SPX / SPY - 30Min View - Morning Update30Min view of SPX shows we stayed within the current wedge pattern for the most part.

There was a small increase above the resistance line which moved the tip of the pattern back by 7 hours. (I don't think this is big deal)

10WeekMA is coming from below like a shark. IMO we have less than a week before SPY/SPX turns down.

News - Steve Bannon was on CNBC this morning (video not up yet). He said Trump will "Drop the hammer on Sunday". Referring to tariffs.

I will update this article if/when CNBC uploads on their YouTube.

Daily view from yesterday

Weekly view

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL.

Shortspy

SPY - 30Min View - Moving Average Prediction for DownturnUsing the 10WeekMA for SPY we can see selloff's occur the last 3 times when price was within $8.60 or less of the moving average (red zigzag).

We are currently less than $8.60 from the moving average - but no selloff.

If we use the normal moving average on 64bars, and ignore the double jump up, by 12/13 price is closer than last selloff.

Last selloff price was $6.70 from moving average, so this would imply we selloff or breakout of the yellow wedge (highly unlikely).

If we breakout to the upside of the wedge, it is possible for the lag to continue for the selloff.

But based on the current wedge being bearish, price being within range of MA for selloff, and 2 fakedowns....we are ready.

Note - If we use the 10WeekMA that is acclerated, we will cross sooner. The gray boxes are almost cut in half. I took the longest expectation here to avoid disappointment.

Exits

-After I post an update when selloff starts (best outcome)

-White top of wedge if FOMO takes us even further into unrealistic outer space

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL

AAPL - Sticking To My Before Year End Prediction - Going DownBased on the Daily trend with AAPL, and the high correlation with SPY, I see us taking our trip down before year end.

The moving average is too close to price with AAPL.

The blue resistance line is multi-year (forming in 1998 see Outter Space Chart) and I don't see price going beyond blue resistance by more than $10.

By next week the 10WeekMA will be around $263.

This implies that price will either cross the MA in a downtrend, or price will go outside blue resistance to escape.

Since the resistance has held for almost 20 years, I consider this strong, so price will go down.

Weekly chart below shows weekly trend extremely close to Bearish flip.

Outter Space chart below shows blue multi-year resistance will most likely not be exceeded.

We stay within blue lines...just like since 1998 LOL

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL

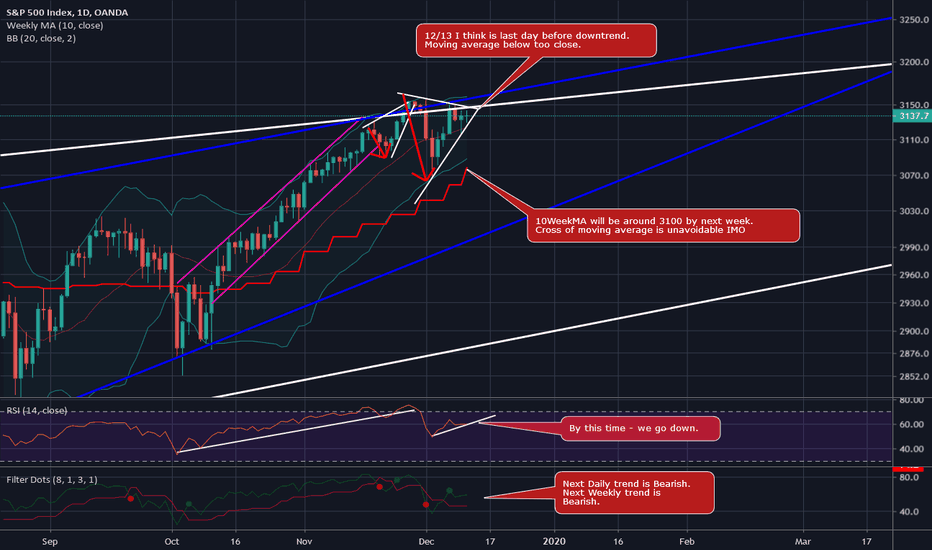

SPX / SPY - Morning Update - Moving Average Getting CloseSPX / SPY - the final wedge within a wedge pattern has little room left to expand further IMO.

Top white resistance line is multi-month resistance from Weekly view chart from 12/9 (see link below).

RSI trend is already high in position and short.

Bollinger Bands are tight. Going back in pattern, last time price angle like this with tight bands we have correction.

By next week, the 10WeekMA will be within striking distance at 3100 on SPX.

Last times we are this close in price to MA we go down.

Next Daily trend is Bearish. Next Weekly trend is Bearish, very close to flipping, and is overextended. We are close.

Exits

1- Blue support line around 3050

2- White support line 2920

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL

AAPL - 10WeekMA Cross UnavoidabaleThe fake breakdown in AAPL and SPY is getting old, but the moving average cross is becoming unavoidable.

The blue resistance line in the AAPL chart is multi-year resistance (hard to breakout).

10WeekMA is pressing upwards toward this blue resistance line, leaving price no room.

10WeekMA is moving roughly $1 per day closer ($4.90 every 5 days).

With current white trendline ending 12/13, coinciding with tariffs, the moving average will be at $261 by this time.

Price will be $5 away from Moving Average right before Xmas.

Everything is lining up - although this is cutting is closer than I prefer.

Exits:

If price goes over $275 or new ATH's.

Pink Support around $240

Blue Support $180 (less likely until massive market selloff)

Please see Outter Space chart below for blue support/resistance lines reference.

JUST BECAUSE I THINK AAPL NEEDS A PULLBACK DOESN'T MEAN I HATE AAPL. PLEASE BE CONSIDERATE

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL

SPX/SPY - 4HR View - Wedge is Back - Could China Pump 2 Dump?SPX / SPY is overextended and on a weekly basis has been bullish over 12 weeks.

This is abnormal with RSI on Weekly in the 80's.

But we keep getting these breakdowns, which lack momentum, and form back into same pattern.

Wedge which has resumed now ends on 12/12.

My SPY Puts are for 12/27.

I am going to consider getting some out into January if price falls by selling the current Puts for profit and moving farther out, possibly waiting for a bounce up for better fill.

The 10WeekMA is getting closer to price. When price crosses this moving average, this will confirm downtrend.

Until this happens, we get strung along.

10WeekMA looks unavoidable to cross price by 12/18 on Daily view (unless price goes over 3160 SPX / $316 SPY. - THIS IS WHAT WE SHOULD WATCH

Way things are looking, there is HEAVY manipulation at play here. Price goes to patterns within a penny precision.

Two Hypothesis

1 - Investors are keeping money in to avoid capital gains for 2019. So they will probably take profits in January 2020.

2 - (New Theory) - China is invested heavily in the US market (aside from Fed QE). There is nothing preventing China (communist) from making money off the fake news and FOMO, and then shorting the market when they tank the China deal. They know when it will happen, why it will happen, and they control the strings. Is it possible China is pumping and waiting to short the market after pulling out of trade deal?

I cannot thank everyone enough for the support and positive comments I receive.

Even if we do not agree, and you can make your position with sources, I can appreciate your position.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL

VIXY / TVIX - Going Higher - Keep On Your Toes HereVIXY/TVIX showing a Buy Signal on the Daily yesterday.

Yellow bull flag formation (kind of sloppy but its there).

Price currently broke out bullishly.

10WeekMA is reaching out farther by the day to reach price. Rate is currently $1 per day closer to price (which is fast).

If we cross 10WeekMA, price should continue higher.

Based on current rate, 10WeekMA should reach price in less than 1 week if we don't pullback.

Based on the action in VIXY, I feel that SPY/SPX has possibility to continue lower into Xmas.

Exits

-Pink wedge top around $19ish

-First gap fill around $14. May pause.

-Second gap fill around $18.

-Last gap fill around $20.

RSI trend should be watched closely for exiting trade or possible reversal.

VIXY/TVIX moves fast so keep on your toes if you want to keep those profits (or set your sell orders/stop losses).

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL.

MTUM - Tracking Momentum - Topping Out & SlowingMTUM is the ETF ticker which tracks momentum.

The pink lines show a megaphone pattern, which is bearish when tilted up. education.howthemarketworks.com

The inner white trendlines of the megaphone show price hitting the angled resistance.

The angled resistance crosses the current white price trendline on 12/13.

Going back in history with MTUM, inside the megaphone we see the price top out end of week.

This happened on July 26th and Sept. 6th. Both which are Friday's.

