Lingrid | GOLD Short-Term Correction From Psychological LevelOANDA:XAUUSD is currently retesting the broken triangle structure from below, having rebounded from the ascending support zone. The price is approaching a confluence near 3,400–3410, where prior breakdown and resistance meet. If this level holds as resistance, the setup favors a bearish continuation toward 3,340 and possibly deeper. The broader structure shows lower highs and increasing rejection pressure below the resistance zone.

📉 Key Levels

Sell trigger: 3,400 rejection

Sell zone: 3,398.660–3,410

Target: 3,340

Invalidation: Break and hold above 3,410

💡 Risks

Momentum from recent rebound could challenge resistance

A higher low formation could tilt sentiment bullish

External factors (Fed, inflation data) may inject volatility beyond the range

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Signalsprovider

Lingrid | GBPUSD Shorting Opportunity At Confluence ZoneThe price perfectly fulfilled my previous idea . FX:GBPUSD is climbing toward the key confluence zone between the downward channel resistance and the 1.34418 horizontal level. The broader trend remains bearish, with repeated lower highs and clear rejection patterns near trendline resistance. A rejection at 1.34418 could trigger another leg lower toward the 1.32500 zone. As long as the pair remains under the red trendline, bearish continuation remains in play.

📉 Key Levels

Sell trigger: Rejection near 1.34418

Sell zone: 1.34418–1.34500

Target: 1.32500

Invalidation: Break and close above 1.34500

💡 Risks

A strong breakout above 1.34500 may flip the structure into bullish

Macro news events could override technical rejection zones

Sideways movement near resistance may reduce clarity of setup

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | BNBUSDT Potential Bullish ContinuationThe price perfectly fulfilled my previous idea . BINANCE:BNBUSDT is rebounding from a higher low along the upward trendline, maintaining its position within the broader bullish channel. After the recent retracement from the peak at resistance, price has stabilized above 750, suggesting accumulation before a potential push higher. As long as it holds the trendline and the key 735–750 support zone, bulls are likely to target the 820 level next. This bullish continuation is fueled by a strong structure of higher lows and a healthy trend.

📉 Key Levels

Buy trigger: Close above 780

Buy zone: 735–750

Target: 820

Invalidation: Break below 730

💡 Risks

Failure to hold 735 support may trigger deeper pullback toward 700

Rejection at 780 could result in extended range-bound movement

Resistance near 820 may cap gains without strong momentum

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | GOLD Potential Bullish Extension Following Pullback OANDA:XAUUSD is rebounding strongly from the support zone after a deep correction from the previous top near 3,437. The price has broken back above the range and formed a new impulse leg, now hovering just above the upward trendline. As long as the structure holds above 3,330, further continuation toward the 3,410–3,437 resistance zone remains likely. The projected wave path shows a bullish scenario targeting a retest of the top trendline.

📉 Key Levels

Buy trigger: Above 3,360

Buy zone: 3,330–3,340

Target: 3,410

Invalidation: Below 3,320

💡 Risks

Rejection from 3,360 trendline may lead to retracement

Failure to hold above 3,330 support could shift bias bearish

Upcoming macroeconomic data might increase volatility

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | XRPUSDT Potential Upside Move From Support ZoneThe price perfectly fulfilled my previous idea . BINANCE:XRPUSDT is rebounding after a breakout from the consolidation zone and testing support around 2.897. The price is forming a bullish structure within a downward channel, aiming to reclaim the mid-level resistance. As long as it remains above 2.897, the bullish wave has room to target the descending channel’s upper boundary near 3.230. Momentum is gradually shifting toward upside continuation following the recent breakout and rebound.

📉 Key Levels

Buy trigger: Break and hold above 2.960

Buy zone: 2.850–2.960

Target: 3.230

Invalidation: Drop below 2.740

💡 Risks

Failure to hold 2.870 could invalidate the rebound

Overall channel remains bearish, posing structural resistance

Broader market sentiment may weigh on breakout momentum

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

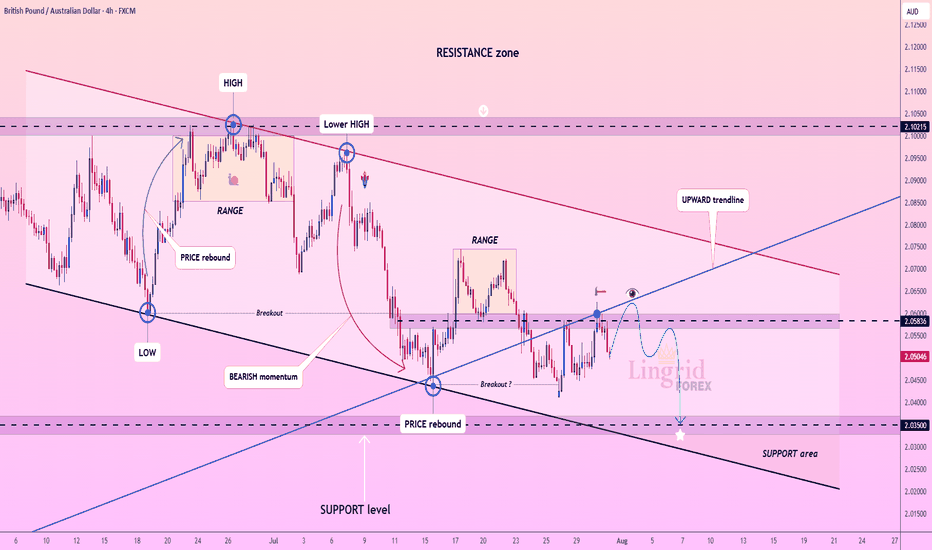

Lingrid | GBPAUD Consolidation - Continuation ScenarioFX:GBPAUD is breaking down from the upward trendline and testing key horizontal support near 2.0500 after rejecting from a lower high in the downward channel. This structure confirms a bearish continuation bias within the broader descending pattern. A clean break below 2.0500 opens the path toward the next support level around 2.0358. The failure to reclaim the lower high signals growing bearish pressure on the pair.

📉 Key Levels

Sell trigger: Break and hold below 2.0500

Sell zone: 2.0500–2.0480

Target: 2.0358

Invalidation: Return above 2.0506

💡 Risks

Bullish defense of 2.0500 could trigger a rebound

Re-entry into the broken trendline may trap sellers

Broader AUD weakness may delay downside move

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

GBPUSD DAILY ANALYSISOn the daily timeframe, GU is currently bearish but right now, it is retracing to a bearish FVG, and i think it wants to complete a 50% fib retracement level before it continues to the downside.

i am expecting my first point of engagement with the market shorts to be at level 1.33662, if that level fails, i will try shorting at 1.34533 and at 1.35308...

XAUUSD – Is This a Short-Term Top?1. What happened yesterday

After dipping to 3340 in early trading—just shy of the key 3335 support where I was looking to buy—Gold resumed its bullish momentum that began on Friday. During the New York session, price spiked to a new intraday high near 3385. However, the final hour brought a pullback, and since then, Gold has entered a tight consolidation range.

2. Key question: Is Gold forming a short-term top?

The 1H chart shows a new failed breakout attempt above 3380 during the Asian session. This left behind a minor double top, with the neckline sitting around 3370. That level is especially important—it aligns with a short-term rising trendline.

3. Why a correction might follow

• Price rejected above 3380 twice

• Small double top visible on LTF

• 3370 is a make-or-break level (neckline + trendline)

• A break below could trigger a correction of the +1000 pips rally from Friday’s lows

4. Trade plan

While there is some evidence of a potential top, this remains a high-risk and aggressive short.

Any attempt to trade against the trend should be done with tight stops and small size .

5. Final thoughts

A short-term top could indeed be in place, but Gold must break below 3370 to unlock deeper downside. Until then, the bulls are still in control—just taking a breather. ⚖️

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Lingrid | EURNZD Major Resistance. Possible ShortFX:EURNZD is approaching the resistance zone after an impulse leg formed from a price rebound off the support level. The triangle pattern near the top suggests market indecision, with the current price testing key resistance near 1.96300. If the pair fails to break and hold above this resistance, a sharp reversal is likely toward the 1.9500 level. Structure favors a bearish reaction unless a confirmed breakout occurs.

