The analysis focuses on the short-term to medium-term timeframe.The analysis focuses on the short-term to medium-term timeframe.

Tug-of-War Between Bulls and Bears: At the current price of 157.04, the market is in a tug-of-war between buyers (bulls) and sellers (bears).

Bulls are defending key support levels near 152.48 (Fibonacci 100% retracement of Wave C) and 154.34 (Expanded Flat target). A hold above these levels could signal a potential reversal.

Bears are attacking resistance levels at 160.31 (Fibonacci 100% projection of Wave C) and 162.82 (Expanded Flat target). A break below 152.48 could accelerate downward momentum.

Recent Price History: The market has been in a downtrend recently, with the price dropping from 191.18 (July 10, 2024) to 157.04. Key Fibonacci levels (e.g., 161.8% retracement at 159.84) and Elliott Wave patterns (e.g., Diagonal Ending Downward Candidate) have guided this decline. Momentum indicators (e.g., RSI at 47.51) suggest the downtrend may be losing steam, but the MACD histogram turning positive hints at a potential short-term bounce.

Current Sentiment (Technical & News):

Technical Indicators: Mixed signals. RSI (47.51) is neutral, while MACD shows a bullish crossover (histogram turning positive). The price is below key moving averages (e.g., 200-day SMA at 167.35), indicating a bearish bias.

News Sentiment: Mixed to slightly negative. Ad revenue pressures and regulatory risks weigh on sentiment, but long-term growth catalysts (AI, cloud) provide optimism. Analysts maintain a "Buy" rating despite near-term challenges.

Synthesis: The technical picture aligns with the news—short-term bearishness (price below MAs, ad revenue concerns) but potential for a reversal if support holds (undervaluation, bullish MACD).

Key Levels & Momentum:

The price is currently below the 50-day SMA (161.89) and 200-day SMA (167.35), signaling bearish dominance.

Momentum is fading (RSI neutral, Stochastic not oversold), but the MACD histogram suggests a possible short-term bounce.

2. Elliott Wave Analysis (Contextualized to Current Price)

Relevant Elliott Wave Patterns:

Diagonal Ending Downward Candidate (Valid): Suggests the downtrend may be nearing completion, with Wave 5 potentially ending near 152.48-154.34 (Fibonacci 100% projection).

Expanded Flat Upward Candidate (Potentially Valid): If the price holds above 152.48, this pattern could signal a corrective rally toward 162.82.

Wave Count vs. Indicators/Sentiment:

The Diagonal Ending pattern contradicts the bearish news sentiment but aligns with oversold technicals (RSI, MACD). This divergence suggests a potential reversal if support holds.

The Expanded Flat pattern would confirm a bullish reversal if the price breaks above 160.31.

Near-Term Projections:

Downside: A break below 152.48 could extend losses to 148.36 (161.8% Fibonacci projection).

Upside: A hold above 152.48 and break above 160.31 could target 162.82 (Expanded Flat target) and 167.35 (200-day SMA).

3. Strategy Derivation (Realistic, Actionable NOW, News Considered)

Primary Strategy: WAIT (due to conflicting signals).

Why Wait? The technical setup is mixed (bullish MACD vs. bearish MAs), and news sentiment is neutral-to-negative. The upcoming Q1 earnings could add volatility.

If Price Holds Support (152.48-154.34):

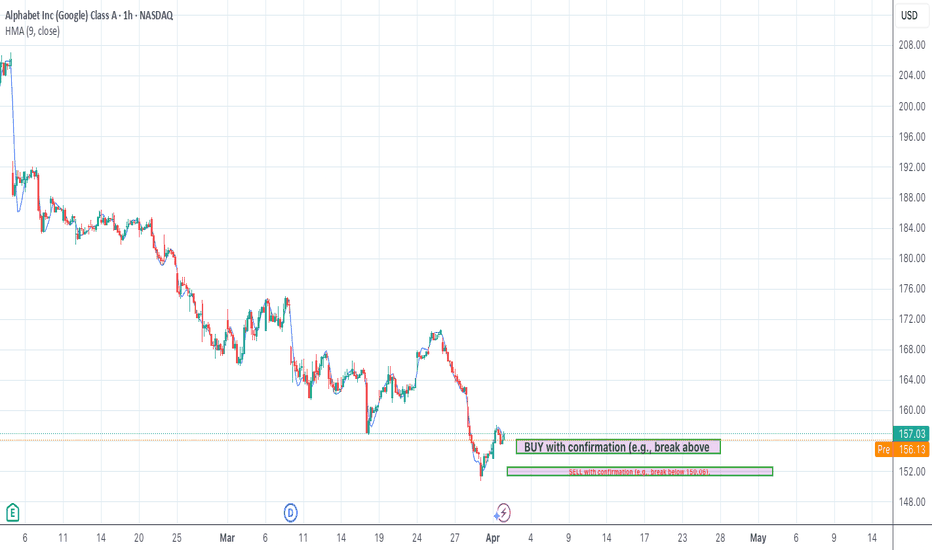

BUY with confirmation (e.g., break above 160.31).

Entry Zone: 154.34-156.13 (Fibonacci 78.6% retracement).

Stop-Loss: 151.44 (below recent low).

Take Profit: TP1 at 160.31 (Fibonacci 100%), TP2 at 162.82 (Expanded Flat target).

Risk/Reward: ~1:2 for TP1.

If Price Breaks Below Support (152.48):

SELL with confirmation (e.g., break below 150.06).

Entry Zone: 152.48-151.44.

Stop-Loss: 154.34 (above support).

Take Profit: TP1 at 148.36 (161.8% Fibonacci), TP2 at 145.90 (Wave 5 projection).

News Context Check:

Earnings uncertainty and ad revenue pressures favor caution. Reduce position size if trading.

4. Trade Setup (Actionable, Realistic, News Aware)

Direction: WAIT (watch key levels).

Key Levels to Watch:

Upside: 160.31 (breakout confirmation).

Downside: 152.48 (breakdown confirmation).

News Reminder: Be mindful of Q1 earnings and ad revenue trends.

5. Summary Section

✅ Investor / Long-Term Holder Summary:

Key Support: 152.48 (accumulation zone if held).

Long-Term Outlook: Undervalued (DCF: $260 vs. $157). Focus on AI/cloud growth.

Action: Wait for pullback to 152.48 or break above 167.35 (200-day SMA).

Short-term-bearish

🧠Short-Term EURUSD Sentiment🔥

According to the latest currency news headlines, short-term sentiment towards the Euro appears slightly downbeat against the US Dollar. While both economies face inflationary headwinds, recent data surprises have painted a relatively weaker picture for the Eurozone bloc.

German industrial orders came in lower than forecast in the latest monthly report, underscoring the challenges manufacturers continue to face from high energy costs and supply chain disruptions. Additionally, French GDP growth slowed more than anticipated in Q3, raising concerns that the second largest Eurozone economy may be slowing.

Comments from ECB officials at regional central bank conferences this week reiterated the bank's commitment to further tightening of monetary policy in the coming months. However, they maintained a cautious stance, stressing that future rate decisions will depend heavily on incoming economic data. This leaves the policy path somewhat uncertain compared to the more hawkish Fed.

In contrast, US jobless claims came in above expectations last week, pointing to underlying resilience in the labor market. This boosted views that the Federal Reserve remains on track to deliver another supersized 75 basis point rate hike at its November meeting. Fed speakers struck a firm tone that inflation must be cooled through forceful rate actions.

Looking at Eurusd technicals, downside momentum has held above 1.0300 for now. However, near-term rallies continue facing resistance below 1.0500 on cautious short-term sentiment. The outlook could brighten if upcoming Eurozone data surprises higher or there are signs inflation is moderating more quickly than expected. But for now, traders appear to favor positioning for dollar strength on a short-term basis.

Technical key aspects of the short term trend and best entry/exit strategy based on the analysis provided in the TradingView charts:

- The short term trend of EURUSD across the timeframes analyzed (weekly to 4H) remains bearish. Price action has been declining within descending resistance lines and channels.

- Best entry for short trades was suggested to be after a bounce from resistance levels or pullbacks from oversold/oversold levels on indicators like the BB bands. This reduces risk of entering at highs.

- Given volatility in currency pairs, optimal stop loss placement would be above recent swing highs or structural resistance levels, around 20-30 pips above entry to limit downside risk.

