CADCHF Will Go Lower From Resistance! Sell!

Please, check our technical outlook for CADCHF.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.615.

Considering the today's price action, probabilities will be high to see a movement to 0.611.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

SELL

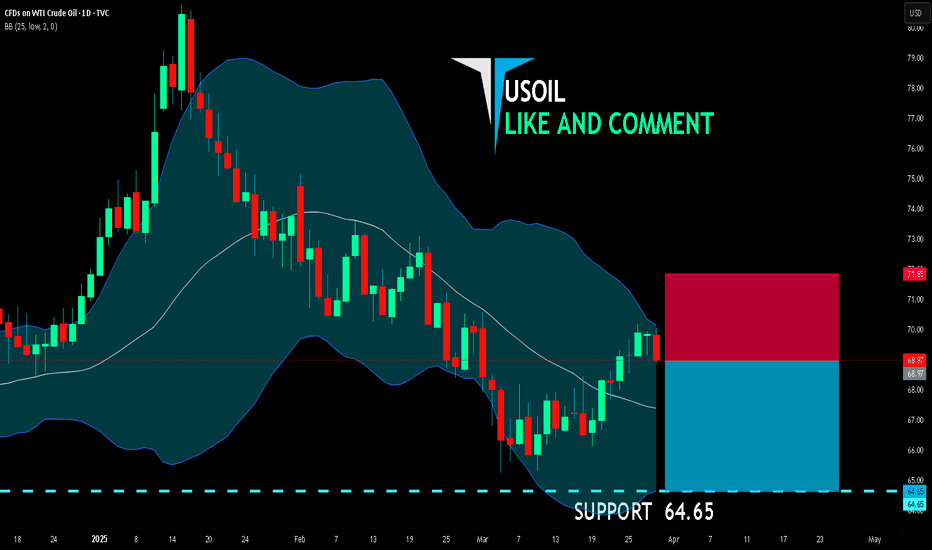

USOIL BEARS WILL DOMINATE THE MARKET|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 68.97

Target Level: 64.65

Stop Loss: 71.85

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

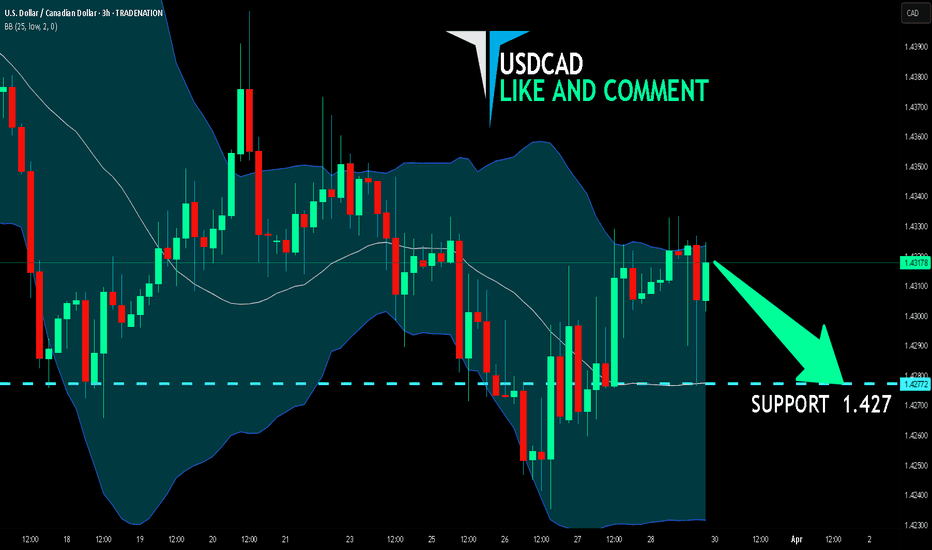

USD/CAD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

The BB upper band is nearby so USD/CAD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 1.427.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

