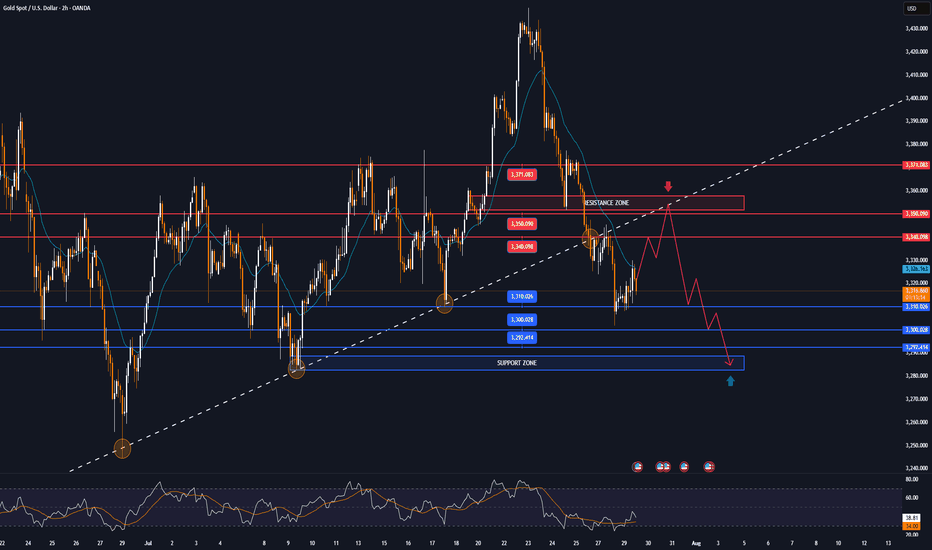

XAUUSD – Bears in Control, but Watch for a Rebound FirstYesterday, after a small bounce from the ascending trendline, Gold broke down and printed an intraday low around $3300.

Right now, the market appears bear-dominated, and further downside continuation is likely in the coming days.

________________________________________

📉 But there’s a catch:

From last week's top, Gold has dropped over 1400 pips without any meaningful correction.

That opens the door for a possible short-term rebound, which could be just a setup for new short entries.

________________________________________

📌 Key levels to watch:

• First resistance: $3350

• Major resistance: $3375 – Only a daily close above this level would shift control back to the bulls

🎯 Until then, any bounce is an opportunity to sell into strength.

A break below $3300 opens the path to $3280, with a likely extension toward $3250.

________________________________________

Conclusion:

The trend is bearish, but don’t chase.

Wait for a corrective rally, then look to sell the rip—unless bulls reclaim $3375, it’s still a bear market.

Let’s see if Gold gives us the setup. 🎯

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Signals

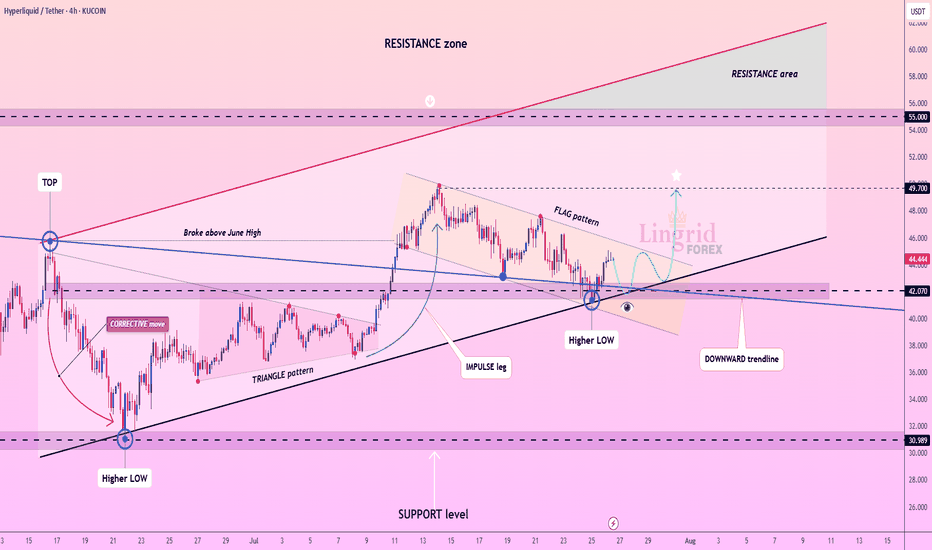

Lingrid | HYPEUSDT Potential Continuation After PullbackKUCOIN:HYPEUSDT is bouncing from a higher low near the 42.070 zone after breaking a descending flag pattern. Price action remains above the ascending support trendline while pressing into a key structure retest. As long as GETTEX:HYPE stays above 42, a bullish leg toward the 49.700 resistance remains likely. Structure suggests a resumption of the impulse phase within the broader uptrend.

📉 Key Levels

Buy trigger: Clean breakout above 45.00

Buy zone: 41.5 – 43.0 (support + flag bottom)

Target: 49.700

Invalidation: Close below 40.00

💡 Risks

Breakdown below the ascending support would weaken the bullish setup

Failure to reclaim mid-flag resistance may lead to deeper consolidation

Broader market weakness in altcoins could delay breakout momentum

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

GOLD trades in narrow range after 4 sessions of sharp declineOn Tuesday (July 29), in the Asian market, the spot OANDA:XAUUSD traded in a narrow range after yesterday's sharp decline, and the current gold price is around 3,315 USD/ounce.

The OANDA:XAUUSD fell to its lowest level in nearly 3 weeks on Monday, mainly due to the trade agreement reached between the United States and the European Union over the weekend, which boosted the Dollar and risk sentiment.

The previous report released by the US Bureau of Labor Statistics showed that the number of US JOLTS jobs unexpectedly increased in May, reaching the highest level since November last year.

The number of JOLTS job vacancies in the US in May was 7.769 million, far exceeding the forecast of all economists surveyed.

Looking back at the data in April, the number of JOLTS job vacancies also showed an unexpected increase.

The JOLTS jobs report is a closely watched labor market data by the Federal Reserve.

In addition, the Conference Board of America's Consumer Confidence Index for July is scheduled to be released on the same day and is expected to be 95.8, compared to the previous value of 93.0.

The fundamental pressure that gold is under

OANDA:XAUUSD came under pressure yesterday and fell to a near three-week low, mainly due to the trade deal between the United States and the European Union (EU) over the weekend, which boosted the Dollar and risk sentiment. Moreover, US President Trump announced “global tariffs” of 15% to 20% on most countries, a change from his previous statement last week.

The deal reached by U.S. President Donald Trump and the European Union late last week will impose a 15% tariff on EU goods, half the rate Trump had threatened, easing fears of a wider trade war.

The U.S. and Japan also reached a deal last week, and U.S. and Chinese officials resumed talks in Stockholm, Sweden, this week with the goal of extending the tariff deadline by 90 days.

Technical Outlook Analysis OANDA:XAUUSD

Gold has been on a four-day losing streak, a decline that threatens bullish expectations as its current position gradually deprives it of any room for further upside.

Specifically, gold has recovered from the psychological level of $3,300 but the actual recovery is not significant, while it is under pressure from the EMA21 which is currently the closest resistance.

On the other hand, gold has fallen below both the long-term and short-term trend channels. If it continues to sell below the 0.382% Fibonacci retracement level, this will confirm a break below the psychological level of $3,300, then the downside target will be around $3,246 in the short term, rather than $3,228.

RSI is pointing down, below 50 and still far from the 20-0 area, also showing that in terms of momentum, gold is also under pressure and there is still a lot of room for decline ahead.

For gold to be eligible for an increase, it needs to at least bring price activity back above the EMA21, back inside the price channels. On the current daily chart, the technical conditions are more inclined towards the possibility of a decrease.

Notable positions will be listed as follows.

Support: 3,310 - 3,300 - 3,292 USD

Resistance: 3,340 - 3,350 - 3,371 USD

SELL XAUUSD PRICE 3355 - 3353⚡️

↠↠ Stop Loss 3359

→Take Profit 1 3347

↨

→Take Profit 2 3341

BUY XAUUSD PRICE 3285 - 3287⚡️

↠↠ Stop Loss 3281

→Take Profit 1 3293

↨

→Take Profit 2 3299

DAX: Local Bearish Bias! Short!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 24,252.78 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

GOLD: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse GOLD together☺️

The market is at an inflection zone and price has now reached an area around 3,321.22 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 3,329.97.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

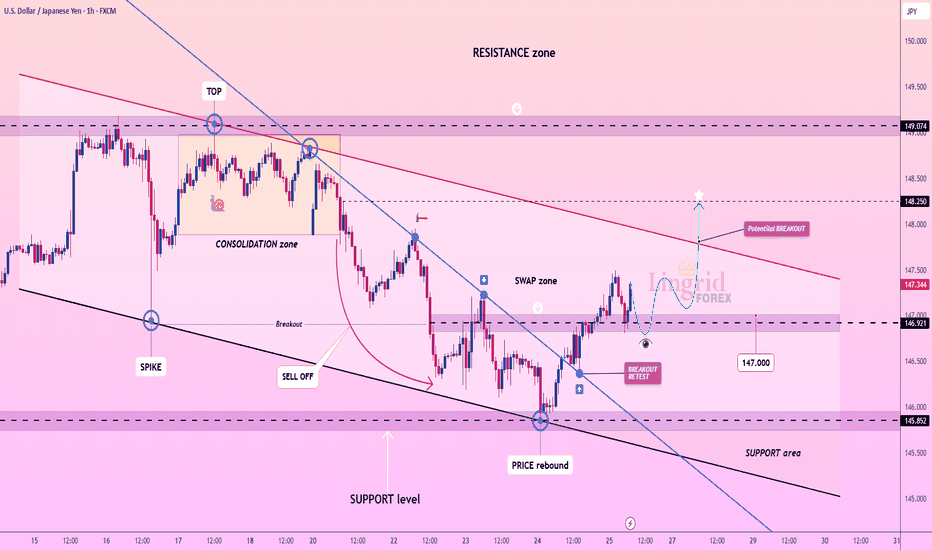

Lingrid | USDJPY Potential Channel Breakout. LongFX:USDJPY is retesting the breakout zone after reclaiming support from a prior swap area near 146.9. Price action has broken above a downward trendline and is forming a bullish retest structure. As long as USDJPY holds above 146.920 zone, the setup favors a continuation toward the resistance barrier. A breakout above the red descending trendline could accelerate upside momentum.

📉 Key Levels

Buy trigger: Break and hold above 147.500

Buy zone: 146.900 – 147.000

Target: 148.250

Invalidation: Break below 146.000

💡 Risks

Failure to break the descending red trendline may trigger renewed selling

Consolidation below resistance could signal buyer exhaustion

Break below 146.000 would invalidate bullish retest setup

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

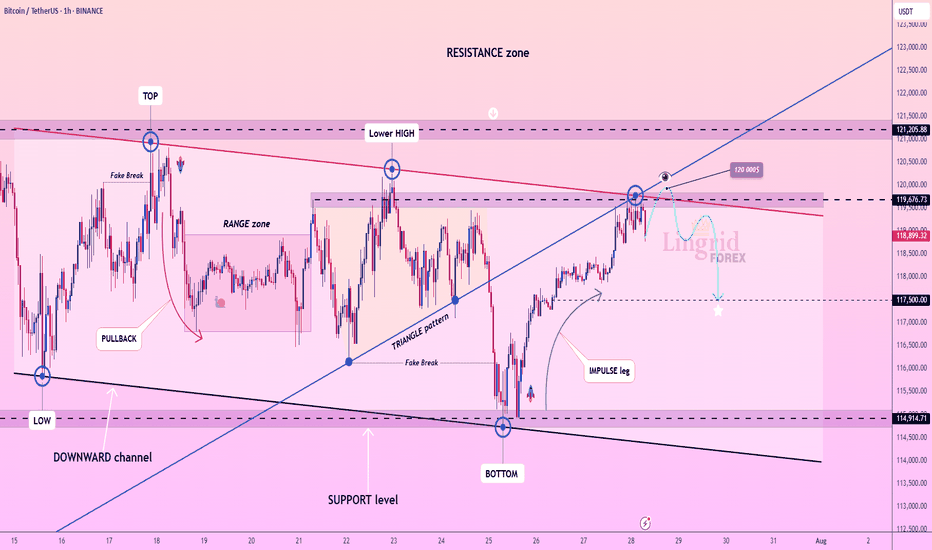

Lingrid | BTCUSDT Range-Bound Market: Short-Term Bearish MoveBINANCE:BTCUSDT has failed to break through the descending resistance near 120,000 and is now forming a lower high within the broader resistance zone. The price action follows an impulsive leg up and is currently tracing a potential reversal pattern under key structural resistance. As long as the market remains capped below 120,000, continuation toward 117,500 is likely. The downward bias is supported by weakening momentum after the bull trap and resistance rejection.

📉 Key Levels

Sell trigger: Breakdown below 119,000

Sell zone: 119,400 – 120,000

Target: 117,500

Invalidation: Break and close above 120,500

💡 Risks

Sudden bounce from the 119,000 handle could trap late sellers

Breakout above 120,000 would shift structure to bullish

Support near 117,500 may slow or reverse bearish pressure

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

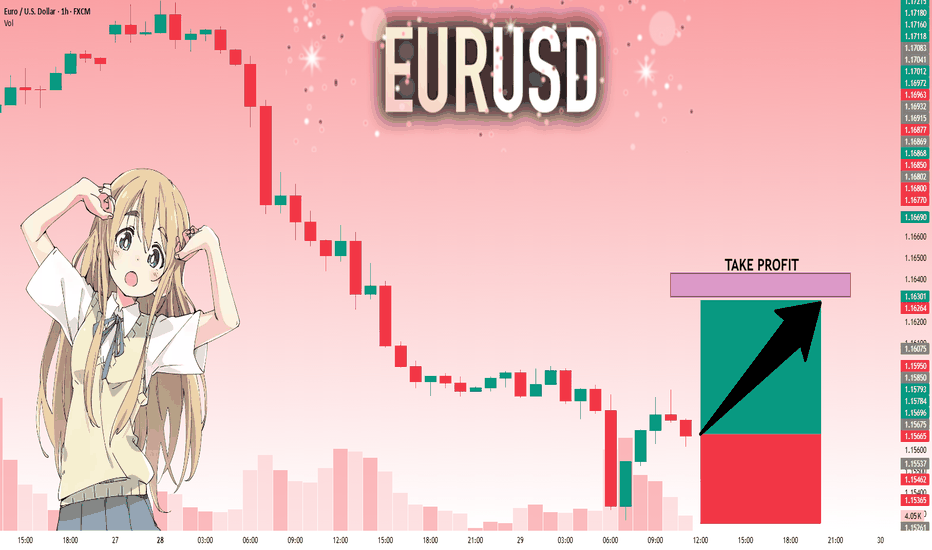

EURUSD: Will Go Up! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.15675 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1.16318.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

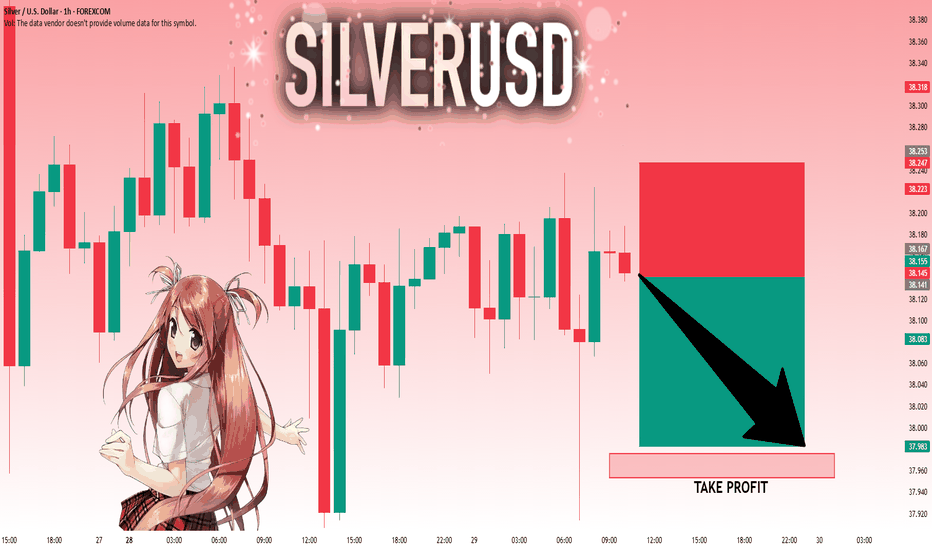

SILVER: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 38.167 will confirm the new direction downwards with the target being the next key level of 37.976 .and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

SILVER Will Grow! Buy!

Please, check our technical outlook for SILVER.

Time Frame: 8h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 3,817.6.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 3,930.1 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURNZD Will Go Down From Resistance! Short!

Here is our detailed technical review for EURNZD.

Time Frame: 6h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 1.941.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 1.927 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPCAD Will Go Down! Short!

Please, check our technical outlook for GBPCAD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 1.833.

The above observations make me that the market will inevitably achieve 1.813 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

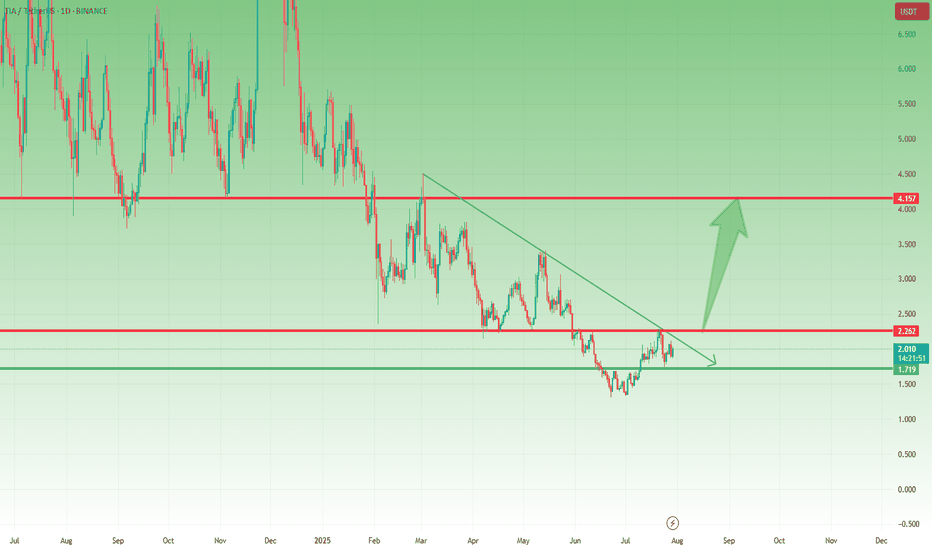

TIA Holding Support – Break Above $2.20 Could Trigger Big MoveLast week, I mentioned that TIA could be preparing for a move and that buying dips around $1.75 might be a good opportunity.

Well, price dropped exactly into that support zone, bounced slightly, and is now consolidating, which could be the calm before the next wave.

________________________________________

📌 Here’s what I’m watching:

• The $2.10–$2.20 zone is now a confluence resistance area (horizontal + descending pressure)

• A break and daily close above this level could trigger a strong leg up, with the next major target around $4.00

________________________________________

📈 Bias remains bullish

As long as $1.70 holds, this setup stays valid, and dips continue to be buyable.

________________________________________

🎯 Trading Plan:

• Looking to buy dips toward $1.80–1.85

• Acceleration expected only above $2.20

• Bearish invalidation only below $1.70

________________________________________

Conclusion:

TIA is respecting structure perfectly. If it breaks above $2.20, we could be looking at a potential double in price toward $4.

EURUSD Is Bearish! Short!

Take a look at our analysis for EURUSD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 1.166.

Considering the today's price action, probabilities will be high to see a movement to 1.159.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Rectangle Consolidation + Bull Trend = BTC Setup for ATHYesterday, Bitcoin dipped and recovered again, following last week's sharp spike down, triggered by the $9B Galaxy Digital sale on behalf of a Satoshi-era investor.

________________________________________

🧠 Why is this important?

Despite being one of the largest BTC sales in history, the move only caused a temporary spike down.

That’s a clear sign of market strength and strong interest on dips.

________________________________________

📉📈 Current Technical Context:

• If we ignore the spike, price is consolidating in a tight rectangle

• That’s typically a continuation pattern

• The broader trend remains strongly bullish

📌 Put all of that together, and we have at least 3 reasons to expect upside continuation

________________________________________

🎯 Key Levels:

• Break + daily close above $120K → likely leads to a new ATH and a potential test of $130K

• Invalidation only comes with a break below $114K

________________________________________

Conclusion:

BTC just absorbed a massive $9B sell without blinking.

As long as $114K holds, I'm bullish and expecting continuation.

Next leg could (and I hope it will) be explosive. 🚀

Lingrid | AVAXUSDT Corrective Move In The MarketThe price perfectly fulfilled my previous idea . BINANCE:AVAXUSDT retraced sharply from the 27.34 resistance zone after making a higher high but found support above the descending trendline. The recent corrective move has paused at a key structure level near 24.96, hinting at potential bullish continuation. A breakout above this local resistance could trigger a rally toward the 26.50–27.34 target zone. Momentum builds as long as price remains above the trendline and higher low structure.

📈 Key Levels

Buy zone: 24.80 – 25.30

Buy trigger: Break and hold above 25.30

Target: 26.50

Invalidation: Close below 24.00

💡 Risks

Downward trendline still active and could act as resistance

Potential for bearish fakeout before breakout

Failure to reclaim 25.30 quickly weakens bullish scenario

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

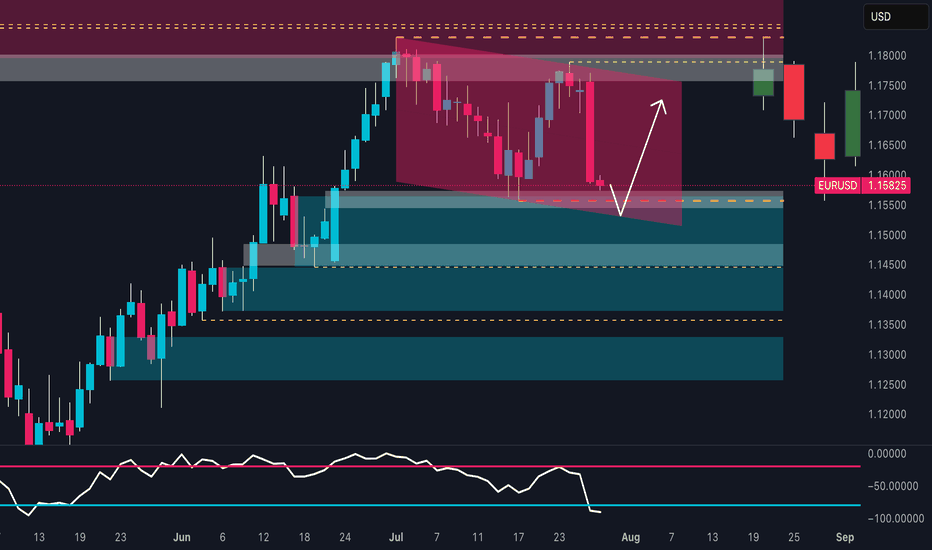

EUR/USD at a Turning Point:Rally or Trap for the Bulls?📉 Technical Analysis

Price has decisively broken out of the descending channel highlighted in recent weeks. The weekly support zone between 1.1540 – 1.1580 is holding, triggering a significant technical reaction. The weekly RSI has entered oversold territory, suggesting a potential short-term reversal.

Key Support: 1.1530–1.1580 (currently reacting)

Key Resistance: 1.1720–1.1780 (inefficiency & supply zone)

Base Case: Potential rebound toward 1.1720–1.1750 before next structural decision

🧠 Sentiment Analysis

82% of retail traders are long, with an average entry at 1.1635

Only 18% are short, a clear minority

This extreme imbalance suggests downside pressure may persist to flush out weak long hands before a genuine reversal takes place.

📊 COT (Commitment of Traders)

USD Index:

Non-Commercials increased both long (+663) and short (+449) positions → uncertain stance but slight USD strengthening

EUR Futures:

Non-Commercials increased long (+6,284) and short (+8,990) positions, but net increase favors the bears

This shift signals a bearish turn in sentiment among large speculators, indicating short-term downward pressure.

📈 Seasonality

In July, EUR/USD historically tends to rise, but:

This year’s price action is underperforming the seasonal pattern, showing relative weakness

August is historically flat to slightly bearish

Seasonality does not currently support a strong bullish continuation

✅ Strategic Conclusion

Current Bias: Bearish-neutral (with short-term bullish bounce expected)

A technical rebound toward 1.1720–1.1750 is likely (liquidity void + RSI bounce + retail imbalance)

However, 1.1720–1.1750 is a key supply zone to monitor for fresh shorts, in line with:

Dollar-supportive COT data

Overcrowded long retail positioning

Weak seasonal context

🧭 Operational Plan:

Avoid holding longs above 1.1750 without macro confirmation

Monitor price action between 1.1720–1.1750 for potential short re-entry

Clean breakout above 1.1780 → shift bias to neutral/bullish

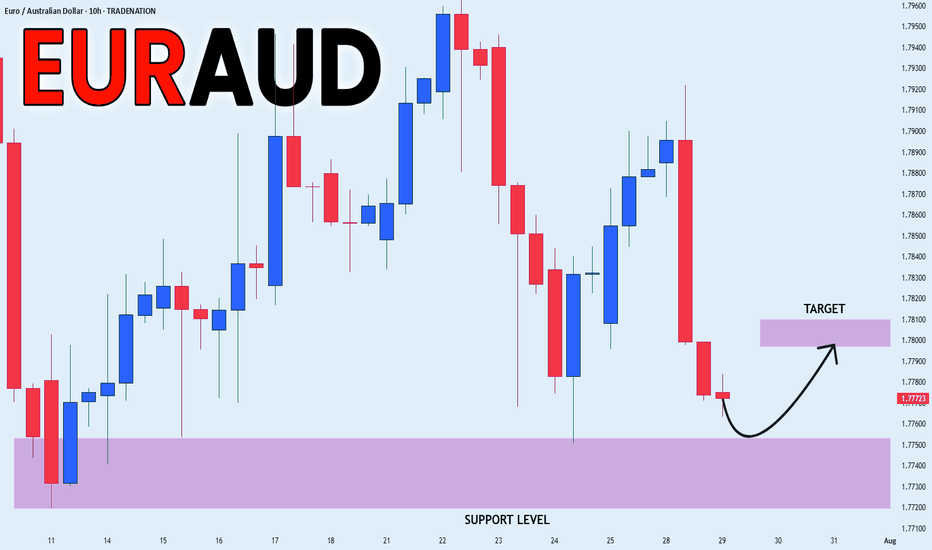

EUR_AUD LOCAL GROWTH AHEAD|LONG|

✅EUR_AUD will soon retest a key support level of 1.7750

So I think that the pair will make a rebound

And go up to retest the supply level above at 1.7800

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-NZD Will Grow! Buy!

Hello,Traders!

EUR-NZD keeps falling

Down and we are bearish

Biased mid-term but there is

A horizontal support level

Below at 1.9370 so after

The retest we might expect

A local bullish correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_CAD RISKY SETUP|LONG|

✅GBP_CAD is going down to retest

A horizontal support of 1.8320

Which makes me locally bullish biased

And I think that we will see a rebound

And a move up from the level

Towards the target above at 1.8380

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-NZD Rebound Ahead! Buy!

Hello,Traders!

AUD-NZD made a retest

Of the wide horizontal support

Level again at 1.0909 and we

Are already seeing a bullish

Reaction so a local bullish

Rebound can be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

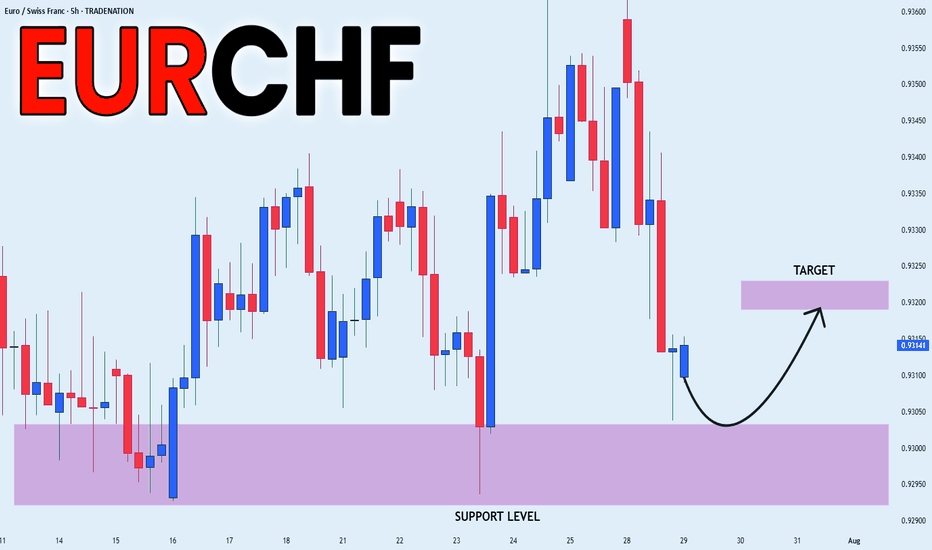

EUR_CHF RISKY LONG|

✅EUR_CHF is set to retest a

Strong support level below at 0.9300

After trading in a local downtrend for some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 0.9320

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.