Seiusdtlong

SEI/USDT at a Critical Level Golden Pocket Reaction Will Define?🔍 Technical Analysis:

1. Market Structure:

SEI/USDT is in a recovery phase after a significant downtrend.

Price is currently testing a crucial area between the Fibonacci retracement levels of 0.5 (0.2778) and 0.618 (0.2515) — known as the Golden Pocket Zone.

2. Key Support & Resistance Levels:

Strong support lies within the highlighted yellow zone (0.2515 – 0.2778), a historical support-resistance flip level.

Key resistance levels to watch:

🔸 0.3521

🔸 0.4715

🔸 0.5936

🔸 0.7025

🔸 0.9407

🔸 1.1361

---

📈 Bullish Scenario:

If price holds above the golden pocket:

A strong rebound is likely, forming a higher low structure.

Bullish confirmation occurs if price breaks and closes above 0.3521 with strong volume.

Upside targets: 0.4715 → 0.5936 → 0.7025 in sequence.

🔹 Additional Confirmation: Bullish reversal patterns (e.g., bullish engulfing or pinbar) around 0.25–0.28 would strengthen the bullish outlook.

---

📉 Bearish Scenario:

If the price breaks below the 0.2515 level:

It could trigger a deeper move toward 0.22 – 0.18 support area.

Further breakdown may bring price below the psychological level of 0.15.

🔻 Bearish confirmation if the price gets rejected from the 0.30–0.35 region with strong bearish candles.

---

📊 Pattern Insight:

Potential Double Bottom formation near the golden pocket zone.

A break above the 0.3521 neckline would validate this bullish reversal pattern.

---

🔖 Conclusion:

This zone (0.25–0.28) is a make-or-break area for SEI. A strong reaction from this golden pocket will determine whether SEI is ready to rally further or fall to new lows.

#SEI #SEIUSDT #CryptoAnalysis #AltcoinUpdate #TechnicalAnalysis #Fibonacci #SupportResistance #GoldenPocket #CryptoTrading #SEIpriceprediction

#SEI/USDT The best future belongs to this coin.#SEI

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.2967.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.2950, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3080.

First target: 0.3221.

Second target: 0.3343.

Third target: 0.3522.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SEI : The best future belongs to this coin.Hello friends🙌

Given the rapid growth that this coin has had and I think it will continue, now that the price is correcting, there is a good opportunity to buy in stages with risk and capital management and move with it to the specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*

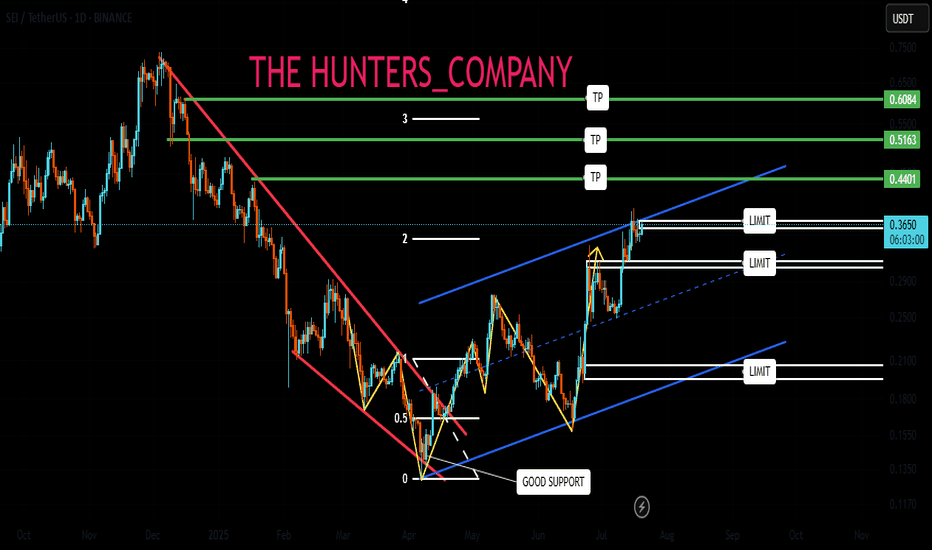

SEI BUY LIMITHello friends🙌

📉According to the downward trend we had, you can see that a reversal pattern was formed at the specified support and buyers entered and raised the price, which caused the formation of an ascending channel.

👀Now that we are at the ceiling of the ascending channel, because there is a possibility of price correction, we will place two more buying steps down and buy with risk and capital management and move with it to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

SEIUSDT Rebounds from Key Support - Pump Loading?BINANCE:SEIUSDT Rebounds from Key Support - Pump Loading?

BINANCE:SEIUSDT just touched a major support level on the 4H chart and is now showing signs of a bullish reversal after breaking above the descending trendline. This setup looks similar to previous price actions where NYSE:SEI delivered sudden explosive moves post-breakout. If history repeats, we could be looking at another strong rally ahead.

Entry looks promising, but as always, manage your risk wisely and set a proper stop loss to protect your capital.

BINANCE:SEIUSDT Currently trading at 0.265

Buy level : Above $0.263

Stop loss : Below $0.243

Target : $0.337

Max leverage 5x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 0.3450.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.3380, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3580

First target: 0.3684

Second target: 0.3850

Third target: 0.4016

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#SEI/USDT Ready to Fly? Breakout #SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.3140.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.3050, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3246

First target: 0.3381

Second target: 0.3521

Third target: 0.3673

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SEI/USDT Ready to Fly? Breakout from Accumulation Zone Signals🧠 Market Overview:

SEI/USDT has just delivered a powerful technical signal — a clean breakout from a major accumulation zone that has been holding price action for several months. With increasing volume and bullish price structure, this breakout could mark the beginning of a sustained upward trend.

The $0.24–$0.27 zone acted as a strong accumulation base. Now flipped into support, this area could serve as the launchpad for the next leg higher if price continues to hold above it.

📌 Pattern Breakdown:

🔸 Pattern: Accumulation Base Breakout

SEI traded sideways for nearly 6 months within a tight consolidation range.

This behavior is typical of institutional accumulation (smart money phase).

A strong bullish breakout above $0.27 has occurred.

Price has successfully retested the breakout level, confirming it as new support.

📈 Bullish Scenario (Primary Bias):

As long as SEI holds above the breakout zone ($0.26–$0.27), bullish continuation is likely.

🎯 Upside Targets:

$0.3521 → Minor resistance and key breakout validation.

$0.4715 → First major historical resistance.

$0.5900 → Strong price memory zone.

$0.5936 – $0.7025 → Key supply zone from previous market cycle.

$0.9407 up to $1.1450 → Long-term extension targets if bullish trend accelerates.

💡 Potential ROI from support to top target: Over 300%

📉 Bearish Scenario (Alternative View):

If price falls back below the breakout zone:

It could signal a false breakout (bull trap).

Price may re-enter the previous range and lose bullish momentum.

Downside levels to watch:

$0.21 (mid-range)

$0.17 (range low)

Failed breakout retest = bearish warning for long positions.

⚖️ Validation & Risk Strategy:

Breakout occurred with strong bullish volume → confirmation signal.

Ideal stop-loss: just below $0.25 to protect against invalidation.

Strategy: Buy on successful retest → Add if price breaks and holds above $0.35.

🧠 Pro Tip for Traders:

This setup is ideal for swing traders and mid-term investors.

The current breakout pattern is consistent with the Markup Phase in the Wyckoff Cycle.

Monitor market sentiment and volume to validate trend continuation.

If Bitcoin remains stable or bullish, altcoins like SEI may strongly outperform.

#SEI #SEIUSDT #BreakoutTrade #CryptoSignals #AltcoinAnalysis #ChartPattern #VolumeBreakout #TechnicalAnalysis #PriceAction #CryptoTraders

SEIUSDT on the Brink of a Major Explosion… or Total Breakdown?Yello Paradisers! Are you prepared to act with precision—or will you get trapped like the rest before the real move begins? #SEI has entered a highly reactive price zone where one wrong candle could invalidate the entire bullish structure. The market is whispering its next move, but only those who understand structure and timing will be ready to capitalize.

💎#SEIUSDT has completed a significant transition from a bearish trend structure to a more bullish one. Earlier, the price formed consecutive Lower Lows (LL) and Lower Highs (LH), confirming bearish momentum. However, that trend shifted once the market printed a Market Structure Break (MSB) around the 0.2121–0.2253 range. This area—previously acting as resistance—has now flipped into a confirmed support zone, marking a critical bullish development.

💎The structure strengthened further when SEI broke above the prior Higher High (HH) and created a Break of Structure (BOS). That move catapulted price into the red resistance zone between 0.2929 and 0.3152, just beneath the last major swing high at 0.3471. This zone is now acting as a ceiling, containing bullish pressure—but the underlying structure remains intact unless we see an invalidation close below key levels.

💎High probability, SEI i retracing back into the 0.618 Fibonacci level at 0.2269, which aligns precisely with the flipped support zone. This is a textbook bullish retest, and as long as the price holds above 0.2121, the probability for continuation remains high. The coming candles will be decisive: they will either confirm strength and fuel continuation—or fail and lead to a complete structure breakdown.

💎If buyers manage to hold the key support zone between 0.2269 and 0.2121, the probability of a bullish continuation increases significantly. The first major target on the upside is 0.3471, which marks the previous swing high and is likely to act as the initial area of resistance. A clean break above that level could open the path toward 0.3812, followed by 0.4086, both of which align with higher timeframe supply zones and represent strong historical resistance. These levels are expected to attract profit-taking and short-term volatility, making them critical decision points for continuation or rejection in the next phase of SEI’s move.

💎However, traders must be alert: any candle close below 0.1554 will serve as a hard invalidation level for this bullish thesis. If that happens, the structure flips bearish, and we would anticipate a deeper correction toward 0.1361 or even lower. That’s the line we are not willing to ignore—structure and discipline come first.

This is not the time to trade emotionally, Paradisers . Retail traders will act impulsively—either FOMOing at the highs or panic-selling at the lows. The smart move here is to observe how price reacts and only execute if there’s clear confirmation and structure support. No guessing. No gambling.

MyCryptoParadise

iFeel the success🌴

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel. This support is at 0.2745.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.2710, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.2813

First target: 0.2887

Second target: 0.2983

Third target: 0.3112

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SEIUSDT Forming Falling WedgeSEIUSDT is showing a highly attractive setup with the formation of a classic falling wedge pattern, a structure known for indicating a strong trend reversal. The price action has respected the wedge boundaries, consolidating with lower highs and lower lows before a decisive breakout appears imminent. With the volume profile confirming increased buying interest, this pattern suggests the potential for an 80% to 90% upside move, capturing the attention of traders searching for breakout opportunities in altcoins.

SEI, the native token for the Sei Network — a sector-focused Layer 1 blockchain built for trading — has been drawing steady investor interest thanks to its unique positioning and growing ecosystem. As more projects adopt Sei’s fast and efficient trading infrastructure, market sentiment around SEIUSDT remains positive. This strong fundamental narrative combined with the bullish wedge breakout strengthens the case for significant gains in the near term.

From a technical perspective, traders should watch for confirmation candles and sustained buying volume above the resistance trendline. A successful breakout with retest could trigger a powerful rally, potentially unlocking the anticipated gains. Keeping an eye on key support zones within the wedge will help manage risk while maximizing the reward potential on this promising setup.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.2470.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.2440, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.2494

First target: 0.2545

Second target: 0.2600

Third target: 0.2690

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SEI/USDT Poised for a Major Breakout – Will It Surge Toward $0.7📊 Full Technical Analysis:

The SEI/USDT daily chart reveals a compelling setup with strong breakout potential. Here's a detailed breakdown:

🔍 Pattern & Key Structure:

Descending Trendline Breakout: SEI has successfully broken out of a long-term descending trendline that has suppressed price action since December 2024 — a strong early signal of a bullish reversal.

Bullish Retest in Progress: The price is currently retesting the breakout area, aligning with a historical demand zone and Fibonacci retracement levels of 0.5 ($0.2468) and 0.618 ($0.2259).

Previous Consolidation Zone: SEI previously moved sideways within a yellow box between $0.18 – $0.25. The breakout from this zone adds bullish confirmation.

🟢 Bullish Scenario:

If SEI holds above the key demand zone ($0.2259 – $0.2468), a strong rally could follow, targeting these Fibonacci resistance levels:

🔸 $0.3068

🔸 $0.3367

🔸 $0.4696

🔸 $0.5438

🔸 $0.6086

🔸 $0.6500

🔸 Final target: $0.7013 (major resistance)

This scenario is validated by a higher low formation and a continuation of the current uptrend, especially if backed by strong volume.

🔴 Bearish Scenario:

If the price breaks below the demand zone ($0.2259 – $0.2468), further downside may be expected, with potential support levels at:

🔻 0.786 Fibonacci at $0.1961

🔻 Historical support zones at $0.18 and $0.13

A bearish breakdown would invalidate the bullish structure and suggest sellers remain in control.

📐 Pattern Summary:

Pattern Type: Descending Trendline Breakout + Bullish Retest

Validation: Retest aligned with Fibonacci & prior consolidation

Bias: Bullish, as long as the price holds above $0.2259

📝 Conclusion:

SEI/USDT is showing early signs of a bullish reversal after a breakout from its long-term downtrend. A continuation toward higher Fibonacci levels is likely if the price holds the key demand zone. Traders should watch for bullish confirmation signals near support before entering.

#SEI #SEIUSDT #CryptoBreakout #BullishSetup #TechnicalAnalysis #FibonacciTrading #CryptoSignals #AltcoinSeason #ChartPattern #CryptoTA

SEI The next big Move#SEI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.2750, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.2600.

Entry price: 0.2813

First target: 0.2879

Second target: 0.2970

Third target: 0.3080

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

SEI Just Broke Out - Massive Rally Incoming?SEIUSDT Technical analysis update

SEIUSDT is testing a long-term descending trendline, which has acted as strong resistance on multiple occasions. Price has now broken above this level with strong volume, signaling a potential trend reversal. And price trading above 100 and 200 EMA, in the coming trading days, we can see a strong bullish move in SEI

NYSE:SEI

SEIUSDT Forming Falling WedgeSEIUSDT has recently confirmed a falling wedge breakout, a strong bullish reversal pattern that often marks the end of a downtrend and the start of an impulsive move upward. The breakout has occurred with solid momentum, and volume is supportive—indicating that buyers are stepping in with conviction. This technical formation suggests a potential price surge ranging between 60% to 70%, aligning with historical projections from similar wedge breakouts.

As shown in the daily chart, SEIUSDT has broken above the wedge resistance and followed up with strong bullish candles. This surge confirms growing demand and positive sentiment in the market. Notably, the immediate targets are marked at $0.34 and $0.37, with upside potential of over 83% from the breakout point, offering attractive risk-reward for traders and swing investors.

Fundamentally, SEI is gaining traction within the decentralized ecosystem. Its focus on high-performance blockchain scalability and its growing developer community is drawing significant attention. Social media chatter and on-chain data also reflect increasing accumulation from retail and mid-tier wallets. Such organic traction often translates into sustainable price movements, especially when paired with strong technical setups like this.

Overall, SEIUSDT is shaping up as a high-potential altcoin play. With technical confirmation, investor interest, and bullish sentiment across the board, this breakout could be just the beginning of a larger trend. Traders should keep an eye on pullbacks for potential entries and watch for continuation above local resistance levels.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.2942.

We have a downtrend on the RSI indicator that is about to break and retest, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.3062

First target: 0.3151

Second target: 0.3290

Third target: 0.3421

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.2696, acting as strong support from which the price can rebound.

Entry price: 0.2790

First target: 0.2894

Second target: 0.3030

Third target: 0.3177

$SEI Testing Critical Resistance After BreakoutNYSE:SEI has finally broken above the long-standing resistance trendline, a strong sign of bullish momentum building up.

Right now, it’s facing some pressure at the marked resistance zone. If bulls manage to flip this area into support, we could see the next leg up. But if it gets rejected here, a short pullback or retest isn’t off the table.

Let the level decide the next move — no need to chase.

DYOR, NFA

SEI/USDT – Bullish Breakout Setup!SEI consolidates in a classic ascending triangle, showing a strong structure with higher lows and flat resistance.

A breakout above ~$0.225 could trigger a move toward higher targets.

Key Levels:

Support: $0.2142 (triangle base)

Resistance: $0.2257 (breakout level)

Stoploss: Below $0.214 (invalidation of structure)

Targets on Breakout:

TP1: $0.2514

TP2: $0.2724

RSI is climbing from mid-range with a bullish crossover, indicating strengthening momentum.

Structure looks favorable as long as support holds. Wait for volume confirmation on breakout for higher probability.

Not financial advice. Do your own research before investing (DYOR).

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.1725.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 Moving Average.

Entry price: 0.1766

First target: 0.1794

Second target: 0.1834

Third target: 0.1890