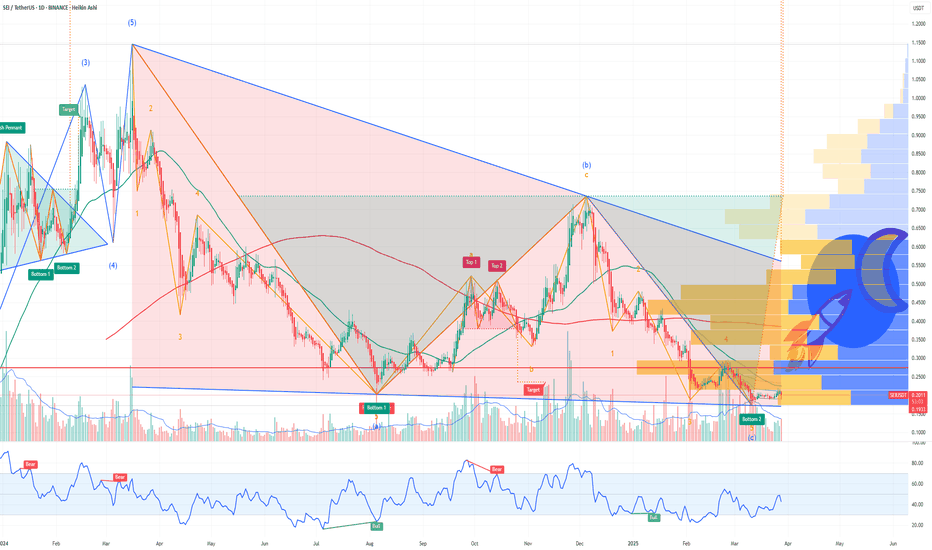

SEI Poised for a Breakout After Bold 23andMe Acquisition Bid !Sei (SEI), the innovative layer-1 blockchain designed for high-speed trading and decentralized finance (DeFi), is flashing strong bullish signals both fundamentally and technically. The recent news that the Sei Foundation is exploring the acquisition of 23andMe, the leading personal genomics company, has sparked excitement in the market. If successful, this strategic move could position Sei at the forefront of the multi-billion-dollar genomic data industry — combining blockchain’s security and transparency with the rapidly growing demand for data privacy.

Why This Is Huge

23andMe recently filed for Chapter 11 bankruptcy protection, opening the door for a potential buyout. The Sei Foundation’s plan to migrate genetic data onto the blockchain would give individuals direct control over their data, allowing them to decide how it’s used and even monetize it. This taps into a massive and underserved market where data security and privacy are becoming critical issues.

Bullish Chart Setup

From a technical perspective, Sei’s chart is showing signs of a major breakout:

✅ Double Bottom: SEI has recently formed a clear double bottom pattern, signaling a strong reversal from recent lows. This is a classic bullish pattern that suggests the selling pressure has been exhausted and buyers are stepping in.

✅ Falling Wedge: SEI is also breaking out of a falling wedge, a high-probability bullish formation. Falling wedges typically lead to strong upside moves as downward momentum fades and buying pressure builds up.

✅ Volume Increasing: Recent spikes in volume confirm that smart money could be accumulating in anticipation of a breakout.

Perfect Storm for a Rally

With a bullish technical setup aligning with a game-changing fundamental catalyst, Sei could be on the verge of a major breakout. A successful acquisition of 23andMe would not only give Sei real-world utility in the health data sector but also drive increased adoption and network activity. If SEI clears key resistance levels, this combination of technical strength and strategic growth could send the token to new highs.

Sei isn’t just another DeFi project — it's positioning itself to be a leader at the intersection of blockchain, health data, and privacy.

This could be the beginning of a powerful new trend for SEI. 🚀

USDJPY Will Go Lower! Short!

Take a look at our analysis for USDJPY.

Time Frame: 3h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 150.395.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 149.580 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

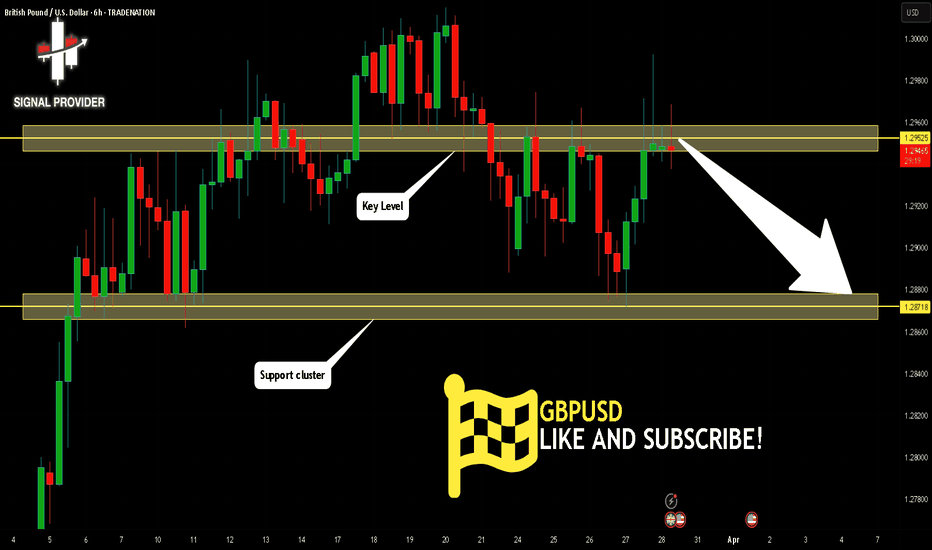

GBPUSD Will Go Down! Sell!

Please, check our technical outlook for GBPUSD.

Time Frame: 6h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 1.295.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 1.287 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPNZD Will Move Lower! Short!

Here is our detailed technical review for GBPNZD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 2.263.

The above observations make me that the market will inevitably achieve 2.229 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

BITCOIN SELLERS WILL DOMINATE THE MARKET|SHORT

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 85,782.07

Target Level: 79,230.93

Stop Loss: 90,149.50

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/USD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

GBP/USD pair is in the uptrend because previous week’s candle is green, while the price is clearly rising on the 4H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 1.291 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

From MAGA to DEFI: The Trump Crypto ConnectionThe relationship between decentralized finance (DeFi), the Trump family, and Kevin O’Leary in 2025 centers around their public involvement in the crypto and blockchain space, particularly highlighted by their participation in events like DeFi World 2025 and specific DeFi projects tied to their names or influence.

The Trump family, notably Donald Trump Jr. and former President Donald Trump, has increasingly engaged with DeFi and cryptocurrency. Donald Trump Jr. spoke at the DeFi World 2025 Conference in Denver on February 26, alongside Kevin O’Leary, signaling a growing interest in blockchain’s potential to shape finance. Posts on X from DeFi confirm their appearances, with Trump Jr. scheduled at 3:00 PM and O’Leary at 3:45 PM, reflecting a shared platform to promote DeFi’s future. Beyond this event, the Trump family is linked to World Liberty Financial (WLFI), a DeFi project launched in September 2024. WLFI aims to democratize crypto lending and borrowing while reinforcing the U.S. dollar’s dominance, operating on Aave’s v3 protocol.

Although Donald Trump and his family are not direct operators of WLFI, the project leverages the Trump brand, with 70% of its token supply held by insiders and 75% of revenues directed to DT Marks DEFI LLC, a Trump-connected entity. Trump himself has pushed pro-crypto policies, including banning central bank digital currencies and exploring a national crypto stockpile, aligning with DeFi’s ethos of decentralization.

Kevin O’Leary, a Canadian investor and “Shark Tank” star, has been a vocal DeFi advocate since at least 2021, when he invested heavily in DeFi Ventures (later renamed WonderFi), targeting 4.5–8% yields on crypto assets. His participation in DeFi World 2025 alongside Trump Jr. underscores his ongoing commitment. O’Leary sees DeFi as a way to bypass financial middlemen, predicting it could transform trading within years. His practical involvement contrasts with the Trump family’s more symbolic and policy-driven engagement, though both share a bullish stance on crypto’s future.

I`m extremely bullish on this coin at this level.

BTC Bitcoin Price Target by Year EndSeveral factors support a bullish outlook for Bitcoin (BTC) to reach $97,500 by the end of the year:

Institutional Adoption and Treasury Investments: Companies like GameStop are incorporating Bitcoin into their treasury reserves, following the lead of firms such as MicroStrategy. GameStop plans to raise $1.3 billion for Bitcoin purchases, indicating growing corporate confidence in BTC as a store of value.

Supportive Regulatory Environment: The U.S. administration has pledged to make the country the "undisputed Bitcoin superpower and crypto capital of the world." Plans include introducing clear regulations for stablecoins and market structures, aiming to stimulate investment and innovation in the crypto sector.

Positive Price Forecasts: Analysts have set bullish targets for Bitcoin, with some predicting prices ranging from $120,000 to $150,000 by year-end. These projections are based on factors like supply shocks and increased institutional adoption.

Seasonal Trends and Market Liquidity: Historically, the second quarter has been favorable for Bitcoin, with increased market liquidity and investor interest. Currently, approximately $31.8 billion in "dry powder" is poised to enter the crypto markets, potentially driving prices higher.

Finite Supply and Growing Demand: Bitcoin's capped supply of 21 million coins, coupled with rising global demand, supports its long-term value appreciation. Its growing acceptance and technological advancements, despite evolving regulatory landscapes, bolster its investment appeal.

These factors collectively suggest a favorable environment for Bitcoin to approach or surpass the $97,500 mark by year-end.

NVDA NVIDIA Price Target by Year-EndNVIDIA Corporation (NVDA) remains a dominant force in the AI and semiconductor markets, with its forward price-to-earnings (P/E) ratio currently at 19.37—a reasonable valuation considering its growth trajectory and market position.

NVIDIA’s leadership in the AI sector, particularly through its cutting-edge GPUs, has driven strong demand from data centers, cloud providers, and AI developers. The company’s recent product launches, including the Hopper and Blackwell architectures, have further solidified its competitive edge.

Despite recent market volatility, NVIDIA's consistent revenue growth and expanding profit margins support the bullish case. The current P/E of 19.37 reflects a balanced risk-reward profile, suggesting that the stock is not overvalued despite its impressive performance.

A price target of $145 by year-end reflects approximately 15% upside from current levels, driven by sustained AI demand and growing market penetration. Investors should watch for quarterly earnings reports and updates on AI chip demand, as these will likely act as key catalysts for upward momentum.

AMD Advanced Micro Devices Price TargetAdvanced Micro Devices (AMD) has positioned itself as a major player in the semiconductor industry, capitalizing on growing demand for high-performance computing, artificial intelligence (AI), and data center solutions. As of now, AMD’s forward price-to-earnings (P/E) ratio stands at 17.12, indicating that the stock is trading at a reasonable valuation compared to its growth potential.

AMD has benefited from the increasing adoption of AI-driven solutions, particularly through its MI300 series of AI accelerators, which have gained traction among major cloud service providers. The company’s expansion into the data center market has also been a key growth driver, with strong sales in EPYC processors contributing to revenue growth.

Furthermore, AMD's strategic acquisition of Xilinx has strengthened its position in the FPGA (Field-Programmable Gate Array) market, enhancing its ability to offer diversified and high-margin products. This, combined with improving margins and consistent product innovation, positions AMD for steady financial performance in the coming quarters.

Given AMD’s solid fundamentals, growing market share in AI and data centers, and attractive valuation at a 17.12 forward P/E, a price target of $125 by the end of the year appears achievable. This would represent approximately 15% upside from current levels, driven by continued revenue growth and expanding profit margins.

FFAI Faraday Future Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FFAI Faraday Future Intelligent Electric prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Puts with

an expiration date of 2025-4-17,

for a premium of approximately $0.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

HUMA Humacyte Options Ahead of EarningsIf you haven`t bought HUMA before the previous rally:

Now analyzing the options chain and the chart patterns of HUMA Humacyte prior to the earnings report this week,

I would consider purchasing the 2.5usd strike price Puts with

an expiration date of 2025-4-17,

for a premium of approximately $0.62.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

LULU Lululemon Athletica Options Ahead of EarningsIf you haven`t bought LULU before the previous rally:

Now analyzing the options chain and the chart patterns of LULU Lululemon Athletica prior to the earnings report this week,

I would consider purchasing the 337.5usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $20.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

USDCHF Is Very Bearish! Sell!

Please, check our technical outlook for USDCHF.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.883.

Considering the today's price action, probabilities will be high to see a movement to 0.865.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CADJPY Will Fall! Short!

Take a look at our analysis for CADJPY.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 105.385.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 101.727 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GOLD SHORT FROM RESISTANCE

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,037.48

Target Level: 2,814.61

Stop Loss: 3,185.84

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/CHF BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

We are going short on the NZD/CHF with the target of 0.503 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDUSD Will Go Lower! Sell!

Here is our detailed technical review for AUDUSD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 0.631.

The above observations make me that the market will inevitably achieve 0.618 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!