonable triggers for spot entries would be a breakout above the 0.8414 supply zone. If I were to buy, I’d enter at this level. The final trigger is 1.1325, which is quite far from the current price, and if BTC Dominance continues upward, it could take several months to reach this zone.

🔽 If you already hold this coin in spot, your stop-loss can be set at a break below the 0.5579 level. A breakdown here would also provide a good short setup in futures, as the price could move toward the bottom of the box or the static level at 0.4322.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Hold on, here is the real deal.District court ruling on the joint motion (June12) still pending—no update yet.

Judge Torres’ ruling – could come any day; depends on district court docket.

Appeals proceedings remain on hold until at least August 15, 2025.

XRP spot ETF decisions delayed:

SEC ETF decisions, comment periods suggest

Franklin Templeton: very likely by late July

ProShares: by June 25

Grayscale: likely October

Bitwise: through June to October

CPI must fall under 2.0%

Oil must retrace to the $70s

Fed must signal a real cut, not conditional pause

DXY must fall below 103

Current War that we all are focused is going to be ended swiftly.

Until then, Hold Your Horses!

XRP - Trade The Range!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈XRP has been trading within a range between $2 and $2.35 in the shape of a flat rising broadening wedge pattern in red.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the green support and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #XRP approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

XRP is so BACK!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

As per our last XRP idea, attached on the chart, it rejected the lower green structure and surged by over 25%.

📈XRP is now bullish long-term trading within the rising channel marked in blue.

Moreover, the upper green zone is a strong structure!

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #XRP retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

TradeCityPro | Deep Search: In-Depth Of XRP👋 Welcome to TradeCity Pro!

Today, we're diving deep into the Uniswap project with Deepresearch. First, we'll review the project information, and then I'll provide a technical analysis of the UNI coin.

🤑Overview of XRP & XRP Ledger (XRPL)

XRP Ledger (XRPL) is a decentralized blockchain launched in 2012 that functions as a currency exchange network, payment settlement system, and remittance platform. It is designed as an alternative to the SWIFT system for international money transfers, enabling instant and low-cost transactions. Of course, these services have not been officially launched yet.

🔹Key Features

Transaction Speed: 3-5 seconds

Scalability: 1,500 transactions per second

Low Fees: $0.0002 per transaction

Energy Efficiency: Carbon neutral and low energy consumption

🔹How XRP Works

XRP operates on an open-source, peer-to-peer, decentralized platform. Unlike Bitcoin and Ethereum, which use Proof-of-Work (PoW) and Proof-of-Stake (PoS), XRP uses the Ripple Protocol Consensus Algorithm (RPCA).

🔹Key Components of XRP Ledger

Consensus Mechanism:

-Transactions are verified by a group of bank-owned servers (validators).

-Users select trusted nodes (Unique Node List - UNL) for transaction validation.

-A transaction is validated if 80% of validators approve it.

-Instead of blocks, ledgers are used to store transactions.

🔹Gateways:

-Acts as a middleman for currency exchange between fiat and cryptocurrencies.

-Anyone can create a gateway to provide liquidity in XRP transactions.

🔹Transaction Fees:

Minimum transaction cost is 0.00001 XRP, significantly lower than bank fees for cross-border payments.

🔹XRP Tokenomics & Vesting Schedule

Total Supply: 100 Billion XRP (Pre-mined)

Current Circulating Supply: ~45 Billion XRP

Escrow System:

-80 Billion XRP was given to Ripple Labs at launch.

-55 Billion XRP was locked in escrow, with monthly releases of up to 1 Billion XRP.

-Unused XRP is returned to escrow to control supply inflation.

Inflation and Deflation Mechanism:

Every transaction burns a small amount of XRP, reducing total supply over time.

Unlike Bitcoin, which is capped at 21 million coins, XRP’s supply management prevents extreme price volatility.

🔹Ripple’s Funding & Investors

Total Raised: $294.5 Million

Current Valuation: $9.8 Billion

🔹Major Funding Rounds

🔹Key Investors & Partnerships

1- SBI Holdings – Major financial institution in Japan, strong supporter of XRP.