📉 Key Levels

Sell trigger: Below 1.9570

Sell zone: 1.96300-1.96450

Target: 1.94985

Invalidation: Above 1.96500

💡 Risks

Bullish breakout above 1.96500 invalidates the short setup

Triangle breakout to the upside may reverse bias

External fundamentals (NZD data/news) could disrupt pattern completion

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | SOLUSDT Corrective Move Completed ? Long OpportunityBINANCE:SOLUSDT is forming a bullish higher low just above the 158.47 support after a corrective pullback from the recent higher high. Price structure remains within the upward channel, and the rebound from key horizontal support signals a continuation setup. As long as the 158.47–160.00 zone holds, price is likely to target the 192.00 resistance near the channel's top. The ascending structure supports a bullish continuation toward the upper resistance band.

📉 Key Levels

Buy trigger: Break above 172.00

Buy zone: 158.47 – 160.00

Target: 192.00

Invalidation: Drop below 150.00

💡 Risks

Breakdown of the ascending structure below 150.00

Rejection near 172.00 without momentum confirmation

Broader market weakness could suppress breakout potential

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | ETHUSDT Short-Term Move: Buying Opportunity at SupportThe price perfectly fulfilled my last idea . BINANCE:ETHUSDT is attempting a bounce after dipping into the lower boundary of its channel near the $3,400 support level. Price action has followed a descending structure with lower highs inside a broad downward channel. As long as the $3,400 zone holds, a rebound toward the mid-range resistance at $3,630 remains viable. Current positioning inside the "BUYING area" suggests momentum may flip bullish if a reversal structure forms.

📉 Key Levels

Buy trigger: Break above $3,630

Buy zone: $3,250 – $3,400

Target: $3,630 – $3,720

Invalidation: Break below $3,250

💡 Risks

Momentum still favors sellers from the recent sell-off

Failure to reclaim mid-range resistance could cap upside

Broader trend remains within a bearish channel structure

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | GOLD Weekly Market Analysis: Strong Bullish ReboundOANDA:XAUUSD market has demonstrated resilience with a strong bullish rebound following the NFP, suggesting that institutional buyers are stepping in at critical support levels. The precious metal is now testing key resistance zones that will determine whether the recovery can gain sustainable momentum.

The chart reveals a compelling technical setup with gold bouncing strongly just above the June low support zone around $3,265. This rebound has pushed price back above the $3,330 level and is now approaching the critical $3,400 resistance area. The strong bullish rebound after the NFP release indicates that the selling pressure faded, with buyers emerging at attractive levels near the June lows.

The previous pullback phase has been contained within the broader ascending channel structure, maintaining the overall bullish framework. The triangle pattern breakout to the downside appears to have been a false move, with the current rebound suggesting that the correction may be complete. The ability to hold above the previous week low has preserved the medium-term uptrend structure.

Key levels to monitor include the immediate resistance at $3,400 and the previous support-turned-resistance at $3,330. A decisive break above $3,400 would likely trigger renewed bullish momentum toward the $3,440-$3,465 zone, while failure to sustain above $3,330 could see another test of the June low support. The strong rebound from critical support levels suggests that the broader bullish bias remains intact, with this correction potentially setting up for the next leg higher.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | EURUSD Confluence Zone: Shorting Opportunity. The price perfectly fulfilled my previous idea . FX:EURUSD is pulling back toward a confluence of resistance formed by the broken upward trendline and the descending channel boundary. Price structure suggests a lower high beneath the $1.16081 zone after a sharp sell-off from the July peak. As long as price remains below this resistance and fails to reclaim the $1.16000 level, further downside toward $1.14510 and lower remains likely. Momentum is favoring continued bearish pressure following the recent breakdown.

