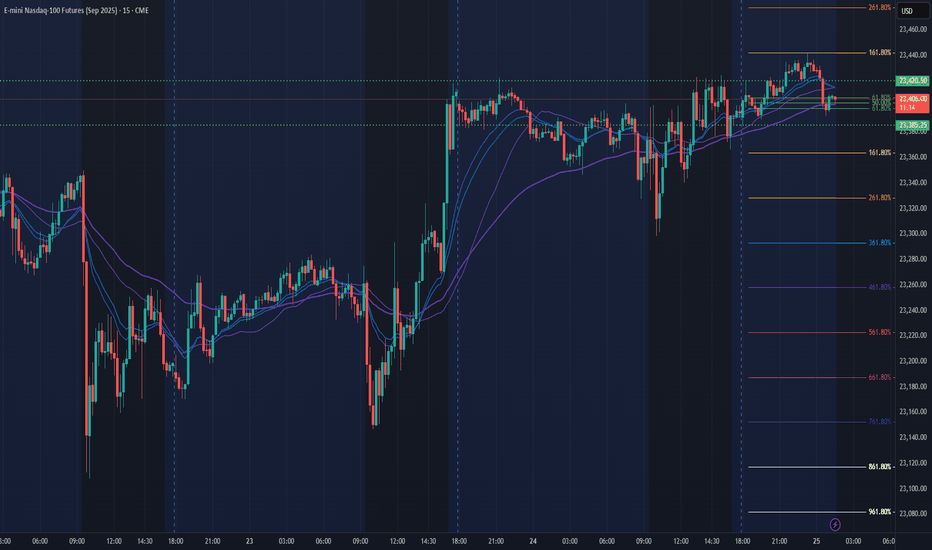

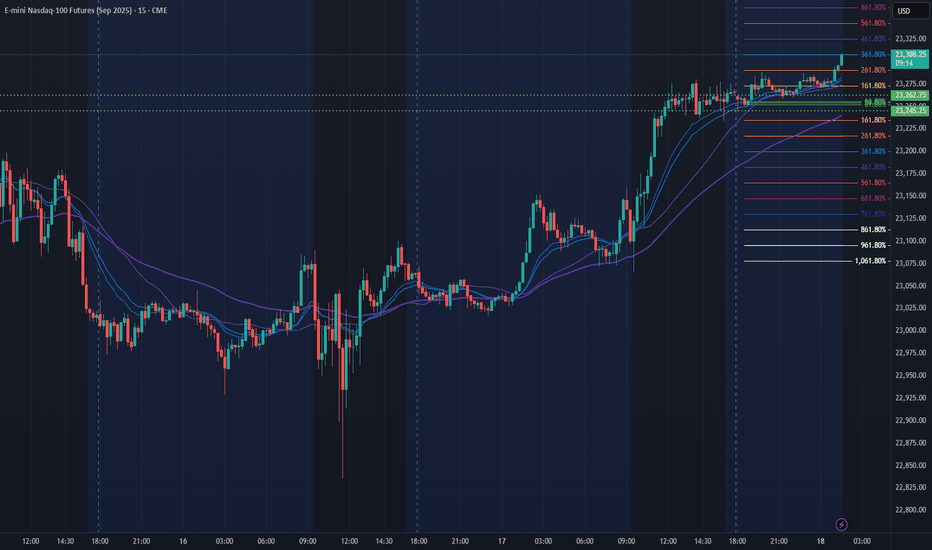

NQ Power Range Report with FIB Ext - 8/12/2025 SessionCME_MINI:NQU2025

- PR High: 23650.00

- PR Low: 23614.50

- NZ Spread: 79.5

Key scheduled economic events:

08:30 | CPI (Core|MoM|YoY)

Temp AMP margins increase for expected economic news volatility

Session Open Stats (As of 12:35 AM 8/12)

- Session Open ATR: 291.18

- Volume: 17K

- Open Int: 290K

- Trend Grade: Long

- From BA ATH: -0.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Sessionopen

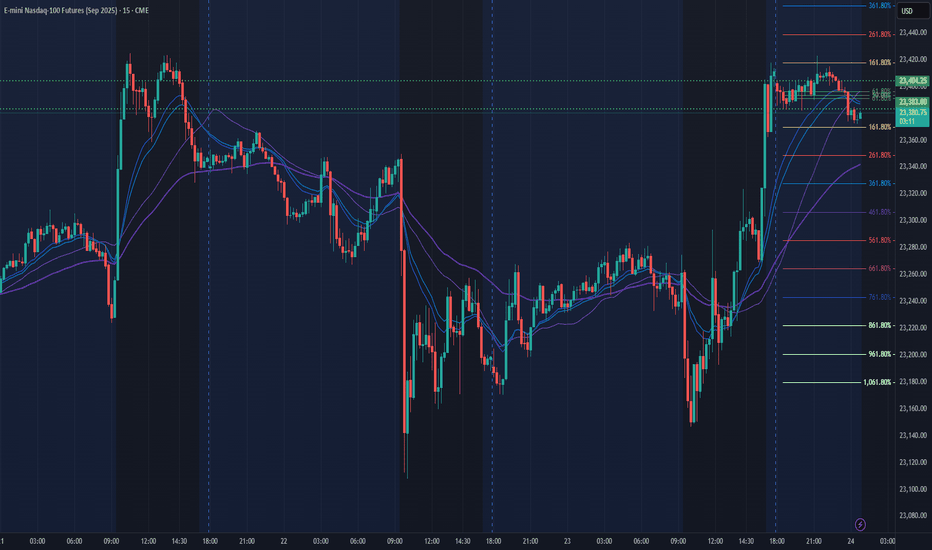

NQ Power Range Report with FIB Ext - 8/8/2025 SessionCME_MINI:NQU2025

- PR High: 23568.00

- PR Low: 23516.00

- NZ Spread: 116.5

No key scheduled economic events

Session Open Stats (As of 12:35 AM 8/8)

- Session Open ATR: 302.51

- Volume: 22K

- Open Int: 282K

- Trend Grade: Long

- From BA ATH: -1.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

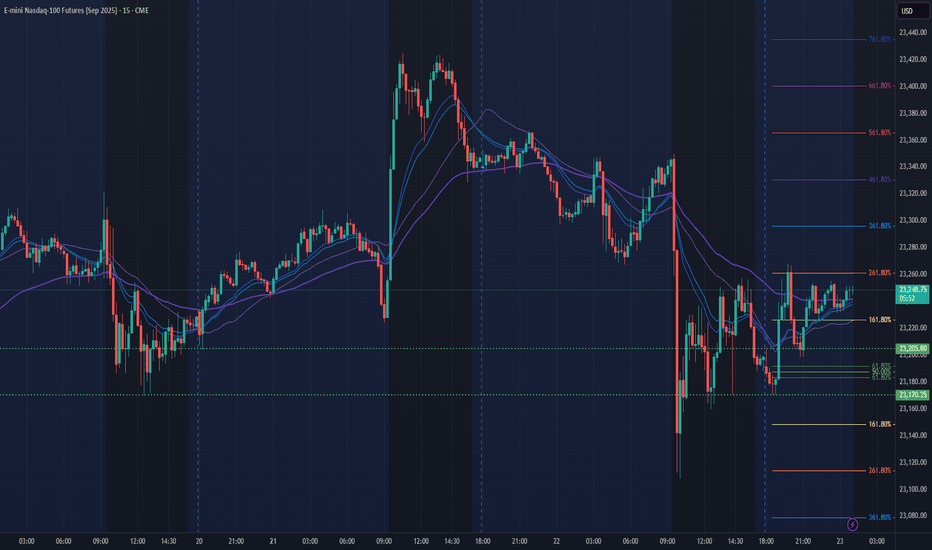

NQ Power Range Report with FIB Ext - 8/7/2025 SessionCME_MINI:NQU2025

- PR High: 23481.00

- PR Low: 23384.50

- NZ Spread: 216.25

Key scheduled economic events:

08:30 | Initial Jobless Claims

13:00 | 30-Year Bond Auction

Session Open Stats (As of 12:35 AM 8/7)

- Session Open ATR: 305.25

- Volume: 34K

- Open Int: 285K

- Trend Grade: Long

- From BA ATH: -1.5% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

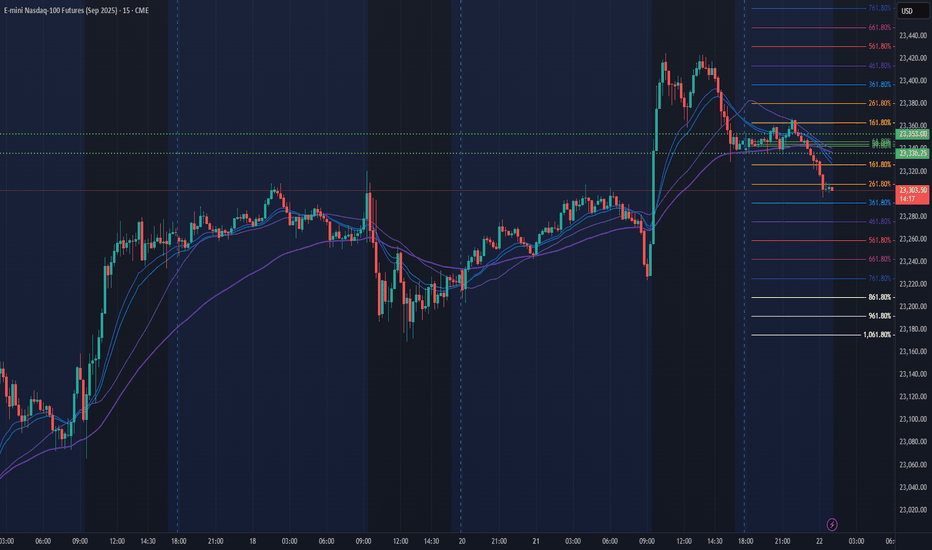

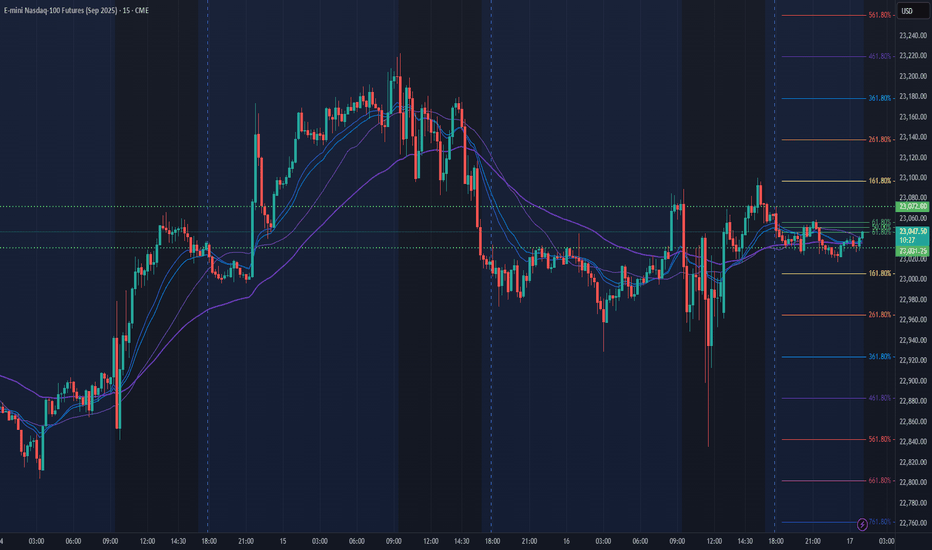

NQ Power Range Report with FIB Ext - 8/6/2025 SessionCME_MINI:NQU2025

- PR High: 23112.75

- PR Low: 23045.50

- NZ Spread: 150.25

Key scheduled economic events:

10:30 | Crude Oil Inventories

13:00 | 10-Year Note Auction

Look above & fail Friday-Monday highs

Session Open Stats (As of 12:35 AM 8/6)

- Session Open ATR: 299.58

- Volume: 32K

- Open Int: 277K

- Trend Grade: Long

- From BA ATH: -2.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 8/5/2025 SessionCME_MINI:NQU2025

- PR High: 23360.00

- PR Low: 23316.25

- NZ Spread: 97.75

Key scheduled economic events:

09:45 | S&P Global Services PMI

10:00 | ISM Non-Manufacturing PMI

- ISM Non-Manufacturing Prices

Session Open Stats (As of 12:35 AM 8/5)

- Session Open ATR: 294.27

- Volume: 23K

- Open Int: 278K

- Trend Grade: Long

- From BA ATH: -2.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 8/1/2025 SessionCME_MINI:NQU2025

- PR High: 23347.50

- PR Low: 23241.75

- NZ Spread: 236.0

Key scheduled economic events:

08:30 | Average Hourly Earnings

- Nonfarm Payrolls

- Unemployment Rate

09:45 | S&P Global Manufacturing PMI

10:00 | ISM Manufacturing PMI

- ISM Manufacturing Prices

Engulfing daily bar from ATH into new week lows

Session Open Stats (As of 12:45 AM 8/1)

- Session Open ATR: 262.82

- Volume: 45K

- Open Int: 280K

- Trend Grade: Long

- From BA ATH: -2.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/31/2025 SessionCME_MINI:NQU2025

- PR High: 23744.25

- PR Low: 23686.00

- NZ Spread: 130.5

Key scheduled economic events:

08:30 | Initial Jobless Claims

- Core PCE Price Index (MoM|YoY)

09:45 | Chicago PMI

New ATHs through Asian hours

Session Open Stats (As of 12:25 AM 7/31)

- Session Open ATR: 244.46

- Volume: 32K

- Open Int: 283K

- Trend Grade: Long

- From BA ATH: -0.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/30/2025 SessionCME_MINI:NQU2025

- PR High: 23474.75

- PR Low: 23449.25

- NZ Spread: 57.0

Key scheduled economic events:

08:15 | ADP Nonfarm Employment Change

08:30 | GDP

10:30 | Crude Oil Inventories

14:00 | FOMC Statement

- Fed Interest Rate Decision

14:30 | FOMC Press Conference

AMP temp margins increase anticipating vol spike for economic events

Session Open Stats (As of 12:25 AM 7/30)

- Session Open ATR: 232.98

- Volume: 16K

- Open Int: 281K

- Trend Grade: Long

- From BA ATH: -0.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/29/2025 SessionCME_MINI:NQU2025

- PR High: 23531.00

- PR Low: 23503.00

- NZ Spread: 62.5

Key scheduled economic events:

10:00 | CB Consumer Confidence

- JOLTs Job Openings

Session Open Stats (As of 12:25 AM 7/29)

- Session Open ATR: 233.38

- Volume: 17K

- Open Int: 280K

- Trend Grade: Long

- From BA ATH: -0.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/25/2025 SessionCME_MINI:NQU2025

- PR High: 23420.50

- PR Low: 23385.00

- NZ Spread: 79.5

Key scheduled economic events:

08:30 | Durable Goods Orders

Session open ATH break and retrace

Session Open Stats (As of 12:45 AM 7/25)

