SEI

SEI breaks the downtrend targets 30cThe SEI network is currently displaying positive price movement after recently breaking out of a downward trend channel that had been in place since the peak on December 5th. On the daily chart, it has been trading sideways within the upper channel, indicating a potential retest of that breakout. However, the momentum isn't particularly strong, especially since Ethereum, the frontrunner in the altcoin resurgence, isn't exhibiting explosive upward movement either.

Should the situation shift and Ethereum regain its leading position, I believe that many struggling smart contract platforms, which have seen their prices plummet by over 80%, could also experience a robust recovery.

If Ethereum manages to climb back into the $2,000+ range, I anticipate that SEI will reach its target on the chart, which is approximately 30 cents.

SEI/USDT Daily Chart Analysis – Potential Reversal ConfirmedThe SEI/USDT chart on the daily timeframe presents a notable Inverse Head and Shoulders (IH&S) pattern, which appears to have completed successfully. The neckline breakout occurred with a strong bullish impulse, suggesting a potential trend reversal from the prior downtrend.

Following the breakout, price encountered a significant resistance zone between $0.275 - $0.295, which acted as a supply area and triggered a short-term pullback. This level aligns with a previous structural breakdown point, adding to its validity as a resistance.

A key demand zone (highlighted in green), located between $0.195 - $0.229, has been marked as the “Long Idea” zone. This area previously served as resistance and now has the potential to flip into strong support upon retest, offering a favorable long entry if price revisits the zone. The current price action suggests that this retest may occur, offering an opportunity to enter with a better risk/reward ratio.

The measured move target from the IH&S pattern points towards the $0.35 region, which also coincides with a major horizontal resistance zone and serves as the primary take profit (TP) target.

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2550.

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.2579

First target: 0.2626

Second target: 0.2681

Third target: 0.2750

SEI Is A Rocket (8H)SEI has started a strong move from the bottom.

After breaking through a resistance zone with little to no reaction, it has now formed a SWAP zone.

Buy orders have been effectively transferred from the SWAP area into the candles, and the price shows strong momentum to push toward higher levels.

As long as the demand zone holds, SEI has the potential to reach the marked target area | or even go beyond it.

However, a daily candle closing below the invalidation level would invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.2000, which acts as strong support from which the price can rebound.

Entry price: 0.2032

First target: 0.2074

Second target: 0.2119

Third target: 0.2164

SEI/USD Long Setup (3D Timeframe)

📈 Overview:

Yesterday, the last 3D bar closed, triggering a LONG entry signal. The price is above the MLR, SMA, and PSAR, which are positive indicators that align with a bullish trend. However, caution is required as the price is currently below the key 200 MA, a level that can act as a strong resistance.

📊 Entry Conditions:

- Price > MLR > SMA > PSAR: Bullish alignment across all key indicators.

- Long Entry: Triggered by the 3D bar close and the alignment of indicators.

⚠️ Risk Warning:

- 200 MA: The price is below the 200-day moving average, which could act as resistance. This is a critical level to watch out for.

- Market Caution: While the signals point towards a potential uptrend, the 200 MA being below the current price adds a layer of risk. We need to be cautious, especially as price could face rejection at this level.

📍Trade Strategy:

- Stop Loss (SL): Consider setting it below last PSAR level to manage downside risk effectively.

- Since the stop loss (SL) is wide, a spot entry is preferred

🔍 Conclusion:

This is a high-risk, high-reward setup. Given the 200 MA resistance, it’s important to monitor price action closely for signs of rejection. If the price breaks above the 200 MA, this could turn into a strong uptrend. Stay flexible and adjust your risk management as needed.

💬 Drop a comment with your thoughts and follow for more updates! 🚀

Sei's Downtrend Has Been Broken —Bull Market Cycle & ProfitsSei's downtrend has been broken, prepare for bullish momentum to build up as SEIUSDT moves toward higher prices. A long-term higher high first followed by a very strong new All-Time High in late 2025. Are you ready?

The downtrend line is shown on the chart. It broke around April 19 and the action has been green since.

We have a perfect bottom pattern and the action is happening safely above the 3-Feb. low.

This is a solid chart setup and reveals that the type of action the market will present consist of straight up, literally. Notice the correction, it has a perfect decline. The same will be true for the rise, you will be able to draw a perfect line for the higher lows as prices rise. The higher highs can become erratic but the base will be stable. There will be huge growth. Current action reveals this clearly.

» The first target has 420% profits potential and the second one 700%. These are strong targets yet easy to achieve. Total growth would be much higher if you start counting from the 7-April low but it is too late for bottom prices now. It is still early though based on the broader picture and market cycle.

It is late for the true bottom, but it is early for huge profits. Understand what I mean?

It is normal not being around when the market hits bottom because the fact that the market is trading at bottom prices means that it is depressed. Nobody wants to be around depressed energy so people go away. But this energy doesn't last forever, it never does things change.

Everything is changing now and instead of a depressed market we will have a growing market, euphoria, fun, excitement and profits. Money is yours to take.

You can make as much as you want, the market will never limit you in any way.

It all depends on your mindset and preparation, how much money are you ready to take home in this Cryptocurrency market bullish phase?

You have my support.

Thank you for reading.

Namaste.

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.1880, acting as strong support from which the price can rebound.

Entry price: 0.1916

First target: 0.1954

Second target: 0.1998

Third target: 0.2052

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1693.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.1700

First target: 0.1724

Second target: 0.1743

Third target: 0.1766

SEI Trend Reversal? Breakout + Higher Low ConfirmedNYSE:SEI has broken above the key descending resistance line, signaling a shift in momentum after an extended downtrend. The price also rebounded strongly from the support zone marked in the chart, forming a clear higher low.