📉 Key Levels

Sell trigger: Rejection from $1.16000

Sell zone: $1.15800 – $1.16081

Target: $1.14510

Invalidation: Break above $1.16081

💡 Risks

A confirmed breakout above $1.16081 may invalidate the bearish setup

Momentum could stall near $1.15000 and lead to consolidation

Support at $1.14510 may attract short-term dip buyers

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | BTCUSD Consolidation PHASE ContinuesBINANCE:BTCUSDT is bouncing from the confluence of an upward trendline and the $112,175 support level, forming a higher low structure. Price remains within an upward channel, with the current pullback holding above key structural support. As long as the higher low remains intact and price stays above $112,175, a continuation toward $120,500 is likely. Momentum appears to be rebuilding within the bullish framework after a period of consolidation.

📉 Key Levels

Buy trigger: Break and hold above $114,680

Buy zone: $111,500 – $112,500

Target: $120,500

Invalidation: Break below $111,000

💡 Risks

Failure to hold the trendline could trigger deeper downside

Resistance at $114,680 may reject early attempts to move higher

Market may stay range-bound if volume remains low

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | GOLD Possible Retest of the Major Support ZoneThe price perfectly fulfilled my previous idea . OANDA:XAUUSD is bouncing from recent lows but remains under pressure below the key resistance at 3,331.90 and the downward trendline. The prior rejection near 3,440 led to a steep selloff with a clean break below the upward channel. Current action shows a potential lower high forming near the broken trendline. A rejection there could send gold tumbling toward the 3,250.00 support zone.

📌 Key Levels

Sell trigger: Failure to reclaim 3,331.90

Sell zone: 3,330 – 3,340

Target: 3,250.00

Invalidation: Strong bullish breakout above 3,340 and descending trendline

💡 Risks

Bullish reversal breaking above downward trendline

Dovish Fed news boosting gold

Unexpected macroeconomic shocks increasing safe-haven demand

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | AUDCAD Swap Zone. Potential Selling OpportunityThe price perfectly fulfilled my last idea . FX:AUDCAD is rebounding from a strong support area after a fake break below 0.88805 and is now moving toward the descending trendline. The price is expected to test the swap zone near 0.89421, where prior support may flip to resistance. This setup favors a SELL scenario from the lower high structure within the flag and downtrend. A rejection from the trendline could resume the bearish continuation back toward support.

📌 Key Levels

Sell zone: 0.89421 – 0.89500

Buy zone: 0.88805 – 0.88600

Target: 0.88805

Invalidation: Break and close above 0.89550

💡 Risks

Bullish breakout through the descending trendline

Sharp reversal from macroeconomic news

Short-term consolidation above 0.89100 weakening momentum

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | TONUSDT Potential Long From the KEY ZoneThe price perfectly fulfilled my last idea . OKX:TONUSDT is pulling back from a fake breakout above 3.590 but holding within the boundaries of an upward channel. The price is approaching strong confluence support near 3.250, where both the trendline and horizontal zone align. A rebound from this level could launch a new bullish leg toward the resistance zone. Buyers will look for confirmation at the bounce area to aim for 3.590 and beyond.

📌 Key Levels

Buy zone: 3.250 – 3.300

Sell trigger: Break below 3.250

Target: 3.590 – 3.700

Buy trigger: Bullish engulfing or breakout from local consolidation near 3.300

💡 Risks

Loss of support at 3.250 trendline

Bearish pressure from broader market sentiment

Another fakeout or choppy move around 3.300–3.400 zone

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

AMZN Amazon Options Ahead of EarningsIf you ahven`t bought the recent dip on AMZN:

Now analyzing the options chain and the chart patterns of AMZN Amazon prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $7.02.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Lingrid | USDCHF Potential Bullish Move Following Level BreakoutFX:USDCHF surged from a higher low and is now retesting the broken structure near 0.802, maintaining its position within the broader upward channel. A clean bounce from this zone would confirm the bullish structure, targeting the upper channel resistance near 0.815. Pullback and higher low structure support continued upside movement with short-term consolidation possible. A breakout from the consolidation box could accelerate momentum toward the resistance area.

📈 Key Levels

Buy zone: 0.802 – 0.805

Buy trigger: Bullish confirmation above 0.805

Target: 0.815

Invalidation: Drop below 0.796

💡 Risks

False breakout near 0.805 may lead to rejection

Failure to form higher high would invalidate bullish sequence

Momentum divergence could slow rally near resistance

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

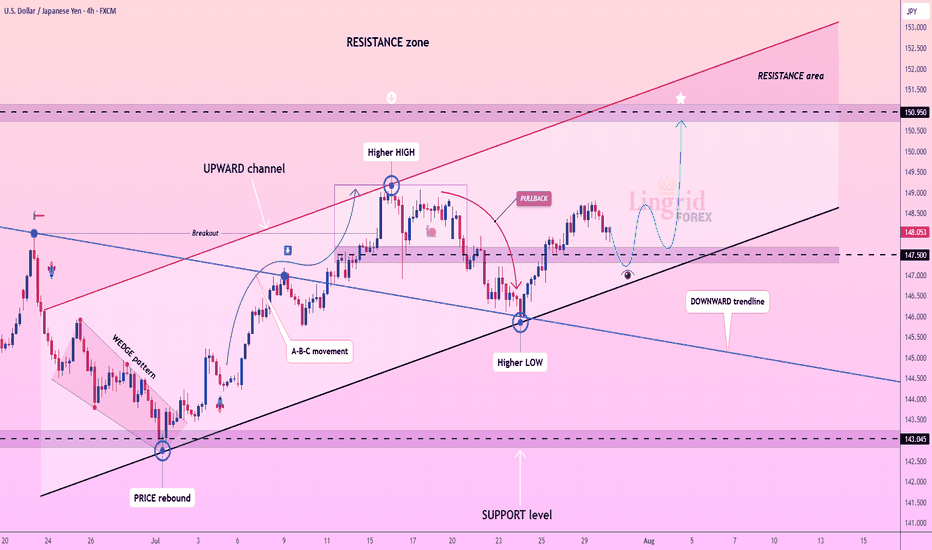

Lingrid | USDJPY Possible Strong Bullish RallyThe price perfectly fulfilled my previous idea . FX:USDJPY is trading within an upward channel after forming a higher low near the 147.50 zone, bouncing from the support trendline. Price action suggests a bullish structure continuation toward the 150.95 resistance, especially if the recent consolidation breaks higher. The overall formation aligns with a healthy correction phase before a potential push into the resistance area. Confirmation above 148.60 would likely accelerate the bullish move.

📌 Key Levels Buy zone: 147.50–147.25

Sell trigger: Below 147.00

Target: 150.95

Buy trigger: Break above 148.80

⚠️ Risks

Break below 147.50 may shift sentiment bearish

Strong resistance awaits near 150.00

Broader market volatility could invalidate pattern

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | GBPAUD Bearish Pressure. Potential ShortThe price perfectly fulfilled my previous idea . FX:GBPAUD rebounded from support and has climbed into a tight resistance zone near 2.05836, but momentum remains weak near the downward trendline. The price structure shows a sequence of lower highs and a tight range below resistance, suggesting sellers are still in control. A rejection at this level would confirm another failed breakout attempt. If confirmed, the pair could revisit the 2.03500 support area with bearish continuation pressure.

📌 Key Levels

Sell trigger: Rejection at 2.05836 and break of 2.05000

Sell zone: 2.05800–2.06000

Target: 2.03500

Invalidation: Strong break and close above 2.06000

💡 Risks

Bullish breakout above trendline resistance

Fundamental surprise (UK/AU economic data)

Shift in broader risk sentiment or AUD weakness

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Lingrid | DOGEUSDT Pullback and Continuation OpportunityBINANCE:DOGEUSDT is currently testing the intersection of its upward channel support and a critical horizontal zone near 0.21378, after a steep corrective decline from the 0.28628 resistance area. The recent price action formed a rounded pullback, suggesting potential accumulation near trendline confluence. A bullish bounce here could trigger a strong rally toward 0.26350 as shown by the projected upward path. Failure to hold the 0.21000 area would expose the pair to deeper downside toward the 0.15706 support.

📌 Key Levels

Buy zone: 0.21000–0.21700

Buy trigger: Break and close above 0.23000

Target: 0.26350

Invalidation: Break below 0.21000

⚠️ Risks

Breakdown of ascending trendline support

Weak volume on upward breakout

Broader market weakness impacting altcoins

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!