#SEI/USDT#SEI

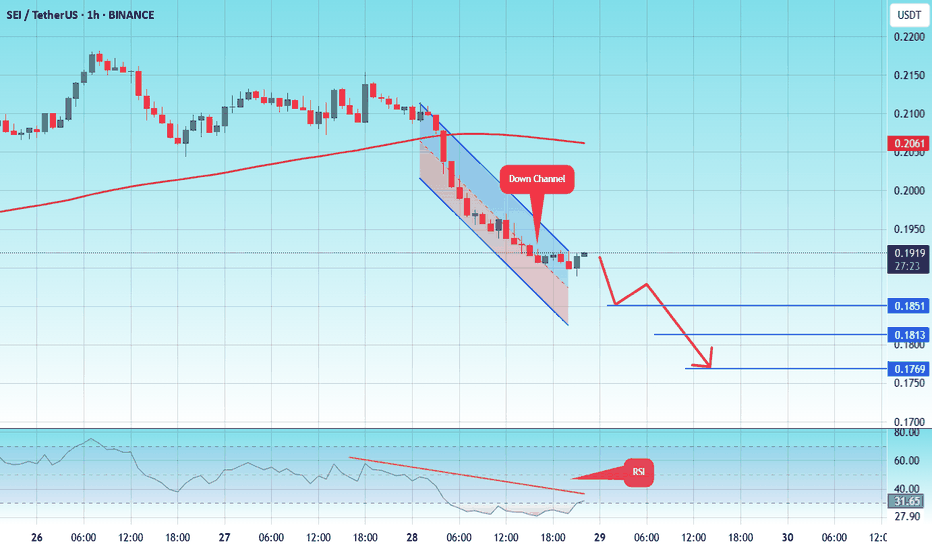

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area at the upper limit of the channel at 0.1920.

Entry price: 0.1915

First target: 0.1851

Second target: 0.1813

Third target: 0.1770

Seilong

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1880.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.1944

First target: 0.1979

Second target: 0.2017

Third target: 0.2059

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.36

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2166

First target 0.2300

Second target 0.2400

Third target 0.2530

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.2138

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2260

First target 0.2300

Second target 0.2350

Third target 0.2400

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.2260

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2362

First target 0.2555

Second target 0.2727

Third target 0.2900

#SEI/USDT Ready to launch upwards#SEI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.3000

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.3040

First target 0.3200

Second target 0.3400

Third target 0.3617

#SEI/USDT Ready to go higher#SEI

The price is moving in a descending channel on the 30-minute frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.3510

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.3545

First target 0.3619

Second target 0.3702

Third target 0.3800

#SEI/USDT Ready to go higher#SEI

The price is moving in a descending channel on the 15-minute frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.3900

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 0.4017

First target 0.4133

Second target 0.4257

Third target 0.4413

#SEI/USDT Ready to go higher#SEI

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at a price of .4060

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 0.4214

First target 0.4330

Second target 0.4500

Third target 0.4674

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.4500

Entry price 0.4555

First target 0.4634

Second target 0.4753

Third target 0.4890

#SEI/USDT Ready to go higher#SEI

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.5040

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.5100

First target 0.5277

Second target 0.5500

Third target 0.5825

SEI - Big Move Ahead? Hi,

This is my new analysis for SEI.

After having been in this correction from mars 16th (275 days) at one point we were down 82%, we are now seeing good signs on the chart.

On the right side you see Solana from 2021 after a big correction (down 77%).

If we begin in the bottom structure we see good similarities for both SEI and Solana.

Right now we are testing big Fibonacci levels on SEI. Recently we tested the 61.8% FIB level and we got rejected (31% down). If we look at the Solana chart from 2021 we see that the same thing happened with Solana at 61.8% FIB level (yellow circle) and got rejected (down 36%).

Solana was stuck under the 61.8% FIB level for around one month and after that the price went up to 4.236 FIB level. The last resistance for Solana was 61.8% FIB.

If we expect the same thing happen to SEI so we are getting ready for targets around 4.236 FIB level and the price will probably hit 4.20-4.50$.

#SEI/USDT#SEI

The price is moving in a descending channel on a 30-minute frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.6020

Entry price 0.6020

First target 0.6227

Second target 0.6470

Third target 0.6760

#SEI/USDT Ready to go higher#SEI

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.6600

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.6636

First target 0.6870

Second target 0.7135

Third target 0.7439

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame upwards and is expected to continue

We have a trend to stabilize above the moving average 100 again

We have a downtrend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of

0.6380

Entry price 0.6650

First target 0.6968

Second target 0.7247

Third target 0.7600

#SEI/USDT / Ready to go up#SEI

The price is moving in a descending channel on the 12-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.3400

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.5030

First target 0.5481

Second target 0.6127

Third target 0.6950

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame

And it is sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at 0.4400

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.4470

First target 0.4670

Second target 0.4880

Third target 0.5160

#SEI/USDT Ready to go up#SEI

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.4874

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.4955

First target 0.5392

Second target 0.5706

Third target 0.6044

#SEI/USDT Ready to go up#SEI

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.4280

We have a downtrend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.4390

First target 0.4621

Second target 0.4843

Third target 0.5136

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame and is sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 0.3555

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.3668

First target 0.3830

Second target 0.4078

Third target 0.4393

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame and is sticking to it very well and is about to break upwards

We have a bounce from the lower limit of the channel at 0.4550

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.4700

First target 0.4900

Second target 0.5090

Third target 0.5355

SEIUSDT: Strong Support, Ready to Climb!!BINANCE:SEIUSDT has recently bounced back from a major support level, demonstrating resilience in its price action. After a brief retracement from a small resistance, the coin is currently trading at the Fibonacci 0.618 level, a significant point often associated with bullish reversals. Given SEI’s reputation as one of the fastest Layer 1 blockchains, coupled with its robust community support, we anticipate a potential uptrend from this level.

On the fundamental side, SEI has established itself as a leading Layer 1 blockchain, known for its speed and efficiency. The strong community backing further enhances its growth potential. With these fundamentals in mind, we can confidently expect SEI to aim for a new all-time high (ATH) in the near future.

BINANCE:SEIUSDT Currently trading at $0.44

Buy level: Above $0.43

Stop loss: Below $0.355

TP1: $0.51

TP2: $0.58

TP3: $0.75

TP4: $1.13

Max Leverage 3x

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts