EURUSD Setup Is Crystal Clear — Here’s My Long & Short TriggersHey, it’s Skeptic. This isn’t about blind price prediction — it’s about spotting clean long and short triggers on EURUSD using daily and 4H structure, DXY correlation, and momentum.

We’ll break down a fresh V-Pattern , exact breakout levels, and how to avoid getting chopped in ranges.

If this helped, give it a boost — peace out.

Skeptic

Skeptic's Night Byte: How to Catch Altcoin MovesHey, welcome to the first episode of the Skeptic's Night Byte

In this quick lesson, we’ll dive into how to spot when liquidity moves from Bitcoin into altcoins .

Each video is about 60 seconds, giving you fast, no-fluff insights to help improve your trading game :)

If you find this useful, give it a boost and share it with your trading circle.

Let’s get started!

Bitcoin’s Next Move? ETH Heating Up & Altcoin Liquidity Shifthey I’m Skeptic,

in this one we’re looking at BTC’s breakout attempt, the good & bad signs in the daily candle, and why ETH & other alts are moving while BTC is ranging.

also sharing my triggers for both BTC & ETH, plus what I’m watching on BTC.D for the week ahead.

manage your risk, don’t fomo — peace out :)

Skeptic's Night Byte: 3 Hacks to Beat a Losing StreakHey, it’s Skeptic 👋

We’ve all been there — losing streaks suck, but they don’t have to wipe you out.

In under 60 seconds, I’ll show you 3 quick hacks that make a huge difference:

Build friction into your trading decisions

Stop letting news events wreck your win rate

Use higher time frames to avoid the noise

Simple moves. Massive impact.

If this helped, hit that boost so I know to drop more tips like this.

$DOGS – Is This Telegram Mini-App Token About to Wake Up?Yo traders, Skeptic from Skeptic Lab! 🩵 Breaking down SEED_ALEXDRAYM_SHORTINTEREST1:DOGS with a skeptical lens — weekly still bearish, daily stuck in consolidation, but key breakout levels could flip the script.

📊 Weekly & daily analysis

📈 4H trigger levels with volume & RSI confirmations

⚠️ Why I avoid trading inside the range

💡 Clear breakout & breakdown setups

Trade smart, keep risk tight, and don’t FOMO. Share your thoughts in the comments, boost if it helps <3

GBPCHF Is Waking Up — This Long Trigger Looks CleanGBPCHF just broke out of a long accumulation and is eyeing fresh bullish momentum. Here’s the exact trigger, stop-loss idea, and RSI confirmation I’m watching this week. If it helps, boost it and let’s catch the move.

Disclaimer: This content is for educational purposes only and is not financial advice. Trade at your own risk.

All the Triggers You Need to Watch This Weekyo its Skeptic from Skeptic Lab 🩵

Quick breakdown of my weekly watchlist — from forex pairs to commodities — including the exact levels and triggers I’m watching for potential setups this week. Whether you trade breakouts or reversals, this list will keep you ahead of the moves.

Disclaimer: This content is for educational purposes only and is not financial advice. Trade at your own risk.

How to Use AI for Crypto Trading (The Right Way)lemme answer real quick: YOU DON’T.

Most traders using AI in crypto are straight up doing it wrong.

Here’s the usual story:

They open ChatGPT and ask,

“Hey… uhm… tell me which altcoin will 100x… Bruh, I heard you know everything, bet you know the next 10x coin!”

ChatGPT confidently replies,

“Sure, buy this coin right now…”

And the trader’s like,

“Ok, thanks.”

Then they jump on Binance, smash that buy button, and lose money faster than you can say ‘left trading’.

Don’t be that guy. Tools like ChatGPT weren’t made for this wild crypto jungle. Crypto’s a messy, super risky market, and ChatGPT’s language models mostly have old info anyway. They can’t give you solid, grounded analysis of what’s really going on — on-chain or across exchanges.