2- Santander & Accenture – Integrated XRP for remittance solutions.

3- Bank of America & American Express – Tested XRP for cross-border payments.

4- BlackRock – Exploring tokenization of U.S. Treasury bonds on XRP Ledger.

🔹Ripple and SEC Lawsuit

Background of the Legal Case

-The SEC filed a lawsuit against Ripple in December 2020, alleging that XRP is an unregistered security.

-Ripple argues that XRP is a digital asset, not a security, and operates similarly to Bitcoin and Ethereum.

Latest Developments

-July 2023 Court Ruling: U.S. District Judge Analisa Torres ruled that XRP is not inherently a security, particularly when traded on secondary markets. However, the court found that Ripple's direct sales of XRP to institutional investors constituted unregistered securities offerings.

-Ongoing Settlement Discussions: Recent reports indicate that the SEC is considering classifying XRP as a commodity in its ongoing settlement talks with Ripple Labs.

Potential Impact on Market

-If Ripple wins – Strengthens XRP’s legal standing, boosts institutional investment, and may set a precedent for other cryptocurrencies.

-If SEC wins – Increases regulatory scrutiny, could affect other blockchain projects, and may impact market liquidity.

🔹Future Roadmap & Developments (2025)

Regulatory Expansion and Compliance:

-Expanding into Dubai with regulatory approval, reducing dependency on the U.S.

-Seeking partnerships with Central Banks for CBDCs (Central Bank Digital Currencies).

Tokenization and Institutional Finance:

-BlackRock partnership to tokenize U.S. -Treasury Bonds on the XRP Ledger.

-Increased use of XRPL for real-world asset (RWA) tokenization.

Enhanced XRP Ledger Capabilities:

-Improvements in transaction speed and cost-efficiency.

-New developer tools for smart contracts and DeFi applications.

🔹TVL overview:

An analysis of the Total Value Locked (TVL) in XRPL reveals that after a significant drop in early November 2024, it has recently shown a modest upward trend. Since early February 2025, TVL has increased from approximately $31.5 million to $34.5 million. Despite this recovery, it remains about 380% below its peak recorded in November.

—

🔹Certik: 94.25

—

🔹Ripple Team and Key Figures Behind XRP

Founders (2012):

-David Schwartz (CTO): Architect of XRP Ledger, leads technical development.

-Jed McCaleb: Co-founder, later founded Stellar (XLM).

-Arthur Britto: Key cryptographic contributor, works on decentralization.

-Chris Larsen: Co-founder, now Executive Chairman.

🔹Current Leadership:

-Brad Garlinghouse (CEO): Drives global expansion, leads SEC legal battle.

-Monica Long (President): Manages Ripple’s growth strategy.

-Kristina Campbell (CFO): Oversees Ripple’s financial operations.

-Stuart Alderoty (Chief Legal Officer): Leads Ripple’s defense in the SEC lawsuit.

-Global Presence: Offices in San Francisco (HQ), London, Singapore, and Duba

🔹On-Chain Analysis of Ripple (XRP)

Following XRP’s all-time high (ATH) in January 2025, network activity has declined sharply, with the number of active addresses returning to levels seen four months ago.

In March, exchange inventories show an increase in inflows, possibly indicating selling pressure from individual holders.

Regarding supply distribution, wallets holding over 1 million XRP (primarily institutions and organizations) have reduced their holdings since the ATH. Meanwhile, the number of addresses holding over 1,000 XRP has increased, but this growth appears to be partly due to transfers from larger holders rather than new demand.

🔹Platforms for creating XRP liquidity pools

Uniswap

KLAYswap

Claimswap

Sologenic

Squadswap

—

🔹Some of the wallets that support XRP:

Atomic Wallet

Trust Wallet

Exodus

Guarda

Xaman

Safepal

MetaMask

Tangem Wallet

BitPay Wallet

Math wallet

Trezor

Now that we have reviewed the project, let’s move on to the chart to analyze it from a technical perspective.

📅 Weekly timeframe

As observed in the weekly timeframe, after breaking 0.6568, an upward leg started, and the price even broke through 1.5728, reaching 3.0590.