- Initial profit targets were identified as lower support levels, around 50-100 pips below entry. This provides a favorable risk-reward ratio of at least 1:2.

- Additional extended profit targets aligned with longer term analysis include monthly or weekly demand zones and support levels offered by structural patterns like descending channels over 100-200 pips lower.

- Traders are advised to exit parts of their position at initial targets and move stops to breakeven on the rest, as well as trail stops closer as the trade moves in their favor, to lock in profits and limit risks of unexpected reversals.

BTC Weekly: Long-Term Bullish Shark Harmonic?Lets take a look at the BTC weekly chart technicals:

RSI is at major lows

Repeated testing of 17k support

Signs reversal on the MACD+Stoch indicators

Increased buy volume on BTC/USDT for KuCoin and Binance

For chart analysis, we can see we are nearing the red line at the bottom, which represents the lowest possible trend floor at around 5.5k along with other support lines at 17k and 10k.

We could see a breakout from the large, declining triangle pattern which I believe is a Bullish Shark Harmonic Pattern . If it proves a valid reversal indicator we could see a good rally from around $12k - $13k. This is my observational opinion.

Alternatively, we could see it test the 10k mark support line below the triangle before a confident reversal signal! I believe this is a more bearish view, but possible.

If we look at market cap indicators, TOTAL, TOTAL1 and TOTAL2, we can see buying volume is higher for BTC relative to altcoints, indicating a possible influx to the largest cap currencies such as ETH, XRP, ATOM, HBAR, etc.

Is This a DCA Oppertunity?

My TL;DR opinion? Neutral-bearish on the short-term, bullish on the long term. Cautiously engaging with solid DCA strategies from these prices.

If we take a look at the wider economy and political climate, there is a tremendous amount of uncertainty surround FIAT after the dollar’s overwhelming rally against the Euro, GBP, and JPY! Gold lost a key support level at $1,700, and major indicies such as NASDAQ are still underperforming.

Whilst crypto is classed as a high-risk asset, some investors are noticing this moment of stability compared to the rest of the global market. It is impossible to make a perfect prediction and we could absolutely see some Lower Lows on crypto before a relief rally.

Silver is a commodity on the radar that could be showing signs of a major upswing, although I have yet to do a confident analysis on it.

With all that said I would personally be comfortable DCAing into crypto from here over time, with the expectation of another respectable dip before a full reversal🙏

Note: Nothing posted constitutes as financial advice, or any form of advice, and is designed to inform and educate!

Visa $V Rejecting off top channel resistance -- BearishGiven FOMC is behind us now and the market is most likely following another leg down I'm expecting a top line rejection off of the large channel on the daily.

Rejected off the 200d MA of $218.11. Expect continuing rejection if we get a dead cat recovery at this point, but ultimately I see this impulse retracing back down. Notice the W pattern several bars before with a clear rejection off the top resistance with the large wick a few days prior.

MACD is making lower highs, RSI is coming back down and about to cross the signal to the bearish side. Stochastic is losing steam as well starting to fall from overbought territory. VI+ looks like its done making an engulfing void to the upside, which indicates that a reversal pattern with VI- is probably around the corner. TTM squeeze looks like its starting to apex as well.

Looking at the fib retrace from the previous low to high, and also following an extension downwards from previous high impulse to recent low and recent high we are looking at support levels of 0.236 at ~ $202.81 and 201.26 which is more or less where current price action is. Therefore expect the next couple of fib supports/resistances to be hit on both the retracement as well as the downward extension.

Retracement supports are as follow --

0.382 $194.42

0.5 $193.06

0.618 $188.70

Fib Extension resistances are as follow --

0.382 $194.91

0.5 $189.79

0.618 $184.66

Looking at the volume profile we see a good shelf of support up to the 0.5 fib extension.

Look for downward movement over the next 6 daily bars (10 days). Price action must clear the support shelf at $200 to continue downwards, otherwise expect sideways action between $200-203.

PT1: -6 pts -2.99% to the 0.382 extension ~ $194.91

PT2: -11.11 pts -5.33% to the 0.5 extension ~ $190 -- I think this is where $V will find support and probably start heading sideways.

