Shortsetup

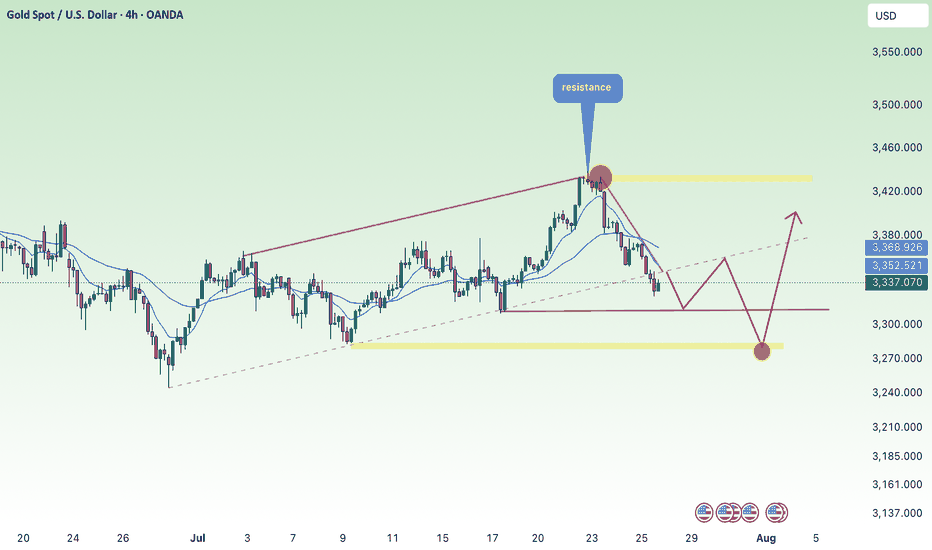

maintain selling pressure around 3300, GOLD ⭐️GOLDEN INFORMATION:

Gold prices extended their slide for a fourth straight session, falling over 0.60%, as the U.S. and European Union reached a weekend trade agreement that halved proposed tariffs on EU goods—from 30% to 15%. XAU/USD is currently trading around $3,312, after earlier touching a high of $3,345.

The trade breakthrough lifted market sentiment, boosting risk appetite. Meanwhile, the U.S. Dollar is regaining strength, with the Dollar Index (DXY)—which measures the greenback against a basket of six major currencies—rising 0.99% to 98.64.

⭐️Personal comments NOVA:

Gold price maintains selling pressure around 3300, continuing the downtrend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3353- 3355 SL 3360

TP1: $3345

TP2: $3332

TP3: $3317

🔥BUY GOLD zone: $3287-$3285 SL $3280

TP1: $3295

TP2: $3307

TP3: $3320

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

ZORA — Parabolic Rally Nearing ExhaustionZORA has been on an explosive run, pumping +1239% in just 20 days. But after such a vertical move, the question is:

Is this rally nearing exhaustion?

Let’s dive into the technicals 👇

🧩 Elliott Wave Structure

Looking at price action through the lens of Elliott Wave Theory, ZORA appears to be completing its 5th wave:

➡️ Wave 3–4 zone: Held around the $0.05 trading range

➡️ Wave 5: Now pushing into the $0.097–$0.103 zone

This area aligns with:

The 1.618–2.0 Fib extension pocket — a typical exhaustion zone for wave 5s

The $0.10 psychological level

🔴 Short Trade Setup

This zone between $0.097–$0.103 is the ideal reversal area to consider shorting, with clearly defined targets and confluence:

Entry: $0.097 – $0.103

Stop-Loss: Above the 2.0 Fib Extension

TP1: Around $0.08

TP2: Around $0.064

Confluence: TP1

Daily Open (dOpen)

0.786 Fib of the local move

0.382 Fib of the 5-wave structure

TP2 (Lower Target):

0.618 Fib retracement of the 5-wave move at $0.064

Risk-to-Reward:

TP1 gives an R:R of 1:8

TP2 offers potential 1:13+

Watch for signs of weakness.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

EURJPY – DAILY FORECAST Q3 | W31 | D28 | Y25📊 EURJPY – DAILY FORECAST

Q3 | W31 | D28 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

OANDA:EURJPY

Get liquidity at the beginning of the week, continue to decrease⭐️GOLDEN INFORMATION:

Gold (XAU/USD) continues to lose ground, slipping to around $3,335 in early Asian trading on Monday. The metal is on its fourth straight day of declines as easing geopolitical tensions and trade progress weaken safe-haven demand. Investors are now turning their focus to the upcoming FOMC policy decision on Wednesday.

Market sentiment has improved following a breakthrough in US–EU trade talks, with both sides agreeing to a uniform 15% tariff on traded goods, effectively ending months of stalemate. The new tariffs will come into effect on August 1. Meanwhile, the US and China are reportedly planning to extend their tariff truce for another three months, according to the South China Morning Post. The renewed risk appetite continues to pressure gold, traditionally favored in times of uncertainty.

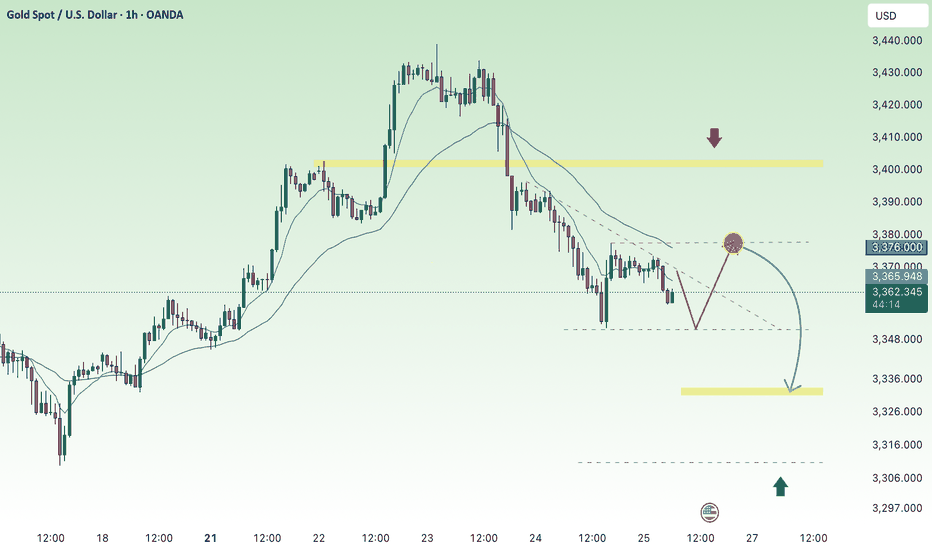

⭐️Personal comments NOVA:

Short-term recovery in Asian session, gold price takes liquidity and continues to accumulate below 3369

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3369- 3371 SL 3376

TP1: $3360

TP2: $3350

TP3: $3340

🔥BUY GOLD zone: $3305-$3303 SL $3298

TP1: $3314

TP2: $3330

TP3: $3342

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price continues to decrease, keep the rate unchanged✍️ NOVA hello everyone, Let's comment on gold price next week from 07/28/2025 - 08/1/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) looks set to close the week lower, pressured by upbeat U.S. economic data and progress in trade negotiations, which have reduced demand for safe-haven assets. Despite declining U.S. Treasury yields, the U.S. Dollar regained some ground. At the time of writing, XAU/USD is trading around $3,336, down nearly 1%.

Looking ahead, the Federal Reserve is widely expected to keep interest rates steady at 4.25%–4.50% for the fifth time this year. Recent data supports this stance, with Initial Jobless Claims falling for the fourth straight week—signaling a resilient labor market—while Friday’s sharp drop in Durable Goods Orders, driven by weaker aircraft demand, adds a mixed tone to the outlook.

⭐️Personal comments NOVA:

Gold prices continue to fall as interest rates remain unchanged almost this week. Along with the H4 time frame, prices continue to break important support and continue to follow a downward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3350, $3428

Support: $3312, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

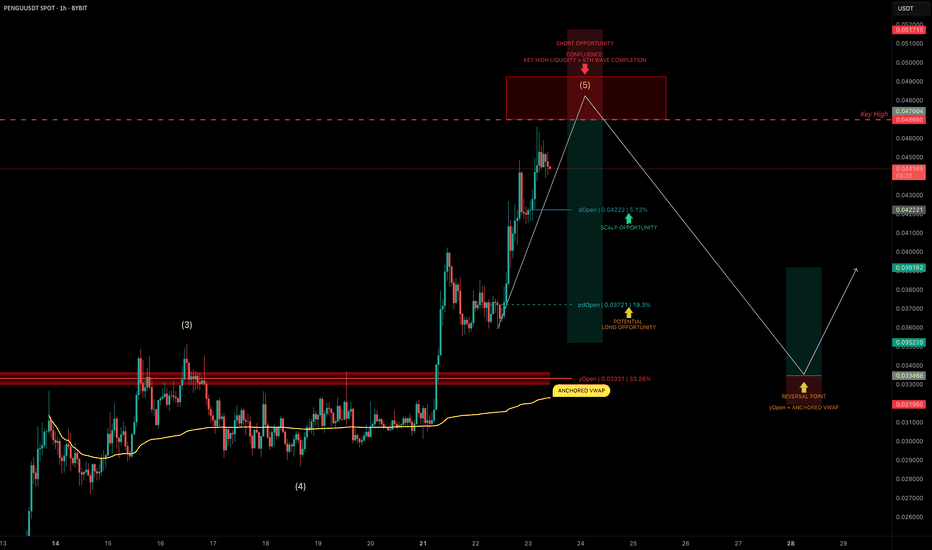

PENGU Topping Out? Targeting 30% Downside After Liquidity SweepPENGU has had an explosive run, but it now looks to be nearing completion of wave 5 of its current Elliott impulse.

We’re approaching a key high at $0.04698, a likely liquidity grab zone — and potentially a great area to position for a short trade.

🧩 Short Setup Overview

➡️ Wave 5 Completion Incoming:

Price is showing signs of exhaustion as it approaches $0.04698, where liquidity is likely stacked above the previous high.

➡️ SFP Trigger Zone:

Watch for a swing failure pattern (SFP) at $0.04698 — confirmation for a potential short entry.

➡️ Psychological Resistance:

The $0.05 level also sits just above — a classic psychological barrier that may get tapped or wicked into.

🔴 Short Trade Setup

Entry: After a confirmed SFP at $0.04698–$0.05

Target (TP): Yearly Open (yOpen) — potential move of ~30%

Stop-loss: Above post-SFP high

R:R: Excellent asymmetry if setup confirms

🛠 Indicator Note

In this analysis I'm using my own indicator called "DriftLine - Pivot Open Zones ", which I recently published.

✅ It helps highlight key open levels, support/resistance zones, and price structure shifts — all critical for confluence-based trade planning.

Feel free to check it out — you can use it for free by heading to my profile under the “Scripts” tab.

💡 Educational Insight: How to Trade Wave 5 Liquidity Sweeps

Wave 5 tops often trap late longs, especially when paired with psychological levels and key highs.

➡️ Patience is key — wait for a rejection pattern or SFP before entering.

➡️ Liquidity sweeps first — then the move.

Final Thoughts

PENGU is pushing toward $0.04698–$0.05, but this may be its final move up before correction.

With the yearly open as a logical target, and clear confluence via DriftLine, this setup offers a clean short opportunity — if confirmation comes.

Stay sharp, let price lead, and trade the reaction — not the prediction.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

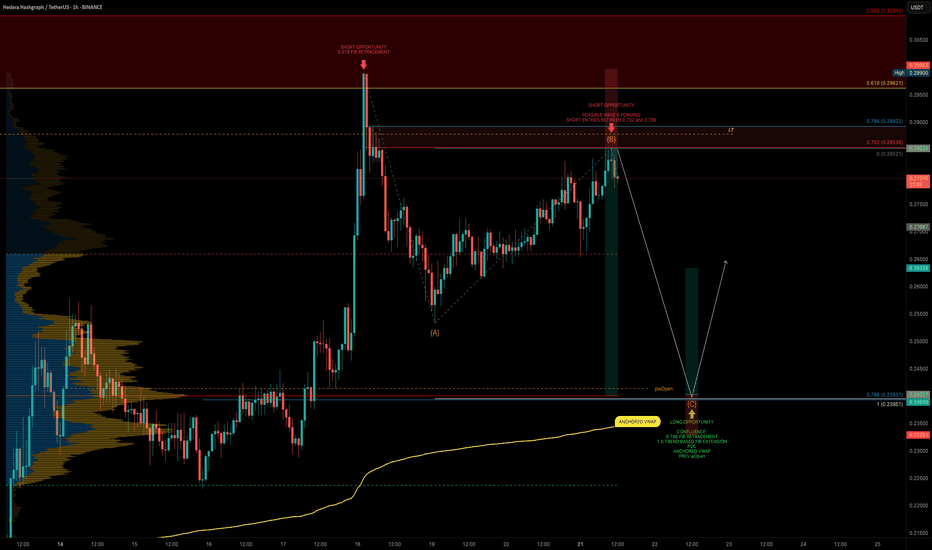

HBAR Game Plan: Short the Bounce, Long the Liquidity GrabHBAR has been moving strongly and is currently offering both short and long trade opportunities based on a clean potential ABC corrective pattern, key fib levels, volume profile, and anchored VWAP. Let’s break down the setup.

🧩 Technical Breakdown

Higher Timeframe Confluence:

0.618 fib retracement from the macro move

1.618 trend-based fib extension

1.272 VWAP band resistance

Point of Control (POC) from the visible range profile

This is marked as a major take profit/short opportunity zone.

For extra confluence, the negative fib extension golden pocket (-0.618 to -0.666) also aligns right at this resistance zone

Current Structure:

We’re potentially completing wave B of an ABC corrective move

Price has retraced into a high-probability short zone

🔴 Short Setup

Entry Zone:

Between the 0.702 and 0.786 fib retracement levels

Why Here?

0.702–0.786 fib retracement → short zone for reversals

Potential wave B top → setting up for a C leg down

Target (TP):

Around $0.25–$0.24, near the expected wave C completion

🟢 Long Setup

Entry Zone:

~$0.25–$0.24 area.

Why Here?

This zone is a strong confluence area:

➡️ 0.786 fib retracement

➡️ 1.0 trend-based fib extension of ABC

➡️ Anchored VWAP from the entire trend, offering dynamic support

➡️ Liquidity pool

➡️ Previous weekly Open

Plan:

Wait for price to complete wave C into this zone, then look for bullish reaction signs to enter long.

💡 Educational Insight

Why the 0.702–0.786 short zone?

These fib levels are often overlooked but are key “hidden” zones where wave B tops out before C waves.

Why anchored VWAP?

Anchored VWAP gives you dynamic institutional support/resistance, especially when aligned with fibs and liquidity.

Why wait for confirmation?

Blindly longing or shorting levels can trap you. Wait for SFPs, wick rejections, or lower timeframe structure flips to boost trade probability.

Final Thoughts

HBAR is in a highly interesting zone, offering both:

A short setup into the C wave,

And a long setup at the C wave completion, backed by multiple confluence factors.

Let the levels come to you and wait for confirmation!

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

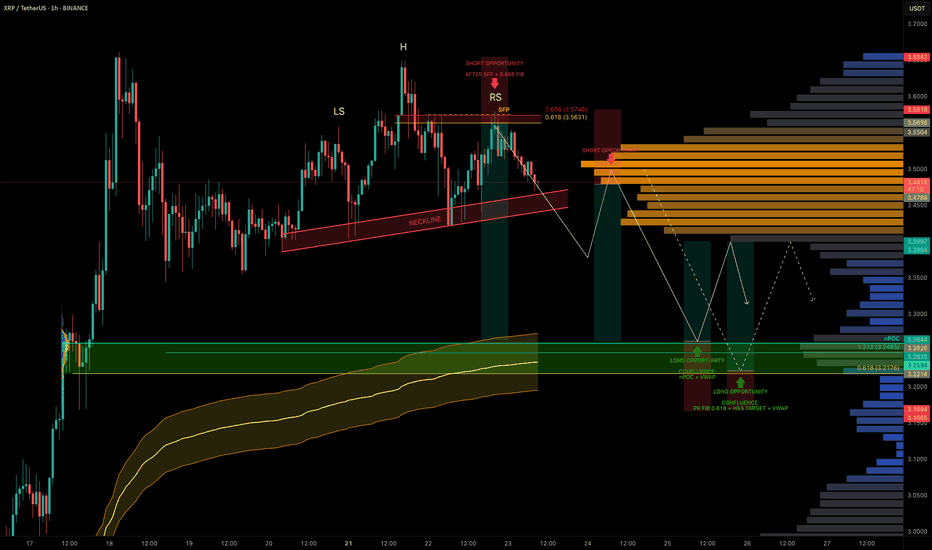

XRP Coiled in Range — Liquidity Below, Trade Setups AheadXRP has been stuck in a trading range around $3.50 for the past 5 days, offering multiple trade opportunities within the chop.

A notable short was triggered after a swing failure pattern (SFP) at the 0.666 fib retracement level near $3.563.

Now, with liquidity building to the downside, we’re watching closely for the next high-conviction setups.

🧩 Current Structure & Short Setup

🔴 Short Opportunity (Triggered):

SFP + 0.666 fib retracement at $3.563 led to rejection.

Market now shows a head & shoulders pattern forming.

Target: $3.2176 (0.618 fib retracement).

Trigger: Watch for a neckline break + retest for short confirmation.

Stop-loss: Above the right shoulder.

🟢 Long Setup:

Watching for a high-probability long around:

$3.26 → nPOC + 1.272 TBFE

$3.23 → anchored VWAP bands

This zone offers strong confluence and could act as the next launchpad.

Long Trade Plan:

Entry Zone: potential entries between $3.26–$3.22, price action needed for confirmation

Stop-loss: Below swing low at $3.1675

Target (TP): ~$3.40

✍️ Plan: Set alerts near the lows and react to price action at the zone — don’t front-run, let structure confirm.

💡 Pro Tip: Trade the Confluence, Not the Emotion

High-probability trades come from confluence, not guessing.

This setup combines nPOC, TBFE, VWAP, fib levels, and classical market structure (H&S) to map precise zones for both longs and shorts.

Let price come to you and wait for confirmation — especially in a rangebound environment where liquidity hunts are frequent.

Final Thoughts

We’re still rangebound, but liquidity is building below.

Keep an eye on the $3.26–$3.22 support zone for long entries and the H&S neckline for short breakdown confirmation.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

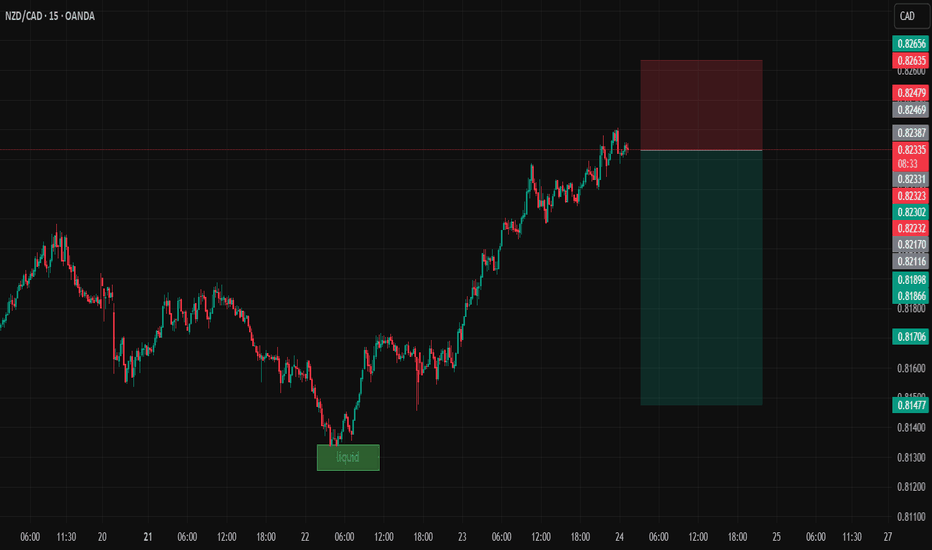

NZDCADDate:

July 24,2025

Session:

Tokyo and London session

Pair:

NZDCAD

Bias:

Short

liquidity pool that is waiting to be swept this week. Looks like price is gonna be magnetized towards that pool level during London and Tokyo. The trade may even stretch into NYC.

Entry: 0.82331

Stop Loss: 0.82635

Target: 0.81475

RR: 2.81

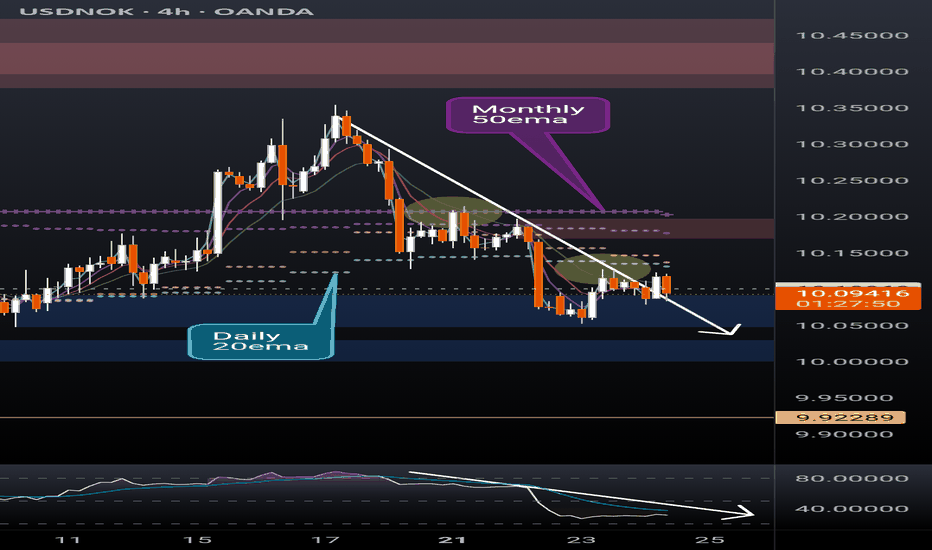

USDNOK short potential setupUSDNOK recently broke down below the monthly 50ema (overlayed on this 4h chart) and has rejected off the daily 20ema (overlayed) twice this week. RSI is showing bearish momentum after a brief overbought period while the PA has remained in a strong downtrend. Short setup potential is evident but not certain.

I'm a cat not a financial advisor.

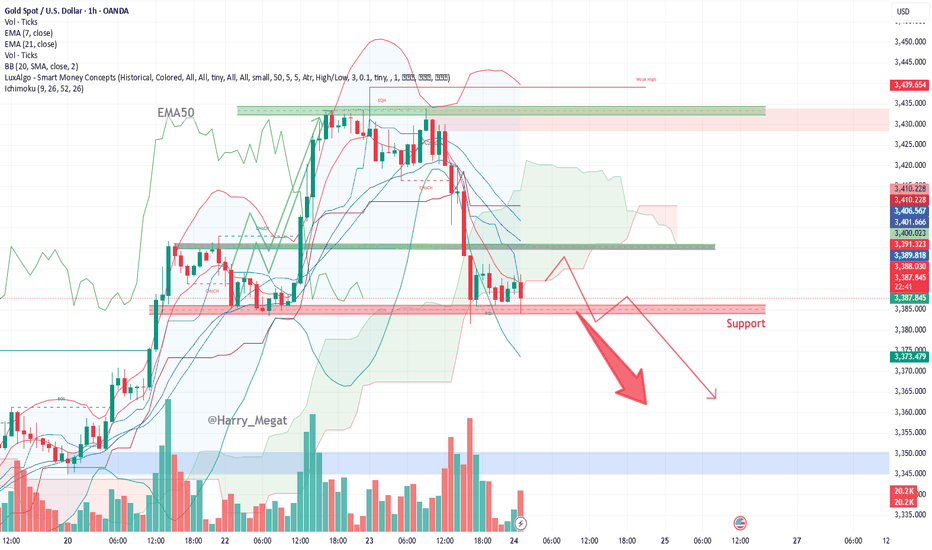

Chart Analysis Gold (XAU/USD)Chart Analysis Gold (XAU/USD)

**Bearish Outlook (Short-Term)**

* **Price is below EMA 7 and EMA 21**, showing short-term bearish momentum.

* Strong **resistance zone** around **\$3,430–\$3,440** was rejected sharply.

* Price has broken below **\$3,405–\$3,395** support and is now **consolidating above \$3,385–\$3,380**, a critical support area.

* Volume is rising on red candles, supporting **selling pressure**.

**Key Support Zone:**

\$3,380 – If broken, next downside targets:

→ **\$3,370**

→ **\$3,360**

*Bullish Scenario (If Support Holds)**

* If **\$3,380** holds and price reclaims above **\$3,395**, a **bounce toward \$3,405–\$3,410** is possible.

* Look for a **break above EMA21 (currently near \$3,402)** for bullish confirmation.

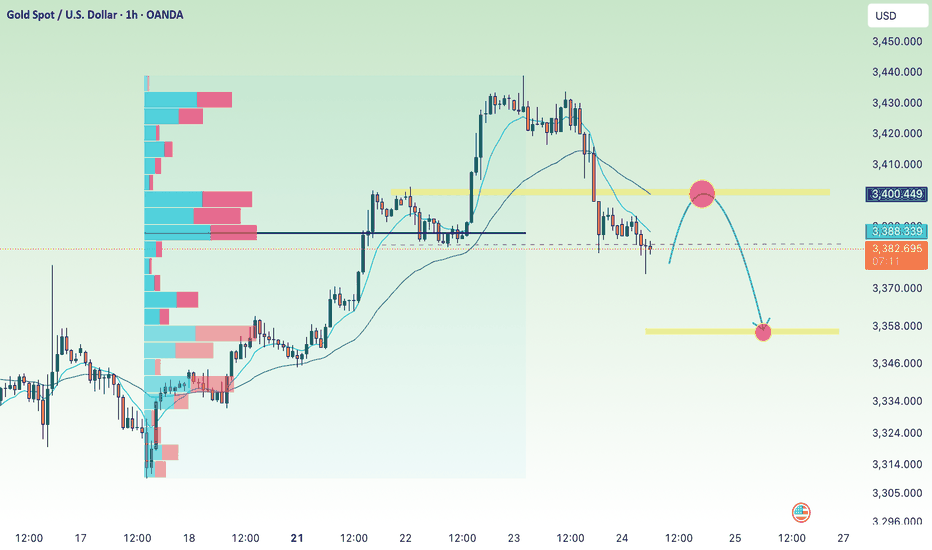

Gold selling pressure decreased at the end of the week⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) remains under modest pressure during Friday’s Asian session, unable to build on the previous rebound from the mid-$3,300s. Renewed strength in the US Dollar, which extends its recovery from a multi-week low, acts as a headwind for the non-yielding metal. Additionally, fresh optimism surrounding the US-Japan trade agreement has dampened safe-haven demand, keeping gold on the defensive for the third consecutive day.

That said, lingering uncertainty over the Federal Reserve’s rate-cut trajectory, along with concerns about its independence amid growing political pressure, could limit the USD's upside. Meanwhile, rising geopolitical tensions—this time along the Thailand-Cambodia border—may lend some support to bullion. Investors now await US Durable Goods Orders data, which could influence the greenback’s direction and provide short-term cues for the XAU/USD pair going into the weekend.

⭐️Personal comments NOVA:

Gold prices are consolidating and starting to fall below 3400 to stabilize. The momentum for an early rate cut is waning.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3399- 3401 SL 3406

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3310-$3312 SL $3305

TP1: $3325

TP2: $3333

TP3: $3345

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices under selling pressure from tariff policy⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) stays under pressure during Thursday's Asian session, extending the sharp pullback from its highest level since June 16 seen the previous day. Optimism surrounding global trade continues to build, fueled by reports that the United States and the European Union (EU) are nearing a tariff agreement, following progress in the US-Japan trade deal. This upbeat sentiment has dampened safe-haven demand and is a major factor weighing on gold prices.

⭐️Personal comments NOVA:

Gold price adjusted down, broke support, faced selling pressure again, accumulated below 3400

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3400- 3402 SL 3407

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3356-$3354 SL $3349

TP1: $3365

TP2: $3373

TP3: $3382

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

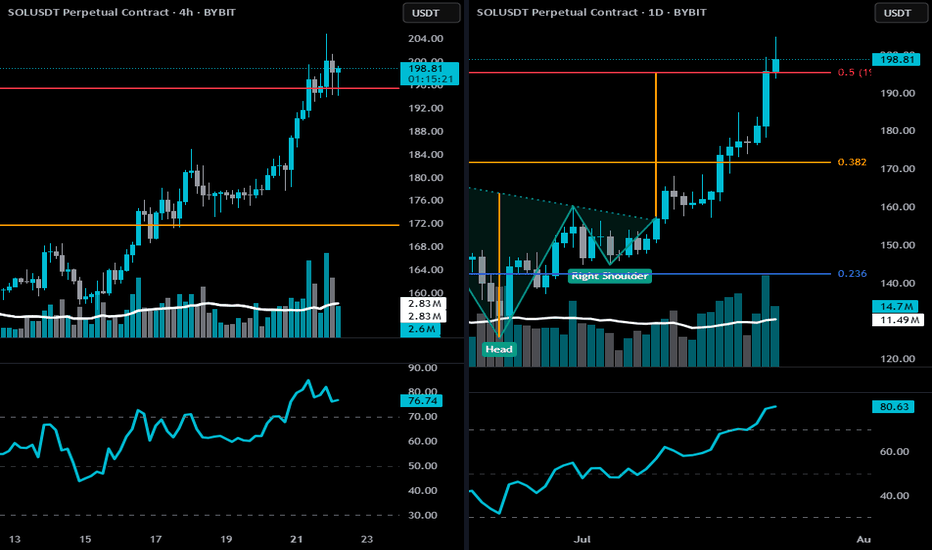

SOL CRUSHING-bearish risks developing🔻 4-Hour Bearish Thesis

🔸 Price Action Clues

SOL is currently stalling at the 0.5 Fibonacci retracement (~$198.18) of the full macro move — a classic profit-taking zone.

