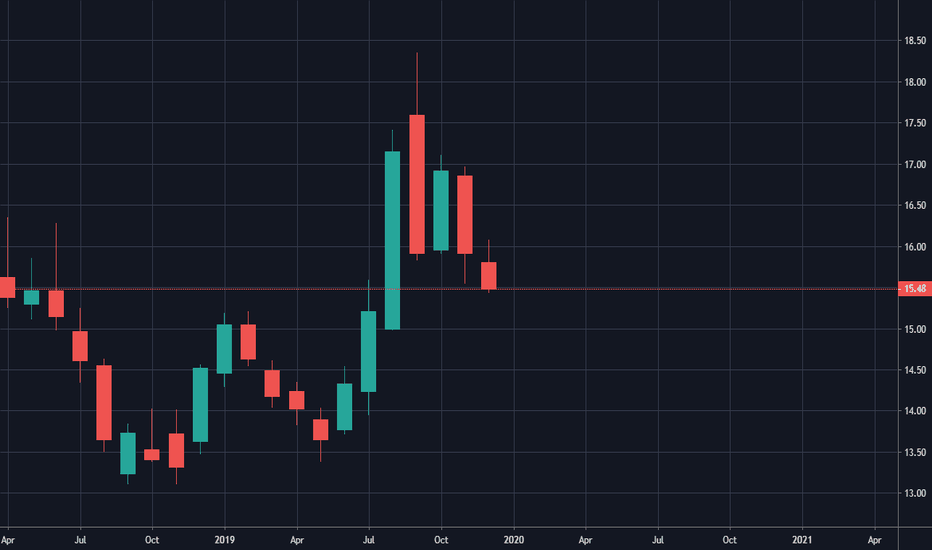

SLV

Silver, likely up move to Phantom Midline, Buying $16 CallsHello traders,

I present you another chart analysed with @coinobsalgos indicators.

Indicators used:

XABCD Scanner

Phantom Script

Phantom is signaling bottom on the 120 and 240 time frames,

Which usually results in an up move to the midline,

Midline prices are displayed in red.

Silver CFD vs SLV etf

I will be trading the ETF with $16 calls, Just below the midline.

Good luck to all

SLV Long Bull flag on monthly chart Monthly Chart shows a very nice Bull Flag for SLV A long stock play can be done if I want to hang onto the stocks for a few months. The length of the flag pole shows about a $3.5 move, so an option about half way up that move with the expiration of March would also work. In fact. I'm looking at the decently16 s priced strike that expires on March 31 2020

a Debit spread can also be done if i also sell the 17 strike on the same expiration That would make the cost of the spread at the current market price $21 with a profit potential of $79

Gold Breaking Out from Horizontal Resistance#Gold just broke above horizontal resistance & now looking to break up from August downtrend channel. A move above 1495 would resume the uptrend from 4Q18 (channel support recently held)

RSI also breaking out from declining resistance

$GLD $GC $GDX $GDXJ $SLV

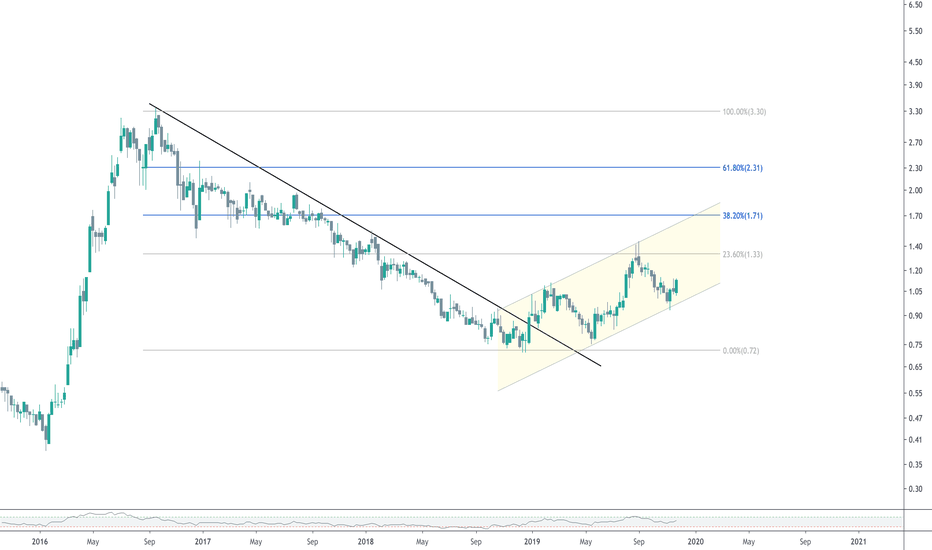

$PAAS Pan American Silver Chart Looking Very StrongI really like this $PAAS chart . . . broke out of an 8yr downtrend line, successfully retested and pushing higher. Could take some time/further consolidation, but get above 22-22.50 and there is major blue sky. #silver $SLV $SIL

SLV Corrective Action Complete?One can never really tell how elaborate corrective actions can be but it does appear that an impulsive move up may be what's coming next. The next major price target is the previous major high around 19.77. It's possible however that this target might not be hit until early next year. With that timeline in mind, I have been adding to 2021 LEAP call positions on the dips and liquidating 2020 calls on rallies. The stochastics indicator reading can be used as one of the tools to provide overbought/oversold readings to take action.

When looking at SPX move since 2009, it's impossible to forecast how high SLV could go if we are in fact entering into a Bull Market. Most Elliott Wave scenarios I've seen suggest that the current moves for gold and silver are merely Wave B of an overall corrective pattern with more downside to eventually come. If we are in the initial phases of a Bull, the length and magnitude of the move could be substantial. With computer algorhythyms and easy money controlling the market action, only short-sightedness and impatience might be the limiting factor in your profits.

Silver SLV XAG - Silver's up! Buy the dip. Buy physical silver!Silver looking good. Gold looking good. Bitcoin looking good. Litecoin looking good. I'm bullish on all of them.

I'd be stocking up on all of these, and get the real thing. Get the physical metal that you can hold in your possession. For cryptocurrency make sure you have your private keys.

SLV XAG Silver - Stop loss update, long the dipI'm playing silver in a bullish macro trend, so I'm still long. However we could see a significant pullback, shaking out weak hands and traders before a higher high. Short traders could be right depending on the degree of retracement.

However I'm not looking to short. I'm looking to long the pullback.