PENGU / USDT : Breaking down from Trendline supportPENGU/USDT is breaking down from the trend line support, but the retest is still in progress. Watch for rejection at key levels.

Pro Tip: Wait for confirmation of rejection before entering the trade and always apply proper risk management to safeguard your position.

Shortsignal

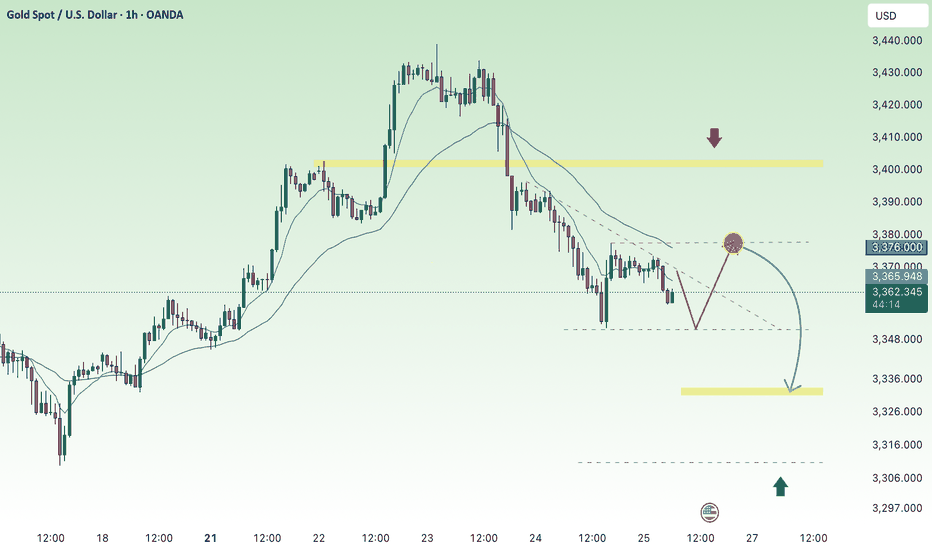

maintain selling pressure around 3300, GOLD ⭐️GOLDEN INFORMATION:

Gold prices extended their slide for a fourth straight session, falling over 0.60%, as the U.S. and European Union reached a weekend trade agreement that halved proposed tariffs on EU goods—from 30% to 15%. XAU/USD is currently trading around $3,312, after earlier touching a high of $3,345.

The trade breakthrough lifted market sentiment, boosting risk appetite. Meanwhile, the U.S. Dollar is regaining strength, with the Dollar Index (DXY)—which measures the greenback against a basket of six major currencies—rising 0.99% to 98.64.

⭐️Personal comments NOVA:

Gold price maintains selling pressure around 3300, continuing the downtrend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3353- 3355 SL 3360

TP1: $3345

TP2: $3332

TP3: $3317

🔥BUY GOLD zone: $3287-$3285 SL $3280

TP1: $3295

TP2: $3307

TP3: $3320

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold selling pressure decreased at the end of the week⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) remains under modest pressure during Friday’s Asian session, unable to build on the previous rebound from the mid-$3,300s. Renewed strength in the US Dollar, which extends its recovery from a multi-week low, acts as a headwind for the non-yielding metal. Additionally, fresh optimism surrounding the US-Japan trade agreement has dampened safe-haven demand, keeping gold on the defensive for the third consecutive day.

That said, lingering uncertainty over the Federal Reserve’s rate-cut trajectory, along with concerns about its independence amid growing political pressure, could limit the USD's upside. Meanwhile, rising geopolitical tensions—this time along the Thailand-Cambodia border—may lend some support to bullion. Investors now await US Durable Goods Orders data, which could influence the greenback’s direction and provide short-term cues for the XAU/USD pair going into the weekend.

⭐️Personal comments NOVA:

Gold prices are consolidating and starting to fall below 3400 to stabilize. The momentum for an early rate cut is waning.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3399- 3401 SL 3406

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3310-$3312 SL $3305

TP1: $3325

TP2: $3333

TP3: $3345

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bears pressure early week below 3300⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) face renewed selling pressure, dipping toward the $3,320 level during the early Asian session on Monday. The pullback comes as June’s stronger-than-expected US Nonfarm Payrolls (NFP) report has reshaped market expectations around the Federal Reserve’s (Fed) policy path. Investors now turn their attention to the upcoming release of the FOMC Minutes on Wednesday for further guidance.

The US economy added 147,000 jobs in June, beating expectations and slightly up from May’s revised figure of 144,000. Meanwhile, the Unemployment Rate held steady at 4.1%. These figures reinforced the view that the labor market remains resilient, thereby lowering the odds of an imminent Fed rate cut. As a result, the US Dollar has strengthened, weighing on non-yielding assets such as Gold.

⭐️Personal comments NOVA:

Downtrend at the beginning of the week, gold price returns to accumulate below 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3337- 3339 SL 3344

TP1: $3328

TP2: $3312

TP3: $3300

🔥BUY GOLD zone: $3297-$3295 SL $3290

TP1: $3308

TP2: $3320

TP3: $3330

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC/USD Short Setup – Breakdown from Bear Flag Edge🚀||| 👆Your Boost is appreciated in Advance👆 |||🚀

Thesis: Bitcoin is trading within a well-defined descending channel, potentially forming a bear flag on the higher time frame. Price is currently hovering just below the key resistance zone near $108,600 (“The Edge”), failing to reclaim the upper boundary of the flag.

