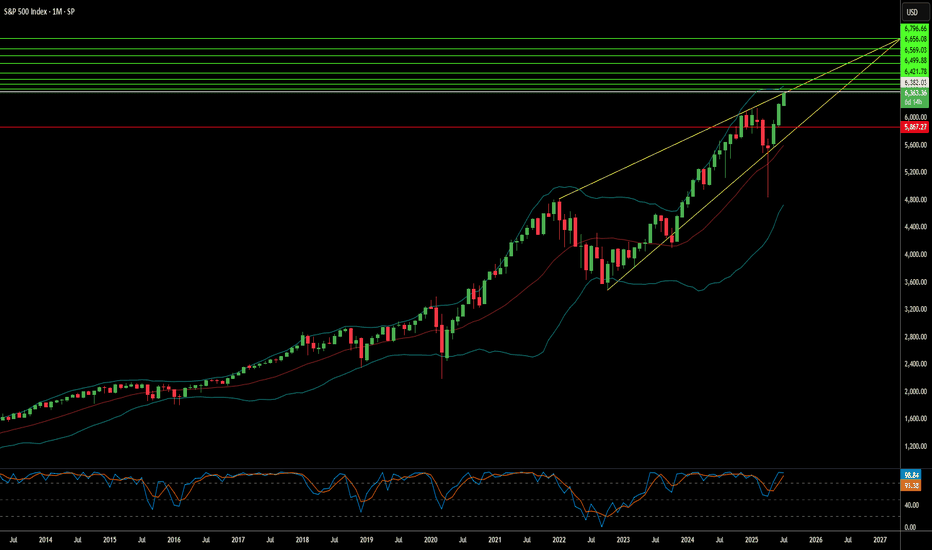

Can the S&P 500's Ascent Continue?The S&P 500 recently achieved unprecedented highs, reflecting a multifaceted market surge. This remarkable performance stems primarily from a robust corporate earnings season. A significant majority of S&P 500 companies surpassed earnings expectations, indicating strong underlying financial health. The Communication Services and Information Technology sectors, in particular, demonstrated impressive growth, reinforcing investor confidence in the broader market's strength.

Geopolitical and geostrategic developments have also played a crucial role in bolstering market sentiment. Recent "massive" trade agreements, notably with Japan and a framework deal with Indonesia, have introduced greater predictability and positive economic exchanges. These deals, characterized by reciprocal tariffs and substantial investment commitments, have eased global trade tensions and fostered a more stable international economic environment, directly contributing to market optimism. Ongoing progress in trade discussions with the European Union further supports this positive trend.

Furthermore, resilient macroeconomic indicators underscore the market's upward trajectory. Despite a recent dip in existing home sales, key data points like stable interest rates, decreasing unemployment claims, and a rising manufacturing PMI collectively suggest an enduring economic strength. While technology and high-tech sectors, driven by AI advancements and strong earnings from industry leaders like Alphabet, remain primary growth engines, some segments, such as auto-related chipmakers, face challenges.

The S&P 500's climb is a testament to the powerful confluence of strong corporate performance, favorable geopolitical shifts, and a resilient economic backdrop. While the immediate rally wasn't directly driven by recent cybersecurity events, scientific breakthroughs, or patent analyses, these factors remain critical for long-term market stability and innovation. Investors continue to monitor these evolving dynamics to gauge the sustainability of the current market momentum.

Sectoranalysis

Tata Consumer - How the Crash was Predictable Despite ResultsTata Consumer Products - Monthly Vs Weekly Comparison

1. On Monthly - the price formed Double Top pattern at 1,235 level on Sep 2024 and started falling 1.5 months ago. The Neckline is 1,017 level and when it breaks below - it will go down to 865, 698 levels

2. On Weekly - the price once again formed Double Top pattern at 1,222 level on 16th Sep and started falling for 5 Weeks already before today and has a target of 1,017 (which COMPLETED today)

One basic / Logical Question - When the price forms Bearish Patterns back-to-back on Multiple Timeframe Charts - How do you even expect the Results (Positive or Negative) to come and save it ????

And Watch today (Oct 21) - the price opened Gap Down - right below the Monthly Double Top Pattern's Neckline (at Candle Body Level) at 1,047 and took the hard Resistance and fell down -8.5% Intraday

But despite the fall - what saved it from Crashing further to LC or ending below -8% ? the same Monthly Pattern's Double Top Neckline (at Wick Level - 1,017)

Now the price is sandwiched between Wick & Candle Levels of Double Top Neckline

Now - Let's review the same situation from a different Source of Truth. A Comparison of Nifty_Tata_25 Index, Nifty FMCG Index

1. Nifty_Tata_25 index is going thru a Falling Parallel Channel and it ended up right below Resistance yesterday. So Obviously TATA Stocks were set to fall today - but Which one of those ? Today there were multiple Tata Stocks disclosing their Quarterly Results. Some Strong, Some Good, Some Weak - but net result the overall Tata Group stock had to go down - That's the destiny

2. Nifty FMCG Index - the price is again going thru Falling Parallel Channel since Sep 26 and today it opened right at the support level of 60,840 and within few mins it crashed below.

Now that FMCG sector is crashing and Nifty_Tata_25 Index has to Fall - which of the 22 Tata Group stocks will take the Brunt of the Fall ???? - Simple - One and Only Tata Consumer Products

Todays' Tata Group Performance

1. Tejasnet +11%

2. Tata Chemicals +9%

3. Tata Investment +3.3%

4. IHCL (Hotels) +3%

These are the best performers today - and all 4 belong to 4 different sectors. Now let's look at the worst performers of Tata Group

1. Tata Consumer -7%

2. TRF -4.2%

3. Rallis -3.5%

4. Voltas -2.5%

Again - these 4 also belong to 4 different sectors and these 4 sectors are different from the best performing 4 sectors.

So, When Tata Group Index HAD TO FALL - its Obvious that Tata Consumer is the Only One to Take the Worst Hit Logically. Makes Sense ????

----------------------------------------------------------------------------------------------------

Now Next Steps.

1. Nifty Tata Index - ended right at support level

2. Tata Consumer - took support of the Falling Parallel Channel bottom and bounced from -8.5% to -7% (Blue Arrow)

So, its clear that Tata Consumer will Rise tomorrow.....But the rise would NOT be enough for Bullish Reversal - Why ? read below

As you can see on the Weekly Chart, the Double Top on Weekly's target is already achieved and hence the fall stopped temporarily, but the target of Monthly Double Top is 865 and 698.

So, tomorrow when the price rises, it would take a resistance from 1,050 levels again and go sideways for few days and then fall below to 865

Read the Blue Path which explains the extrapolated path it would take to fall down to 865 and even to 698 if needed

Major Sectors that may influence US Markets this week!Health Care

Following an extended consolidation phase from December 2021 to August 2024, the healthcare index has developed an Inverted Head & Shoulder pattern.

With a recent breakout, the index is now set to experience significant upward momentum.

Industrials

Similar to the healthcare index, the industrials sector has also established an Inverted Head & Shoulder pattern. Following its breakout, this index has shown positive movement.

With a recent breakout from a brief consolidation phase, the index is ready to climb once more.

Financials

The financial sector plays a vital role in the US stock market. Recently, the financial index experienced a robust breakout after a lengthy consolidation phase, indicating that this sector could enhance the overall US market.

Real Estate

The real estate sector has faced challenges for a considerable time, with the index suffering a significant downturn. However, following a recent breakthrough, the index is making progress toward recovery.