Currently, SEI is pushing through a critical zone where support previously flipped into resistance, now testing the 50 EM as the next challenge.

If the price can hold above this zone and close with strength, the next leg up could target $0.30–$0.50, as shown on the chart.

DYOR, NFA

SEIUSDT | Weak Structure Persists, Eyes on Red Box ResistanceSEIUSDT continues to reflect weakness in its structure, and until proven otherwise, the red boxes remain key resistance zones. Buyers are still not stepping in with meaningful strength, and the overall market context doesn’t support a bullish shift yet.

🔴 Resistance Zones Are Still Dominant

The red boxes align with former support levels that now act as barriers. This type of flip often traps late buyers and offers great setups for short opportunities — but only with confirmation.

🔍 What to Watch For

Lower-Time-Frame Breakdown Patterns: Inside these red boxes, look for signs like bearish engulfing candles or lower highs on the 5-15 min charts.

CDV & Orderflow Weakness: If cumulative delta volume and tape show absorption or hidden selling, the likelihood of rejection increases.

Risk Management First: Use these zones not just for direction, but for well-defined invalidation points. If price pushes through and retests from above, then it's time to pivot your bias.

🚨 If Buyers Show Up…

I won’t stick to my short bias blindly. If SEIUSDT can break through the red resistance with strength, and more importantly hold above it, I will reassess and look for long setups — especially on the retest with bullish confirmations.

Markets can shift quickly, and we trade based on what the chart shows, not what we hope. For now, SEI remains under pressure. Be patient, act on signals, and never force a trade just because the price is near a key level.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

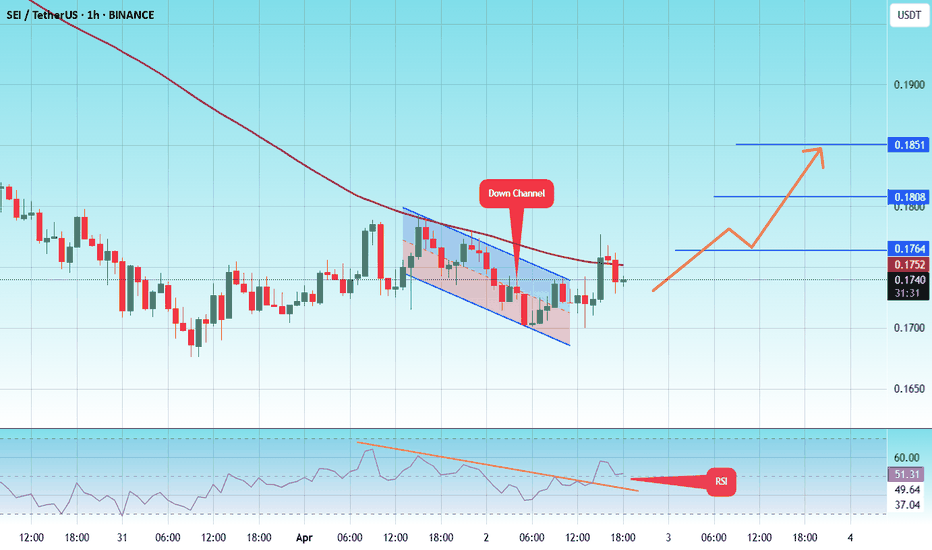

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1754.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.1823

First target: 0.1847

Second target: 0.1884

Third target: 0.1942

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.1600.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.1614

First target: 0.1625

Second target: 0.1642

Third target: 0.1665

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.1700.

Entry price: 0.1730

First target: 0.1764

Second target: 0.1808

Third target: 0.1850

SEI — Breakout + Strong Fundamentals = Perfect 1:9 SetupFinally broke the downtrend line — and it's not just about the technicals here. Fundamentals on SEI are looking really solid, and that adds even more confidence to the setup.

Planning to load on a small pullback and retest of the trendline — that’s where the real entry lies.

This one’s shaping up to be a textbook 1:9 RR play. Don’t sleep on it.

Enrty: 0.17-0.178

TP: 0.4

SL: 0.15

More thoughts in my profile @93balaclava

Personally I trade on a platform that offers low fees and strong execution. DM me if you're curious.

SEI: Your Altcoin ChoiceThe last session produced the highest volume since November 2024 and activated the baseline of a rounded bottom pattern that launched the first SEIUSDT bullish wave.

SEI's first bullish wave produced more than 1,101% growth. The peak happened in March 2024. After this peak, bearish all the way. The next major low happened on the 7-April 2025 trading session, 3D. More than a year of bearish action. I say this is enough.

A long-term higher low is present vs October 2023. The chart is clear and easy. Market conditions are about to change. The high volume on the more than a year strong higher low indicates that buyers were present. Support is activated but still early. Confirmation comes when multiple sessions close green without the last low, 0.1303, getting challenged again.

I don't think we should wait for confirmation. The wise move would be to do like the whales and start an accumulation phase. Instead of waiting for a certain market condition to be met, once support is hit we start to buy as much as we can. Prices will always fluctuate and fake signals are the norm. The market can move down and pierce support just to produce a fake bearish signal and then grow. It is very hard if not impossible to predict the short, short-term. When focusing on the bigger picture, we know the market is set to grow next. Knowing this, we buy, accumulate, as much as we can in anticipation of this bullish wave.

It is early but a long-term correction is over. What follows, is growth.

Thank you for reading.

Namaste.

SEI/USDT:BUY LIMITHello dear friends

Given the price drop we had in the specified support range, the price has been able to create higher ceilings and floors.

Now, given the good support of buyers for the price, we can buy in steps with capital and risk management and move towards the specified goals.

*Trade safely with us*