Lingrid | GOLD bulls Maintain MARKET DominanceThe price perfectly fulfilled my last idea . It hit the target zone. OANDA:XAUUSD market continues to climb, having broken and closed above the psychological 3000 level. Previously, the price struggled to break through, creating a range before this upward movement. I think the ideal buy price could be just below the previous day's low and the psychological level. At this stage, the market may form a corrective move toward the support level and the upward trendline then rebound. I expect the range zone around 2980 to act as a solid support area in anticipation of the bullish trend's continuation. My goal is resistance zone around 3055

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Signalservice

Lingrid | NZDJPY Monthly-Level Shorting OpportunityThe price perfectly fulfilled my last idea . It hit the TP level. For the past two weeks, FX:NZDJPY price has been in a bullish trend; however, it has hit the resistance zone and is currently moving sideways around this level. On the daily timeframe, a rejection candle has formed, but the price has yet to retest the February high where liquidity is resting above. I expect the price may aim to grab that liquidity before moving lower while forming a bearish divergence. If we see a rejection at the resistance around 87.500, there is a good possibility that the price will create a corrective leg. My goal is support zone around 85.800

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Lingrid | DOTUSDT capitalizing on PULLBACK in a BEARISH TrendThe price perfectly fulfilled my last idea . It hit the target zone. BINANCE:DOTUSDT market bounced off a level that was previously tested in November. Following this bounce, the price appears to be forming an ABC pullback and is moving towards the channel boundary. Examining the chart, we can see that the price has respected the resistance zone multiple times. Given the current bearish trend, the market may enter a consolidation phase, and therefore I expect that the price to consoldiate and stabilizing between 4.88 and 4.00. My goal is support zone around 4.100

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Hellena | GOLD (4H): LONG to 161.8% Fibo lvl area at 3038.Dear colleagues, I believe that the upward movement is not over yet. The bulls have gained strength and the upward five-wave movement is not over yet!

I expect that the wave “3” of senior and middle order is not yet complete. Possible correction to the area of 2955.837, then I expect an upward movement to the area of 161.8% Fibonacci extension 3038.730.

As usual - the upward movement is in priority, so I do not recommend short positions, but I recommend long limit pending orders.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | Oil (4H): SHORT to the area of 64.00 (Wave C).Colleagues, at the moment we see a situation where it is difficult to determine the end of the movement. Wave “C” is not completed and I believe that we should expect the continuation of the downward movement. I do not set distant targets, so I expect the price to reach the area of 64.00.

A correction to the area of 67.884 shift is possible.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Gold is on Fire—But Can Bulls Hold the Line?Gold has been surging, and while I expected it to hit $3,000 this year, I definitely didn’t anticipate it happening in the first semester...

So, let’s address the big question: Can the bulls maintain this level?

Looking at the chart, since early March, TRADENATION:XAUUSD has climbed 2,000 pips (around 7%), but what stands out is that 1,500 of those pips (5%) came in just one week.

No matter how strong the bullish momentum and fundamentals are, I believe this kind of rally is unsustainable.

Technical Outlook

After pulling back from its all-time high of 2,950, gold made a false breakout, followed by an almost vertical move upward, briefly interrupted by two consolidation phases.

Fundamental Factors

The FOMC meeting is today, and while rates are expected to remain unchanged, the real market mover will be Jerome Powell’s press conference. His comments could trigger significant price action.

My Take

I expect gold to start correcting after the press conference, regardless of what Powell says. However, this is a highly risky trade, so I’ll stay on the sidelines until I see a clear reversal signal.

Final Thoughts

At the time of writing, gold is consolidating within another rectangular range, with resistance at 3,040. If we see a spike above and then a drop back to around 3,030, that would signal ( for me ) that gold has topped—at least for now. In that case, I’ll be looking to short with a target of at least 500 pips. Until then, my approach is simple: wait and see.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Lingrid | AUDCHF short OPPORTUNITY at Top of the MARKET RangeThe price perfectly fulfilled my last idea . It hit the target zone. As we can see, FX:AUDCHF is oscillating between the 0.56550 and 0.55000 levels, having recently reached the top of this range. After bouncing off the support level, the price began to form an ABC move, which typically precedes a pullback. Additionally, the price has reached the upper border of the channel and trendline, where it has previously dropped twice. Given that the price is currently consolidating, I think it may bounce off the resistance again, leading to a move lower as we anticipate a continuation of the sideways trend. My goal is support zone around 0.55835

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Historic Milestone for Gold: My Outlook and Key Support LevelsLast Friday, for the first time in history, Gold printed a "3" handle, and since the beginning of the year, it has already climbed an impressive 4,000 pips.

However, what matters most now is what Gold will do next.

As we can see on the chart, after reaching a new all-time high (ATH) at 3005, Gold has started to pull back slightly and has recently formed a support level around 2980.