📊 Market volume was decreasing before the start of the upward movement but surged with the upward trend, although it is currently on the decline again.

✨ The SMA25 has reached the candles, and the price has pulled back to this area. This indicator might introduce new momentum into the market. If it breaks above 3.0590, we could witness the next upward leg.

💫 If this SMA is broken, the price could correct further down to 1.5728. SMA99 could also act as dynamic support.

🛒 For spot purchases, you can enter upon breaking 3.0590. However, if the price corrects further, new triggers will be formed.

📅 Daily Timeframe

In the daily timeframe, as you can see, the price has formed a range box between 2.0032 and 3.3117 and has managed to maintain itself well within this area.

✔️ The 2.0032 area overlaps with the 0.236 Fibonacci level, and if this area breaks, the price could move down to lower Fibonacci levels.

🎲 Market volume in the box is decreasing, which could bring the next price move closer as decreased volume reduces price volatility and allows more whales to influence the price significantly.

⚡️ If the RSI oscillator can stabilize above 50, it might introduce some upward momentum into the market, potentially driving the price up to the box's ceiling. The main trigger for a bullish market is breaking 3.3117.

🔽 For short positions, you can confirm a downward movement with the break of 2.0032, but be aware that this movement is a bearish correction against the main market trend.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | UNIUSDT Ready to Break the Trend Line👋 Welcome to TradeCityPro Channel!

Let's analyze and review one of the best crypto DeFi projects and projects that have good income in the crypto space!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

In the weekly time frame, we are witnessing a deep correction of this coin and the situation is not very good and these events are also due to the recent negative news in the market, but we experienced a 68 percent drop!

We have now reached an important support which is 5.599 and in terms of price it is really a good price for the yoni but I don't have any suggestions to buy it right now because it is a very strong downtrend and we need to form a structure!

Even if we need to lose a percentage of the movement, we will lose it so that we can enter with the momentum and we do not need to buy a step like the others and for now we will watch for a purchase, but to exit after the level of 4.051, I will exit myself

📈 Daily Timeframe

The same thing is happening on the daily time frame and after being rejected from 18.664 and not reaching this price ceiling, we went for a price correction and formed a box between 12.830 and 15.264

After breaking the bottom of this box, we started a downward movement and I had a bounce to this support and I went to continue the fall and now we have reached the important support of 5.617 and we are probably going to go for a time range and form a box

Currently, it is expected that we will go for a range and form a price structure and we must consider that sellers are no longer willing to sell and have been on it for a few days This is the support level and it is not a good level to buy at the moment, but if we form a box after it breaks, we can buy.

⏱ 4-Hour Timeframe

On the four-hour time frame, this recent decline is also clearly visible on the chart and has even caused us to form a downward trend line of the retracement type.

I should mention that trend lines are divided into two categories: retracement and continuation. Continuing trend lines are those that continue our main trend after the trend line breaks and usually we do not need a trigger to trade it, but retracement trend lines are trend lines that change our main trend and to open a position with them, I myself wait for the trend line to break and a confirmation trigger!

📈 Long Position Trigger

with the above explanation, after the trend line and trigger 6.287 break, we can open a risky long position, but if this happens, by forming a higher bottom and top after breaking that top, we will have a much better trigger and we are more confident that the trend will continue

📉 Short Position Trigger

our task is completely specific, and after breaking 5.721, we can open our position, and we can also continue to do the same with each rejection from this trend line and get confirmation for the position if the volume increases, but our main trigger will still be 5.721

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

$4 to $16 with power hour making +60% run $10 to $16It was consolidating for 4 hours after morning news that investor or group purchased at least 5% stake in the company and filled with SEC. This made the stock pop to +150% on the day as traders speculated it could be a big reputable firm or individual so they want to be in as well. After strong support it moved further to +300% area total on the day and I warned everyone on time to get ready for $10 and $11 buys for the vertical new highs.

Last hour brought easy money NASDAQ:RGC

the Head and Shoulders of the Month!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 This week, XRP rejected the $2 support level and has been trading higher.

Today, XRP formed an inverse head and shoulders pattern and broke its green neckline upward.

🏹 As long as the bulls hold, a movement towards the upper bound of the falling red channel would be expected.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Richard Heart defeats the SEC A U.S. district court judge has dismissed the Securities and Exchange Commission’s (SEC) lawsuit against Richard Heart. Judge Carol Bagley Amon ruled that the allegations against Heart lack a connection to the United States.

Heart is known for founding the HEX token, the PulseX trading platform, and the PulseChain blockchain. The SEC initiated legal action against him in July 2023, claiming that the three tokens—Hex (HEX), PulseChain (PLS), and PulseX (PSLX)—were unregistered securities. The commission also accused Heart of misusing $12.1 million of investor funds to indulge in luxury items like sports cars, Rolex watches, and the world’s largest black diamond.

“The alleged misappropriation occurred through digital wallets and crypto asset platforms, none of which were alleged to have any connection with the United States,”

“Case dismissed. Thank you Judge Amon,”

Heart is an American citizen who has been living in Finland for several years. He faces serious charges there, including income tax evasion amounting to hundreds of millions of dollars from June 2020 to April 2024, as well as an assault charge from September. Reports suggest that the tax issues are connected to the launch of certain tokens, while the assault charge stems from an incident involving a minor in February 2021.

Finnish police suspect that he has left the country, and in December, an Interpol red notice was issued for him. In January, authorities in Finland confiscated 20 luxury watches from a third party that allegedly belonged to Heart.

All the while the law enforcement has searched for him, Heart has maintained a presence on social media. “If the haters really wanted to get me down they could raise more than the GETTEX:27M I did for medical research. Write free self help books better than my sciVive and Fix The World. Work in the courts for legal precedent for P2P publishing software. Found things that work flawlessly and become valuable,” he wrote on X in December.

Bitcoin - Will Bitcoin Hit $100,000?!Bitcoin is trading below the EMA50 and EMA200 on the four-hour timeframe and is trading in its descending channel. Bitcoin’s upward correction and its placement within the channel ceiling will allow us to resell it. It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy within the demand range.

During the past trading week, spot Bitcoin ETFs saw a capital outflow of $651 million, breaking their consecutive weekly inflow streak in the United States. Similarly, U.S. spot Ethereum ETFs experienced a modest capital outflow of $26 million, reflecting a nearly neutral trend in this segment.

Over the past few months, Bitcoin and Ethereum have followed different trajectories—Bitcoin has seen a substantial price increase, whereas Ethereum has faced notable challenges. One contributing factor to this divergence has been the economic policies proposed by U.S. President Donald Trump, which have favored Bitcoin.

Bitcoin’s price is currently just below $100,000, after approaching $110,000 in mid-January. Meanwhile, Ethereum has significantly declined from its recent high in December, as concerns over a potential “dangerous” bubble have emerged.

Wall Street giant Goldman Sachs has unofficially confirmed that it has purchased approximately $2 billion worth of Bitcoin and Ethereum in the form of exchange-traded funds (ETFs). According to a regulatory report, Goldman Sachs ramped up its investments in Bitcoin and Ethereum ETFs during the fourth quarter, increasing its Ethereum ETF holdings by 2000% and boosting its Bitcoin ETF investments to over $1.5 billion.

The ETFs acquired by Goldman Sachs include Bitcoin and Ethereum funds managed by BlackRock, as well as those under the control of Fidelity and Grayscale.

In 2023, BlackRock led the campaign for U.S. regulatory approval of spot Bitcoin ETFs, culminating in the launch of a series of these funds in January 2024. These ETFs quickly became some of the fastest-growing exchange-traded funds in history.

For the first time in November, U.S. physical Bitcoin ETFs surpassed $100 billion in net assets, with BlackRock’s iShares Bitcoin Trust (IBIT) now managing over $60 billion in assets.

However, some analysts have downplayed the significance of Goldman Sachs’ Bitcoin and Ethereum ETF investments. James Van Straten, a senior analyst at CoinDesk, stated: “Goldman Sachs’ position, like that of many other banks and hedge funds, is not necessarily a net long position.”

