NVDA NVIDIA Price Target by Year-EndNVIDIA Corporation (NVDA) remains a dominant force in the AI and semiconductor markets, with its forward price-to-earnings (P/E) ratio currently at 19.37—a reasonable valuation considering its growth trajectory and market position.

NVIDIA’s leadership in the AI sector, particularly through its cutting-edge GPUs, has driven strong demand from data centers, cloud providers, and AI developers. The company’s recent product launches, including the Hopper and Blackwell architectures, have further solidified its competitive edge.

Despite recent market volatility, NVIDIA's consistent revenue growth and expanding profit margins support the bullish case. The current P/E of 19.37 reflects a balanced risk-reward profile, suggesting that the stock is not overvalued despite its impressive performance.

A price target of $145 by year-end reflects approximately 15% upside from current levels, driven by sustained AI demand and growing market penetration. Investors should watch for quarterly earnings reports and updates on AI chip demand, as these will likely act as key catalysts for upward momentum.

Signalspackage

VKTX: Unusual Options Flow & a Breakthrough Weight-Loss DrugIf you haven`t bought CKTX before the recent rally:

Now you need to know that Viking Therapeutics (VKTX) is a speculative biotech stock in the GLP-1/GIP agonist space, aiming to challenge market leaders like Eli Lilly and Novo Nordisk. Recently, I noticed unusual options flow — specifically, Jan 16, 2026 $60 strike calls

Key Bullish Points

1) Riding the Obesity Drug Boom

VK2735 is Viking’s dual agonist candidate showing promising early weight-loss efficacy, with potential overlap benefits in NASH (liver disease). The obesity treatment space is expected to exceed $100B by 2030—huge upside if their trials continue positively.

2) Options Flow Tells a Story

Those Jan 2026 $60 calls caught my attention precisely because the stock currently trades in the mid-$60s. These aren’t cheap lottery plays—they’re strategically timed wrt trial readouts, partnerships, or acquisition interest. Essentially, someone anticipates meaningful upside in the near future.

3) Descending Wedge — Chart Looks Bullish

VKTX peaked near $100, then pulled back into a well-defined descending wedge. If it breaks out above $70–$72 with volume, that could kick off a classic reversal trade.

Smart Money Options Flow — Near-Term Bet:

Recently, I spotted unusual open interest in $60 strike calls expiring Jan 16, 2026 — that’s only about 7 months away.

This means someone is positioning for a big upside move relatively soon, likely betting on positive Phase 2b/3 data, a partnership deal, or even buyout chatter within the next few quarters.

Short-dated, out-of-the-money call flow like this often hints at near-term news — not just a long-dated hedge.

RGTI Rigetti Computing Options Ahead of EarningsIf you haven`t bought RGTI before the rally:

Now analyzing the options chain and the chart patterns of RGTI Rigetti Computing prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2027-1-15,

for a premium of approximately $6.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SE Sea Limited Options Ahead of EarningsIf you haven`t bought SE before the rally:

Now analyzing the options chain and the chart patterns of SE Sea Limited prior to the earnings report this week,

I would consider purchasing the 150usd strike price at the money Calls with

an expiration date of 2025-9-12,

for a premium of approximately $9.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

LVS Las Vegas Sands Options Ahead of EarningsIf you haven`t bought LVS before the rally:

Now analyzing the options chain and the chart patterns of LVS Las Vegas Sands prior to the earnings report this week,

I would consider purchasing the 48.5usd strike price Puts with

an expiration date of 2025-7-25,

for a premium of approximately $1.22.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

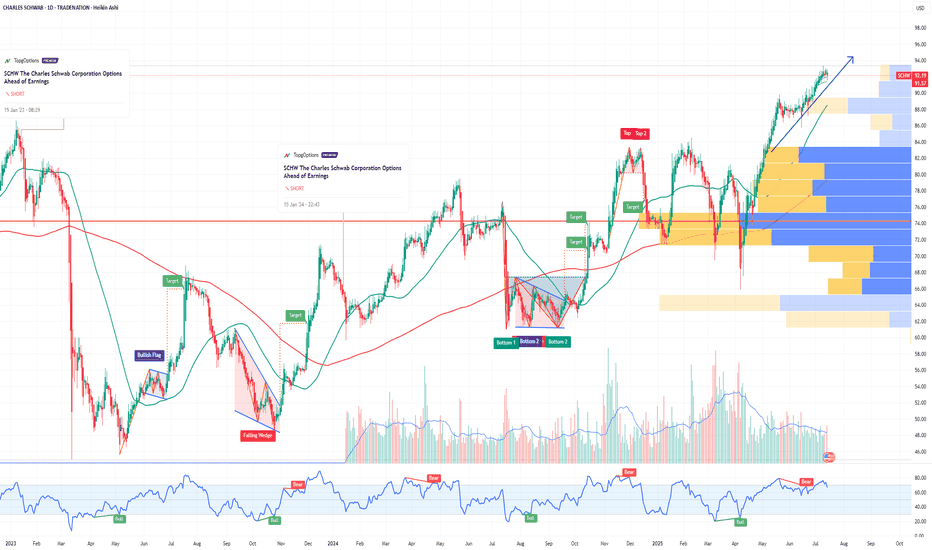

SCHW The Charles Schwab Corporation Options Ahead of EarningsIf you haven`t sold SCHW before the sell-off:

Now analyzing the options chain and the chart patterns of SCHW The Charles Schwab Corporation prior to the earnings report this week,

I would consider purchasing the 92.5usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Why BABA Alibaba Could Rebound Strongly by Year-End 2025If you haven`t bought BABA before the recent rally:

What you need to know:

BABA’s fundamentals, fueled by e-commerce, cloud, and AI, support its technical bullishness:

E-commerce and Cloud Rebound:

Q1 2025 revenue grew 7% year-over-year, with Taobao/Tmall rebounding and cloud revenue surging due to AI demand.

Alibaba’s cloud division, China’s largest, benefits from hyperscaler AI workloads, with 15% profit margin projections by 2029.

AI Leadership:

BABA’s AI assistant and generative AI tools drove a 70% stock surge in early 2025, positioning it as a leader in China’s AI race.

At 12x forward P/E with 8% revenue CAGR, BABA is undervalued (fair value ~$162).

Share Buybacks:

Aggressive share repurchasing (6% annual reduction) boosts EPS, with $1 trillion GMV reinforcing e-commerce dominance.

Macro Tailwinds:

Easing CCP regulations and China’s stimulus measures (e.g., rate cuts) support BABA’s rally.

Minimal U.S. exposure insulates BABA from trade war risks.

Conclusion: BABA’s Path to $168

BABA’s technicals, with a bullish breaker and wedge, signal a breakout above $125–$130, targeting $150–$168 by year-end 2025. Fundamentally, its e-commerce dominance, cloud/AI growth, and undervaluation make it a standout. Traders should buy dips near $110–$115 or await a $130 breakout. With stimulus and buybacks as catalysts, BABA is set to soar.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SNAP Upside PotentialIf you haven`t bought SNAP before the previous earnings:

SNAP Key Fundamental Strengths in Q1 2025:

Metric Q1 2025 Result Year-over-Year Change

Revenue $1.36 billion +14%

Daily Active Users (DAU) 460 million +9%

Monthly Active Users (MAU) 900 million+

Net Loss $140 million -54% (improved)

Adjusted EBITDA $108 million +137%

Operating Cash Flow $152 million +72%

Free Cash Flow $114 million +202%

SNAP strong fundamental performance in Q1 2025, marked by accelerating revenue growth, expanding user engagement, sharply improving profitability, and robust cash flow generation, sets a solid foundation for a potential stock rally this year.

The company’s innovation in AR, diversified revenue streams, and healthy balance sheet further support a bullish outlook. Investors focusing on fundamentals can view Snap as a growth stock with improving financial health and significant upside potential in 2025.

My price target is $14.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

FIVE Five Below Options Ahead of EarningsIf you haven`t bought FIVE before the previous earnings:

Now analyzing the options chain and the chart patterns of FIVE Five Below prior to the earnings report this week,

I would consider purchasing the 115usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $4.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NTNX Nutanix Options Ahead of EarningsIf you haven`t bought NTNX before the recent rally:

Now analyzing the options chain and the chart patterns of NTNX Nutanix prior to the earnings report this week,

I would consider purchasing the 80usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $5.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RKT Rocket Companies Options Ahead of EarningsIf you haven`t bought RKT before the previous earnings:

Now analyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.37.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TEAM Atlassian Corporation Options Ahead of EarningsIf you haven`t sold TEAM on this top:

Now analyzing the options chain and the chart patterns of TEAM Atlassian Corporation prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-5-2,

for a premium of approximately $8.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AAL American Airlines Group Options Ahead of EarningsIf you haven`t bought the dip on AAL:

Now analyzing the options chain and the chart patterns of AAL American Airlinesprior to the earnings report this week,

I would consider purchasing the 9usd strike price Puts with

an expiration date of 2025-5-2,

for a premium of approximately $0.44.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NKE NIKE Options Ahead of EarningsIf you haven`t sold NKE before the previous earnings:

Now analyzing the options chain and the chart patterns of NKE NIKE prior to the earnings report this week,

I would consider purchasing the 73usd strike price Puts with

an expiration date of 2025-3-21,

for a premium of approximately $3.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SEDG SolarEdge Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2025-2-28,

for a premium of approximately $1.76.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AMAT Applied Materials Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AMAT Applied Materials prior to the earnings report this week,

I would consider purchasing the 180usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $6.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CMCSA Comcast Corporation Options Ahead of EarningsAfter CMCSA reached the previous price target:

Now analyzing the options chain and the chart patterns of CMCSA Comcast Corporation prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $1.86.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

INTC Intel Corporation Options Ahead of EarningsIf you didn’t buy during last year’s double bottom on INTC:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 22usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $1.56.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the breakout:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 185usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $8.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

OZK Bank OZK Options Ahead of EarningsIf you haven`t sold OZK before the previous earnings:

Now analyzing the options chain and the chart patterns of OZK Bank OZK prior to the earnings report this week,

I would consider purchasing the 42.5usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $3.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BBAI BigBear ai Holdings Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 2usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GIS General Mills Options Ahead of EarningsIf you haven`t sold GIS before the previous earnings:

Now analyzing the options chain and the chart patterns of GIS General Mills prior to the earnings report this week,

I would consider purchasing the 57.5usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $1.92.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SLB Schlumberger Limited Options Ahead of EarningsIf you haven`t sold the Double Top on SLB:

Now analyzing the options chain and the chart patterns of SLB Schlumberger prior to the earnings report this week,

I would consider purchasing the 40usd strike price Puts with

an expiration date of 2025-6-20,

for a premium of approximately $3.17.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.