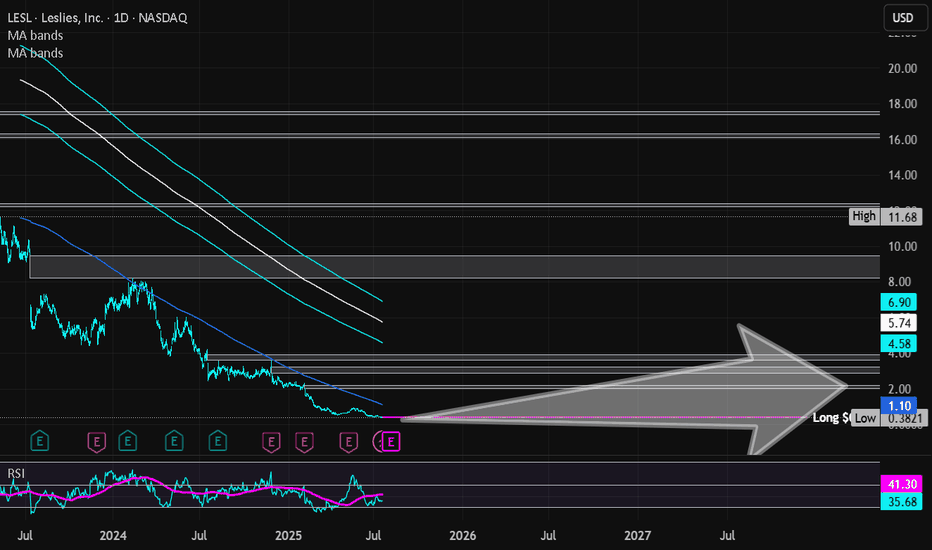

Leslies Inc | LESL | Long at $0.41**VERY risky trade - 25% or more risk of bankruptcy**

Leslies NASDAQ:LESL is a direct-to-consumer pool and spa care brand in the U.S., selling chemicals, equipment, and services. The stock dropped 88.86% last year due to weak demand, flat revenue, shrinking gross margins from stock write-downs, higher rent, shipping costs, and an earnings miss (-$0.25 vs. -$0.244). High debt, market share losses to e-commerce, and a competitive pool supply market also contributed.

On a positive note, the company generated $1.33 billion in revenue for fiscal year 2024. New leadership has entered the picture, cost-cutting is starting to happen, and summer season may boost pool sales. While 2025 is still projected to be a rough year, revenue is forecasted to grow 6.4% in 2026 and 2027 and earnings are likely to turn positive (based on company statements). While this is a *highly risky* play and there are absolutely better companies out there, I think there is a chance this ticker may get some steam in the near future. 7% short interest, 176 million float.

Thus, at $0.41, NASDAQ:LESL is in a personal buy zone.

Targets into 2027:

$1.00 (+143.9%)

$2.00 (+387.8%)

Shortinterest

Short squeezes are happening!Discussing some potential short squeeze candidates.

Some of these names have already bolstered huge gains and looking to potentially squeeze higher if price action holds firm.

All of these names need to be monitored in the near term for opportunities.

Shorts get nervous when stocks are moving higher.

AI, SPWR, CHWY, WOOF

WKHS Short Interest Rose Dramatically a Week Ago LONGThe daily chart of short interest for WKHS rose 6X beginning a week ago. The level is 13X

what it was in November. Coupled with the price action of today it is entirely plausible that

shorts are liquidating quickly given today's 25% breakout. Buyng to cover getting synergized

with new buyers could cause a trendline slope to escalate substantially morphing something

more or less curvilinear into more of a parabolic fit to the " trajectory". So the questions are

is this a short squeeze? How high of a price before the momentum slows or fails? Is it too late

to get in? Are other penny stocks potentially behaving in a similar fashion right now?

Is it even possible to short the shares of this penny stock or is it all put options covering

100 shares per each? This will be interesting for sure no matter how it plays out. I have

doubled my position earlier today and it was not a small one. Once I see signs of consolidation,

or some moving averages going flat towards a zero slope or a mass index indicator triggering.

I will take a piece out for the realization of some profit and hold the rest for whatever the

next more might be. I think the first sign that a squeeze is underway if for the tremendous

short interest volume to waterfall off a cliff.

Why is short interest in Best Buy less than its peers? What is the short interest in consumer electronics retailer Best Buy (NYSE: BBY) ahead of its second-quarter financial results on August 30?

On the last trading day, Best Buy had roughly 12 million shares in short interest, reflecting 5.97% of its outstanding shares. By midday Aug. 19, 5.5 million Best Buy shares are available to be shorted, according to management consulting company Fintel.

BBY stock dipped nearly 4% at close of trading Aug. 19 and had another marginal decline at the start of this week. The company’s stock was almost in the green last week, after peaking at $86.35 on Tuesday, and creating a new multi-month high. However, BBY eventually closed lower on the week thanks in part to the aforementioned 4% drop.

Keeping off the most shorted list

Despite the challenges it had to endure, Best Buy remains absent from the list of most shorted stocks.

The list of stocks on the most-shorted list in August, include Intercept Pharmaceuticals (NASDAQ: ICPT), Bed Bath & Beyond (NASDAQ: BBBY), MicroStrategy (NASDAQ: MSTR), WeWork (NYSE: WE), Upstart (NASDAQ: UPST), and Beyond Meat (NASDAQ: BYND). All the above stocks have short interest above 35.00% of its outstanding shares.

Best Buy's peer group average for short interest as a percentage of float is 25.57%, which means it has far less short interest than most of its peers.

Second-quarter outlook

Like other retailers, the company is sailing in murky waters given current macroeconomic conditions. High inflation rate, interest hikes and even energy cost could add more challenges to these companies.

For Best Buy, some think the company's revenue and profitability are on-track to recovery after record-lows in the first quarter, setting the stage for a long-term rebound after bottoming in July.

However, Best Buy, may not be so bullish in its own outlook. BBY is slated to announce second-quarter results on August 30 and it expects to report a roughly 13% decline in comparable sales and an approximately 7.5% hike in revenue compared with the pre-pandemic second quarter of fiscal-year 2022.

Best Buy CEO Corie Barry said, "as high inflation has continued and consumer sentiment has deteriorated, customer demand within the consumer electronics industry has softened even further, leading to Q2 financial results below the expectations we shared in May."

The company also plans to suspend share buybacks but assured the payment of quarterly dividends.

Nq - Short Interest / Gamma Squeee July 15 - July 21Call Buyers were able to earn off the July 15th Gamma Squeeze

into the Day prior to Expiry July 22nd, Friday.

Wall Street managed a near-perfect Trifecta on the move, flipping

the trade on its head into the Close Thursday.

Overbought Conditions moving into Friday assure the Squeeze has

a higher probability of Reversal.

__________________________________________________________

Kick 'em when they're down, kick 'em when they're up.

Perfection in Grifting MAximum Sh_t Mix

Algebra, brah... simple, basic Math that provided hope for the

Bulls and anxiety for the Bears.

It's a Counter-intuitive Trade on balance and what Traders need to

anticipate when we see large overbought readings for NQ.

We had that event with the Highest RSI of 2022 for NQ leading

into the TOSS.

___________________________________________________________

Aggravating - these perfect Pivots from Port to Starboard. The Boat

Tips and sends the mixed into the drink. Wall Street's Algos have become

extremely adept at siphoning off each and every spike in Liquidity within

the Options expected ranges.

This makes it difficult to determine exactly what they are doing on a

Weekly basis until Extremes are reached.

Unfortunately for most Options traders, the Pre NYSE has provided the

exit on Fridays if you are on the opposing side of the Ship.

____________________________________________________________

At present, it's a Holeshot range until the 2nd test of the recent highs

or an outright collapse to lower lows over the coming days to a week.

Short Sale VolumeThis excludes Dark Pool Derivatives as well as Notional Contracts Globally.

Since December there has been a large accumulation of Sell Positions.

The Positions were pressed on January 11, 2022.

__________________________________________________________________

Hedge Funds, Institutions, and Insiders have been selling at the fastest pace

in the prior 156 Months.

CRTX Cortexyme 51.19% of float shortedCRTX, Cortexyme, has one of the highest short floated in the market, 51.19%.

The only one with a higher short interest could be BKKT.

Price Target 1: $21.40

Price Target 2: $30.50

Stop loss: $10.50

Looking forward to read your opinion about it

BKKT Short Float 84.72% ! Ready for an Epik Gamma Squeeze ???BKKT perfectly touched the institutional support level of the Fibonnaci 0.618 retracement and now we see a doji trend reversal candle!

According to Finviz, the Short Float is 84.72%! I haven`t seen such a level since the GME gammasqueeze play!

About BKKT:

Cryptocurrency exchange Bakkt announced a partnership with Mastercard to offer crypto debit and credit cards.

Thanks to Mastercard and Bakkt, businesses and banks will be able to issue their own branded crypto debit and credit cards to consumers who want them.

How big do you think this can be?

Bakkt's also announced a separate deal with Fiserv .

Gavin Michael: “We want to provide consumer choice. We want to be able to provide the availability to use crypto currency in an everyday transaction,”

Is this the start of crypto adoption or what?

Bakkt also partnered with Google to allow its users to purchase goods and services using cryptocurrencies through the Google Pay wallet.

My price target is 66usd!

What is yours?

ROOT Short Squeeze candidateLook at that chart! Isn`t it beautiful?

ROOT, Root Inc. Cl A has the highest amount of FLOAT SHORTED in the market right now: 46.48%

The Average Volume is high, 8,099,037usd.

This should be a short squeeze candidate.

My price target is the 6.63usd resistance short term and 12.8usd in case of a short squeeze.

I look forward to read your opinion about it.

$CLOV short interest still high above 20%. Pre-earnings pump?CLOV (Clover Health) short interest has dropped from the 40%s to the 20%s, which is still relatively high. The technical setup here is optimal after $CLOV fell to 4-month support. I'd still like to see more volume here but we could see a quick pump to the $10 mark pre-earnings (August 11). Following the unusual options activity 32,000 call options expiring Jul 23 were opened at the $9 strike price today.

Massive Short SqueezeVIAC down from over $100 to less than $40 in a rapid decline, slow bleed for the last few weeks increased shorting.

Short Interest currently at over 100M shares on a float of 550M, solid company which got caught up in the forced liquidation of Archegos Capital positions.

Tightly packed Squeeze triggers above 20MA at 41.99,42.69,43.11,44.37,46.25,48.40,49.51.

Target $60 on Pop.

TKAT- Gamble on the NFT crazeGambling on TKAT is in a way not much different from gambling on blockchain stocks back in 2017.

Anything digital is a fair game in the realm of NFT as even tweet was up for sale as Jack Dorsey demonstrated that today.

TKAT's Insider ownership is almost 50% and TKAT's institutional ownership is close to zero, indicating the high volatility this stock possesses.

Volume has retraced more than 66% since it reached its record on Wed. It seems to me that TKAT is at beginning of the distribution stage.

Short interest is low and market is irrational so I'm not ruling out a modest correction followed by the continuation.

Game plan: Market buy 1/5, then fill out the rest in the demand zone.

TKAT is volatile. DO your own due diligence. Not the investment advice.

Buying Opportunity for $SDC$SDC is forming a diagonal led by an ascending trigonal into two bullish pennants (flag on the second). This stock has a large short interest and could pop off if it breaks the channel, but otherwise it still has large Elliott wave upside potential. Price target is listed at the top of the channel (C).

Chart looks bullish and it took a small dip to the edge of the channel on the daily. This is the 2hr for more accurate lines and technical indicators.

GME 226.42% short interest! (Surely after the squeeze)Hello, here I am updating you on the GME short story before anyone else (I got connections).

The FINRA updated the numbers. I don't know, maybe this is some kind of error? 226%! It's USO Oil all over again... They're tearing retail to pieces.

finra-markets.morningstar.com

A whole lot of novices got really excited AFTER Melvin got squeezed. Tried to warn them but they were too riled up.

They won a fight, felt empowered, then they overextended (overstayed their welcome) and got all mowed down.

"We're sticking it to the man", the man is up 80% on his short and probably locked in profit already.

AMC SI is down, from 78% to 38%, it did not get the "we're beating Wall Street" attention GME had so random novices did not get in throwing money at Wall St shorts.

finra-markets.morningstar.com

As always, the "little guy" is late to the party. I got called a "boomer" with a "boomer mentality" for not fomoing in, and laughed at for wanting to short sell...

This time short sellers have an extremely expensive entry, and I'm sure they have loads of cash behind them, retail won't push the price to $5000 and squeeze them.

I wonder why the price gapped after Melvin got liquidated. Short sellers noticing the crowd euphoria and baiting them? They took the bait so hard.

I wonder if regulators, and congress which is investigating Robinhood will be able to figure that one out?

It probably won't cross their minds that billions were made shorting the stock at the top when it suspiciously gapped up, and then buying was halted.

They have no clue so we might never find out. They're stuck on thinking "short sellers bad", "refuse to lose", "Robinhood stopped trading to stop the squeeze".

That's the dogma now. Maybe these many short sellers shorted "early", and they did want to stop the squeeze, and maybe not in which case good luck convincing the mindless herd of dogma addicts that the truth is something else.

Let's take a moment to remember Oil:

Robinhood bagholders did not even hold it (noobs rush to close at breakeven or tiny profit when it goes their way, and diamond hands hold when they lose), so what was the point of USO? It was just some "TA" ticker on a phone app to them? They could have bought a future with a 6, 12, 24 months expiry, that terrible ETF has heavily underperformed Oil, it was a good short (and long Oil future obviously - one with backwardation is that was available).

Back then you also had the novices that thought they were geniuses that spotted $1 Oil barrels and thought for some odd reason no one else wanted to buy those.

Boy did they learn their lesson when it went to -40!

Wall Street is Muhammad Ali, dancing around, teasing retail, and all these novices are his many angry opponents that rage at never being able to hit.

Nothing will ever change. Low skill, low knowledge, high excitation (emotional) players will keep losing, pros will keep winning, it's like the laws of gravity.

$GME - New Short Position - 3:1 R/RI believe the party is officially over for Gamestop.....and the WSB crowd.

Volume drying up, below several key EMAs, and a boatload of bearish fundamental catalysts. $215.00 is the support to watch for a break below - sellers will pile on if we lose this level.

We are short MOC at $225 on 02/01/2021 with a target of $113.50 and stop-loss of $262.00 for a 3:1 risk-reward ratio.

Feel free to comment and share your thoughts!

$GME is going to $500Contextual immersion trading strategy idea.

GameStop Corp. operates as a multichannel video game, consumer electronics, and collectibles retailer in the United States, Canada, Australia, and Europe.

The demand for shares of the company still looks higher than the supply.

I think the short squeeze will continue, thanks wallstreetbets.

Short interest over 100% and free money from FED are not a joke.

So I opened a long position from $220;

stop-loss — $80.

take-profit — $500.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!