Silver

$ETH = Silver and $BTC = Gold Means WHAT!?They say Ethereum is the Silver to ₿itcoin being Gold.

If that's the case, does that mean that the ceiling for CRYPTOCAP:ETH will forever be stuck at $4,800

just like TVC:SILVER being capped at $48 for the past 45 years?

Does anyone really think ETH will be higher than $4,800 in 45 years???😆

A true store of value 💯

SILVER: Local Bullish Bias! Long!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 32.833 will confirm the new direction upwards with the target being the next key level of 33.123 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

SPY/QQQ Plan Your Trade For 4-15 : BLANK pattern day.As I stated in this video, last night I looked through the data and could not find any reference for this pattern going back more than 11 years. Same thing for tomorrow's pattern.

That means these are very RARE pattern setups and we'll have to watch to see how price action plays out today.

If there were no reference points over 11+ years of Daily price data (more than 2500 Daily Price Bars), then this is something very unique.

I believe today will act like a Reversal Bar. Potentially rallying off a lower opening price and setting up a type of Gap Lower Rally type of pattern - but that is just a guess.

At this point, trade smaller quantities until we see how price reacts this morning.

Gold and Silver make a BIG MOVE overnight - breaking above the $3300/$33 levels I suggested were critical psychological levels.

This is an INCREDIBLE rally in metals (thanks, China).

At this point, if you were long metals like I was, you can thank me all you want.

Be aware that metals will likely pause a bit above this psychological level, then start to move higher again.

The next big target is $3600-$3750 for Gold.

Bitcoin is doing exactly what I stated it would do - rolling into a top as demand for BTCUSD wanes. I believe the next low for BTCUSD will be closer to $60k-$63k. Pay attention.

Going to be a good day for everyone holding Gold/Silver/Miners CALLS (like I kept suggesting).

GOT SOME.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SILVER at a CROSSROADS: Bounce or CRASH to $28?🔹 General Context

Silver has shown a strong bullish reaction from the lows around $28, later reaching a key monthly supply area between $34 and $35. However, this zone has once again been firmly rejected, leaving room for a potential deep retracement.

🟥 Key Zones

🔴 Monthly Supply Zone (34.00 - 35.00 USD): Strong resistance already tested multiple times. Candlesticks show strong rejections and long upper wicks.

🟥 Weekly Supply Zone (33.00 - 34.00 USD): Breaker block or mitigation area that triggered a strong bearish move.

⬛ Current Weekly Support Zone (32.00 - 31.90 USD): Price is currently testing this area. A new impulse could arise here — or we may witness a breakdown.

🟦 Monthly Demand Zone (28.20 - 29.20 USD): The last area defended by buyers in the mid-term. A realistic target in case of breakdown.

📊 Price Structure

The short- to medium-term trend remains bearish, with lower highs and strong rejection candles.

Current price action shows indecision, with lower wicks on recent weekly candles but smaller bullish bodies — a sign of potential accumulation... or just a pullback?

📉 RSI (Relative Strength Index)

RSI is in the neutral-high zone, not yet overbought, but in a downward phase → more room for downside if buyers don’t step in soon.

No clear divergences visible, but watch for signals on the daily timeframe.

🧭 Possible Scenarios

✅ BULLISH Scenario:

Condition: Support holds between 32.50 and 31.90 USD with a clear reversal candle.

Target: Move back toward the supply zone at 33.80 – 34.90 USD.

Confirmation: Break above 33.00 USD with increasing volume.

❌ BEARISH Scenario:

Condition: Weekly close below 31.90 USD → sign of weakness.

Target: Zone between 29.20 – 28.20 USD, a potential new institutional buy area.

Confirmation: Strong bearish break with follow-through and lack of buying reaction.

🧠 Operational Conclusion

Silver is at a critical decision point: bearish pressure from the monthly zones is evident, but as long as the 31.90/32.00 zone holds, buyers may still defend. A clean breakdown would open the door for a drop below $30.

SILVER: Bulls Are Winning! Long!

My dear friends,

Today we will analyse SILVER together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 32.235 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

SPY/QQQ Plan Your Trade For 4-15 : Base Rally PatternToday's pattern suggests the SPY/QQQ have been busy forming a BASE and may transition into a moderate rally mode.

I believe this move will prompt the SPY to move above the $550 level, potentially targeting $555-565 over the next 48 hours.

This upward move could be related to news or Q1:2025 earnings.

I don't believe the markets really want to move downward at this time, although I do believe the markets will move into a topping pattern by the end of this week.

Gold and Silver are moving into BLANK pattern day, today. Given the fact that we are between rally patterns and the metals charts show a very clear FLAGGING formation (watch my video), I believe we are moving into a FLAG APEX that will prompt a move above $3300 (for Gold) and $33 (for Silver). It's just a matter of time.

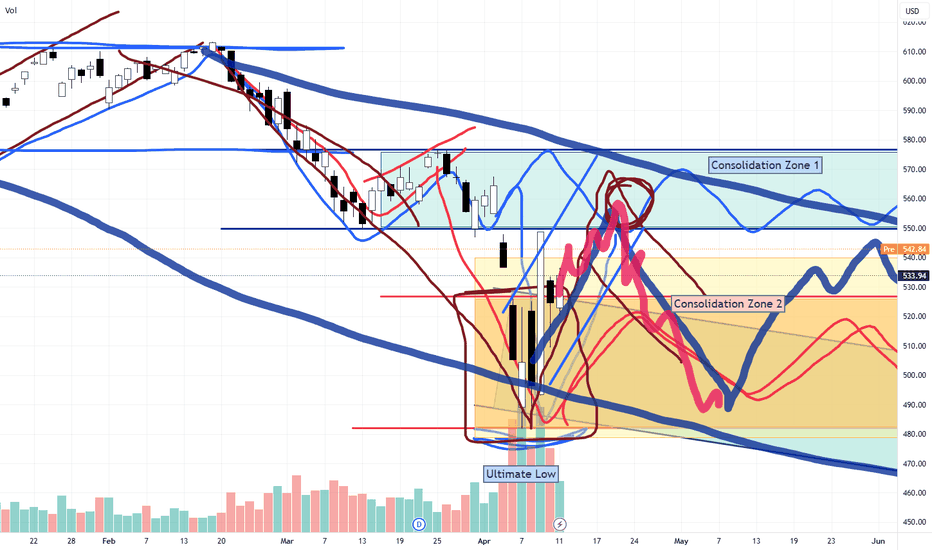

BTCUSD is still struggling in the Consolidation phase. As I keep suggesting, I believe the next move for Bitcoin is to the downside. But, until we break this consolidation phase, price will continue to roll around within the consolidation range.

Remember, we are going to be moving back to more normal volatility. So you need to understand these huge daily ranges are going to vanish over the next 3-5+ days.

Volatility will likely move back to the 1% to 2.5% range very quickly.

Get some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SILVER BEARISH BIAS RIGHT NOW| SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,225.6

Target Level: 3,081.7

Stop Loss: 3,321.8

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 6h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAGUSD Silver: Navigating Transition from Rally to Correction.Technical Analysis: XAGUSD (Silver)

📈 Silver (XAGUSD) is displaying bullish momentum following a significant rally. The precious metal has pushed into higher territory, creating an overextended condition on the price chart.

💹 Currently trading at a premium level, Silver appears ripe for a potential retracement. This elevated positioning suggests buyers may be exhausting their momentum, creating favorable conditions for a corrective move.

🔄 From a Wyckoff perspective, we're observing a classic distribution pattern with price action ranging sideways after the strong upward move. This horizontal consolidation often precedes a change in direction, as smart money potentially distributes positions to retail traders at these premium levels.

