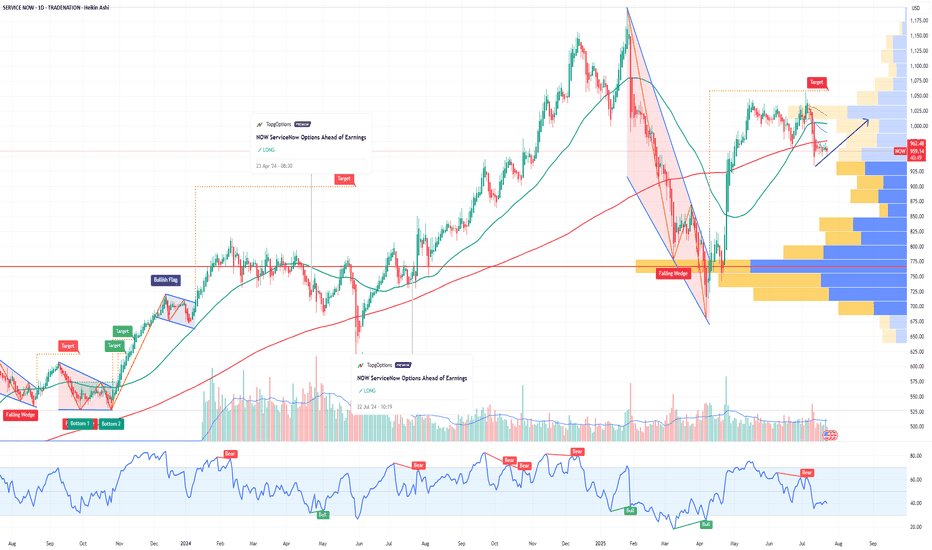

NOW ServiceNow Options Ahead of EarningsIf you haven`t bought NOW before the recent rally:

Analyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 960usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $97.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signalsforex

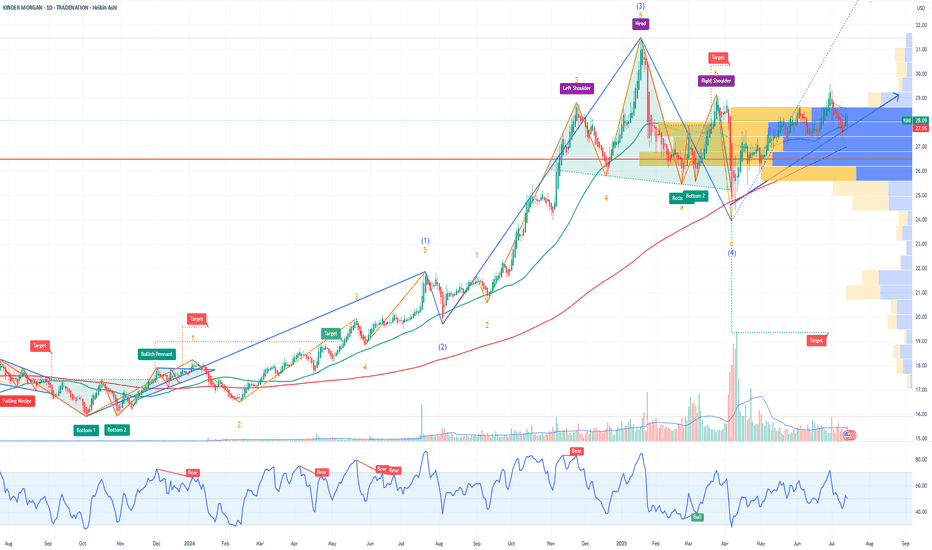

KMI Kinder Morgan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of KMI Kinder Morgan prior to the earnings report this week,

I would consider purchasing the 28.5usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $0.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Baidu ($BIDU): China’s Google Is Ready to Break OutIf you haven`t bought BIDU on the previous dip:

What you need to know now:

1. Baidu = The Google of China

Baidu dominates China’s search engine market, holding over 60% market share, making it the Google equivalent in the world's second-largest economy.

Its advertising business is deeply entrenched in Chinese internet infrastructure.

As digital ad spending rebounds in China, Baidu’s core business benefits directly.

2. AI and Autonomous Driving Moonshots

Baidu is China’s national AI champion, pouring billions into next-gen technologies:

Ernie Bot (Baidu’s ChatGPT competitor) is now integrated across its ecosystem and enterprise offerings.

Apollo Go, Baidu’s autonomous driving platform, already operates robo-taxis in multiple Chinese cities and has received licenses for fully driverless operations.

Baidu also provides AI cloud services, competing with Alibaba Cloud and Huawei.

With the Chinese government pushing AI self-sufficiency, Baidu is one of the biggest beneficiaries.