==================================================================

Entry: 🔻 Short at $106,850 – Price is rejecting the upper channel resistance and failing to break above “The Edge”

Stop-Loss: 🔺 $109,000 – Above the recent swing high and invalidation of the flag structure

Take-Profit 1: ✅ $104,700 🎯

Take-Profit 2: ✅ $102,400 🎯

Optional extended:

TP4: $98,000 – Full measured move of the flag breakdown

Risk-Reward Ratio: ~1:1 to 1:4 depending on target

====================================================================

#MJTrading

#BTCUSD #Bitcoin #CryptoTrading #ShortSetup #BearFlag #TechnicalAnalysis #PriceAction #MarketStructure #SwingTrade #TradingView

SHORT ON EUR/GPBWe have a rising channel (bearish reversal chart pattern) at a major level of resistance (confluence)

Price has given us a breakout of the channel to the downside and is currently respecting resistance.

I will be selling EUR/GBP to the next support level looking to catch over 120 pips.

Gold prices continue temporary downtrend⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) came under renewed selling pressure during Friday’s Asian session, dipping to their lowest level in over a week, near the $3,344–$3,345 range. The decline was largely driven by the Federal Reserve’s hawkish tone, which emphasized persistent inflation risks and suggested a more gradual path to interest rate cuts—dampening demand for the non-yielding precious metal. Nevertheless, fragile market sentiment and a cautious risk environment may continue to lend some support to gold, potentially cushioning it against steeper declines.

⭐️Personal comments NOVA:

Selling pressure continues to maintain, pushing gold price down to 3304 today, the downtrend price line is maintaining well.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3418- 3420 SL 3425

TP1: $3400

TP2: $3382

TP3: $3370

🔥BUY GOLD zone: $3306-$3304 SL $3299

TP1: $3315

TP2: $3328

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

GBPUSD consolidates resistance zone and declinesPlan GBPUSD day: 16 June 2025

Related Information: !!!

The Pound Sterling (GBP) ticks up to near 1.3590 against the US Dollar (USD) so far on Monday, remaining inside Friday’s trading range. The GBP/USD pair is expected to keep trading within a tight range as investors have sidelined ahead of monetary policy announcements by the Federal Reserve (Fed) and the Bank of England (BoE), due on Wednesday and Thursday, respectively.

At the start of the week, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, edges down to near 98.00.

Investors will closely monitor the interest rate guidance from both central banks, while they are expected to leave those unchanged at their current levels

personal opinion:!!!

At the beginning of the week, there was not much important news. GBPUSD price was sideways and reacted to resistance and support zones.

Important price zone to consider :

SELL point: zone 1.35950

Sustainable trading to beat the market

Adjusted down 3385 at the beginning of the week⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) climbed toward $3,445 during the early Asian session on Monday, marking their highest level in over a month as mounting tensions in the Middle East and growing expectations of a Federal Reserve rate cut bolstered demand for safe-haven assets.

Despite stronger-than-expected US economic data on Friday, investors remained focused on geopolitical risks. The University of Michigan’s Consumer Sentiment Index for June jumped to 60.5, well above the consensus forecast of 53.5 and May’s reading of 52.2. However, markets largely shrugged off the data.

Instead, attention turned to the escalating conflict in the Middle East, where Israel’s recent strike on Iran has intensified fears of broader regional instability. In response, Iranian authorities warned they would “respond firmly to any adventurism,” reinforcing gold’s appeal amid global uncertainty.

⭐️Personal comments NOVA:

At the beginning of the week, gold prices adjusted slightly down, returning to the liquidity zone of 3385, before continuing the uptrend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3462- 3464 SL 3469

TP1: $3450

TP2: $3440

TP3: $3430

🔥BUY GOLD zone: $3390-$3388 SL $3383

TP1: $3400

TP2: $3410

TP3: $3422

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC accumulates, back to 108,500Plan BTC today: 16 June 2025

Related Information:

The price of gold is nearing its all-time high as tensions in the Middle East escalate, but analysts say they’re doubtful Bitcoin will do the same as investors prioritize other safe-haven assets.

The price of gold rose to $3,450 per ounce on Monday, just $50 shy of its all-time high of just below $3,500 in April, according to TradingView.

The usually slow-to-move asset has gained a whopping 30% since the beginning of the year, catalyzed by US President Donald Trump’s trade tariffs and, more recently, an escalation of military action in the Middle East following an Israeli missile strike on Iran on June 13, which caused Bitcoin prices to fall.

Gold prices have also been linked with inflationary pressures, as it is considered a safe haven and an inflation hedge by investors.

personal opinion:

The crypto market recovered at the beginning of the week after being affected by war news. It will almost certainly continue to maintain the 4.5% interest rate, so it will be difficult to break ATH this week.

Important price zone to consider :

Sell point: zone 108.400 - 108.600 SL : 109.100

Take profit : 107.900 - 107.000 - 106.000

Sustainable trading to beat the market