⚠️ Particularly noteworthy is the potential for a spring formation. If price breaks below the current range only to reverse sharply higher, this false breakdown could trap shorts and fuel further upside momentum. Conversely, a decisive break below market structure could confirm distribution is complete.

🎯 Trade Idea: Monitor the 30-minute timeframe for a clear break of market structure to the downside. Such a breakdown following this sideways ranging behavior would align with Wyckoff distribution principles and could signal the beginning of a more substantial correction.

🔍 Entry on confirmation of the breakdown with targets at key support levels would provide a measured approach to capitalizing on the potential reversal from these premium prices.

XAGUSD H4 | Be arish Reversal Based on the H4 chart, the price is approaching our sell entry level at 32.71, a pullback resistance

Our take profit is set at 31.25, a pullback support.

The stop loss is set at 34.52, a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

SILVER Will Grow! Buy!

Hello,Traders!

SILVER is trading in an

Uptrend and the price is

Now consolidating above

The horizontal support

Of 31.80$ and as we are

Bullish biased we will be

Expecting a further bullish

Move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER My Opinion! SELL!`

My dear subscribers,

This is my opinion on the SILVER next move:

The instrument tests an important psychological level 32.295

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 30.783

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SILVER: Local Bearish Bias! Short!

My dear friends,

Today we will analyse SILVER together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 32.134 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

SPY/QQQ Plan Your Trade For 4-14 : Up-Down-Up PatternToday's pattern suggests the markets will move in a moderate upward price trend.

Although I don't expect anything huge today, I do believe the EPP structures/layers support this upward price move and that we'll see the SPY attempt to move back towards/above 550 over time.

The QQQ will likely follow the SPY higher over the next 5+ days.

Don't get too excited about this upward price move because it is structurally moving to setup a PEAK that will transition into a downtrend near April 22-25. This peak will create a downward price flag (a new inverted EPP) structure that will assist in developing a new sideways price structure carrying into June/July.

In other words, it looks like we are trapped between 480-585 on the SPY, and we will likely stay within that wide consolidation range for another 2-3 months.

Gold should attempt to rally this week, trying to break above $3300. I believe this is a critical level for Gold and also presents a breakaway level for Silver near $33.00

Bitcoin has moved into APEX VOLATILITY and will continue to trap BUYERS into believing BTCUSD is breaking away from the consolidation range. This is a BULL TRAP.

I believe BTCUSD will ROLL OVER within about 4-5 days - setting up a big breakdown move as the SPY/QQQ also roll downward in about 5+ days.

We still continue to see volatility and sideways price action. Still lots of opportunities for skilled traders.

Get Some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SILVER Will Move Lower! Sell!

Please, check our technical outlook for SILVER.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 3,219.5.

Considering the today's price action, probabilities will be high to see a movement to 3,090.7.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

SILVER Is Bullish! Buy!

Please, check our technical outlook for SILVER.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 3,027.0.

Considering the today's price action, probabilities will be high to see a movement to 3,231.0.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

SILVER (XAGUSD): Strong Bullish Sentiment

With 2 breakouts of 2 key daily resistances,

Silver demonstrates a very strong bullish sentiment.

I believe that it will keep rising this week

and reach at least 3265 resistance.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD & SILVER Weekly Market Forecast: Wait For Buys!In this video, we will analyze the GOLD & Silver Futures. We'll determine the bias for the upcoming week of April 14-18th, and look for the best potential setups.

Gold is still bullish, making new ATH's. Silver is not as strong, but had a very strong previous week after sweeping the range lows.

I would take valid buy setups in Gold, but not in Silver. I would prefer sells in Silver. Trade one, not both. The stronger for buys and the weaker for sells.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

SILVER SHORT FROM STRONG RESISTANCE|

✅SILVER is going up now

Following the market-wide

Bullish rebound on most assets

But a strong wide resistance

Level is ahead around 33.00$

Thus I am expecting a pullback

And a move down towards

The local target of 31.75$

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.