3. Cheap Valuation with High-Tech Exposure

Baidu trades at a forward P/E under 10 and price-to-sales under 2, despite being a major player in AI, cloud, and mobility.

That’s a fraction of what US tech firms with similar ambitions (like Alphabet or Tesla) are valued at.

Over $25 billion in cash and investments on the balance sheet adds a margin of safety.

4. Government Support & Stimulus Tailwinds

The Chinese government is pivoting back toward supporting tech innovation, especially in AI, after years of regulatory crackdowns.

Baidu is aligned with national AI and autonomous driving goals.

If the government ramps up fiscal stimulus, especially in infrastructure and technology, Baidu will likely benefit.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

U Unity Is the Leader Powering the Mobile Gaming Boom in 2025If you haven`t bought the dip on U:

Now you need to know that U Unity Software stands as the dominant platform for mobile game development, fueling one of the fastest-growing segments in the global gaming industry. As mobile gaming continues its explosive expansion, Unity’s leadership in providing an accessible, powerful, and cross-platform game engine positions it for substantial growth and sustained market dominance in 2025 and beyond.

1. Unity Powers Over 70% of Mobile Games Worldwide

Unity is the engine behind more than 70% of all mobile games, a staggering market share that underscores its ubiquity and developer preference in the mobile gaming space.

This dominant position is supported by Unity’s user-friendly interface that appeals to a broad spectrum of developers—from indie studios to AAA game creators—enabling rapid prototyping and high-quality game production.

The company’s “build once, deploy anywhere” approach allows developers to launch games seamlessly across iOS, Android, consoles, and emerging platforms like AR/VR, saving time and development costs.

2. Mobile Gaming Market Growth Fuels Unity’s Expansion

The global mobile gaming market is projected to grow by $82.4 billion from 2025 to 2029, at a CAGR of 11.3%, driven by rising smartphone penetration, 5G connectivity, and increasing demand for multiplayer and free-to-play games.

Unity’s platform is uniquely positioned to capture this growth, as 90% of developers surveyed in 2025 reported launching their games on mobile devices.

The Asia-Pacific (APAC) region, accounting for over half of the mobile gaming market, represents a key growth area where Unity’s tools are widely adopted.

3. Cutting-Edge Technology and Innovation in Gaming Development

Unity’s continuous innovation, including the release of Unity 6 and Unity Vector, supports developers with advanced rendering, AI-driven content creation, and enhanced networking tools for smoother multiplayer experiences.

The platform’s integration of AI enables real-time, player-driven experiences such as dynamic content and adaptive storylines, which are becoming industry standards in 2025.

Unity’s cloud-based services and analytics empower developers to optimize monetization strategies, balancing user experience with in-app purchases and rewarded ads, which are booming in hybrid-casual games.

4. Thriving Developer Ecosystem and Support Network

Unity boasts a massive and active developer community, with over 8,000 companies worldwide adopting its platform for game development.

The Unity Asset Store and extensive tutorials reduce development time and costs, enabling faster time-to-market and innovation cycles.

This ecosystem fosters collaboration and accelerates problem-solving, making Unity the preferred choice for both startups and established studios.

5. Strong Financial Performance and Market Position

In Q1 2025, Unity reported revenue of $435 million with an adjusted EBITDA margin of 19%, reflecting operational discipline and strong demand for its platform.

Despite a GAAP net loss, Unity’s positive adjusted earnings per share ($0.24) and growing free cash flow demonstrate improving profitability metrics.

Unity’s leadership in mobile game development and expanding footprint in AR, VR, and metaverse projects provide multiple avenues for future revenue growth.

6. Cross-Platform and Metaverse Growth Opportunities

Unity’s “build once, deploy anywhere” philosophy extends beyond gaming into virtual concerts, interactive worlds, and digital marketplaces, positioning the company at the forefront of the metaverse evolution.

Enhanced networking and cloud gaming capabilities enable high-quality experiences across devices, including mobile phones and AR glasses, broadening Unity’s addressable market.

MDB MongoDB Options Ahead of EarningsIf you haven`t exited MDB before the selloff:

Now analyzing the options chain and the chart patterns of MDB MongoDB prior to the earnings report this week,

I would consider purchasing the180usd strike price Puts with

an expiration date of 2025-6-6,

for a premium of approximately $4.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AI C3ai Options Ahead of EarningsIf you haven`t bought AI before the previous earnings:

Now analyzing the options chain and the chart patterns of AI C3ai prior to the earnings report this week,

I would consider purchasing the 23.5usd strike price Calls with

an expiration date of 2025-5-30,

for a premium of approximately $1.31.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CVX Chevron Corporation Options Ahead of EarningsIf you haven`t sold CVX before the retracement:

Now analyzing the options chain and the chart patterns of CVX Chevron Corporation prior to the earnings report this week,

I would consider purchasing the 125usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $5.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BMBL Bumble Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BMBL Bumble prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $1.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Market Outlook for GBP/NOKThe pair is consolidating near the 13.80–13.90 demand zone, presenting a potential reversal opportunity.

A rebound from here could target 14.05, while a break lower may intensify the sell-off. Price action in this area will guide the next trend.

Follow up for the end result.

PALLADIUM - Key zone to Watch for the Next MoveOANDA:XPDUSD is present in a key resistance zone, a level that has previously acted as a turning point for strong bearish reversals. The recent upward momentum leading into this zone increases the probability of heightened selling interest.

This could set the stage for a potential decline toward the 957.900 level. But If the resistance is decisively broken, it could mean further bullish advances, suggesting a continuation of the upward trend.

In other words, XPD/USD is at a critical point, with the resistance zone likely to determine the market's next direction.

-Price to watch 957.900,

-A breakout would indicate further bullish continuation.

Remain disciplined, wait for definitive confirmation before entering positions. This shows the importance of careful analysis and adherence to trading plans.

NZDSGD - in Resistance zone - Can it get to 0.76700?OANDA:NZDSGD is in a supply zone that has before been an area for bearish reversals.

As of now, the pair is testing this critical region, and based on previous price action, a rejection could potentially drive the price lower toward the 0.76700 level.

But if the price breaks through this resistance, it would invalidate the bearish bias and open up the possibility of a continued upward movement. In that case, you can look for the next key resistance levels for potential targets for bullish continuation.

Keep a close watch on price behavior in this region and use prudent RISK management strategies to navigate the market's uncertainty.

Feel free to share your thoughts or views in the comments!

FIVE Five Below Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FIVE Five Below prior to the earnings report this week,

I would consider purchasing the 100usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $5.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ASTS AST SpaceMobile Options Ahead of EarningsIf you haven`t bought ASTS before the major breakout:

Now analyzing the options chain and the chart patterns of ASTS AST SpaceMobile prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2025-5-16,

for a premium of approximately $6.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

MS Morgan Stanley Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MS Morgan Stanley prior to the earnings report this week,

I would consider purchasing the 115usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $2.26.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

VZ Verizon Communications Options Ahead of EarningsAnalyzing the options chain and the chart patterns of VZ Verizon Communications prior to the earnings report this week,

I would consider purchasing the 44usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $1.23.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TSM Taiwan Semiconductor Options Ahead of EarningsIf you haven`t sold TSM here:

Then analyzing the options chain and the chart patterns of TSM Taiwan Semiconductor prior to the earnings report this week,

I would consider purchasing the 100usd strike price at the money Calls with

an expiration date of 2024-9-20,

for a premium of approximately $11.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RIVN Rivian Automotive Options Ahead of EarningsIf you haven`t sold RIVN when they started to recall vehicles due to loose fasteners:

Then analyzing the options chain and the chart patterns of RIVN Rivian Automotive prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $3.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

JD Options Ahead of EarningsIf you haven`t sold JD before the previous earnings:

Then analyzing the options chain and the chart patterns of JD prior to the earnings report this week,

I would consider purchasing the 35usd strike price Calls with

an expiration date of 2024-6-21,

for a premium of approximately $1.29.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PANW Palo Alto Networks Options Ahead of EarningsIf you haven`t bought the dip on PANW:

Then, after analyzing the options chain and the chart patterns of PANW Palo Alto Network prior to the earnings report this week,

I would consider purchasing the 300usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $27.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GOEV Canoo Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GOEV Canoo prior to the earnings report this week,

I would consider purchasing the 3usd strike price Puts with

an expiration date of 2024-5-17,

for a premium of approximately $0.68.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TTD The Trade Desk Options Ahead of EarningsIf you haven`t bought TTD before the previous earnings:

Then analyzing the options chain and the chart patterns of TTD The Trade Desk prior to the earnings report this week,

I would consider purchasing the 90usd strike price Puts with

an expiration date of 2024-6-21,

for a premium of approximately $5.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PINS Pinterest Options Ahead of EarningsIf you haven`t sold PINS before the previous earnings:

nor entered in the Buy area:

Then analyzing the options chain and the chart patterns of PINS Pinterest prior to the earnings report this week,

I would consider purchasing the 35usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $5.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ETSY Options Ahead of EarningsIf you haven`t sold ETSY before the previous earnings:

Then analyzing the options chain and the chart patterns of ETSY prior to the earnings report this week,

I would consider purchasing the 70usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $12.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.