Gold Analysis – New Leg of Correction Incoming?It’s been a “special” week for Gold, with wild swings that kept me mostly on the sidelines – except for Monday’s take profit. Now, however, the market is starting to show more clarity.

❓ Has the Market Topped Out?

After a dip to 3260, the price reversed sharply, gaining over 1,000 pips to reach 3367. Yet, both recent attempts to push higher were rejected.

Now, with the spike from 3360 to 3500 looking like a blow-off top, the stage seems set for a new leg of correction.

🔍 Key Technical Signs:

• Heavy selling pressure near recent highs.

• Price action suggests buyers are exhausted.

• 3370 becomes a key resistance – as long as it holds, bearish setups are favored.

📉 Trading Plan:

My approach is simple:

👉 Sell rallies

🎯 Target: a 1,000+ pip drop if 3370 remains intact.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Signalprovider

EUR/USD: Is the Uptrend Losing Steam?EUR/USD has had an exceptionally strong month, gaining over 7% from bottom to top – one of the best performances in EUR’s history against the dollar.

But now, things are starting to shift.

🧭 Possible Long-Term Trend Change?

Beyond the impressive rally, the bigger story might be the potential shift in the long-term trend. However, after such a sharp move up, a correction is not only likely – it may already be underway.

🔍 Technical Outlook:

- Price pushed above the key 1.15 psychological level but failed to hold momentum.

- A bearish consolidation is forming.

- A classic Head and Shoulders pattern appears to be developing, with a neckline near 1.13.

- A break of that level could open the door for a deeper retracement, with a target around 1.11.

🛠️ Trading Plan:

I’m looking to sell rallies, ideally near 1.1450, to maintain a 1:3 risk-to-reward ratio.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

USD Index: A Possible Reversal in Sight?Since early February, right after Trump’s inauguration, the USD Index (DXY) has been under pressure, falling sharply by over 10%.

However, after hitting the 98.00 level, things seem to have stabilized. We're seeing the early signs of a relief rally.

🔍 Technical Perspective:

- This week’s candlestick pattern suggests a bullish reversal.

- The dip on Wednesday was quickly bought, showing buyer interest.

- A minor correction occurred yesterday, but dips are being well supported.

- Currently, the DXY trades around 99.60, just under the psychological level of 100.

🎯 Outlook:

As long as 98 remains intact, the bias shifts towards a potential rebound.

First target: 102 – a logical resistance zone and prior support.

This is not yet a confirmed trend reversal, but the price action is shifting. The key now is how the market reacts around the 100 level. A break above could trigger further bullish momentum.

Solana – Bear Market Rally or Reversal?Like the rest of the crypto market, Solana started rebounding on April 8th, pushing more than 50% up from the recent lows. But just like with many altcoins, I'm not convinced this is a true trend reversal. Instead, it looks more like a classic bear market rally.

Let’s not forget: SOL is coming down from nearly $300. A bounce from $95 to $150 is strong, yes—but in the bigger picture, it’s still just a correction.

📍 Key resistance zone: $160–$170

As long as price remains under this zone, the probability of another leg down remains high.

🧠 My plan:

If Solana creates a new local high around $160, I’ll be looking to sell into the rally.

🎯 Target:

$100 at least, depending on how the market reacts.

Crypto Euphoria Is Back, But Should It Be?📈 Bitcoin is back above 90k and the crowd is cheering again: moons, 150k by summer, non-stop hopium.

But is the overall picture that bullish? Not even close.

📊 Looking at the Total Market Cap chart :

- After that long November to late February consolidation, Total finally broke below the 3T support

- We retested the break and new local lows followed

- The recent bounce? Looks corrective, not impulsive

- And we’re still trading below 3T and with good percentages

❗ Conclusion:

I’m not buying into the hype.

In fact, I’m expecting a new leg lower – possibly all the way to 2T

📌 Trading Focus:

Shorting Solana and ETH

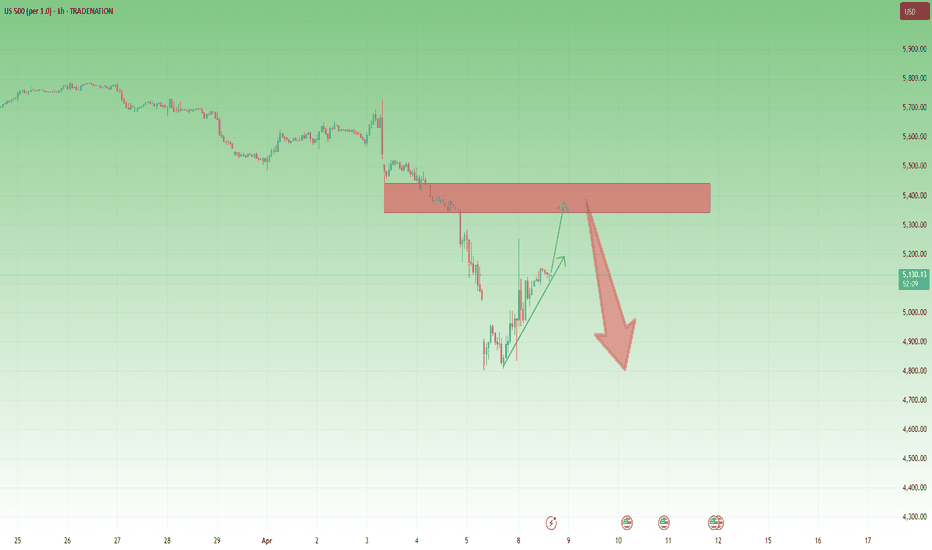

SP500 remains very bearish overall📈 In my previous post, I highlighted the confluence support zone and the potential for a bounce — and we got it. SP500 rallied around +10% off the lows.

But let’s not get too comfortable...

❓ I s the worst behind or is this just a trap before the next leg down?

From my perspective, the correction is not over.

The current bounce looks more like a bear market rally than a true reversal.

📉 Why I expect another drop:

1. Technically, as long as SP500 is trading below 5500-5600 zone, the structure remains bearish

2. Fundamentally, the backdrop hasn’t improved — if anything, it’s getting worse

3. Price is approaching a major resistance zone, which I plan to sell into

📌 My Plan:

I’m watching this zone for signs of weakness.

If momentum fades, I’ll look to short, targeting at least 5k, potentially even a new local low.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GOLD – Will the Correction Continue or Is It Over?📉 What happened yesterday?

Gold extended its drop and touched a low around 3260. A recovery of around 1000 pips followed — a typical day for Gold lately, just daily noise...

However, during the Asian Session, selling pressure kicked in again and we’re now seeing fresh weakness.

❓ Has Gold finished correcting or is there more to come?

That's the big question. And the answer might lie in the 3300 zone — specifically the 3285–3300 range. Why? Because this is where the last powerful bullish impulse started, the one that took Gold to kiss the 3500 level.

🔍 Why continuation of the correction is still possible:

- We’re seeing a retest of support, not a new higher low – this weakens the bullish case.

- The Asian Session high lines up with the old ATH, potentially forming a Head and Shoulders pattern – not confirmed, but worth watching.

At least the market madness of the past days has now given us clearer levels to work with:

→ Below 3280 = further downside possible, with 2k pips target if H&S confirms

→ Above 3350 = likely trend resumption, aiming again for 3500

📌 My trading plan:

Even though I always work with 2 scenarios, I usually have a preferred one. It's not the case at this moment, so I'm still out.

- If I see momentum above 3350, I’ll look to buy.

- If I see a break under 3300 with confirmation, I’ll look to sell continuation.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Silver Update – April Rollercoaster Ends in Bullish Setup?What a month it has been for Silver also!

In early April, the metal broke down from a rising wedge pattern, triggering a waterfall drop of around 6,000 pips. The plunge took us right into the 28 zone, but the reversal that followed was nothing short of spectacular.

In just two trading days, Silver rocketed back above the key 30 level, and the rally didn’t stop there. By mid-month, it reclaimed the 32 support – a level previously broken during the drop.

📉 Last week, however, price action turned quiet compared to the volatility in Gold, with Silver entering a tight consolidation.

But here’s the key point:

➡️ Despite the sharp early-month drop, the structure is now bullish again and remains so as long as 32 holds.

💡 Trading Plan:

I'm looking to buy dips near 32 in anticipation of a breakout above 33.15 – the upper boundary of the recent consolidation.

If that level gives way, Silver could accelerate its gains and make a new attempt toward 35.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold Madness –5k Pips in 10 Days,drop almost 2k after. Now What?The last 10 trading days in Gold can be summed up in just one word: madness.

Back on April 9, the price was still under 3000 – yesterday it kissed 3500, marking an explosive 5000-pip rally in less than two weeks. That’s over 15% gain in no time!

🔙 As I mentioned in yesterday’s educational post , even though I expected a major correction, the lack of a clear stop loss setup made me choose the safest option: staying out.

Well, Gold did what it does best – surprise. Just before reaching a new all-time high, price reversed and at the time of writing, it has already dropped over 1600 pips from the peak.

📉 From a technical perspective, there are some important developments:

- Price has broken below the rising trendline, signaling a potential shift on short term

- Now, it's heading towards the 3250 support zone, which is aligned with the 50% Fibonacci retracement of the recent rally.

- This area could become a battleground – if bulls step in, we might see another bounce.

💡 Trading Plan:

From the selling side, the only potential setup I see is around 3450, but with a huge stop loss, making it less attractive.

On the buy side, I’ll be watching the 3250 level closely. If price action shows strength there, I may consider entering long – but only if the market conditions align properly.

Until then, I’m observing from the sidelines. No FOMO – just disciplined strategy. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

ETH Bulls Might Have a Shot – Tight Range Before the Breakout📅 What just happened on ETH?

Ethereum recently printed a local bottom just below 1400 – a level that felt unthinkable just a few months ago. But as it often happens in crypto, the unexpected became reality.

💡 What came next?

From that low, ETH bounced strongly, signaling the start of a natural correction. While I personally don’t believe this is the final bottom, I do see opportunity on the upside.

🧐 What the chart tells us:

Sharp reversal from under 1400

Quick drop but failed continuation lower

Current tight consolidation, which often leads to breakout setups

🧠 My view:

Right now, this looks like a temporary bottom, and until proven otherwise, I’m interested in buying the dip. As long as the structure holds, bulls might have the upper hand short-term.

🎯 My Trading Plan:

Looking to go long, with 1800 as my target.

Risk-Reward? I’m aiming for at least 1:2, so I’ll be waiting for the right entry signal before jumping in.

Massive Rally, Massive Resistance – Time to Sell GBPUSD?The last two weeks felt like a rollercoaster for GBPUSD. It all started with a gap down on Monday, April 7, but that weakness didn’t last. The pair filled the gap and then rallied hard – over 700 pips!

🤔 Key Question – Is the move sustainable, or are we topping out?

Now the pair is approaching a massive resistance zone, one that dates back to 2019. While the bullish sentiment and USD weakness could push it toward 1.3500, this isn’t a breakout I’d blindly chase.

📉 Why I'm expecting a reversal:

Price is entering a long-term resistance area – a major barrier.

700 pips of upside happened fast – a pullback is likely.

USD weakness might fade, creating downward pressure.

1.3450–1.3500 is my key sell zone.

📊 My Trading Plan:

I’ll be watching for clear signs of weakness near 1.3450 – such as rejection candles or slowing momentum. If the market confirms, I’m looking for a 500 pip move down, with 1.3000 as the first major target.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold Hits New ATH Again: Is the Bull Run Unstoppable?After printing a new All-Time High on April 17, Gold entered a brief correction that ended on April 18 at 3285. However, the daily candle closed strong at 3327, right before the long Easter weekend.

Fast forward to Monday's ASIA session open, Gold showed no hesitation and pushed into yet another ATH at 3384.

The bullish momentum is so aggressive that it feels like nothing can stop this trend. While I do expect heavy volatility going forward, the core strategy remains clear:

👉 Buy the dips.

Key Level to Watch:

📍 First support zone = 3350

At this level, I will actively look for long entries, targeting a potential new ATH later this week.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EURUSD: Watch for buys around 1.09625!Hey traders!

EURUSD has played out beautifully according to yesterday’s analysis, hitting our key levels with precision. The bullish momentum remains intact, and I'm still targeting the previous week's high at 1.11450.

Before the next leg up, I anticipate a pullback towards the Asian session low around 1.09625. This level could serve as a potential liquidity grab and demand zone, a perfect spot for buyers to step back in.

✅ Watch for bullish rejections or confirmation candles around 1.09625 to signal that buyers are defending the level. If confirmed, it could be the start of a solid move back to the upside.

📊 What’s your bias on EURUSD today? Bullish or bearish?

Let me know in the comments below! 👇

If you found this idea helpful, please consider supporting it with a boost, your support means a lot! 🙏🔥

Previous Idea

How it played out

Gold: Buy setup brewing around 3045 – wait for confirmation!Hey traders! 👋

I’m eyeing a potential long opportunity on Gold in the 3030–3045 zone, but only with proper confirmation.

The shiny metal has broken and closed above Monday’s high with strong momentum, signaling short-term strength. However, considering the overall short-term bearish bias, I anticipate a pullback toward the 78.6% Fibonacci retracement level.

💡 Here's the plan:

🔸 Wait for price to dip into 3030–3045

🔸 Watch for bullish rejection candles or confirmation patterns

🔸 If confirmed, go long with targets at 3088 and 3123

🎯 This could be a great opportunity to catch the next leg up while still respecting short-term corrections.

If this setup adds value to your analysis, I’d truly appreciate your boost. Thanks for the continued support and happy trading! 💛📈

Buy the Dips Towards 3080 – Gold Builds a Strong Base 🟡 What happened with Gold (XAUUSD) yesterday?

In yesterday's analysis, I mentioned that I was bullish on Gold, expecting a resumption of the upward move with targets extended to 3080 and interim resistance at 3050.

Although the price rose, it found strong resistance at the 3020 zone, which prompted me to close my buy trade with around 400 pips profit (although I was aiming for closer to 1k pips).

Afterward, the market started to drop and breached under 3000 again.

However, once the price reached the 2970 zone, bulls entered the market strongly and pushed the price back above 3000.

❓So now what? Is the correction over or will it continue?

Looking at the chart, we can clearly see two things:

✅ A solid support has formed around 2960-2970 zone

✅ A double bottom is in the making, with a well-defined neckline at 3020

________________________________________

📌 Why the bullish bias remains valid:

• 2960-2970 proved to be a strong demand zone

• Price reclaimed the 3000 level after the dip

• Double bottom structure is forming = possible breakout ahead

• 3020 is the key level to break for continuation

________________________________________

🎯 Trading Plan:

The preferred strategy remains:

➡️ Buy the dips

🎯 Main target: 3080

❌ Invalidation: daily close below 2960

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Bulls Take Control – Can EURUSD Reach 1.1150 Again?1. What happened (recap):

Last week, EURUSD reached the 1.1150 zone, a level that hasn't been touched since August-September last year. After that, the pair started a correction. Although the week started with a gap down yesterday, bulls took control and pushed the pair higher.

2. Key Question:

Has EURUSD completed its correction, or is another drop coming?

3. Why I expect further upside:

• 🔑 A retest of the formed support at 1.09 occurred during yesterday’s New York session, followed by a fresh rebound.

• 📊 The drop from 1.1150 appears corrective in nature, suggesting the possibility of a new leg up.

• 🎯 As long as 1.09 holds, my strategy is to buy dips with the primary target being a retest of the 1.1150 resistance zone.

4. Trading Plan:

📌 I’m looking for buying opportunities on dips, aiming to retest the 1.1150 resistance area. This scenario is invalidated only by a daily close below 1.09.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold's Rollercoaster: From 3167 ATH to 2950 Support–What's Next?Since the beginning of the year, Gold has been on an impressive uptrend, gaining over 5000 pips, culminating with last week's ATH at 3167.

As I highlighted throughout last week's analyses, even though we're in a strong uptrend, the price was too far deviated from the mean, making a correction inevitable.

✅ Friday Recap:

After testing the resistance zone formed at 3135-3140, Gold dropped hard, closing the week 1000 pips lower from its peak during Friday's session.

📉 Recent Developments:

The correction continued yesterday, with Gold recently touching an important confluence support around 2950.

📈 What's Next?

I expect an upward movement and resumption of the uptrend, with targets at:

• 3050 zone 📌

• 3080 zone 📌

🎯 Plan:

Buy dips near support, aiming for the mentioned targets. The analysis would be negated if we see a clear break below 2950. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Bulls are not of the woods, not by far1. What happened yesterday?

In my weekend analysis covering US indices , I mentioned that US500 (SP500) could drop and test the ascending trend line starting back at the pandemic low. This line is confluent with the horizontal support level given by January 2022 ATH, offering a good opportunity for traders to open long positions.

Indeed, at least on CFDs and futures, this trend line was touched, and the price rebounded strongly from there.

2. Key Question:

Will we have a full V-shape recovery, or will the price drop back below 5k in the coming sessions?

3. Why I expect a continuation of the correction:

🔸 Strong Resistance: The US500 has established a robust ceiling around the 5350-5400 zone(also a gap there)

🔸 Lack of Building Momentum on Support: There's no clear indication that this resistance will be broken anytime soon with the lack of accumulation under 5k

🔸 Potential for Further Decline: Given the current market structure, a drop below 5k remains a realistic possibility in the upcoming sessions.

4. Trading Plan:

🎯 My Strategy: Playing the range.

✅ Buy near the 4800 support.

✅ Sell into the resistance zone between 5350 and 5400.

5. Conclusion:

I’m watching for market confirmations and will continue applying this range strategy until there’s a clear directional change. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold’s Wild Ride: Is the Correction Over?Yesterday was an insane day for Gold—while I expected a strong drop to at least 3,080, I didn’t anticipate such a sharp reversal after the sell-off.

Now, the big question is: Has Gold finished correcting, or is more downside coming?

________________________________________

Why I Expect Another Wave of Selling

📉 Gold Still Looks Vulnerable – Despite the rebound, I don’t believe the correction is over.

📉 Key Resistance Established – The 3,135–3,140 zone has now formed a strong ceiling, limiting upside potential.

📉 Selling Rallies Remains the Plan – Even with yesterday’s bounce back above 3,100, my outlook remains unchanged.

________________________________________

Trading Plan: Selling Spikes During NFP

🔻 Looking for price spikes during the NFP report as opportunities to sell into strength.

🔻 Targeting a new leg down toward the 3,030 support zone.

The correction is likely not done yet—let’s see if the market confirms it. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Nasdaq's Drop: A Temporary Rebound Before More Downside?I've been calling for a strong correction in the Nasdaq (and all major U.S. indices) since the start of the year—long before the tax war even began. I warned that a break below 20,000 was likely, with my final target set around 17,500.

And indeed, the index has fallen—regardless of what the so-called "cause" might be. Right now, Nasdaq is trading at 18,400, sitting right at a minor horizontal support zone.

________________________________________

A Short-Term Rebound Before More Downside?

📉 Overall Bias Remains Bearish – The broader trend still points lower.

📈 Rebound Likely – A push above 19,000 in the coming days wouldn’t be surprising.

⚠️ High-Risk Setup – Going long here is risky, given the current macroeconomic backdrop.

________________________________________

Trading Strategy: Short-Term vs. Long-Term

✅ For Short-Term Traders & Speculators – A temporary upside correction could offer a buying opportunity.

❌ For Swing & Long-Term Traders – It's better to wait for this rebound to fade and position short for the next leg down.

While a bounce could be on the cards, the bigger picture still points lower—I remain bearish in the long run. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold new ATH at 3,168: A Final Push Before the Drop?Yesterday was a high-volatility day, and we all know why.

Gold surged to yet another all-time high at 3,168, and luckily, I had already closed my sell trade around break-even—otherwise, my stop loss would have been triggered.

________________________________________

Gold Still Set for a Hard Drop?

Despite the rally, my outlook remains unchanged—I still believe Gold is due for a significant correction.

📉 3,100 Held as Support – But buyers are struggling to hold onto gains around 3150

📉 Every New High is a Selling Opportunity – So far, Gold has failed to sustain its breakouts, reinforcing a potential distribution phase.

________________________________________

Trading Plan: Selling the Rallies

🔻 Target: At least 3,080

🔻 Preferred Strategy: Continue selling into rallies

For now, I remain bearish and will keep looking for opportunities to short the market. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Bitcoin- Short term recovery?As you know, I am bearish on Bitcoin in the long term. However, in the short term, the cryptocurrency could see a recovery.

Yesterday, the price tested the 81,000 support zone once again and rebounded from that level. Now, Bitcoin is pushing against the 83,500 resistance, and I believe a breakout is likely.

If that happens, we could see further gains, with 86,500 as the next key target for the bulls.

In conclusion, I’m bullish on BTC in the coming days and will be looking to buy dips.

Gold's trend has too many friendsThere’s a well-known saying in trading: “The trend is your friend.”

I firmly believe in this principle. However, when price movements become too extreme—too fast and too far—it’s wise to exercise caution, even if you’re not ready to take the opposite side of the trade.

And right now, I believe that’s exactly the case with Gold.

________________________________________

Why a Major Gold Correction is Likely

As I’ve been repeating like a broken record since Monday, Gold’s price is severely deviated from the mean, signaling that a brutal correction is on the horizon.

After reaching a new all-time high of 3,150, Gold retraced yesterday, dropping to 3,100—a support level formed earlier in the week. A rebound followed, but as I’ve explained in an educational article, this price action looks more like a stepwise distribution rather than true buying strength.

The key point?

➡️ Support isn’t holding because buyers are stepping in—it’s holding because big sellers have paused selling.

________________________________________

Still Bullish, But a Drop is Coming

There’s no doubt that Gold is in a strong uptrend. But even if it drops 1,000 pips, the overall bullish trend would still be intact.

Key Technical Signs of Weakness

📉 Trendline Break – Yesterday, Gold broke below the rising trendline, marking the first sign of weakness.

📉 Failed Rebound – Despite a short-term bounce, the price is now more likely confirming the break rather than invalidating it.

📉 Lower High in Progress? – The next minor support sits at 3,120. If Gold breaks below this level, we’ll have confirmation of a lower high, which strengthens the bearish case.

________________________________________

Targeting the Correction

If Gold breaks below 3,120, I expect a move below 3,100, targeting:

🎯 Soft target: 3,080

🎯 Likely target: 3,030 – 3,040

I believe it’s only a matter of time before this brutal correction plays out.

Let’s see how it unfolds! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.