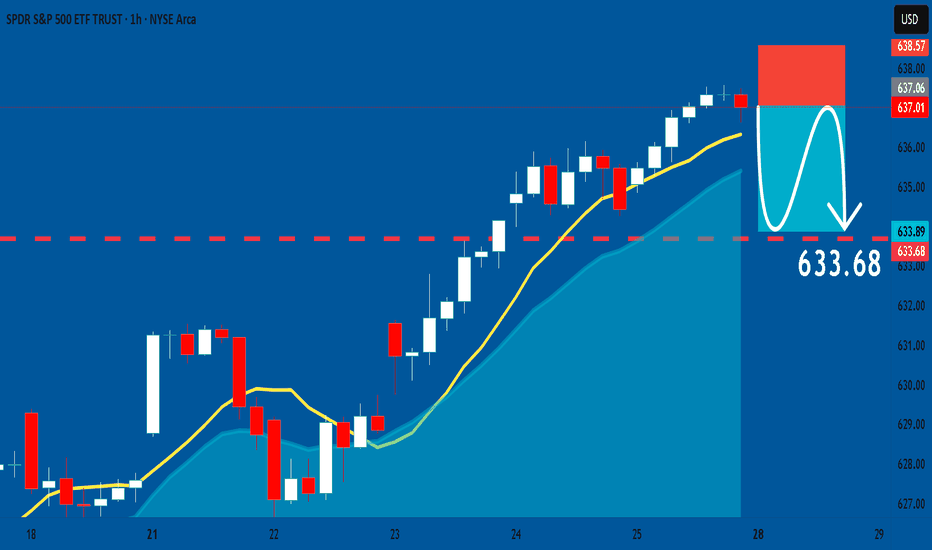

SPY: Bearish Continuation & Short Signal

SPY

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short SPY

Entry Point - 637.01

Stop Loss - 638.57

Take Profit - 633.58

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Signal

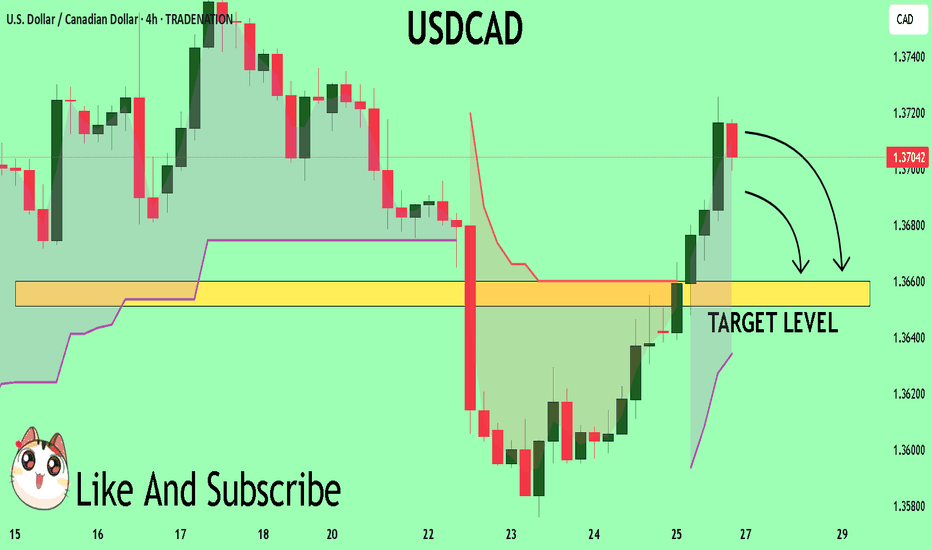

USDCAD Buyers In Panic! SELL!

My dear subscribers,

This is my opinion on the USDCAD next move:

The instrument tests an important psychological level 1.3704

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.3660

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

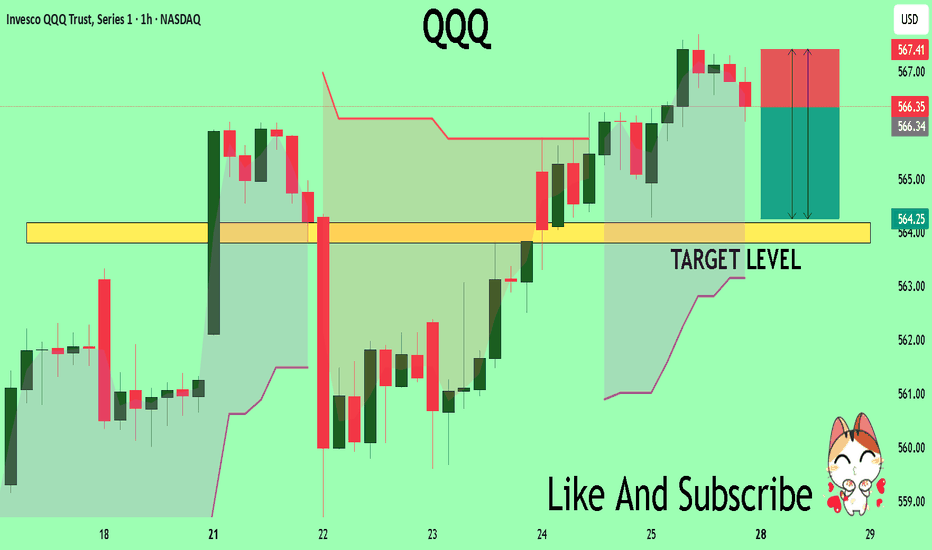

QQQ Massive Short! SELL!

My dear followers,

This is my opinion on the QQQ next move:

The asset is approaching an important pivot point 566.35

Bias - Bearish

Safe Stop Loss - 567.41

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 564.18

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

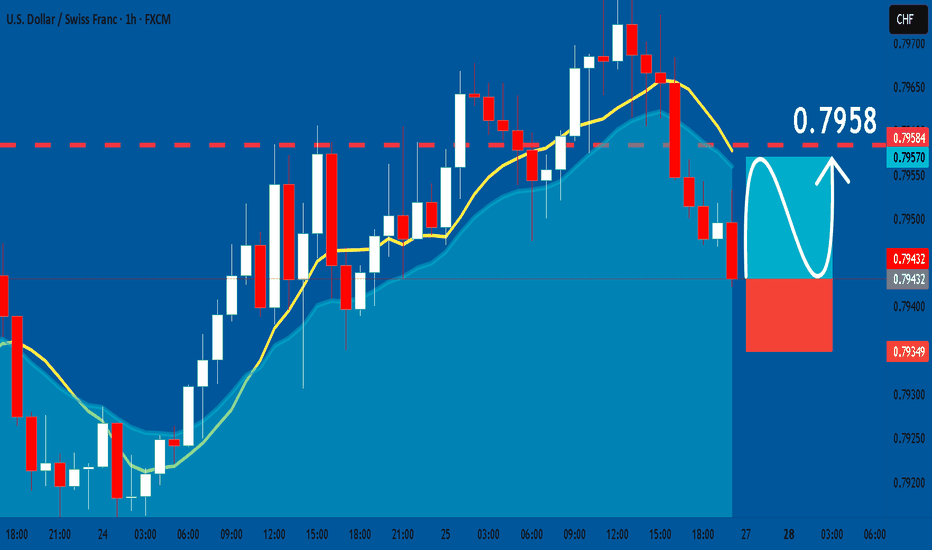

USDCHF: Long Signal Explained

USDCHF

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long USDCHF

Entry - 0.7943

Sl - 0.7934

Tp - 0.7958

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

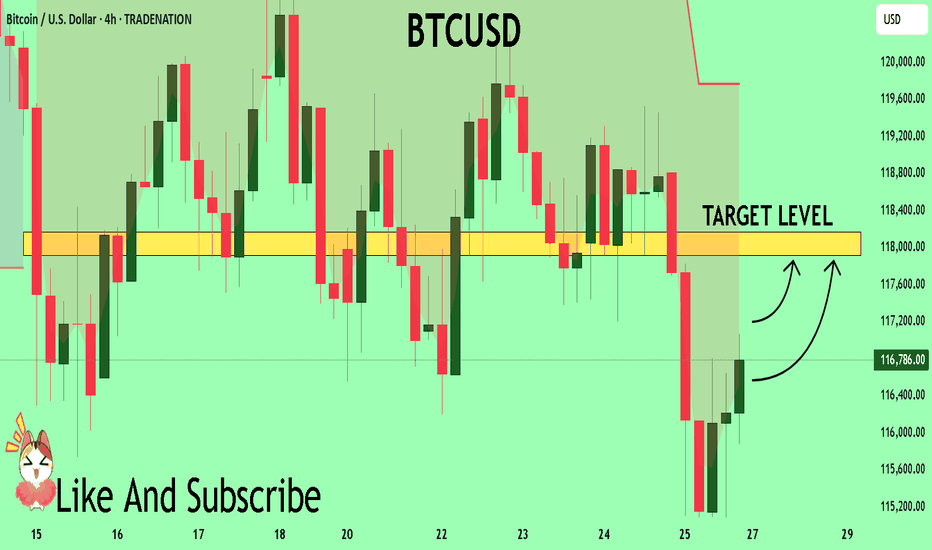

BTCUSD What Next? BUY!

My dear friends,

Please, find my technical outlook for BTCUSD below:

The price is coiling around a solid key level - 11678

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 11791

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

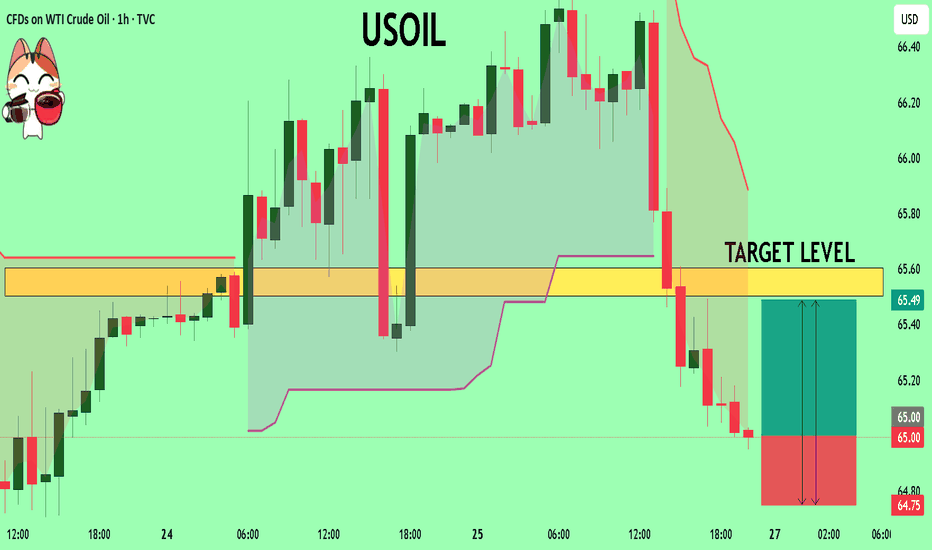

USOIL My Opinion! BUY!

My dear friends,

Please, find my technical outlook for USOIL below:

The instrument tests an important psychological level 65.00

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 65.50

Recommended Stop Loss - 64.75

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

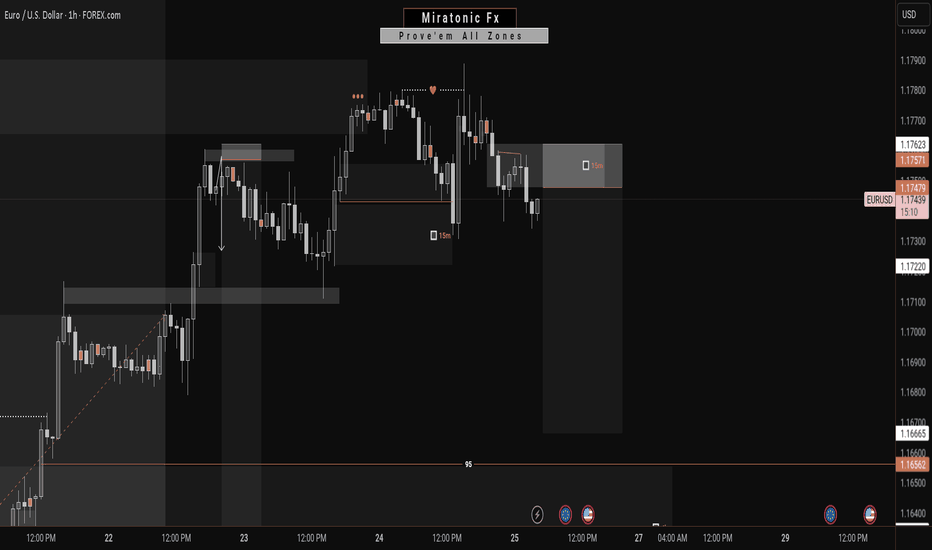

EURUSD: Long Signal with Entry/SL/TP

EURUSD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURUSD

Entry - 1.1724

Stop - 1.1714

Take - 1.1743

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

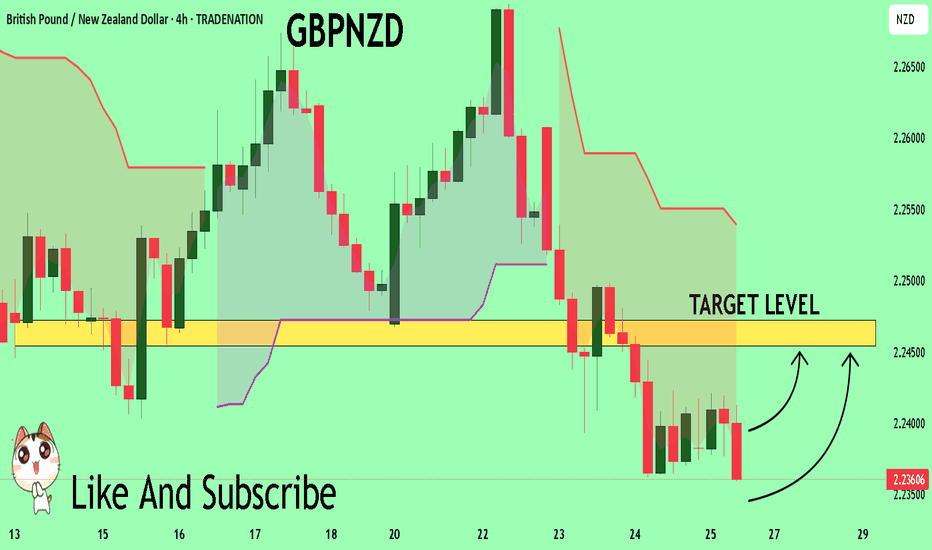

GBPNZD Will Explode! BUY!

My dear friends,

My technical analysis for GBPNZD is below:

The market is trading on 2.2361 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.2454

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

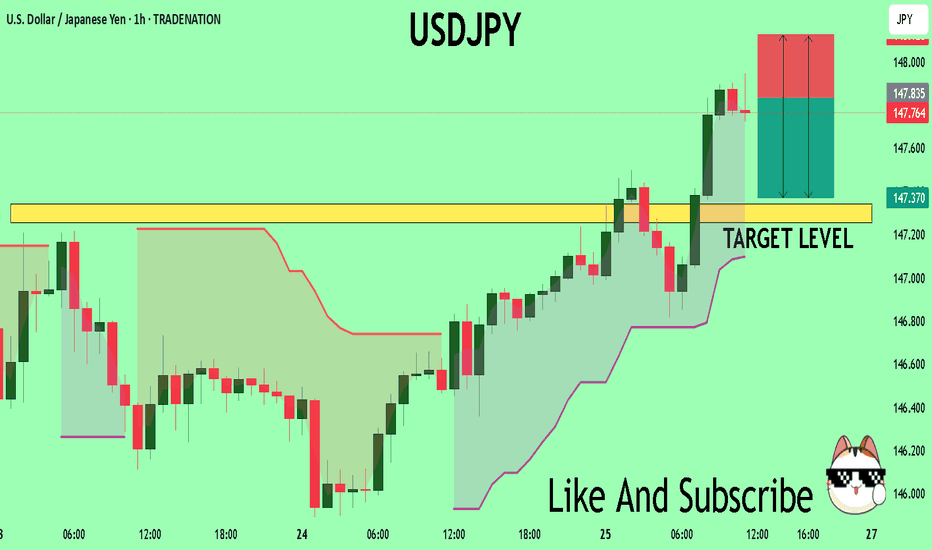

USDJPY Under Pressure! SELL!

My dear subscribers,

My technical analysis for USDJPY is below:

The price is coiling around a solid key level - 147.83

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 147.34

My Stop Loss - 148.12

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD | Time For A Pullback?The week kicked off with strong impulsive moves to the upside, leaving no room for deeper correction. Then slowly from Wednesday, we started to see a decline in strength in the bullish run.

Now, with price edging toward the next swing low for a possible bearish change of character, is this a good way to ride the stream to the downside?

Keep your A-game on as we watch price unfold, and trade reactively to price movement.

Do not forget to guard your capitals with risk management.

Good luck traders. 👍

Follow me for more and more of these analyses.

See you on the next one. 🫡

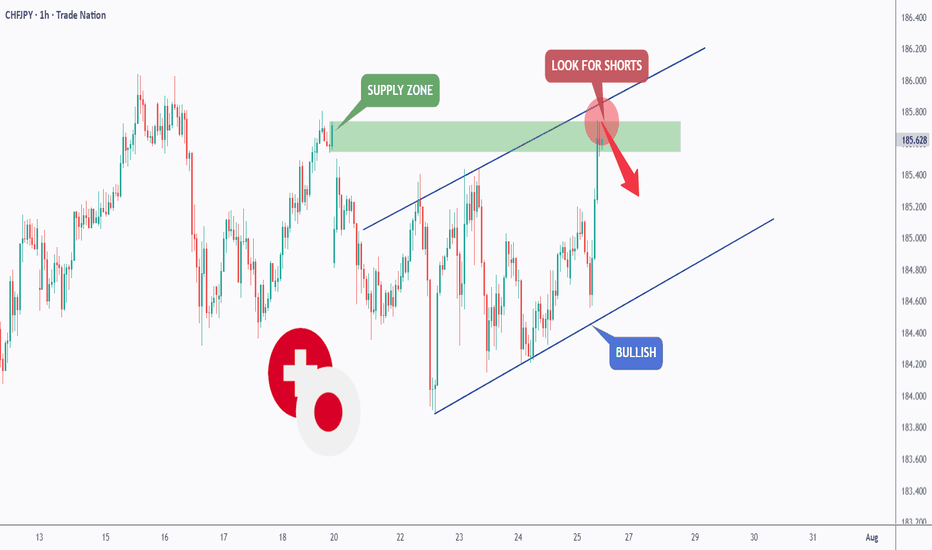

CHFJPY - The Bulls Are Exhausted!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈CHFJPY has been overall bullish trading within the rising channel marked in blue and it is currently retesting the upper bound of it.

Moreover, the green zone is a strong supply.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper blue trendline and green supply.

📚 As per my trading style:

As #CHFJPY is hovering around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

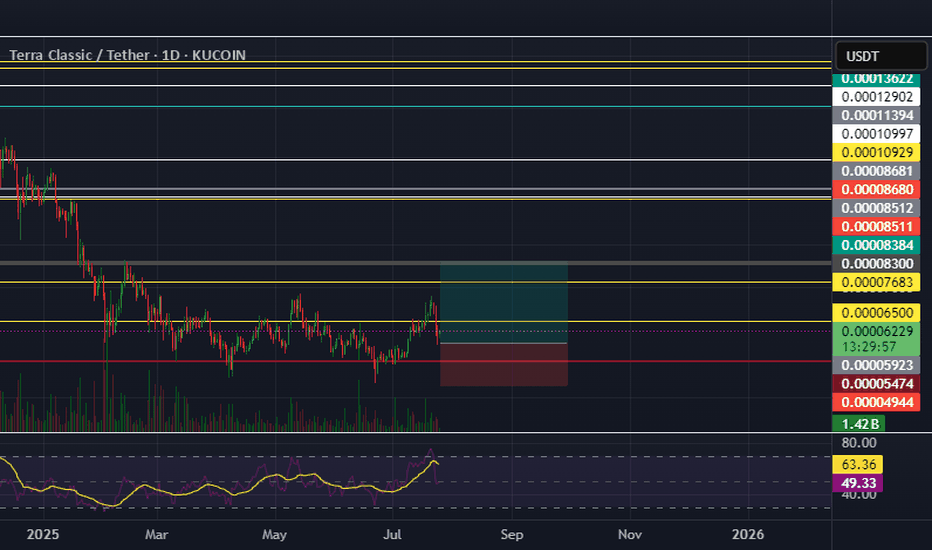

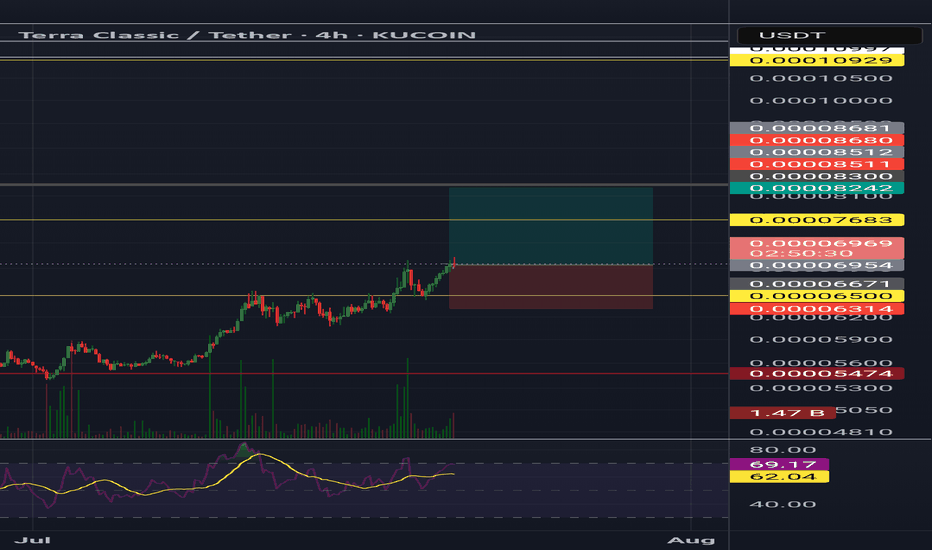

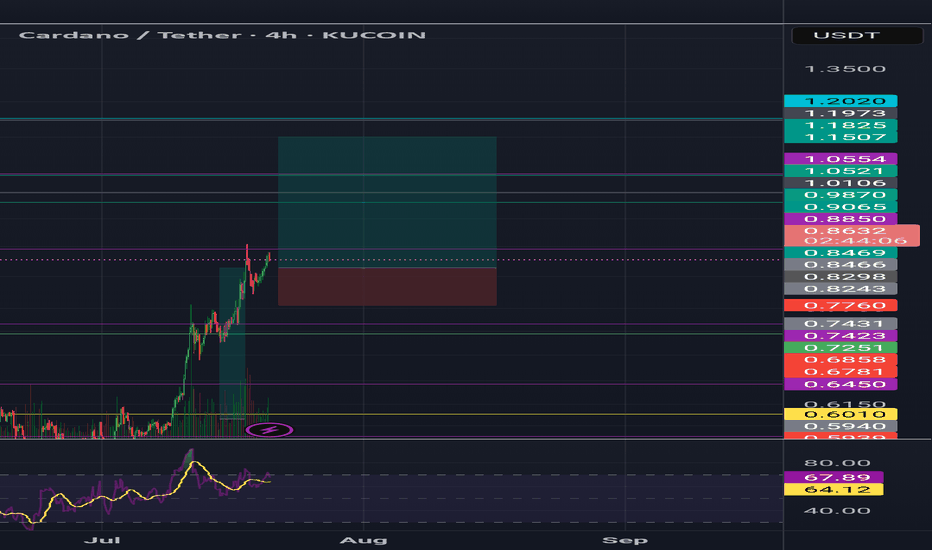

Blokblok usdt daily analyses

time frame daily

long position risk of ratio >9

target 0.00075$

if price breaks the upper line my long position will start. duration of this forecast is long

if it cannot break and move between orange lines my short position will be active. this duration is short

short position risk of ratio >2

target 0.00027$

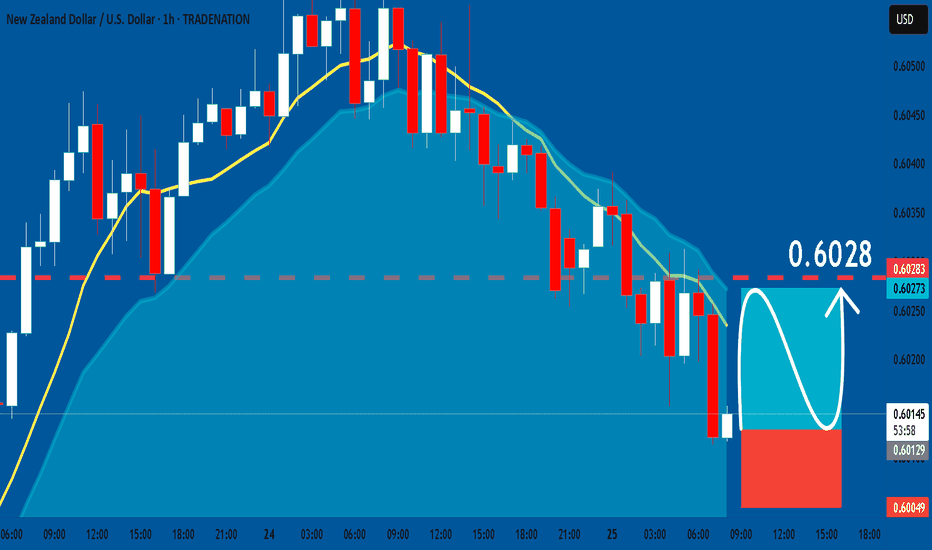

NZDUSD: Free Trading Signal

NZDUSD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long NZDUSD

Entry Point - 0.6013

Stop Loss - 0.6004

Take Profit - 0.6028

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

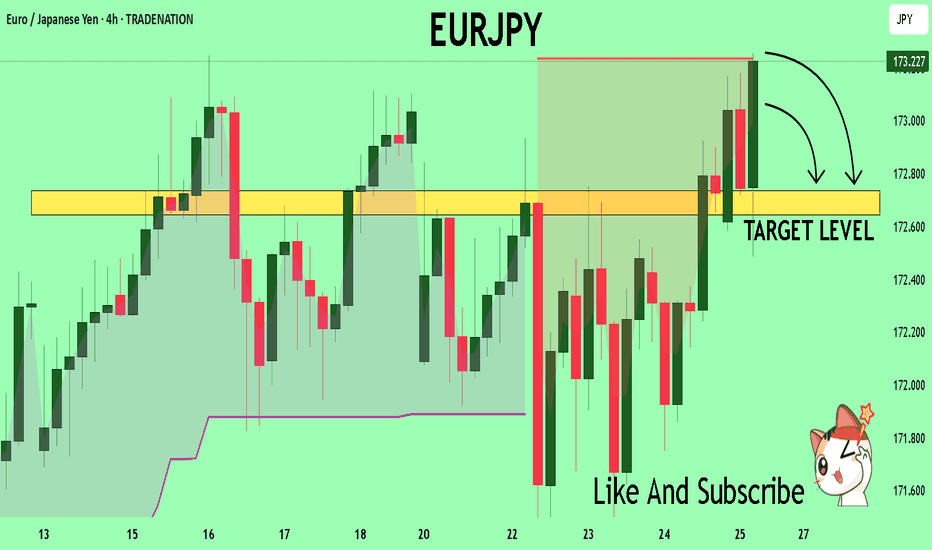

EURJPY Technical Analysis! SELL!

My dear subscribers,

EURJPY looks like it will make a good move, and here are the details:

The market is trading on 173.19 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 172.73

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

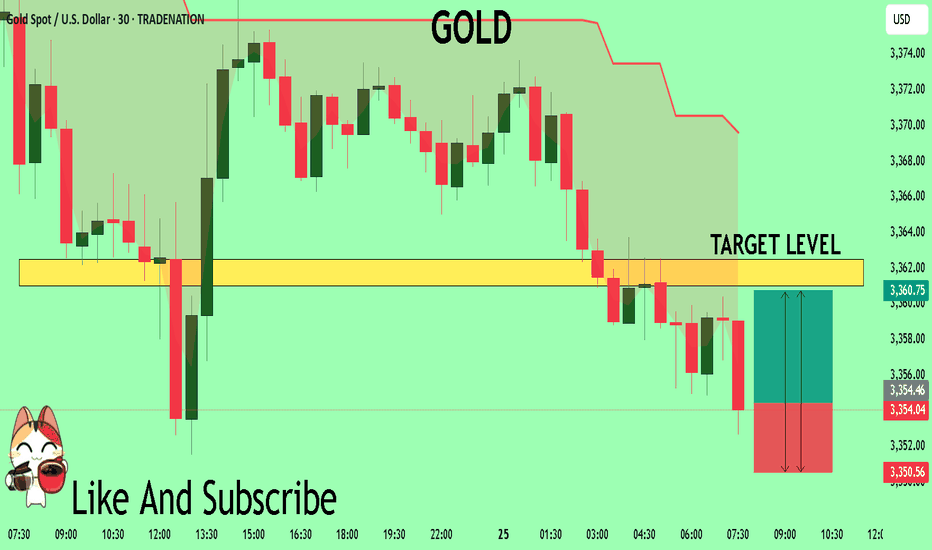

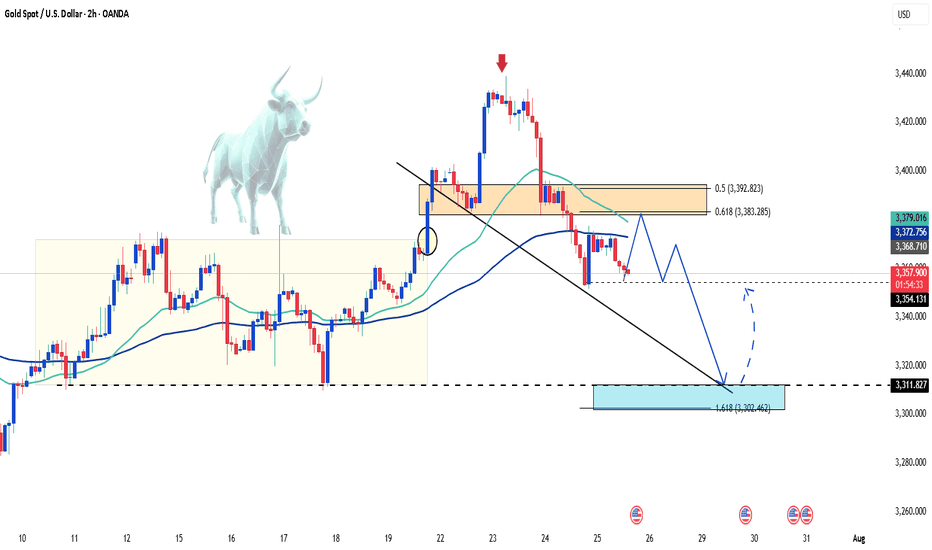

GOLD The Target Is UP! BUY!

My dear followers,

I analysed this chart on GOLD and concluded the following:

The market is trading on 3354.1 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3361.01

Safe Stop Loss - 3350.5

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Gold dips on profit-taking, long-term outlook still bullishGold prices continued to decline this morning as investors locked in profits following the precious metal’s recent rally above $3,400.

In the short term, further downside is possible if profit-taking persists and capital flows shift toward equities, especially as U.S. stock markets hover near record highs. However, gold remains a favored safe-haven asset for the long run amid ongoing global economic and geopolitical uncertainties.

Markets are also turning their focus to the upcoming Federal Reserve policy meeting on July 29–30. While the Fed is expected to hold interest rates steady this time, many investors still anticipate a potential rate cut in September. A low interest rate environment typically supports non-yielding assets like gold.

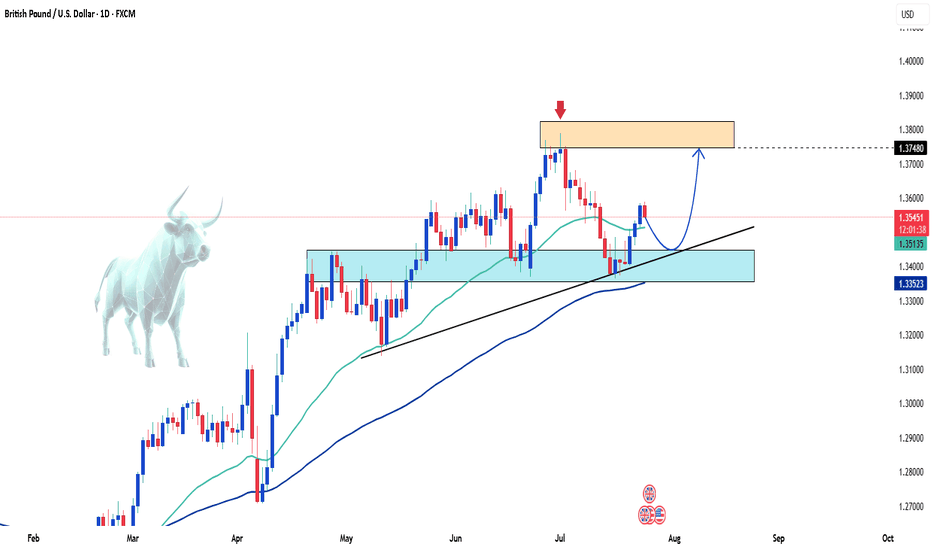

GBPUSD Rebounds Strongly – Is the Uptrend Ready to Resume?Hello traders!

On the D1 chart, GBPUSD is showing a strong recovery after bouncing off the support zone around 1.33500–1.34500. This rebound happened right at the ascending trendline and the confluence with the EMA, reinforcing the strength of the bullish zone.

The overall bullish structure remains intact. As long as price stays above the trendline, I expect GBPUSD to continue its move toward the resistance area near the recent highs.

My strategy is to look for buying opportunities around the support zone or after a confirmation signal from price action following a minor pullback.

Good luck and happy trading!

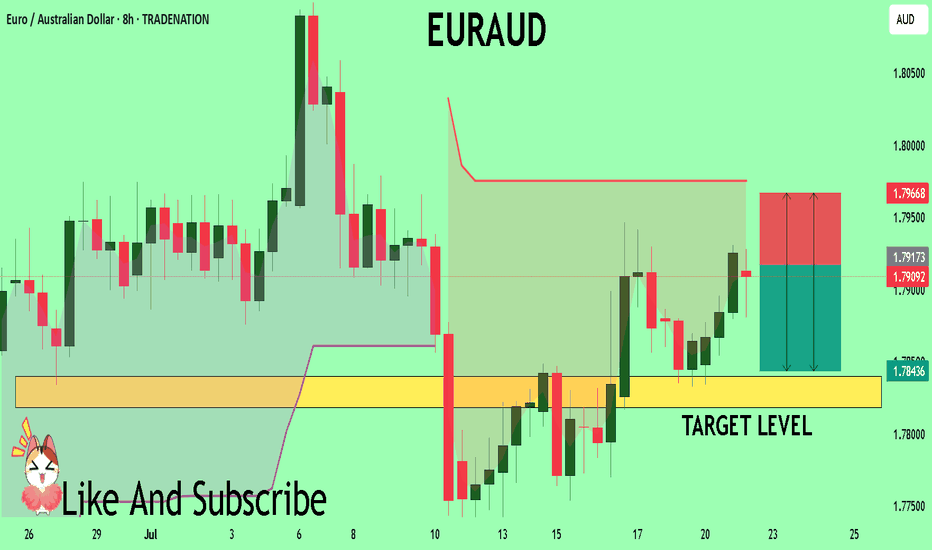

EURAUD Set To Fall! SELL!

My dear followers,

I analysed this chart on EURAUD and concluded the following:

The market is trading on 1.7917 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.7840

Safe Stop Loss - 1.7966

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK