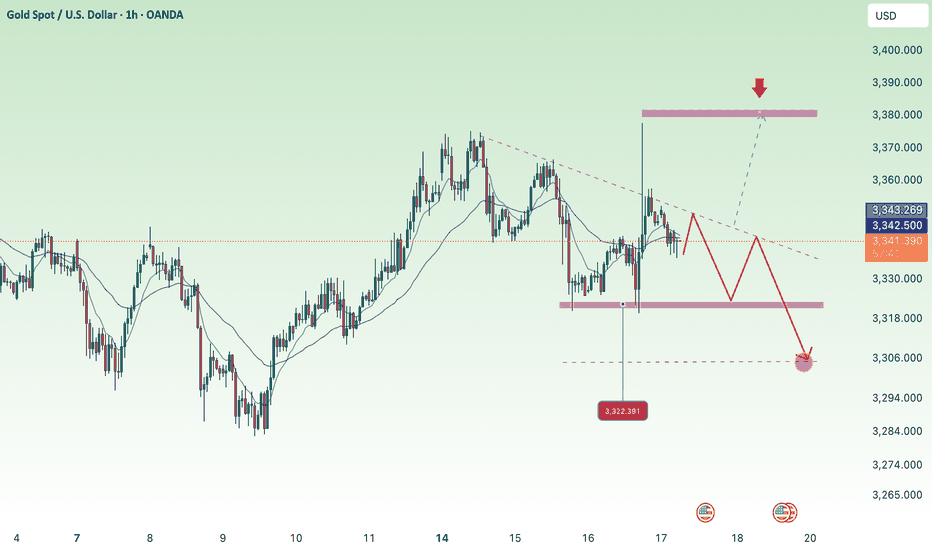

Gold price moves sideways above 3320⭐️GOLDEN INFORMATION:

Gold prices advanced during the North American session, gaining 0.78%, supported by headlines suggesting US President Donald Trump had discussed firing Federal Reserve (Fed) Chair Jerome Powell. Although Trump later denied the reports, calling it “highly unlikely” unless fraud was involved, the speculation lifted demand for the precious metal. At the time of writing, XAU/USD is trading around $3,348, after briefly reaching a daily high of $3,377 following Trump-related headlines.

According to Bloomberg, Trump floated the idea during a meeting with GOP lawmakers focused on cryptocurrency regulation, noting that most attendees reportedly supported Powell’s removal.

Beyond political drama, softer US economic data and ongoing geopolitical tensions also underpinned gold’s gains. The latest US Producer Price Index (PPI) came in below expectations but remained above the Fed’s 2% inflation target. Meanwhile, Israeli airstrikes in Syria helped limit downside pressure on bullion, though Gold’s upside remained capped below the $3,400 level following the recent US consumer inflation report.

⭐️Personal comments NOVA:

Gold price moves sideways in the price range of 3306 - 3380, accumulating and waiting for information on US tariffs and interest rates

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3381- 3379 SL 3386

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3306-$3304 SL $3299

TP1: $3318

TP2: $3330

TP3: $3343

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Selllimit

bch midterm sell limit"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

xrp sell limit midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

inj sell limit"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

eth longterm buy sell limit"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

inj sell limit"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

FTM is ready to short Phantom is ready for another hard fall ahead, keep an eye on shorts

Let's go.....

Buy/Sell Stop vs Buy/Sell LimitDifference between order types explained

Buy and Sell Stop vs Buy and Sell Limit

When trading in the market, understanding different order types is crucial for maximizing your potential and managing risk. This guide will delve into the key differences between Buy/Sell Stop and Buy/Sell Limit orders, helping you decide which order type best suits your trading strategy.

Buy and Sell Stop Orders:

Function: Stop orders are designed to automatically trigger a buy or sell order once the market price reaches a predetermined level. This level is known as the "stop price."

Buy Stop: This order is placed above the current market price for a security. When the market price rises and touches the stop price, the order automatically converts into a market buy order, aiming to purchase the security at the best available price.

Sell Stop: This order is placed below the current market price for a security. When the market price falls and touches the stop price, the order automatically converts into a market sell order, aiming to sell the security at the best available price.

Use Cases: Stop orders are primarily used to:

Limit losses: By placing a stop-loss order below your purchase price, you can automatically sell the security if the price falls to a certain level, minimizing potential losses.

Capture profits: By placing a stop-loss order above your purchase price, you can automatically sell the security if the price rises to a certain level, locking in profits.

Enter a trade automatically: Stop orders can be used to enter a trade automatically when the price reaches a specific level, eliminating the need for constant market monitoring.

Buy and Sell Limit Orders:

Function: Limit orders allow you to specify the maximum price you are willing to pay when buying (Buy Limit) or the minimum price you are willing to accept when selling (Sell Limit).

Buy Limit: This order is placed below the current market price for a security. It will only be executed if the market price falls to your specified limit price or lower.

Sell Limit: This order is placed above the current market price for a security. It will only be executed if the market price rises to your specified limit price or higher.

Use Cases: Limit orders are primarily used to:

Buy or sell at a specific price: This allows you to control the price you pay or receive for the security, ensuring you achieve your desired outcome.

Avoid market fluctuations: By placing a limit order, you can avoid paying inflated prices during periods of high demand or selling at deflated prices during periods of low demand.

Set a target price: Limit orders can be used to set a target price for selling your security, automatically triggering a sale when the price reaches your desired level.

Key Differences:

Execution: Stop orders are guaranteed to be executed once the stop price is reached, while limit orders are only executed if the market price reaches the specified limit price.

Price: Stop orders are market orders, meaning they are executed at the best available price after the stop price is triggered. Limit orders specify the maximum price you are willing to pay or the minimum price you are willing to accept.

Risk: Stop-loss orders can help limit losses, while limit orders can help control the price you pay or receive for the security.

Choosing the Right Order Type:

The best order type for you will depend on your individual trading strategy and risk tolerance. Consider the following factors when choosing between stop and limit orders:

Market volatility: In volatile markets, stop orders may be preferable to limit orders, as they guarantee execution once the stop price is reached.

Desired price: If you have a specific price in mind for buying or selling a security, a limit order is the best choice.

Risk tolerance: Stop-loss orders can help limit losses, while limit orders can help control the price you pay or receive for the security.

By understanding the key differences between stop and limit orders, you can make informed decisions about which order type best suits your trading needs and helps you achieve your desired outcomes.

A Tale of the EUR/USD Forex PairOnce upon a time, in the bustling realm of the forex market, there existed a fierce battleground where bulls and bears clashed for supremacy over the EUR/USD pair. Our story unfolds on the 15-minute battlefield, where traders keenly observed the unfolding drama.

As the sun rose on the trading day, vigilant traders scanned the charts for signs of opportunity. Among them was a seasoned analyst, whose keen eye for market dynamics brought forth a tale of shifting tides and looming intrigue.

With a determined gaze, our analyst set out to uncover the subtle nuances of the market's structure. Like a skilled detective, they searched for clues that would reveal the intentions of both the bullish and bearish factions.

Amidst the chaos of price action, a pattern began to emerge – a telltale sign of a weakening bullish trend. Higher lows were breached, and candlestick formations whispered tales of struggle and resistance. The bulls, once mighty and indomitable, now found themselves faltering in their quest for upward momentum.

Yet, the bears were not to be underestimated. With each failed attempt by the bulls to rally, the bears seized upon the opportunity to assert their dominance. Support levels crumbled beneath the weight of their relentless onslaught, marking a significant shift in market sentiment.

Undeterred by the challenges they faced, the bulls made one last valiant effort to turn the tide in their favor. Alas, their endeavors proved futile, and the bears emerged victorious, their roar echoing across the trading floor.

In the midst of this tumultuous battle, our analyst saw an opportunity – a chance to capitalize on the newfound strength of the bears. With a calculated strategy in mind, they waited patiently for the opportune moment to strike.

As the London session dawned, the stage was set for action. With nerves of steel and unwavering resolve, our analyst entered the fray, placing sell limit orders in anticipation of a retracement.

And so, the story unfolds, a tale of triumph and adversity, of bulls and bears locked in an eternal struggle for dominance. In the ever-changing landscape of the forex market, only those who possess the keenest insight and the steadiest hand can hope to emerge victorious.

NZD/USD Sell Limit SetupThe NZD/USD currency pair has exhibited a bearish trend through a significant portion of 2023. This analysis draws upon multiple technical observations and recent market dynamics that underscore a potential continuation of this bearish trajectory.

Recent Lows and Bearish Momentum: The pair recently plunged to a fresh low for 2023 at 0.5815, indicating a strong bearish momentum. Although there was a slight recovery to 0.5840, the overwhelming bearish pressure persists, signaling a potential further downside .

Critical Support Level:The level of 0.5800 has emerged as a crucial support zone. A sustained move below this level could unveil additional downside potential, possibly extending the bearish trend towards deeper values not witnessed in late October 2023 .

Yearly Trend and Correction Phase: Since the onset of 2023, the pair has been on a declining trajectory, moving from a yearly high of 0.6534 down to 0.5887. Although there was a minor correction phase around 0.5979, the prevailing trend remains bearish.

