Bellway - Building momentumBuy Bellway (BWY.L)

Bellway plc is a major UK residential property developer based in Newcastle upon Tyne. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Market Cap: £3.9Billion

The medium-term trend is bullish on Bellway. The shares have corrected lower in recent weeks and appears to have found some support at 3125p. There was strong move higher in yesterday’s session and further upside towards resistance at 3710p is expected in the short term.

Stop: 3078p

Target 1: 3600p

Target 2: 3710p

Target 3: 3800p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

SIPP

Wood Group - Corrective move higher expected.Buy Wood Group (WG.L)

John Wood Group PLC is a United Kingdom-based energy services company. The Company provides a range of engineering, production support, maintenance management and industrial gas turbine overhaul and repair services to the oil and gas and power generation industries.

Market Cap: £2.3Billion

The long-term trend does not paint the best of pictures for Wood Group but there are some signs of the bearish momentum stalling. A few hammer candles have formed around support at 326p. The large bullish candle that has formed today looks set to burst through resistance at 362.5p. There is potential for a recovery move towards 510p over the medium term.

Stop: 334p

Target 1: 400p

Target 2: 510p

Target 3: 600p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Mediclinic - Looking for healthy gains.Buy Mediclinic (MDC.L)

Mediclinic International plc (Mediclinic) is an international private healthcare services provider. Mediclinic is focused on providing acute-care, specialist-orientated, multi-disciplinary healthcare services.

M arket Cap: £2.7Billion

Mediclinic broke above resistance at 374p back on the 17th October 2019. The momentum did not continue as the shares have consolidated lower in recent days. The move higher today is an impressive once and this appears to have completed a bullish flag/pennant pattern. This is often considered a continuation pattern and therefore further upside is expected from here.

Stop: 351.5p

Target 1: 458p

Target 2: 500p

Target 3: 512p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

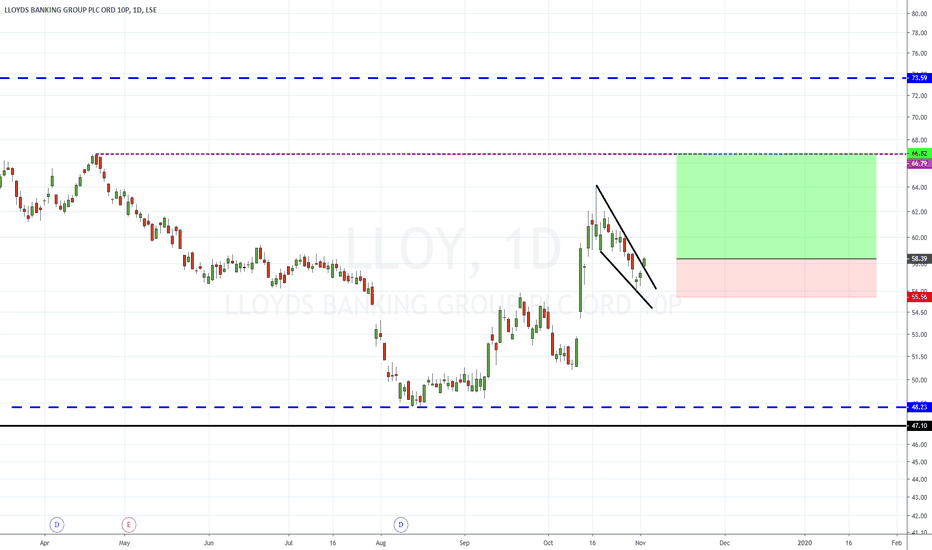

Lloyds - Banking on a move higher.Buy Lloyds Banking Group (LLOY.L)

Lloyds Banking Group plc is a provider of financial services to individual and business customers in the United Kingdom. The Company's main business activities are retail and commercial banking, general insurance, and long-term savings, protection and investment.

Market Cap: £40Billion

Lloyds gapped higher this morning and looks set to close outside of the wedge pattern that has formed on the daily chart. A continuation higher looks possible. The next major resistance to target is 66.8p.

Stop: 55.5p

Target 1: 66.8p

Target 2: 73.50p

Target 3: 80p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Vodafone - Reiterating my bullish view.Buy Vodafone (VOD.L)

Vodafone Group Plc is a telecommunications company. The Company's business is organized into two geographic regions: Europe, and Africa, Middle East and Asia Pacific.

Market Cap: £43Billion

I am reiterating my bullish view on Vodafone today. The shares have found support at the lower end of the bullish channel. The momentum overall still appears bullish. Higher prices towards 174p is expected.

Stop: 155p

Target 1: 173.9p

Target 2: 189.90p

Target 3: 200p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

WH Smiths - Travelling towards 2600p?Buy WH Smiths (SMWH.L)

WH Smith PLC is a United Kingdom-based retailer in convenience, books and news for travelling customers. The Company is a high street stationer, bookseller and newsagent. The Company operates through two segments: High Street and Travel. The Company's Travel business sells its products to cater for people on the move or in need of a convenience offer.

Market Cap: £895Million

WH Smith's share price appears to have completed a triple bottom on the move above resistance at 2164p. In recent days the shares have corrected lower to find support at the neckline of the pattern. The projected upside target is at 2436p and beyond that 2604p. The momentum continues to be positive following upbeat results posted on the 17th of October. Higher prices are expected.

Stop: 2130p

Target 1: 2324p

Target 2: 2436p

Target 3: 2600p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Elementis - A break above 167.9p and it will be in its element.Buy Elementis (ELM.L)

Elementis plc is a United Kingdom-based specialty chemicals company. The Company operates through two segments: Specialty Products and Chromium. The Specialty Products segment provides functional additives to the coatings, personal care and energy markets.

Market Cap: £895Million

The bearish momentum in Elementis appears to have slowed in recent weeks. It’s an early call, but I think a bottom pattern could be about to complete. The shares posted an impressive turnaround from the lows in yesterday's session to form a large hammer candle. A break of resistance at 167.9p should get things going on the upside. The medium-term target is up at 209p.

Stop: 139.6p

Target 1: 175p

Target 2: 198p

Target 3: 209p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Just Group - Just about to explode?Buy Just Group (JUST.L)

Just Group plc, formerly JRP Group plc, is a financial services company. Its segments are insurance, other segments and corporate activities. The insurance segment writes insurance products for the retirement market, which include guaranteed income for life solutions and defined benefit de-risking solutions, care plans, and drawdown contracts, and invests the premiums received from these contracts in corporate bonds, lifetime mortgage advances, and other financial investments.

Market Cap: £660.9Million

Just Group has been in the process of forming a bottom pattern for the past couple of months. The break above resistance at 57.50p confirms the pattern and projects an upside move to 79.30p over the short to medium term. There is also an unfilled gap at 96.50p, which formed when the company posted disappointing results. I like the prospects of recovery from here.

Stop: 54p

Target 1: 72.75p

Target 2: 79.30p

Target 3: 96.50p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

easyJet - Ready to take off again?Buy EasyJet (EZJ.L)

easyJet plc is a United Kingdom-based low-cost airline carrier. The Company operates as a low-cost European point-to-point short-haul airline. The Company operates through its route network segment. The Company operates on over 820 routes across more than 30 countries with its fleet of over 250 Airbus aircrafts.

Market Cap: £4.77Billion

Having completed a large inverse head and shoulders bottom in the middle of September the shares have been on a great run. The recent spike to highs of 1330p was met with some profit-taking. The correction lower has been quite shallow, and the price now appears to have broken higher from a pennant pattern. This is considered a continuation pattern and therefore the expectation is for further upside in the short to medium term.

Stop: 1171p

Target 1: 1383p

Target 2: 1505p

Target 3: 1600p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

United Utilities - Something in the water?Buy United Utilities (UU.L)

United Utilities Group plc, the United Kingdom's largest listed water company, was founded in 1995 as a result of the merger of North West Water and NORWEB. The group manages the regulated water and wastewater network in North West England, which includes Cumbria, Cheshire, Greater Manchester, Lancashire and Merseyside, which have a combined population of nearly seven million.

Market Cap: £5.8Billion

United Utilities has broken out of a bearish channel with an impulsive move higher. The correction lower in recent days has been limited and buyers appear to be emerging once again. A flag formation may be taking shape which would suggest a continuation higher over the short term. The ultimate target is for a move to 1065p, which is a previous high dating back to May 2017. It’s also a nice one for income investors with a dividend yield of 4.74%.

Stop: 816p

Target 1: 940p

Target 2: 1000p

Target 3: 1065p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Rentokil - Time to catch some gains?Buy Rentokil Initial (RTO.L)

Rentokil Initial plc provides fully integrated facilities management and essential support services to government and commercial sector organization all sizes across all business sectors. The Company provides services in pest control, hygiene, workwear, facilities and plants.

Market Cap: £8.17Billion

Rentokil is trading in an exceptional long-term uptrend. The shares have once again bounced from the trend support line and this typically proceeds a move to new highs. If the trend is to continue, then its an ideal entry level. A break below 430p would invalidate the idea.

Stop: 430p

Target 1: 500p

Target 2: 530p

Target 3: 550p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Hikma Pharmaceuticals - Injecting some bullish momentum.Buy Hikma Pharmaceuticals (HIK.L)

Hikma Pharmaceuticals PLC develops, manufactures, and markets pharmaceutical products. The Company offers branded and non-branded generic and in-licensed pharmaceutical products. Hikma Pharmaceuticals serves customers worldwide.

Market Cap: £4.79Billion

The long-term trend on Hikma remains bullish. The corrective move lower in recent weeks has found some support at the 38.2% Fibonacci level. The posting of a bullish engulfing candle while simultaneously breaking from a wedge pattern is bullish for short term sentiment. Further upside is expected from here, targeting the previous highs at 2345p from 15th March 2017.

Stop: 1920p

Target 1: 2210p

Target 2: 2345p

Target 3: 2400p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Compass Group - Buying the dip to the long term trend line.Buy Compass Group (CPG.L)

Compass Group PLC provides food and support services. The Company's segments include North America, Europe, Rest of World and Central activities. The Europe segment includes Turkey and Russia. The Rest of World segment includes Japan. The Company delivers services in sectors, including business and industry; healthcare and seniors; education; defense, offshore and remote, and sports and leisure.

Market Cap: £31.19Billion

Compass is trading in a fantastic long-term uptrend and this is showing no signs of stopping. The latest correction appears to have found some buying support at the long-term trend line. We expect the shares to rally towards the upper end of the corrective channel before eventually breaking higher towards new highs.

Stop: 1890p

Target 1: 2050p

Target 2: 2145p

Target 3: 2250p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

AstraZeneca - Breaking from a wedgeBuy AstraZeneca (AZN.L)

AstraZeneca PLC (AstraZeneca) is a biopharmaceutical company. The Company focuses on discovery and development of products, which are then manufactured, marketed and sold. The Company focuses on three main therapy areas: Oncology, Cardiovascular & Metabolic Disease (CVMD) and Respiratory, while selectively pursuing therapies in Autoimmunity, Infection and Neuroscience.

Market Cap: £90.48Billion

AstraZeneca is breaking higher from a corrective wedge pattern on the daily chart. The long-term uptrend remains bullish and a move towards new highs is expected.

Stop: 6565p

Target 1: 7465p

Target 2: 7580p

Target 3: 8000p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

NMC Health - One to watchBuy NMC Health (NMC.L)

NMC Health plc is a private healthcare services provider in the United Arab Emirates. The Company operates through two segments: healthcare and distribution & services. The healthcare segment is engaged in providing professional medical services, comprising diagnostic services, in and outpatient clinics, provision of all types of research and medical services in the field of gynecology, obstetrics and human reproduction and retailing of pharmaceutical goods. It also includes the provision of management services in respect of a hospital.

Market Cap: £5.68Billion

NMC Health appears to be forming a bottom pattern on the daily chart. A break above resistance at 3016p is required to complete the pattern, which as this stage is still in the ‘one to watch’ category. The completion of an inverse head and shoulders bottom pattern targets a move to 4325p over the short to medium term. Investors with a more speculative nature could buy at current levels to improve the upside potential. The idea would be invalidated on a move below 2420p.

Stop: 2420p

Target 1: 3015p

Target 2: 3760p

Target 2: 4325p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Babcock - Potential bottom forming.Buy Babcock (BAB.L)

Babcock International Group PLC is a holding company. The Company provides engineering services. Its segments include Marine and Technology, Defence and Security, Support Services and International. The Marine and Technology segment delivers support to the United Kingdom Royal Navy's submarines, naval ships and infrastructure. It also offers solutions in engineering, equipment management, consultancy, information and knowledge management. The Defence and Security segment offers engineering and training support services.

Market Cap: £2.68Billion

Babcock appears to be in the process of forming a bottom pattern on the daily chart. A break above 576p is needed to confirm the bottom pattern. Buying now is a pre-emptive move but it offers fantastic risk/reward at the current levels. The company is likely to benefit substantially on a Brexit deal.

Stop: 490p

Target 1: 576p

Target 2: 740p

Target 2: 800p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

IG Group - Inverse head and shoulders bottomBuy IG Group (IGG.L)

IG Group Holdings plc is a United Kingdom-based company, which is engaged in online trading. The Company provides contracts for difference (CFDs) in over 17 countries globally. The Company's segments include UK, Australia, Europe and Rest of World. The UK segment consists of its operations in the United Kingdom and Ireland, and derives its revenue from financial spread bets, CFDs, binary options and execution only stockbroking. The Australian segment derives its revenue from CFDs and binary options. The Europe segment consists of its operations in France, Germany, Italy, Luxembourg, the Netherlands, Norway, Spain, Sweden and Switzerland, and derives its revenue from CFDs, binary options and execution only stockbroking.

Market Cap: £2.2Billion

IG has completed an inverse head and shoulders bottom pattern on the daily chart. The move higher stalled at 648 and has corrected lower towards the neckline of the pattern at around 580p. This also lines up with a couple of Fibonacci support levels. The bullish outside candle that has formed today suggests that further upside could be seen in the short term.

Stop: 555p

Target 1: 630p

Target 2: 733p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Hurricane Enery - Buying the bottom of the rangeBuy Hurricane Energy (HUR.L)

Hurricane Energy plc is engaged in the exploration of oil and gas reserves principally on the United Kingdom Continental Shelf. The Company's acreage is on the United Kingdom Continental Shelf, West of Shetland, on which the Company has approximately two basement reservoir discoveries, each containing approximately 200 million barrels of oil equivalent (MMboe).

Market Cap: £827.54Million

Hurricane Energy is trading in a neat range on the daily chart. The support at 38p has held successfully and the shares look set to close above the 10EMA. This could be a sign that bullish momentum is about to return. The upper end of the range comes in at 60.70p which is our short to medium term target.

Stop: 36.4p

Target 1: 60.70p

Interested in UK Small Caps?

Join our free Telegram channel for up to date analysis on the best small-cap opportunities in the UK right now.

t.me

Flowtech - Go with the floBuy Flowtech Fluidpower (FLO.L)

Flowtech Fluidpower plc is a United Kingdom-based distributor of technical fluid power products. The Company operates through two divisions: Flowtechnology, which is geographically split into Flowtechnology UK (FTUK) and Flowtechnology Benelux (FTB), and Power Motion Control (PMC). FTUK and FTB focus on supplying distributors and resellers of industrial maintenance, repair and operation (MRO) products, primarily serving urgent orders rather than bulk offerings. The PMC division is engaged in the design and assembly of engineering components and hydraulic systems, which are managed by component supply along with a service and repair function.

Market Cap: £64.98Million

Flowtech is trading in a neat range between 98.5p to 165.5p on the daily chart. The company pays a dividend, which is quite rare of a small cap business. The recent ex-dividend date has been shrugged off with no real impact on the share price. There is an unfilled gap at 120.5p, which is our first target, beyond that we believe the share price could climb towards 149.5p, then 165.5p.

Stop: 95p

Target 1: 120p

Target 2: 149p

Target 3: 165p

Interested in UK Small Caps?

Join our free Telegram channel for up to date analysis on the best small-cap opportunities in the UK right now.

t.me

Clean up with Reckitt BenckiserBuy Reckitt Benckiser (RB.L)

Reckitt Benckiser Group plc is a manufacturer and marketer of health, hygiene, post-natal and home products. The Company's segments include ENA and DvM. The ENA segment consists of Europe, Russia/Commonwealth of Independent States (CIS), Israel, North America, Australia and New Zealand. The DvM segment consists of North Africa, Middle East (excluding Israel) and Turkey, Africa, South Asia, North Asia, Latin America, Japan, Korea and the Association of Southeast Asian Nations (ASEAN). Health, Hygiene, Home and Portfolio Brands categories are split across the geographical segments of ENA and DVM. Its range of hygiene products includes disinfectant cleaners, automatic dishwashing detergents, pest control, depilatory products and acne treatments. The Company's portfolio of brands includes Durex, Mucinex, Scholl, Strepsils, Cillit Bang, Clearasil, Dettol, Harpic, Lysol, Mortein, Veet, Air Wick, Calgon, Vanish and Woolite.

Market Cap: £44Billion

Reckitt Benckiser has had an indifferent few months. So often it’s a mainstay of investors portfolios with its predictable growth and solid stream of income. In recent months the share price has been in consolidation mode and not really offered investors very much. In recent weeks a bullish channel has formed, and we are beginning to see investors return on spells of weakness. The latest move from the lower end of the channel could be the beginning of a fresh move higher towards resistance at 7175p

Stop: 5980p

Target 1: 6710p

Target 2: 7165p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Vodafone - Rising at 5G speed.Buy Vodafone (VOD.L)

Vodafone Group Plc is a telecommunications company. The Company's business is organized into two geographic regions: Europe, and Africa, Middle East and Asia Pacific (AMAP). Its segments include Europe and AMAP. Its Europe segment includes geographic regions, such as Germany, Italy, the United Kingdom, Spain and Other Europe. The Other Europe includes the Netherlands, Portugal, Greece, Hungary and Romania, among others. Its AMAP segment includes India, South Africa, Tanzania, Mozambique, Lesotho, Africa, Turkey, Australia, Egypt, Ghana, Kenya, and among others. The Company provides a range of services, including voice, messaging and data across mobile and fixed networks.

Market Cap: £43.13Billion

Vodafone has had a terrible couple of years as the share price has plummeted from 240p to lows of 122p. There are some encouraging signs appearing, which began with the break of the bearish channel and the formation of a rounded bottom on the daily chart. The break of resistance at 147.86p confirmed the bottom pattern and suggests further upside will be seen over the medium term. The first target is the measured move of the bottom pattern at 174p, beyond that we see the price reaching closer to 200p. In the very short term, the shares are trading in a neat channel, buying interest looks set to continue.

Stop: 151.95p

Target 1: 174p

Target 2: 190p

Target 3: 193p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Bango - More upside expectedBuy Bango (BGO.L)

Bango PLC (Bango) offers the Bango mobile payment platform. The Company's principal activity is the development, marketing and sale of technology to enable mobile phone users to make payments for digital content and media on smartphones and tablets. The Company's segments include End user activity and Platform fees. The End user activity segment includes the content access fees paid by end users for accessing chargeable content provided by digital merchants, adjusted to take account of whether Bango is agent or principal in the transactions.

Market Cap: £94.28Million

Bango has formed a bottom pattern on the daily chart. The double bottom completed on the move above resistance at 130p. The shares have been in consolidation mode in recent weeks but now look set to head higher over the short to medium term. We have major resistance around 198.5p, which also lines up with the 61.8% Fibonacci resistance level at 192.5p. We expect to see the short term sequence of higher highs and higher lows continue.

Stop: 115p

Target: 192.5p

Interested in UK Small Caps?

Join our free Telegram channel for up to date analysis on the best small-cap opportunities in the UK right now.

t.me

Greggs - Buying the dipBUY – GREGGS (GRG)

Greggs plc is a United Kingdom-based bakery food on-the-go retailer. The Company's products and services consist of a range of fresh bakery goods, sandwiches and drinks in its shop.

Fundamentals

The success story of Greggs is quite remarkable with the shares rising significantly over a 5-year period. The baker recently delivered an ‘exceptional trading performance’, total sales were up 14.7% and like-for-like sales were up 10.5%. The introduction of vegan sausage rolls has been a massive success and no doubt brought new customers to stores across the country. The recent decline looks like a decent opportunity to buy.

Best Broker Target Price: 2300p (UBS 28/08/2019)

Worst Broker Target Price: 1780p (Berenberg Bank 16/05/2019)

Technical Analysis

The long-term chart of Greggs shows a spectacular uptrend. The recent dips from the highs of 2496p has been uncharacteristic and could present a fantastic opportunity to buy. Corrections are normal for share prices and following this recent bout of profit taking the shares now look more attractive. The close above the 10EMA on the 28th August 2019 could be a signal of bullish momentum returning. A move back to the highs to reassert the long-term trend is expected.

Recommendation: Buy

Buy between 2000-2100p

Stop: 1895p

Target: 2495p