Multiple upper wicks and indecisive candles at resistance indicate supply absorption and buyer exhaustion.

After a steep rally, price is moving sideways in a rising wedge/flag, which is a bearish continuation pattern if broken downward.

🔸 Momentum + RSI

RSI at 76 is extended and flattening — often a zone where short-term pullbacks begin.

No confirmed bearish divergence yet, but momentum is weakening compared to earlier stages of the rally.

🔸 Volume Profile

Volume on recent pushes is lower than during breakout, suggesting diminishing bullish conviction.

Bearish if a breakdown below $194 occurs — that's the former breakout level and wedge support.

🧨 4H Breakdown Confirmation

Break below $194 (key short-term support) → opens downside targets:

🔻 $186–$182 (prior breakout base)

🔻 $171 (0.382 Fib retracement zone)

🔻 Daily Bearish Thesis

🔸 Price Action + Key Zone

Price is pressing against the neckline target ($198.18) of the inverse H&S pattern.

Stalling under the red resistance line and 0.5 Fib.

Recent candle closed with a small upper wick + reduced body size, hinting at hesitation after a parabolic run.

🔸 RSI Risk

RSI is at 80.41 — very overbought on daily.

While not immediately bearish on its own, this often precedes either:

Sharp correction, or

Prolonged consolidation

🔸 Fibonacci & Macro Resistance

$198–$200 is a confluence zone of:

0.5 Fib retracement

Previous structural resistance

Measured target of inverse H&S pattern ALREADY HIT.

This is not a great spot to initiate new longs — any weakness here invites a pullback.

⚠️ Invalidation of Bearish Thesis

A strong daily close above $200–$204, ideally with expanding volume, would invalidate the bearish outlook and shift momentum toward $219 (0.618 Fib).

🧠 Summary:

Yes, there is a short-to-mid-term bearish risk developing on both 4h and daily:

Overbought RSI

Stalling at major Fib resistance

Decreasing momentum

Vulnerable if $194–$195 breaks

Remember: this WILL MOST LIKELY BE A SHORT-SHORT pullback, not a confirmed trend reversal… yet. BUT I'VE INITIATED A STARTING POSITION!

THIS IS NOT FINANCIAL ADVICE. DrAnkin Smöökëē Whizkee. Edumacational Purpiz Only!

Open AI building it's own Browser- Open AI building it's own Browser. They have the talent to build it.

- Apple buying Perplexity AI

- MARKETSCOM:GOOGLE chrome isn't the best. I find Firefox better than Chrome but that's subjective. There's no stickiness in web browsers honestly. It's just that there are no good options.

- Recently, Google chrome added some weird looking AI summarizer on top which must be reducing number of organic hits to the website.

- I'm bullish long term but bearish short term. Open AI is really disruptor and has strong talent density better than Google in my opinion.

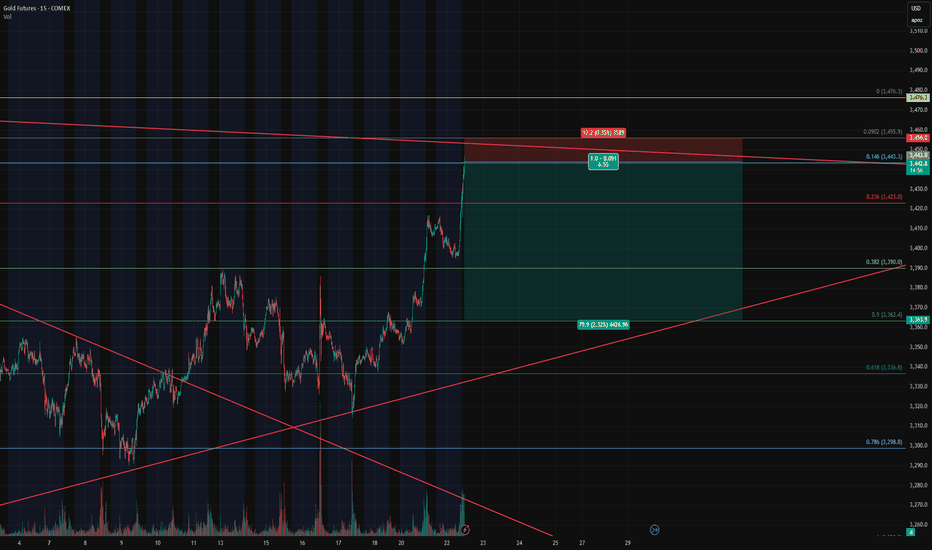

Gold Futures – Closing Longs and Flipping Short at Key Fib🔴 Gold Futures – Closing Longs and Flipping Short at Key Fib Confluence

Instrument : Gold Futures – COMEX ( COMEX:GC1! )

Timeframe : 15-Minute

New Position : Short

Entry Zone : ~3442

Target : ~3362

Stop Loss : ~3458

Risk/Reward : Approx. 6.5+

Setup Type : Reversal from Overextension / Fib Resistance

💡 Trade Recap & Strategy Shift

We’ve officially closed both our recent long entry and our larger swing long position, locking in substantial profit on this move off the 0.618 retracement.

Now, we’re flipping short based on the following:

Price reached the 0.146 Fib extension from the previous retracement leg, a level often overlooked but powerful when confluence lines up.

Trendline resistance from the upper channel has been tagged.

Momentum is showing early signs of stalling after a strong vertical push — textbook overextension.

The rally into this level lacked divergence or structural buildup, increasing the chance of a snapback.

🛠️ Short Setup Details

Entry: 3442 (after signs of exhaustion near Fib confluence)

Target: 3362 (prior structure + 0.382 retracement)

Stop Loss: 3458 (just above high / resistance zone)

Risk/Reward: 6.5:1 — excellent profile for a countertrend play.

📌 Watch For

A break below 3390 will be key confirmation of momentum shifting back down.

Failure to hold 3442 on a retest will invalidate the short and re-open the door for a squeeze higher to 3476/3480.

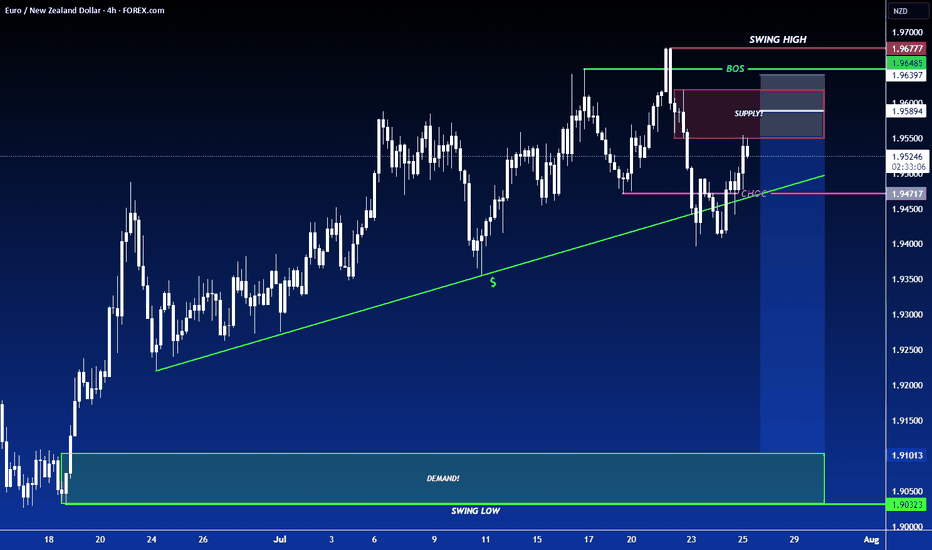

With trend exhaustion in sight and high confluence resistance overhead, we’re taking the opportunity to pivot short — fully aware of the volatility this region can bring.

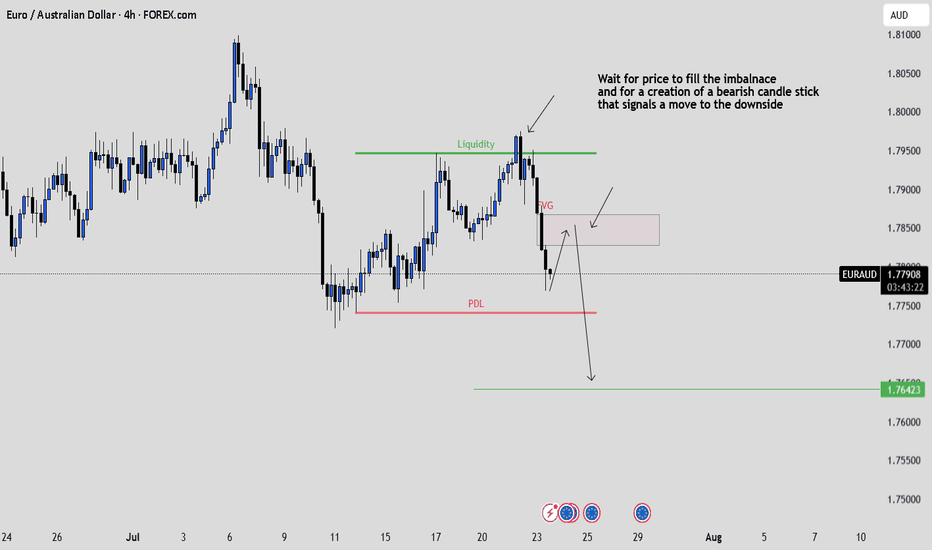

EURAUD: Waiting for the FVG Tap and Confirmation to ShortPrice ran previous liquidity and dropped aggressively, creating a clean FVG.

I’m now watching for price to retrace into that imbalance and form a strong bearish candle. If it does, I’ll be looking to short down

Clean structure. Just waiting for confirmation.