BUT, if you wanna cut through the hype and dodge the FOMO, this quick guide is for you. I’ll show you how to use AI the right way — with real on-chain and off-chain data, and special AI agents built specifically for crypto research.

Wanna keep going? Cool, let’s dive in. If not, peace out and don’t waste your time.

1. Use AI That Actually Processes On-Chain and Off-Chain Data

Real AI power kicks in when you talk about scale — thousands of tokens, millions of wallet moves, shifting stories everywhere. Humans can’t keep up, but AI can process it all instantly, in real time.

Look for AI tools that analyze stuff like:

Wallet behavior and how smart money moves.

Token velocity and decentralized exchange volumes.

Social sentiment from Twitter, Reddit, Discord, Telegram.

Developer activity, governance updates, protocol changes.

How market narratives pop up and spread.

2. Use AI Agents Made Just for Crypto Research

Crypto’s not like stocks or forex. It’s faster, fragmented, and shaped by both on-chain wallet moves and off-chain communities.

That’s where specialized AI agents shine. They understand stuff like:

How wallets behave during airdrops.

How Telegram groups hype early projects.

How dev activity correlates with price moves.

Instead of raw data dumps, these crypto-native AI agents spot patterns that’d take humans days to find. Like spotting when big wallet clusters start accumulating in a new ecosystem, or when a protocol suddenly blows up on social media.

3. Combine Research & Automation for Full-Spectrum Edge

I’m personally pumped about this part. Imagine an AI agent tracking low-cap funds moving into Telegram channels, running sentiment analysis, then tracking smart wallets accumulating tokens (even mixing in technical analysis).

Finally, it finds your risk management , sets triggers, and helps you enter trades with clear stop-loss and target levels.

Quick heads-up: Because of TradingView’s house rules, I can’t drop any links here — you gotta search and find your best AI tools on your own.

Remember : The only way to survive this market is to stay skeptical , watch risk management like a hawk, and keep your head cool. So if you feel FOMO creeping in or money management slipping — close your laptop, hit a coffee shop, and order a espresso. Trust me, it’s worth it.

Thanks for sticking with me till the end of this lesson. Im Skeptic from Skeptic Lab & If this helped, smash that boost button and I’ll catch you in the next one! :)

This V-Pattern on SPX500 Is Stupid CleanHey, it’s Skeptic.

In this video, I’m breaking down a clean V-pattern setup on SPX500 — right in line with what I taught in yesterday’s educational post.

We’re starting from the Daily time frame and walking through the logic behind my long trigger, why the previous fakeout was actually useful, and how to set your stop-loss depending on your trading style (H4 vs 15min).

This isn’t just chart talk — it’s about reading the story behind the candles.

If it helped you see things clearer, give it a boost and drop your thoughts below.

Let’s keep learning — one trap at a time.

Until next time, peace out.

📌 Disclaimer: This video is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk.

EURGBP Setup So Clear It Feels IllegalHey, it’s Skeptic.

Spotted a super clean breakout forming on EURGBP — and it lines up across multiple tools (RSI, 7SMA, momentum candles).

In this video, I’ll walk you through the daily trend, explain why I’m only looking for longs, and show the exact 15m trigger I’m watching.

No hype, no FOMO, just reason.

If it helps, boost it. Appreciate you 🫡

Disclaimer: This is not financial advice. Do your own research, manage your risk, and stay sharp out there.

Ethereum Long Trigger Just Got Valid — Don’t Miss This SetupHey, it’s Skeptic from Skeptic Lab.

In this breakdown, we’re looking at a fresh long opportunity on Ethereum after a clean 45% move from our last trigger.

I’ll walk you through the daily and 4H timeframes, explain why the correction looks weak, and where the next breakout trigger is setting up.

Plus, I’ll show you how ETHBTC can help confirm the move and improve your risk/reward.

If this gave you clarity or value, give it a boost — and I’ll catch you in the next one.

Disclaimer: This is not financial advice. Always do your own research before making any trading decisions.

From Fakeout to Takeoff: How the V-Pattern REALLY WorksEver seen a support level break, only for the price to rocket back up in a V-shape? That’s the V-Pattern in action! In this post, Skeptic from Skeptic Lab breaks down the step-by-step mechanics of this powerful setup. From the fakeout that traps short sellers to the surge of buy orders from liquidations, you’ll learn exactly how buyers flip the script and create explosive reversals. Perfect for traders looking to spot high-probability setups. Join me to decode the markets—check out the steps and level up your trading game!

SUI’s Next Big Move? Key Levels You Must WatchHey friends, it’s Skeptic 🩵

In this video, I’m diving into the current setup on SUI – whether to long or short, plus an update on market context and risk zones.

I broke down key levels, previous triggers, and what price action is hinting at next.

This one’s packed with insights, especially if you're in futures or looking for an entry on spot.

⚠️ Don’t forget about risk management – chasing pumps is a recipe for FOMO and mistakes.

💬 Let me know your thoughts on SUI in the comments, and let’s talk setups.

Market Stuck in Limbo? XAGUSD Update & Likely Range AheadLet’s talk silver.

The market's clearly undecided — no real momentum, just hesitation.

We’re approaching overextended RSI levels, so don’t expect fireworks just yet.

Im Skeptic from Skeptic Lab and In this quick update, I’ll show you what I’m watching for both long and short triggers …

and why a range might dominate the next few days.

👉 Watch till the end to avoid getting trapped by fake breakouts.

USDCAD Update: Don’t Sleep on This Uptrend’s First LegYo traders, Skeptic from Skeptic Lab here! 🚀 USDCAD’s serving a hot long trigger for pattern traders chasing the first leg of a big uptrend! We’ve got an ascending triangle breakout on the daily, with bullish candles stacking up, hinting at a return to the weekly bullish trend. Too early to confirm, but the momentum’s fire.

📈 Today’s FOMC meeting’s got everyone buzzing—will Powell cut, hold, or drop resignation hints? Check the full setup in the video, but with crazy news like Federal Funds Rate

, s tick to high-probability trades, keep risk low, and no FOMO or revenge trading! Drop your thoughts, boost if it vibes <3

Still Losing After Backtesting? This Fixed It.Let’s get straight to it.

If you’ve gone through the "nerd arc" and the "backtesting arc" but still aren’t profitable...

What’s the fix?

In this short write-up, I’ll walk you through 3 brutal truths that made me finally see green.

Is it hard?

UH—Damn right.

But let’s go 👇

1. Market Understanding

This isn’t something you "learn" from a course.

It’s something that clicks after dozens of stop losses and live trades.

Here are a few ways I got more comfortable with it:

1. Don’t fear opening trades or hitting stop loss.

Each trade gives you data. More trades = more experience = better market feel.

What’s the requirement? Capital and risk management. Without that, you won’t even survive long enough to "get" it.

2. Journaling every single trade.

Write everything: your thoughts, screenshots, feelings — before and after.

Too lazy to do it? Left trading. Simple.

3. Be the detective.

Read the chart like a story. No, seriously.

Think of Bitcoin as a character with real moods.

Every candle tells you something.

That 5% pump? Buyers pushing up. Then bears smacked it down — candle closed red.

Now price is bleeding again.

Why?

🔍 Be the detective.

4. Analyze the market every day — even without trading.

The more you observe, the more you see. Structures. Patterns. Behavior.

Easy? Nah.

It takes discipline — like posting one story text to Insta for 1,000 days straight. Still wanna try?

2. Personal Trading Plan

Remember how I said "don’t fear opening trades"?

Well — after you’ve opened a bunch, you can start tailoring your own trading plan based on you.

This isn’t a PDF you can steal off Google.

Only after seeing how you behave in trades, you’ll know what rules make sense.

Maybe:

"I don’t trade when I’m emotionally off."

"This setup gave me the best results over 100 trades."

Just don’t copy-paste someone else’s rules.

Make a flexible structure, then let the details emerge from the market and your own experience.

Now —

Take a deep breath.

When was the last time you enjoyed your coffee?

More than a day ago?

Go make one now.

Might not get to taste it tomorrow.

Not everything in life is trading :)

3. Psychology

Ah, the final boss.

Still my weakest area, honestly.

But here are a few real things that helped:

Tip 1: WRITE.

Just write whatever you feel.

Telegram saved messages? Notebook?

Or if you're like me (🧠nerd), Notion.

Do it for 60 days straight — then feed that journal to ChatGPT and analyze yourself.

Takes time, but the patterns you'll see are... magical.

Tip 2: Money & Risk Management.

When you know your stop loss means only -0.25% of your capital…

why should you panic?

For me:

I place the SL, set a TP alert, and leave the screen.

No emotions, no fear.

Why? Because when capital is protected, so is my psychology.

Truth is, trading emotions aren’t just during the trade — they live in your head all day.

When your mental energy’s drained?

You’ll miss A+ setups.

Fall for BS ones.

Lose focus.

It’s complicated.

Because humans are complicated.

Our brains are the most tangled system known.

And somehow, out of all that noise, consciousness emerges.

A miracle.

So don’t expect to always feel calm.

Just aim to get better.

That’s it.

Thanks for sticking around.

These are just my thoughts, from one tired trader to another 🧠

I’m no expert—just sharing what’s worked (and what hasn’t).

If it helped, a boost would mean a lot.

🚫 Don’t FOMO

✅ Manage your capital

Until tomorrow —

Peace out. ✌️

EURNZD Update: This short trigger could spark a waterfall dropYo traders, Skeptic from Skeptic Lab! 🩵 EURNZD just broke its daily upward trendline, setting up a sharp drop. Weekly shows a fading uptrend. Daily’s got a strong bearish candle, full body, no buyer fight. 4H trendline broke and... more on this video:)

👀Beware of fakeouts this week—volatility’s high! Trade smart, keep risk tight, and don’t FOMO. Share your thoughts in the comments, boost if it helps <3

How I Analyze Any Coin in 60 Seconds: 4-Step Masterclass!Heyy traders, it’s Skeptic from Skeptic Lab! 🩵 I’m breaking down my lightning-fast method to analyze any coin in just 60 seconds . This 4-step process is how I spot long/short triggers like a pro. Buckle up, let’s dive in:

✔️ Step 1: Identify HWC/MWC/LWC (10 seconds)

Nature’s got a cool vibe—bet a lot of you hit the outdoors on weekends. When I see an apple tree from afar, it’s majestic, but up close, I spot branches and worm-eaten fruit. From a distance, I miss the details; up close, I lose the tree’s grandeur. Markets work the same. You need different timeframes to grasp the market structure. With practice in Dow Theory, trends, and tools, spotting HWC (Higher Wave Cycle), MWC (Mid Wave Cycle), and LWC (Lower Wave Cycle) becomes second nature. For me, this takes 10 seconds.

Want a full HWC/MWC/LWC guide? Check my free article I wrote a while back—it’s a hands-on tutorial ( link Cycle Mastery ).

📊 Step 2: Draw Support/Resistance Lines (20–30 seconds)

I start with higher timeframes: Monthly, then Weekly, then Daily. Once I’ve drawn lines up to Daily, I don’t always redraw for lower timeframes—often, I just adjust them.

Pro tip : Give more weight to the right side of the (recent data) since it’s fresher and more valuable. I change line colors for 4-hour lines, so I know they’re less critical than Daily. I don’t draw lines below 4-hour, but if you’re a scalper, tweak this to your strategy. This step takes me 20–30 seconds, the longest part.

