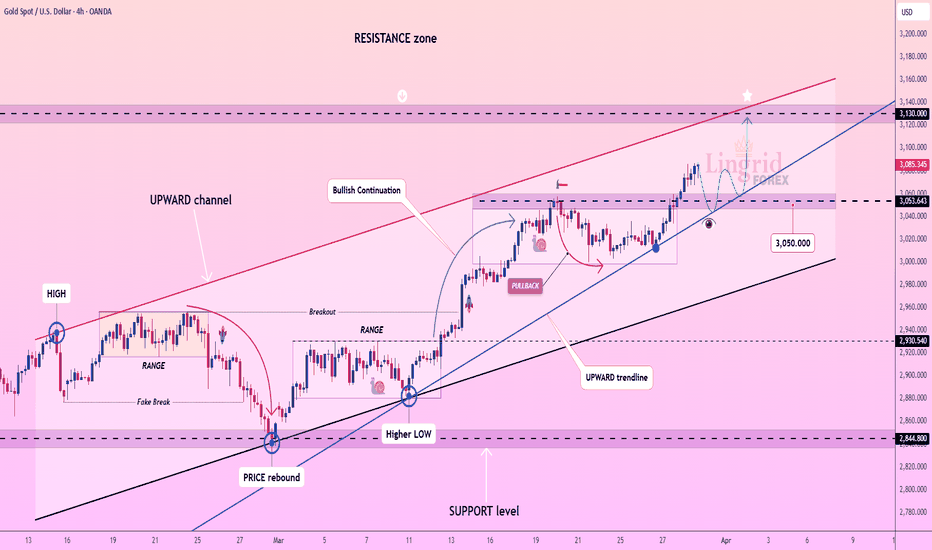

Lingrid | GOLD possible CONSOLIDATION Following a Fake BreakThe price perfectly fulfilled my last idea . It hit the take profit level. OANDA:XAUUSD appears to have made a false break of Tuesday and Wednesday's highs before reversing. Currently, the market is forming a bearish long-tailed bar on the daily timeframe, which may indicate a deeper correction or a consolidation zone between the 3100 and 3140 levels. If the price pulls back toward the support level, I believe it may rebound from there. Given the upward trendline and channel border, this area could serve as an optimal entry point in anticipation of further upward movement. However, with high-impact news scheduled for today, we should remain vigilant, as the market may experience increased volatility. My goal is resistance zone around 3160

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Signalsprovider

Lingrid | GBPNZD potential UPWARD Breakout. LongThe price perfectly fulfilled my last idea . It hit the target zone. FX:GBPNZD price is making higher highs and higher closes, indicating that the market is in a bullish phase. Recently, it tested the previous resistance zone and then bounced back because the markets usually breaks through key levels on the third or fourth attempt. If the market rebounds from the support level, we can expect a continuation of the current bullish trend. Additionally, the market is forming an ABC pattern, suggesting that the price may reach the 2.3000 level in the near future. My goal is resistance zone around 2.29000

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | TONUSDT bearish DIVERGENCE at Resistance ZoneOKX:TONUSDT market has formed a double top in the resistance zone, accompanied by a bearish divergence at the resistance zone and channel border. It failed to break above the psychological level of 4.00 forming a fake breakout. Additionally, the price has broken and closed below the upward trendline after taking liquidity above last week's high. This suggests that the market is likely gearing up for a corrective phase. I anticipate that the price may move lower towards the lower levels, possibly retesting the 3.00 supporrt level. My goal is support zone around 3.30

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | GOLD anticipating Potential MARKET RetracementThe price perfectly fulfilled my last idea . It hit the target zone. Overall, OANDA:XAUUSD market is in the process of forming an ABC move, with the C point nearing completion around the 3175 resistance zone. The market has made a corrective move of about 1.9% from the peak of the consolidation zone before. I think that the price might create a similar pullback from the all-time high zone. Given the high-impact news scheduled for today, it’s possible that the price could retest the area below yesterday's low. However, considering the current momentum, I expect the market is likely to bounce off the support level and the upward trendline, ultimately moving forward to complete the ABC pattern. My goal is resistance zone around 3170.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | AUDCHF shorting OPPORTUNITY from Previous WEEK's HighThe price perfectly fulfilled my last idea . It hit the target zone. FX:AUDCHF market is currently moving towards the previous week's high after completing an ABC move. In addition, we have the upper boundary of the channel and a trendline, along with the significant round number at 0.56000 above. Since overall trend on higher timeframes remains bearish, I think that the price may rebound from this resistance level again, especially if the market shows the end of this retracement. Overall, I expect the market to form a fake breakout followed by a bearish move from the resistance. My goal is support zone around 0.55285

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Lingrid | DOGEUSDT potential PULLBACK and BEARISH ContinuationBINANCE:DOGEUSDT market has recently broken and closed below the upward trendline, indicating a shift in momentum. Overall, it is making lower lows and lower closes, demonstrating a clear bearish dominance. The resistance zone at the 0.1800 level has proven to be a significant barrier, with the price bouncing off it multiple times. If the price rejects this level and creates a fake breakout at this zone, it may continue to move lower, especially considering the overall downward trend. Furthermore, on the weekly timeframe, the formation of a long-tailed bar suggests that the price may retest the support level around 0.1300. My goal is support zone around 0.15350

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

EOSUSDT(EOS) Updated till 02-04-25EOSUSDT(EOS) Daily timeframe range. PA trying to push toward 0.9283. which is recent resistance. it had a clean break but to keep retrace intact it need to stay above 0.6801. volume is decent here.

Lingrid | GBPJPY Potential UPWARD CHANNEL Breakout. ShortThe price perfectly fulfilled my last idea . It hit the TP level. The overall

FX:GBPJPY price formed ABC movement, with the C point completed around the 196.000 level then boucned off. Recently, the price broke and closed below the 194.000 level, that has become a resistance zone. The market has since formed a daily inside bar pattern, and a breakout above or below Monday's high and low will likely determine the next move. Currently, the price is testing the lower boundary of a channel that coincides with the support level at 193.000. I think the price may form a range zone at this level before potentially continuing downward and breaking out of the upward channel. My goal is support zone at 192.200

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Lingrid | XRPUSDT daily Head and Shoulders PatternThe price of BINANCE:XRPUSDT is currently making lower lows and lower closes. The market has declined from the resistance zone around 2.50, breaking through previous support levels and making a shift in the market structure. When we zoom out, we can see the formation of a significant head and shoulders pattern on the daily timeframe, which suggests that the price may drop below the 1.50 support level. I think this pattern will play out, pushing towards lower support levels if the price ramains below the resistance and trendline. I expect that XRP will retest the at least support level at 2.00 and further lower levels, unless unexpected news causes a surge in price. My goal is support zone around 1.90

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Lingrid | GOLD breaks Records REACHING New All-Time HighOANDA:XAUUSD market gapped up and continued to rise, reaching a new all-time high. It has already approached the resistance zone I highlighted in the weekly forecast and is above the 3100 level, which could serve as an entry zone due to the range and upward trendline below. As the monthly candle is set to print today, I believe the price may trade sideways around the current levels. However, if the price makes a correction toward support and rejects it, we should look for a buying signal in the market. My goal is resistance zone around 3150

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

EUR/USD: Range-Bound with Bearish Potential Below ResistanceThe EUR/USD market recently completed an ABC pullback, briefly testing above Friday’s high, but price action remains contained within last week’s range, signaling a lack of clear trend direction.

If the price rejects the current resistance zone, a move lower is likely, possibly forming another ABC structure toward the 1.06000 support level. With the zone below 1.07700 already cleared—despite a prior false breakout—a retest of that area is possible. Unless the price manages a close above 1.08500, the pair is expected to drift toward last week’s low, with the next target at the support zone around 1.07610

Lingrid | EURUSD ABC pullback Completed. Possible SHORTOANDA:EURUSD market formed an ABC pullback and tested the area above Friday's high. The price action remains within the previous week's range, indicating a lack of overall trend in the market. However, if the price rejects the resistance zone, I believe it may drop further, potentially forming another ABC move toward the 1.06000 support level. Since the price has cleared zone below the 1.07700 level, it may retest this area, despite the previous false breakout. I anticipate that if the price does not close above the 1.08500 resistance zone, it will likely move toward the previous week's low. My goal is support zone around 1.07610

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

BTC/USDT: Range-Bound Movement with Rebound Potential from Key SThe BTC/USDT market recently tested last week’s high but pulled back after encountering resistance near the 89,000 level. On the daily timeframe, the latest candle formed a doji, signaling weakening selling pressure.