Index Alert:IT Index is showing a possibility of strong breakoutIT Index has given a proper closing above both 50 and 200 days EMA (Mother and Father Line) at 34023. It was threatening to do so since few days. All it needs to do for confirming upside is a proper bullish candle tomorrow and closing above important resistance levels of 34269 and 34632. If this happens the next levels of resistance for IT index will be 35337, 35731, 36591, 37690 and 38000+. This indicates a strong possibility of a Bull-Run in most Large It stocks. Mid and Small Cap It may also benefit. This may be due to possibility of a rate cut by US FED. If it does not happen the chances of rally fizzling out are also there. So cautiously investor can start picking up large cap It stocks in X/2 or X/3 or SIP Mode. On the lower side if there is no good news from US the support levels are 33947 and 33759 (50 and 200 days EMA - Mother and Father line), followed by 33391 and 32627. The bottom for It index currently as per chart can be seen at 31385. Infosys, TCS, HCL Tech, LTIM, Tech Mahindra, Wipro, Mphasis, LTTS and Coforge. Other It stocks like Mastek, Happiest Minds, Birls Soft, FSL etc. should also be on investor radar. Choose wisely and never forget stop loss in uncertain market.

Note: IT Companies happens to have my strong bias since decades. It is one of my Favorite index for investment purpose. My portfolio is quiet heavy on IT. During the recent fall, I have personally increased weightage of It in my Portfolio. Please do your own additional research and invest wisely.

Daily Consolidation Potential Reboundsince the weekly reversal in favor of bears for AMEX:MJ etf and cannabis stocks, the daily bounce has turned back downward, and is approaching recent multi week lows.

this set of oscilatiry trend regularity indicators show when there is potential for retracement in the opposite direction should these levels hold.

India's Growth Story - Top 5 Sectors which will be in Lime-LightA Quick Overview of Global Major Economies

Japan, US, UK, Australia, Germany are officially in Recession

USA has not declared Recession officially as it is just covering up the underlying problem

Chinese Economy is in serious turmoil

Now where does India Stand?

Which Sectors within India are dependent on these Foreign Economies?

Which Sectors are in "Atmanirbhar" status ? which can continue their Rally ?

As you all know Indian IT Industry is heavily dependent on Foreign Projects - US / UK / European / Australian IT Offshoring projects. Given these major economies are in Recession - IT will likely face "Some Impact". At the same time, globally there is big GaGa on Generative AI and Indian IT industry focussing on AI - is all set to Offset the negative impact from Classical Offshoring Projects. This will help ease some pressure on IT companies, but overall IT is expected to have slower growth

Keeping aside the Politics, the current Governmental Policies are so favorable for the following sectors and hence I believe in India's Growth Story and expect a Blasting Rally on the below sectors

Energy: India has transformed from a country begging western world for permission to buy Uranium for Domestic Nuclear Energy generation to a Country which stands tall on the use of All types of Green Energy (Solar, Wind, Hydrogen, Hydro-Electric etc...) and has become Truly Atmanirbhar in generating enough power for us. Green Energy is just starting up - there is much more to go and investments on Green Energy sector is only going to multiply after the Election

Defence: India again has transformed from being a Major Defence Equipment Importer to a Major Defence Exporter. This again is a Sunrise Sector and Indian Defence Sector is going to grow multi-fold in future both in Short and Long Term and hence the Rally would Continue and even Grow bigger after the Election

PSU: As you all know, the Central Govt is emphasizing on PSUs so much and advertising heavily in Parliament, Rajya Sabha/Lok Sabha to invest in PSUs. Irrespective of any politics, given the upcoming Election, the Govt cannot afford to have an impact to their Brand Image if PSUs crash. They won't allow that either Pre-Election or even Post-Election and Technically many PSU stocks are on the verge of Breakout / doing a Retest after break out. Long long way to go on PSU side

Railways: With 3000+ New Trains, Bullet Trains, Conversion of traditional trains into Vande Bharat - the govt has made their plans clearly and invested heavily on Railway Modernisation plan. Even in the Interim budget there is strong Emphasis on Railway sector which is only going to multiply after the Election and hence the brief pause that we see in Railways will get released post Election and there is much Bigger Rally awaited in Railways in the next 3-5 years