Last month, BlackRock CEO Larry Fink revealed that he had been in discussions with sovereign wealth funds regarding Bitcoin investments, predicting that such talks could push Bitcoin’s price as high as $700,000.

Fink, who spearheaded Wall Street’s entry into the cryptocurrency market last year through a series of Bitcoin ETFs, told Bloomberg at the World Economic Forum in Davos: “If all these discussions had materialized, Bitcoin’s price could have reached $500,000, $600,000, or even $700,000.”

In another major development, the U.S. Securities and Exchange Commission (SEC) officially announced that Ripple is not considered a security and should not be subject to securities regulations. This decision marks a significant victory for Ripple and could ease regulatory constraints and lawsuits that the SEC has pursued against other altcoins.

Additionally, the SEC has indicated that it may drop its lawsuit against Coinbase and has requested 30 days to review the exchange’s applications. Earlier this week, the SEC also dropped its case against Binance, signaling that SEC Chairman Gary Gensler’s crackdown on cryptocurrencies has largely failed. The lawsuit against Coinbase had been one of the most significant regulatory actions against the crypto industry during Gensler’s tenure at the SEC.

TradeCityPro | Navigating NEXO's Financial Waters👋 Welcome to TradeCityPro!

In this analysis, I want to discuss the NEXO coin for you. The NEXO project is a payment platform. This coin has always had issues with the US government and has been involved in several legal cases, but now, with Trump as president, it's experiencing a more relaxed environment.

📅 Weekly Timeframe

In the weekly timeframe, we are witnessing an upward trend that started from a low of $0.521 and has managed to reach $1.523 with high buying volume and upward momentum.

🔍 After reaching the $1.523 area, a correction phase started, and the price dropped to $0.923, forming a range box between $0.923 and $1.523.

🔼 Considering the size of the candles, price behavior, and volume, it seems that buyers have been stronger than sellers in this range because they have managed to test the resistance at $1.523 three times, weakening this area with each attempt.

✨ Currently, the price is moving toward this resistance again. Given the high market momentum and key indices like TOTAL, this coin could also see significant momentum if it aligns with these indices, potentially breaking this resistance.

🚀 If the $1.523 resistance is broken, the price targets are around the Fibonacci Extension levels of 1 and 1.618, which approximately align with the $2.6 and $4.9 areas.

💵 Regarding market cap, the current price has a market cap of $900 million. Given this market cap, the potential to reach these targets could increase.

📉 In case of a correction, the first significant area is $0.923. A break below this area could signal a trend change. A break below 50 in the RSI could also indicate a trend change.

📅 Daily Timeframe

In the daily timeframe, we can see more details of the price movement within the box. As observed, the price in its last upward move has managed to move toward the $1.542 resistance after breaking the previous high of $1.065.

👀 After reaching $1.542 and the peak of buying volume, a price correction began with decreasing volume, correcting down to the 0.5 Fibonacci level. This area is also an important support zone, and the price has reacted to this zone, now moving back toward the $1.542 resistance.

⚡️ Currently, breaking the 60.23 level in the RSI could be very crucial. If this area is breached, considering the momentum entering the market, the likelihood of breaking $1.542 increases.

📈 The best long trigger currently is at $1.542. If the price stabilizes above this area, we can expect an upward price movement.

💥 On the other hand, if selling volume enters the market and we see large red candles, more significant corrections are possible, and the price could drop at least to the previous low of $1.212, the 0.5 Fibonacci area.

💫 In case of a deeper correction, the next support areas are the 0.618 Fibonacci level ($1.144), $1.065, and $0.0950. If the RSI breaks below 50, we can expect a confirmation of a downward momentum, making it a risky move to anticipate further price drops without solid triggers.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

XRP - Roadmap to $3Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📦XRP has been trading within a large range, bounded by two round numbers, $2 and $3, forming a symmetrical triangle.

Last week, after rejecting the lower boundary of the triangle, XRP turned bullish in the short term.

