GOLD H1 Market Update: Bear Trap / liquidity sweep BUY DIPS📊 Technical Outlook update

🔸Bullish OUTLOOK

🔸3050 USD Resistance Heavy

🔸3000/3040 Trading Range

🔸2990 potential Bear Trap

🔸Price Target BULLS: 3100 USD - 3150 USD

🔸Recommended Strategy: BUY DIPS 2990

📊 Gold Market Summary – This Week

💰Gold Price Surge: Gold prices soared above $3,000, prompting Bank of America to raise its price target.

💸Profit-Taking Pressure: After the surge, mild profit-taking caused a slight price correction.

🛡️Safe-Haven Demand: Gold continues to show strength, supported by safe-haven flows amid economic uncertainty.

📅 Economic Data Impact: U.S. economic data (e.g., 0.9% rise in durable goods orders) is influencing gold prices, pushing them to session highs.

🔄Consolidation with Bullish Outlook: Gold is consolidating but remains bullish due to favorable U.S. dollar performance and Federal Reserve policies.

🌍Geopolitical Tensions: Ongoing Russia-Ukraine conflict and U.S.-Russia tensions continue to support gold’s status as a safe-haven asset.

💎 Summary:

Gold remains resilient with strong demand, positive economic indicators, and geopolitical tensions supporting its value, despite minor price corrections.

Silver

Mid-Week Analysis March 27-28: USD FX Majors Stock Indices, ...In this video, we look back on the forecasts from this past weekend, and check how they are playing out to this point in the week.

USD Index, S&P500, Nasdaq ,Dow Jones, Gold, Silver, Platinum, Copper, EUR, GBP, AUD, NZD, CAD, CHF, JPY.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

SPY/QQQ Plan Your Trade for 3-26-25 : Flat-Down PatternToday's Flat-Down pattern for the SPY/QQQ suggests the markets will consolidate in a sideways channel, generally drifting downward.

As I've been warning all of you for the past month+, the market will likely roll over into a topping formation over the next few days, then start an aggressive downward trend targeting $525-535 on the SPY.

Today's video covers some details related to my expectations and how traders can prepare for the bigger moves I see pending.

Gold and Silver are poised for a potentially BIG BREAKOUT move to the upside. And I still believe Gold/Silver are going to rally another 15-20% within the next 30-45 days.

Bitcoin should follow the SPY/QQQ into a "rollover top" type of pattern then shift into a downward price trend over the next few days.

Everything is following my predictions/expectations almost perfectly.

Now, we try to profit from some of these big moves.

Go get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

XAGUSD Channel Up aiming for the new Higher High.Silver (XAGUSD) has been trading within a Channel Up for exactly year (since the March 27 2024 Low). Its current Bullish Leg started on the December 31 2024 (Higher) Low after almost touching the 1W MA50 (red trend-line).

Once the price broke above the 1D MA50 (blue trend-line) on January 28 2025, it remained above it ever since, which is what happened on both previous Bullish Legs. We expect a +30% rise and a test of the 1.382 Fibonacci extension as the previous Higher Highs. Our Target is just below that at 37.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Silver Rises as Markets Eye Trump TariffsSilver rose above $33 on Tuesday, rebounding as trade and economic concerns supported safe-haven demand. Hopes that Trump may adopt a more targeted tariff plan ahead of the April 2 deadline offered some relief, though his new pledges to tax autos and pharmaceuticals added uncertainty. Expectations of further Fed rate cuts also supported silver. Markets now anticipate one cut in June, another in September, and growing chances of a third in December.

If silver breaks above $33.80, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

Silver H1 | Falling to an overlap supportSilver (XAG/USD) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 33.56 which is an overlap support that aligns with the 23.6% Fibonacci retracement.

Stop loss is at 33.15 which is a level that lies underneath an overlap support and the 50.0% Fibonacci retracement.

Take profit is at 34.18 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

SILVER IS UNDERVALUED - A trade of a decade!Silver is undervalued! The pattern is over 50 years old and on a massive timeframe.

Silver and gold are always a good add to a strong portfolio. Currently it's in the progress of completing the handle of the cup and handle. 48$ will be a big resistance, but after that it will gap up over years to it's 1.618 as target. This wil take a give or take 10 years.

XAG/USD Trade Ideas: Navigating Key Resistance and Support ZonesSilver 's Next Move: Technical and Fundamental Insights for XAGUSD Traders 🚀📊

Technical Analysis 📊

The chart provided is a 4-hour chart of Silver (XAG/USD) with Fibonacci retracement levels applied. Here's a detailed technical breakdown:

Trend Analysis 📈:

The price has recently rebounded from a low near $32.90 and is now trading at $33.66.

The short-term trend appears bullish, as the price has made a higher low and is attempting to break higher.

Fibonacci Retracement Levels 🔢:

The Fibonacci retracement levels are drawn from the recent swing high to swing low.

The price has retraced to the 50% Fibonacci level ($33.35) and is now testing the 0% retracement level ($33.80), which acts as resistance.

The 61.8% retracement level ($33.24) and 78.6% retracement level ($33.09) are key support zones if the price pulls back.

Resistance and Support 🛑🛠️:

Resistance: The immediate resistance is at $33.80 (0% Fibonacci level). A break above this level could open the door to further upside, targeting $34.25 (50% Fibonacci extension).

Support: The first support is at $33.35 (50% Fibonacci level), followed by $33.24 (61.8% Fibonacci level).

Candlestick Patterns 🕯️:

The recent candles show indecision near the resistance level, indicating a potential pause or reversal.

If a strong bullish candle forms above $33.80, it would confirm a breakout.

Momentum 🚀:

The price is showing bullish momentum, but the resistance at $33.80 needs to be cleared for further upside.

Fundamental Analysis 🌍

Silver's Role as a Safe Haven 🛡️:

Silver often acts as a hedge against inflation and economic uncertainty. If there are concerns about global economic stability or inflationary pressures, silver demand could increase.

US Dollar Impact 💵:

Silver is inversely correlated with the US Dollar. If the USD weakens due to dovish Federal Reserve policies or poor economic data, silver prices could rise.

Industrial Demand ⚙️:

Silver has significant industrial applications, particularly in electronics and renewable energy. Any positive developments in these sectors could support silver prices.

Upcoming Economic Events 📅:

The chart shows upcoming economic events (likely US-related). If these events lead to USD weakness or increased market uncertainty, silver could benefit.

Trade Idea 💡

Scenario 1: Bullish Breakout 🚀

Entry: Buy above $33.80 (on a confirmed breakout).

Target: $34.25 (50% Fibonacci extension) and $34.50 (psychological level).

Stop Loss: Below $33.35 (50% Fibonacci level).

Scenario 2: Pullback and Rebound 🔄

Entry: Buy near $33.35 (50% Fibonacci level) or $33.24 (61.8% Fibonacci level) if the price pulls back.

Target: $33.80 (0% Fibonacci level) and $34.25.

Stop Loss: Below $33.00.

Scenario 3: Bearish Reversal 📉

Entry: Sell below $33.24 (61.8% Fibonacci level) if the price fails to hold support.

Target: $33.00 and $32.90.

Stop Loss: Above $33.50.

Conclusion ✅

The current setup favors a bullish bias 📈, but the resistance at $33.80 is critical. A breakout above this level could lead to significant upside, while a failure to break higher may result in a pullback to key support levels. Monitor price action closely around the Fibonacci levels and upcoming economic events for confirmation. ⚠️

Disclaimer ⚠️

This analysis is for informational purposes only and should not be considered financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose. Always conduct your own research or consult with a licensed financial advisor before making any trading decisions.

SPY/QQQ Plan Your Trade For 3-25-25 : Top PatternToday's Top Pattern suggests the SPY/QQQ will find resistance slightly above yesterday's closing price level and attempt to roll over into a bearish price trend.

Watch today's video to see which levels I believe will be the top for the SPY & QQQ.

I do expect metals to rally over the next 3+ weeks and I'm watching for this morning's bounce to carry onward and upward.

Bitcoin should be rolling downward off that FWB:88K top level I predicted months ago.

We are moving into a topping phase - so get ready for the markets to attempt to ROLL DOWNWARD over the next 5+ trading days into a deeper low price level.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Silver H1 | Falling to swing-low supportSilver (XAG/USD) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 32.85 which is a swing-low support.

Stop loss is at 32.54 which is a level that lies underneath an overlap support and the 61.8% Fibonacci retracement.

Take profit is at 33.56 which is a swing-high resistance that aligns close to the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Tariff Fears Drive Silver to $33.10Silver rose above $33.10 per ounce on Tuesday, snapping a four-day losing streak. The market focused on U.S. diplomatic efforts in the Russia-Ukraine conflict and escalating violence in the Middle East after an Israeli airstrike on a Gaza hospital.

A weaker U.S. dollar also supported silver, with concerns growing that Trump’s proposed tariffs could slow economic growth, fueling speculation of further Fed rate cuts. Meanwhile, investors assessed China’s outlook after Premier Li Qiang urged global cooperation to stabilize economic conditions.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

SILVER SHORT FROM RESISTANCE

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,314.3

Target Level: 3,276.5

Stop Loss: 3,339.5

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

SPY/QQQ Plan Your Trade for 3-24-25 : Bozu Trending PatternToday's Bozu Trending pattern suggests a very aggressive price move is likely. I believe this move will be to the upside after my weekend research suggested we are moving into a "blow-off" topping pattern that will act as a Bull Trap.

Overall, I belive the SPY/QQQ have about 2-3 days up upward price trending early this week, then the markets will suddenly roll into a topping pattern and start to aggressively move downward.

The next base/bottom of the continued downward price trend sets up in early/mid April. The March 21-24 base/bottom is likely the minor base/bottom we have seen over the past 3-5+ days.

I believe the breakdown in the SPY/QQQ late this week and into next week will result in a new lower low - causing the Consolidation phase of this downturn to extend down to the 520-525 level on the SPY.

Bitcoin is very close to my $88,000 upper target level (only about $250 off that level). Get ready, BTCUSD should make an aggressive move downward after stalling near the FWB:88K level peak.

Gold and Silver are moving into a trending mode. I believe both Gold and Silver will rally this week and into the next few weeks as we expand into the Expansion phase.

Buckle up. If my research is correct, we are going to see a BIG ROLLOVER this week.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SILVER Will Go Lower From Resistance! Short!

Take a look at our analysis for SILVER.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 33.211.

Taking into consideration the structure & trend analysis, I believe that the market will reach 31.952 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish Setup📊 Overview of the Chart

This 4-hour chart of Silver (XAG/USD) provides a classic example of a Rising Wedge Breakdown, a bearish reversal pattern. The price initially followed a strong uptrend, forming a series of higher highs and higher lows, but failed to sustain momentum at the key resistance zone (~$34.00 - $34.50). This led to a breakout to the downside, which has now confirmed a shift in market sentiment from bullish to bearish.

This analysis will break down each key level, the technical indicators supporting this trade setup, and how traders can approach it effectively.

🛠️ Breakdown of the Chart Components

1️⃣ Rising Wedge Formation (Bearish Pattern Identified)

The price action created a Rising Wedge, which is a bearish pattern characterized by an uptrend where the higher highs and higher lows start converging into a narrowing range.

This shows that while buyers were pushing prices higher, their strength was gradually fading.

The breakdown of this structure signaled a loss of bullish momentum, leading to a shift in trend.

2️⃣ Resistance Level & Sell Zone Identified

The resistance level at $34.00 - $34.50 has acted as a supply zone where sellers stepped in, preventing further upside.

A bearish rejection at this zone confirms that sellers are still dominant.

3️⃣ Retest of the Broken Support (Key Confirmation)

After the breakout from the wedge, the price made a retest of the broken trendline, a classic move before further downside.

Retesting this area confirms that it is now acting as resistance rather than support, further strengthening the bearish case.

4️⃣ Trendline Breakout – Shift in Market Structure

The dashed trendline was previously supportive, but now that the price has broken below it, it has turned into a resistance level.

This shift in market structure is a strong bearish signal.

5️⃣ Key Support Levels & Target Projection

The next major support level is at $32.00, a level where price previously found demand.

The ultimate target price is around $31.18, which aligns with historical support and Fibonacci retracement levels.

📉 Trading Strategy – How to Trade This Setup?

✅ Entry Point (Short/Sell Setup)

A good shorting opportunity arises if the price retests the resistance at $33.50 - $34.00 and shows bearish confirmation (like a rejection candlestick or a bearish engulfing pattern).

📍 Stop Loss (SL) Placement

SL should be above $34.20 to avoid getting stopped out by potential fakeouts.

🎯 Take Profit (TP) Levels

TP1: $32.00 (First support level)

TP2: $31.18 (Final bearish target)

📊 Risk-Reward Ratio

Entry at $33.50 - $34.00 with SL at $34.20 and TP at $31.18 provides an excellent risk-to-reward ratio (~1:4).

📌 Market Sentiment & Conclusion

🔴 Bearish signals are dominant, suggesting further downside potential.

📉 A strong bearish move is expected if the price fails to reclaim $34.00.

🎯 Targeting $31.18 in the upcoming sessions.

📢 Final Advice: Traders should watch for confirmation before entering trades. A successful retest and rejection at $33.50 - $34.00 will be a high-probability short setup. 🚀

🔥 Follow price action and risk management principles for a successful trade! 🔥

Silver's Limited Rebound at $33.06Posting a modest rebound after last week’s dip, silver currently trades around $33.06 per ounce. The recovery is limited as easing geopolitical tensions compete with the pressure from a strong U.S. dollar. Demand stays strong due to tariff uncertainty and inflation risks, but weak industrial outlook, mainly from China, and hopes for a Russia-Ukraine ceasefire are limiting silver’s gains. Still, tightening supply and global economic concerns are helping keep silver near five-month highs.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

GOLD H1 Update: Pullback in Progress BUY DIPS TP 3 100 USD🏆 Gold Market Update (March 24th 2025)

📊 Technical Outlook update

🔸Bullish OUTLOOK

🔸Broke out and set new ATH

🔸Strong UPTREND: Sequence of Higher Lows

🔸Recommend to BUY DIPS 2950 USD

🔸Price Target BULLS: 3075 USD - 3100 USD

📈 Market Performance & Price Action

🚀 Gold Hits All-Time High – Reached $3,057.21/oz this week

📊 Driven by: Geopolitical tensions + economic uncertainty

🏦 Federal Reserve Impact

🛑 Fed Keeps Interest Rates Steady at 4.25%–4.50%

🔮 Signals 2 rate cuts likely in 2025 due to slowing growth

📉 Lower rate outlook supports bullish gold sentiment

💹 Gold Investment Trends

📈 Gold ETFs Outperform Physical Gold

GDX (Gold Miners ETF) ↑ 32%

GLD (SPDR Gold Shares) ↑ 15.5%

📊 Investors leaning toward mining stocks & ETF exposure for higher returns

Trading Is Not Gambling: Become A Better Trader Part III'm so thankful the admins at Tradingview selected my first Trading Is Not Gambling video for their Editor's Pick section. What an honor.

I put together this video to try to teach all the new followers how to use analysis to try to plan trade actions and to attempt to minimize risks.

Within this video, I try to teach you to explore the best opportunities based on strong research/analysis skills and to learn to wait for the best opportunities for profits.

Trading is very similar to hunting or trying to hit a baseball... you have to WAIT for the best opportunity, then make a decision on how to execute for the best results.

Trust me, if trading was easy, everyone would be making millions and no one would be trying to find the best trade solutions.

In my opinion, the best solution is to learn the skills to try to develop the best consistent outcomes. And that is what I'm trying to teach you in this video.

I look forward to your comments and suggestions.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

XAGUSD - Hunting for Bullish Entries on Smaller TFThe Silver/USD 4-hour chart displays a significant retracement from recent highs around $3,420, with price currently rebounding near the $3,300 level. This correction has brought price to test both the ascending trendline and the horizontal support at $3,275 (marked by the red line), creating a potential buying opportunity. Given the overall uptrend structure and the recent bounce from this dual support zone, we need to prepare for finding buy setups on smaller timeframes. Traders should shift to lower timeframe charts (15-minute, 30-minute, or 1-hour) to identify precise entry signals. The price action suggests a potential retest of the upper blue reaction zone after completing the current zigzag correction, as indicated by the directional arrow on the chart. Monitoring these smaller timeframes will help capture optimal entry points with tighter stop-losses while maintaining the broader bullish bias shown on this 4-hour chart.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER: Bullish Forecast & Outlook

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the SILVER pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

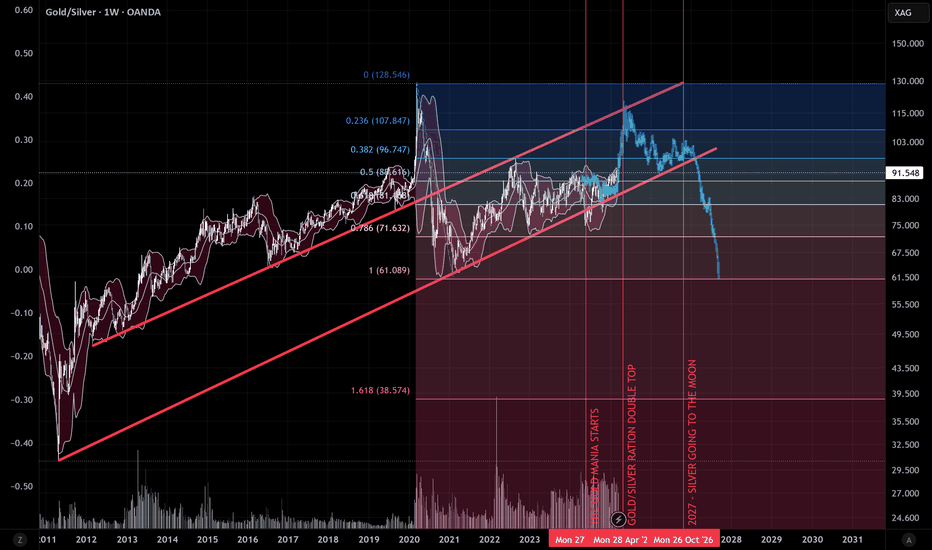

GOLD TO SILVER RATIO ABOUT TO TOP OUT !!OANDA:XAUXAG The current Gold rush and the weak demand in Retail for Silver, Platinum or even Palladium clearly shows that Gold TVC:GOLD is heading for a double top in the coming two to three months against Silver TVC:SILVER , after which Silver will start having the upper hand and totally outperform Gold (add in Platinum and Palladium as well). This would also perfectly coincide with my editorial Silver prediction to break the $45-50 barrier in 2027 from a year ago: