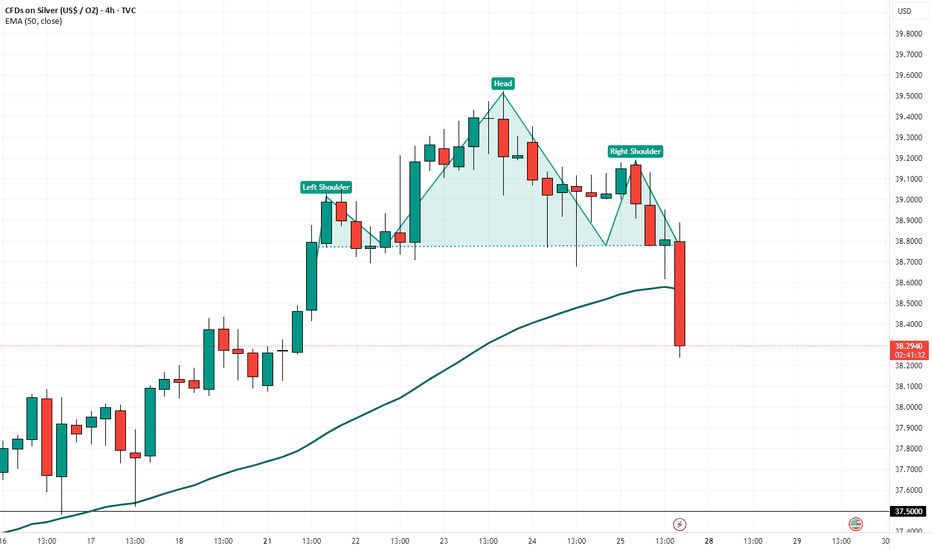

Head & Shoulders Pattern Confirmed bearish sign A clear Head and Shoulders pattern has formed on the 4H timeframe, and confirmation is in place after a decisive break below the neckline around $39.00.

🔍 Technical Breakdown:

Left Shoulder: Formed around July 11–15

Head: July 19–23 peak

Right Shoulder: Developing through July 24–25

Neckline: ~$39.00 zone (now broken)

Current Price: ~$38.30

Target: ~$38.00 – $37.80 (based on pattern projection)

The break below the 50 EMA adds bearish confirmation. Caution is advised unless price reclaims the neckline level.

Silversqueeze

Future Nearing.Been peeped Silver since 2023, watch as price rally above $42 soon. Especially with Gold topping out above $3K. The future, full of robotics and humanoids, is nearing. Who’s ready? Who’s scared? Who’s taking advantage of this opportunity?

Whatever happens, do not fomo, stay calculated.

Cycles and Sentiment may no Longer Matter - SilverWatch video for more detail on the trajectory for silver's next move

EDIT: in the video I said "convert unleveraged to leveraged"

I mean to say take profit on leveraged positions and convert to unleveraged accordingly depending on how quickly we approach 35-40

Silver Breakout Likely within Weeks - 32.75 Line in the SandSilver approaching 32.75 level after completing a corrective move this week.

37.75 is the line in the sand. A close above this level will confirm a historical breakout.

35 is almost certain and 40-45 a possibility before undergoing a larger, intermediate level correction.

Watch for more detail.

Lower rates means Silver to 40?The US dollar is trending lower.

Rates are expected to be lowered.

Unemployment number rising.

Presidential election has candidates talking about give aways.

War is still happening.

China is in deflation.

Banks are seeing credit card delinquency's rise.

There are 2 "technical" patterns implying a 40 ish silver price if we continue to break out. And remember all times highs are at 50 ish.

The recent weeks price action is encouraging and is implying breakout higher.

twitter/x is full of "silver squeeze" chatter again. good to see the buzz start up again.

Be safe.

Silver Idea - $100/oz by the middle of 2026It's quite simple really. If we are in a precious metals bull market, signaled by the most recent breakout in gold and silver, then this is how i expect the next few years to occur in the silver market.

In order for the price to breakout higher, $30/oz is required to be broken first, then $50/oz as the gold/silver ratio breaks down below the indicated 13 year long red support line.

Assuming the arc indicates an approximate timeframe, based on the pattern I'm seeing in the gold/silver ratio, by the middle of 2026 silver should be circa $100/oz. This would only require $3000/oz gold and a gold/silver ratio of 30.

Silver is about to rally hard. Just look to history.Its simple really.

If the silver/stocks ratio breaks out, in combination with a breakdown of the gold silver ratio, money inflows from both stocks and precious metals investors flows into silver.

The last time this happened, lead to a strong silver rally.

At the moment, we just need to wait for the gold/silver ratio to breakdown below the green line, then its off to the races for silver.

Is gold or silver the trade to make this week? This week's trade could be a decision between gold and silver.

The former might be swayed by the seven fed officials that are planned to speak this week, while the latter could be influenced by the #SilverSqueeze movement that is tangentially related to the meme stock frenzy that reignited last week.

Gold Technical

Gold (XAU/USD) prices rose at the end of the week but did not quite test the all-time high around $2,431.

Gold is trading well above the 20 Simple Moving Average (SMA), with the 100 and 200 SMAs maintaining bullish slopes much below it. Renewed buying pressure beyond $2,413 might push prices above the $2,420 mark.

Silver Technical

Silver (XAG/USD) is nearing the multi-year high at $31.40. A significant break at the end of the week saw Friday's sharp rise validate the break above the multi-year trendline. The challenge for the coming week is whether silver can maintain this bullish momentum despite entering overbought territory. The frenzy we saw in meme stocks might be dampening down too, with 2 days of declines following the surge. But it might be premature to count anything out yet.

The 14-period Relative Strength Index (RSI) is in the range of 70.00, possibly suggesting bullish momentum. The next resistance level is $31.50 from May 2011. In this fundamentally detached market, the next support could lie all the way back at where the metal was trading before the surge.

Silver Miners vs Silver SpotThis might be the explosion that will kickstart the silver stocks. This chart is showing a possible W formation that's about to break out... as well as the 25 weekly crossing the 52 weekly, which is usually pretty significant. Lastly, if it can break above the ichimoku cloud, then this ride might take off.

Silver Squeeze Meme AGAIN? Do not get tricked!AMEX:SLV It's that time again! #silversqueeze is trending on social media. This meme resurfaces every 2-3 years CONSISTENTLY when whomever thinks the time is right to take retail traders' money. With Gold AMEX:GLD making new highs they are trying it once again.

Watch my video from 2021 and do the research on Google News yourself! Wait for the price action confirmation that I talk about in this video! Do not get tricked!

COMEX:SI1! COMEX:GC1!

Which is shinier: Bitcoin or Gold? Okay plebs, listen up.

This is the chart I've been using to trade between precious metals and bitcoin, ethereum, and other cryptos. It is a custom chart, adding gold and silver with a modern ratio, doing the same with BTC and ETH, and pitting them against each other. What you get? A smooth chart that obeys technical analysis quite nicely.

And here we have a compression triangle. I drew those dotted lines of the triangle before it pinged them the last 2 times upward and downward, so I know it's legit. And what happens with a compression triangle? When it gets to that last bit like it is now, it breaks out in one direction or the other. The direction is yet undecided, but it FAVORS the direction it was going before the triangle started forming. That is, it is more than likely to break out strongly in the upward direction, favoring precious metals.

This has been building for quite some time, and indicates that the smart money has been rotating from the crypto sector to the PM sector REGARDLESS OF HOW YOU PERSONALLY FEEL ABOUT GOLD. I know, it can be a hard pill to swallow, but hey, the charts don't lie and I'd rather give it to you straight.

Makes sense, afterall, we're in crypto winter atm. At the same time, global economies are unstable, which historically favors gold.

While I believe one day digital gold will shine again, that day is probably a few years off at least. For now, real gold is what shines. Peace yall

THIS IS NOT FINANCIAL ADVICE

Want to know how I trade directly between cryptos and allocated physical precious metals? You'll have to ask me.

Silver Bull Flag breakout into Eve and Adam Bottom ResistanceSilver has just broken out of its bull flag. Now sitting under the Eve and Adam bottom Resistance. Considering the current Silver fundamentals, I strongly believe that this will break up. Silver being accumulated massively as hedge to dying USD. I would hate to be short here.

Silver Long Strategy Good Morning Traders,

Before FOMC, while the expectations and guesses have been spoken to everywhere, Silver might form an inverse H&S targeting the area between 22-23.

I'll share my long gameplay below;

Entry point : 20.10

TP : 22-23 ( I'll look into the momentum and Fed decision while deciding my actual target.

SL : 18.60

Since this strategy is counter trend. I suggest that your lot size should be smaller than 1.

I hope your week goes well.

Thanks.

The perfect trap for the silver buyers As we all know the heavy news speaking loudly about silver. Although of course they are half right and I will let them buy it on Monday all tbe way to 28.8 $ make them happy , and then just when they think its going to fly to 1000$, then the sellers will show up to take the money away. we will be looking for shorts on Tuesday onwards. with long term hold of up to a week, aiming for lower prices first target would be around 24$ where we may take some positions off , followed by our main target of 20$ .

lets see how it plays out.

Are we being fooled? Silver too WTF!After finding Wyckoff reaccumulation zones on Ethereum AND Bitcoin. Now I see it on silver too. Please leave me your thoughts and feedback.

Gold and Silver have been Outperforming Cryptos since Nov 9thIn this custom precious metals (Gold and Silver) versus top cryptos (BTC and ETH) you can see the last lowest low was November 9th in what appears to be a bottoming formation. Price ratios continued in an upward channel (shown in yellow) and have just confirmed a breakout upwards from that channel. Suffice it to say, PMs have been outperforming major cryptos since early November 2021.

This is not financial advice. The trend is your friend, so it may be time to rotate crypto holdings into #gold or #silver or a ratio of both. Luckily there is a platform that allows you to do this directly called Kinesis. Kinesis also allows the storage AND delivery at any time of your precious metals, and in a specifically allocated account (no unallocated pools). They also offer 5 ways to partake in their fee-sharing program including the holder yield - which means it's not just free storage, but you get paid to store with them. Check out their informative videos to find out more or sign up kms.kinesis.money

Silver Miners: Blow-off 5th Wave Rally Imminent in SILJThe SIL and SILJ ETF's are both following a classic impulsive pattern that began with our low in the spring of 2020. After a powerful 3rd wave blow-off rally that peaked in the summer of 2020, a seemingly endless 4th wave correction has been grinding away all hope in the metals sector. However, we may have reason to be bullish as there are clear signs that the correction is over and that the 5th wave has commenced!

Not only is there great confluence at the 0.382 ext targets overhead, but metals are famous for 5th wave extension blow-off tops which can drive up prices levels to the 0.618 ext and beyond! They are not easy to predict and take off parabolically, so it is prudent to leg-in carefully and methodically as a setup develops. We have similar setups developing in gold ( GDX / GDXJ ) and copper ( COPX ) as well!

I use Elliott Wave analysis to project price levels for different assets and asset classes. EW is a form a technical analysis that is absolutely NOT based on fundamentals. Please be aware that this video is not intended to act as financial advice. I am not a trained or certified financial professional. You may invest based on a strategy tailored to your own skill and risk-tolerance levels.

SIL & SILJ Component Stocks:

SIL ETF - Global X Silver Miners ETF:

WPM - Wheaton Precious

POLY LN - Polymetal

PAAS - Pan American Silver Corp

SSRM - SSR Mining Inc

HL - Hecla Mining Co

FR CN - First Majestic S

FRES LN - Fresnillo PLC

010130 KS - Korea Zinc Co Ltd

BVN - Buenaventura-ADR

PE&OLES* MM - Industrias Penol

SILJ ETF - ETFMG Prime Junior Silver Miners ETF:

AG - First Majestric Silver Corp

PAAS CN - Pan American Silver Corp

AUY - Yamana Gold Inc

SSRM CN - SSR Mining Inc Com NPV

MAG CN - MAG Silver Corp Com

SIL CN - Silvercrest Metals Inc

HL - Hecla Mng Co

TRQ CN - Turquoise Hill Resources Ltd

GATO - Gatos Silver Inc

EXK - Endeavor Silver Corp

#silver #gold #silversqueeze