As I also mentioned in my Friday analysis, although I expect a correction, I don’t see Gold dropping all the way back to test the previous ATH zone at 2950 , which should now act as a strong support. Instead, even if Gold breaks below the newly formed 2980 support, I will be watching for reversal signs between 2965 and 2970, and from there, I expect a new bullish wave and a fresh all-time high.

In conclusion, my strategy remains unchanged: buy the dips.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Lingrid | ETHUSDT October 2023 LEVELS ReachedBINANCE:ETHUSDT price continues to push lower, reaching the support level that was last tested in October 2023. Historically, we can observe similar price action from 2021, when the price fell from the 4300 level and subsequently bounced off the 1700 support zone, leading to all-time highs. On the current chart, we see that the price has broken above the downward trendline that has acted as a resistance zone for the month. I think the price will continue to move sideways for the next couple of weeks, potentially pushing higher if we see buying pressure from the support level. My goal is resistance zone around 2190

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

USD/JPY Eyes 151 Resistance After Bullish BreakoutLast week, USD/JPY reached my target at the 146 zone. After testing this support level, the pair began to reverse upward and broke above the falling wedge pattern, signaling a potential trend change.

On Friday, the pair formed a higher low, followed by another one today.

As of now, USD/JPY is trading at 147.75, just below a key horizontal resistance level. A breakout above this level could lead to further upside, with the next target around the 151 resistance zone.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Resistance at 1.3T: Is a Deeper Crypto Correction Coming?The long-awaited Trump inauguration, which was expected to trigger an altcoin season, had the exact opposite effect. This once again proves that when the majority of market participants expect one outcome, the market often does the opposite.

After several days of testing support, the "tax policy" announcement triggered a breakdown below the 1.3T level, causing Total 3 to drop around 30% to 1T.

The market is now experiencing a normal rebound, but I am not very optimistic in the medium term.

Technically, 1.3T has now turned into strong resistance. In my opinion, after this rebound, a new leg down is likely.

I expect a drop below 1T, potentially reaching around 900B in the near future.

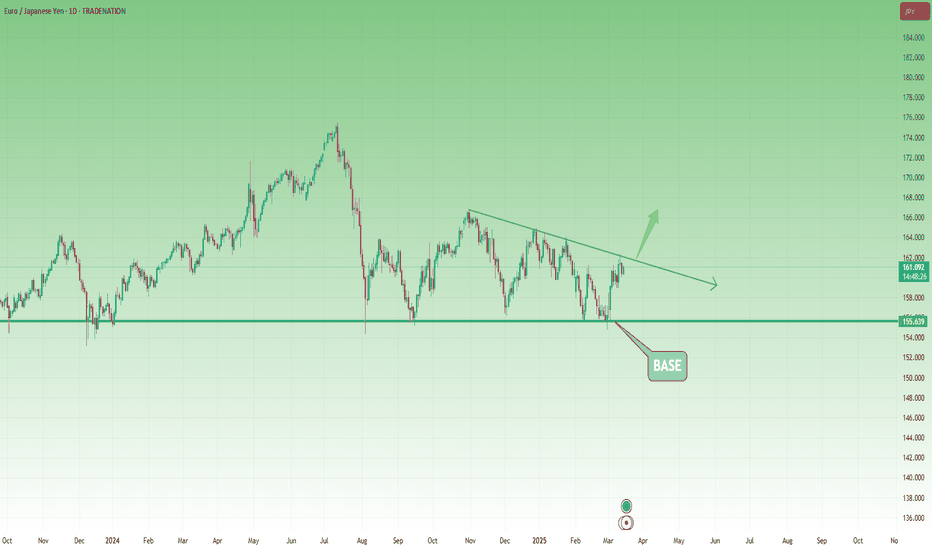

EUR/JPY Trade Setup: Buying the Dip Toward 160 for a 1:2.5 R/RSince reaching a low around 155 at the beginning of August, EUR/JPY has been trading within a defined range.

Earlier this March, the pair once again tested the lower boundary of this range and, as before, rebounded strongly. A higher low was established at the start of this week, suggesting that 159 may now serve as a new base of support.

In my view, EUR/JPY is likely to continue its upward trajectory, and a move toward 165 could materialize in the near future.

Conclusion:

Pullbacks toward the 160 area should be considered potential buying opportunities. With a stop-loss set around 158 and a target at 165, this setup offers an attractive risk-to-reward ratio of approximately 1:2.5.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Lingrid | GOLD Weekly MARKET AnalysisOANDA:XAUUSD market remains strongly bullish as we have now reached the psychological level at 3000. The price has broke and closed above the previous resistance zone around the 2955 level, indicating that this area holds significant importance for the market. This suggests that, should the price retest this zone, there is a high likelihood of a bounce.

