SEC

Bitcoin Today: SEC delays, but market growthPrice

Yesterday, despite the new statement from SEC about delaying the SolidX Van Eck Bitcoin ETF decision again, after short fluctuations at the 6400 level bitcoin found a support and went upwards accompanied by a rise in volumes. At the end of the yesterday, BTCUSD reached 6600 level, and today already broke above Bearish Trend Line. On the way up the price will meet an important resistance level 7000, which coincides with the 100-days EAM at this point. A breakthrough above 7000 will be a major turnaround signal, until then an entering the long positions stays a risky business. For now, the most important for the bullish trend is to hold above 6600 level. High volatility and buying volumes in this area will be a sign of readiness to test 7000. Comeback below 6600 would be a bullish sign.

Today forecast

Trading in the 6600 - 7000 zone.

Latest news

SEC delaying ETF decision from until February of 2019

The SEC has published an official statement saying that it is postponing its decision on the approval of the CBOE’s application to be able to trade shares of the SolidX Van Eck Bitcoin ETF (Exchange Traded Fund.) Following initial delays, a decision was expected by September 30th; now, a decision isn’t expected until February of 2019.

“Institution of such proceedings is appropriate at this time in view of the legal and policy issues raised by the proposed rule change,” an official statement by the Commission reads. “Institution of proceedings does not indicate that the Commission has reached any conclusions with respect to any of the issues involved.”

The SEC also said that it is seeking public opinions and information from the public in order to inform its decision and that it had received more than 1400 letters about the matter so far.

In general, people's reaction can be characterized as follows: Delays are some sort of a sign that the SEC is slowly warming up to the idea of a Bitcoin ETF. For now, delays are more promising that outright denials, of which there have been many.

“Being delayed was a best-case scenario. It was never going to be approved,” – Reddit user anti09

A critical vulnerability in Bitcoin Core, that threatened the bitcoin network for two years, is eliminated

On Tuesday, September 18, an unscheduled release of the Bitcoin Core client under version 0.16.3 took place, the release eliminated a critical vulnerability that threatened the DOS attack on the network. The exploitation of the bug was, however, not an easy task, and fortunately, no one took advantage of them.

As stated in the accompanying comments of Bitcoin Core developers, the vulnerability was exploited by the user who wished to remain anonymous. The exploitation of the bug, which was called CVE-2018-1744, allowed an attacker to disrupt almost 90% of the nodes, and only 12.5 BTC would be required to carry out the attack - the size of the reward currently received by the miners for the block. Built-in Bitcoin Core Fast Internet Bitcoin Relay Engine (FIBRE) engine would also contribute to the attack.

The Optech mailing list explains that the bug CVE-2018-17144 appeared in the Bitcoin Core 0.14.0 release, which was released in November 2016, and affected all subsequent versions up to 0.16.2. Its exploitation allowed to disrupt the network when trying to validate a block containing a transaction that tries to double-spend the input. Such block would be invalid and could only be created by miners willing to give up the loss of a reward of 12.5 BTC (about $ 80,000 at the current rate).

It is worth noting that this vulnerability was the result of the so-called human factor, and responsibility is on those developers who approved the corresponding code change. Among them were, for example, Gregory Maxwell, Vladimir van der Laan, and Matt Corallo.

For now, there were no statements from the Bitcoin Core developers, as to whether any analysis of the incident will be conducted and whether a public report on the causes of the incident will be made and how to avoid the recurrence of such cases in the future.

Bitcoin Today: SEC says no to ETNsPrice

During the weekends BTCUSD tested the 5750 – 6250 support zone, the price found support on the Bearish Trend Line and managed to come back in the lateral channel, above 6250. Still, medium price lean closer to 6250 with each day, making the movement further down more probable. Fundamental support stays shallow, so there are not many factors that could contribute to the growth right now. For today: overall state is bearish, support is 5750 - 6250, 6600 is the closest resistance. To change the bearish state, we will need to see the price going above 7000.

Today forecast

Trading in the 6000 - 6600 zone. Fall below 6250 – bearish signal.

Latest news

SEC suspended trading of USD-linked ETNs from XBT Provider

“The Securities and Exchange Commission announced the temporary suspension of trading in the securities Bitcoin Tracker One (“CXBTF”) and Ether Tracker One (“CETHF”) commencing at 5:30 pm EDT Sept. 9, 2018, and terminating at 11:59 pm EDT Sept. 20, 2018.”- @SEC_News

The US Securities and Exchange Commission (SEC) has ordered the suspension of trading of dollar-tied exchange note (ETN) Bitcoin Tracker One ("CXBTF") and Ether Tracker One ("CETHF") from XBT Provider AB in the US market.

The stated reason for this decision is the alleged confusion of market participants about the nature of these instruments.

SEC stated that some broker-dealers who applied for opening trades in crypto-currency ETNs called them crypto-currency ETFs. At the same time, the issuer of instruments characterizes them as "certificates without equity participation".

The restraining order will last until September 20.

Recall, that CXBTF and CETHF were listed at the Nasdaq Stockholm stock exchange in August 2018. And the first bitcoin-based security from the XBT Provider called Bitcoin Tracker One (BTO) was released in April 2015. Which gave markets additional hope about institutional future. With the above SEC decision, the picture will add negativity.

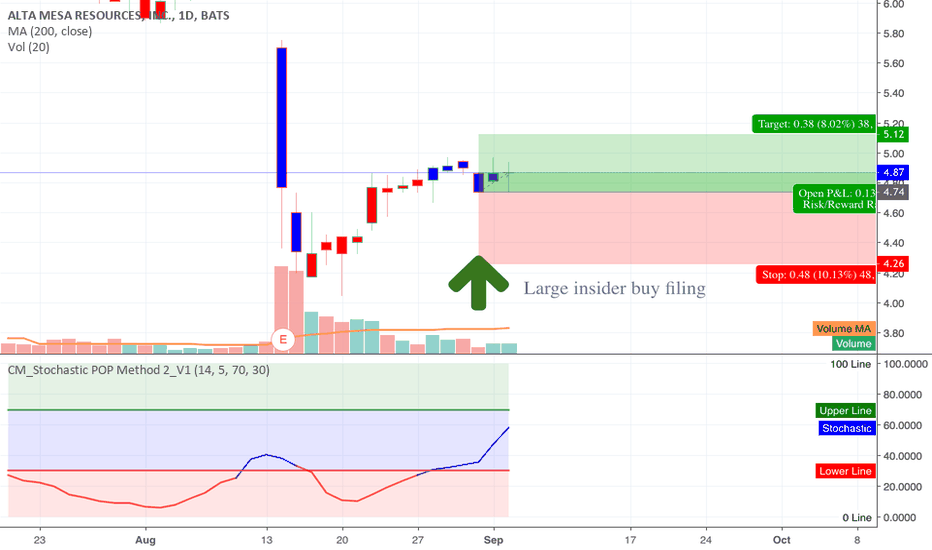

Large insider buy filing in AMRBayou City Energy Management LLC increased their ownership by 12%. They purchased 422,000 shares worth $2,065,360 at an average price of $4.89. At the moment of filing the shares were priced at $4.74. Take profit at 8%, stop loss at 10%, close automatically after 14 days.

We can see correction in few daysGreetings to you all the TradingView readers! We are the team of analysts for the top crypto channel on Telegram and we are here with the fresh idea.

We are likely to see the correction within 2-3 days, as Stoch RSI says. The indicator stayed beside the upper limit for a whole week, which is a proper period to make the price respond to the indicator’s intending. Currently, the Stoch and RSI lines are crossing each other, which predicts the following decreasing. But this signal needs 1 to 5 days to be performed.

Anyway, we expect 6550 price to the end of the current correction, and not lower. We already offered a reason for this price falling within our last idea .

Here we want to notice that 1H and 4H of Stoch RSI are currently changing or are going to turn into the growth, which indicates the price drop from the higher positions than the present ones. See more of reliable info and analytics on our Telegram account.

With respect, Lemon Insiders Team.

Not time to test the bottom yet!Hi, all the TradingView readers. We suddenly decided to go out of the Telegram frames (having 30k subscribers on the channel and 20k bot users) and show up on the TradingView to send our ideas and messages more precisely.

Let’s examine the topic thoroughly. Currently, we see a slight correction started from 7120. Under the correction, the price has fallen slightly lower than expected. But we were able to catch the right time to average it out and now we are in the channel having profit.

For some reason, everybody’s claiming that the current correction is just the end of the story and we’re going to renew the bottom price and all the other weird and mostly factless thoughts. I mean, indeed, the correction is real cause’ the growth itself was quite noticeable. In the moment, we are monitoring Stoch RSI (our preferred indicator) which clearly shows (on 4H and 1H) that it's going to reverse. This kind of the significant indicator’s fallen usually notifies us of an upcoming collection and a potential indicator’s reverse motion.

In addition to Stoch RSI, we are quite interested in LONG&SHORT BItfinex and monitor it as well. It shows an exciting thing now. Short positions have been closed while falling, long positions have been opened in the same moment. Short and long positions crossing happened on the falling stage, not on the raising one. Which is quite strange to us. After all, the crowd of traders never act like this. People trade more in the direction of price, not vice versa. Cause’ it’s not a good time for this now. So you certainly can determine the “big player” moves, who’s trying to hold the long position.

It’s too early now for renewing or testing the price bottom as we're still not on the strong downward line, which holds out for six month already, constantly killing our hope for the bright Bitcoin future.

To push away the line we should reach it first. And we will definitely reach it with the price of $7400-7600 per coin. On this point we can finally start considering the strong short position and the bottom price testing.

Well, probably, it won’t ever happen. Cause’ if you attentively check the motion pattern of the chart, you’ll notice the very last raising hump is quite different from all the others. The new hump is based on the bigger values and it grows in a slower way while all the previous humps consist of the impulse candles. It can be considered not just a hump but a future flat causing an impulse. Under the possible ETF approval, we may finally get out of this triangle by the end of September and will “draw” something new and quite intriguing.

We’re certainly keeping in mind a situation of the stock going to the very bottom. But it’s highly unlikely as all the indicators suggest the opposite. However, it’s still a crypto, where everything is possible)

So we are still holding a long position.

Thank you for reading this! Welcome and Follow our daily analytics in Lemon Insiders telegram account to stay up to dated!

Sincerely, Lemon Insiders Team

Markets mature, Bitcoin resists against SECs recent rejectionIs the price of Bitcoin really rising and falling because of the SECs decision to reject several ETF proposals? Or were the markets following their own flow all along? We saw two rejection cycles in August, but the outcome for the price of Bitcoin was different in each case. I am more than happy about this, because there is only one outside pressure, which should be the only reason for having an impact on its price: new successful steps on its way to mass adoption. Everything else is simply dust.

Stellar Lumens price is compressing, lows and highs move closer Always an interesting development within a chart. To know something is going to happen soon is kinda exciting to follow. To me it feels like we'll have some outbreak soon. The markets seemed to be unimpressed towards the SECs recent denial of further ETF proposals. This only shows that markets are following their own rules and traders are building up some kind of immunity towards a certain kind of real world chatter. We are listening to the silent before the storm.

Bitcoin Today: SEC bamboozlingPrice

Though yesterday closed with a slight growth, the pattern stays as a lateral stagnation accompanied by a decrease in volumes. Recent comments from the SEC officials, that they will reconsider the disapproval orders for nine bitcoin ETFs issued on Wednesday, caused even more confusion on the markets, leaving the price in its comfortable boundaries 6250 – 6600. Wider technical view stays bearish and without a sufficient positive fundamental news the price will eventually lose grab on this levels and start to go lower to the 6000 support. From above we have 6600 resistance and the whole strong resistive zone up to 7000.

Today forecast

Trading in the 6000 – 6600 zone. Possible bearish rally.

Latest news

SEC intends to review the refusals

As was reported by CoinDesk, the US Securities and Exchange Commission (SEC) announced its intention to reconsider its previous decision to deny the launch of nine bitcoin-oriented ETFs.

In a letter to by SEC secretary Brent Fields addressed to the senior advisor of the NYSE Group, David De Gregorio, says:

"This letter is to notify you that, pursuant to Rule 43 I of the Commission's Rules of Practice, 17 CFR 20 I .43 1, the Commission will review the delegated action. In accordance with Rule 431 (e), the August 22 order is stayed until the Commission orders otherwise."

The time frame during which the Commission intends to take final decisions on the proposed ETF is not specified. A copy of the letter was also received by Cboe Global Markets.

The news of the SEC's intention to reconsider its decision was first reported by Commissioner Hester Pearce, who earlier criticized the refusal to launch the bitcoin-ETF of the Winklevoss brothers.

“In English: the Commission (Chairman and Commissioners) delegates some tasks to its staff. When the staff acts in such cases, it acts on behalf of the Commission. The Commission may review the staff's action, as will now happen here.”, @HesterPeirce.

9 ETF proposals are denied by the SEC, probably push BTC downAnother hit for several Bitcoin ETF proposals, which might push BTC below 6.000 today. But who cares? I think that the down pressure on BTC looses on strength and I see a trend reversal on the horizon. BTC price is bottoming out in an elongated belly shape, and from this point onwards, we shall see prices climbing upwards steadily, pushing towards more and more resistance levels. It might take some time but chances are looking good. I will feel further confirmed, if this latest news will not have the downside impact, many expect them to have. So lets have a close look at BTC prices over the next 24-48 hours.

Bitcoin Today: SEC answer until 23thPrice

The price continues to fluctuate inside the 6250 – 6600 channel, high selling volume at the end of the day brought BTCUSD to the 6250 level but quickly found a support and all selling volumes were closed near the 6250. Today we see a continuation of the lateral movement which gradually lowering bulls appetite for the current price levels and eventually could push the price lower, at least to 6000 support. Overall, the rule of thumb is simple – the longer we stay lateral – the more probable to go lower looking for buyers. Given that this week the market expects to hear the SEC response to the next ETF request (Thursday, August 23 - ProShares Bitcoin ETF), we will probably see a breakthrough out of this channel soon, the direction will depend from the SEC answer of course. Boundaries for today stays the same as yesterday: 6600 from above and 6250 from below.

Today forecast

Trading in the 6250 – 6600 zone.

Latest news

Next SEC decision until August 23

Less than a month after delaying a decision date on Cboe's VanEck/SolidX bitcoin ETF, the U.S. Securities, and Exchange Commission (SEC) is poised to approve or disapprove another pair of proposed ETFs.

Officials at the U.S. securities regulator are set to make a decision on the ProShares Bitcoin ETF and the ProShares Short Bitcoin ETF by Thursday, August 23. Unlike Cboe's VanEck/SolidX bitcoin ETF request, this rule change proposal – filed by ProShares in conjunction with NYSE Arca – cannot be delayed any further.

The ProShares ETF proposals – initially submitted to the SEC last December – are underpinned by bitcoin futures contracts, rather than any physical holdings of bitcoin itself. In other words, the ETF's value will be determined by the bitcoin futures contracts trading on CME or the Cboe Futures Exchange, according to the original filing.

ProShares originally proposed the futures-based ETFs in September 2017 but noted at the time that the futures market was young and "there can be no assurance that an active trading market for bitcoin futures contracts will develop or be maintained," according to the filing.

To date, the regulator has only denied or delayed bitcoin ETF proposals, with the latest denial coming last month when it rejected a proposal filed by Gemini founders and long-time bitcoin investors Cameron and Tyler Winklevoss.

The Winklevoss proposal had already been rejected in the spring of 2017, but the Bats BZX Exchange, which submitted the proposal, filed an appeal that was later heard by SEC commissioners.

Restarting BTC bull rally with (unlikely) Bitcoin ETF approval.In my previous idea (see below) I tried to build a potential scenario for the downside. Here I will TRY to create a scenario for how things could unfold in case of a bitcoin ETF approval. I was reading a Medium article that suggested that a possible scenario was that in case the ProShares ETF got approved the VanEck ETF might still get declined. The reason for this would be that the ProShares ETF trades futures where the VanEck ETF trades actual bitcoins (hence the larger amount of hype surrounding the VanEck ETF). Trading in actual bitcoins would make the SEC question custody which they might not be ready to approve.

This is a very hypothetical idea to help one prepare for an unlikely scenario. I have no idea how likely this scenario is however one reason I found this scenario interesting was that this sequence of events could possibly bring us back to a recovery similar to after the Dotcom bubble. I have previously created an idea (see below) on the similarities between NASDAQ Dotcom bubble and bitcoins last bull rally. In my mind I still find this kind of recovery reasonable as cryptocurrencies was (obviously) over hyped in the last rally as was Internet stocks in the Dotcom bubble. However Internet technology did have its merits (obviously) and the market recovered. Blockchain technology (obviously) also has its merits so in my mind a similar recovery would be reasonable to suggest. The market however can disagree (obviously). Getting back above the long term support line (green trend line) would be very positive in my mind. Also the breakouts and retracements/back tests could potentially align well with this long term trend line and previous tops.

Even though I find the above idea interesting I believe more downside is more likely before the next rally. However I will keep this idea in mind to be prepared in case of a unlikely ETF approval.

If you liked my idea please follow me to help me justify publishing more ideas here on TV. As always please feel free to criticize and give feedback as this is the primary reason that I currently publish ideas on TV.

Good luck everybody

Bitcoin Today: correction to bearish trend?Price

Yesterday went in an expected manner, fluctuating between 6250 and 6600. For now, BTCUSD is holding above 6250 which is important for an upward overview. Nonetheless, until the price reaches 7000 – 8000 zone this upward movements could be considered as a correction of the bearish trend. As the negative news background, has changed to neutral we expect a continuation of lateral movement for today, maybe with testing of 6600 during the US trading session. Boundaries: 6000 – 6250 zone as a support and 6600 – 6800 as a resistance.

Today forecast

Trading in the 6000 – 6800 zone.

Latest news

Chris Concannon, CBOE president and CEO optimistic about ETF approval

The moment when the Securities and Exchange Commission (SEC) will improve their attitude regarding bitcoin-ETF is not far off. This view was expressed by the president of the Chicago Option Exchange (CBOE), Chris Concannon.

CBOE president also said that the launch of bitcoin futures, which took place at the CBOE in December, indicates the maturity of cryptomarkets. Concerning ETF on the basis of futures, Concannon noted that since no one has yet tested this product, one important task is to determine the correct level of liquidity.

SEC also concerned about volume issue. The trading volume of bitcoin futures is relatively low in comparison with contracts for such commodities as oil or gold. ETF is designed to solve this problem. However, the SEC is unlikely to approve crypto-currency ETF-products without sufficient liquidity of bitcoin futures themselves.

As Concannon noted, in the crypto industry, ETF can offer huge dividends to pioneers.

Recall, on August 7, the SEC extended the term of consideration of the joint application for the creation of bitcoin-ETF from the companies VanEck and SolidX. Nevertheless, representatives of CBOE and the above-mentioned firms are still convinced of the positive outcome of the case.

Bitcoin Today: Bearish, no hints on reversal yetPrice

BTCUSD has been showing growth yesterday but did not leave the 6000 - 6600 correctional zone thus did not violate the August bearish tendency. For nearest days we have a 6600 resistance and Bearish Trend Line from above and 6250 – 6000 supportive zone from below, the price will react on these levels. Break above 6600 will only send the price to the next resistive zone 6600 – 6800, which have to be crossed as well to show any hints for a turnaround. Fall below 6000 will open the 2018 low at 5750. Such closeness to the 2018 lows already adds to the bearish scenario, to turn the overview into the more positive side - we need to see a fast rebound from lows and come back above 6800 or even 7000. The longer the price will stay near the lows – the more chances to make new lows.

Today forecast

Trading in the 6000 – 6600 zone.

Latest news

Comments on ETF situation from market insiders

Internet news portal The Ico Journal published comments on ETF situations "from their insider sources". Source in the Van Eck, a former employee from SEC and someone from CBOE, all seem to have positive expectations regarding approvals of ETFs in future. The main idea is that SEC will approve ETF, they just trying to show a responsible approach and make everything as much safe as possible. Although there is no guarantee of reliability of the source, the article reflects the positive vision, which should be taken into account. Article from The Ico Journal (by Rogue Trader) with the direct speech from sources lower:

After yesterday’s panic reaction to the CBOE, Van Eck SolidX Bitcoin ETF procedural delay we thought it important to reach out to our CBOE contacts, Van Eck back channels, and industry vets to get their reactions. They didn’t disappoint – and you will pick up a theme very quickly in the commentary from three separate and institutionally different sources regarding the topic.

All gave nearly unanimous opinions about two issues of crypto interest; the expected delay and continued high expectations connected to eventual approval.

Our most consistent CBOE source responded via text this way (unedited): “Expected and the markets are acting irrationally to the announcement. Every single submission like this has gotten a delay. Again, expected. Still expect approval. 99% expectation. Print it, but as always, don’t use my name. :)”

A source we were passed at Van Eck responded via email with this: “Our team expected this delay, almost to the hour, and has been an expectation in our planning process. We won’t say when we expect an approval, but there has been specific speculation that we actually agree with and have incorporated into our timeline. We are in no way surprised by this. Most importantly, we believe our submission is the strongest yet to be put in front of US regulators, and believe that strength will be rewarded.”

We shared the above feedback from a source in our network who happens to be a former SEC employee now in the private sector (within the last three months): “The four people I still talk to on the daily at the SEC are basically telling me this ‘it is going to get approved but we are going to make the markets understand that we dug really, really deep i.e. investor protection/transparency’. And that makes sense. The vast majority of the public still has no idea what ‘digital assets’ are or what it means. So when you do an approval like this, and the successive approvals that will follow in this asset class – think of the 3-5 year return number that will be associated with this market? And maybe that is the key to the Van Eck SolidX approval? It is set up as an accredited investor vehicle. That singular element is probably what gives so many of us a firm belief in its approval. And it is a stroke of genius by the Van Eck SolidX group.”

That is where we believe the strength of this approval really lies. The $200,000 price tag effectively puts a floor on the type of investors who can realistically purchase shares. The product instantly becomes the property of accredited investors and institutional organizations.

Bitcoin Today: To be or not to be for ETF, that is the questionPrice

Spending most of the day on the 6500 level Bitcoin eventually managed to buy-out all bullish volumes and went downwards, heading to the 6000 support. A pause on the 6250 level confirms the importance of the 6000 – 6600 zone but doesn't break downward tendency yet. The market has already shown its reaction on the latest SEC statement (to extend the decision period on VanEck until September 30), which once more confirms that now Bitcoin is highly driven by the ETF question. So, for now, we expect to see a lateral movement in the 6000 – 6600 zone until the next SEC statement which probably will be released till August 23 as it is the deadline for ProShares application answer. To consider any bullish developments we will need to see the price going above the 6600 level until then outlook stays strictly bearish.

Today forecast

Trading in the 6000 – 6800 zone.

Latest news

SEC deadlines for the next two months

The U.S. Securities and Exchange Commission (SEC) is set to make final decisions on nine proposed bitcoin exchange-traded fund (ETF) in the next two months.

ON Tuesday SEC stated about delaying a decision on a proposed rule change from the Cboe BZX Exchange that, if approved, would allow for the listing of an ETF backed by blockchain startup SolidX and investment firm VanEck.

Yet the SolidX-VanEck proposal – first put forward in June – is just one of four filings in waiting.

Combined with past submissions from firms ProShares, Direxion and GraniteShares, a total of 10 bitcoin-related funds are being weighed by SEC officials, according to public records, although the VanEck/SolidX bitcoin ETF is the only "physical" ETF among all the proposals.

Those deadlines are set by the time at which the proposals are published in the U.S. Federal Register, with an initial decision due 45 days after that time. Still, the agency can postpone this timelines to as many as 240 days following publication in the Register.

The deadline for a decision on two funds from ProShares is August 23, is just over two weeks away. The rule change paving the way for those products was submitted by NYSE Arca on December 4, 2017.

September will see a series of deadlines for bitcoin ETFs, starting on September 15, the date by which two funds by GraniteShares will receive a thumbs-up or thumbs-down. The funds were initially proposed on January 5.

The deadline for Direxion's four funds is September 21, as indicated by public records, after being first submitted on January 4.

SEC punted its decision on the SolidX-VanEck proposal to September 30. However, given the way in which the agency considers such proposals, additional time may be carved out, pushing a final decision deadline to as far as late February of next year.

To be sure, the agency could release its decisions ahead of its prescribed deadline (as the SEC did this week).

SEC Postpones Bitcoin ETF decision - Is Crypto Markets Over SoldThe prices of Bitcoin, Ethereum and all other major cryptocurrencies are sharply down Wendesday following an announcement by the U.S. Security and Exchange Commission (SEC) that they will delay the decision on approving the expected first-ever Bitcoin ETF.

BTC/USD continuously following its' bearish trend, according to Bollinger Bands (BB), as long as the prices remain between the 20 days moving average (MA) the lower band.

Bitcoin tries reaching close to its support at $6383 but bounce back as buyers interrupt.

Relative Strength Index (RSI) is on 30, offering “over sold” market signal, we are currently still waiting for another signal from MACD of crossing the Signal one line. Once signal received, we might see Bitcoin prices going back towards $6718 (Resistance 1).

The launch of a Bitcoin ETF would likely be a big boost for Bitcoin and other coins, as it would open the doors to institutional investors to invest in the crypto market.

Bitcoin Today: No ETF decision on August 10 Price

Yesterday BTCUSD fell sharply, breaking the 6800 support on the way, after SEC statement on the prolongation of decision period for ETF applications. The price did stumble on 6600 support for a short time, but after a while broke below and now trading around the 6500 level. 6000 is a near-term target, by reaching it Bitcoin will erase all gains and positiveness from the July growth, which was provoked mostly by the speculations about ETF applications. For now, overall price pattern is bearish with a target on 6000. A breakthrough below 6000 will send the price to 2018 minimum at 5750. Nonetheless, 6000 level should have strong supportive value, as it is close to the 2018 min, so a bounce-off from this level is probable. To gain any positiveness we need to see the price moving above the 7000 level in nearest term.

Today forecast

Trading in the 6000 – 6800 zone.

Latest news

The SEC has extended the decision-making period for VanEck SolidX Bitcoin-ETF until September 30

SEC (US Securities and Exchange Commission) has extended the decision-making period for the application to List and Trade Shares of SolidX

Bitcoin Shares Issued by the VanEck SolidX Bitcoin Trust. This is stated in a document published on Tuesday, August 7, on the Commission's website.

Initially, it was assumed that the meeting of the Commission, at which officials will decide on changes in the rules of trade at the Chicago Stock Exchange (CBOE), where the fund should be traded, will be held on August 10. However, this date has now been postponed to September 30.

The application of VanEck and SolidX was filed on June 6. If the application approved VanEck SolidX Bitcoin Trust will be immune from theft and loss of funds. It will also be tied to a new index from Van Eck, which instead of exchanges will collect the price of bitcoin from US-based over-the-counter (OTC) platforms.

The price of VanEck SolidX Bitcoin Trust shares was set at $ 200,000, which means that the new ETF will be primarily targeted at institutional investors.

Earlier, a source in the SEC, who wished to remain anonymous, made it clear that the agency was interested in approving this application.

News almost immediately affected the course of bitcoin, which, having risen during the day's session above 7100, went down sharply, dropping below 6600 as on 8 August 8:30 UTC.

30K, 50K & 70K PREDICTIONS FROM THE HEDGE FUND MANAGERS...Haven't you heard it? 'Certainly this year, q2.. q3 , before the year end, no doubt, etc...' We all wish for it, and it is possible, we know...

But how does that look in reality... well... we gotta roll up those sleeves... and break some walls actually, or .. will Wallstreet do it for us?

They will ! Question is... when ? And will they short first, still hidden between the retailers?

Well, here's our deadline... great things to happen before old years eve then...

August 16, ETF's decision of the SEC for a basket of coins listing or not, last chance to add some power in the game, after the 2 rejected proposals of the Winklevoss twins, as we made it already to 8.4K.. but don't we need a little bit more?