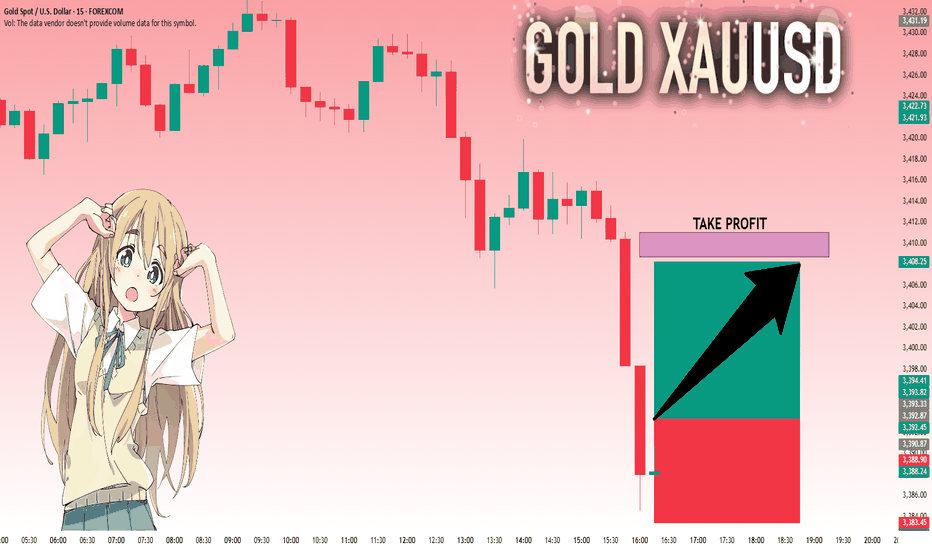

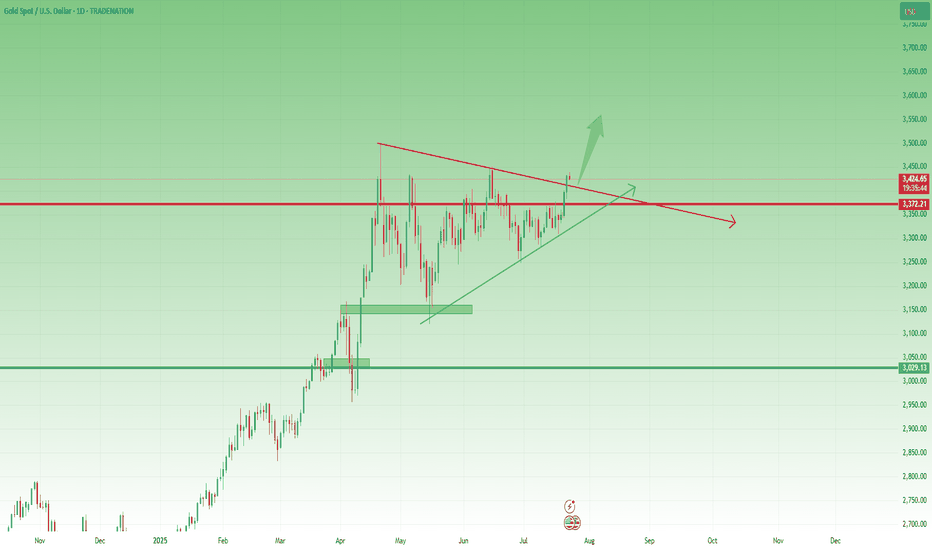

GOLD: Move Up Expected! Long!

My dear friends,

Today we will analyse GOLD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 3,393.33 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

Signals

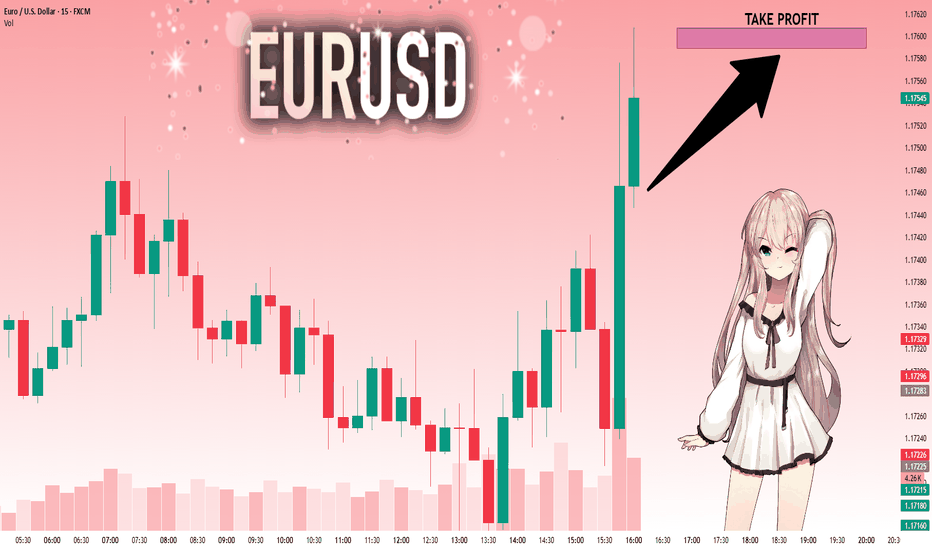

EURUSD: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse GOLD together☺️

The market is at an inflection zone and price has now reached an area around 1.17463 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 1.17589.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

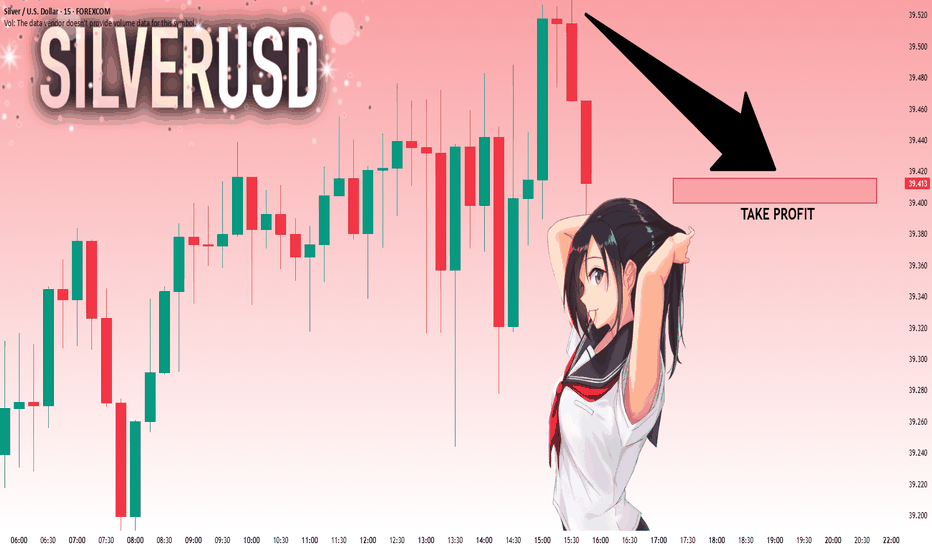

SILVER: Will Go Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 39.520 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 39.416..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

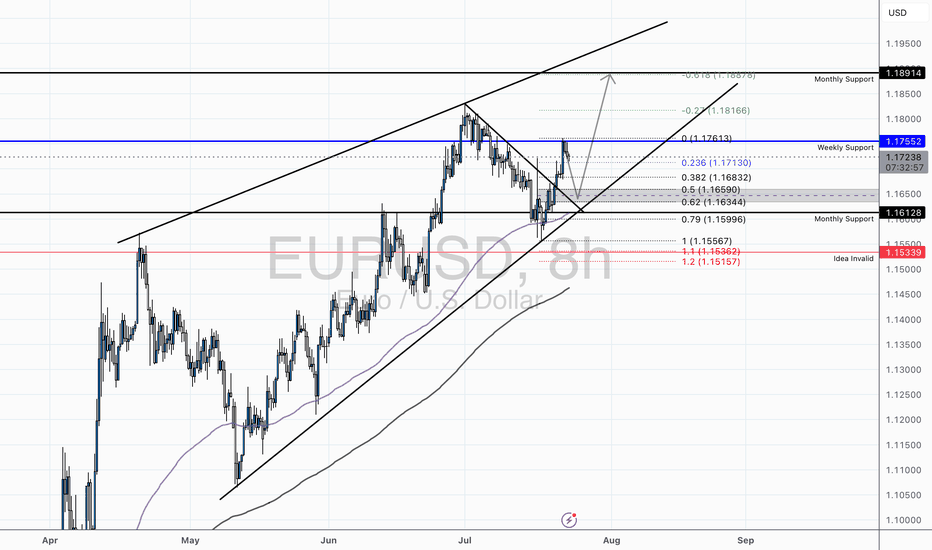

EUR/USD - Holding Bullish Structure Above Key Fibs and TrendlineTechnical Overview:

EUR/USD continues to respect its ascending channel structure, currently rebounding from the lower trendline support while trading above the 50 EMA and 200 EMA. After a healthy retracement to the monthly support (1.16128), the pair has shown strong buying interest, supported by bullish RSI divergence from oversold conditions on the 8H chart.

Key Levels:

Support Zone: 1.1613 – 1.1634 (Fib Cluster + Channel Support + Monthly Support)

Resistance Zone: 1.1755 (Weekly Resistance) followed by 1.1816 (0.27 Fib Extension) and 1.1887 (0.618 Extension)

Invalidation Level: Below 1.1533 (1.272 Fib + Structural Breakdown)

Confluences:

Price broke above a descending correctional trendline, indicating a potential bullish continuation.

Multiple Fibonacci levels (0.382, 0.5, 0.618) have stacked around the previous consolidation area, increasing probability of a sustained move.

RSI bounce from below 40 suggests short-term momentum reversal.

Trade Idea:

We may see a minor pullback into the 1.16344–1.1659 area before a potential continuation higher. Conservative bulls may wait for a retest of this zone with a bullish engulfing or pin bar confirmation before entering long.

Targets:

First target at 1.1755 (prior weekly resistance)

Second target at 1.1816 (Fib extension)

Final target near 1.1887 (major resistance / upper channel boundary)

Risk Management:

A break and close below 1.1533 would invalidate the bullish setup and signal potential bearish pressure returning to the pair.

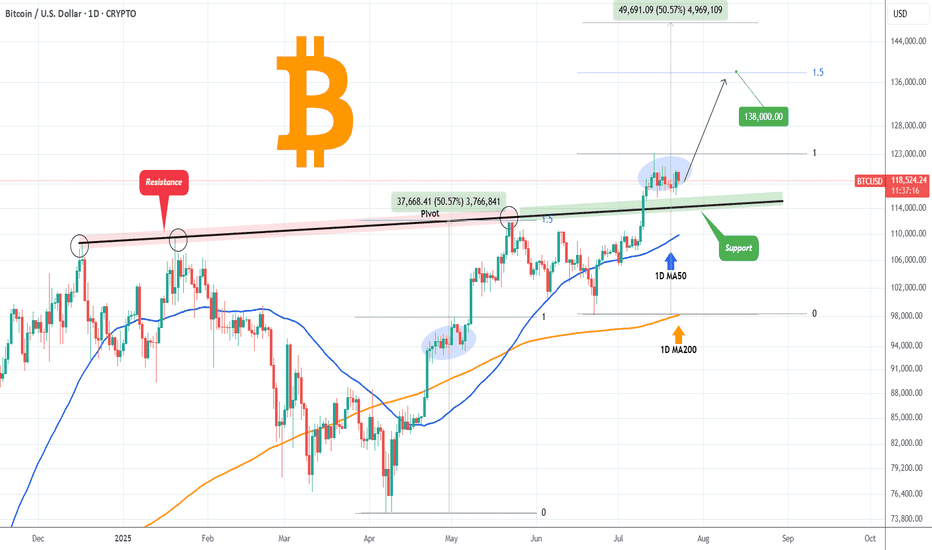

BITCOIN Former Resistance turned Support!Bitcoin (BTCUSD) is consolidating right above the December 17 2024 Pivot trend-line, a level that started off as a massive Resistance delivering two strong rejections but has now been turned into Support, holding this consolidation.

The 1D MA50 (blue trend-line) will soon cross this Pivot trend-line and will confirm it as a Support with the price technically looking for a new Bullish Leg towards the 1.5 Fibonacci extension at least ($138000), similar to the April - May uptrend, which also consisted of an Accumulation Phase much like the current.

Can the Pivot trend-line provide the necessary support for such a rebound? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

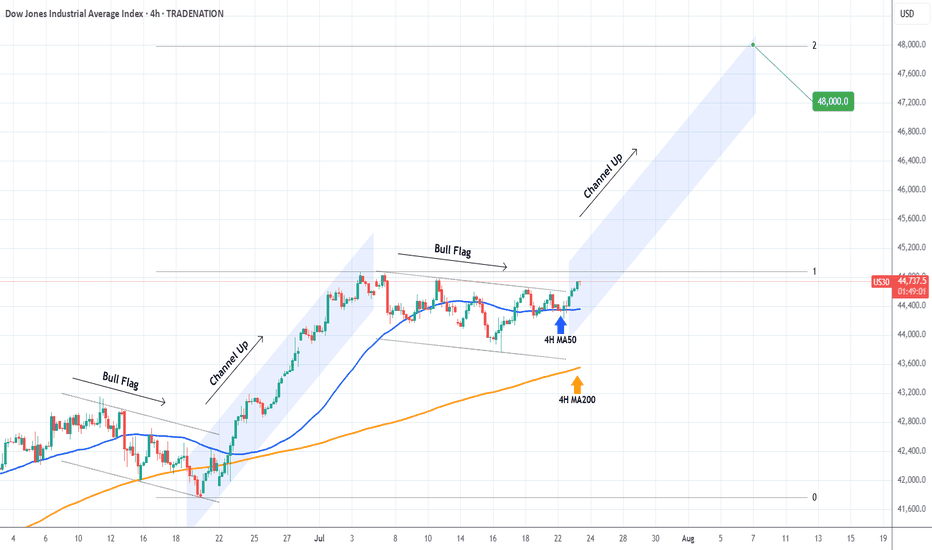

DOW JONES Strong rebound on its 4H MA50.Dow Jones (DJI) is having a strong rebound exactly on its 4H MA50 (blue trend-line). This is taking place just after the price broke above the Bull Flag that served as the accumulation pattern following the previous Channel Up.

This is a repetitive pattern and most likely we will now see the new Channel Up starting. The technical Target on such formations is the 2.0 Fibonacci extension at 48000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

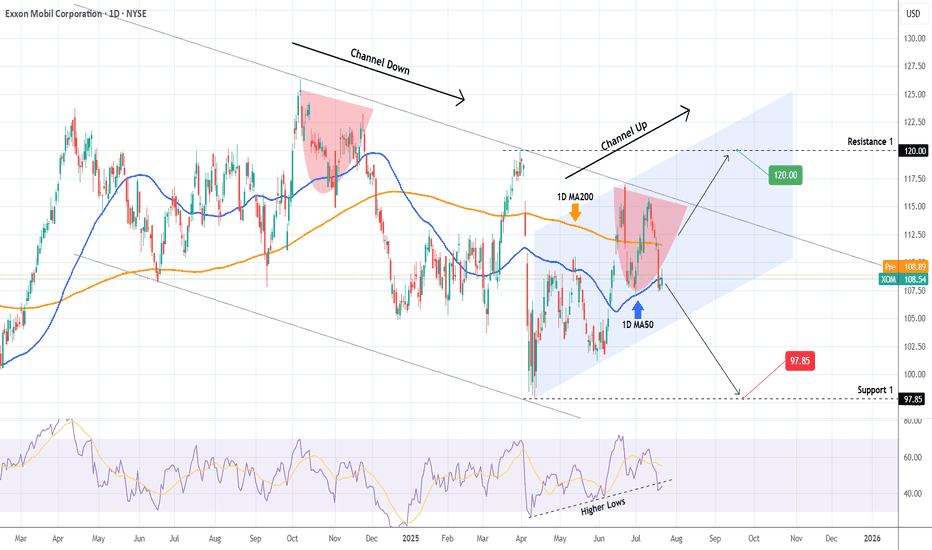

EXXON MOBIL Critical crossroads.Exxon Mobil (XOM) has been trading within a Channel Down since the June 17 2024 Low and just recently on the July 11 2025 High, it made a Lower High pattern similar to November 22 2024.

As long as the price trades below the 1D MA200 (orange trend-line), we expect to start the new Bearish Leg and test at least Support 1 (97.85).

If however it breaks above the 1D MA200 it will invalidate all prior Lower High patterns, and will most likely follow the (blue) Channel Up to break above the Channel Down. In that case, we will be targeting Resistance 1 (120.00).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

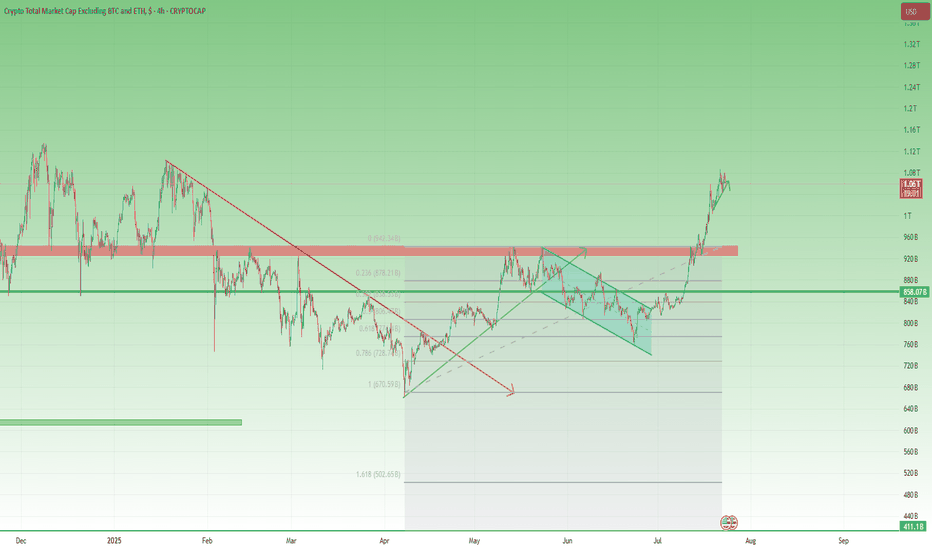

Total3 – Back Above 1T, but Will It Offer a Second Chance?📈 What happened since April?

After the sharp low in early April, Total3 began to recover steadily.

Toward the end of the month, it broke above the falling trendline that had been holding since January — a key technical shift.

This triggered a strong recovery rally, pushing total altcoin capitalization (excluding BTC & ETH) to the 930–940B resistance zone.

📉 Then came the pullback…

Price printed a double top near resistance, followed by a drop — but not a bearish one.

Instead, the correction was orderly, forming a bullish flag, with the low landing right on the 61.8% Fibonacci retracement. Classic healthy structure.

🚀 The latest breakout

Earlier this month, Total3 launched a very impulsive leg up, reclaiming the 1 trillion level with strength.

At the time of writing, we’re trading back above 1T, and momentum remains on the bulls’ side.

However, the chart does look a bit overextended in the short term, suggesting a correction could follow soon.

🧭 Trading Plan – Will We Get a Retest?

The textbook play would be to wait for a deep pullback toward previous support levels.

BUT – I don’t believe we’ll get a full retest of the breakout. Altcoins may stay elevated or correct only modestly.

Instead, I’ll be watching the 1T zone and slightly below — that’s where I’ll look to load up on interesting altcoins.

📌 Conclusion:

Total3 has broken structure, reclaimed key levels, and is showing classic bullish continuation behavior.

The market may not offer you the perfect entry — but small dips near 1T could be all we get before another move higher. 🚀

Be prepared. Don’t wait for perfection in a market because rarely gives it.

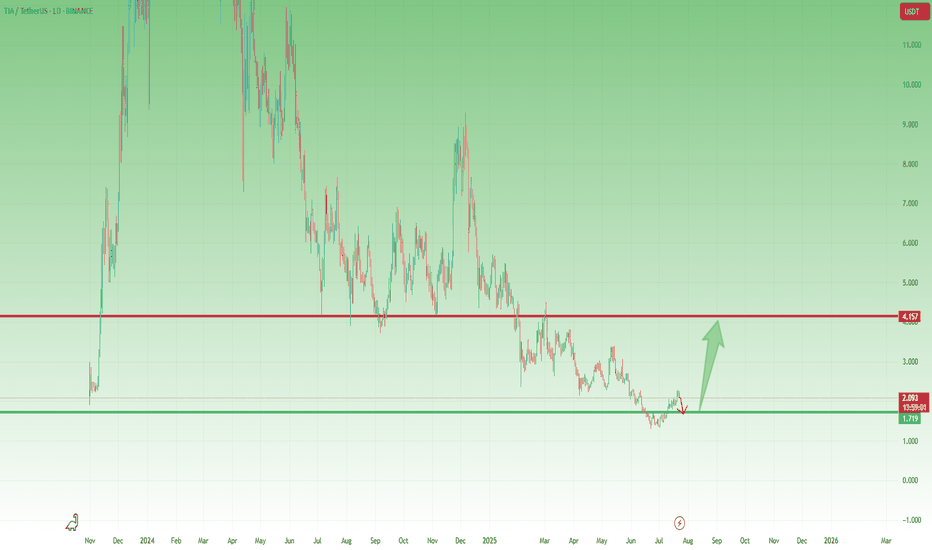

TIA- Is the Coin Finally Ready to Wake Up?After its launch on Binance in November 2023 and the immediate 10x pump, BINANCE:TIAUSDT has been, to put it mildly, a constant disappointment.

Since then, the hype has faded, and the price slowly deflated — leaving holders frustrated and the chart uninspiring.

🔍 Recent Signs of Life

However, something has started to shift.

After a fresh dip to 1.35, the coin formed a small double bottom and managed to recover above the 2.00 zone.

⚠️ Important to note: the rise hasn’t been impulsive.

But in the context of a broader altcoin revival — which I've outlined in my recent dominance analyses — TIA could become a decent candidate for a relief rally.

🔽 What I’m Watching

The recent structure looks like a bearish flag, and there’s a decent chance the pattern breaks down first before any real rally begins.

That’s why I’m watching the 1.70 area closely.

If price dips into that zone and gives a positive reversal signal, I’ll look to buy the dip.

🎯 Target and Potential

My upside target for this move is around 4.00, which would represent over 100% potential from the entry zone.

No moon calls. Just technical setup + potential market rotation + favorable risk/reward.

✅ Conclusion

TIA isn’t a favorite.

But sometimes, unloved charts offer the cleanest reversals.

I’ll let the market speak near 1.70.

If it holds and gives confirmation — I’m in. 🚀

DOGEUSD Is that a textbook Livermore Cylinder to $1.5 ??Doge (DOGEUSD) has been trading within a Bullish Megaphone for the majority of its Bull Cycle since the October 09 2023 Low. We may technically claim that this has been so far one massive Accumulation Phase, along with the rest of the altcoin market.

A pattern that draws strong comparisons with that Megaphone has been 'Livermore's Accumulation Cylinder'. Jesse Livermore, an American stock trader, came with a revolutionary trading pattern a century ago, whose principles often apply perfectly to today's financial assets.

This is what we do on today's Dogecoin analysis, we apply this Accumulation Cyclinder on Doge's Bullish Megaphone. Even though not a perfect fit obviously, the main characteristics apply, with clearly visible Bullish and Bearish Legs.

Based on this model, the market is right now starting the aggressive break-out phase above the Cylinder. Technically the Accumulation is over and the price may pursue levels 8 and 9, which give price Targets of $1.50 and $12.00 respectively.

Now, even though $12.00 falls well after (6 months or so) the expected duration of the current Bull Cycle, $1.50 is well within its limits (October - November 2025) and exactly double the price of the previous Cycle High. This makes it a very attractive Top candidate.

So do you think Doge is inside a Livermore Cylinder that is about to break out parabolically?

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

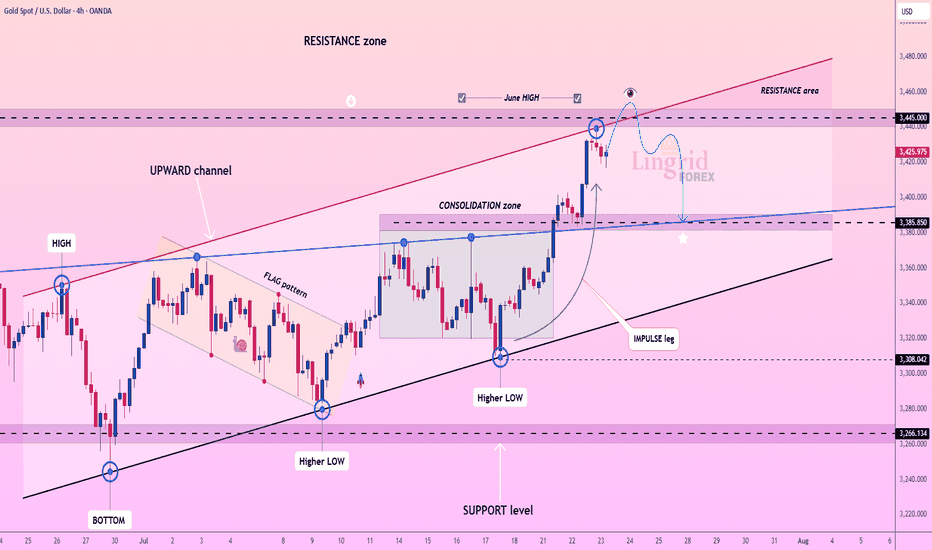

Lingrid | GOLD Key Resistance Zone. Possible Short-Term TradeThe price perfectly fulfilled my last idea . OANDA:XAUUSD has reached the upper boundary of the resistance zone around 3,445 after a strong impulse leg from the support trendline and the breakout of consolidation. Price action shows signs of exhaustion just below the June high, forming a potential reversal pattern near the channel top. If gold fails to hold above this resistance, a short-term pullback toward the 3,385 level becomes likely. The setup favors a short-term corrective decline unless bulls reclaim control with a breakout above the red trendline.

📉 Key Levels

Sell trigger: Rejection below 3,445

Sell zone: 3,430–3,445

Target: 3,385

Invalidation: Close above 3,480

💡 Risks

Breakout continuation toward 3,480

Sustained momentum from recent impulse leg

DXY weakness boosting gold's appeal

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

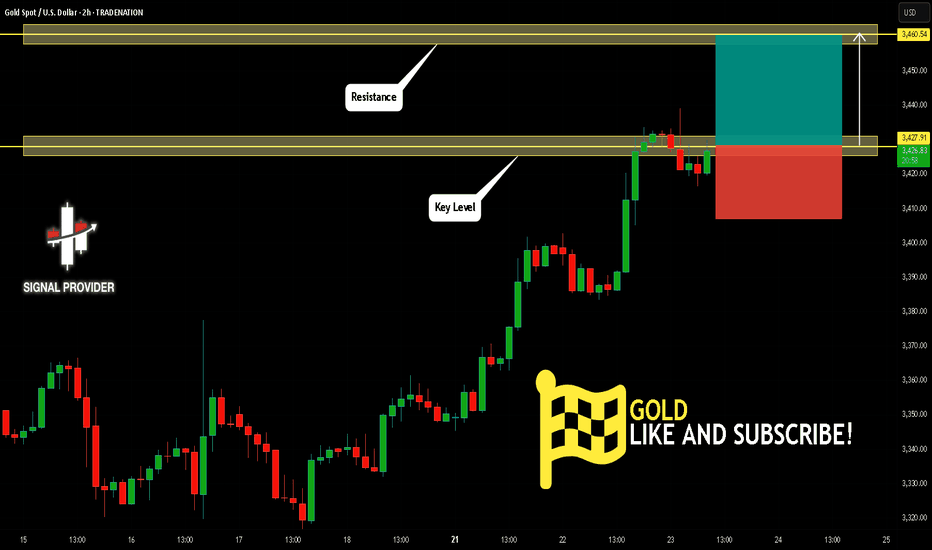

GOLD Will Go Up! Buy!

Please, check our technical outlook for GOLD.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 3,427.91.

The above observations make me that the market will inevitably achieve 3,460.54 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

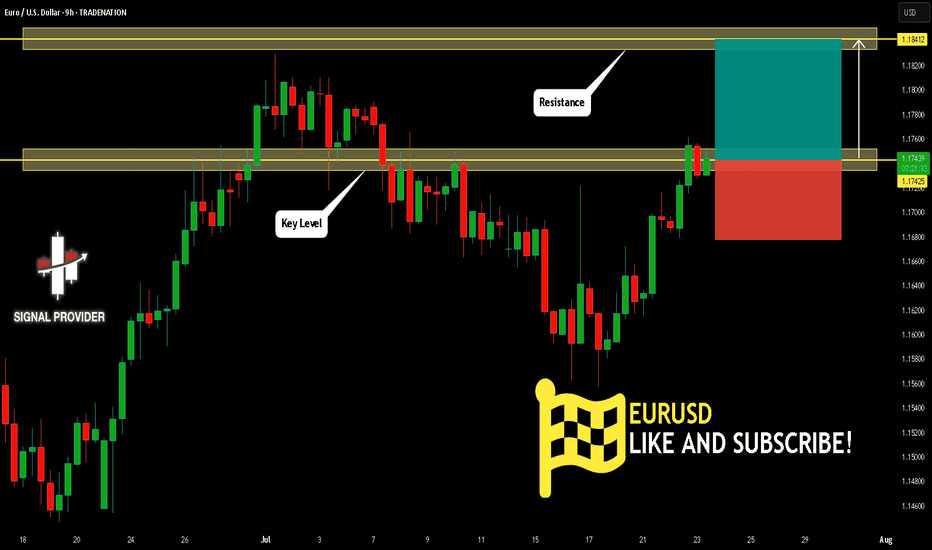

EURUSD Will Move Higher! Long!

Here is our detailed technical review for EURUSD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 1.174.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.184 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

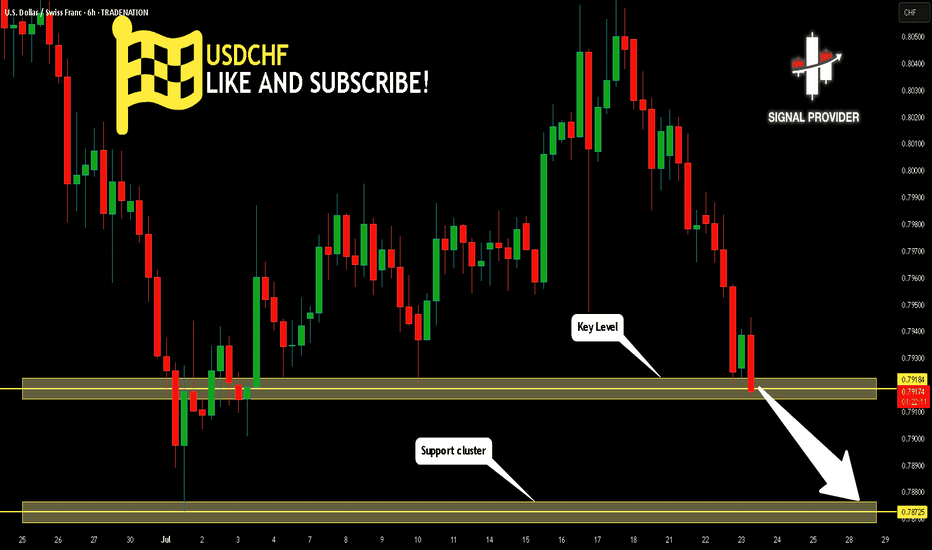

USDCHF Is Bearish! Sell!

Take a look at our analysis for USDCHF.

Time Frame: 6h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.791.

Considering the today's price action, probabilities will be high to see a movement to 0.787.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

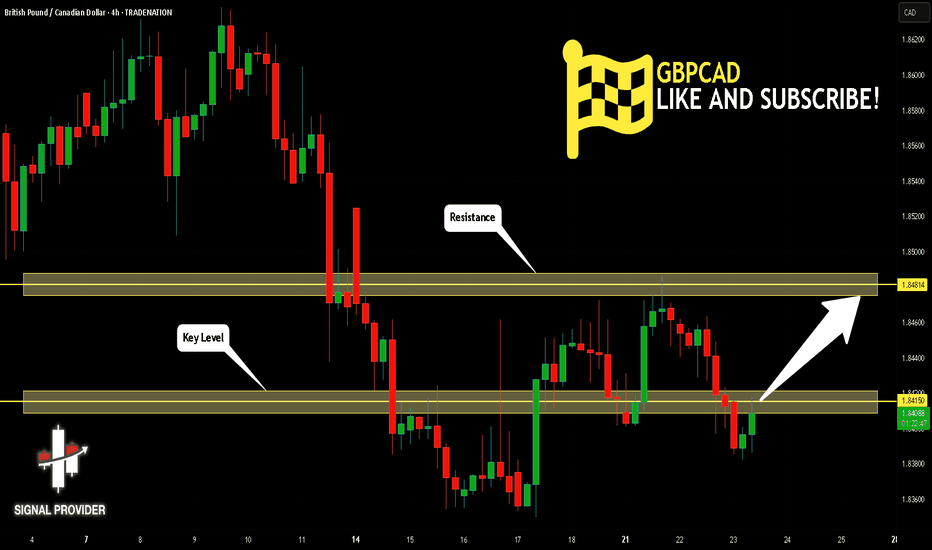

GBPCAD Is Very Bullish! Buy!

Please, check our technical outlook for GBPCAD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 1.841.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 1.848 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

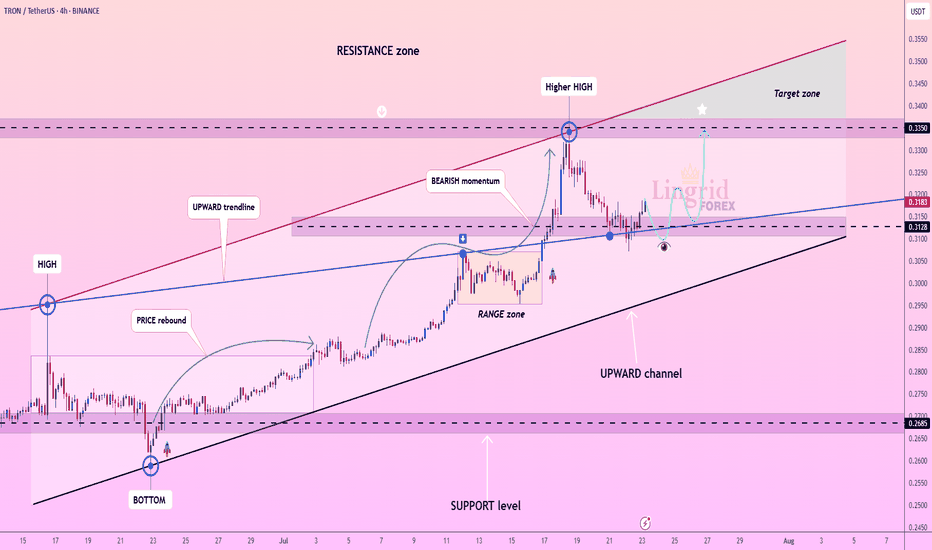

Lingrid | TRXUSDT Pullback Following the Bullish Momentum BINANCE:TRXUSDT is consolidating after retreating from the 0.3350 resistance, following a higher high within the upward channel. Despite short-term bearish momentum, price has rebounded off the key 0.3128 support near the blue trendline. A break above recent highs may open a move back toward the resistance zone and upper channel. As long as the ascending structure holds, bullish continuation remains favored.

📉 Key Levels

Buy trigger: Break above 0.3190

Buy zone: 0.3128–0.3160

Target: 0.3350

Invalidation: Break below 0.3090

💡 Risks

Failure to reclaim breakout structure

Channel support breakdown

Broader market weakness in altcoins

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

"Handle Tightening… Is RPSG Ready to Explode?"Once upon a trend, RPSG Ventures brewed a picture-perfect Cup & Handle—a structure born not out of coincidence, but crowd psychology and silent accumulation.

After nearly 9 months of consolidation, the stock crafted a deep, symmetrical cup (between November 2024 and May 2025). Traders forgot about it. Volumes dried. Hope faded.

But quietly, the handle formed—short, shallow, and tight. It’s not just a chart pattern—it’s a test of patience. And now, the breakout zone at ₹971.80 is like the rim of a boiling kettle: silent… until the whistle.

🧭 Possible Future?

If it breaks out: A rally toward ₹1,264 isn't just possible—it’s logical.

If it fakes out: Back to base, retest near ₹890.

💬 What makes this unique?

This isn’t just technical analysis. It’s a behavioral pattern. Fear, exhaustion, optimism—they're all baked into this structure. Cup & Handle isn’t bullish because of lines—it's bullish because it reflects crowd hesitation turning into confidence.

🚨 "Spill or Serve?" — comment below .

🧠 Watch the volume.

🛑 Don't jump the gun.

✅ Let the breakout come to you.

📜 Disclaimer:

This is not trading advice—this is pattern psychology in motion. Always consult your financial advisor before making real trades. This story is meant to provoke thought, not profits.

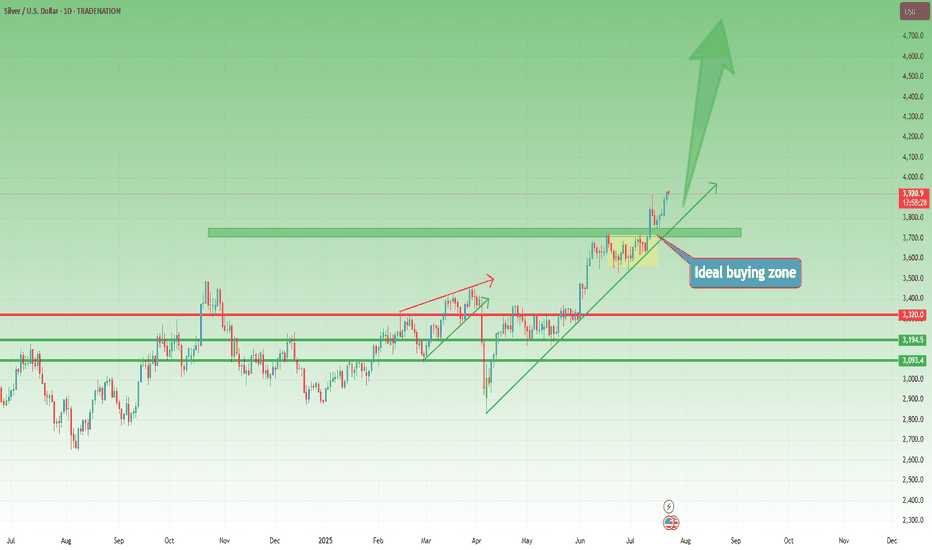

XAGUSD Outlook – 40 Remains the Next TargetIn my previous XAGUSD analysis, I argued that the trend was strongly bullish and that a move toward 40 was the next logical outcome. At the time, price was correcting, and I highlighted the 37.50 zone as a key area to look for long opportunities.

✅ Indeed, Silver respected that zone perfectly —

It retested the broken consolidation, found support, and then surged higher, marking a new multi-year high in yesterday’s session.

________________________________________

🔍 What Now?

Nothing has changed in the broader view:

• Trend: Strongly bullish

• Structure: Higher highs and higher lows remain intact

• Behavior: Dips are being bought aggressively

As long as the recent 37.50 low is not broken, the strategy remains straightforward:

Buy dips within bullish continuation

________________________________________

🎯 40 in Sight — But Don’t Be Surprised if It Goes Further

The 40 zone remains the natural next target — a major psychological level.

But based on current momentum and breakout strength, Silver could go even higher in the coming weeks and months. If buyers keep control, we might even see new ATH test by year's end (50 zone).

________________________________________

🟢 Conclusion

This breakout confirms the larger trend.

The pullback to 37.50 was bought, as expected, and now Silver is making its move.

Strategy should remain the same:

Stay long above 37.50

Buy the dips

Watch how price reacts near 40 — but keep an open mind for higher levels

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold Update – Strong Breaks, Strong BullsYesterday, after the break of the key 3370 resistance, Gold corrected slightly toward 3383, then consolidated briefly in that area. From there, it launched into a strong new leg up, closing the day once more near the highs, around 3430.

📌 What’s important here is that the price did not even come back to retest the broken resistance — now turned support. Combined with the strong daily close near the high of the range, this gives us a clear message:

➡️ Bulls are in full control.

________________________________________

🔍 This Week – Three Key Breaks

So far this week, Gold has delivered three major breakouts:

• ✅ A clean breakout from the box consolidation that kept price stuck and indecisive last week

• ✅ A decisive break above the 3400 psychological figure

• ✅ A breakout above the symmetrical triangle resistance, which had been forming since late April

Each of these is significant on its own. Together, they suggest a shift toward a more aggressive bullish scenario.

________________________________________

🔮 What’s Next?

All these breakouts point to the potential for more gains ahead.

In fact, the next logical step could be an attempt to mark a new All-Time High.

My view remains the same:

Buying dips remains the strategy of choice, with a focus on the 3400 zone as a key support area, and a swing target around 3500.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

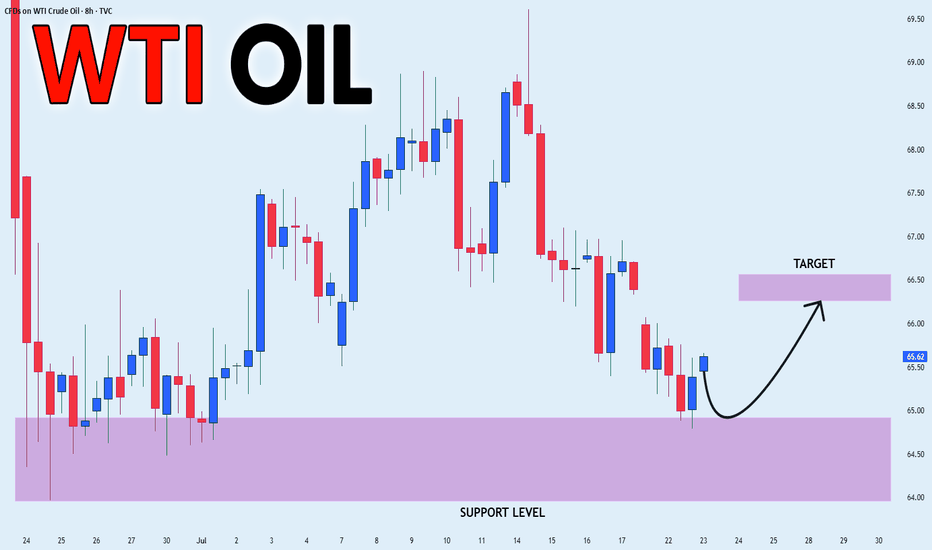

USOIL POTENTIAL LONG|

✅CRUDE OIL has retested a key support level of 65.00$

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 66.27$ is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER Bullish Breakout! Buy!

Hello,Traders!

SILVER is trading in a strong

Uptrend and the price made a

Bullish breakout of the key

Horizontal level of 39.10$

So we are bullish biased

And we will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.