The price has reached the two-week low, where underlying liquidity may trigger a bounce—especially around the psychological 80,000 level. With the market consolidating after recent sell-offs, a move toward the 85,000 area is possible. A monthly doji close is also anticipated, reflecting the broader indecision. The next upside target is the resistance zone around 84,000

Lingrid | BTCUSD continues to Consolidate. Potenial LongBINANCE:BTCUSDT market tested the previous week's high but then pulled back from the resistance zone around 89,000. On the daily timeframe, the last candle is a doji, indicating a loss of selling pressure. Additionally, it reached the low of the last two weeks, and below this level, there is liquidity waiting to be tapped. Given that the overall market is moving sideways after sell offs, I believe the price may bounce off the PWLs and the psychological level at 80,000 towards the 85,000. Overall, I expect the monthly candle to close as a doji as well. My goal is resistance zone around 84,000

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Lingrid | GOLD Weekly MARKET OutlookOANDA:XAUUSD market started the week quietly, but we saw significant bullish movements on Tuesday and Friday. At this stage, any pullback in the market may be viewed as a buying opportunity. The market broke through and closed above the previous resistance zone around 3050 level. Furthermore, it closed above the high from the previous week, marking four consecutive bullish weeks.

On a lower timeframe, the market formed an ascending triangle pattern, which is a bullish continuation pattern. If the price breaks above this pattern next week, it could continue to climb higher. Given the recent bullish momentum in the market, there’s a possibility that the price may consolidate after such a strong move, similar to what we observed between Monday and Wednesday. Alternatively, we might see a corrective move toward the previous week’s high, which would present an optimal entry zone.

With the ongoing tariff war in mind, I expect the bullish trend to persist until the price action shows otherwise.

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Lingrid | SUIUSDT fake break of CONSOLIDATtion zoneThe price perfectly fulfills my last idea . It hit the target level. BINANCE:SUIUSDT consolidated around the 2.30 level before breaking above it; however, the price subsequently pulled back and returned to the consolidation zone. This behavior resembles a "dead cat bounce," as we did not observe further upward movement. Below, we can see an upward trendline that has been tested multiple times. I believe the price may break through this trendline and continue moving downward since it was tested may times. My goal is support zone around 2.100

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

VIDTUSDT(VIDTDAO) Updated till 28-03-25VIDTUSDT(VIDTDAO) Daily timeframe range. PA trying to hold above its 0.01233 level. it can have some relief if it gets a valid close above 0.02066. not so much retail interest it can see better day if market gets some volume.

XAU/USD: Pullback Likely After Breakout Above Key ResistanceThe XAU/USD market has broken above last week’s high and is now testing the 3080 resistance level. Following this strong move, a pullback appears likely before any further advance. With bullish momentum still dominant, the market may continue higher or enter a sideways phase into next week.

If a pullback occurs, the previous resistance zone, now acting as support, could offer a buying opportunity—particularly near the 3050 level. With high-impact news on the horizon, the market may either range or retrace before resuming its upward trend. The next key target is the resistance zone around 3085

GBP/AUD: Consolidation Breakout Signals Bullish ContinuationThe GBP/AUD market remains in a range-bound structure, fluctuating between the 2.0300 support and 2.0600 resistance levels. Recently, price broke and closed above both a downward trendline and the previous two daily highs, reinforcing a bullish bias.

With strong momentum visible on the daily timeframe, the market appears to be setting up for a consolidation expansion pattern. If the price continues to hold above the trendline and support level, a retest of last week’s high is likely, with further bullish movement possible. The next target is the resistance zone around 2.06490

TON/USDT: Bullish Continuation Builds Above Key Breakout ZoneThe TON/USDT market is maintaining its upward momentum after breaking out of a consolidation phase, currently testing the psychological level of 4.00. Although a pullback toward the support level and upward trendline remains possible, the breakout and close above the consolidation zone suggests that this area may now act as support.

On the daily timeframe, a bullish engulfing candle has formed, reinforcing the presence of strong buying pressure. If the market retests and holds above the breakout zone, further upside is likely. The next key target is the resistance zone around 4.40, with potential to extend toward the 4.50–4.80 range