Tight Recent Trading Range: The pair navigated through a tight trading range recently, sustaining values near lows. Despite a fleeting run-up to 0.60555, the pair met with incremental selling pressure leading to a subsequent decline.

Trade Setup: Based on the prevailing bearish sentiment, a short swing trade setup is proposed: Entry Point: A short entry is advised at 0.595, aligning with a potential resistance zone near the recent correction phase. Stop Loss: A stop loss is set at 0.605, slightly above the recent run-up, to mitigate potential reversals against the trade. Take Profit: The take profit target is set at 0.575, near the critical support level, anticipating a further decline.

CHFJPY Short | Trade AnalysisHello Traders, here is the full analysis.

Watch strong action at the current levels for SELL. GOOD LUCK! Great SELL opportunity CHFJPY

I still did my best and this is the most likely count for me at the moment.

Support the idea with like and follow my profile TO SEE MORE.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

Patience is the If You Have Any Question, Feel Free To Ask 🤗

Just follow chart with idea and analysis and when you are ready come in THE GROVE | VIP GROUP, earn more and safe, wait for the signal at the right moment and make money with us💰

Actual wave analysis for BTCUSDT. The bottom has not passed yet.Current bullish movement possible is the correction Elliot's wave 4 to the previous fall from 30300$ to 24800$. The correction wave 4 could be either long in time or sharp and deep. Here deep variant is represented.

According to this version the price can not be higher than the highest point of correction wave 2, and also the level 23.6 fib is close (29000$). So we can put sell limits to the 29000$ with stop loss around 30300$.

Predict SELLING eur/jpy before tonight's CPIEUR/JPY remains up slightly as it consolidates the previous day's declines around 148.380 early on Wednesday. In doing so, the cross shows a bullish pennant chart pattern in the hourly shadow chart. , giving the recent confirmation score.

It should be noted, however, that the MACD line and the Relative Strength Index (RSI) (14) are slow to challenge the quote's upside momentum, alongside the immediate barrier at 148.40

Even if EUR/JPY buyers confirm a bullish pennant breakout, the 50 SMA around 147,500 could act as an additional hurdle before directing the pair towards its theoretical target near 148,000.

Conversely, a breakdown of the aforementioned pennant support line, near 147.500, could challenge the bullish histogram and possibly direct the pair towards the support of the line. SMA 200 near 146.400.

GOLD: What is the price of gold tomorrow?TVC:GOLD Gold prices remain low around $2,000 as it searches for fresh clues to extending its three-week downtrend, especially after posting its first weekly loss in three weeks. In doing so, the yellow metal portrays market anxiety amid concerns about the US debt ceiling, as well as banking concerns. However, the unclear calendar and mixed updates from the Federal Reserve (Fed), as well as US government officials, have pushed XAU/USD lower ahead of important events/data of this week.

Gold price depicts a bearish triangle formation on the Daily chart, currently between $2,030 and $2000. That said, bearish signals from the Moving Average Convergence and Divergence (MACD) indicator, as well as the steady Relative Strength Index (RSI), set at 14, also give see the next downtrend in XAU/USD.

However, a clear break of the 2000$ support becomes necessary for Gold to move towards its theoretical target of around 1,900$.

Canh SELL GOLD vùng giá 2022-2025

Stoploss: 2030

Take profit 1: 2017

Take profit 2: 2012

Take profit 3: 2006

SWING TRADING: SELL LIMIT ORDER FOR USDJPY. TARGET 129.550TRADE TYPE: SELL LIMIT

TRADE DIRECTION: SHORT

TIMEFRAME: 4H

ENTRY PRICE: 131.660

STOP LOSS: 133.100

TAKE PROFIT: 129.550

RISK TO REWARD: 1:1

ANALYSIS: Price broke the demand zone / support and is likely looking to aim for upcoming demand zone / support. stop loss ideally placed above supply zone / swing high

Follow this thread for any future updates regarding this specific trade.

CAUTION: Trading outcome is Probability Based and could wipe out your account if risk management and strategy is not followed properly. Cheers

POSITION TRADING: USDCAD SELL LIMIT ORDER. TARGET 1.30200TRADE TYPE: SELL LIMIT

TRADE DIRECTION: SHORT

TIMEFRAME: WEEKLY

ENTRY PRICE: 1.35400

STOP LOSS: 1.40600

TAKE PROFIT: 1.30200

RISK TO REWARD: 1:1

ANALYSIS: Price broke the demand zone/ support and is likely looking to aim for upcoming demand zone/ support. stop loss ideally placed above supply zone/ swing high

Follow this thread for any future updates regarding this specific trade.

CAUTION: Trading is a Probability Game and could wipe out your account if risk management and strategy is not followed properly. Cheers