Watching MTUM as an indicator of SPY, we confirm MTUM and SPY shared the same selloff on Dec. 2.

So using MTUM we see that we may stretch out to the end of week here.

I am hoping we go sooner. Theta is killing my options.

If you are getting reamed on your options contracts by waiting, looks like we have a week left here.

If you have large positions, you can either add to reduce cost basis as we get higher OR move your positions farther out for a small loss if you are worried about time.

I think the MTUM chart (for me) confirms there will be no China deal on 12/15.

Each person should draw their own conclusions and make adjustments if necessary

Thank you very much to everyone who is supporting me with positive comments while we get jerked around here.

I really appreciate this community, those who follow my posts, and anyone who leaves good vibes in comments very much.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL, ROKU

SPX / SPY - Weekly View - Hangman Doji SPX and SPY both confirmed a hangman doji for end of week last week. :)

This bearish doji normally signals a reversal in price trend. en.wikipedia.org(candlestick_pattern)

I am seeing a bearish pattern ending last week, bearish pattern premarket today, and bearish patterns.

Weekly view shows same view of white 30Min wedge, inside blue ascending wedge, inside white main ascending wedge.

This is a fairly complex pattern at this point.

I almost feel like the algo computers are playing chess, but running out of squares. Check mate coming soon for the downturn.

Trend dots at bottom show we are rolling over.

Once the dots actually cross, trend is confirmed on Weekly. This will be BIG.

If you look at the chart history, the max gains are achieved by entering BEFORE the downturn.

The downturn trend cross is often the huge red candle where the money is made.

Daily view on SPX / SPY is showing a bearish harami candlestick doji (but too soon to tell as we are premarket).

Article below confirms we need to watch for next day or two to see if this is the turn.

investinganswers.com

If price on SPX / SPY goes to new ATH's or over $316 ALL BETS ARE OFF.

I will be changing my Puts expiry if this happens and will update the chart.

Today's 30Min View Chart with 2 News Links

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL, ROKU

SPX / SPY - 30Min View - Wedge, In a Wedge, In another WedgeSPX on the 30Min is showing we are consolidating in a wedge.

An ascending wedge is a bearish pattern.

If you ask me - having a wedge, in a wedge, in another wedge should be extremely bearish. LOL

We are in a white wedge (could be ascending wedge based on support angle), inside a blue ascending wedge, which is inside the main multi-week white ascending wedge.

The white multi-week ascending wedge will be shown in the Daily or Weekly view.

10WeekMA double jumped higher which is good.

Price is closer to 10WeekMA. Price cross of MA will confirm downtrend.

I am waiting for price to break the current white wedge pattern by tomorrow. (SPX is showing after market hours 23:00).

If price breaks above wedge or goes to new ATH's, ALL BETS ARE OFF. I will be pulling out of short/puts if we go above $316 SPY.

I will update Daily and Weekly view momentarily.

News:

French riots/protests over pensions (similar to US upcoming issue with pensions funded by corporate debt).

2 days ago - www.youtube.com

Repo Crisis Fueled by 4 Banks, Fed Balance sheet increasing at SAME level as market Hmmmm - all sourced information

Today - www.youtube.com

SPX / SPY - Weekly Trend - Irrelevant Jobs #'sJobs Report was released today showing an increase in jobs added.

To me, people working 2-3 part-time jobs is not adding employment.

Most people in this group need to work multiple jobs because of poor pay, causing inflated jobs numbers.

While the CNBC anchors say "goldie locks" for stocks, the charts show 12+ weeks of bullish trend indicating prices are overbought.

The Weekly trend on multiple charts seems to line up with Christmas week and the week after.

RSI trend is 2 weeks MAX from breaking down.

Next trend on Weekly is Bearish.

Capitulation dots show that selling has started due to overbought price in a long bullish trend.

December 2018 selloff lasted about 4 weeks - bullish trend took 1 week to reverse from same current trend level.

Based on all these factors I see the bearish trend confirmation occurring the week of 12/9 or 12/16.

I will be adding SPY puts into any strength in this area.

Markets are closed Christmas Day (Wednesday), which means people will have family the entire week visiting.

While people are with their family, this would be the perfect time for the rug to be pulled by institutions.

They steal 401K's while people eat turkey - then buy the dip caused by Stop Loss orders into January.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL, ROKU.

AAPL - Weekly View - Bearish Continuation - Don't Be FooledWeekly view of AAPL confirms downtrend is just beginning.

RSI trend is about to be broken. Weekly RSI is overbought at 76+.

Bullish trend is overextended. Weekly Bullish trend has been going since Sept.2nd week.

16 weeks bullish trend was longest recently (after December 2018 selloff). 12 Weeks is overextended.

AAPL is hitting blue resistance line which has multiple contact points back to 1999. See AAPL Outter Space chart below.

Hash Ribbons show that capitulation has started.

Based on this I have increased my Puts into January. Jan 17 2020 Puts $255 Strike.

I see AAPL going down for several weeks based on the info above and previous trends.

This also confirms for me that SPY should continue down as AAPL is a major SPY component.

If you compare AAPL and SPY (SPX) they are identical in both price action and indicators. One fall-both fall.

AAPL Outter Space Chart

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL, ROKU.

SPX / SPY - Bear Flag - Retest 3130 Before DescentSPX is forming a Bear Flag on multiple time periods (easier views are 1Hr or less).

I added a Aqua colored channel to the chart, as it appears this last support was not retested.

For this reason with the Bear Flag combination, I see we continue down by Friday if not Monday next week.

While the SPX is forming a Bear Flag, VIXY is forming a Bull Flag.

This inverse relationship is also an indicator to me that the patterns will continue.

Exits

Exit 1 - Dark blue line around SPX 3020 or SPY $302

Exit 2 - White support line at bottom, but is more to occur in 2020.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY and AAPL.

VIXY / TVIX - Bull Flag - Inverse Relationship with SPX/SPY VIXY is forming a Bull Flag as SPX (or SPY) forms a Bear Flag.

Price is reaching out to 10WeekMA just like SPX.

The inverse relationship continues between these two, which confirms to me that the "hidden trend" is still in play.

We are basically consolidating on the way down.

Much like oxygen masks come out when a plane goes down to keep people calm, they are slowing the descent to keep people from panicking.

Exits

Exit 1 - I am waiting to pink line/top gap fill. Looking back I see VIXY filling all Daily gaps - despite it being full of gaps.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY and AAPL.

VIXY / TVIX - Weekly ViewVIXY just turned bullish on trend for Weekly view yesterday.

We have close gaps to fill above to $20.

RSI has bullish divergence on Weekly view. Normally goes to 70 before calming down again.

Looking at VIXY, SPY, and AAPL together I think the bigger picture is we are headed lower.

Market is overbought. All these charts are correlating together in direct or inverse relationships.

Massive gap fill opportunity at $55ish (when market goes into massive correction we fill $55 gap).

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY and AAPL.

SPX/SPY - Update Part 2 of 2 - Weekly Trend Turning BearishWeekly trend for SPX/SPY is turning bearish.

We flashed a sell signal on the weekly candle yesterday. This is significant as this happens AT the turn down.

0.618 Fib Extension is around same level as 10WeekMA. The blue support is around 0.50 Fib Extension. Multiple things line up. :)

Indicators

RSI trend on Weekly is maxed out and very close to breaking down through trendline.

Next weekly trend is bearish. This confirms we should break the RSI trendline.

Please see "SPX/SPY - Update Part 1 of 2 - Bear Flag on 1HR" for the other chart this morning.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY and AAPL.

SPX/SPY - Update Part 1 of 2 - Bear Flag on 1HRPrice was moving in white channel last night and broke into yellow Bear Flag pattern.

This provided time for price to balance on the way down without shock.

It also provides time for 10WeekMA to come up and meet price. Price goes below this red zigzag line and we continue down based on past history.

Indicators

RSI Trend line will be shown in Part 2 of 2

Next trend on 1HR view is Bearish. We continue down IMO today or by end of week.

Yes - I see the "possible" trade news on China today.

No - I do not believe it after "we have deal" , "no we don't", "not until elections", "no wait we have a deal again".

My position will change when the chart bearish pattern completes OR if the pattern fails. We are still in play.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY and AAPL.

VIXY / TVIX - Volatility Pays $$$ - Not Done YetExit Points

Top gap fills or pink resistance line around $19.

RSI at 75 exit. Last two bullish runs RSI topped around 75 before downtrend.

I think we are just getting started here. Bigger money coming in!

Unusual Activity 22K ATM Calls on VIXY purchased TODAY. John Najarian uploaded a video.

Can't believe I beat this dude to the punch. Charts rule!

www.youtube.com

This confirms to me that SPY downtrend and DJI downtrend continues. Stay frosty and on your toes my friends!

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY and AAPL.

SPY - Gap Down Today / Exit Points for Short/PutsHappy to see some of my friends on here making money this morning. Glad we saw this coming!

As we continue to work this trade, I have others into January and February. So things are stacking up nicely. :)

Top gap got filled. Two more gaps below to fill (farthest gap down is $295).

Exits for Shorts/Puts-

1st - RSI 30 - price will rebound upwards. Time exit before RSI rebounds.

2nd - At gap fills ($295)

3rd - Price going to yellow support $300, or pink support next same as gap fill $295 level.

I will update chart when trend changes to bullish.

SPX Chart from Today below (mostly similar - for reference)

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, VIXY.

Short SPY and AAPL.

DJI - Headed to 26500 - ISM and CCI Supporting EvidenceDow Jones is following the pattern from previous chart.

Headed towards "first stop" on chart at 26,500ish. May continue to 2nd stop on chart.

We all know that news lies to the public. But when the actual data reports are available they demand review.

We should be reviewing the data personally to ensure it matches what news anchors are reporting. We are actively being deceived.

ISM - Manufacturing Index for Supply Chain

"November was the fourth consecutive month of PMI® contraction, at a faster rate compared to the prior month"

Look at the chart for - "Manufacturing at a Glance" on the link below. If we are contracting in every aspect, faster than previous month, how is the economy strong?

www.instituteforsupplymanagement.org

Consumer Confidence Index - "The consumer is strong" everyday on the news.

Then why does the actual chart show we have been in downtrend since 2018?

If this is a leading indicator, we are being actively LIED TO as no one actually looks at the report. We just follow what is on the TV.

data.oecd.org

Lastly, if we use the Cyclically Adjusted PE Ratio (which is based on average inflation-adjusted earnings from the previous 10 years) we see SP500 at a PE Ratio OVER 30

So while the news is telling you that we are in line with SP500 at 19 times earnings, they are twisting the story.

www.multpl.com

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, VIXY.

Short SPY and AAPL.

SPX / SPY - Update - No China DealSPX confirming downtrend this morning - NO RETRACEMENT :)

Filter Dots show trend is already mid-level. We can get to blue support line without a break.

Watch for price to stop at 10WeekMA zigzag line. Will update chart around this time.

Looking at previous downtrends, we see that RSI normally goes to 30 before any price pause/small retracement.

We should expect a downtrend without pause until we hit RSI 30.

If we are not at support blue line or white line before we get to RSI 30, we should pause and continue downward.

I do not expect the market to tolerate this stall tactic from Trump. Article - Trump says it might be better to wait until after 2020 election for a China trade deal

www.cnbc.com

Jeff Gundlach - “In 2018, GDP grew by 5% while national debt grew at 6%. This implies the entire economic growth of 2018 was debt based.” He goes on to say that the “problem that causes the next recession will be interest rate manipulation (going to zero interest rates/QE money printing)” 7mins15sec into video www.youtube.com

Let's not forget the taxpayer bank bailouts. Goldman Sacs ruined the housing market, got a $10billion taxpayer loan never to be payed back, outsourced 1000 jobs right after getting the money screwing American's further, and NOW Goldman Sacs is having one of the biggest stock buybacks EVER ....WITH OUR TAXPAYER DOLLARS!

investorplace.com

thinkprogress.org

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, VIXY.

Short SPY and AAPL.

VIXY / TVIX - Turning BullishBuy signal triggered on Daily.

RSI divergence is bullish. RSI still at 30 ( oversold).

Fisher Transform shows trend flipped bullish (need to watch to make sure trend stays bullish).

Gaps to fill above price and past 10WeekMA. If price goes above red zigzag, then I believe we fill top gaps to $20.

SPY is showing a Sell signal on the Daily. I will update chart shortly. SPX chart was updated this morning.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, VIXY.

Short SPY and AAPL.