SUPPORT AND RESISTANCE BREAKOUT ALERT!🚨 Attention Traders! 🚨

XAUUSD is on fire, breaking records with power! 🔥 Here's the latest:

Current Range: We're seeing a fierce battle between 3017 and 3043. Will we break out soon?

Bearish Scenario: Watch out for a possible dip below this range. If that happens, targets like 2988 and 2978 could be in play. ⚠️

Bullish Scenario: A breakout above 3043 opens up buying opportunities! Watch for movement above 3072, with targets at 3124 and 3150. 🚀

💬 Join the Discussion! What are your thoughts? Let’s ride this wave and make the most of the opportunities ahead! 💎

Signalservice

Lingrid | GOLD Weekly Outlook: Bullish Momentum Faces CorrectionOANDA:XAUUSD market has been bullish; however, Friday turned bearish with a nearly 3.8% decline. After such bullish momentum, this pullback seems normal. In the current timeframe, price completed the ABC move, which is typically followed by a pullback—exactly what we've seen recently. On the weekly timeframe, the price formed a long-tailed bar, indicating it may retest the support zone below the 2900 level. However, considering the upward momentum in the market and the fact that price did not close below the previous week's low, this scenario seems less likely.

I believe we're facing a similar scenario to what we saw in the last week of February, when the market fell around 4% but subsequently reached all-time highs. Right now, areas to consider going long include just below the week's low and the psychological level at 3000. Additionally, we have the channel border as well as the upward trendline serving as potential support. Another scenario worth noting is what happened before the US election last November, when prices fell around 9%, which could mean a retest of the 2900 level. Overall, next week the price may move sideways for a couple of days after bearish impulse leg or bounce off the 3000 level.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | BTCUSD breaking KEY Support Levels. Potential ShortThe price perfectly fulfilled my last idea . It reached the target. BINANCE:BTCUSDT recently broke and closed below the March low. Furthermore, it broke below the psychological key level at 80,000 and the upward trendline. The weekly candle also closed bearish with a long tail, suggesting that the price may fall below the next support level at 70,000. On the daily timeframe, the price action is forming an ABC move which also suggests that the price may go below the 70,000 level. I think if the price remains below the 77,000-78,000 resistance zone, there is a chance of movement toward lower levels. I expect the price to retest the support level and channel border. My goal is support zone around 70,000

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Crypto Sell-Off: Is Solana Headed for $80?Without a doubt, Solana was the hottest topic in the crypto market last year and at the start of this one—especially with the meme coin craze.

However, after peaking near $300, the price began to decline in what initially appeared to be a normal correction. But once Solana broke below the $200 mark, things turned ugly, and the price quickly dropped to the key $120 support zone—a level that held strong over the past year.

Now, it looks like Solana is on the verge of breaking below this support, which could trigger an acceleration toward $80, with the $100 psychological level as an intermediate stop.

________________________________________

Why the Downside is Likely to Continue

📉 Bulls Can’t Hold Gains – Short-term rallies are fading fast, showing a lack of real buying strength.

📉 Bearish Engulfing Candle – Yesterday’s price action printed a lower high, adding further pressure on support.

📉 $120 Breakdown Incoming? – If this level fails, expect a sharp decline toward $80.

________________________________________

Trading Plan: Selling Under $130

🔻 Sell Rallies Below $130 – Targeting a move to $80 in the medium term.

🔻 Only a Sustained Move Above $130 – Would shift Solana to a neutral stance—not bullish by any means.

For now, the bearish pressure remains, and selling rallies is the strategy to follow. 🚀

Lingrid | ETHUSDT approaching Key SUPPORT LevelBINANCE:ETHUSDT market has been moving sideways throughout the month, with the price gradually approaching the support level around 1700. The current month has closed bearish, and there is a possibility that the price may dip below the previous month's low before making a move higher in the long term. As we approach the mid of the current month, there seems to be a potential for the price to start moving upward. I anticipate that the price may briefly go below the 1700 level and then bounce back if it forms a fake breakout. This could present a buying opportunity, especially if the price shows signs of reversal after testing that support level. My mid-term goal is resistance zone around 2300.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Gold’s Wild Ride: Is the Correction Over?Yesterday was an insane day for Gold—while I expected a strong drop to at least 3,080, I didn’t anticipate such a sharp reversal after the sell-off.

Now, the big question is: Has Gold finished correcting, or is more downside coming?

________________________________________

Why I Expect Another Wave of Selling

📉 Gold Still Looks Vulnerable – Despite the rebound, I don’t believe the correction is over.

📉 Key Resistance Established – The 3,135–3,140 zone has now formed a strong ceiling, limiting upside potential.

📉 Selling Rallies Remains the Plan – Even with yesterday’s bounce back above 3,100, my outlook remains unchanged.

________________________________________

Trading Plan: Selling Spikes During NFP

🔻 Looking for price spikes during the NFP report as opportunities to sell into strength.

🔻 Targeting a new leg down toward the 3,030 support zone.

The correction is likely not done yet—let’s see if the market confirms it. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Lingrid | GOLD Pre-NFP Price ACTION in the MarketOANDA:XAUUSD market has spiked down, dipping below the 3100 level. The previous daily candle is a large doji, indicating that the market is consolidating. I think the price may continue to move sideways until the NFP data is released. It’s possible that the price will create a triangle pattern, with the current weekly candle closing near the previous week’s high. The price has almost tested the 3050 level and subsequently bounced off that level, suggesting that there may be potential for a continued upward movement. Overall, we should watch for developments around these key levels, especially as we approach the NFP release. My goal is resistance zone around 3129

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

NFP REPORT IMPACT ON XAUUSD ALERT!🚨 XAUUSD Market Alert 🚨

🔥 Current Action: XAUUSD is currently range-bound between 3101 and 3114—will it break out soon? The market’s at a critical point, and a sharp move could be on the horizon!

📉 Bearish Scenario: If price slips below this zone, keep an eye on potential support levels at 3070 and 3054. A downward shift could set up fresh opportunities for sellers.

📈 Bullish Scenario: On the flip side, a solid break above 3114 could trigger buying pressure, with targets at 3140 and 3170. A move like this could spark a new uptrend, especially with NFP data on the way, which could impact the gold market!

💬 Let’s Talk Strategy: What’s your take on the XAUUSD setup? Share your insights, and let’s navigate this golden opportunity together! 💰🚀

Lingrid | CADJPY channel BREAKOUT. Potential Bearish MoveFX:CADJPY market recently broke and closed below the upward channel and following the channel breakout, the price has formed a range zone around 130.500. On the 1H timeframe, the market is making lower lows, while the daily timeframe shows a large engulfing candle, suggesting that the correction may be coming to an end. Given that today we have high-impact news, we can expect increased volatility in the market. I think that the price may move lower if it remains below the 104.000 resistance zone. My goal is support zone around 102.500

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Hellena | GOLD (4H): SHORT to 38.2% Fibo lvl 3050.Dear colleagues, the price has been in an upward movement for quite a long time and I believe .that it is time for a correction in the “2” wave.

I think it is possible that there may be a small update of the maximum of the top of wave “1” to 3176.771, then I expect a correction to the area of 38.2% Fibonacci level 3050.

As usual there are 2 possible entry options:

1) Market entry

2) Entry by pending limit orders, if the price updates the maximum.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | Oil (4H): SHORT to support area 65.268.We need to talk about one important nuance. Many people ask “Hellena, you say you can't buy oil, but it's going up. Well, it is, yes. But all my data and wave markings suggest that the price will soon start a downward movement. There are major changes in geopolitics and I am not in a position to stop them. I just set a stoploss and wait for the trade that will bring me profit.

Now coming to the forecast, I think that the downward movement will start soon, but before it, the price may rise quite high, maybe even to the area of 74.000.

But the main direction is the support area of 65.268.

There are 2 possible ways to enter the trade:

1) Entry at market price.

2) Limit pending sell orders if the price starts an upward movement to the area of 74.484.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Nasdaq's Drop: A Temporary Rebound Before More Downside?I've been calling for a strong correction in the Nasdaq (and all major U.S. indices) since the start of the year—long before the tax war even began. I warned that a break below 20,000 was likely, with my final target set around 17,500.

And indeed, the index has fallen—regardless of what the so-called "cause" might be. Right now, Nasdaq is trading at 18,400, sitting right at a minor horizontal support zone.

________________________________________

A Short-Term Rebound Before More Downside?

📉 Overall Bias Remains Bearish – The broader trend still points lower.

📈 Rebound Likely – A push above 19,000 in the coming days wouldn’t be surprising.

⚠️ High-Risk Setup – Going long here is risky, given the current macroeconomic backdrop.

________________________________________

Trading Strategy: Short-Term vs. Long-Term

✅ For Short-Term Traders & Speculators – A temporary upside correction could offer a buying opportunity.

❌ For Swing & Long-Term Traders – It's better to wait for this rebound to fade and position short for the next leg down.

While a bounce could be on the cards, the bigger picture still points lower—I remain bearish in the long run. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold new ATH at 3,168: A Final Push Before the Drop?Yesterday was a high-volatility day, and we all know why.

Gold surged to yet another all-time high at 3,168, and luckily, I had already closed my sell trade around break-even—otherwise, my stop loss would have been triggered.

________________________________________

Gold Still Set for a Hard Drop?

Despite the rally, my outlook remains unchanged—I still believe Gold is due for a significant correction.

📉 3,100 Held as Support – But buyers are struggling to hold onto gains around 3150

📉 Every New High is a Selling Opportunity – So far, Gold has failed to sustain its breakouts, reinforcing a potential distribution phase.

________________________________________

Trading Plan: Selling the Rallies

🔻 Target: At least 3,080

🔻 Preferred Strategy: Continue selling into rallies

For now, I remain bearish and will keep looking for opportunities to short the market. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Lingrid | GOLD possible CONSOLIDATION Following a Fake BreakThe price perfectly fulfilled my last idea . It hit the take profit level. OANDA:XAUUSD appears to have made a false break of Tuesday and Wednesday's highs before reversing. Currently, the market is forming a bearish long-tailed bar on the daily timeframe, which may indicate a deeper correction or a consolidation zone between the 3100 and 3140 levels. If the price pulls back toward the support level, I believe it may rebound from there. Given the upward trendline and channel border, this area could serve as an optimal entry point in anticipation of further upward movement. However, with high-impact news scheduled for today, we should remain vigilant, as the market may experience increased volatility. My goal is resistance zone around 3160

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | GBPNZD potential UPWARD Breakout. LongThe price perfectly fulfilled my last idea . It hit the target zone. FX:GBPNZD price is making higher highs and higher closes, indicating that the market is in a bullish phase. Recently, it tested the previous resistance zone and then bounced back because the markets usually breaks through key levels on the third or fourth attempt. If the market rebounds from the support level, we can expect a continuation of the current bullish trend. Additionally, the market is forming an ABC pattern, suggesting that the price may reach the 2.3000 level in the near future. My goal is resistance zone around 2.29000

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | TONUSDT bearish DIVERGENCE at Resistance ZoneOKX:TONUSDT market has formed a double top in the resistance zone, accompanied by a bearish divergence at the resistance zone and channel border. It failed to break above the psychological level of 4.00 forming a fake breakout. Additionally, the price has broken and closed below the upward trendline after taking liquidity above last week's high. This suggests that the market is likely gearing up for a corrective phase. I anticipate that the price may move lower towards the lower levels, possibly retesting the 3.00 supporrt level. My goal is support zone around 3.30

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | GOLD anticipating Potential MARKET RetracementThe price perfectly fulfilled my last idea . It hit the target zone. Overall, OANDA:XAUUSD market is in the process of forming an ABC move, with the C point nearing completion around the 3175 resistance zone. The market has made a corrective move of about 1.9% from the peak of the consolidation zone before. I think that the price might create a similar pullback from the all-time high zone. Given the high-impact news scheduled for today, it’s possible that the price could retest the area below yesterday's low. However, considering the current momentum, I expect the market is likely to bounce off the support level and the upward trendline, ultimately moving forward to complete the ABC pattern. My goal is resistance zone around 3170.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Hellena | EUR/USD (4H): LONG to the resistance area 1.09484.Dear colleagues, the upward impulse of the five-wave movement is not over yet, and at the moment we see the end of the correction of wave “4”.

I believe that the price can still slightly update the low and reach the area of 1.07232 , but the priority is the upward movement in wave “5”, so I expect the price to reach the resistance area of 1.09484.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Bitcoin- Short term recovery?As you know, I am bearish on Bitcoin in the long term. However, in the short term, the cryptocurrency could see a recovery.

Yesterday, the price tested the 81,000 support zone once again and rebounded from that level. Now, Bitcoin is pushing against the 83,500 resistance, and I believe a breakout is likely.

If that happens, we could see further gains, with 86,500 as the next key target for the bulls.

In conclusion, I’m bullish on BTC in the coming days and will be looking to buy dips.

Gold's trend has too many friendsThere’s a well-known saying in trading: “The trend is your friend.”

I firmly believe in this principle. However, when price movements become too extreme—too fast and too far—it’s wise to exercise caution, even if you’re not ready to take the opposite side of the trade.

And right now, I believe that’s exactly the case with Gold.

________________________________________

Why a Major Gold Correction is Likely

As I’ve been repeating like a broken record since Monday, Gold’s price is severely deviated from the mean, signaling that a brutal correction is on the horizon.

After reaching a new all-time high of 3,150, Gold retraced yesterday, dropping to 3,100—a support level formed earlier in the week. A rebound followed, but as I’ve explained in an educational article, this price action looks more like a stepwise distribution rather than true buying strength.

The key point?

➡️ Support isn’t holding because buyers are stepping in—it’s holding because big sellers have paused selling.

________________________________________

Still Bullish, But a Drop is Coming

There’s no doubt that Gold is in a strong uptrend. But even if it drops 1,000 pips, the overall bullish trend would still be intact.

Key Technical Signs of Weakness

📉 Trendline Break – Yesterday, Gold broke below the rising trendline, marking the first sign of weakness.

📉 Failed Rebound – Despite a short-term bounce, the price is now more likely confirming the break rather than invalidating it.

📉 Lower High in Progress? – The next minor support sits at 3,120. If Gold breaks below this level, we’ll have confirmation of a lower high, which strengthens the bearish case.

________________________________________

Targeting the Correction

If Gold breaks below 3,120, I expect a move below 3,100, targeting:

🎯 Soft target: 3,080

🎯 Likely target: 3,030 – 3,040

I believe it’s only a matter of time before this brutal correction plays out.

Let’s see how it unfolds! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

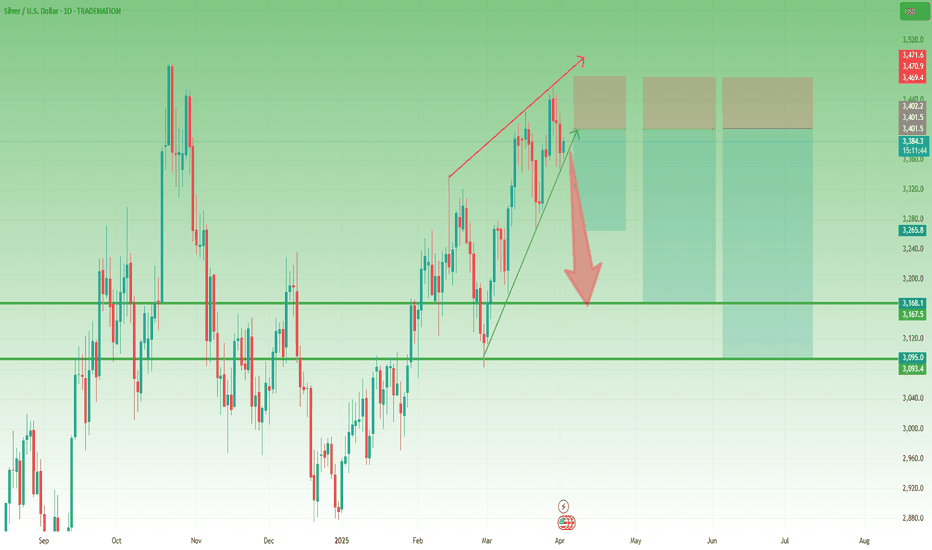

Silver could drop 2k+ pipsSilver has been on the rise recently, but unlike its big brother, Gold, it started rolling back down on Friday—even as Gold continued to print new all-time highs, culminating at 3,150 yesterday.

This divergence between the two metals could be an early sign that Silver is losing momentum.

________________________________________

Technical Signs of Weakness

📉 Rising Wedge Formation – Since early March, Silver’s price has been contained within a rising wedge, a classic bearish pattern signaling an impending breakdown.

📉 Testing Key Support – Right now, the price is hovering above wedge support. If Gold fails to hold above 3,100, I expect Silver to break down as well.

________________________________________

Targeting the Breakdown

If Silver breaks below support, I expect:

🎯 Initial target: $32

🎯 Final target: $31 (a key support zone)

Trading Plan: Selling the Rallies

Given the current setup, my strategy is to sell into rallies, aiming for at least a 1:2 risk-reward ratio.

Let’s see if Silver follows through on this bearish setup! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Lingrid | AUDCHF shorting OPPORTUNITY from Previous WEEK's HighThe price perfectly fulfilled my last idea . It hit the target zone. FX:AUDCHF market is currently moving towards the previous week's high after completing an ABC move. In addition, we have the upper boundary of the channel and a trendline, along with the significant round number at 0.56000 above. Since overall trend on higher timeframes remains bearish, I think that the price may rebound from this resistance level again, especially if the market shows the end of this retracement. Overall, I expect the market to form a fake breakout followed by a bearish move from the resistance. My goal is support zone around 0.55285

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