TON/USDT : The Next Bullish Rally Ahead? (READ THE CAPTION)By analyzing the #Toncoin chart on the 3-day timeframe, we can see that the price is currently trading around $3.00, which is approximately 60% below its all-time high of $8.20. If Toncoin can hold above the $2.80 level, we may expect further bullish momentum in the mid-term.

The next potential upside targets are $3.39, $3.64, $4.20, and $4.66.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Shibainu

BTC/USD: The Bull Run Isn’t Over yet! (READ THE CAPTION)By analyzing the #Bitcoin chart on the weekly timeframe, we can see that price has finally started rising as expected and has hit all our targets, breaking above $100,000. Bitcoin is currently trading around $103,000, and now we must wait to see if it gets rejected from this level. If there's no rejection and price breaks and holds above $110,000, we could expect higher targets around $130,000 and even $163,000 in the coming weeks. So far, this analysis has delivered over 39% return!

The Previous Analysis :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

SHIBUSDT – Perfect Confluence Zone Holding Strong!CRYPTOCAP:SHIB has just bounced from a critical confluence zone, combining:

✅ Channel support

✅ Previous breakout zone

✅ Golden pocket retracement

This triple-layered support has historically acted as a powerful launchpad, and the price is already showing early signs of strength.

The price structure is tightening inside a long-term wedge, and a breakout from the upper resistance trendline could trigger a massive upside leg.

First breakout test near 0.024

Potential long-term move toward 0.07+

In shorter timeframe, CRYPTOCAP:SHIB broke out of its long-standing falling wedge pattern and is now retesting the breakout zone. With bullish volume creeping in, this move could ignite a powerful trend reversal toward the 0.0000239 zone. Ideal structure for spot entries with defined risk!

SHIB could be coiling for something massive. Keep an eye on structure and volume.

If you find this analysis helpful, please hit the like button to support my content! Share your thoughts in the comments, and feel free to request any specific chart analysis you’d like to see.

Shiba Inu Eyes 20% Surge, Targeting 0.000016 Breakout SoonHello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Shiba Inu 🔍📈.

Shiba Inu has recently seen an extraordinary surge in trading volume, suggesting imminent large-scale activity likely driven by whales. The asset is currently trading within a parallel channel, indicating a period of consolidation. In the short term, I anticipate a potential price increase of at least 20%, targeting the key level of 0.000016.📚🙌

🧨 Our team's main opinion is: 🧨

Shiba Inu's massive recent volume hints at big whale moves ahead, and with price in a parallel channel, I’m eyeing a 20% jump toward 0.000016 soon.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

Shiba Inu 1,479% Bullish Wave Starts Now (2025 Bull Cycle)Shiba Inu is now starting a new rise similar to early 2024, February, but much stronger much stronger.

Good afternoon my fellow Cryptocurrency trader, here we have a long-term chart.

The structure of the chart is quite revealing and leaves no room for doubts. SHIBUSDT is bullish now.

There was a correction after the March 2024 high ending in higher low. This then proceeded to produce a lower high and then a new lower low. The action is now bullish as it recovered above the August 2024 low.

Three weeks closing green now, trading green as this one is yet to close. This week is the confirmation as closure happens above long-term support. Touch and go. The action moved below on a wick just to recover, this is a strong bullish signal and when the week ends at 0.000012500 or higher full bullish confirmation is in. The 2025 bull market starts.

Early 2024 was the initial bullish breakout and this breakout produced massive growth, it was great but nothing compared to what is coming next. The next wave will be many times bigger because 2024 was still part of the transition year while 2025 is the bull market. 2026, after the peak and new All-Time Highs, a bear market will develop.

The bear market is followed by a new period of sideways, transition and then a new bull market. The market moves cycles and these are repeated over and over like night and day. 4-years based on the Bitcoin halving. It can extend but most likely it will continue to be the same.

The targets can be seen on the chart. Maximum growth, strong comes ahead.

» A nice target sits at 0.000139 for 894% and new ATH potential up to 1,479% at 0.000220. We will have to wait and see, it is too early but the market is turning green now and will continue to trade green. It can happen that it go higher rather than lower based on the chart. It can happen that rather than overestimating the potential of this pair, we are underestimating it, this too would be good, the more it grows the better it gets.

Namaste.

BTC/USD: Do You Think Bitcoin Will Break Above $100K Again?By analyzing the #Bitcoin chart on the weekly timeframe, we can see that after our last analysis, the price successfully hit the $80,800 target and even dropped close to the second target at $73,700. Eventually, after forming a bottom around $74,400, Bitcoin saw renewed demand and has since surged to $93,600.

Take note: the $93,480 to $99,500 zone is a key supply area, and the primary expectation is for the price to face rejection from this level. However, after a possible short-term correction, I expect Bitcoin to resume its upward move toward targets above $100,000.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Latest Analysis :

ALTCOINS | ALT Season | Buy Zones PART 2💥 SUI / BINANCE:SUIUSDT

SUI ideal buying points, weighing heavier towards the lower zone:

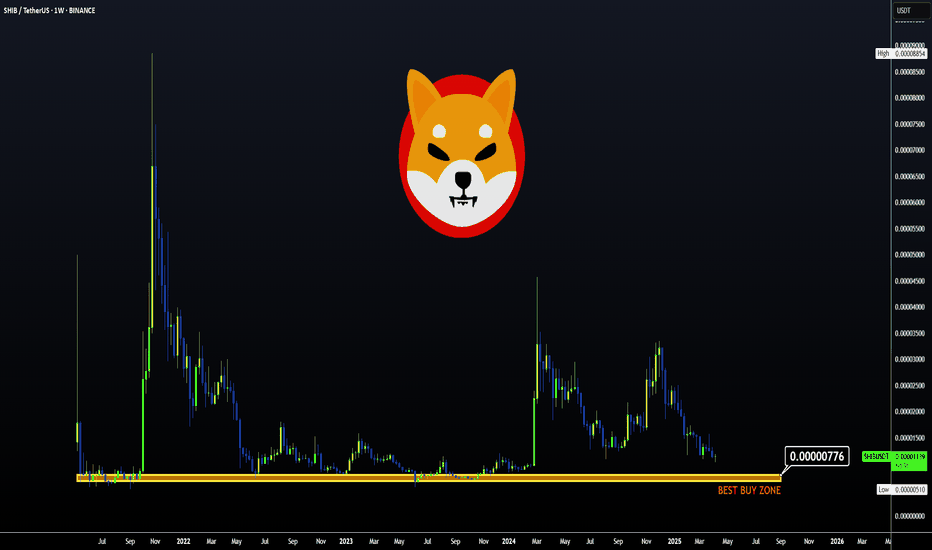

💥 SHIBA / BINANCE:SHIBUSDT

SHIB ideal buying zone is approaching, but ideally the lower zone is the better buy:

💥 DOT / BINANCE:DOTUSDT

Dot worries me for the reason that it has retraced nearly all the way to 2021 prices. Therefore I'll keep trades small, with modest TP zones.

BUY zone for a swing, not accumulation:

💥 PEPE / BINANCE:PEPEUSDT

PEPE buy zone seems far away, but considering how hard alts can drop in only a few days, I'd be ready with the orders, hanging heavier towards the lower zone:

💥 BINANCE / BINANCE:BNBUSDT

BINANCE shows promising swings. Ideal BUY zones include:

For the next cycle, in other words long term target, I'd watch the 1.618 at least:

This would make it an accumulation buy.

________________

Shiba Inu Nears Major Support - Breakdown or Bounce?The $0.000005 - $0.000008 range has been a key support zone for Shiba Inu over the years. With a double-top "M" pattern in play since March 2024, and current market price at $0.00001231, CRYPTOCAP:SHIB is approaching this critical area once again.

What do you think - will price test the zone, or is a pump incoming from here?

Drop your thoughts!

Kindly support this idea with a LIKE👍 if you find it useful🥳

Happy Trading💰🥳🤗

Don’t Miss the Next Shiro Neko SurgeShiro Neko is setting up for another breakout.

Consider buying in the next few days — it may surpass its all-time high at any moment.

Remember: it hit a 1 Bi market cap in just one day.

Don’t underestimate it — 2 Bi within a week is on the table.

Stay sharp. 📈🐾

#ShiroNeko

ShibaInu SHIB price analysisNow the price of CRYPTOCAP:SHIB is at the top of the Buy zone.

But do we want to buy this asset in our portfolio: more likely no than yes.

Well, who already has #ShibaInu purchased, then he can only wait for a miracle in the form of at least x2 growth by the summer of 2025, to the range of $0.000029-0.000030

Or maybe OKX:SHIBUSDT price will repeat the "feat" of its older brother CRYPTOCAP:DOGE ? 👇

The patterns of price behavior on the global chart are quite similar, what do you think ?

#SHIB/USDT#SHIB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, this support at 0.00001100.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.00001224

First target: 0.00001284

Second target: 0.00001344

Third target: 0.00001417

Shiba Inu (SHIB) Shows First Major Bullish Signal Amid Market ReAfter weeks of downward pressure, Shiba Inu (SHIB) (traded on WhiteBIT) has recorded its first notable bullish retrace, hinting at a potential trend reversal. The asset is currently trading near $0.00001337 and has successfully broken above the 26-day EMA—a key technical level that often signals the start of broader upward momentum.

This breakout is significant, marking SHIB’s first major move above resistance since February’s downtrend. The token’s local support now sits at $0.0000122, and if bullish momentum continues, SHIB could target the next major resistance at the 50 EMA ($0.0000145). A further push above this level could solidify the reversal.

Additionally, the Relative Strength Index (RSI) at 50.75 suggests growing buying pressure. A move above the 55-60 zone would reinforce the bullish setup and potentially trigger further gains. With market liquidity also increasing, traders seem to be re-entering SHIB, setting the stage for possible continued upside.

$LEASH Set For A Surge Amidst Breaking Out of a Falling Wedge The Price of Doge Killer ($LEASH) is set for a massive surge amidst breaking out of a falling wedge pattern. A pattern formed on the start of January, 2025 that saw $LEASH lose about 33% of value albeit the general crypto landscape was bearish for over 3 weeks now.

We saw CRYPTOCAP:BTC swinging in the $80,000 - $86,000 axis, with CRYPTOCAP:ETH also swinging in the $1900- $2100 pivot. Additionally, should Doge Killer ($LEASH) token break the 1-month high pivot, a bullish continuation move is inevitable.

What Is Doge Killer (LEASH)?

Doge Killer (LEASH) is a token in the Shiba Inu (SHIB) ecosystem. Shiba Inu is commonly referred to as the “Dogecoin (DOGE) killer” because of its enormous popularity. SHIB grew to become the second-largest canine-inspired coin in the crypto space and aims to be the Ethereum (ETH)-based counterpart to Dogecoin’s Scrypt-based mining algorithm. Besides LEASH, there is also Bone ShibaSwap (BONE), another dog coin that is part of the Shiba universe, which can be traded on its own ShibaSwap decentralized exchange (DEX).

Doge Killer Price Live Data

The live Doge Killer price today is $173.74 USD with a 24-hour trading volume of $1,646,362 USD. Doge Killer is up 12.37% in the last 24 hours, with a live market cap of $18,485,943 USD. It has a circulating supply of 106,399 LEASH coins and the max. supply is not available.

SHIBUSD can go x7 from here.Shiba Inu / SHIBUSD is rebounding at the bottom of the 3.5 year Triangle.

The 1week RSI is on a similar sequence as February-May 2023, which eventually rose aggressively by +661.50%.

Considering that the price made last week a Double Bottom with the August 5th 2024 low, this is a unique long term buy opportunity.

Buy and target 0.00008450

Follow us, like the idea and leave a comment below!!

Will Shiba’s 20% decline reach the crucial 0.0000090 support?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Shiba 🔍📈.

Shiba appears to have become a stagnating asset, resembling a "walking dead" in the market. In my upcoming educational analysis, I will delve deeper into such tokens, providing a more comprehensive understanding. Currently, Shiba is trapped within a descending channel, and I anticipate a further decline of at least 20%. The primary target for this downtrend is 0.0000090, a significant monthly support level that will play a crucial role in determining its future price action.📚🙌

🧨 Our team's main opinion is: 🧨

Shiba is stuck in a downtrend, with a 20% drop likely, targeting the key support at 0.0000090.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

SHIB Experiences Token Burns: What's Next?Shiba Inu (SHIB) is currently trading at $0.00001166. This price reflects a sharp decline from $0.00001541 on March 10, aligning with a broader cryptocurrency market downturn that saw the total market capitalization drop by 4.4% over the past 24 hours. SHIB’s current price sits below its 50-day SMA ($0.00001647) and 200-day SMA ($0.00001939), signaling a bearish trend in the medium to long term. Recent social media posts on X note a significant token burn rate, with over 15 million SHIB burned in the last 24 hours, reducing supply, a factor that could bolster the price over time. However, for the short-term 1-hour timeframe, volatility and market sentiment are driving the action.

Technical Indicators and Key Levels

On the 1-hour chart, SHIB is testing a key support zone around $0.00001100, with additional support levels at $0.00001051 and $0.00001001 if the downward pressure continues. The price is likely below short-term moving averages (e.g., 20-period or 50-period), reinforcing the bearish momentum in this timeframe. The Relative Strength Index (RSI) was recently reported at 31.80, hovering near oversold territory (below 30), which could suggest a potential bounce if buying interest picks up. On the upside, resistance levels to watch include $0.00001278, $0.00001403, and the recent high of $0.00001541. Breaking these levels would require a shift in market dynamics, likely accompanied by a surge in trading volume.

Potential Scenarios and Trading Considerations

Two primary scenarios emerge for SHIB on the 1-hour chart. Bullish Case: If the price holds above $0.00001100 and attracts buyers, it could rally toward $0.00001278 or even $0.00001403, especially if volume increases on upward moves. However, the broader market’s bearish sentiment might limit gains, so any recovery could be short-lived. Bearish Case: If selling pressure breaks $0.00001100, SHIB could slide toward $0.00001051 or $0.00001001, particularly if high volume confirms the downtrend. The recent token burns add a positive long-term narrative, but their impact is unlikely to dominate this short timeframe. Traders should also monitor broader market catalysts—such as shifts in crypto sentiment, that could influence SHIB’s next move.

Final Tips

In this volatile setup, timing is critical. Watch the $0.00001100 support closely, a hold or break here will dictate the short-term direction. Look for volume spikes to confirm any breakout above $0.00001278 or breakdown below $0.00001100. Given the market-wide downturn, risk management is essential, use tight stop-losses and avoid chasing momentum without confirmation. Stay alert for news or whale activity that could jolt the price, and let the chart guide your decisions.

Potential Price Movements

Bullish Scenario: A move above $0.00001278 could target $0.00001403.

Bearish Scenario: A drop below $0.00001100 may test $0.00001051 or lower.

Note: Volume confirmation is key, watch for spikes to validate price action.

Shiba Faces Potential 30% Drop: Set Stop-Loss for SafetyHello and greetings to all the crypto enthusiasts, ✌

In several of my previous analyses, I have accurately identified and hit all of the gain targets. In this analysis, I aim to provide you with a comprehensive overview of the future price potential for Shiba Inu , 📚🎇

While we may observe upward candles as part of completing the current bearish phase, which I have clearly depicted on the chart, the potential for further decline remains. I foresee another drop of at least 30% for Shiba, with a primary target price of 0.00001120. The bearish channel is still active and may extend downward. Given this, it's crucial to implement a stop-loss strategy to mitigate any downside risk. Protect your investment by closely monitoring the market's behavior and adjusting accordingly. 📚✨

🧨 Our team's main opinion is: 🧨

There might be a short-term upward movement, but Shiba could still drop another 30% to around 0.00001120, so make sure to set a stop-loss to protect your investment.

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