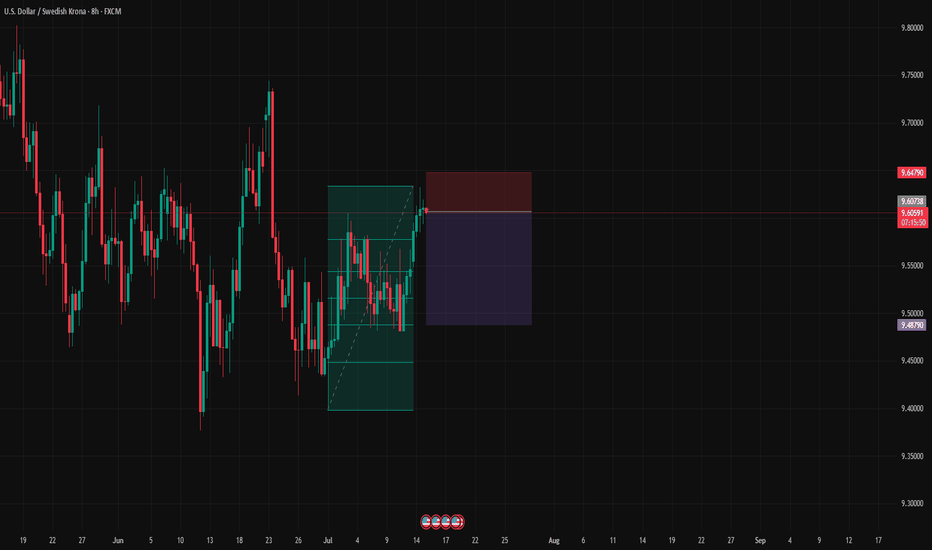

#010: USD/SEK SHORT Investment Opportunity

At the opening of the 8-hour candle, the price touched the 200-mark moving average with surgical precision on volume compression, signaling the exhaustion of the bullish movement underway since the end of June.

🔍 What strengthened the short position:

The price hit a key area defended by institutions, confirmed by increased open interest and compression in FX options between 9.68 and 9.69.

Retail investors are over 76% long, completely exposed to the wrong side.

Our entry was calculated after the false breakout, and we are positioned exactly below the zone where large traders have already loaded their short positions.

The trade is protected by future passive orders placed below 9.5000, where banks will defend their positions. Our stop is therefore outside the path of stop hunters.

📌 Short-term macro context:

Although the dollar remains strong, USD/SEK has reached a technical and statistical level that historically marks the beginning of short-term corrections, ideal for tactical trading.

SEK

SEK/MXN 8H SHORT Selling Opportunity

Hello, I am Forex Trader Andrea Russo and today I want to talk to you about a SHORT selling opportunity on SEKMXN.

After careful technical and fundamental analysis, I decided to enter a SHORT position on the SEKMXN cross at the level of 2.0465. My strategy includes a profit target (Take Profit) set at 1.75%, while the protection level (Stop Loss) is set at 0.59% to manage the risk effectively.

Technical Analysis

The chart shows a clear bearish trend, supported by overbought signals on the RSI and MACD indicators. In addition, the price has recently tested a key resistance, suggesting a possible reversal.

Fundamental Analysis

From a macroeconomic perspective, the Swedish krona (SEK) is facing pressure from weak economic data, while the Mexican peso (MXN) benefits from a more stable economic environment and competitive interest rates.

Trading Strategy

Entry: 2.0465

Take Profit (TP): 1.75%

Stop Loss (SL): 0.59%

This setup offers an interesting risk/reward ratio, ideal for those looking for short-term opportunities with a calculated risk.

Conclusion

Forex trading requires discipline and rigorous risk management. This trade on SEKMXN represents an interesting opportunity, but as always, I recommend doing your own analysis before entering the position.

Happy trading everyone!

USDSEK The most 'neat' sell you can take!The USDSEK pair has been trading within a Channel Down since the May 01 2024 High. The price has been on its latest Bullish Leg since the September 27 Lower Low and right now the price is just a step before testing the top (Lower Highs trend-line) of the Channel Down.

At the same time, the 1D RSI touched the 70.00 overbought barrier and turned sideways for the past week. This is a bearish sign as every time it did so since April 30, the Channel Down had topped.

As you can see there is a high degree of symmetry within this Channel and we expect the new Bearish Leg that will start to follow the same parameters. The previous ones bottomed after around -7.00% declines and on the -0.236 Fib extension.

As a result our sell Target as of today is 9.90500 (above the -0.236 Fib on less than -6.89% decline).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDSEK Bearish break-out imminent.The USDSEK pair is testing the Internal Higher Lows trend-line of the 2-year Channel Down pattern, below both the 1D MA50 (blue trend-line) and 1D MA200 (orange trend-line). Having made its last Lower High just above the 0.786 Fibonacci level (similar to the previous Lower High), it is technically expected to break the Internal Higher Lows trend-line and extend to a new Channel Down Low towards the end of the year.

As you can see the structure of this pattern is very symmetrical and with the last Lower Low being just above the -0.186 Fibonacci extension, we expect the next to be at 9.7500 at least.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDSEK Under both major MAs. Sell opportunity.The USDSEK pair is consolidating below both the 1D MA50 (blue trend-line) and the 1D MA200 (orange trend-line). This is half-way through the new Bearish Leg of the 1.5 year Channel Down, with the recent Top in May being formed on the 0.786 Fibonacci, just like the previous Lower High (November 01 2023).

The current consolidation resembles that of November - December 2023, which eventually bottomed on the 1.382 Fibonacci extension. As a result, we expect the price to resume the bearish leg soon and our Target is 10.000 (Fib 1.382).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Trade Like A Sniper - Episode 43 - USDSEK - (14th June 2024)This video is part of a video series where I backtest a specific asset using the TradingView Replay function, and perform a top-down analysis using ICT's Concepts in order to frame ONE high-probability setup. I choose a random point of time to replay, and begin to work my way down the timeframes. Trading like a sniper is not about entries with no drawdown. It is about careful planning, discipline, and taking your shot at the right time in the best of conditions.

A couple of things to note:

- I cannot see news events.

- I cannot change timeframes without affecting my bias due to higher-timeframe candles revealing its entire range.

- I cannot go to a very low timeframe due to the limit in amount of replayed candlesticks

In this session I will be analyzing USDCOP, starting from the 3-Month chart.

If you want to learn more, check out my TradingView profile.

USDSEK Sell signal on the 0.786 Fib.The USDSEK pair hit the 0.786 Fibonacci retracement level of the previous Lower High of the long-term Channel Down and has immediately reacted with a rejection. This rejection is the ideal short-term sell entry for a 1D MA50 (blue trend-line) test, which the current Bullish Leg hasn't tested since March 21 2024. Our Target is 10.6000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Battle of the Vikings - Ragnar vs EarlIn the duel of the Nordic nations between the strong Norwegian Ragnar (NOK) and the fierce Swedish Earl (SEK), only one can survive.

I am betting my gold coins on the Norwegian krone for the following reasons:

- NOKSEK is fundamentally undervalued

-> fundamentally the pair should rather be trading at 1.04 - 1.05

- Norges Bank surprised EVERYONE (including me) with an interest rate hike last week

-> inflation is still giving it a hard time

- Oil saw some strength again recently

- NOKSEK with a seasonally strong phase in January and February

- Norges Bank could reduce its NOK sales in the new year

- Rebalancing flows

From a Swedish perspective:

- The unemployment rate has recently been higher than expected (looting Vikings are currently less in demand)

- Swedish inflation rate fell more than expected (due to house prices (no, not Viking huts))

- Riksbank sold more FX reserves than expected within its hedging programme

-> less powder available

USDSEK 6-week Trading planThe USDSEK pair followed our trading plan to perfection last time we made a sell call on it (October 06 2023, see chart below) as it completed the Head and Shoulders pattern and aggressively declined to hit our 10.4500 Target:

At the moment the price is ranging within the 1D MA50 (blue trend-line) and 1D MA200 (orange trend-line) being Support and Resistance levels respectively. We have identified the long-term pattern to be a Channel Down since the September 26 2022 High and the current rise since the December 27 2023 Lower Low to be the new Bullish Leg to a Lower High.

The dynamic parameters here are the 0.618 and 0.382 Fibonacci retracement levels. When the previous Bullish Leg hit the 0.618 Fib for the first time on the way up, in got rejected strongly and pulled-back to the 0.382 Fib. As a result and as long as the 1D MA50 holds, we will be bullish targeting the 0.618 Fib at 10.7500 where we will then turn bearish, targeting the 0.382 Fib at 10.4500 where contact can be made with the 1D MA50.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURSEK may try to cost 11 krones again soonEURSEK may try to cost 11 krones again soon on a strong weekly downtrend after a triple top on a weekly chart perspective.

Plus, check this out.

Sounds pretty interesting.

* research.sebgroup.com

I personally may re-enter a couple of times if my SL is hit, but who knows.

USDSEK: Rising towards the September high.USDSEK crossed over the LH trend-line as well as the 1D MA50, ending the 1 month pullback and turning the 1D timeframe bullish again (RSI = 57.915, MACD = -0.004, ADX = 28.535). According to two same fractals within 2023, we should be expecting at least a test of the Resistance, if not the 1.236 Fibonacci extension. As long as the 1D MA50 holds, we are short term buyers aiming at September's High (TP = 11.250).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDSEK Head and Shoulders giving an end-of-year sell.We haven't looked at the USDSEK pair in exactly 1 year but it was that Higher Higher rejection (see chart below) that gave us the best sell opportunity since COVID:

On the 1D time-frame an Ascending Triangle has emerged since and the price has been rejected on the latest September 21 Higher High. We can see the emergence of a Head and Shoulders pattern that is supported on Higher Lows. Similar Higher Lows structures have been formed on long-term peaks, you can even see the resemblance on the 1D MACD sequences.

As a result, if the market closes a 1D candle below the 1D MA50 (blue trend-line), we will see and target a potential contact with the 1W MA100 (red trend-line) at 10.4500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDSEK: Head and Shoulders at the PCZ of a Bearish ABCDUSDSEK is trying to confirm a Right Shoulder of a Bearish Head and Shoudlers Pattern at the PCZ of a Harmonic Bearish AB=CD. If it is able to goback down from here and break through the neckline then we could see action similar to what we saw on the EURHUF.

Emerging market currencies to outperform G10 in 2023With the global economy showing more resilience and the Fed slowing its pace of tightening, we believe EM currencies can outperform relative to G10 peer currencies this year. Attractive real yields should result in market participants accumulating exposure to developing currencies, while our assumption for contained banking sector stresses should lead to improved risk appetite.

USDSEK - Let's sit & wait...USDSEK - Let's sit & wait...

Most favourite plan to do on the weekend is my weekend analysis. The market is close, going through higher TF, getting into the zone and ready to crush another week of trading!

USDSEK - Another trading pair I occasionally trade. I feel the behaviour of SEK is very interesting, i'd say I do trade relatively small on this pair but the risk/rewards are great. For now we are waiting for a break to either direction and this is a similar theme on all FX pairs I am looking at. When the market are these conditions I usually add alerts and perhaps limit orders.

Key Tip: Don't forget to follow your trade plan and if you don't have one MAKE ONE!

Trade Journal

USDSEK On the most critical 7-year ResistanceThe USDSEK pair has been rising parabolically all year due to the well-known fundamental reasons empowering the USD amidst the high inflation. The price has finally reached though a technical level that we have to consider as it has been forming long-term tops over the past 7 years.

As you see on this 1W chart, the Resistance we are referring to is the Higher Highs trend-line that started after the April 13 2015 High. Every Higher High after that, was formed on every +0.5 Fibonacci extension (1.5, 2.5) and two weeks ago, the 3.5 Fib was reached and strongly rejected the price, again exactly on the Higher Highs trend-line.

However since last week, the price resumed the uptrend and is again about to test that strong Resistance cluster. As long as it closes below, it remains a good long-term sell opportunity. If fundamentals continue to have their way though, then this 7 pattern will be invalidated and buying will remain the only option, in which case the 4.5 Fib will be our target.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDSEK Pull-back in September but bullish long-termWe haven't updated the USDSEK pair for over 2 months and on the long-term it still looks bullish. This chart is on the 1D time-frame, where the price reached again the 2.5 Fibonacci extension as on the July 12 High. With the 1D RSI hitting the Lower Highs trend-line twice, which is the level where all price Highs have been made since November 24 2021, it is very probable that this is the new High of the current bullish sequence.

All Highs then pulled back to at least the 1D MA50 (blue trend-line), with the Buy Zone since November 10 2021 being within the MA50 and the 1D MA100 (green trend-line). The 1D RSI has again a Zone indicating where we can buy the pair after the pull-back is completed.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------