Max PT: -16.11 pts -8.03% to the 0.618 fib extension ~ $185 -- Long shot, will have to continuously monitor to see how we move along with the macro and how the volume profile shapes up over the next few days.

Stop loss: ~$203.50 +1.53% from current action -- This would be the last stop on the volume profile upwards where the next would be a gap towards the upside.

When youtubers talk about higher and higher, I scream ALERT 🚨🚨Hello everyone,

I believe less and less in technical analysis ...

After spending more than a year staring at charts and drawing lines, I realized that the stock market has an alternative to my moves every time.

We can say that we have a correction, a flag that is responsible for the continuation of declines.

On the other hand, we have higher and higher lows and lows, which says about the trend reversal, and of course a lot of analysts claiming that there will be no more declines.

What to believe? I believe that BITCOIN will be cheap at 28k-30k and then it will be time to buy or enter futures in the long-term.

I wouldn't be surprised if the price was pushed by a wick even at 24k.

I sit with SHORT and wait for the Youtuber money to fall into my hands: D

I must warn you about the descent because this is my vision for the near future. Don't be fooled by temptation!

The plan to delete us is very simple: D Let's show them that it's growing, and they'll wake up in the morning with nothing.

Remember that I may be wrong, but the truth is, this is a fight with the player on the other side of the monitor.

Comment and like,

Regards

#buydips

Visa | Short Term Bearish / Long Term BullishI'll try to be brief: all the indicators and trend lines indicate a low-volatile (which is an advantage for the solidity especially in a long-term perspective) and growing trend of Visa. However, following the trend from March 2020 (as I always say "the new modern era for the world") until today November 2021, Visa has always retraced each level of the Fibonacci retracement until it touches its maximum peak, resulting in and current decline (currently Visa broke the previous trendline, but it was predictable as its trend up to that moment was really exaggeratedly bullish).

Due to the low volatility of the market I suspect that the retracement in the short term could lead Visa to further losses, I assume an additional 3 or 4 points up to around $ 206/207 per share (which is not many in a long-term perspective anyway but for a day trader instead can be an abyss), coinciding with the 0.382 Fibonacci retracement; at that moment I have good reason to think that Visa will restart its bullish run also quite efficiently (let's say that by early 2022 I would not be surprised if we were at $ 260 per share) to get back in line with its innovative power and with the previous trend which has just been broken, as mentioned before.

In conclusion, as usual DYOR (!!!), mine is just a "brainstorming" seeing the chart and knowing the company, however I admit I have a recently opened position on Visa, so I have no reason to lie :)

Another correction before the final pump to 100K+ BTC ? Hi all, my first post here.

I did an Elliot wave count on bitcoin since the end of the 2018 bear market, where the next bull run actually began. Looks like we are still in the corrective 4th wave of the long-term bull phase. And the recent drop could have started the c wave correction of the final phase of the 4th wave. What do you guys think? To support the thesis, one can also see the momentum divergences and volume divergences that mimic the April-May carnage on the charts. Not trying to push fud around but just some technical analysis. I know that the on-chain metrics and yadi yada are bullish and all, but that ain't stopping whales to dump their bags. Hodlers can chill but 50X longers need to keep an eye out.

Not Financial Advice, have a great Sunday :)

BTCUSD potential short coming up! Hi guys,

This is my first post on TV but I am excited to join the community. I will be sharing some of my thoughts around day/swing trading Crypto and perhaps more instruments at a later stage as my TA and philosophy mature.

I decided to share some TA around the big boy BTC as my first go at making my TA public.

As always guys, this is not financial advice and purely ideas around what trades I am looking at next. Here we go,

We recently got rejected by the weekly level combined with the trend line which flipped as resistance.

We're currently bouncing at a support zone I had lined out with the blue box (and I am long from 47k). We're currently supported by:

POC of the range

Daily level

Global sellers .5 fib

1H 200 EMA (not shown)

Previous resistance/support zone

Multiple fib levels

My next trade would be a SHORT at the golden pocket (highlighted in red) and confluence for the short would be:

Untapped .66 from the seller's fib

Daily level

Previous support waiting to be flipped as resistance

the resistance trend line

We have a volume POC in that zone

I expect increasing bearish divergence on the 1H+ time frames

ENTRY: 49.3k - 49.5k

INVALIDATION: 49.8k: I prefer a tight stop loss as we might see a short squeeze in case we consolidate under the golden pocket

TAKE PROFIT: take profit 1 will be 45.5. I will monitor market structure and the strength of the rejection to find the next take profits.

Let me know your thoughts and if you are also looking for a short as your next day-trade.

XRP Update End of SepI hope October is bearish for anything that isnt the $, I would really expect some surprises this month in terms of what markets can do.

If XRP can see $0.175 again before November I would be a happy chap, great buying opportunity at this price, this daily fib extension line up nicely with the support below.

Lets see what PA develops at the start of October 🤞

$APT - Where to go from here (Short Term BEARISH)I forgot to post over the weekend my apologies but a quick overview of APT and what's it doing at the moment. Over the weekend we had somewhat of a bull flag going on after the break of the ascending triangle, as price approached the bottom support at 14.80 bears stepped in and dumped the stock as I mentioned before in my last post that could have been one of the possibilities that would happen. APT is currently in consolidation phase trying to understand where to go from here. So what does this mean now?

Currently I think that the bears are in control of the stock for now. I can see it hitting the $13 region and then it will bounce from that resistance and retest back up to $14.

Good luck!

*not financial adviser

We are headed to $5900BTC is going to go to at least $5900 before there will be another prolonged period of quiet price action. As it can be seen on the chart posted, a Bart pattern is about to complete. In addition to that, we have now completed an Adam and Eve double top. Get out while you can! She's coming down..

GBPAUD: SHORT TRADE IDEA (250 PIPS REWARD)GBPAUD is looking bearish as buyers are losing hold from the 61.8% fibonacci level, Hopefully bearish sentiment continues with this momentum and drive price downwards towards 1.9300 level(TP level). This would certainly be a move for next week.

Risk Warning : The risk of loss in trading Foreign Exchange (FOREX) can be substantial.

You should therefore carefully consider whether trading is suitable for you in the light of your financial condition.

Goodluck !

Happy Friday :)

Bitcoin looks like a short in near term and looks bullish in LTBitcoin is a very unique opportunity in the financial universe as it presents a possible change in how we value currencies and how we use currencies itself as we may well move from paper currencies to this new world of digital currency. That being said about the tremendous value of this new currency......you still have supply/demand and basic market scenarios playing out here which is that there may be a retracement coming up based on technical indicators. The product itself is revolutionary but price discovery will continue to be elusive as long as it's in this momo. hysteria type of phase. Going back to any investment that "went up like a straight line..........they ALL eventually retraced some if not a good bit" soooooo basically saying this is a revolutionary product and investment but will have many points of price discovery along the way. Right now......based on basic FIbs and MacD......Bitcoin could retrace to 16725 for a 23% Fib retrace or to 14914 area for a 38% Fib retracement.

NDX--Nasdaq 100 Short Term RetracementI have a couple lines drawn as you can see. Both provide what I think are points of resistance for a possible brief retracement. The orange line is a daily estimate and the blue line is a weekly estimate (you can switch the views in the upper left corner of your screen right next to the ticker--1D is one day, 1W is one week, etc.) Even though the blue line was drawn on a weekly chart, it still looks pretty decent to me on daily. I think NDX is possibly going down (only briefly; I think the Bulls are still pretty strong right now so don't panic) due to the two Black Crows which you can view with the chart set on weekly. Theory/Estimate #1--Orange is the resistance and the NDX will drop to 6220/6230ish within a couple days, or at the most by end of this week (Friday, December 08, 2017) and use that to bounce up. Theory/Estimate #2--Blue is the resistance and NDX will drop to roughly 6200ish and bounce. Blue resistance may take slightly longer than Orange; possibly a couple weeks. I think once it hits either of those resistance lines it will continue its uptrend. A wild card to consider: Christmas shopping is in full swing and the Market may reflect consumer spending, both online and at "brick and mortar" locations.

I am not a professional. I am an amateur who is not licensed, certified, or compensated (financially or otherwise) by anyone or any organization to give financial or Stock Market advice. Use your best judgment. I am not currently in any play, or hold any positions with or for NDX; nor do I plan to enter any during 2017.