However, on the daily timeframe, the picture becomes slightly concerning. The price tested the global upward trendline and then closed below it. Historically, after each test of this level, the price has formed a pullback, so we may see a correction in the market this time as well. Given the current strong interest in gold—mainly due to global geopolitical concerns and ongoing tariff wars—the market may only experience a minimal retracement. Overall, any pullback at this stage could present a buying opportunity in anticipation of trend continuation.

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Lingrid | EURUSD Bear-FREE Zone. Potential BUY OpportunityFX:EURUSD price is still consolidating following the significant bullish momentum in the market. Since Tuesday, it has mainly been moving sideways and is currently trading within that range. The market has reached a key resistance zone, but last week, we did not see any potential pullback. It appears that the price may continue to move sideways before making its next move. Notably, an ABC pullback is forming after the its completion, we might see a strong possibility of trend continuation. I expect the price to dip below last week's low, followed by a bullish move from the support level around 1.07800 and the upward trendline. My goal is resistance zone around 1.10000

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Bitcoin under 40k? Possible, but is this also probable?In life, anything is possible , and when it comes to crypto, everything is possible .

But, as I mentioned in my educational post yesterday, there’s a big difference between what is possible and what is probable.

In this article, I want to analyze the possibility of Bitcoin dropping below $40,000 and more importantly, what would need to happen for this scenario to shift from just possible to truly probable.

________________________________________

BTC — From All-Time High to Distribution?

If we look at the Bitcoin chart, we notice that after the first all-time high very close to $100,000 at the end of November, the market began a consolidation phase.

Although we saw two more all-time highs — one around $108,000 in mid-December and another near $110,000 in January — the entire structure from late November to late February appears to be a distribution pattern rather than a healthy continuation.

Once Bitcoin broke below $90,000, we can consider this distribution phase complete, with a target for short positions around $75,000 — a level I’ve highlighted in my previous posts.

________________________________________

Long-Term Logarithmic Chart — Diminishing Returns and the Bigger Picture

Looking at the long-term logarithmic chart, we can see a clear pattern of diminishing returns:

• The first major leg up, starting in late 2011, was approximately 600x and lasted about two years, followed by a correction.

• The next leg was 100x, spanning four years, followed by another correction.

• Then, a 20x rally, which lasted just over a year.

• Finally, the most recent leg up has been around 7x.

What’s crucial here is that returns are decreasing and, even more importantly, the last leg up looks more like an ascending channel than a parabolic move like in previous cycles.

________________________________________

The Significance of the Ascending Channel

This ascending channel is not unusual — the market has matured, and big players are now involved, reducing volatility.

However, ascending channels on the long-term often signal potential reversals, rather than continuation.

________________________________________

What Would Make $40,000 Probable?

Now, let’s address the real question: What would need to happen for Bitcoin to drop to $40,000?

Zooming in on the logarithmic chart, it becomes evident that the $72,000 - $75,000 zone is a major support confluence.

If this area is broken — meaning a weekly candle closes below this level — the scenario of BTC dropping toward $40,000 becomes probable.

The target zone I’m watching in this case is $32,000 - $36,000, a strong historical support that is clearly visible on higher timeframes.

________________________________________

Conclusion — Watch the Key Levels, Not What you Hope

To conclude:

• Bitcoin dropping to those extreme levels is possible, but not yet probable.

• Probabilities will shift only if key support levels are broken — specifically $72k-$75k.

• The market has matured, cycles are changing, and returns are diminishing, so expecting a repeat of past parabolic runs may not be realistic.

• As traders and investors, we must focus on the charts and key levels, not on hopium and hype.

Gold Eyes $3,000 Breakout: Buy the Dip Strategy Remains in PlayYesterday, as expected, Gold reached a new all-time high, coming very close to the key $3,000 psychological level.

Currently, the price is undergoing a minor correction, consolidating the strong gains from yesterday — which may present traders with a fresh opportunity to join the prevailing bullish trend.

The $2,955 level, representing the previous ATH, now acts as a key support. However, in my view, Gold is unlikely to revisit this level, as it would be too obvious and heavily watched by the market. Instead, I expect a shallow pullback followed by a new impulsive leg higher, likely pushing the price above the $3,000 mark.

Conclusion:

The strategy remains unchanged — buy dips in anticipation of a breakout to new all-time highs beyond $3,000.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Lingrid | PEPEUSDT anticipating a BEARISH Move after PullbackBINANCE:PEPEUSDT market declined to its August lows. Given that it has been in a bearish trend for over eight weeks, I anticipate that the price may now move sideways around this level to facilitate accumulation. Typically, following a period of strong momentum, markets tend to consolidate and trade in a horizontal pattern. Observing the price action, we can see that it is forming an ABC pullback, which often precedes a rollback. I expect the market to retest this support level, potentially establishing a range zone. Historically, if we look back, the price has previously formed a range zone before breaking through, and this pattern may repeat itself. My goal is support zone around 0.00000610

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