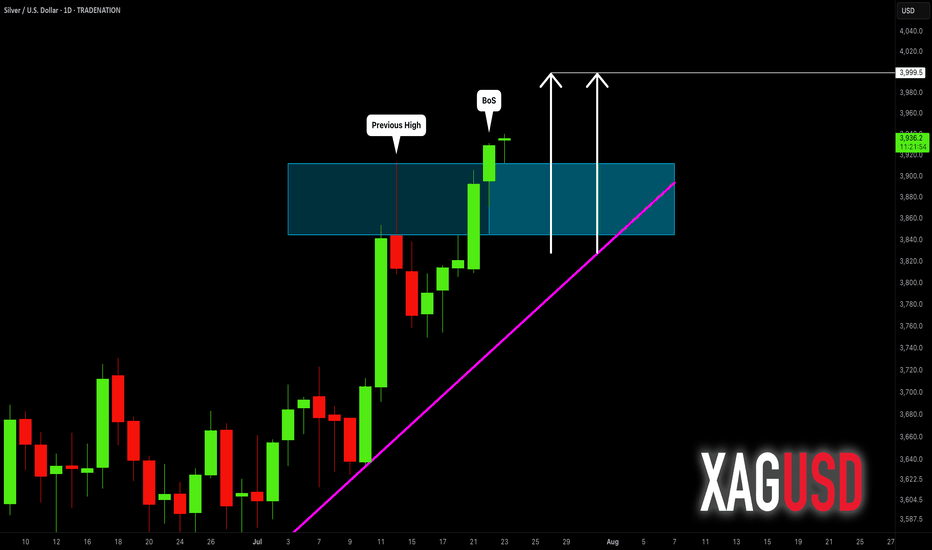

SILVER (XAGUSD): Confirmed Break of Structure

Silver updated a year's high yesterday, breaking a strong daily resistance.

With a confirmed Break of Structure BoS, we can expect that

the market will rise even more.

The next strong resistance is 40.

It is a round number based psychological level.

It can be the next goal for the buyers.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis

Silversignals

Silver Analysis – Strong Bulls and a Clean Setup AheadLast month, Silver printed a new multi-decade high, a major technical milestone.

Since then, price has entered a sideways consolidation, forming a rectangle — but what stands out is this:

👉 Silver bulls have absorbed every dip, even when Gold dropped.

That’s strength. And strength usually precedes breakout.

🔍 Current Situation

At the time of writing, price is trading around 37.20,

and from the current structure, it looks like nothing is standing in the way of an upside break.

We don’t predict — we prepare...

And this chart looks ready.

🎯 Next Target: 40.00 USD?

A push to 40.00 looks like the next “normal” target.

But don’t forget: that’s a 3,000 pip move.

This type of move will require patience

Plan your trade.

Respect your risk.

Let the bulls work. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

SILVER (XAGUSD): Correction is Over?!

It looks like Silver has finally completed a consolidation within

a wide horizontal parallel channel on a daily.

A new higher high formation today indicates coming growth.

Because if its Friday, I suggest looking for trend-following buy from Monday.

Let the market close above the underlined resistance to let it set a Higher Close

as well.

Look for buying after a pullback, aiming at 38.0 as the first goal.

❤️Please, support my work with like, thank you!❤️

XAGUSD Strong accumulation waiting for a break-out. Silver (XAGUSD) has been trading within a 3-month Channel Up pattern and since the June 18 Higher High, it has entered a Descending Triangle.

This has previous been an Accumulation pattern, which after broken to the upside, it led to June's High. Similarly, we expect a bullish break-out once the 4H RSI breaks above its MA, and as long as the 4H MA200 (orange trend-line) holds, we expect a +15.50% minimum rise (like the first Bullish Leg of the Channel Up), with our Target se at 40.500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Is the Uptrend Over? Critical Break on the Silver 1-Hour ChartHey everyone,

After the upward trend structure on XAGUSD broke down, the support level was breached, followed by a pullback. Because of this, my target level is 35.286.💬

Also, keep a close eye on key economic data releases on the fundamental side, as they could significantly influence your strategy.

I meticulously prepare these analyses for you, and I sincerely appreciate your support through likes. Every like from you is my biggest motivation to continue sharing my analyses.

I’m truly grateful for each of you—love to all my followers💙💙💙

SILVER (XAGUSD): Buyers Show Strength

Silver is going to rise more, following a strong bullish sentiment this morning.

The price violated a strong falling trend line and an intraday horizontal resistance.

These 2 breakouts indicate a strong buying pressure.

The price may grow more today and reach 37.14 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER (XAGUSD): Where is the Next Resistance?!

What a rally on Silver this week.

The market easily violated a resistance cluster

based on the last year high.

Analyzing a historic price action, the next strong resistance

that I found is around 37.4

It is based on an important high of 2012.

That can be the next mid-term goal for the buyers.

❤️Please, support my work with like, thank you!❤️

SILVER TO 40$ HELLO TRADERS

As i can see Silver is still trading inside a upward channel and did not created any big moves like Gold and its under value i am expected a boost from this zone to 40 $ incoming days if it did notr break the channel friends its just a trade idea share ur thoughts with us we love ur comments and support Stay Tuned for more updates

XAGUSD Multi-year Channel Up targeting $40 at least.Silver (XAGUSD) had a strong rebound on its April 07 2025 Low and that maintains the long-term bullish trend as not only did it kept clear of the 1W MA100 (green trend-line) but also rebounded on the long-term 1W RSI Support Zone.

This kept the 2.5-year Channel Up intact and the current structure looks very similar to late 2023 - early 2024 before the Resistance break-out. The Bullish Leg of this Channel Up have so far been identical (+48.93%) so if we repeat that, we can expect Silver to reach $42. We have a more modest Target at $40, which falls exactly at the top of the Channel Up.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

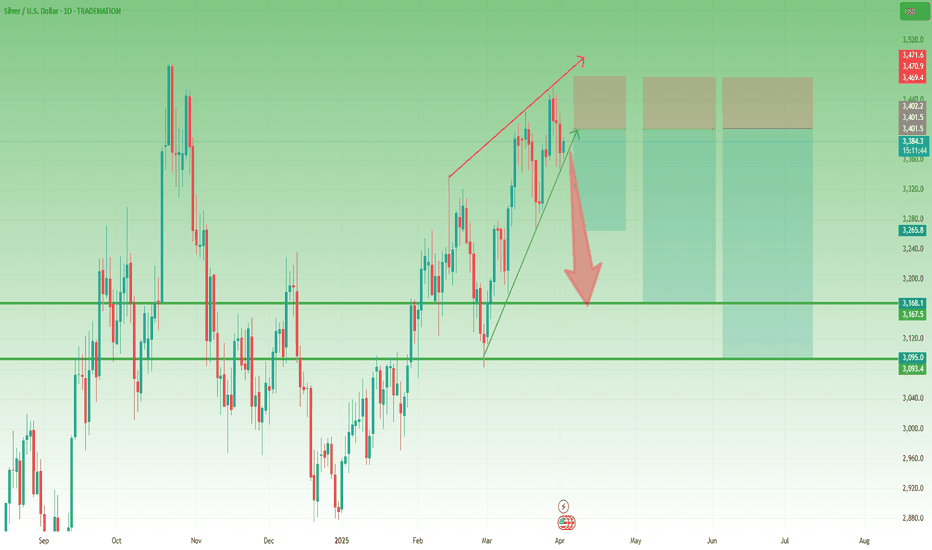

SILVER (XAGUSD): Pullback is Ahead!

There is a high chance that Silver will pull back from

the underlined blue daily resistance.

As a confirmation, the price formed a double top pattern

on that on an hourly chart and violated its neckline.

Goal - 33.185

❤️Please, support my work with like, thank you!❤️

Silver Update – April Rollercoaster Ends in Bullish Setup?What a month it has been for Silver also!

In early April, the metal broke down from a rising wedge pattern, triggering a waterfall drop of around 6,000 pips. The plunge took us right into the 28 zone, but the reversal that followed was nothing short of spectacular.

In just two trading days, Silver rocketed back above the key 30 level, and the rally didn’t stop there. By mid-month, it reclaimed the 32 support – a level previously broken during the drop.

📉 Last week, however, price action turned quiet compared to the volatility in Gold, with Silver entering a tight consolidation.

But here’s the key point:

➡️ Despite the sharp early-month drop, the structure is now bullish again and remains so as long as 32 holds.

💡 Trading Plan:

I'm looking to buy dips near 32 in anticipation of a breakout above 33.15 – the upper boundary of the recent consolidation.

If that level gives way, Silver could accelerate its gains and make a new attempt toward 35.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

XAG/USD "The Silver" Metal Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 1 Day timeframe (32.000) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 27.000 (or) Escape Before the Target

⚙💿XAG/USD "The Silver" Metal Market Heist Plan (Swing/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

Detailed Point Explanation 📋

Fundamentals 🌟: Silver’s dual role ensures resilience, but USD and rates cap gains ⚖️.

Macro 📊: Inflation aids 🔥, but growth and policy risks create volatility ⚡.

Geopolitics 🌐: Safe-haven demand helps 🛡️, though trade wars hurt industrial use 🚨.

Supply/Demand ⚖️: Deficit is a strong bullish driver 📉, despite short-term fluctuations ⚡.

Technicals 📉: Near-term weakness 🐻 within a broader uptrend 🐮.

Sentiment 😊: Balanced ⚖️, with cautious optimism prevailing 🌟.

Seasonal 🍂: Neutral ⚖️, with minor weather-related disruptions ❄️.

Intermarket 🔗: Gold supports 🥇, USD resists 💵 – a tug-of-war ⚔️.

Investors/Traders 👥: Long-term bulls 🐮 vs. short-term bears 🐻 reflect split views ⚖️.

Trends 🔮: Short-term dip 📉, medium/long-term rally potential ⬆️.

Outlook 📝: Mildly bullish ⭐, favoring longs over 6-12 months 🐮.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

SILVER (XAGUSD): Strong Bullish Sentiment

With 2 breakouts of 2 key daily resistances,

Silver demonstrates a very strong bullish sentiment.

I believe that it will keep rising this week

and reach at least 3265 resistance.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER (XAGUSD): More Growth is Coming

Following Gold, Silver formed a strong bullish pattern on an hourly time frame.

I found the ascending triangle formation and a breakout of its neckline

as a strong bullish confirmation.

I expect growth at least to 31.7 level now.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver could drop 2k+ pipsSilver has been on the rise recently, but unlike its big brother, Gold, it started rolling back down on Friday—even as Gold continued to print new all-time highs, culminating at 3,150 yesterday.

This divergence between the two metals could be an early sign that Silver is losing momentum.

________________________________________

Technical Signs of Weakness

📉 Rising Wedge Formation – Since early March, Silver’s price has been contained within a rising wedge, a classic bearish pattern signaling an impending breakdown.

📉 Testing Key Support – Right now, the price is hovering above wedge support. If Gold fails to hold above 3,100, I expect Silver to break down as well.

________________________________________

Targeting the Breakdown

If Silver breaks below support, I expect:

🎯 Initial target: $32

🎯 Final target: $31 (a key support zone)

Trading Plan: Selling the Rallies

Given the current setup, my strategy is to sell into rallies, aiming for at least a 1:2 risk-reward ratio.

Let’s see if Silver follows through on this bearish setup! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

SILVER (XAGUSD): Strong Resistance Ahead

Silver is very close to the resistance based on the last year's high.

Watching how strong is the bullish momentum, I got a feeling

that it is going to be broken.

A daily candle close above that will provide a strong bullish confirmation.

The price will keep rising to the new highs then.

❤️Please, support my work with like, thank you!❤️

XAGUSD Channel Up aiming for the new Higher High.Silver (XAGUSD) has been trading within a Channel Up for exactly year (since the March 27 2024 Low). Its current Bullish Leg started on the December 31 2024 (Higher) Low after almost touching the 1W MA50 (red trend-line).

Once the price broke above the 1D MA50 (blue trend-line) on January 28 2025, it remained above it ever since, which is what happened on both previous Bullish Legs. We expect a +30% rise and a test of the 1.382 Fibonacci extension as the previous Higher Highs. Our Target is just below that at 37.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

SILVER (XAGUSD): Bullish Continuation Ahead

Silver formed a strong bullish pattern on a 4H.

I see a bullish flag with a candle close above its resistance line.

I think that the market is going to continue rising.

Next resistance 34.2

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER (XAGUSD): Pullback From Resistance

In comparison to Gold, Silver looks bearish after a test of a key daily resistance cluster.

A head and shoulders pattern on an hourly time frame confirms a local

bearish sentiment and overbought state of the market.

The price may continue retracing at least to 3291 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver’s Price Action Hints at Further Decline After reaching a high in mid-February, Silver formed a lower high on the 25th, even as Gold hit a new all-time high.

Following the recent decline in both metals, this pattern repeated itself—Silver did not make a new low, whereas Gold did, but found support in a key zone.

However, analyzing the price structure, Silver’s chart remains bearish. In recent trading hours, a small flag continuation pattern has formed, signaling potential further downside.

Given this setup, I expect Silver to break the pattern and continue its decline, with 31 as the next key support level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Silver Struggles at Resistance – Bearish Setup in Play?Since reaching the 32.30 resistance zone last Wednesday, OANDA:XAGUSD has been trading in a range-bound consolidation phase.

On Friday’s NFP release, the price spiked back into this resistance area but quickly reversed, closing the day near the 31.70 support level.

Currently, Silver is rebounding once again from this support, which could present a good shorting opportunity for sellers.

My bias is bearish as long as 32.50 resistance holds, and I expect a potential decline toward 31.00 in the near term.