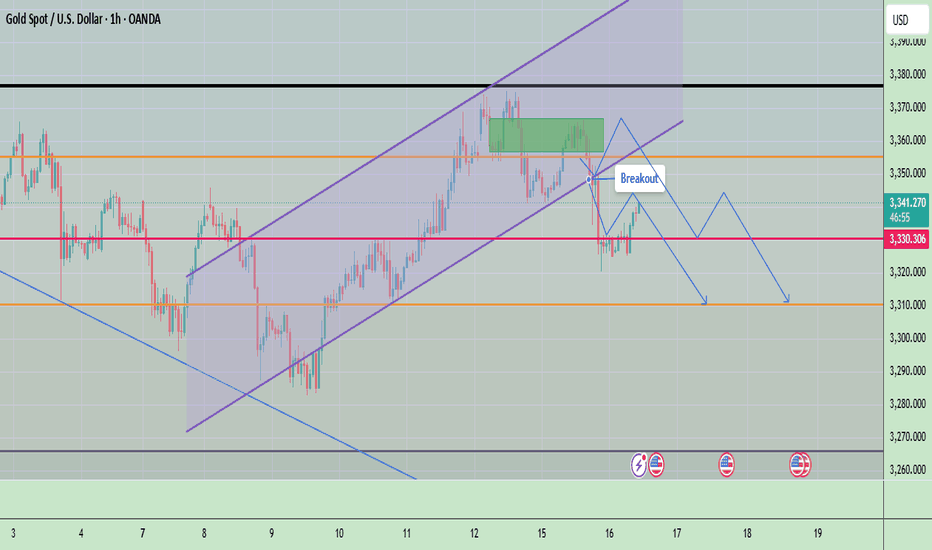

Gold Faces Strong Rejection Below $3,365 – Bearish Wave Ahead?Gold is currently trading around $3,359, showing signs of exhaustion after climbing from the $3,248 low. The chart illustrates a textbook scenario of channel rejection after testing the upper boundary of the descending wedge and failing to break above the $3,365–$3,392 resistance zone. Price is now hovering just below the diagonal black trendline, indicating a potential lower high formation and setting up for another bearish wave.

📌 Key Technical Highlights

Resistance Zone: $3,365–$3,392

This area marks the confluence of the black long-term trendline, the top of the descending purple channel, and the previous high at $3,392.

Price attempted a "Possible Retest" as annotated on the chart and is now starting to pull back—showing signs of bearish rejection.

Bearish Scenario (Blue Arrows):

Multiple downward arrows show likely bearish paths if the current resistance holds.

Key short-term targets:

$3,337, $3,320, $3,303, Strong support at $3,293–$3,248

Further downside may test extension levels toward $3,220–$3,200 by early August if momentum builds.

⚠️ Bearish Confirmation Criteria

Failure to close above $3,365 (black trendline)

Breakdown below $3,337 followed by $3,320

Strong selling pressure supported by fundamentals (e.g. USD strength, Fed hawkish stance)

✅ Invalidation / Bullish Outlook

A decisive breakout and close above $3,392.73 would invalidate the bearish structure.

In that case, targets would shift toward:

$3,412, $3,434, $3,490 (long-term trendline intersection)

However, today's U.S. CPI (Consumer Price Index) release adds a layer of volatility and potential trend disruption, making this a high-risk trading day.

📊 CPI News Impact – What to Watch

High CPI (Stronger than forecast):

- Increases expectations of further Fed tightening → strengthens USD → bearish for gold

- Likely scenario: sharp drop toward $3,337 → $3,320 → $3,293

Low CPI (Weaker than forecast):

- Signals disinflation → weakens USD → bullish for gold

- Possible breakout above $3,365 → retest of $3,392 → if broken, target $3,412 and $3,434

Neutral or as expected CPI:

- Likely leads to whipsaw — fakeout on both sides

- Caution advised — wait for candle close confirmations post-news

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Shortxauusd

Gold Rejected Post-CPI – Bearish Momentum Building Below $3,365Gold is currently trading near $3,338, continuing to show signs of rejection after testing the key $3,365–$3,392 resistance zone. The market has reacted to the July 15 U.S. CPI release, and despite initial volatility, gold failed to break above its major diagonal trendline, forming a lower high, a strong technical sign of weakening bullish momentum.

If price breaks below $3,330, it could trigger a wave of selling pressure down to $3,303 and $3,248 in the coming days. Traders should monitor price behavior around these zones for short-term entry opportunities.

📌 Technical Breakdown

Resistance Zone:

- $3,365–$3,392 remains the critical ceiling where gold got rejected for the third time in recent sessions.

- This zone aligns with the top of the descending wedge, long-term black trendline.

Bearish Structure Forming:

- After multiple attempts, gold could not sustain above the resistance.

- A series of lower highs and a weakening bullish push suggest a bearish continuation is likely.

Support Levels to Watch:

- Immediate: $3,337

- Mid: $3,320

- Strong: $3,303 (0.382 Fib) and $3,293

- Final Target: $3,248 → $3,220 → $3,193

🔺 Bullish Invalidation Scenario

If gold manages a clean breakout and close above $3,392, this bearish setup will be invalidated. In that case, upside targets would include:

- $3,412

- $3,434

- $3,490 (macro trendline)

But at the moment, that seems unlikely unless driven by unexpected fundamentals.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

downtrend, gold price below 3300⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) remain under pressure during Wednesday’s Asian session, slipping below the $3,300 level and hitting their lowest point in over a week. The decline comes amid growing consensus that the Federal Reserve (Fed) will maintain interest rates at elevated levels for an extended period, especially as expectations rise that aggressive US tariffs could fuel inflation in the months ahead.

This outlook has driven US Treasury yields higher and kept the US Dollar (USD) anchored near a two-week high reached on Tuesday — a key headwind for the non-yielding precious metal, which continues to face downward pressure as a result.

⭐️Personal comments NOVA:

Gold price breaks support, DOW H1 formation, gold downtrend below 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3344- 3446 SL 3351

TP1: $3335

TP2: $3320

TP3: $3302

🔥BUY GOLD zone: $3256-$3254 SL $3249

TP1: $3268

TP2: $3280

TP3: $3298

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

stable tariffs, gold price impact reduction✍️ NOVA hello everyone, Let's comment on gold price next week from 06/30/2025 - 07/04/2025

⭐️GOLDEN INFORMATION:

Gold prices plunged over 1.5% on Friday as risk appetite strengthened, fueled by a combination of positive geopolitical and economic developments. Easing tensions between Israel and Iran, the formal trade agreement between the United States and China, and continued efforts by Washington to strike new commercial deals with global partners lifted market sentiment—dampening demand for safe-haven assets like bullion.

At the time of writing, XAU/USD is trading at $3,274, having pulled back from an earlier high of $3,328. On Thursday, the White House confirmed the signing of a long-awaited trade pact with China, marking an official end to the protracted trade war. US Commerce Secretary Howard Lutnick also indicated that additional agreements may be finalized ahead of the July 9 deadline

⭐️Personal comments NOVA:

Information on tariff negotiations is gradually becoming stable and favorable. Information on inflation showing signs of increasing, dxy increase is also a temporary pressure causing gold price to return to the 3200 mark.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3307, $3348, $3390

Support: $3248, $3202

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold back below 3200 today?⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) edged lower to around $3,230 during early Asian trading on Tuesday, weighed slightly by a modest rebound in the US Dollar (USD). However, lingering concerns over the health of the US economy—especially in the wake of Moody’s recent credit rating downgrade—may help limit further downside for the precious metal.

The Greenback’s recovery is curbing upside momentum for USD-denominated assets like gold. Still, heightened economic uncertainty continues to underpin safe-haven demand. Moody’s downgraded the US sovereign rating from "Aaa" to "Aa1" on Friday, citing escalating debt levels and interest obligations that now exceed those of other similarly rated nations. These developments are keeping risk sentiment fragile and lending underlying support to gold prices.

⭐️Personal comments NOVA:

Accumulate along the upper and lower trend lines, gold price will break and take more liquidity than the downtrend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3224- 3226 SL 3230 scalping

TP1: $3215

TP2: $3208

TP3: $3200

🔥SELL GOLD zone : 3276- 3278 SL 3283 scalping

TP1: $3260

TP2: $3250

TP3: $3240

🔥BUY GOLD zone: $3152 - $3150 SL $3145

TP1: $3165

TP2: $3180

TP3: $3195

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

16 hours ago

Gold price downtrend with PPI news⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) extended their decline for a second consecutive session on Thursday, marking the third drop in the past four days and slipping to a more than one-month low below the $3,150 mark during Asian trading hours. The sustained downward pressure is largely driven by renewed optimism following signs of a meaningful de-escalation in the US-China trade dispute — a development that has dampened demand for traditional safe-haven assets like gold.

The announcement of a 90-day trade truce between the world’s two largest economies has also helped ease recession fears in the U.S., prompting investors to scale back expectations for aggressive monetary policy easing by the Federal Reserve. This shift has supported a continued rise in U.S. Treasury yields, further weighing on demand for the non-interest-bearing yellow metal.

⭐️Personal comments NOVA:

Downtrend, bears continue to put downward pressure on the market, heading towards the 3100 price zone

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3198- 3200 SL 3205

TP1: $3190

TP2: $3180

TP3: $3170

🔥BUY GOLD zone: $3101 - $3099 SL $3094

TP1: $3110

TP2: $3120

TP3: $3130

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable sell order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Downtrend - will gold price return to 3233?⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) rebounded from an early Asian session drop to a multi-day low, reclaiming ground above the $3,300 psychological level in the past hour. The precious metal continues to draw support from persistent geopolitical uncertainties, including the Russia-Ukraine conflict, intensifying tensions in the Middle East, and renewed friction along the India-Pakistan border. That said, the upside appears constrained by improving risk sentiment, driven by renewed optimism surrounding a US-UK trade agreement and the launch of US-China tariff negotiations over the weekend.

⭐️Personal comments NOVA:

Gold prices are under great selling pressure as trade negotiations on tariffs are becoming more active. They may return to the 323x price zone and continue to accumulate.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3351- 3353 SL 3358

TP1: $3340

TP2: $3330

TP3: $3320

🔥BUY GOLD zone: $3232 - $3234 SL $3227

TP1: $3245

TP2: $3260

TP3: $3270

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable sell order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

bullish momentum, accumulating around 3400⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) regained strong upward momentum during the Asian session on Thursday, rebounding sharply above the $3,400 level in the past hour and recovering much of its overnight pullback from a two-week high. The renewed demand for the safe-haven metal comes as US President Donald Trump downplayed expectations of an imminent resolution to the US-China trade dispute, stating he feels "no rush" to finalize an agreement. Heightened geopolitical tensions—including the ongoing Russia-Ukraine war, instability in the Middle East, and escalating military friction between India and Pakistan—further support gold's appeal as a defensive asset.

⭐️Personal comments NOVA:

Gold price continues to recover well around 3400, FED's speech is quite moderate, predicted early by investors, the market is positive in the recovery trend this week

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3438- 3440 SL 3445

TP1: $3425

TP2: $3410

TP3: $3395

🔥BUY GOLD zone: $3352 - $3350 SL $3345

TP1: $3365

TP2: $3380

TP3: $3400

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable sell order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold's short-term decline continues⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) regained strong upward momentum during the Asian session on Thursday, rebounding sharply from the previous day’s steep decline and ending a two-day losing streak near the $3,260 weekly low. The renewed buying interest comes amid lingering concerns over the protracted trade impasse between the US and China, following US Treasury Secretary Scott Bessent’s comments indicating that the standoff could drag on.

Compounding market anxiety is the persistent uncertainty surrounding President Donald Trump’s tariff policies and their broader implications for global growth. These factors have fueled a fresh wave of safe-haven demand, driving investors back toward gold.

⭐️Personal comments NOVA:

Still under selling pressure, gold price is consolidating below the downtrend line. Trading around 3300 and lower.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3412- 3414 SL 3419

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3228 - $3230 SL $3223

TP1: $3240

TP2: $3250

TP3: $3260

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price stabilized again, trading around 3300⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) found fresh buying interest during the Asian session on Wednesday, pausing its pullback from the previous day’s record high near $3,500. Attempts by the US Dollar (USD) to rebound from multi-year lows faltered, as investor confidence in the US economic outlook continues to erode amid President Donald Trump’s erratic tariff policy shifts.

Additionally, growing expectations of more aggressive monetary easing by the Federal Reserve (Fed) have triggered renewed selling pressure on the greenback. This, in turn, has reinforced demand for the non-yielding yellow metal, helping gold regain upward momentum as investors seek shelter from mounting economic and policy uncertainty.

⭐️Personal comments NOVA:

The slowdown and downward adjustment of gold are inevitable. Profit-taking psychology and cooling news of tariffs and Russia-Ukraine military forces caused gold prices to fall.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3410- 3412 SL 3417

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3281 - $3283 SL $3276

TP1: $3290

TP2: $3300

TP3: $3315

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bulls recover, gold prices grow OLD ATH ⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) climbs modestly toward the $3,080 mark during early Asian trading on Wednesday, buoyed by renewed safe-haven demand as trade tensions between the United States and China intensify.

In a fresh move, US President Donald Trump announced a 90-day delay on new tariffs—set at 10%—for most US trading partners to allow space for negotiations. However, he simultaneously escalated trade friction with Beijing, raising tariffs on Chinese imports to a staggering 125% “effective immediately,” citing China's "lack of respect for global markets."

⭐️Personal comments NOVA:

The rapid recovery and large fluctuations of gold prices show that the impact of Trump's 90-day tariff postponement news is very strong. The price zone of 3135 and 3167 will be under great selling pressure. There is not much momentum for gold prices to create new ATHs.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3164- 3167 SL 3171

TP1: $3150

TP2: $3140

TP3: $3130

🔥BUY GOLD zone: $3074 - $3076 SL $3069

TP1: $3090

TP2: $3105

TP3: $3123

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Selling pressure remains, gold price adjusts down⭐️GOLDEN INFORMATION:

Suki Cooper, an analyst at Standard Chartered, noted, “Gold is often seen as a liquid asset that investors turn to when they need to meet margin calls in other areas, so it's not uncommon for gold to decline following a risk event, considering its function within a diversified portfolio.”

On the data front, the US economic calendar showed a solid employment report, with private sector employers adding more than 200,000 jobs in March. Although the Unemployment Rate ticked up slightly, Bloomberg suggested this was “largely due to rounding.”

According to figures from Prime Market Terminal, money market participants have already priced in more than 1% worth of rate cuts from the Federal Reserve by 2025.

⭐️Personal comments NOVA:

Short-term downtrend, disputed price zone 3054 - 2975. Gold price continues to adjust down at the beginning of the week.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3084 - 3086 SL 3091

TP1: $3070

TP2: $3055

TP3: $3040

🔥BUY GOLD zone: $2973 - $2971 SL $2966

TP1: $2980

TP2: $2990

TP3: $3000

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

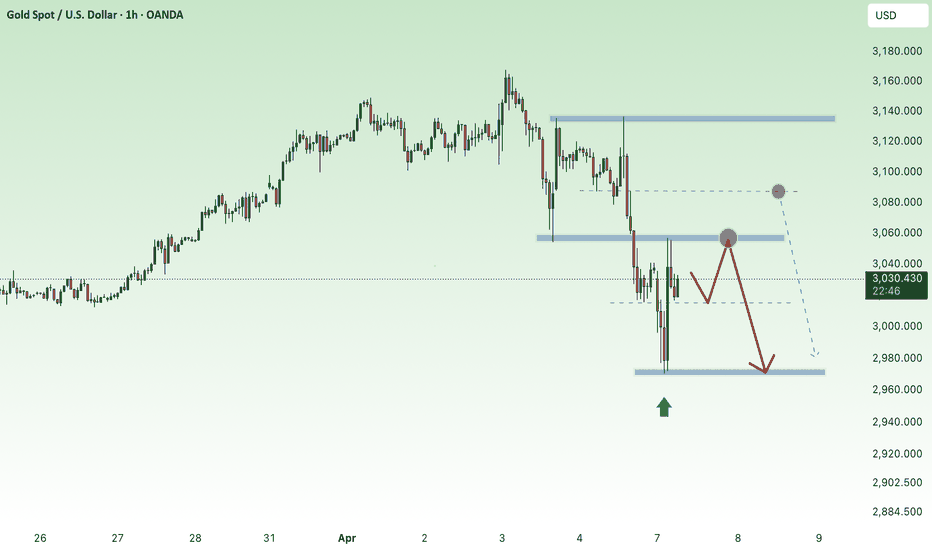

Gold prices start to cool down - back to 3000✍️ NOVA hello everyone, Let's comment on gold price next week from 04/07/2025 - 04/11/2025

🔥 World situation:

Gold (XAU) prices deepened their decline on Friday, sliding to a seven-day low of $3,015 before rebounding slightly, after remarks from Federal Reserve (Fed) Chair Jerome Powell suggested that inflation may accelerate again due to the impact of tariffs. At the time of writing, XAU/USD is trading at $3,029, representing a 2.70% drop.

Market volatility persisted as tensions escalated in the ongoing trade conflict between the United States (US) and China. In addition, Powell dampened hopes for imminent Fed rate cuts, stating that tariffs are expected to affect the US economy by slowing growth and pushing inflation higher.

According to a Financial Times (FT) report, hedge funds faced their largest margin calls since the Covid-19 pandemic, triggered by President Trump’s Liberation Day announcement.

🔥 Identify:

The FOMO increase in gold prices is starting to show signs of stopping due to concerns about economic recession. Gold prices will continue to decline back to the price range below 3000, stabilizing the market again.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3054, $3076, $3105, $3135

Support : $2998, $2953

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

NF - Will gold prices continue to fall?⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) finds it difficult to build on Thursday’s late recovery from the $3,054 region—its lowest level in a week—and comes under renewed selling pressure during Friday’s Asian session. The metal has dipped back below the $3,100 threshold in recent trading; however, the broader market backdrop still suggests caution is warranted before anticipating any significant correction from the record high reached just a day earlier.

⭐️Personal comments NOVA:

Waiting for gold price to react to decrease at trendline H1, still a downward trend, fear of trade crisis, world economy

⭐️SET UP GOLD PRICE:

🔥 SELL 3134 - 3136 SL 3141

TP1: $3125

TP2: $3110

TP3: $3090

🔥BUY GOLD zone: $3033 - $3035 SL $3028

TP1: $3045

TP2: $3060

TP3: $3075

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price start to adjust yet?⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) face renewed selling pressure during the Asian session on Friday, retreating toward the $3,030 level in recent trading, inching closer to the previous session’s low. The US Dollar (USD) maintains its upward trajectory for the third consecutive day, prompting some profit-taking on the precious metal ahead of the weekend. However, a confluence of supportive factors is likely to keep bullion resilient, positioning it for a third consecutive week of gains.

⭐️Personal comments NOVA:

Breaking the trend, has gold price really been in the weekend price adjustment rhythm? According to NOVA, it has started. Before the tax policies in early April, the market needs a little balance in terms of liquidity on the selling side.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3040 - $3042 SL $3047

TP1: $3030

TP2: $3020

TP3: $3010

🔥BUY GOLD zone: $3019 - $3017 SL $3014 scalping

TP1: $3023

TP2: $3030

TP3: $3040

🔥BUY GOLD zone: $3000 - $3002 SL $2995

TP1: $3010

TP2: $3020

TP3: $3030

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price recovers, waiting for CPI inflation data today⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

The US 10-year Treasury yield rebounds, rising six basis points to 4.282% as markets focus on potential Federal Reserve rate cuts.

Meanwhile, US real yields—measured by the 10-year Treasury Inflation-Protected Securities (TIPS), which typically move inversely to gold prices—climb 5.5 basis points to 1.963%, posing a headwind for the non-yielding metal.

The Atlanta Fed’s GDP Now model projects a -2.4% contraction for Q1 2025, marking the first negative reading since the COVID-19 pandemic.

⭐️Personal comments NOVA:

Recovering in the sideway price range below 2930

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $2928 - $2930 SL $2935

TP1: $2920

TP2: $2910

TP3: $2900

🔥BUY GOLD zone: $2894 - $2896 SL $2889

TP1: $2900

TP2: $2910

TP3: $2920

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bears dominate gold continues today⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) find support near the $2,880 level during Tuesday’s Asian session, drawing dip-buyers and partially recovering from the previous day’s drop to a one-week low.

Investor sentiment remains cautious amid uncertainty over US President Donald Trump’s trade policies and their potential impact on the global economy. The prevailing risk-off mood, compounded by geopolitical tensions, continues to fuel demand for the safe-haven metal

⭐️Personal comments NOVA:

US economy plummets, fears of recession due to rising trade tensions

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $2915 - $2917 SL $2922

TP1: $2910

TP2: $2900

TP3: $2890

🔥BUY GOLD zone: $2860 - $2862 SL $2855

TP1: $2870

TP2: $2880

TP3: $2890

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

H1 bearish pattern appears , XAU / USD ⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

The US labor market showed signs of slowing last month, reinforcing expectations that the Federal Reserve will proceed with multiple rate cuts this year. This sentiment pressured the US Dollar while boosting the price of USD-denominated commodities.

Data from the US Bureau of Labor Statistics (BLS) on Friday revealed that Nonfarm Payrolls (NFP) rose by 151,000 in February, following January’s upwardly revised 125,000 (previously 143,000), falling short of the 160,000 market forecast.

Meanwhile, the Unemployment Rate edged up to 4.1% from 4.0% in January, while annual wage inflation, measured by Average Hourly Earnings, ticked higher to 4.0% from 3.9%, though it was revised down from an initial 4.1%.

⭐️Personal comments NOVA:

Gold price is sideways around 2910 at the beginning of the week, H1 frame shows head and shoulders pattern, downtrend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $2928 - $2930 SL $2935

TP1: $2920

TP2: $2910

TP3: $2900

🔥BUY GOLD zone: $2891 - $2893 SL $2886

TP1: $2900

TP2: $2910

TP3: $2920

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

SIDEWAY waiting for news this week⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

As a result, investors turned to bullion for safety, driving prices toward the $2,900 mark. Meanwhile, the US 10-year Treasury yield dropped two basis points to 4.176%, its lowest level since December 2024.

Commenting on the economy, St. Louis Fed President Alberto Musalem acknowledged steady economic growth but cautioned that recent data indicate potential downside risks.

⭐️Personal comments NOVA:

Continue in correction phase - gold price under selling pressure below 2900. Sideway and waiting for important news this week

⭐️SET UP GOLD PRICE:

🔥 BUY GOLD zone: $2851 - $2853 SL $2846

TP1: $2860

TP2: $2870

TP3: $2880

🔥 SELL GOLD zone: $2898 - $2900 SL $2905

TP1: $2890

TP2: $2880

TP3: $2870

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

trend towards 2845, trend continues to strengthen! gold ⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

Gold price (XAU/USD) declines for the second consecutive day, hitting a two-week low around $2,860 during Friday's Asian session. The US Dollar (USD) continues its recovery for the third straight day, supported by expectations that the Federal Reserve (Fed) will maintain its hawkish stance due to persistent inflation. This strengthens the USD and weighs on the non-yielding gold.

⭐️ Personal comments NOVA:

The gold price adjustment is mandatory, along with the influence of the world financial sectors, selling off at the same time. The trade war is very close, gold is also negatively affected by investors.

⭐️ SET UP GOLD PRICE:

🔥 SELL GOLD zone: $2891 - $2893 SL $2898

TP1: $2885

TP2: $2878

TP3: $2870

🔥 BUY GOLD zone: $2846 - $2844 SL $2839

TP1: $2852

TP2: $2860

TP3: $2870

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE :

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

continue to decrease, return to price zone 2904⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

US consumer confidence saw its biggest drop since August 2021, falling to 98.3 in February from 105.3, according to the Conference Board.

Richmond Fed President Thomas Barkin said on Tuesday that he favors a wait-and-see approach on interest rates until there is clear evidence that inflation is returning to the Fed’s 2% target.

Meanwhile, Dallas Fed President Lorie Logan suggested that, over time, the Fed should prioritize purchasing shorter-term securities to better align its portfolio with Treasury issuance, as reported by Bloomberg.

⭐️ Personal comments NOVA:

Still a downtrend today, back to the price range of 2900, 2890 to accumulate the uptrend

⭐️ SET UP GOLD PRICE:

🔥 BUY GOLD zone: $2905 - $2903 SL $2900 scalping

TP1: $2908

TP2: $2912

TP3: $2920

🔥 BUY GOLD zone: $2889 - $2887 SL $2882

TP1: $2895

TP2: $2903

TP3: $2910

🔥 SELL GOLD zone: $2946 - $2948 SL $2953

TP1: $2940

TP2: $2930

TP3: $2920

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE :

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Scalping ! XAU ! wait for price recovery at SELL entry 2947⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

Chicago Fed President Austan Goolsbee emphasized on Monday that the central bank will adopt a cautious approach, waiting for more clarity before considering rate cuts.

Meanwhile, the World Gold Council (WGC) reported that gold-backed ETFs saw their biggest weekly inflow since March 2022.

Traders now focus on upcoming US data, including the Conference Board's Consumer Confidence Index and the Richmond Manufacturing Index, along with speeches from Fed officials, which could impact the USD.

⭐️ Personal comments NOVA:

Accumulated price zone according to H1 trendline, continue sideways waiting for tariff momentum to reach 3000

⭐️ SET UP GOLD PRICE:

🔥 SELL GOLD zone: $2947 - $2949 SL $2952

TP1: $2943

TP2: $2938

TP3: $2930

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

XAU / USD, recovery at the beginning of the week⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

Gold price (XAU/USD) sees renewed buying interest during the Asian session on Monday but stays within its recent range near last week’s record high. Ongoing uncertainty over US President Donald Trump's trade tariffs and their global economic impact, coupled with broader risk aversion, supports the safe-haven metal. Additionally, geopolitical tensions and a weaker US Dollar further bolster demand for gold.

⭐️ Personal comments NOVA:

Gold price recovered positively at the beginning of the week, mainly sideways and accumulated below 2955

⭐️ SET UP GOLD PRICE:

🔥 BUY GOLD zone: $2916 - $2918 SL $2911

TP1: $2920

TP2: $2925

TP3: $2930

🔥 SELL GOLD zone: $2952 - $2954 SL $2959

TP1: $2948

TP2: $2940

TP3: $2930

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account