📉 Step 3: Analyze Candles, Volume, Oscillators, and Indicators (10–15 seconds)

Here, I check everything I can: candles, volume, oscillators, and indicators . The goal? Stack confirmations for my triggers. Think RSI hitting overbought, volume spikes, larger candle sizes, or momentum surges—you get the vibe. This step’s length depends on your tool mastery. For me, it’s quick because I know what to look for.

🔔 Step 4: Check Coin Dominance (5–10 seconds)

This is the most critical yet simplest step. We need to track where liquidity’s flowing . For example, if SOL/BTC is bearish, I skip buying Solana—liquidity’s exiting. BTC.D (Bitcoin Dominance) is also key. The relationships dominance creates are complex and don’t fit in one analysis, but if you want a full dominance tutorial, drop it in the comments!

🔼 Key Takeaway: Using these 4 steps—HWC/MWC/LWC, support/resistance, candles/indicators, and dominance—I analyze any coin in 60 seconds. Your speed depends on experience and knowledge. If you’re new, this might take 60 minutes per coin, but don’t sweat it— practice makes you lightning-fast . Thanks for vibing with this educational idea! <3 I’ll catch you in the next one—good luck, fam!

💬 Let’s Talk!

Want a dominance tutorial or more tips? Hit the comments, and let’s crush it together! 😊 If this guide lit your fire, smash that boost—it fuels my mission! ✌️

AUD/CAD’s Big Move: Don’t Sleep on This Breakout Setup!Hey traders, Skeptic from Skeptic Lab here! 🔥 While everyone’s freaking out over interest rate news and Non-Farm Employments , AUD/CAD ’s stealing the show on the daily time frame.

📉Post-tariff crash, it’s rebounding strong. A daily resistance break could kick off a major uptrend. Use RSI overbought/oversold ( linked in my TradingView article ) to confirm momentum.

👀Beware of fakeouts this week—volatility’s high! Trade smart, keep risk tight, and don’t FOMO. Share your thoughts in the comments, boost if it helps <3 🩵

5 Lessons from My First 100 TradesAfter executing and reviewing over 100 real trades in crypto, forex, and gold — I found patterns. Bad patterns. Repeating mistakes. And lessons I wish someone had told me earlier.

So I broke them down into 5 key insights that changed how I trade — and might just save you thousands.

📘 Here’s what’s inside:

1️⃣ Smart Profit-Taking:

How I turned 10 R/R into 32 R/R using a dynamic exit plan.

📘Further resource:

Cycle Mastery (HWC/MWC/LWC)

---

Multi-Timeframe Mastery

2️⃣ The Sleep Edge:

70% of my losing trades happened after bad sleep. Here’s why that matters more than emotions.

3️⃣ No More Blind Stop Orders:

Why I stopped using buy/sell stops without real candle confirmation — and what I do instead.

📘 Further reading:

Breakout Trading Mastery

---

Indecision Candle Strategy

4️⃣ Multi-Layered Setups Win:

How structure, S/R, patterns, and timing stack into high-probability entries.

5️⃣ News Trading? Just Don’t.

The data behind why most of my SLs were hit near news time — and how I avoid the trap.

💡 These aren’t theories. These are real lessons from real trades.

If this video helped you or sparked an “aha” moment, give it a boost, commenting your takeaway, and sharing it with a fellow trader.

lets grow together :)

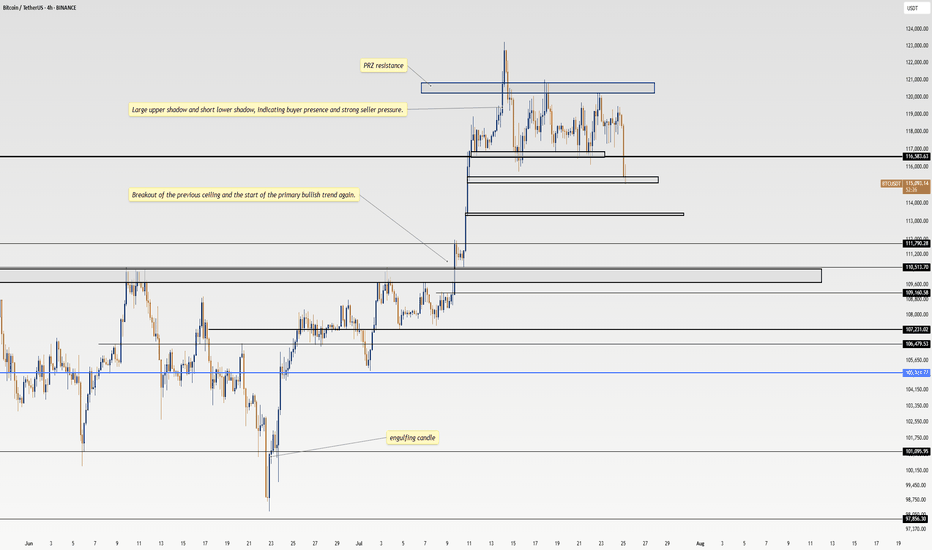

Bitcoin’s Epic Run from 80K to 120K: What’s Next for BTC?Yo traders, it’s Skeptic from Skeptic Lab! 🩵 Diving into Bitcoin’s wild ride from 80K to 120K—breaking down the key supports, resistances, and what’s next for BTC.

From the $76k bounce to smashing $110K, we’re eyeing the $120K PRZ. Will it correct or keep soaring? Check the video for the full scoop! Drop your thoughts or coin requests in the comments, boost if it vibes & Let’s grow together!

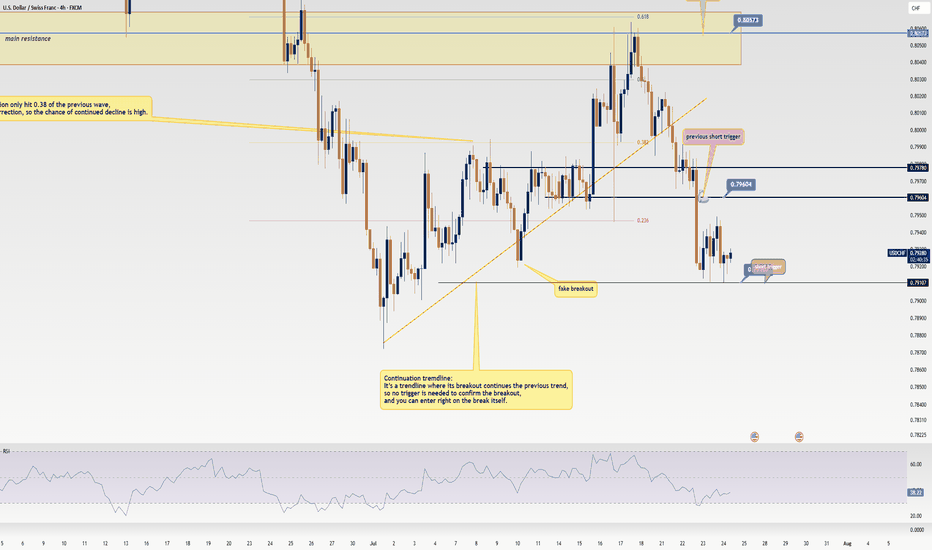

USD/CHF Update: Missed the Last Short? Grab the New Trigger!Yo traders and market lovers, it’s Skeptic from Skeptic Lab! Here’s a quick USD/CHF update: my last short trigger after the support break gave us a 50-pip drop . With a solid stop loss, you’re likely sitting on a 2:1 R/R; risk-takers might even be at 5:1. I’m breaking down a fresh trigger in this video—don’t miss it! Drop your thoughts or coin requests in the comments, give it a boost if it helped , and don’t miss my educational post coming tonight on Skeptic Lab’s TradingView page with lessons from my first 100 trades—it’s gonna be fire. Catch you tonight! 😎