- Session Open ATR: 248.86

- Volume: 20K

- Open Int: 274K

- Trend Grade: Long

- From BA ATH: -0.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/24/2025 SessionCME_MINI:NQU2025

- PR High: 23404.25

- PR Low: 23383.00

- NZ Spread: 47.75

Key scheduled economic events:

08:30 | Initial Jobless Claims

09:45 | S&P Global Manufacturing PMI

- S&P Global Services PMI

10:00 | New Home Sales

Front run ATH, advertising breakout potential

Session Open Stats (As of 12:15 AM 7/24)

- Session Open ATR: 258.10

- Volume: 18K

- Open Int: 271K

- Trend Grade: Neutral

- From BA ATH: -0.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/23/2025 SessionCME_MINI:NQU2025

- PR High: 23205.00

- PR Low: 23170.25

- NZ Spread: 77.75

Key scheduled economic events:

10:00 | Existing Home Sales

10:30 | Crude Oil Inventories

Session Open Stats (As of 12:25 AM 7/23)

- Session Open ATR: 261.82

- Volume: 34K

- Open Int: 270K

- Trend Grade: Neutral

- From BA ATH: -0.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/22/2025 SessionCME_MINI:NQU2025

- PR High: 23353.00

- PR Low: 23336.00

- NZ Spread: 38.0

Key scheduled economic events:

08:30 | Fed Chair Powell Speaks

Session Open Stats (As of 1:45 AM 7/22)

- Session Open ATR: 260.85

- Volume: 19K

- Open Int: 277K

- Trend Grade: Neutral

- From BA ATH: -0.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/18/2025 SessionCME_MINI:NQU2025

- PR High: 23262.75

- PR Low: 23245.25

- NZ Spread: 39.0

No key scheduled economic events

Pushing ATH through overnight hours

Session Open Stats (As of 1:15 AM 7/18)

- Session Open ATR: 272.56

- Volume: 18K

- Open Int: 286K

- Trend Grade: Neutral

- From BA ATH: -0.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/17/2025 SessionCME_MINI:NQU2025

- PR High: 23072.00

- PR Low: 23031.25

- NZ Spread: 91.25

Key scheduled economic events:

08:30 | Initial Jobless Claims

- Retail Sales (Core|MoM)

- Philadelphia Fed Manufacturing Index

Session Open Stats (As of 12:35 AM 7/17)

- Session Open ATR: 274.88

- Volume: 18K

- Open Int: 268K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/16/2025 SessionCME_MINI:NQU2025

- PR High: 23034.25

- PR Low: 22973.75

- NZ Spread: 135.5

Key scheduled economic events:

08:30 | PPI

10:30 | Crude Oil Inventories

AMP margins raised overnight for expected PPI volatility

Session Open Stats (As of 12:25 AM 7/16)

- Session Open ATR: 277.22

- Volume: 27K

- Open Int: 277K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

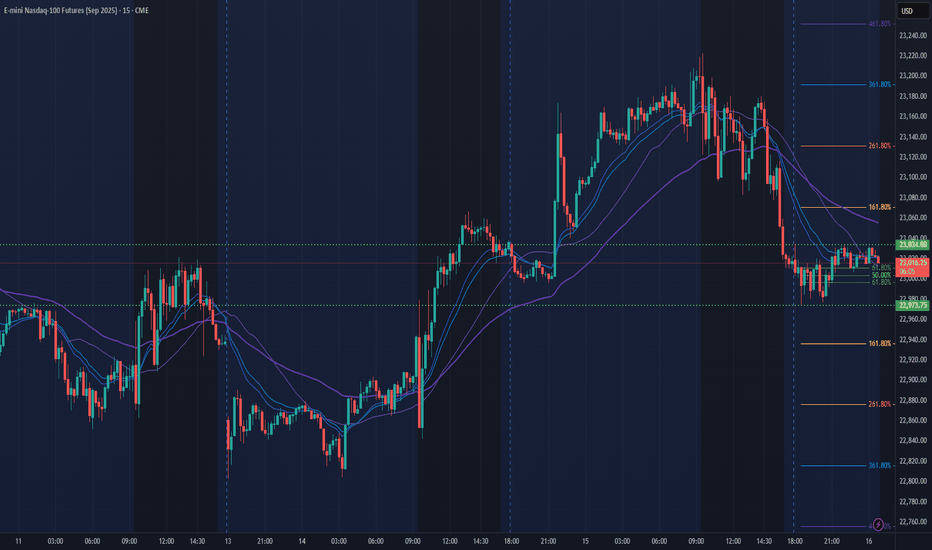

NQ Power Range Report with FIB Ext - 7/15/2025 SessionCME_MINI:NQU2025

- PR High: 23036.00

- PR Low: 23000.00

- NZ Spread: 80.5

Key scheduled economic events:

08:30 | CPI (Core|MoM|YoY)

Asian hours vol spike breakout swing into new ATHs

Session Open Stats (As of 12:15 AM 7/15)

- Session Open ATR: 290.39

- Volume: 42K

- Open Int: 276K

- Trend Grade: Neutral

- From BA ATH: -0.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/11/2025 SessionCME_MINI:NQU2025

- PR High: 23039.75

- PR Low: 23004.50

- NZ Spread: 78.75

No key scheduled economic events

High 200+ range volatility during Asian hours

Session Open Stats (As of 1:35 AM 7/11)

- Session Open ATR: 301.79

- Volume: 48K

- Open Int: 268K

- Trend Grade: Neutral

- From BA ATH: -0.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/10/2025 SessionNQ Power Range Report with FIB Ext - 7/10/2025 Session

CME_MINI:NQU2025

- PR High: 23065.25

- PR Low: 23033.25

- NZ Spread: 71.5

Key scheduled economic events:

08:30 | Initial Jobless Claims

13:00 | 30-Year Bond Auction

Session Open Stats (As of 12:35 AM 7/10)

- Session Open ATR: 300.61

- Volume: 20K

- Open Int: 270K

- Trend Grade: Neutral

- From BA ATH: -0.4% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/9/2025 SessionCME_MINI:NQU2025

- PR High: 22923.00

- PR Low: 22900.50

- NZ Spread: 50.5

Key scheduled economic events:

10:30 | Crude Oil Inventories

13:00 | 10-Year Note Auction

14:00 | FOMC Meeting Minutes

Session Open Stats (As of 12:25 AM 7/9)

- Session Open ATR: 303.33

- Volume: 16K

- Open Int: 270K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/8/2025 SessionCME_MINI:NQU2025

- PR High: 22853.50

- PR Low: 22808.50

- NZ Spread: 100.5

No key scheduled economic events

Session Open Stats (As of 12:25 AM 7/8)

- Session Open ATR: 318.85

- Volume: 24K

- Open Int: 269K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/2/2025 SessionCME_MINI:NQU2025

- PR High: 22723.00

- PR Low: 22683.00

- NZ Spread: 89.5

Key scheduled economic events:

08:15 | ADP Nonfarm Employment Change

10:30 | Crude Oil Inventories

Session Open Stats (As of 12:25 AM 7/2)

- Session Open ATR: 328.85

- Volume: 20K

- Open Int: 265K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/1/2025 SessionCME_MINI:NQU2025

- PR High: 22886.75

- PR Low: 22852.50

- NZ Spread: 76.75

Key scheduled economic events:

09:30 | Fed Chair Powell Speaks

09:45 | S&P Global Manufacturing PMI

10:00 | ISM Manufacturing PMI

- ISM Manufacturing Services

- JOLTs Job Openings

Holding in ATH range

Session Open Stats (As of 12:45 AM 7/1)

- Session Open ATR: 329.32

- Volume: 21K

- Open Int: 269K

- Trend Grade: Neutral

- From BA ATH: -0.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone