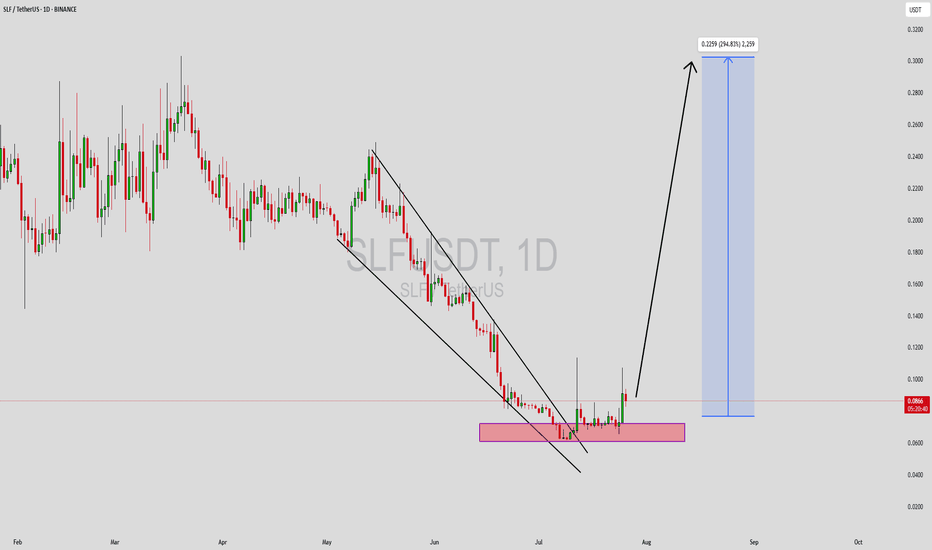

SLFUSDT Forming Falling WedgeSLFUSDT is currently exhibiting a classic falling wedge pattern, a bullish formation that typically signals a potential trend reversal. The narrowing of the wedge, combined with consistent price compression and higher lows, indicates that sellers are losing control while buyers begin to step in. This pattern often results in a strong breakout to the upside, and given the current structure, SLF is poised for a potential explosive move.

Volume levels remain healthy, which reinforces the likelihood of an impending breakout. Increased trading activity at support zones shows that investors are accumulating, anticipating a shift in momentum. Historically, falling wedges with strong volume confirmation have led to aggressive rallies, and in SLF’s case, analysts are expecting gains in the range of 190% to 200%+. This aligns well with both technical and psychological targets on the chart.

The market sentiment around SLFUSDT is turning increasingly positive as the project garners more attention in crypto communities. With on-chain metrics improving and social mentions growing, SLF is being recognized as a potential breakout play. If the price breaks out of the wedge and flips resistance into support, a sharp rally could follow—making it one of the high-reward setups currently in the altcoin market.

Traders should watch for a decisive breakout candle backed by rising volume, which could be the key confirmation to enter this trade. The structure is well-formed, investor interest is rising, and all technical indicators point toward an upcoming bullish move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

SLF

FLS (SPOT)BINANCE:SLFUSDT

#SLF/ USDT

Entry (0.080 - 0.088)

SL 4H close below 0.0756

T1 0.100

T2 0.120

T3 0.147

Extra Target

T4 0.165

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

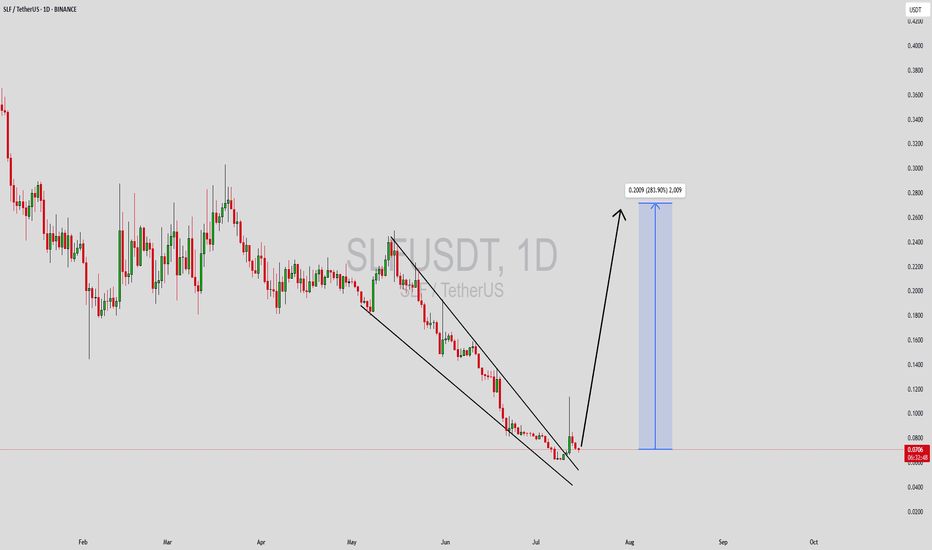

SLFUSDT Forming Falling WedgeSLFUSDT is showing an impressive technical setup that’s catching the attention of traders and investors alike. The crypto pair has formed a clear falling wedge pattern, which is known to be a bullish reversal pattern in technical analysis. This suggests that a breakout to the upside could be imminent, opening the door for a potential gain of 240% to 250%+. With volume looking strong and steady, this pattern gains even more significance, indicating that a major shift in market sentiment could be underway.

Many traders look for falling wedge patterns because they often signal the end of a downtrend and the beginning of a new bullish phase. SLFUSDT’s price action aligning with this pattern makes it a high-probability setup for swing traders and long-term holders who want to position themselves early. The crypto market’s current momentum adds further confidence that once the breakout confirms, a powerful price rally could take shape, rewarding patient investors.

It’s worth noting that investor interest in this project is growing, with more eyes turning towards SLFUSDT as it holds a promising use case and potential for future development. A breakout from this falling wedge could also attract new capital inflows, pushing prices even higher. Traders should watch for strong volume spikes and sustained price action above key resistance levels to confirm the bullish reversal. With the right market conditions, SLFUSDT could outperform many other altcoins this cycle.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Monthly Candle volatility growthThe market remains extremely sluggish in the seasonal flat, but there is a possibility of increased volatility this week and next. In this regard, I would like to consider the market situation and the likely prospects. First of all, in the medium term, the probability of a flat of about 100k for bitcoin and 2500 for ether prevails until the opening of the new half-year. There are no sufficient arguments for a significant break and trend towards 210k for bitcoin and 5k for ether. In addition, strong statistics for the United States began to be released, which increases the likelihood of a retest of 1900-2100 on ether and 85-90k on bitcoin. That is, until August, I am still more likely to expect a flat of 95-110k and 2250-2750 under an optimistic scenario. With a more negative picture, there remains the possibility of a major drawdown of the market until the retest of the loyalties of the first quarter on the tops.

A significant spike and bullish trend may be facilitated by the cancellation of Trump's duties voluntarily or in court, a truce in Ukraine, or the consolidation of brent above $ 69-70 while maintaining growth. In the event of a resumption of duties or a collapse of oil below $ 60, the probability of a fall in the crypt will become extremely high.

Against the background of the closing of the last bullish monthly candle and above 2500 on ether, we have technical signals for continued purchases. This week, there is a possibility of a major wave of purchases in the first half of the month with an attempt to move. However, strong US statistics are likely to continue to dampen growth attempts. Starting next week, it is worthwhile to carefully consider the volume of positions in the work due to the high probability of a market drawdown in the second half of the month. At the end of the week, I will assess the probability of maintaining purchases in the second half of the month, depending on the statistics released this week and the dynamics of oil.

To date, I am still considering the most oversold coins for scalping that have not been assigned the chess fio adx monitoring tag with possible growth waves of up to 70-100% from current levels. Fan tokens with a growth potential of up to 100-200% remain in a highly undervalued position, among which I work with atm acm city porto Lazio alpine juv. For storing funds in the medium term, quick looks interesting with the main long-term support at 0.020-21. The cos slf data pivx token can also show growth waves of up to 30-40%.

As I wrote earlier, large-cap coins, against the background of a seasonal flat and likely sales, may continue to fall slowly until August, in the absence of major growth in the tops or the index of dominance of altcoins.

Technical analysis of $SLF asset: growth prospectsAt the moment SLF asset demonstrates quite promising dynamics, which is confirmed by a number of technical signals. Price trading in the green range (the area of positive dynamics) indicates stable demand and confidence of market participants in the growth potential of the asset.

One of the key factors is the price consolidation above the exponential moving average (EMA 50). This indicates a change of the short-term trend to an upward one and can be considered as a signal for further strengthening of positions. In addition, the support from the EMA 50 acts as a dynamic level, which reduces the probability of a significant pullback.

In terms of analyzing Fibonacci levels, the current market structure also provides interesting opportunities. If we consider the correction from the previous move, the nearest upside target is at 0.55 USD, which corresponds to 1.618 on the Fibonacci scale. This level historically acts as a point of attraction for price movements and may become a logical target for the current trend.

Alex Kostenich,

Horban Brothers.

SLF BINANCE:SLFUSDT

SLF / USDT

4H time frame

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

The altcoin market has reached its goal, we are catching reversaThe market remains quite boring for now, but we are nearing the end of a steady decline and the opportunity for growth in alcohols, I think it's time for another review. First of all, I want to note that there are not yet sufficient arguments for going to 75k for bitcoin, which I recommend that you keep in mind since the end of the year to understand the medium-term prospects of the market and the depth of immersion of the alt market.

Last week, there was a fairly large wave of dollar sales, which completely stopped the trend of its strengthening, but has not yet given a reliable trend change. If the dollar continues to fall this week with the euro consolidating in the range of 1.050-75, then bitcoin will give a new wave of growth towards 110-115 with further attempts to reverse the month for altcoins. So far, this scenario has prevailed by a small margin in my opinion. The statistics coming out will play an important role, especially the negative ones for the United States. In a negative scenario, the euro will fall below 1.045 again, which will cause the crypto to get stuck in a sluggish flat.

In the first half of the week, the probability of maintaining sales within the framework of shadow drawing according to the current weekly candle prevails. From Wednesday to Friday, buyers will start looking for reasons to buy back coins with a weekly reversal turning into a monthly reversal in an optimistic scenario for individual coins.

However, once again I would like to draw your attention to the fact that the goals for bitcoin up to 60-75k remain relevant and are highly likely to be fulfilled closer to the summer. At the moment, we are only looking for scalping opportunities against the bear market, while bitcoin remains flat in the range of 90-110. It is not necessary to top up large-cap coins that are in drawdown, as the fall is highly likely to continue until autumn.

The alt dominance index reached the target level on the 9% test, which I indicated. In this regard, after the rebidding, the probability of a slow reversal of the altcoin market prevails with targets up to 12.5-15% according to the altcoin dominance index. The formation of this reversal partially compensates for the likely drawdown of bitcoin.

In the current market, coins with the monitoring tag have taken the most interesting position, as they are in the most oversold position. Vite stands out strongly, which closed the last weekly bullish candle, which is highly likely to lead to a reversal this week to 0.0150-75. There is also a high growth potential for cream troy hard for an attempt to reverse the month.

Let me remind you that coins with the monitoring tag have a constant threat of delisting, which most often occurs from Monday to Wednesday before lunch. At this time, it is worth keeping a short stop on these coins at the current price, or scalping with these tools in the second half of the week. Despite the delistings, the coins of this group have always brought significant profits due to frequent oversold prices and very volatile growth impulses.

Among coins without the monitoring tag, vib and ast stand out the most. However, it is worth considering the incomplete issue of ast, which can lead to an additional drawdown if coins are added to circulation. Also interesting for scalping are pda vidt alpaca og pivx amb wing uft slf with possible growth waves up to 50-70%. Quick and combo, which are suitable for medium-term storage of funds, are also suitable for strong support, as they are fairly reliable projects. Combo (formerly cocos) already pleased us with X's in 21-22, when I recommended him to work.

SLFUSDT: %500 VOLUME SPIKE | HUGE OPPORTUNITYSLFUSDT has experienced a 500% daily volume increase, indicating heightened interest. However, the price is declining rapidly, and buyers have not yet shown significant activity.

🔵 Demand Zones: The blue boxes on the chart represent potential areas for a price reaction.

📊 Entry Strategy: Monitor for upward breakouts in these zones on lower time frames before considering entries.

⚠️ Risk Management: Exercise caution and manage your risk carefully, as the market remains volatile.

Patience is crucial let the market confirm buyer activity!

Follow me for tracking the crypto volume spikes and trading points. You can see my accuracy below.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

Slf/UsdtBINANCE:SLFUSDT

**Current Price**: **$0.4442** 📉

**Resistance Area**: **$0.5600** 🔴 (Price has been rejected from this area, so it's a key resistance level to watch)

---

**Key Support Areas**:

- **First Support**: **$0.3800** 🟢 (This is the level to watch for a potential bounce 🚀)

- If the price doesn't hold at **$0.3800**, the next support level is at **$0.3200** 🔴.

---

In summary:

- **Resistance**: **$0.5600** 🔴 (Keep an eye on this area!)

- **First Support**: **$0.3800** 🟢 (Watch closely for a potential bounce!)

- **Next Support**: **$0.3200** 🔴 (If the price drops further, this could be the next stop!)

---

If the price holds at **$0.3800**, we could see a nice recovery 🌱🚀. But if it breaks, keep **$0.3200** on your radar as the next key level to watch. 👀

**Not financial advice!** Always do your own research and make informed decisions! 📊💡

SLF/USDT: Poised for a Breakout at Key Trendline SLF/USDT: Poised for a Breakout at Key Trendline 🚀

SLF/USDT is preparing for an exciting move as it approaches a crucial trendline resistance 📉➡️📈. The price is consolidating within a tight range, signaling potential energy for a breakout 💥. If confirmed, we could see a strong bullish rally unfold 📊. Keep an eye on this pair for key signals 👀.

Key highlights:

1. Trendline resistance: SLF/USDT is testing a trendline that has acted as a barrier in the past. A successful breakout could trigger a notable upward trend 🔑.

2. Volume confirmation: A surge in trading volume during the breakout will indicate strong buying pressure 🔥.

3. Momentum indicators: RSI and MACD suggest growing bullish momentum ⚡, hinting at the possibility of a breakout.

How to confirm the breakout:

- Wait for a clear 4H or daily candle close above the trendline resistance 📍.

- A visible increase in volume during the breakout is a strong bullish signal 📊.

- Watch for a retest of the broken resistance, turning it into support ✅.

- Stay cautious of false breakouts, such as sudden reversals or wicks above the trendline ⚠️.

Potential targets (if breakout succeeds):

- Initial resistance:

- Next key zone:

Risk management strategies:

- Use stop-loss orders to safeguard your capital 🛡️.

- Ensure your position size aligns with your overall risk tolerance 🎯.

This is for educational purposes only and not financial advice. Always do your own research (DYOR) 🔍 before making trading decisions.

SLF WYCKOFF WYCKOFF accumulation/distribution pattern on the SLF chart. Could this be the start of a reversal and a move up?? I think it could.

My reason is as a fresh new coin this is good for a Bullrun, little to no selling pressure as price rises due to no bag holders selling at break even from previous bull cycles.

A rounded bottom structure can provide a base for price to rally from, it proves a growing confidence from buyers, once the top of this mini range gets breached and accepted above it's a great breakout play.

ATH is at +156% from current price, and as I stated before there is little to no selling pressure on the way up either which will help this to grow quickly once it gets going. A project that is in its first Bullrun in price discovery is a great combination!

Long Manulife/Short SLFI worked for both companies and I preferred Manulife. It is larger than SLF for a reason: it's just better.

The other main reason I would want short SLF is that it DENIED me service which is basically fraud (lawsuits coming, right Arvid Shamiri who can be reached at (416) 213-7450).

The other reason is because the ratio chart of MFC/SLF shows a clear uptrend which means Manulife is outperforming Sunlife. The best part is you're "market hedged" and don't have to worry about grampa Powel fucking aorund with rates...

Short SLFWhy Short SLF?

1 - They hung up on me when I asked them to pay for the hospital fees

2 - because I said so

3 - They said they "couldn't find me in the system"

4 - there's a long term Head & Shoulders formation (very bearish)

5 - Manulife is better and is in a reverse Head & Shoulders position

6 - As you can see on the chart there is a clear downtrend

SLF - Rising wedge breakdown Short, from current label to $36SLF seems breaking down from a rising wedge formation. Good moneyflow divergence. We think it will decline from current label & it can easily decline to $36 area.

* Trade Criteria *

Date first found- February 2, 2017

Pattern/Why- Rising wedge breakdown

Entry Target Criteria- from current label or retest to resistance around $39.

Exit Target Criteria- $36

Stop Loss Criteria- $40.13

(Note: Trade update is delayed here.)