Infra: Next to Railways, the Govt has emphasized and invested heavily on the Infrastructure development and expansion throughout the country and detailed out their intentions even during the Interim budget. India's Road / Rail / Sea & Airport Infrastructure is seeing a Massive Growth in recent years making the setup ready for Make-in-India Theme and Ease-of-Doing-Business themes drawing huge amounts of Foreign Investments

Given these reasons, I see a major and continued growth and expansion of the above 5 Macro Sectors and their dependent Sub-sectors like Cement, Steel & Metal sectors both in Short and Long Term (both pre and post-Election)

I believe in India's Growth Story - both the Story & Screenplay are super Strong and Indian Economy is positioned so strong among their Global Peers and heading for non-stop growth while other majors have started to fall down (China, Germany, Japan, UK, France, USA etc...)

Keep Holding your Winners. Always Analyse Technical Charts, Support & Resistance Levels of Individual Stocks before taking position

Disclaimer:

Stocks-n-Trends is NOT registered with SEBI. We do not provide Buy / Sell recommendations - rather we provide detailed analysis of how to review a chart, explain multi-timeframe views purely for Educational Purposes. We strongly suggest our followers to "Learn to Ride the Tide" and consult your Financial Advisors before taking any positions.

If you like our detailed analysis, please do rate us with your Likes, Boost and share your comments

-Team Stocks-n-Trends

Rounding bottom pattern almost complete in Nifty IT SectorNifty IT sector has almost completed the rounding bottom pattern. This consolidation phase was more than 2 years long. Thus, the probability of a sustainable breakout is high. I will look to go long in IT sector leaders via call options/ cash buys. What about you all?

PS: Typical targets are the depth of the rounding bottom pattern which is 29%. This can be achieved by the end of the year.

Investors' Holy Grail - The Business/Economic CycleThe business cycle describes how the economy expands and contracts over time. It is an upward and downward movement of the gross domestic product along with its long-term growth rate.

The business cycle consists o f 6 phases/stages :

1. Expansion

2. Peak

3. Recession

4. Depression

5. Trough

6. Recovery

1) Expansion :

Sectors Affected: Technology, Consumer discretion

Expansion is the first stage of the business cycle. The economy moves slowly upward, and the cycle begins.

The government strengthens the economy:

Lowering taxes

Boost in spending.

- When the growth slows, the central bank reduces rates to encourage businesses to borrow.

- As the economy expands, economic indicators are likely to show positive signals, such as employment, income, wages, profits, demand, and supply.

- A rise in employment increases consumer confidence increasing activity in the housing markets, and growth turns positive. A high level of demand and insufficient supply lead to an increase in the price of production. Investors take a loan with high rates to fill the demand pressure. This process continues until the economy becomes favorable for expansion.

2) Peak :

Sector Affected : Financial, energy, materials

- The second stage of the business cycle is the peak which shows the maximum growth of the economy. Identifying the end point of an expansion is the most complex task because it can last for serval years.

- This phase shows a reduction in unemployment rates. The market continues its positive outlook. During expansion, the central bank looks for signs of building price pressures, and increased rates can contribute to this peak. The central bank also tries to protect the economy against inflation in this stage.

- Since employment rates, income, wages, profits, demand & supply are already high, there is no further increase.

- The investor will produce more and more to fill the demand pressure. Thus, the investment and product will become expensive. At this time point, the investor will not get a return due to inflation. Prices are way higher for buyers to buy. From this situation, a recession takes place. The economy reverses from this stage.

3) Recession :

Sector Affected : Utilities, healthcare, consumer staples

- Two consecutive quarters of back-to-back declines in gross domestic product constitute a recession.

- The recession is followed by a peak phase. In this phase economic indicators start melting down. The demand for the goods decreased due to expensive prices. Supply will keep increasing, and on the other hand, demand will begin to decline. That causes an "excess of supply" and will lead to falling in prices.

4) Depression :

- In more prolonged downturns, the economy enters into a depression phase. The period of malaise is called depression. Depression doesn't happen often, but when they do, there seems to be no amount of policy stimulus that can lift consumers and businesses out of their slumps. When The economy is declining and falling below steady growth, this stage is called depression.

- Consumers don't borrow or spend because they are pessimistic about the economic outlook. As the central bank cuts interest rates, loans become cheap, but businesses fail to take advantage of loans because they can't see a clear picture of when demand will start picking up. There will be less demand for loans. The business ends up sitting on inventories & pare back production, which they already produced.

- Companies lay off more and more employees, and the unemployment rate soars and confidence flatters.

5) Trough :

- When economic growth becomes negative, the outlook looks hopeless. Further decline in demand and supply of goods and services will lead to more fall in prices.

- It shows the maximum negative situation as the economy reached its lowest point. All economic indicators will be worse. Ex. The highest rate of unemployment, and No demand for goods and services(lowest), etc. After the completion, good time starts with the recovery phase.

6) Recovery :

Affected sectors: Industrials, materials, real estate

- As a result of low prices, the economy begins to rebound from a negative growth rate, and demand and production are both starting to increase.

- Companies stop shedding employees and start finding to meet the current level of demand. As a result, they are compelled to hire. As the months pass, the economy is once in expansion.

- The business cycle is important because investors attempt to concentrate their investments on those that are expected to do well at a certain time of the cycle.

- Government and the central bank also take action to establish a healthy economy. The government will increase expenditure and also take steps to increase production.

After the recovery phases, the economy again enters the expansion phase.

Safe heaven/Defensive Stocks - It maintains or anticipates its values over the crisis, then does well. We can even expect good returns in these asset classes. Ex. utilities, health care, consumer staples, etc. ("WE WILL DISCUSS MORE IN OUR UPCOMING ARTICLE DUE TO ARTICLE LENGTH.")

It's a depression condition for me that I couldn't complete my discussion after spending many days in writing this article. However, I will upload the second part of this article that will help investors and traders in real life. This article took me a long time to write. I'm not expecting likes or followers, but I hope you will read it.

@Money_Dictators

DAILY SECTOR WATCH🟢WEED STOCKS TOP 10

Teradyne

Curaleaf Holdings

Green Thumb Industries

Trulieve Cannabis Corp

Canopy Growth Corp

Verano Holdings Corp

Cronos Group Inc

Tilray Brands Inc

Cresco Labs Inc

SNDL Inc

🔴CRYPTO COINS TOP 10

Bitcoin

Ethereum

Binance Coin

XRP

Dogecoin

ADA

Matic

Tron

Dot

Solana

🟣INDEXES

US30

S&P 500

FRA40

GER30

NTH25

ASX200

EUSTX50

JPN225

HK50

Banknifty

🔵SPACE STOCKS TOP 10

Iridium Communications Inc

Ses

Rocket Lab USA Inc

Aerojet Rocketdyne Holdings Inc

Viasat

Maxar Technologies

Eutelsat Communications

Astra Space Inc

Sats

Planet Labs

🟤RETAIL FOOD STOCKS TOP 10

Kroger Company

Albertsons Company

Sendras Distribiduira S A

Sprouts Farmers Market

Grocery Outlet Holdings

Weis Market Inc

Ingles Markets Inc

Arko Corp

Companhia Brasileira De Distribuidao American

Beyond Meat

XLE a W3 BO of 2GANN FAN lines+wedge move or a bulltrap to W4?XLE formed a big H&S pattern in 2002 & has since bottomed during pandemic. From there, it started a blue rising wedge which had a more chance of breaking down. However, due to the Russian invasion, it broke to the upside above the H&S green neckline.. Measuring the height of this wedge gives a target of 82.40 which XLE had reached & recently exceeded. It also exceeded 2 GANN FAN lines from 2002 & 2020 lows but registered a big red candle the next day.

I think XLE is currently at an impulse wave 3 of 3. XLE must hold 79 for wave 3 to continue higher. Losing 79 may signal a corrective wave 4 of 3 back down to retest the wedge at near the 68 level before a wave 5 0f 3 starts. It may even retest the green H&S neckline started in 2002 approximately near the 66 level.

Supports at 79, 68 & 66.

Resistances at 88 (1.618 Fib) & 92.24(2.0 Fib of recent wave b in a zigzag move)

There is better chance of XLE holding 79 with wave 4 & do the last wave 5 of 3 as the world energy crisis is not abading in the near future. XLE is the ultimate winning sector for months.

Not trading advice

ES: S&P Sector Performance YTDYou can clearly see that Energy has been the leader, and is in fact the only reason why ES isn't below 3600 right now.

Consumer discretionary has taken quite a beating all year, likely due to higher input costs. Worth noting is that consumer staples appears to now be joining consumer discretionary in this downtrend.

Utilities are behaving as the sector should be expected to behave during a bear market.

Rallies in ES all year have been hollow, with falling volume and open interest on the way up, and increasing volume and open interest on the way down.

I expect these trends to continue into the summer.

MJ Set To Apex Near Jan 31, 2022 - Get ReadyThis could be a big move in the Cannabis sector with a very broad Pennant/Flag formation setting up.

Great opportunity for another Reddit/Retail rally with the pending cannabis legislation being discussed and a strong technical price pattern confirming a potential breakout move.

Are you ready for another big rally in the cannabis sector?

A Study of Sector Rotation during year 2021 [Market Rotation]Sector Rotation Analysis starting from Jan 2021

While 2020 was a wonderful year for many investors, 2021 has been riddled with changes in the stock market thus far. In this analysis, I compared multiple ETFs that track different specific sectors in the market in order to visualize these changes. The periods and commentary are broken down month by month with the sector leaders and losers of that month.

A little about Sector Rotation:

Sector rotation in the market tends to follow the stages of business cycle—recovery, expansion, slowdown and recession.

Recovery

During the Recovery stage, feds will keep interest rates low while long-term rates rise. The material, financial, and industrial sector tends to take the lead during this phase.

Expansion

During the Expansion stage, the economy will expand at a stable pace while fed take a neutral stance on rates but credit conditions will ease. Again, long-term rates increase. Financials, Industrials, Technology, and Consumer Discretionary sectors will excel in this phase.

Slowdown

During the Slowdown phase, the economy peaks then starts to stagnate as inflation grows. At this point, credit conditions will be strained and stocks may fall. The sectors that do best in this phase are Consumer Staples, Energy, Health Care, and Materials.

Recession

During a Recession, the economy shrinks and feds cut rates. Long term rates decrease. Healthcare, Utilities, and Consumer Staples will do best in this phase.

2021 Sector Rotation Commentary

During January , we tested all-time highs for the most part. Several events that occurred were the Senate run-off, the inauguration of President Joe Biden, and even the GameStop Frenzy. In world news, the number of Covid-19 cases were spiking and investors were optimistic that the vaccine would become available and help open the economy back up. Chair of the Federal Reserve, Powell pledged that the central bank will leave interest rates near zero. During early January, Energy was king of the sectors but mid-way through was overthrown by Real Estate and Communication Services. The sector losers of January were Energy, Financials, and Materials.

February kicked off Earnings Season and we saw higher-than-anticipated numbers with a lot of companies beating Earnings expectations. One of the main events that occurred during February was the Treasury Yield started increasing significantly, this sent growth and tech stocks plummeting down (as they would be impacted more than established companies with well-balanced sheets and already sustainable revenue). A lot of low to mid cap stocks were significantly impacted by the rising yields and even up to today as I am writing this, still has not recover fully ($FUBO, $NIO, $PLTR, $SPCE). We saw a rotation from growth to value stocks. The Energy sector took reign over Real Estate while Communication Services rose steadily too. The sector losers of February were Materials, Health Care, and Consumer Staples sectors.

Early March was the bottom of the sell-off that started towards the middle of February. Some notable events were the Suez Canal mishap, several banks getting slapped with margin calls worth Millions of dollars due to exposure from Archegos, and the $1.9 Stimulus was finally passed! The stimulus benefited the banks, airlines, and other consumer discretionary stocks so we saw a slight rally in cause of the news. Real Estate, Energy, and Finance continue to lead amongst the other sectors while Technology, Consumer Staples, and Healthcare continued to remain sector losers.

It's Early May now and the market is starting to look both frothy and toppy. You can see a slight decline/curve from all sectors in the most recent period. Earnings Season is still going on but we saw many companies that met or exceeded expectations, sell-off after reporting earnings. We have also seen an increase in the VIX (volatility indicator) as a reaction on several news such as President Joe Biden's proposal to increase tax on corporations as well as the wealthy. The sector leaders today are (1) Energy, (2) Financials, and (3) Real Estate while the Sector Loser goes to Technology.

I hope this analysis is able to give insight on the current market in regards to different sectors. If there's one thing that is apparent in this analysis, it is that the rotation from growth stocks to value stocks continue. While Tech stocks were a favorite during the Covid-19 lockdown, Tech has been overthrown in favor of everyday necessities like Energy and Financials this year.

-Natalie Garces, OptionsSwing Analyst

ASX:XMM - Keep a close watch on sector and companiesASX:XMM - Keep a close watch on sector and companies

~The sector is in an uptrend after making a bottom in Jan 2016

~the previous high was made in Nov 2008

~after a gap of close of 13-14 years sector has come to the limelight.

~Strong global demand

~China demand for minerals

~ Global infrastructure post-COVID-19 - Govt push

~DON't forget over 50% of the consumption of iron ore is from infrastructure

~Iron ore consumption worldwide increasing steadily

~ ASX listed companies in my watch list.

1. $BSL

2. $CHN

3. $DEG

4. $ILU

Trend analysis

Fundamental analysis

Beyond technical analysis

Healthcare Critical LevelTechnical Analysis

The 200ema has been tested several times, and has worked very well as a mid-term support level.

Risk reward ratio is easy to set-up with a 3:1 ratio approximately.

Sector & Industry Analysis

It is important to note that the industries inside the sector have different performance, which has been very useful to analyze what the market thinks of the risk of healthcare with the election coming up.

The following list is the Healthcare Industries with a 6-month performance % move, as well as a some good ETF to follow/trade:

Healthcare Technology --> +56% // have not found appropriate ETF.

Biotechnology --> +21% // XBI (smaller biotech), IBB (large-cap biotech), ARKG (genomics)

Healthcare Equipment --> +19% // IHI

Healthcare Providers --> +5.51% // IHF

Pharmaceuticals --> -1.3% // IHE

Materials at multi-level supportMaterials sector has been showing relative strength. It is actually 3th in YTD performance, after 1. Technology, 2. Discretionary (Mega-cap lead sectors)

Today it is resting on the 100ema, which has been supportive since march 23rd crash.

This level is also coinciding with early 2020's high, as well as 4 other tests of the support; including a failed breakout, which worked the next time it tried.

OBV has been supportive of the uptrend. (BULL)

RSI showing slight divergence as the last bottom late September has a slightly higher RSI(10) than the current one. (BEAR)

A strong close below $60 would deny the support, and make the chart a short-term bearish one.

Financials in trouble200sma has been a strong resistance since the March drop. The red circles show 4 times trying to get to it.

Placing fibonacci retracement lines shows confluence with a support level (green rectangle from late June --> early July)

The 20sma crossed below the 50sma on September 27th. (Bearish signal trend model)

Also, if we close at the current price, we are getting a bearish engulfing candle.

I would feel comfortable getting in around $22.7, being fundamentally bullish on the sector.

Transports: Consolidating during market downturnTechnical

20sma is being supportive, but it is recommended to keep your stops somewhat below the average.

A close below $190 would be a bearish warning.

The broad market has been taking a downturn over the past week. The Transportation industry has been consolidating, showing relative strength over the rest of the market.

Fundamental

While the white house cannot get it together to pass the fiscal stimulus, transportation could be a gainer as it is likely they will spend on Infrastructure.