For the bulls to maintain control and regain the long-term trend, a breakout above the red trendline and the green structure is required.

Such a breakout would target $3 as the initial objective. 🎯

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

XRP IS STILL RANGING!!!!!!!FUNDAMENTAL OUTLOOK

I hope all is well traders. These are the fundamentals/hype that have the XRP community buzzing.

1. Ripple vs SEC Update – Judge Approves Sealing of Key Documents

2. Gary Gensler, the Chairman of the SEC, has announced his resignation effective at noon on January 20, 2025

3. CEO Brad Garlinghouse met with President-elect Donald Trump at Mar-a-Lago on January 7

The approval of sealing key documents definitely brings huge buzz for the community. In my personal opinion, if you are willing to hide any type of information then it is considered ALPHA. What kind of alpha that might be? Only the judge will ever know but if they are insisting on sealing some information then best believe it has pivotal data (technology, price predictions, future involvement with other companies/tech etc).

Gary Gensler leaving will also “potentially” send XRP to new highs since he was the main catalyst on why crypto was heavily regulated. There is a probability that price will sky rocket on 1/20 which on a technical outlook agrees (bias wise) to that theory. Now Brad Garlinghouse having dinner with the Donald Trump also has everyone going crazy. I see this both bullish and bearish as sometimes making it too obvious is too obvious. However this meet up gives positive conviction on the SEC vs RIPPLE case finally ending. As you can see, there is a bunch of moves being made with positive speculation but the charts will always tell it all.

TECHNICAL OUTLOOK

We are still ranging. On a technical standpoint price has not made any significant changes to give us a conviction for price to reach ATH. With that being said, this price action translates to the whales moving price sideways in order to prepare for the following big dates (SEC vs RIPPLE outcome and or Gary Genslers date of resignation). With those 2 major headlines weeks away, we can theorize that this accumulation is being created for this next leg up/down. As for my approach portfolio wise, I will be observing on the sidelines with my active buy limit orders on standby. Pro tip: This is a unit game, accumulate as much UNITs as you can because UNITs will buy you FREEDOM.

As always, trade safe.

Mr.Oazb

XRP - History Repeating Itself... Again!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📔I find the OKX:XRPUSDT 4H chart interesting.

Previous post:

Do you notice a pattern here?

is XRP doing again?

🔄 If history will repeat itself, a break above the green zone around $2.7 is needed to signal the start of the next bullish movement.

🎯Once the setup is activated, $3 will be the short-term target, and then $5.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Bitcoin - Bitcoin finally reached 6 digits!Bitcoin is above the EMA50 and EMA200 in the 4H timeframe and is trading in its ascending channel. risk ON sntiment in the US stock market or investing in Bitcoin ETF funds will lead to its continued upward movement. which will cause the failure of the resistance zone. After the authentic failure of this area, we will see Bitcoin reach the ceiling of the channel.

Capital withdrawals from Bitcoin ETFs or risk OFF sentiment in the US stock market will pave the way for Bitcoin to decline. The target of this downward movement will be the level of 90 thousand dollars.

It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and compliance with capital management in the cryptocurrency market will be more important.

Last week, Donald Trump appointed Paul Atkins as the new chairman of the Securities and Exchange Commission (SEC), a decision that sparked mixed reactions. Hester Peirce, popularly known as the “Crypto Mom,” expressed her strong support for Atkins to replace the current SEC chairman, Gary Gensler. She stated, “Based on my previous experience working with him in this organization, I can’t imagine a better candidate for this position.”

Meanwhile, Caroline Crenshaw, a current member of the SEC, has been nominated for another term and now awaits Senate confirmation. If approved, she will serve on the commission until 2029. During her tenure, Crenshaw has taken a notably strict stance on cryptocurrencies, earning a reputation for being even tougher than Gary Gensler. One key point of contention is her opposition to approving Bitcoin Exchange-Traded Funds (ETFs). In a letter dated January 2024, she cited concerns such as investor protection and market manipulation as reasons for her dissent. These views have led some to label her as the primary adversary of the crypto industry.

Bitcoin Spot ETFs now hold over one million bitcoins, surpassing the holdings of Bitcoin’s anonymous creator, Satoshi Nakamoto. Within less than a year, these funds have become the largest bitcoin holders in the world.

Lawrence Summers, a former U.S. Treasury Secretary, told Bloomberg that the idea of establishing strategic bitcoin reserves is “ridiculous.” However, he welcomed efforts to regulate the crypto space and foster financial innovation. Summers also expressed skepticism about reducing government spending through the Productivity Department, calling it a challenging path.

The performance and weekly and annual returns of major Layer 1 cryptocurrencies are shown in the accompanying chart. Meanwhile, Pavel Durov, the founder of Telegram, appeared in a Paris court to face charges of facilitating illegal activities through his messaging app. Durov, who was temporarily detained on August 24, was released after posting a $6 million bail but has been barred from leaving France until March 2025. French prosecutors have accused him of running a platform that aids illicit activities. If convicted, Durov could face up to 10 years in prison and a fine of €500,000. This case has raised concerns about privacy-focused technologies in the Web3 space.

At the same time, the number of cryptocurrency wallets with non-zero balances has reached 400 million. Michael Saylor, the CEO of Microstrategy, recently shared his proposed bitcoin purchasing strategy with crypto enthusiasts. He reiterated that bitcoin should be considered a long-term asset and advocated for using a Dollar-Cost Averaging (DCA) strategy for sustainable growth.

Saylor, one of bitcoin’s most prominent supporters, stated that for the past four years, he has consistently advised investors to “buy bitcoin and never sell.” He emphasized that bitcoin should be held as a long-term capital asset rather than a short-term profit tool. Saylor recommended that investors enter the market every three months using funds they do not need and hold the investment for at least ten years. He also stressed that investors should not worry about short-term volatility and should avoid stress by adhering to this strategy.

The trading volume of spot cryptocurrencies reached $2.7 trillion last month, marking the highest level since May 2021. A new survey revealed that over 80% of cryptocurrency holders admitted that their investment decisions were influenced by emotions like Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD). The survey, which included 1,248 participants, showed that 84% invested due to FOMO and 81% due to FUD.

Kraken Exchange commented that the findings suggest many investors trade based on emotions and fears rather than logical strategies. These emotions often stem from misunderstandings or mistrust about the future of specific cryptocurrencies. The survey also revealed that FOMO drives investors to chase rising prices, while only 17% focus on buying opportunities during price drops. Interestingly, 63% of cryptocurrency holders acknowledged

XRPUSD Weekly triangle currently retesting as exact wick supportEven though we are still inside the triangles on the logarithmic chart, we have now been above this key linear chart symmetrical weekly triangle now for 2 consecutive weekly candle closes, and sure enough the big dump that coincided with the SEC’s appeal found wick support right on the top trendline of this triangle retesting it currently as support. It’s certainly plausible that price could continue to fall back inside the linear chart symmetrical triangle here, however closing the currentl weekly candle above ot’s top trendline here and maintaining it as precise wick support would be such a bullish sign were it. To happen that then I would start wondering if the entire appeal thing might actually not go through because maintaining this as support should validate the breakout and send price action on its way up to find that $3.73 cent measured move target. Of curse still very probably we could dip back inside this triangle one more time as well, either way I thought it’d be a good idea to repost this triangle and also include a screenshot of the current wick support zoomed in. *not financial advice8

The weekly linear symmetrical triangle truncatedI wanted to post thesame triangle I posted in the previous idea,but instead of starting the top trendline from the ath in 2018 starting it from the second highest wick.I think both are valid but wanted to give this one its own separate chart since in doing so it makes both the top trendline of the triangle and the bottom have a more similar length and also gives me a easy red ,ove line that is tilted forward which could be useful should the dotted measured ove line start to act as additional support or resistance along the way to the target. Once again as I said in the previous idea, no breakout has been confirmed of this in ear triangle pattern just yet, but the current weekly candle is holding wick support exactly on the top trendline currently which is an optimistic sign. Still completely possible it loses that support but for now it seems post worthy so I can keep a close eye on it. *not financial advice*