OPENING: XME JUNE 19TH 24/30 SHORT STRANGLE... for a .94 credit.

Notes: Selling a delta neutral short strangle in the first expiry in which the at-the-money short straddle is paying greater than 10% of the underlying. Given the smallness of the instrument, will do additive adjustments if necessary to delta under hedge.

Shortstrangle

OPENING: NFLX FEBRUARY 21ST 300/385 SHORT STRANGLE... for a 7.04 credit.

Notes: Manning up and selling a 16 delta short strangle here in the February monthly (31 days' duration) with strikes tweaked slightly over my "Week Ahead" post. If you're of a defined risk bent, the 290/300/370/380 10-wide is paying 3.38; the 295/300/370/375, 1.87.

OPENING: XBI MARCH 20TH 80/105 SHORT STRANGLE... for a 1.75 credit; delta .60/theta 3.57.

Notes: Selling the 15's with the intent to add to delta balance if necessary. Since this is shorter duration than some of my other broad market or exchange-traded fund stuff, I may go for the full 50% max, but will see how it goes. I would note that this is generally less liquid than I like to see (.20 wide markets).

"THE KID": OPENING: SPY SEPT 18TH 274/355 SHORT STRANGLE... for a 7.50 credit; delta/theta -.04/4.08.

Notes: We talked a bit over the winter break about she wants to do this coming year in terms of trading, and this is the type of setup she went with: highly liquid options, broad market, selling in the shortest duration that pays, and managing aggressively, rather than waiting for "approaching worthless" or 50% max.

Here, she sold the 16 delta short strangle in the first expiry in which the at-the-money short straddle pays greater than 10% of the value of the underlying. She'll look to delta balance via additions up to the max she wants to devote to the position and/or do run-of-the-mill adjustments such as rolling as needed (or so I've been told).

OPENING: SPY OCT 16TH 275/370 SHORT STRANGLE... for a 6.47 credit. Scratch at 84.87.

Notes: Back to cutting net delta a smidge in the first expiry in which the at-the-money short straddle is paying more than 10% of the share price with a 16P/8C short strangle. Delta/theta -11.03/23.65, extrinsic 46.72.

Also looked at rolling out the short delta heavy short straddle aspect out to October with some minor strike improvement to cut some delta attributable to that without doing an additive adjustment, as well as trying to strike improve the 282 short call, but neither of those options seemed particularly productive from a delta cutting standpoint. Naturally, I could have also just rolled one of the short puts out and/or up ... .

OPENING: SMH MAY 15TH 110/155 SHORT STRANGLE... for a 3.62 credit.

Notes: Going out in time to the first expiry in which the at-the-money short straddle pays more than 10% of the value of the underlying. Will look to manage fairly aggressively, looking to take profit early. Just looking to keep some semblance of a theta pile on and burning while I wait for a volatility pop to put on trades in shorter duration expiries.

OPENING: QQQ JUNE 19TH 166/2 X 232 RATIO'D SHORT STRANGLE... for a 5.03 credit.

Notes: Set up in the first expiry in which the at-the-money short straddle pays greater than 10% of the value of the underlying and where expiry-specific implied is at 20.7% versus the paltry 15.8% it is here in November.

Granted, this is a very long time to wait for one's candy -- 234 days 'til expiry. However, I don't intend to wait that long and will opt to take profit starting at 25% max (~1.25).

OPENING: IWM JUNE 19TH 135/2 X 185 RATIO'D SHORT STRANGLE... for a 3.43 credit.

Notes: Selling premium in the first expiry in which the at-the-money short straddle pays greater than 10% of the value of the underlying. In spite of this little volatility pop here, it remains in June for IWM. 16 delta on the put side, doubled up at half the delta on the call to accommodate skew. Will manage aggressively, taking profit at 25% max as opposed to waiting for the usual 50%.

The defined risk alternative is a double/double iron condor with the short put side twice the width of the call side, but the call side doubled up with the short leg at half the delta of the put side (e.g., 125/135/2 x 185/2 x 190).

OPENING: QQQ MARCH 20TH 161/2 X 220 RATIO'D SHORT STRANGLE... for a 3.96 credit.

Metrics:

Max Profit: $396

Max Loss/Buying Power Effect: Undefined/$3810

Break Evens: 157.04/221.96

Delta/Theta: -.64/3.77

Notes: It's the beginning of the month, so time to slap some broad market nondirectional on in the major having the highest background implied volatility (QQQ). Going out to March with this one, selling the 15's on the put side and doubling up on the 8's on the call side to accommodate skew. A bit longer than I'd like, but the goal is keep theta on and grinding and not sit around for an ideal volatility pop (although I've got plenty of dry powder if that occurs, which I'll use to put on stuff in shorter duration when that happens).

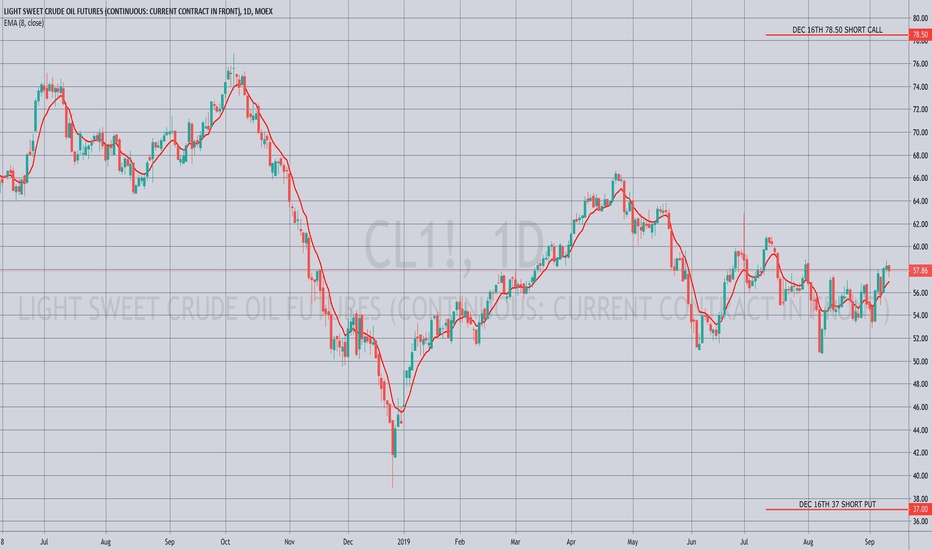

OPENING: /CL DEC 16TH 35/75 SHORT STRANGLE... for a .21 ($210)/contract credit.

Notes: Sneaking a smidge more 2 standard deviation short strangle on in the December cycle ... . (See Post Below).

OPENING: /CL DEC 16TH 44/82 SHORT STRANGLE... for a .77 ($770) credit.

Metrics:

Max Profit: $770

Max Loss: Undefined

Buying Power Effect: ~$1200

Break Evens: 43.23/82.77

Notes: Layering on some more short strangle in /CL in the December cycle with the short call at the 1 standard deviation strike, the short put at the same delta. Some obvious call side skew there ... .

OPENING: QQQ JAN 17TH 162/2X215 RATIO'D SHORT STRANGLE... for a 4.00/contract credit.

Max Profit: $400/contract ($200 at 50 max)

Max Loss/Buying Power Effect: Undefined/$3760 on margin

Break Evens: 157.99/217.01

Delta/Theta: .14/4.16

Notes: Doing short calls 2 to 1 to accommodate skew with the puts at the 16 deltas, the calls at the 8's ... .

OPENING: IWM FEB 21ST 125/2 X 170 RATIO'D SHORT STRANGLE... for a 3.46 credit.

Metrics:

Max Profit: 3.46

Max Loss/Buying Power Effect: Undefined/~29.40

Break Evens: 121.52/171.74

Delta/Theta: -.21/3.16

Notes: Selling IWM premium in the expiry in which the at-the-money short straddle is paying more than 10% of the value of the stock. Adjusted call side slightly compared to "The Week Ahead Post." Will look to take profit at 50% max, adjust sides on side test and/or side approaching worthless .... .

OPENING: EEM MARCH 20TH 2 X 3 33/46 SHORT STRANGLE... for a 2.00 credit.

Metrics:

Max Profit: $200/$100 at 50% max

Max Loss/Buying Power Effect: Undefined/$1120

Break Evens: 31.98/46.68

Delta/Theta: 1.51/-3.36

Notes: I had to putz a bit to accommodate skew on the call side ... . Will look to take profit at 50% max, adjust on test of side break even or on side approaching worthless to avoid its going no bid.

OPENING: /CL DEC 16TH 37/78.5 SHORT STRANGLE... for a 2.00/contract credit.

Metrics:

Max Profit: $200/contract

Max Loss/Buying Power Effect: Undefined/$610

ROC: 32.8% ROC at max; 16.4% at 50% max

Break Evens: 36.80/78.70

Notes: A high probability of profit 2 standard deviation short strangle ... .

OPENING: QQQ DEC '20 162/207 SHORT STRANGLE... for a 4.22 credit.

Max Profit: $422 ($211 at 50 max)

Max Loss: Undefined

Break Evens: 157.78/211.22

Delta/Theta: 1.03/4.14

Notes: Going out to December to sell a 16 delta short strangle that basically covers all of the 2019 range ... . Will look to take profit at 50% max.

GE short strangle, July 12 9/10.5, 3+ month channel There is a clear channel that adheres to the peaks and troughs of the sideways trend on the price movement on the daily charts, starting from February 28th, 2019. Both the upper and lower boundaries of the channel have been tested multiple times during this period -- the more times the limits are tested, the stronger the both support and resistance become. The lower bound is at $9.00 and the upper bound is at $10.50.

By simultaneously selling the OTM $9 call and OTM $10.50 put, there is a maximum profit of $32 per contract reached if the price of GE is between at expiry. The break-even points are at $8.68 and $10.82 respectively. We are choosing the July 12th contracts as GE is expected to report earnings July 19th. With 25 days until expiry, as a net seller we will collect the theta premium as GE stays within the historical channel that has held up over 3.5 months.

OPENING: SPY JUNE 28TH 271/274/296/299 IC; 274/296 STRANGLE... for a 1.02/contract credit (the short strangle -- for 3.43).

Metrics (Iron Condor):

Max Profit: $102/contract

Max Loss: $198/contract

Break Evens: 272.98/297.02

Delta/Theta: -3.86/1.61

Notes: A late post, as these were opened on Friday -- the iron condor in a smaller account where buying power is limited; the short strangle in an account where that is less of a concern. I used the quarterlies, since the June monthly was a bit closer in time than I would ordinarily like and wanted to add in some Plain Jane broad market short premium without scrounging around for plays in less liquid underlyings or in the exchange-traded funds that had high implied but in which I already have plays (XOP, SMH, EWZ, XBI). As usual, will look to manage intra-trade on side test with untested side approaching worthless via rolling in of the untested and look to take profit at 50% max. Admittedly, the rank and background implied (24/16) isn't as high as I would like ... .

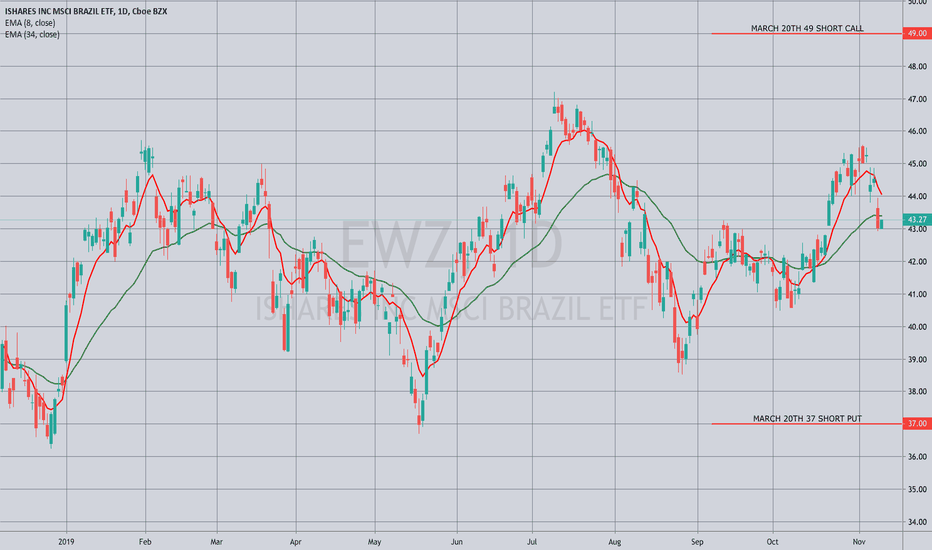

THE WEEK AHEAD: TWTR EARNINGS, EWZTWTR (41/54) announces earnings on Tuesday before market open; pictured here is a May 17th 30/39 short strangle.

Metrics:

Max Loss/Buying Power Effect: Undefined/3.50/contract

Max Profit: 1.09

Break Evens: 28.91/40.09

Delta/Theta: -3.99/4.92

Front Week to May Opex Volatility Differential: 41.5%

Notes: Look to put a play on in the waning hours of the Monday session, adjusting the strikes to reflect any movement in the underlying if necessary.

For those of a defined risk bent, the May 17th 27/31/38/42 iron condor is paying 1.13 with a buying power effect of 2.87, break evens of 29.87/39.13, and delta/theta of -1.24/2.9. It isn't quite what I like to see out of these (one-third the width of the widest wing in credit). By going slightly wider, you give up some credit at the door while increasing probability of profit.

On the exchange-traded fund front, not much is rocking. Moreover, we're still in between cycles for me, with May opex being too short in duration and June being a touch long. As with last week, I'm looking to put something on in EWZ (14/30), since I don't have anything on at the moment, but have really just been waiting for June to get closer in time: the June 21st 36/44.5 short strangle is paying 1.23 with a buying power effect of about 4.10/contract, break evens at 34.77/45.73, and delta/theta metrics of -2.1/2.35. It's a little wider than I usually like to go (~25 deltas), but if I'm going to but it on early in the cycle, I want a little more room to adjust if necessary.

The standard 25/10 iron condor in the June cycle is the 34/37/44/47, which is paying 1.02 with a buying power effect of 1.98, break evens of 35.98/45.02, and delta/theta of -2.05/1.07.

WORKING: AMD MAY 17TH 22/32 SHORT STRANGLE... for a 1.13/contract credit.

Metrics:

Max Loss/Buying Power Effect: Undefined/$270/contract

Max Profit: $113

Break Evens: 20.87/33.13

Delta: -4.36

Theta: 3.28

Notes: Earnings in 22, so not looking to stay in this trade for long. High implied at 66 with excellent options liquidity ... .