SPY/QQQ Plan Your Trade For 2-3-25 : Breakaway PatternOn a day like today, where the markets broke down with a huge GAP downward, what can I say except...

Just like I predicted.

For months I've been warning of the Jan 21-23 Inauguration peak/top that will lead to a Deep-V breakdown on Feb 9-12. And, like clockwork, the markets peaked just after January 23 and rolled downward into the breakdown phase - headed towards my Deep-V base/bottom setup near Feb 9-12.

At this point, I'm just going to sit back and collect my profits. You should be doing the same thing today - BOOK those profits.

Gold and Silver are moving into an upward CRUSH pattern. It could be very explosive.

Bitcoin has broken downward again - just like I predicted.

Over the next 30+ days, the markets will enter a very volatile and rotating price phase. Be prepared for wild price rotations.

This is a true trader's market. Go get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

Silver

XAGUSD Analysis: Bullish Trend Faces Resistance – What’s Next?👀 👉 In this video, we analyze XAGUSD (silver) in detail. While it has been in a bullish trend on the higher timeframe, it is currently trading into resistance and appears overextended. On the four-hour timeframe, we can see a bearish break in structure. My overall bias remains bullish, but I’m waiting for a break of the current high, followed by a retest and fail, before considering an entry. This is not financial advice.

Short Term Pain for Long Term GainAfter an amazing and wild week last week, I believe tomorrow will be the start of an even crazier one. Trump Tariffs, Oil and Gas up along with the US Dollar, while tech is on the verge of another break down. Will Bitcoin finally break below 89k, while Gold and Silver possibly break to the upside? Exciting times if you're ready for it.

Bullish Momentum Catching Up in SilverThe Price has been on a quite choppy rise. It gives rise to several possible interpretations for the structure, but after several weeks of waiting it seems like it was creating a strong accumulation of orders, setting a base if you may, before taking off strongly to the upside. In the Wave Principle context we might be seeing a series of waves 1 & 2, no finally moving into the latter stages of a minor wave three.

The commodities market tends to display its strongest phase of the cycle in its last leg, leading me to believe that we are about to experience an aggressive rally during the minor wave five of higher degree wave three.

The rally hit a minor pause on Thursday and moved sideways for the rest of the week, however the break up should come swiftly after this coming week starts.

I do need to see the price respect the Friday low at around 31.12 for the view to hold. We might see some slight variations on the theme but a continued move below said level throw a wrench on the setup as a whole.

Happy Trading :)

LITECOIN BITCOIN (BEST-CASE)Like Bitcoin, CRYPTOCAP:LTC is first and foremost a digital currency that can be exchanged peer-to-peer, untrusted and securely, very quickly and at minimal cost.

The modifications made to the Bitcoin blockchain to give rise to Litecoin’s blockchain required only minor efforts in terms of IT development, as most of the innovation came from Bitcoin.

Nevertheless, Litecoin’s strength lies in the fact that these changes are few but significant:

A ”proof of work” that uses the Scrypt hash function rather than SHA-256 for Bitcoin

Block creation four times faster, with an average interval of 2.5 minutes instead of 10 minutes

Total number of units four times greater, with 84 million instead of 21 million

Mining difficulty changes every two and a half days instead of every two weeks

On the other hand, as with Bitcoin, the issuance of new litecoins is halved every 4 years (halving): since August 2019, miners have received 12.5 litecoins as a reward for each block validated.

BRIEFING Week #5 : Still Patient...Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

Weekly Market Forecast Feb 2-7thThis is an outlook for the week of Feb 2-7th.

In this video, we will analyze the following FX markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

HG | Copper

The indices were not easy to trade last week, as there were plenty of fundamentals at play. However, they are relatively still strong, and I am looking for further gains next week.

NFP week, imo, is best traded Mon-Wed. Thurs will likely see consolidation until the NFP news announcement Friday morning. I will look to fade the news release on Friday for NY Session.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

SILVER: Short Trading Opportunity

SILVER

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short SILVER

Entry Point - 31.324

Stop Loss - 31.671

Take Profit - 30.750

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

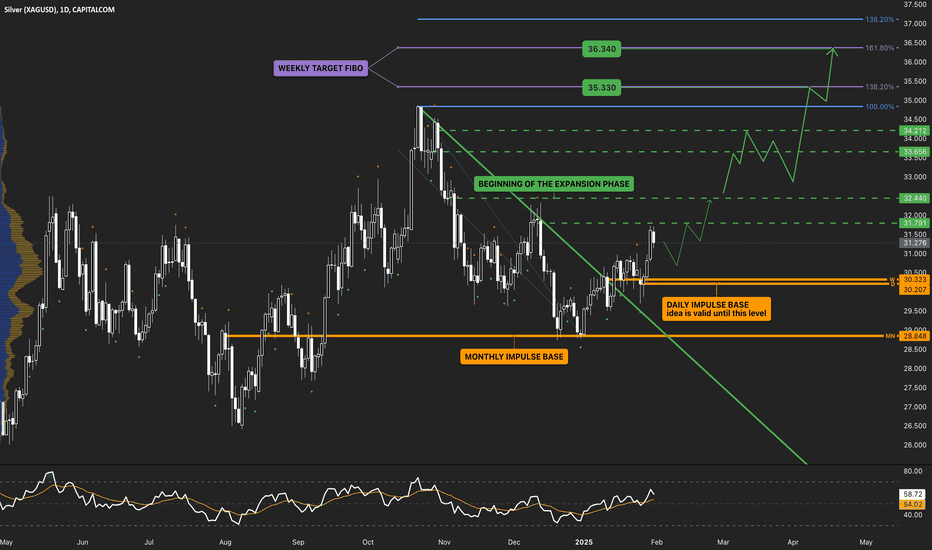

SILVER // bull trend in sync across major timeframesThe trend has just become bullish across the monthly, weekly, and daily timeframes, however, the market is still in an accumulation phase.

Each dashed level represents an untested breakdown that requires attention from the buyers.

If the market transitions into the expansion phase, the Fibonacci target levels on the weekly and daily timeframes become valid targets.

Key Fundamentals

Silver has experienced significant price movements, driven by industrial demand, supply constraints, and macroeconomic factors. As of late January 2025, silver is trading at $33.88 per ounce, reflecting a 3% decline after a two-week rally that pushed it to nearly 13-year highs. Despite the recent pullback, silver has surged 40% over the past year.

Key Factors

Industrial Demand:

Silver is widely used in solar panel manufacturing and electronics, with industrial demand reaching a record 654.4 million ounces in 2023, marking the third consecutive year where demand outpaced supply (Investopedia).

Supply Constraints:

Global silver supply has struggled due to weaker mine production and labor strikes in major producing countries like Mexico. These disruptions have contributed to a supply deficit, further supporting higher prices (Wall Street Journal).

Investment Demand:

Economic uncertainties and lower interest rates have driven investors toward precious metals as safe-haven assets. The iShares Silver Trust alone saw $856 million in inflows, reflecting rising investor interest (Wall Street Journal).

Macroeconomic Factors:

The Federal Reserve’s recent interest rate cuts have increased the appeal of non-yielding assets like silver. Meanwhile, China’s increased investment in silver, partly due to gold import restrictions, has further bolstered demand (Wall Street Journal).

Actionable Insights

Bullish Case:

Continued Industrial Demand: With ongoing growth in renewable energy and electronics, silver demand is expected to remain strong.

Supply Deficits: Ongoing production challenges could sustain upward price pressure.

Bearish Case:

Economic Recovery: If the global economy recovers faster than expected, investor preference may shift away from safe-haven assets, leading to a price decline.

Interest Rate Increases: If central banks reverse course and raise interest rates, the appeal of non-yielding assets like silver could diminish.

———

Orange lines represent impulse bases on major timeframes, signaling the direction and validity of the prevailing trend by acting as key levels where significant momentum originated.

Level colors:

Daily - blue

Weekly - purple

Monthly - magenta

H4 - aqua

Long trigger - green

Short trigger - red

Clean (not yet tested) breakdown - dashed green

Clean (not yet tested) breakout - dashed red

———

Stay grounded, stay present. 🏄🏼♂️

<<please boost 🚀 if you enjoy💚

SILVER SHORT FROM RESISTANCE

Hello, Friends!

SILVER pair is in the downtrend because previous week’s candle is red, while the price is obviously rising on the 6H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 30.534 because the pair is overbought due to its proximity to the upper BB band and a bearish correction is likely.

✅LIKE AND COMMENT MY IDEAS✅

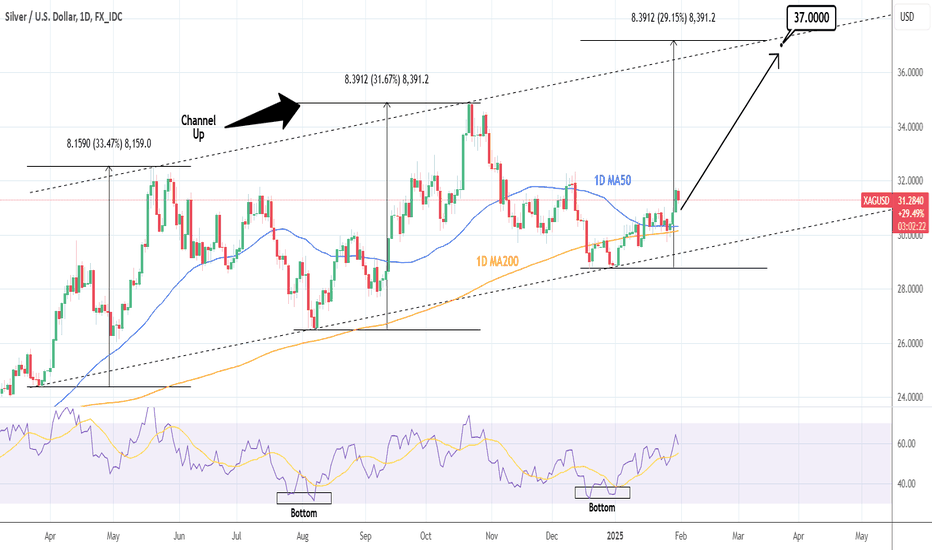

XAGUSD: Channel Up has started new rally to 37.000Silver turned bullish on its 1D technical outlook (RSI = 59.696, MACD = 0.197, ADX = 24.838) as it has validated the start of the new bullish wave of the long term Channel Up. The price has been detached from the 1D MA50 and is approaching the December 12th high. The 1D RSI is expanding a rebound from a Double Bottom much like Silver's previous low on August 7th 2024. So far the Channel Up has had two bullish legs of 33.47% and 31.67% respectively. Assuming a slight rate of decline on each subsequent bullish wave, we anticipate the current to reach +29.15% and we are targeting a little under it (TP = 37.000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Plan Your Trade : Behind The Scenes - Learning PerspectiveI created this video to help answer a question from a follower.

One of the biggest concerns for traders is how to use my research/info in a way that benefits them.

My Plan Your Trade videos are based on Daily & Weekly price patterns/cycles. I won't delve into the Intraday research much because it is almost impossible to predict 2 to 10-minute price bars/action throughout the day when new hits and external price data may dramatically change how price moves throughout the day. I would have to continue making videos every 30 to 45 minutes to help you understand the dynamics of intraday price action.

Either way, watch this video to learn a bit more about my research and why I'm trying to help traders learn to make better decisions.

I'm really not here to tell you what to trade - or when to trade. I'm here to help you learn to make better trading decisions ON YOUR OWN.

I try to help you learn to become a more knowledgeable and skilled trader by sharing some of my advanced research and demonstrating patterns, setups, price levels, and Cycle Patterns.

The only thing I can do to help you become a better trader is to help you learn better skills and techniques. If you treat trading like gambling, you'll go broke (often). If you understand trading as a process of grabbing profits when efficient and limiting risks, you'll survive and grow your account over time.

It's really that simple.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

Gold & Silver Go Ballistic: The Fed Collides with Trump!Well, well, well… look who’s breaking records like a rockstar smashing guitars. Gold just hit an all-time high, blasting past $2,795 per ounce like it’s got a rocket strapped to its back. 🚀💰 Meanwhile, silver? Oh, she’s not just tagging along—she’s on a mission, up 60 cents to $31.65 per ounce. 🎯⚡

But wait… this isn’t just your average bull run. There’s blood in the water, and the sharks are circling. 🦈💸

🔎 Behind the Scenes: The COMEX Panic

Turns out, Trump’s tariff threats have thrown institutional traders into full-blown “Oh Sh*t” mode. 🏃💨 They’re scrambling to move gold and silver into the U.S. before any new taxes hit, and it’s causing absolute chaos in the background. The COMEX is feeling the squeeze, and some traders? They can’t even source the metal to cover their bets—so they’re bailing out of positions before they get steamrolled. 🚨📉

And if you think silver is done partying, think again. An analyst at TD Commodities just threw gasoline on the fire, warning that the market is severely underpricing a potential EXPLOSION in silver prices. 🔥💥 With tariffs on Mexico & Canada looming, this thing could go vertical any second now. 📈🤯

💀 Meanwhile, in Trump Land…

The Orange Man himself is out here taking shots at the real villain (in his eyes)—the Federal Reserve. 🎯💀 In a classic Trumpian mic drop moment, he blamed the Fed for wrecking the economy with inflation:

👉 “If the Fed had spent less time on DEI, gender ideology, 'green' energy, and fake climate change, Inflation would never have been a problem.” - Trump, straight from Truth Social. 🔥🎤

Love him or hate him, one thing’s for sure—markets are feeling the heat. And if these tariffs go live, this gold & silver rally could turn into an absolute face-melter. 🏆🔥

📢 Stay locked in. This ride’s just getting started. 🚀💰

SPY/QQQ Plan Your Trade For Jan 31 : GAP PotentialAs we move into the end of January 2025, I'm still watching for technical failure near these higher levels. On Monday, we saw a huge breakdown in the markets just days after my Jan 21-23 Top prediction. Now, as we are moving into the Feb 9-11 DeepV base/bottom pattern - I've been expecting the markets to move into a downward trending phase - which has not happened yet.

The way I see the markets right now and how I would offer a general interpretation of the trend is "struggling to find/set a new trend".

In other words, the markets are really congested in a wide range. I believe the markets will attempt to move downward after today's opening GAP higher.

I believe the markets are going to continue to struggle to find support and trade in a downward-sloping consolidated price range until Q3/Q4:2025.

I believe the markets are reacting to earnings and continued support right now, but that will ultimately resolve as a breakdown phase over the next 60+ days - leading to the multiple BASE/BOTTOM patterns my cycle research suggests will happen.

So, I continue to explain what I see in the context of the broader cycle phases.

Gold and Silver may rally a bit today - but we have a CRUSH pattern on Monday - so try not to carry any positions over the weekend.

BTCUSD is struggling to move away from very strong consolidation. It is also setting up multiple Excess Phase Peak patterns. I believe we need to be patient as BTCUSD struggles to find a new trend. Right now, I see more downside potential than upside potential.

I would offer one warning about today. Today's opening GAP will likely prompt a breakdown in price (moving downward) as we head into next week.

I believe next week will be very volatile. Buckle up.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

Silver Analysis by zForex Research TeamSilver Surges to $31.7 on Fed Speculation and Supply Deficit

Silver jumped past $31.7 per ounce on Thursday, a six-week high, as Fed policy speculation boosted demand for non-yielding assets.

The Silver Institute projected a fifth straight annual supply deficit despite higher output from China, Canada, and Chile.

Investors also assessed industrial demand, particularly from Chinese solar panel manufacturers, a key driver of silver consumption.

Technically, the first resistance level will be 32.00 level. In case of this level’s breach, the next levels to watch would be 32.50 and 32.90 consequently. On the downside 30.90 will be the first support level. 29.80 and 29.30 are the next levels to monitor if the first support level is breached.

Silver/Gold Ratio AnalysisOften you will see the Gold/Silver ratio chart get more analysis. However, I like to look at this one as I find it easier to spot the bottoms.

Rarely has silver traded at this level to gold. At .01, it means that it would take 100oz of silver to trade for 1 oz of gold.

Historically, this ratio has traded higher. With gold pushing up towards all time highs, and silver often lagging gold, the silver trade is on.

SILVER | The longest timeframe cup & handle in history!SILVER has been forming a cup-and-handle pattern for the past 45 years. And even though SILVER has made some incredible moves during that time, its price has been blatantly manipulated by the LBMA (London Bullion Market Association), central banks around the world, and a completely fraudulent derivatives market that circulates fake paper silver at hundreds of times greater than the underlying asset. Prices have been artificially suppressed for decades to prop up the global fake fiat currency Ponzi scheme and tighten the grip of control over nearly every asset and human being—making these fake currencies appear legitimate when they are clearly instruments of debt and deception.

This artificial suppression of SILVER and many other commodities is coming to an end as the debt-and-death paradigm unravels before our very eyes.

The day is rapidly approaching when SILVER will enter true price discovery, and people will not believe the price points it will reach in the very near future. Silver is one of the most—if not the most—undervalued physical assets of all time.

Good luck, and always use a stop-loss!